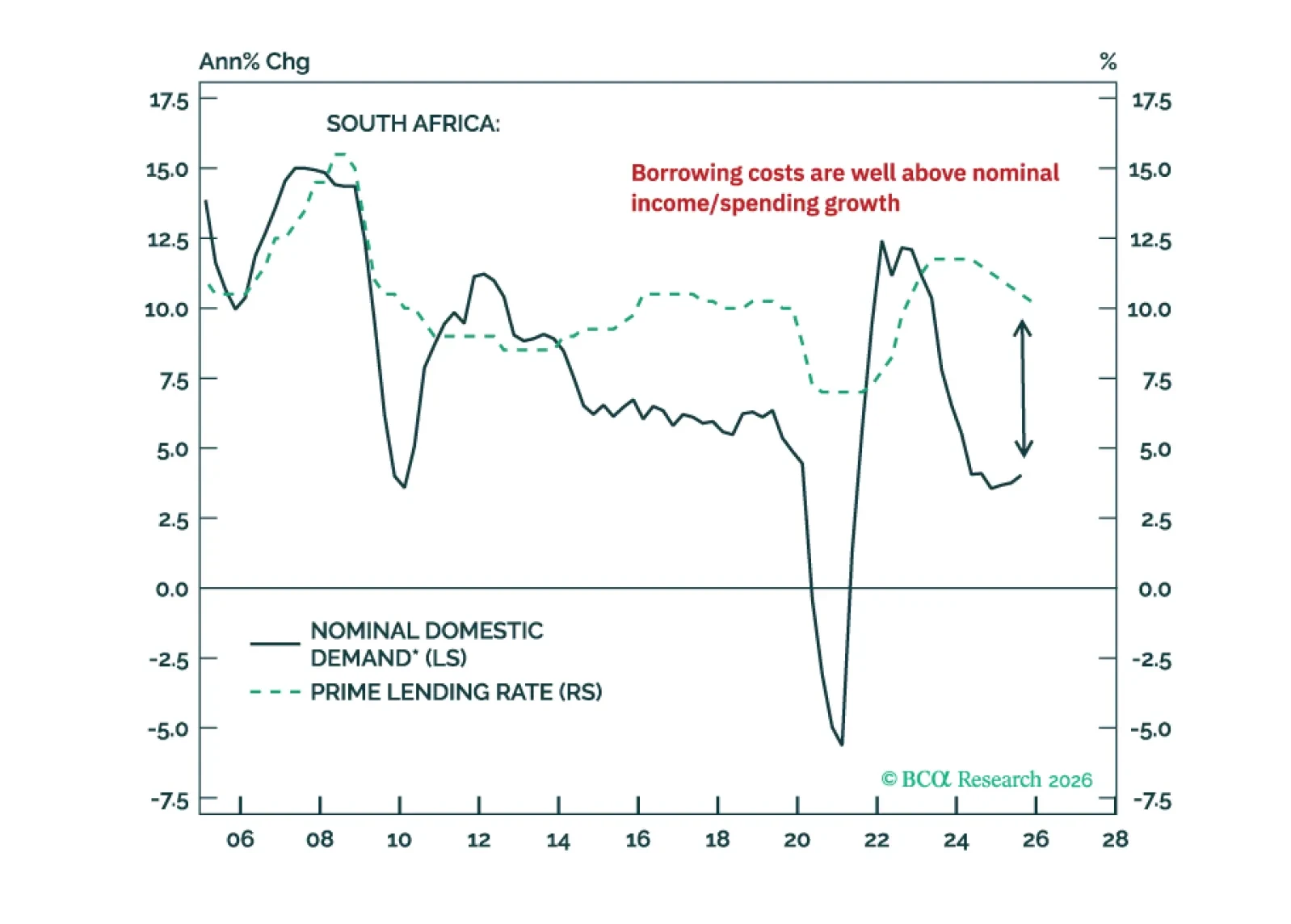

The precious metal bonanza has not resolved the South African economy’s plight. Nor did it improve its public debt sustainability issues. Investors should brace for a reversal in South African stocks, bonds, and the currency.

Our Portfolio Allocation Summary for January 2026.

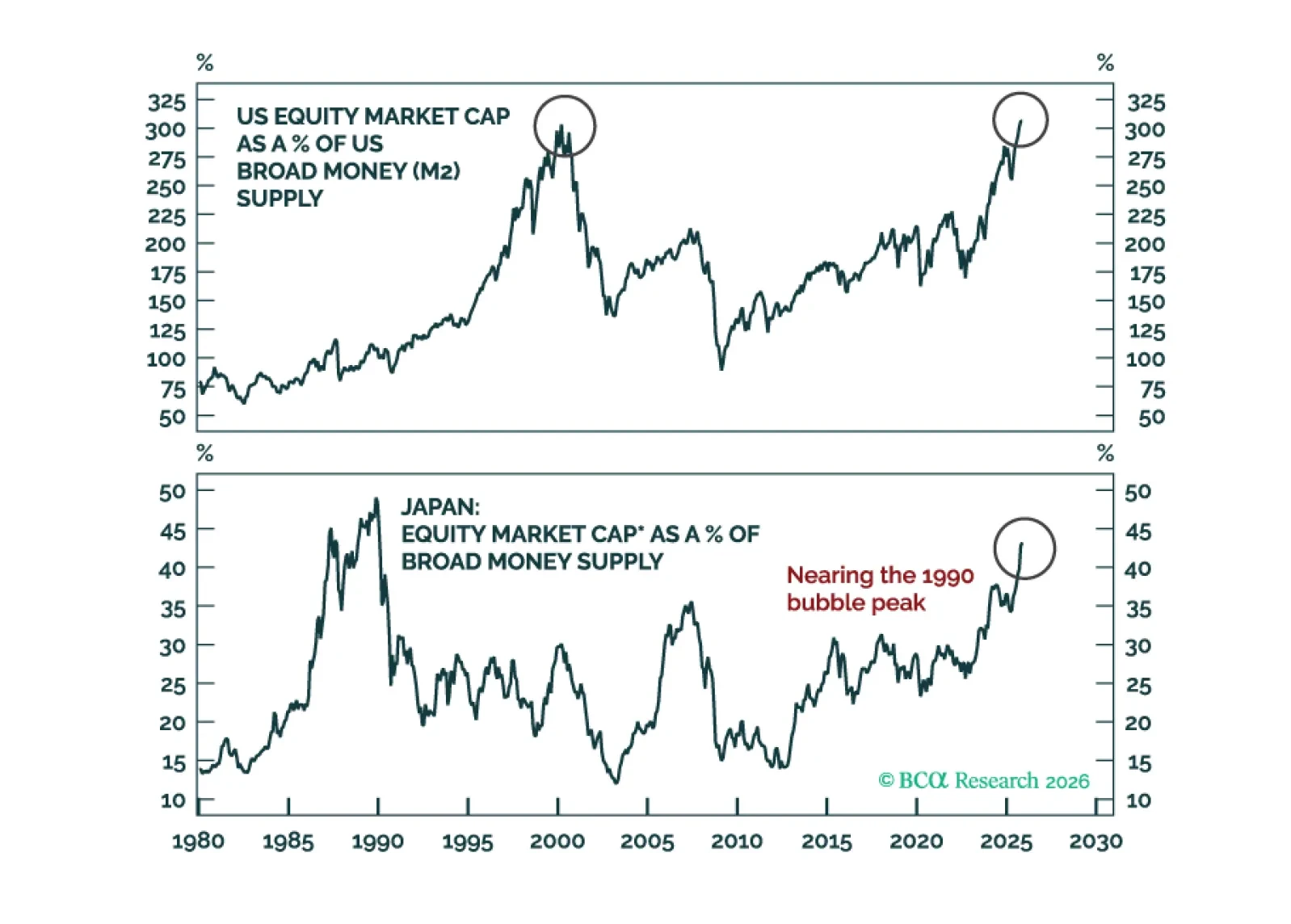

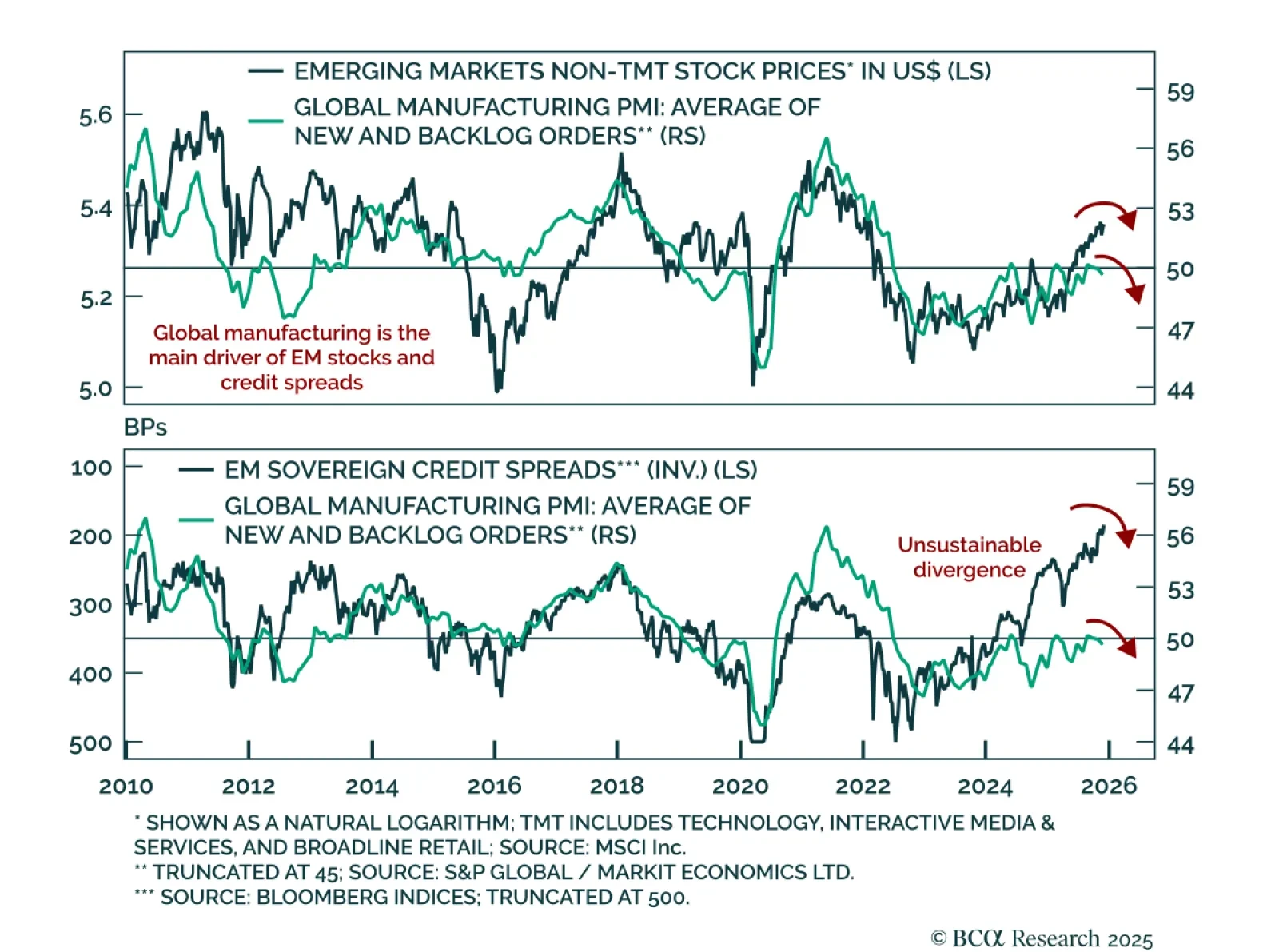

At major technical crossroads, markets eitherpull back before staging a sustainable breakout, or attempt to break out only to drop considerably (i.e., a fakeout). We believe the latter dynamics are more likely to play out.

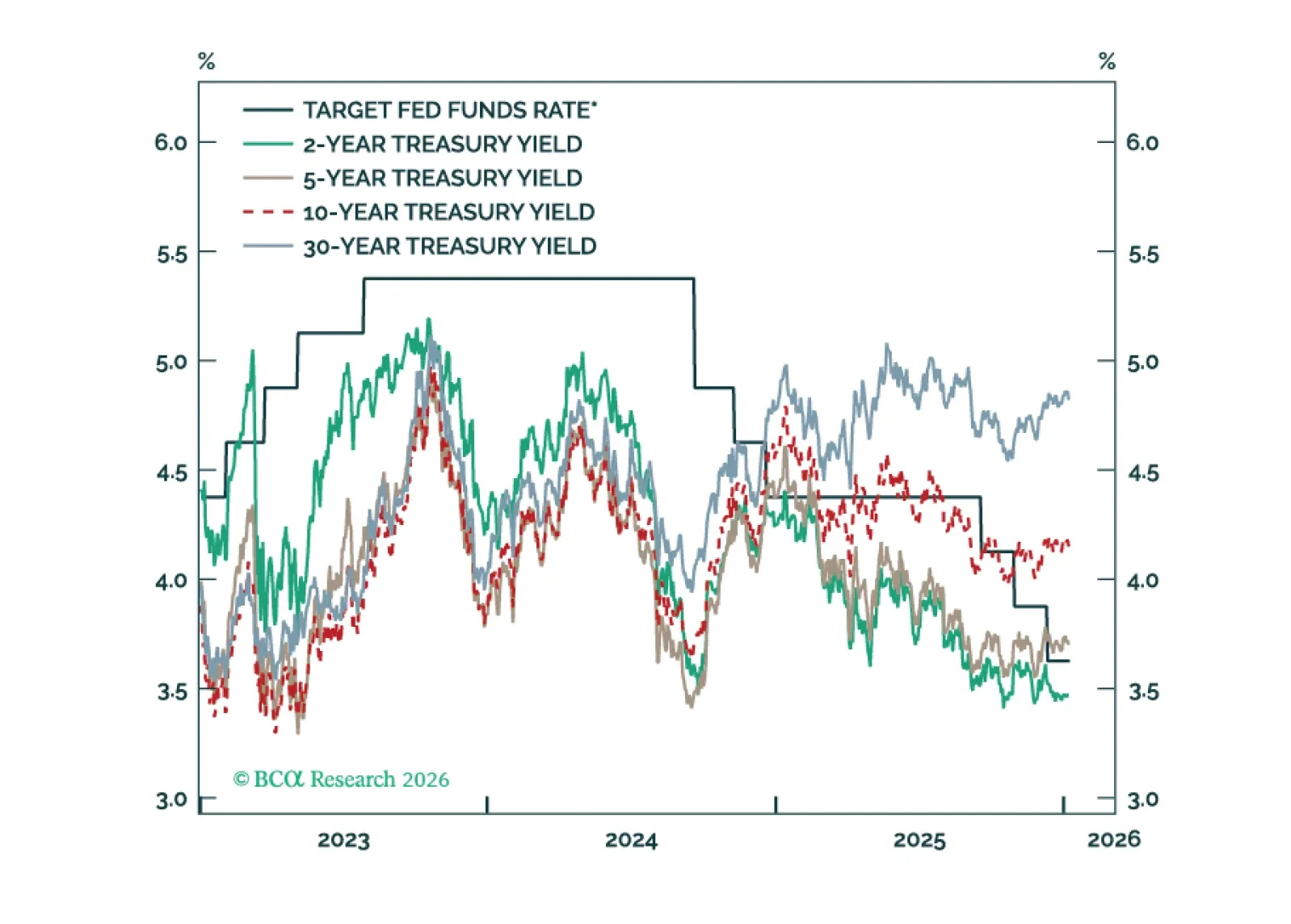

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

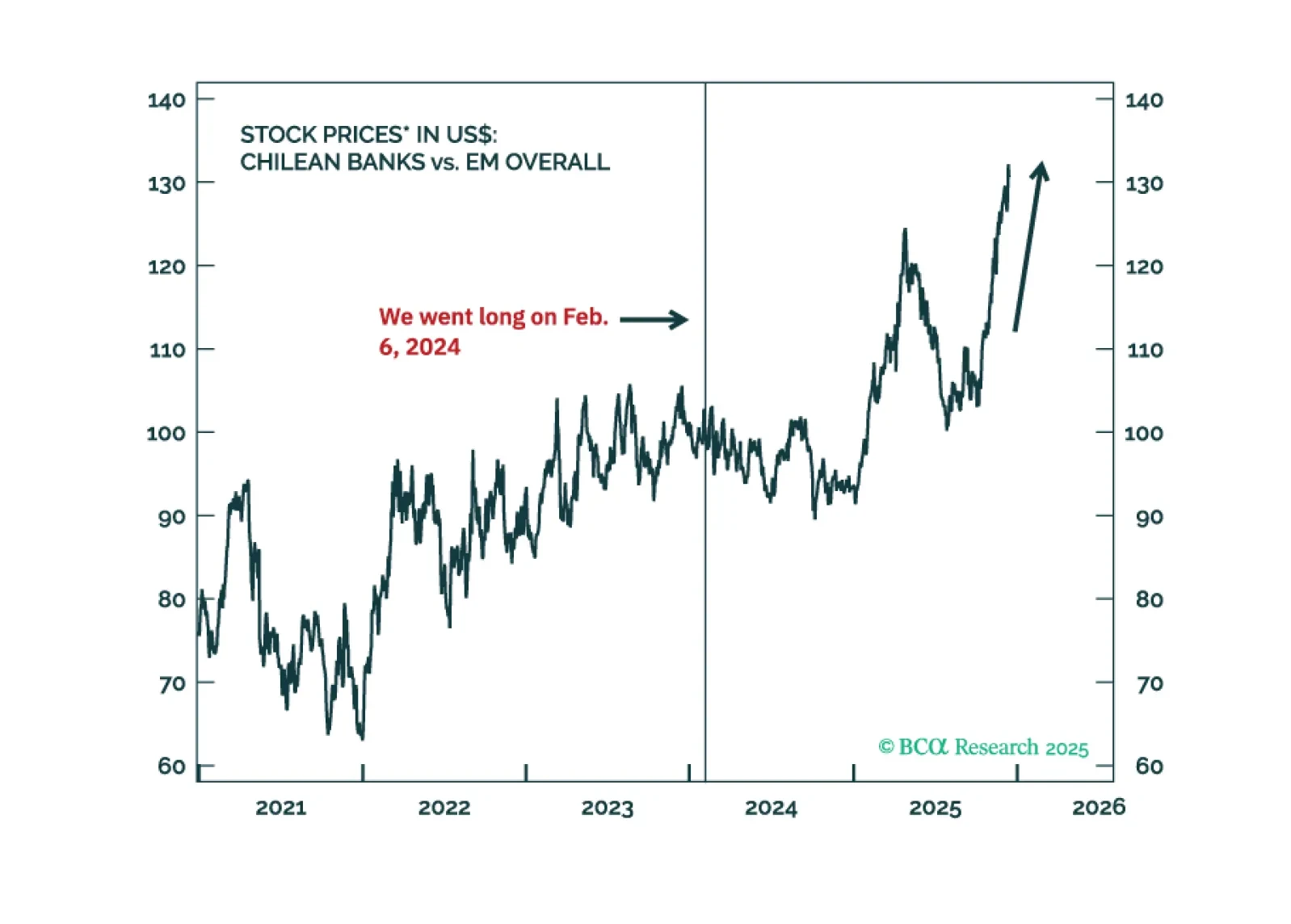

Following this weekend's election, we reiterate an overweight stance across Chilean risk assets relative to EM benchmarks and advise buying local currency government bonds (currency unhedged).

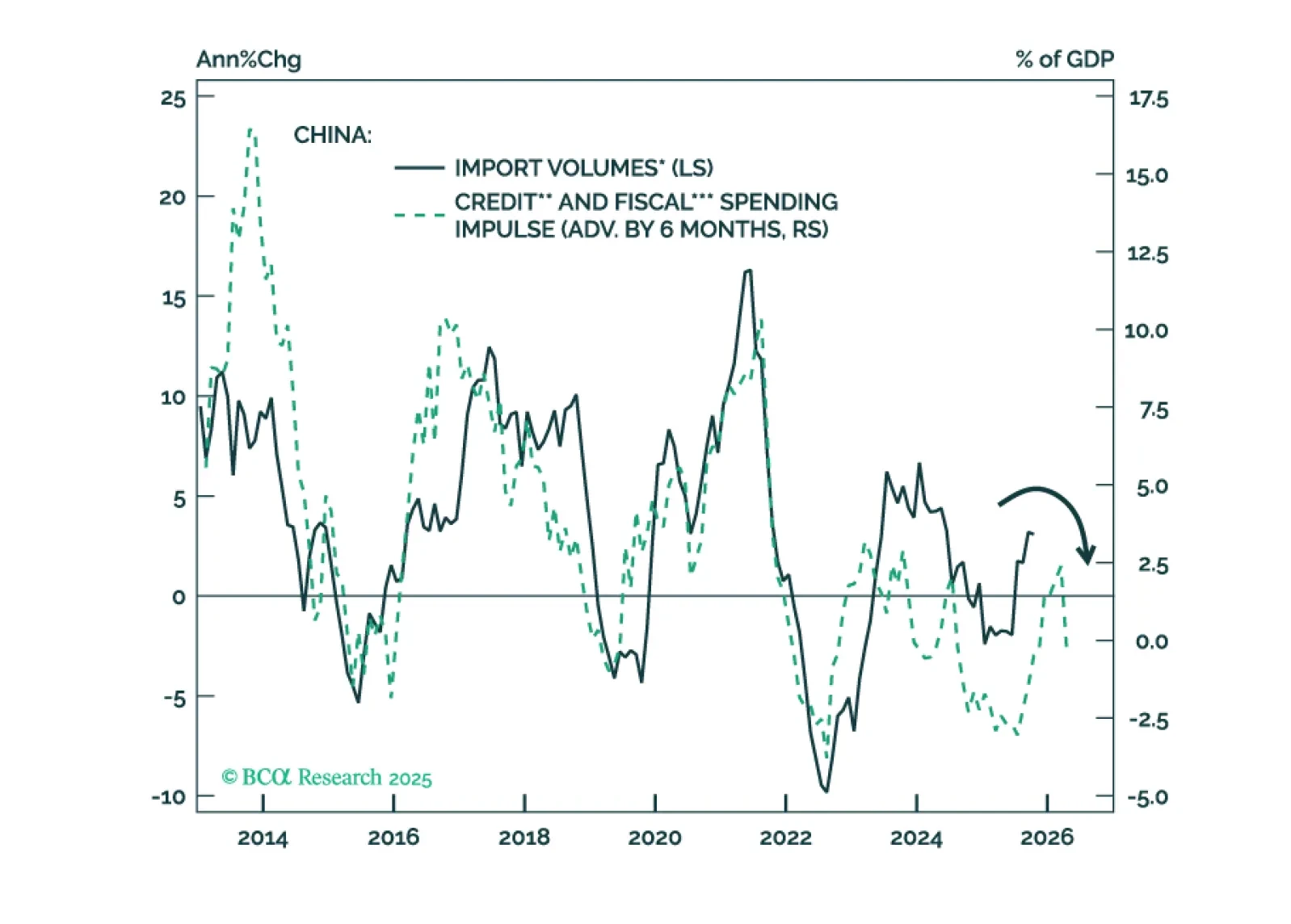

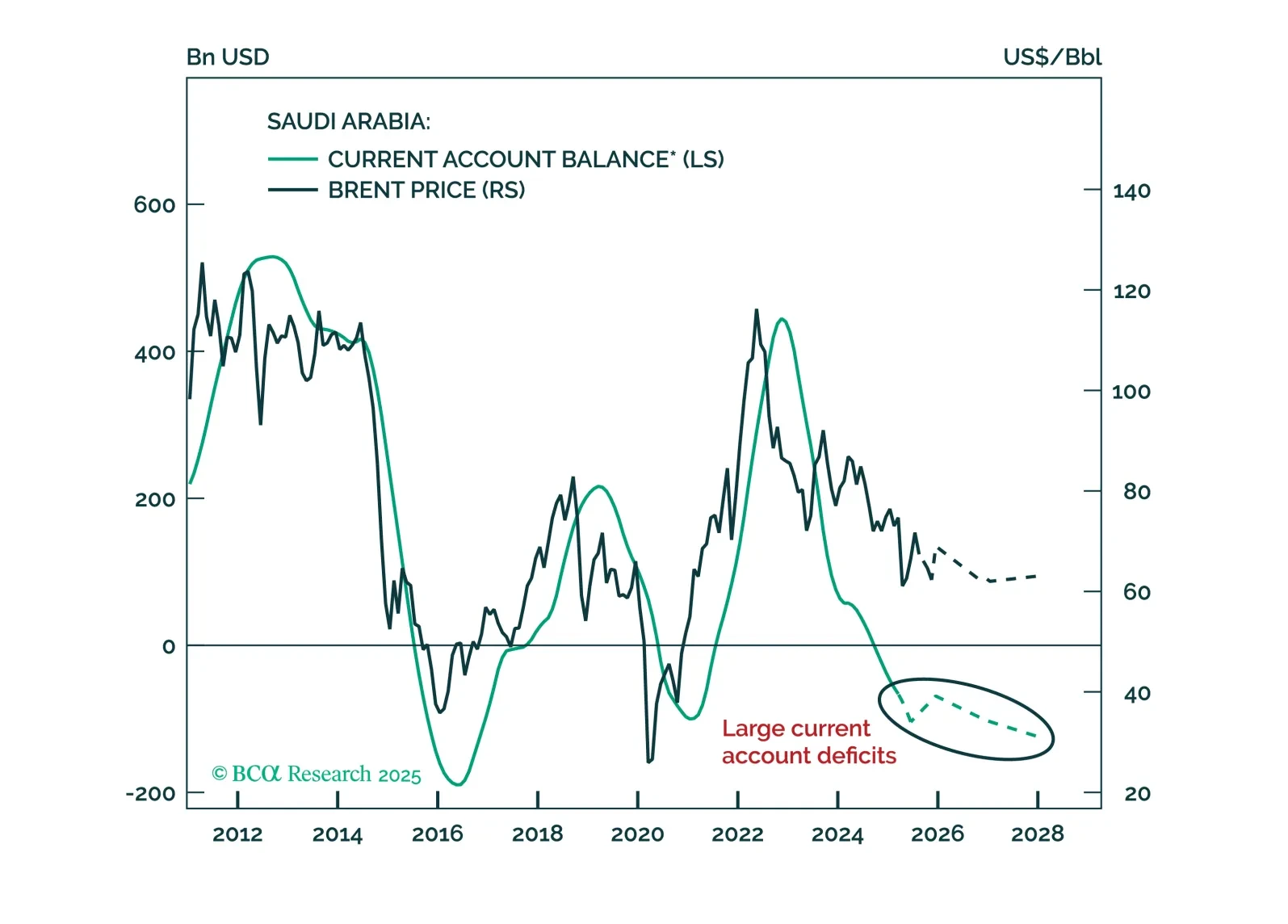

Our Emerging Markets, China, and Commodity strategists recommend avoiding EM and DM risk assets, underweighting the US, and overweighting domestic bonds outside the US. In global equity portfolios, they maintain a neutral EM…

Our Portfolio Allocation Summary for December 2025.

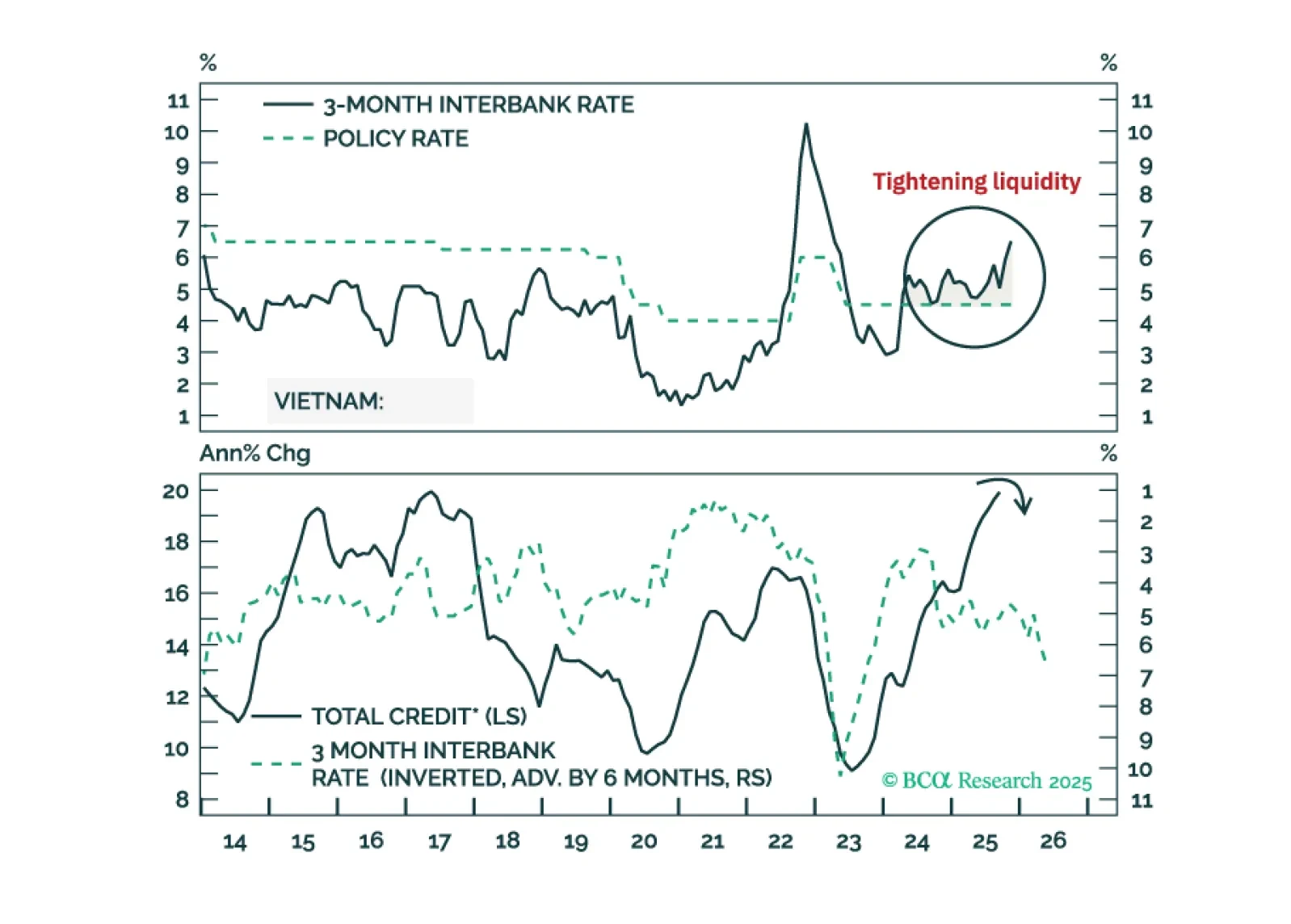

We remain bullish on the alpha-generating potential of Vietnamese stocks over the medium and long term. But our negative outlook on global/EM beta makes us bearish on this bourse in absolute terms over the medium term.