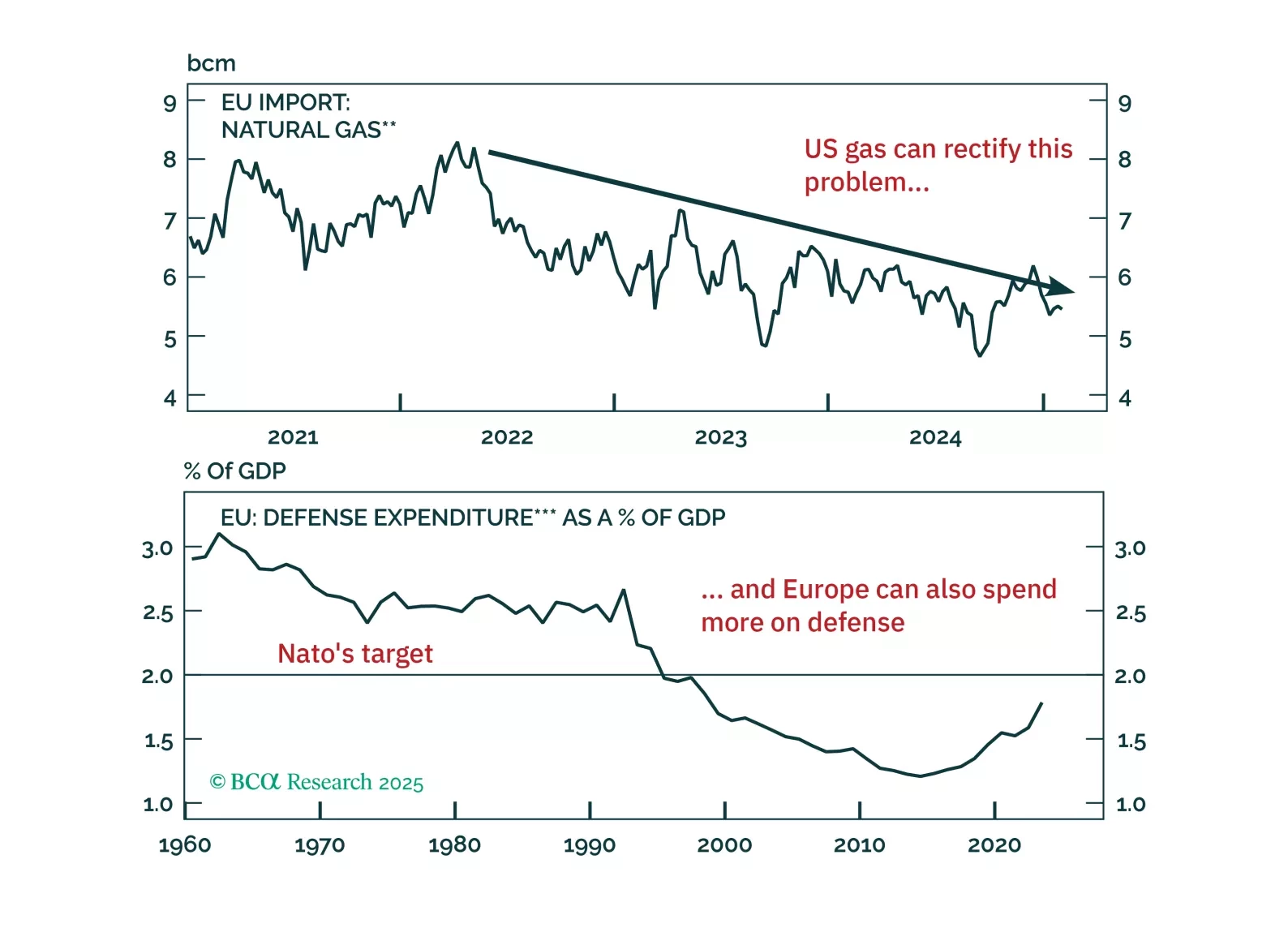

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

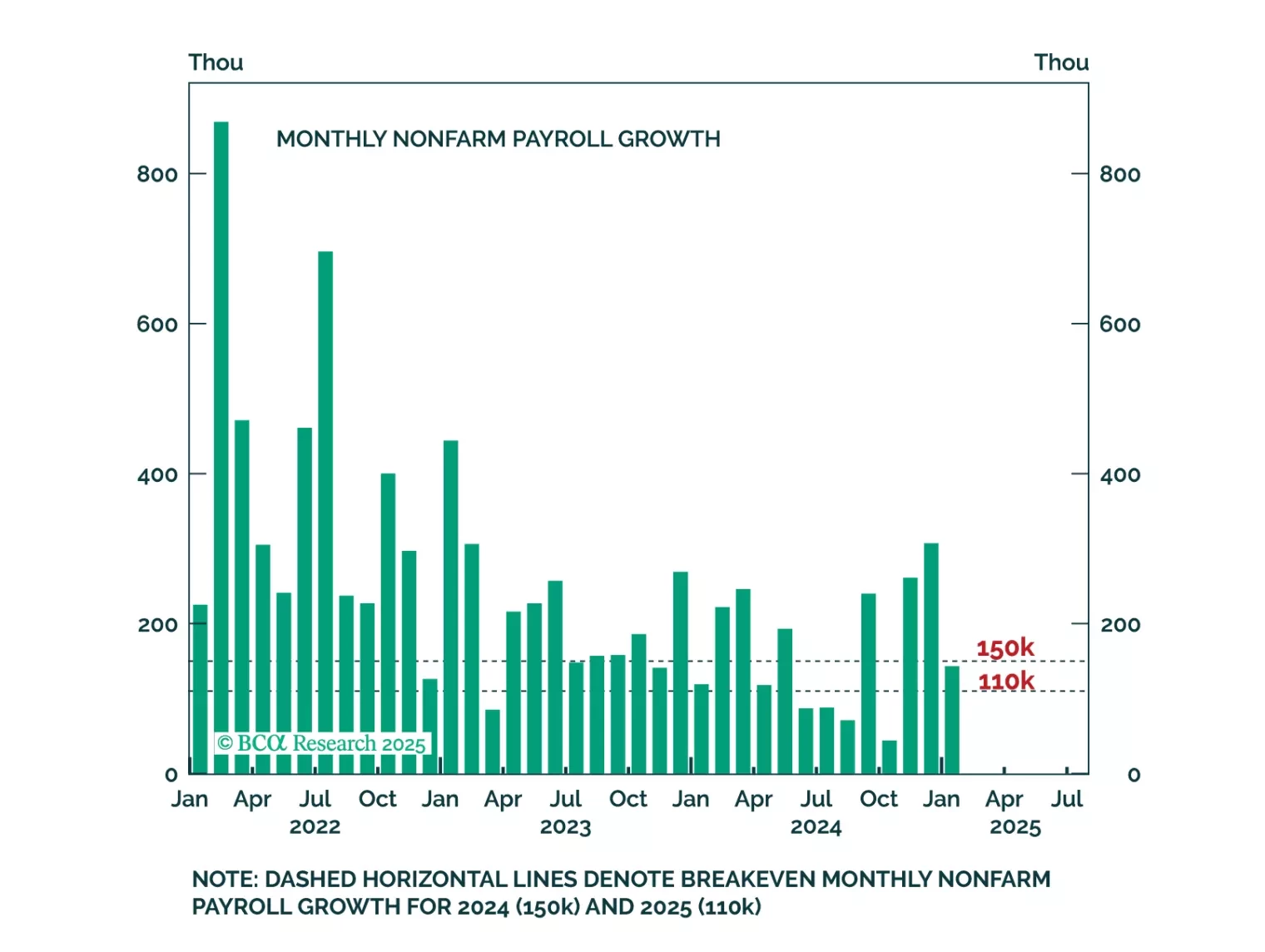

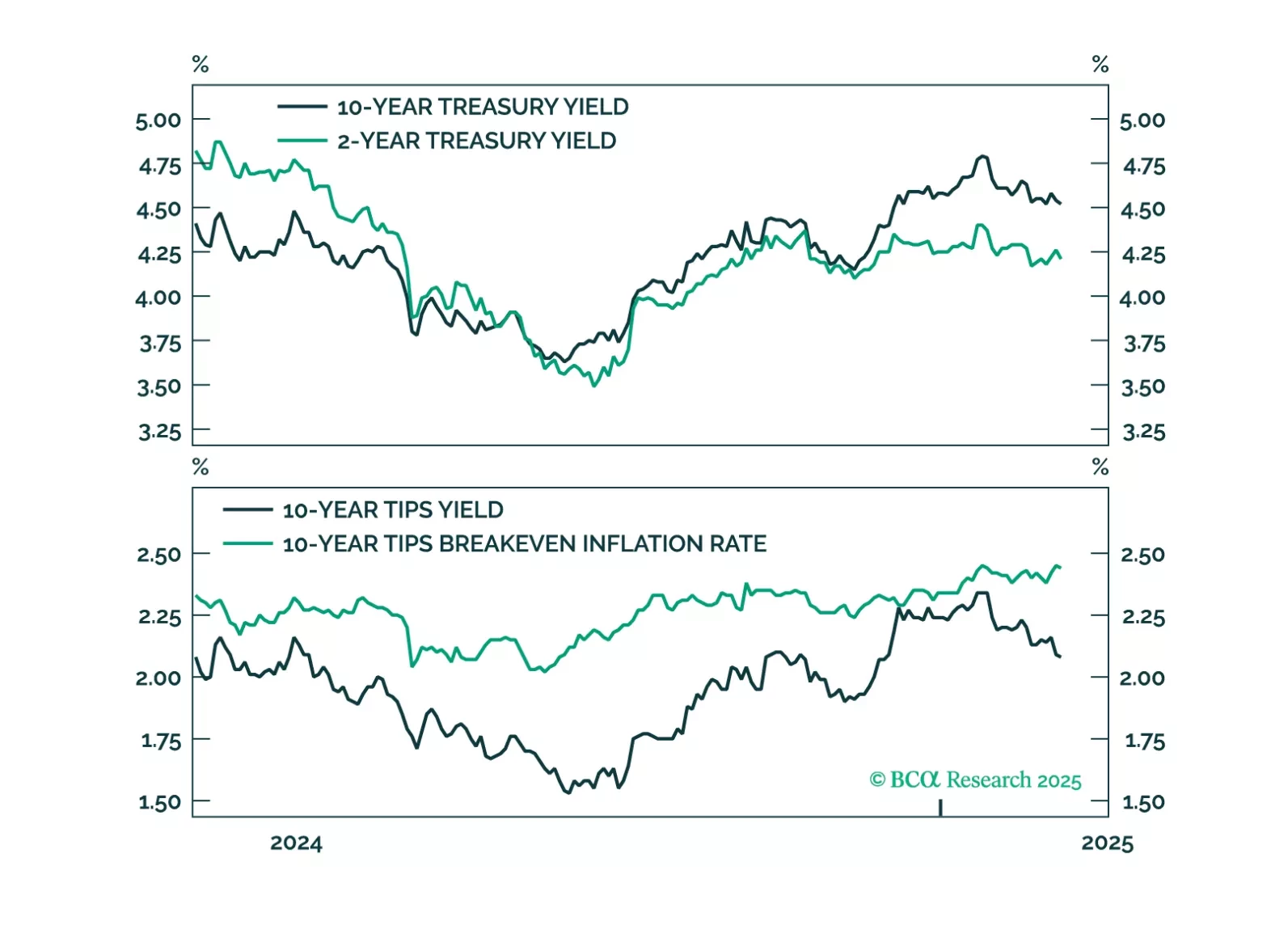

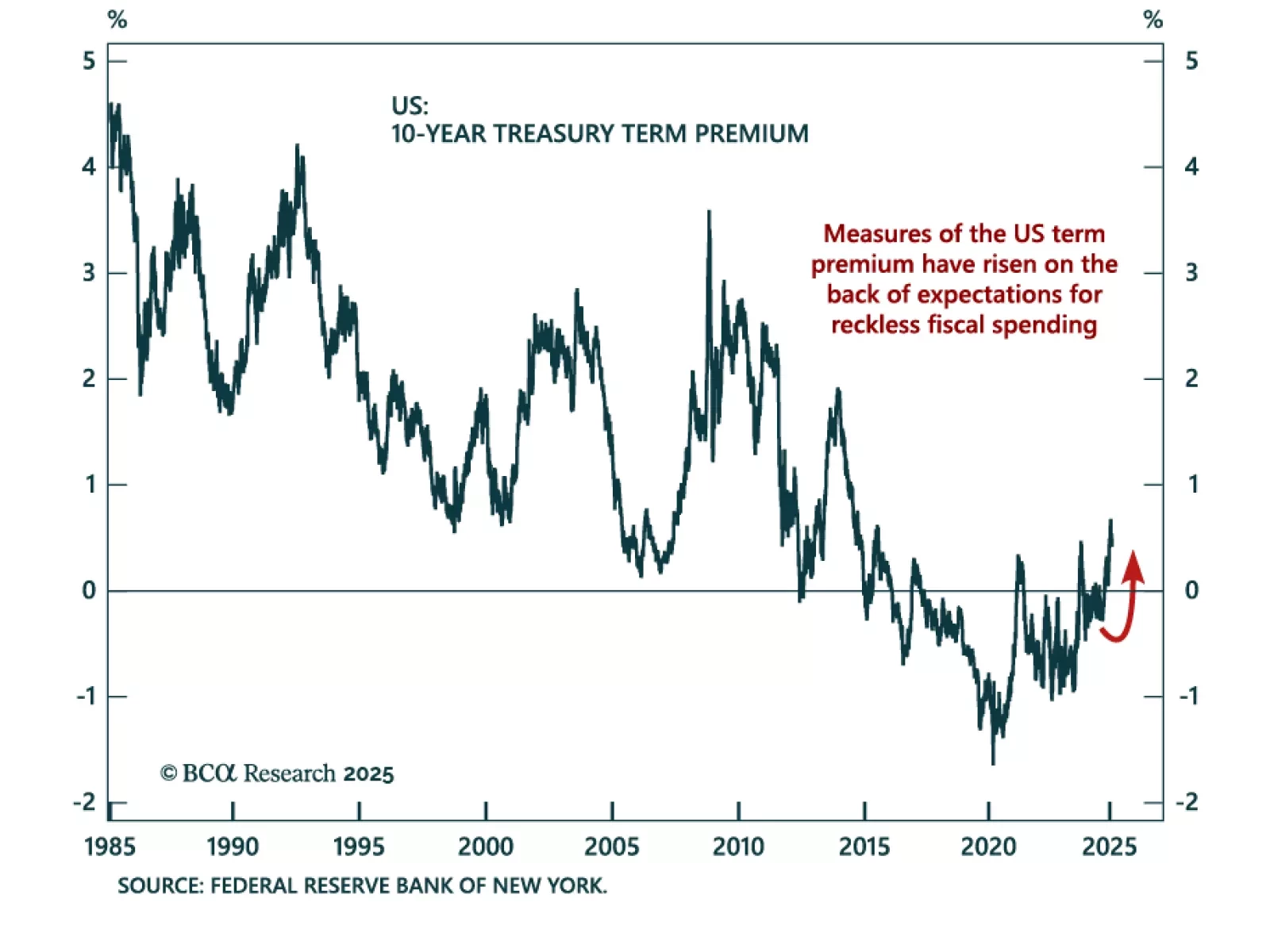

Some thoughts on this morning's employment data and Treasury Secretary Bessent's recent attempts to talk down the 10-year Treasury yield.

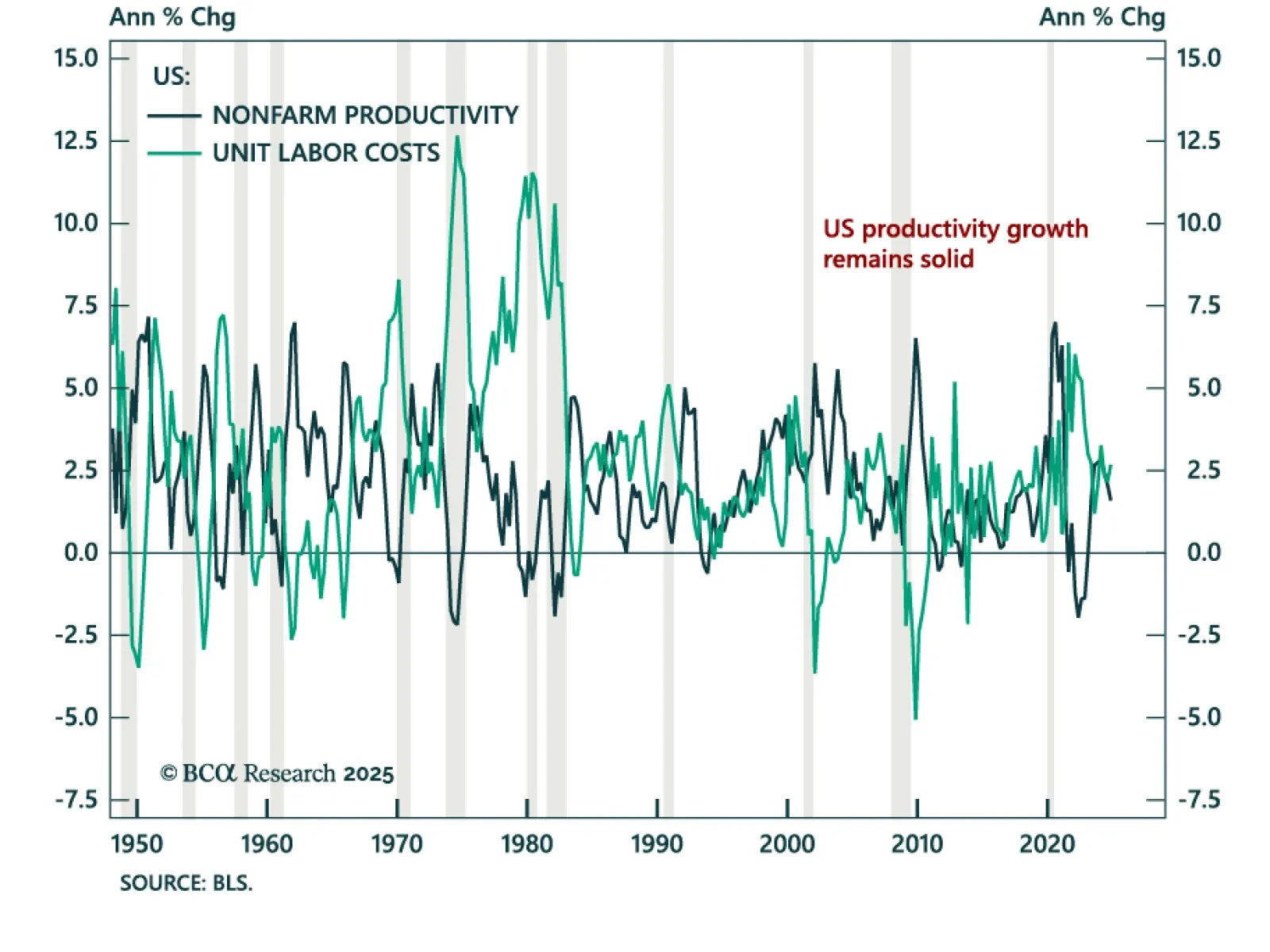

Preliminary nonfarm labor productivity for Q4 came in line with estimates, decreasing to 1.2% annualized growth from an upwardly-revised 2.3%. Unit labor costs growth was lower than expected, but still jumped to 3.0% from a…

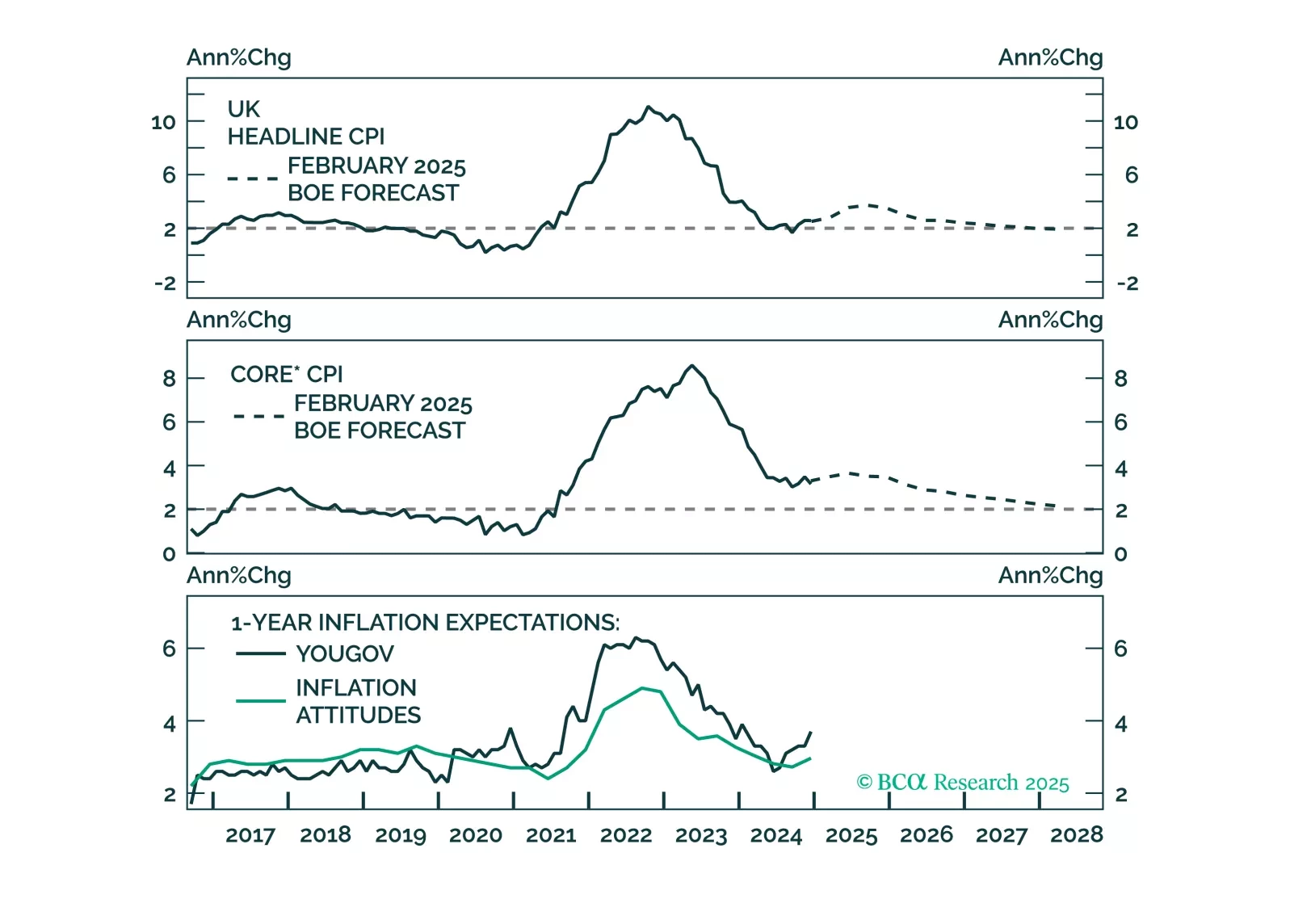

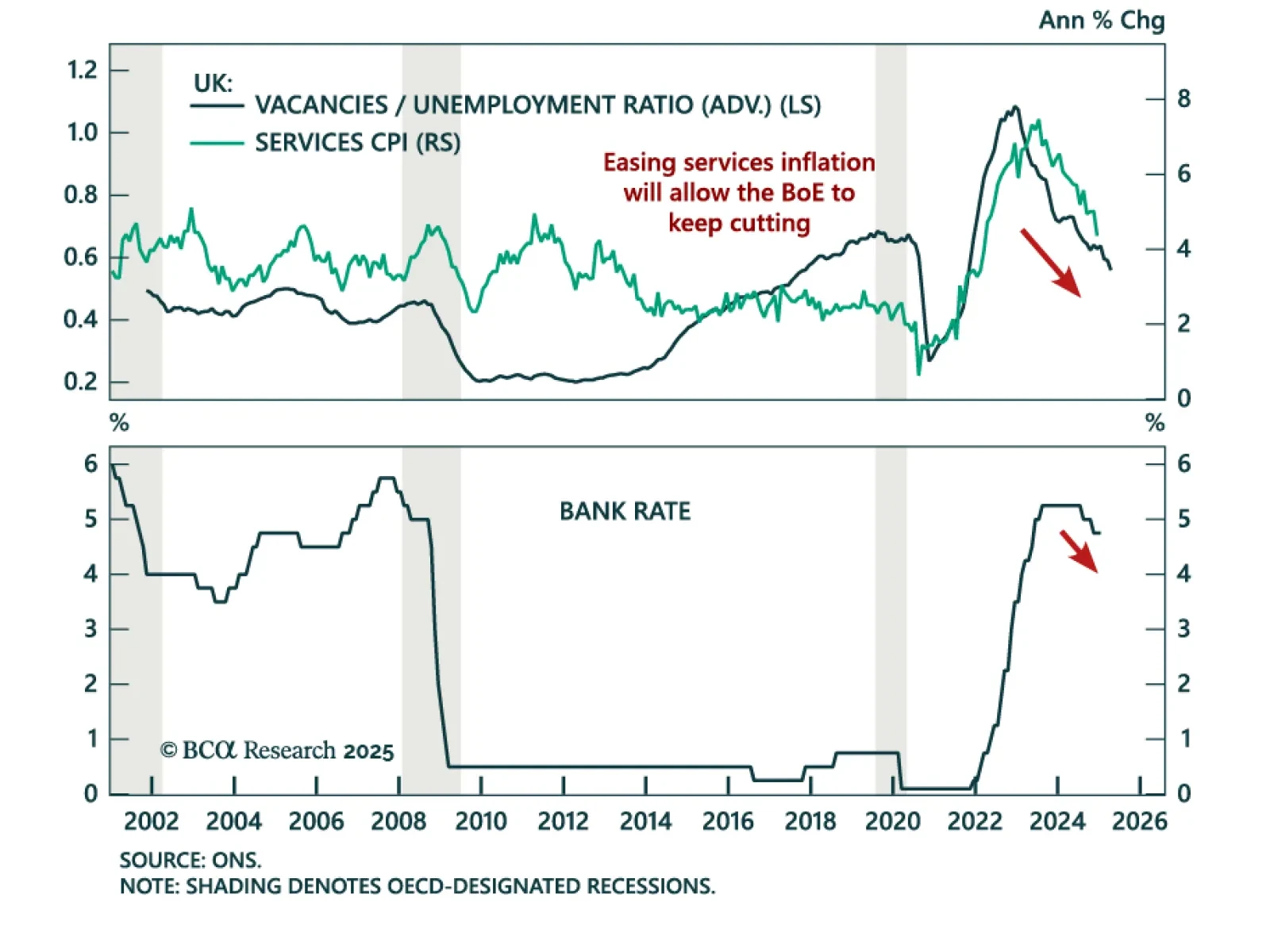

The Bank of England cut its policy rate by 25 bps to 4.5%, with two members of the MPC voting to cut 50 bps instead. The BoE acknowledged “substantial progress on disinflation”, driven by a tight policy stance and stabilized…

Treasury Secretary Scott Bessent commented that one of the Trump administration’s priority was lowering 10-year bond yields. Bessent’s 3/3/3 plan, boosting growth to 3% from deregulation, increasing US oil production by 3 mmb/d, and…

Following today’s Bank of England’s policy meeting, at which the policy rate was cut by 25 bps, we discuss our outlook for monetary policy in the UK. We expect the gradual easing to continue and discuss the investment implications…

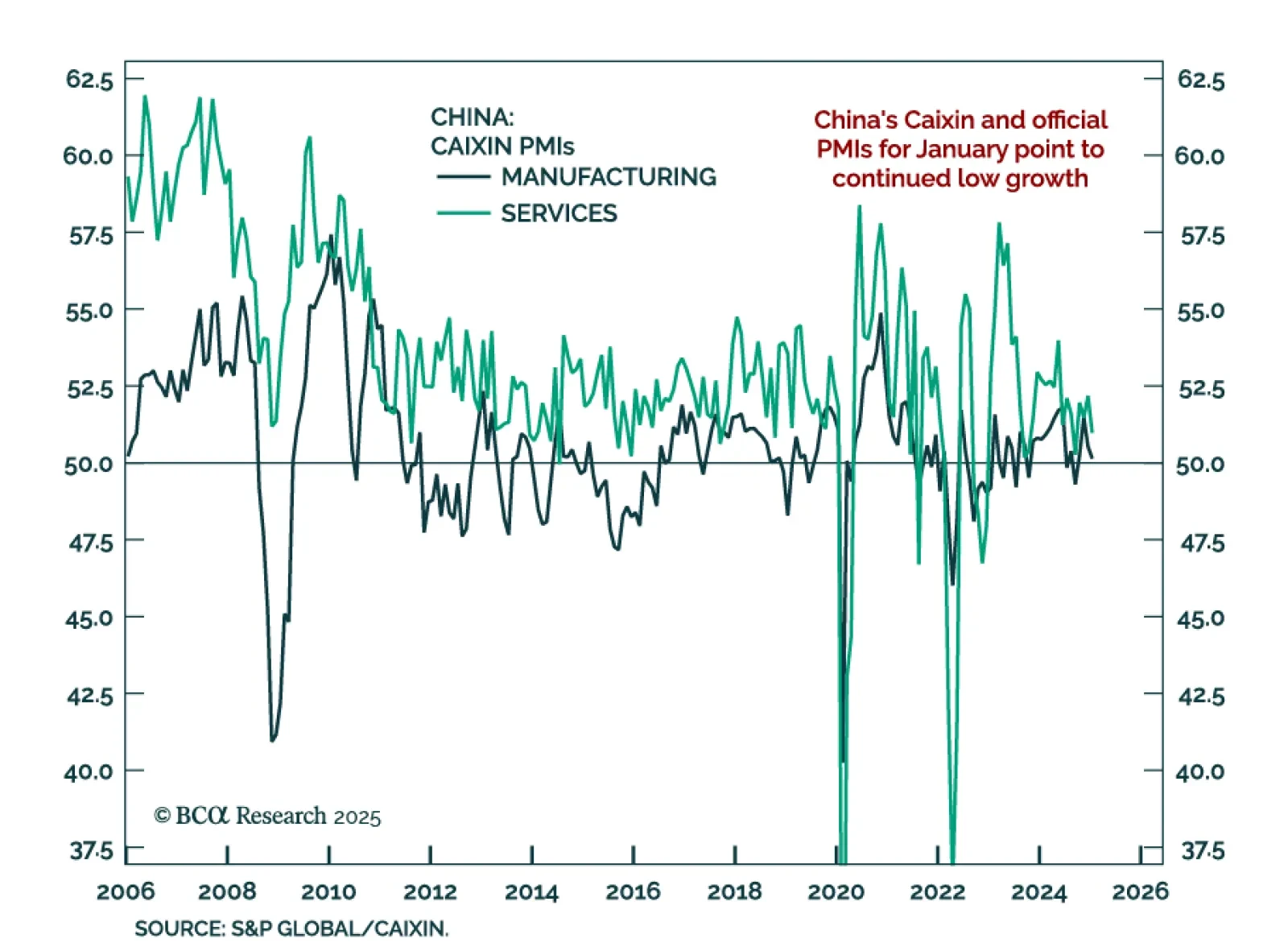

China’s Caixin PMIs decelerated in January, with the composite ticking down to 51.1 from 51.4. The decrease was driven by both manufacturing, which fell to 50.1 from 50.5, and services, which fell from 52.2 to 51.0. The data is…

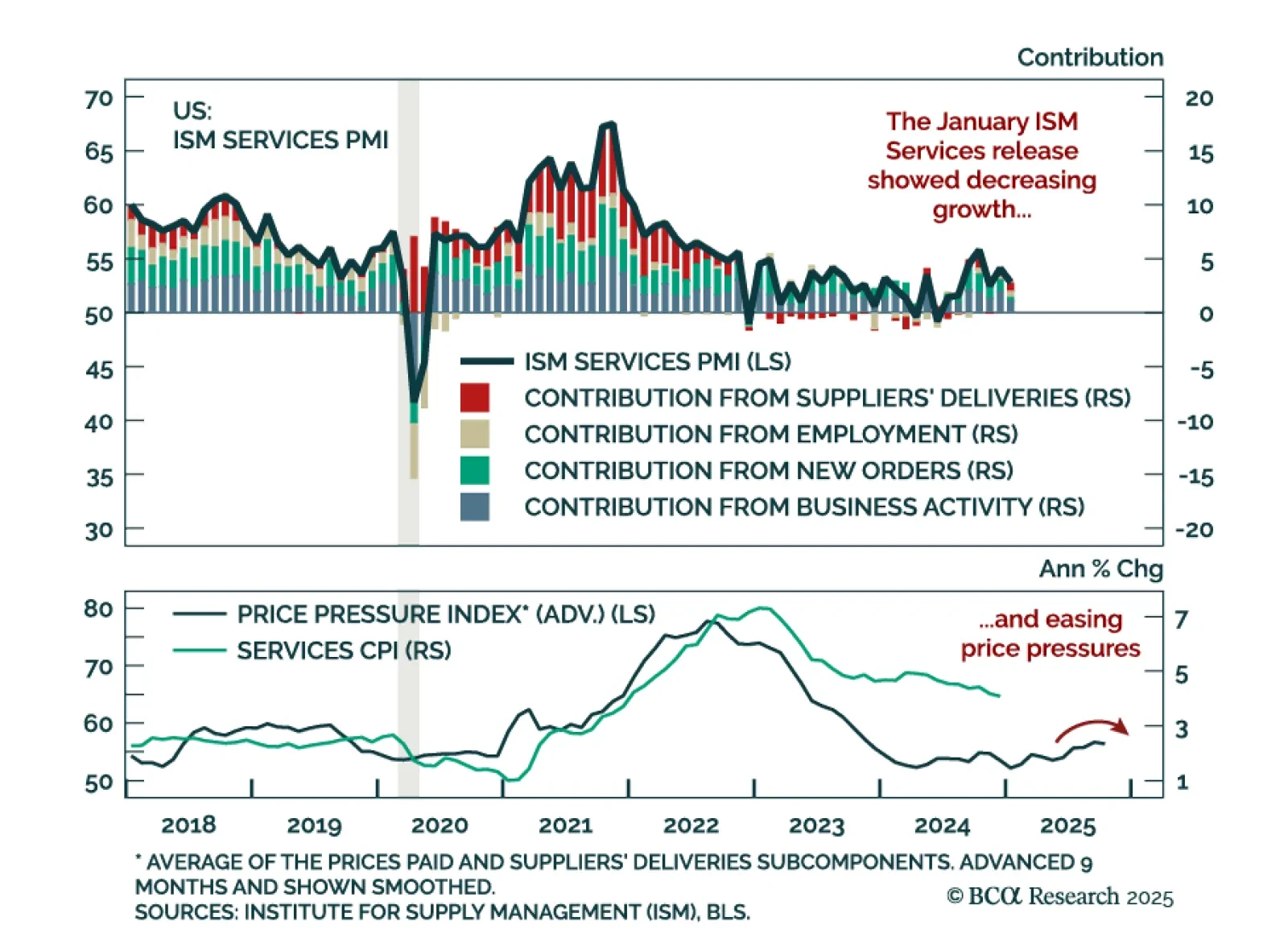

The January ISM Services missed estimates, decreasing to 52.8 from 54.0 in December. The move was driven by activity components, while employment and suppliers’ delivery times increased. Additionally, the prices paid measure…

Our Portfolio Allocation Summary for January 2025.