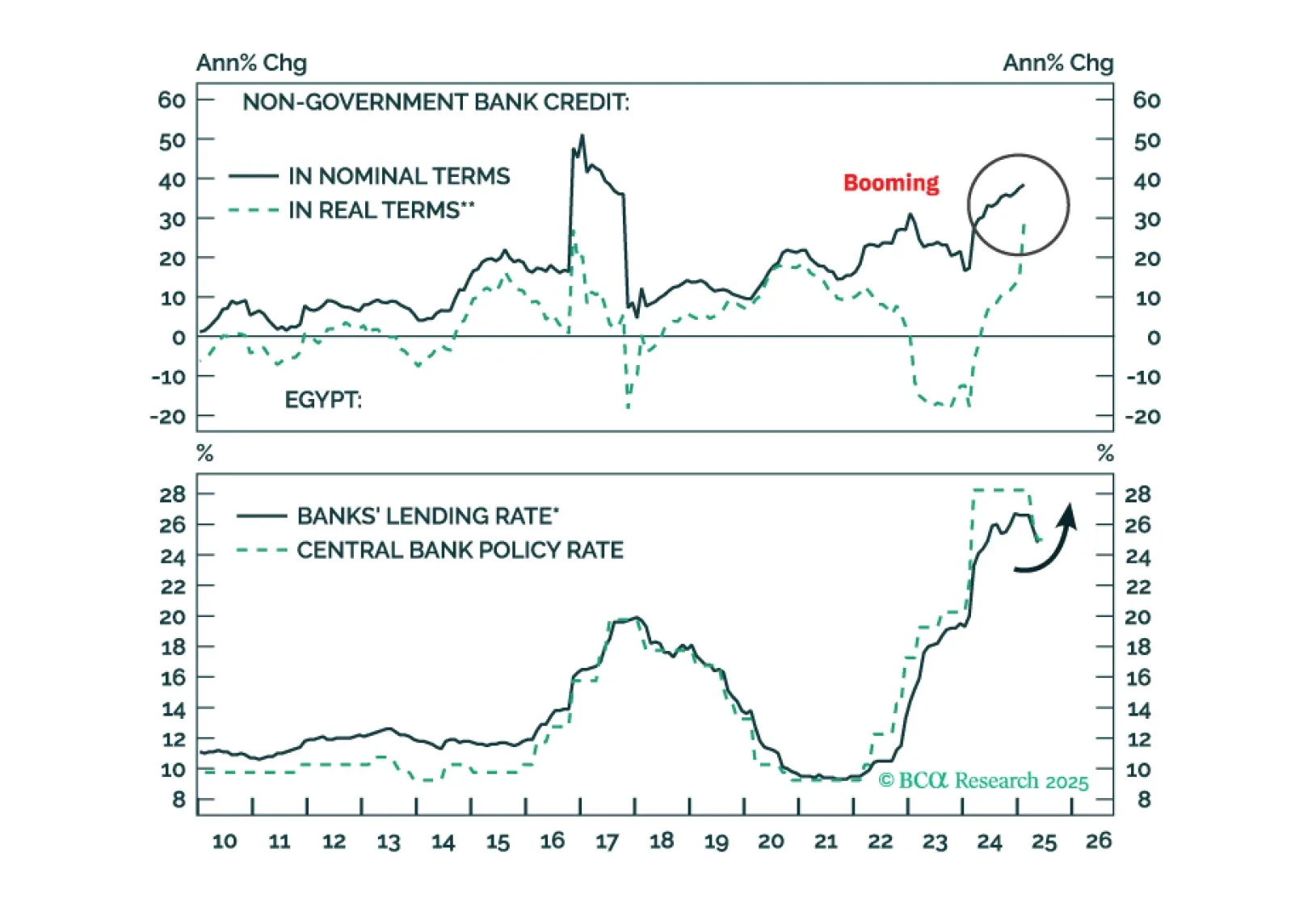

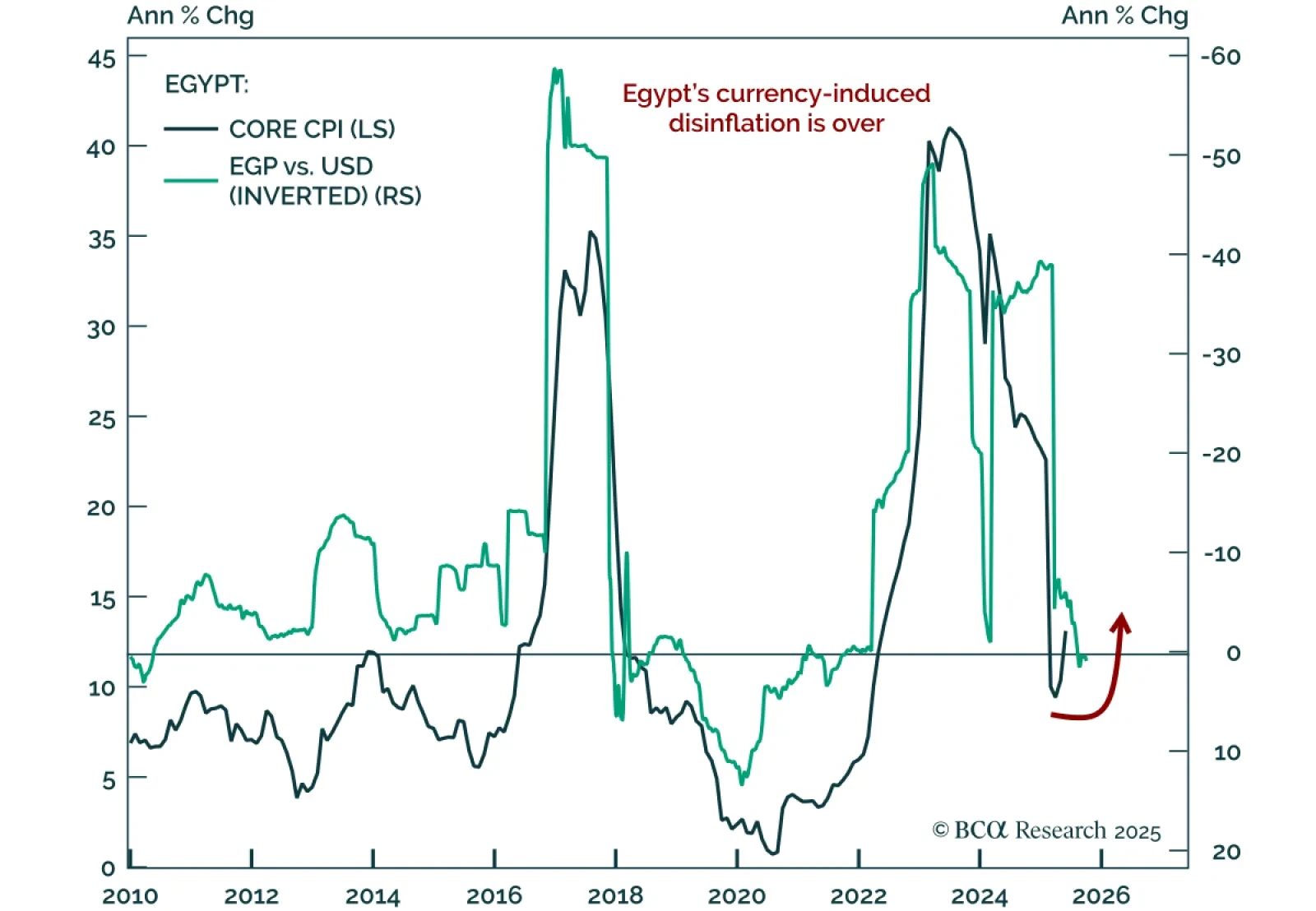

The Central Bank of Egypt cut rates by 100 bps to 22%, but inflation and FX risks argue for caution on Egyptian assets. Our Emerging Markets strategists note that while slowing inflation enabled four cuts this year, price pressures…

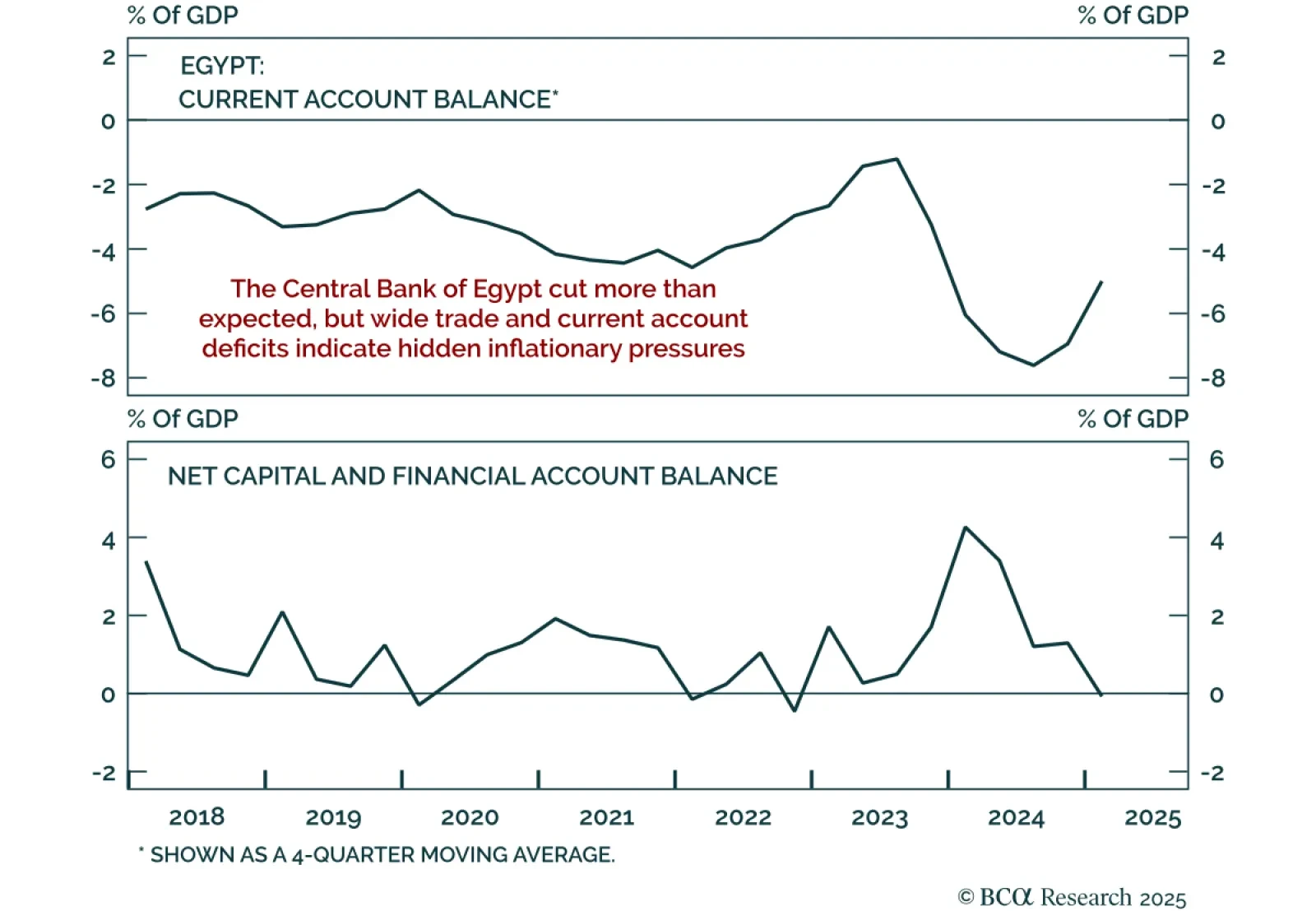

Egypt’s surprise 200 bps rate cut raises risks of re-accelerating inflation and currency pressure. The Central Bank of Egypt lowered the overnight lending rate to 23%, a larger-than-expected move. Our Emerging Markets strategists…

Downward pressure on the pound will rise in the coming months. Inflation will go up, so will bond yields. It’s time to book profits on Egyptian domestic bonds.

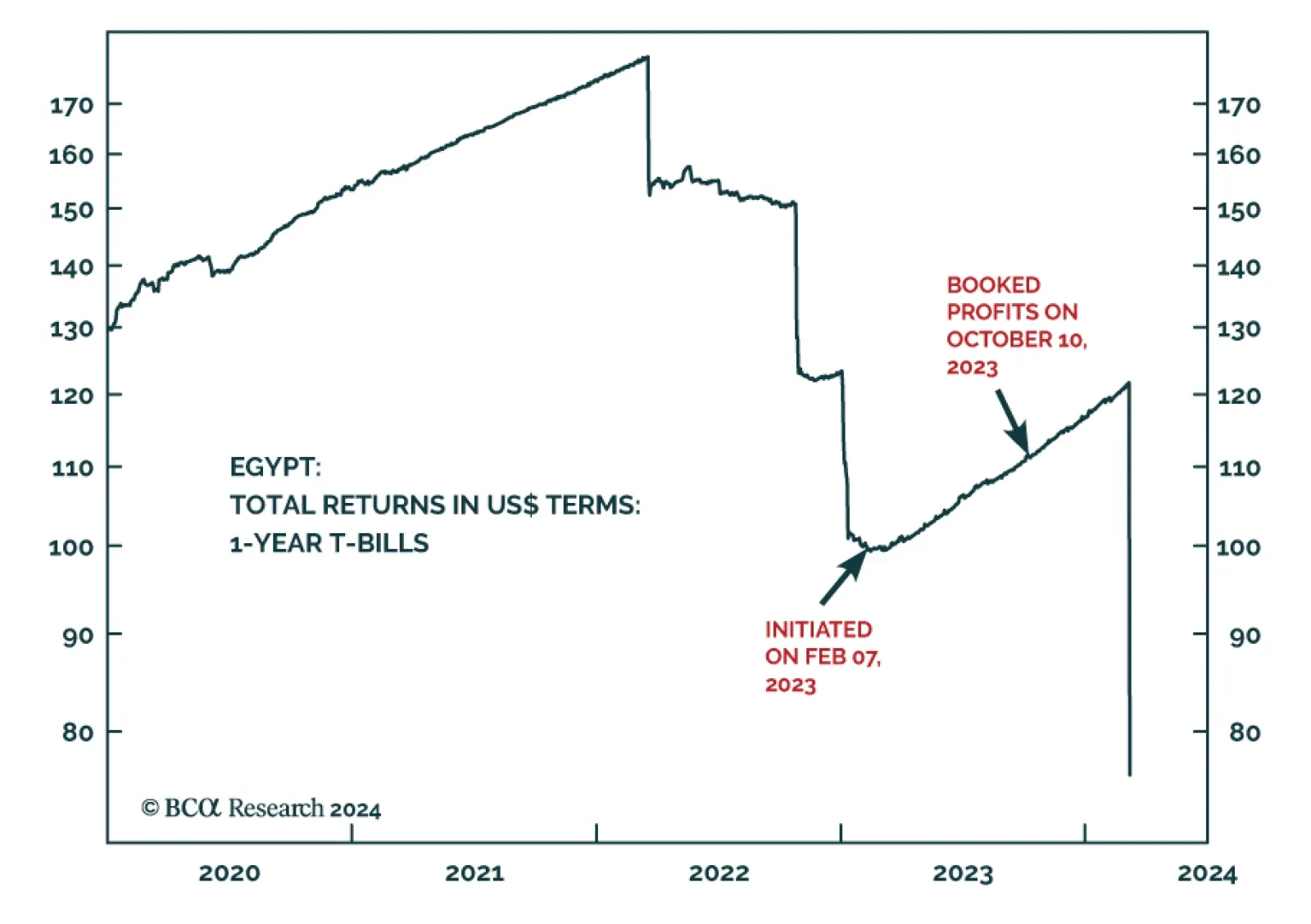

Our Emerging Market Strategy (EMS) colleagues recommended booking an 11.4% gain on their Egyptian T-bill trade initiated earlier in the year. Now that currency-devaluation risk has been removed from the picture for the…

After the significant devaluation of the pound, we now recommend going into Egyptian assets again.

Investors should book profits on our long Egyptian Treasury bill trade as the outlook for the Egyptian pound has worsened. The position has generated an 11.4% return in US dollar terms since its initiation eight months back.

The risk-reward profile of Egyptian domestic bonds are very attractive over the next six to 12-months. Go Long.

Executive Summary The Egyptian pound remains vulnerable to further devaluation due to a large external financing gap. Egyptian authorities are facing the “Impossible Trinity”. They cannot simultaneously determine the…

Highlights Tight fiscal and monetary policies under the auspices of the IMF agreement and a relatively benign balance of payments position will allow authorities to avoid currency devaluation in the next 6-12 months. However, these…

Highlights Authorities will be reluctant to devalue the currency this year to avoid a pass-through of higher global food prices into domestic food prices. Yet, chronically underwhelming economic growth will ultimately force the…