Highlights In the short run, extreme policy uncertainty is problematic for risk assets. In the long run, gargantuan fiscal and monetary stimulus continues to support cyclical trades. Equity volatility always increases in the…

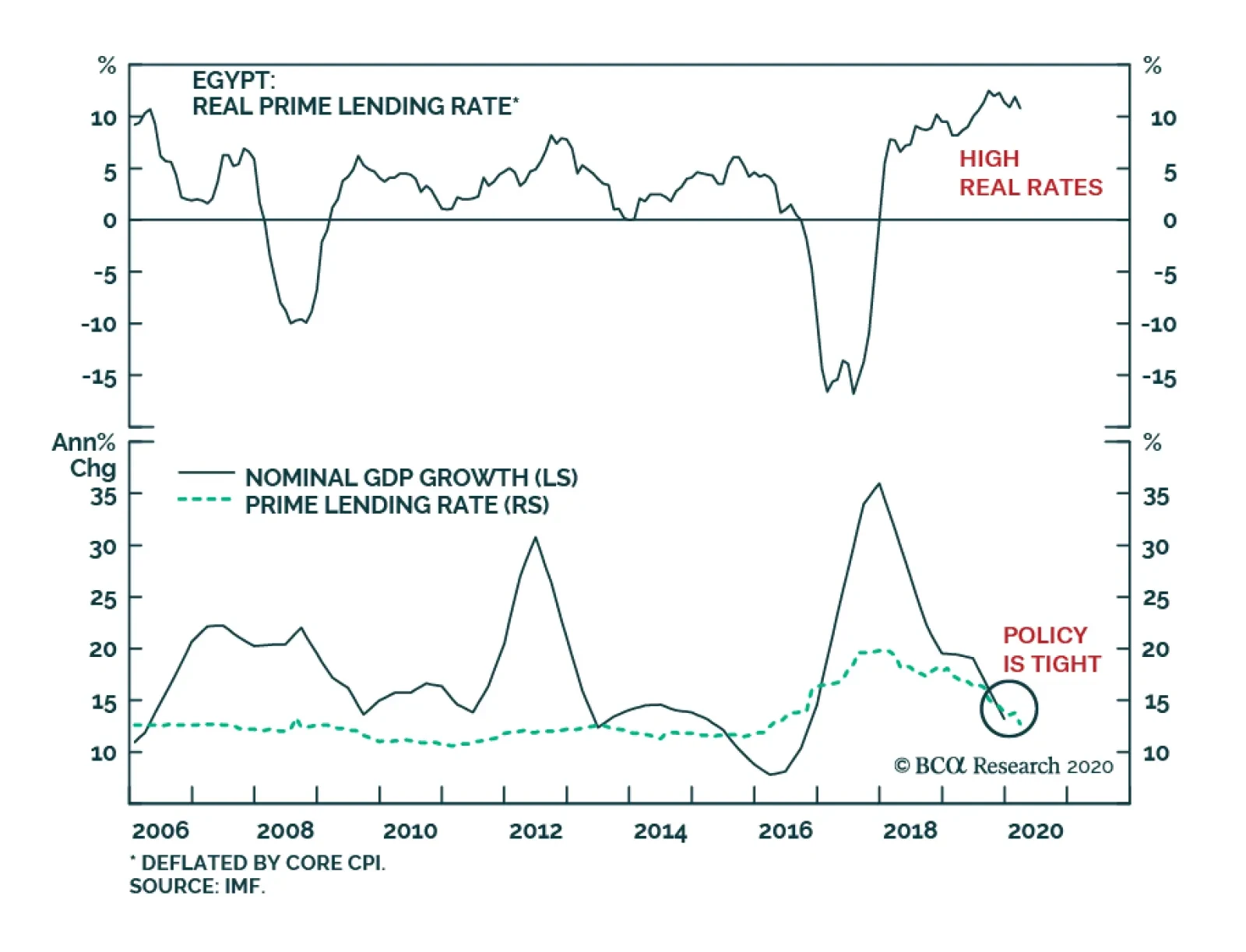

BCA Research's Emerging Markets Strategy service believes that the Central Bank of Egypt (CBE) will allow the currency to depreciate and will cut interest rates materially. A Devaluation would offer an attractive opportunity…

Highlights Egypt’s balance of payments have deteriorated materially due to both the crash in oil prices and the global pandemic. The country’s foreign funding requirements in 2020 are high and the currency is under…

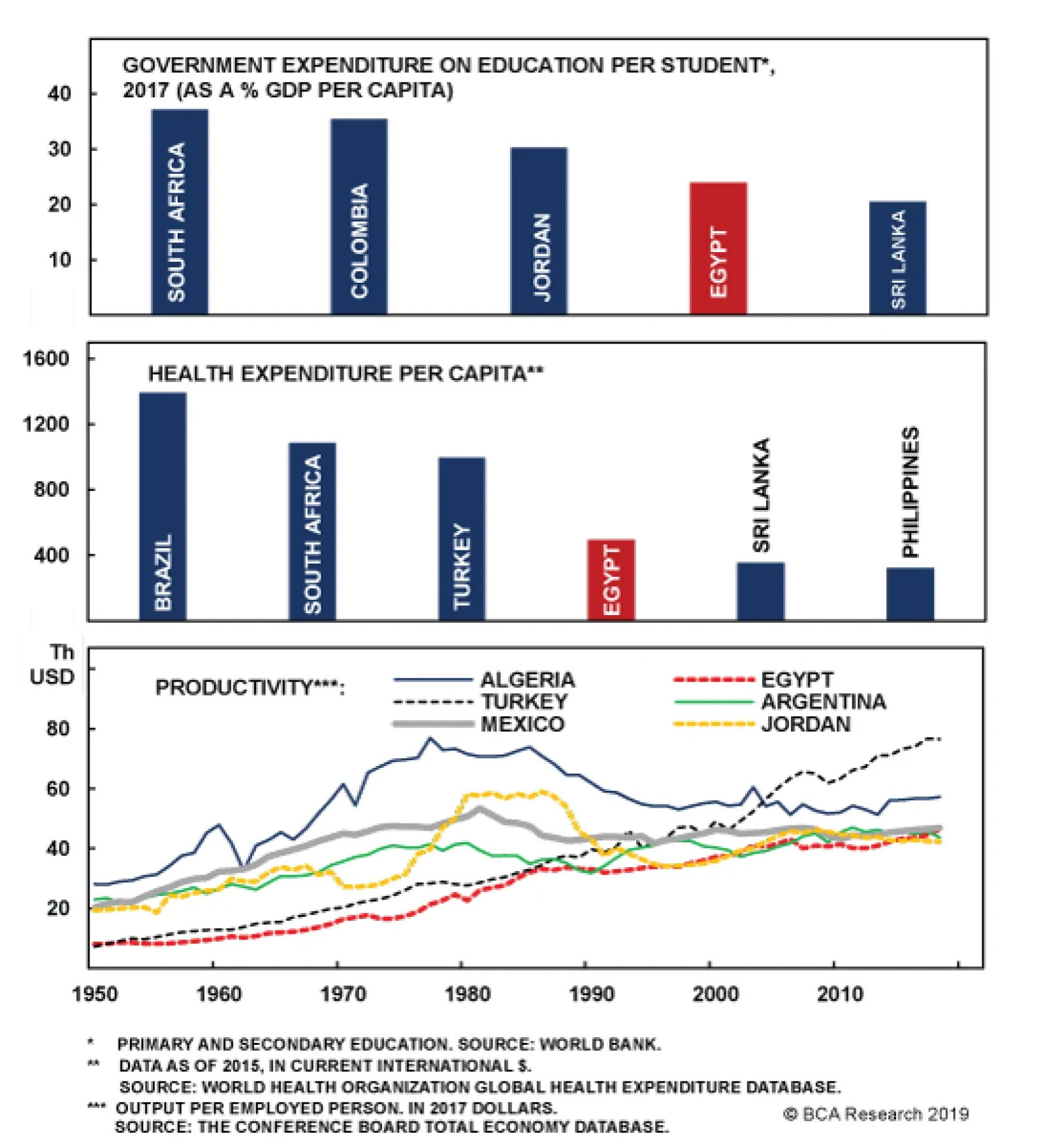

For one, Egypt remains heavily reliant on its external environment. This environment has been largely cooperative throughout Sisi’s term in office, but a global or EM downturn could cause investment to collapse. Meanwhile,…

Global trade is plummeting as commodity prices remain depressed and emerging markets unravel. Even if oil were not plumbing new lows, we would remain bearish on EM economies, where poor governance and low efficiency suggest that more…