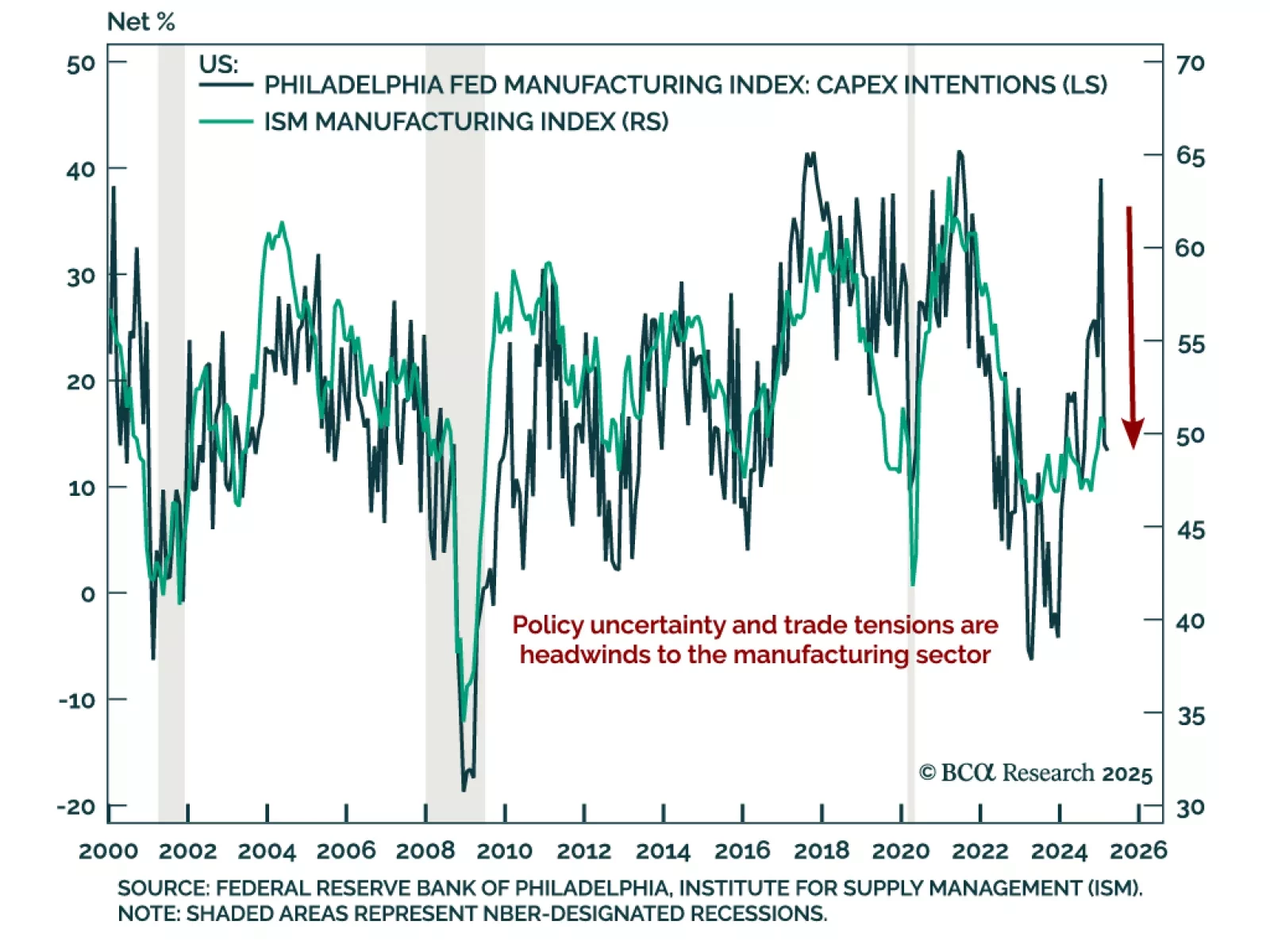

The March Philadelphia Fed Manufacturing index beat expectations, but still fell from 18.1 to 12.5, significantly down from January’s lofty 44.3 reading. Most activity components slowed except for current employment and work hours.…

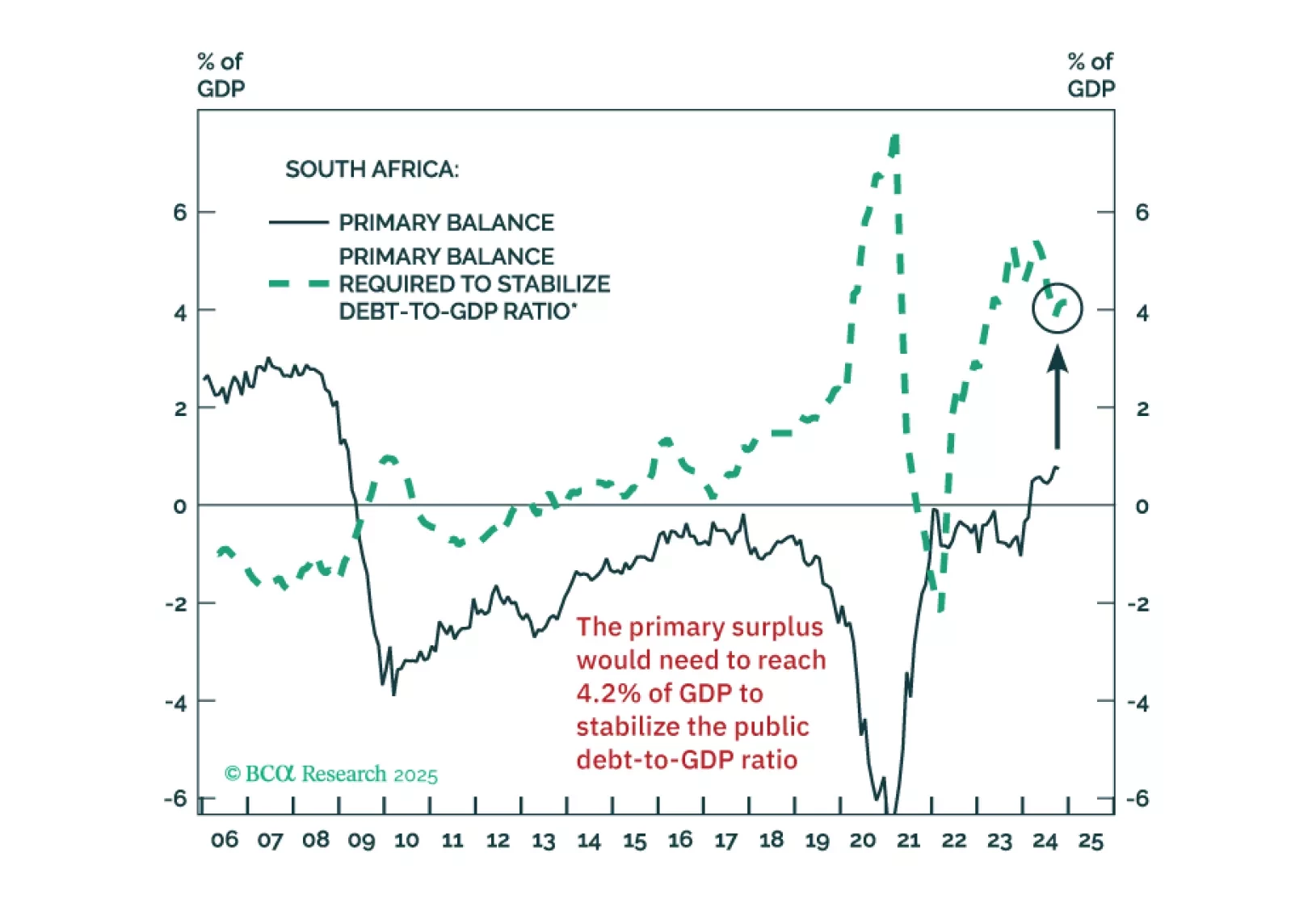

The South African government seems to believe that some fiscal retrenchment can stabilize the public debt-to-GDP ratio. But that’s a misconception. The country will need draconian spending cuts to achieve this.

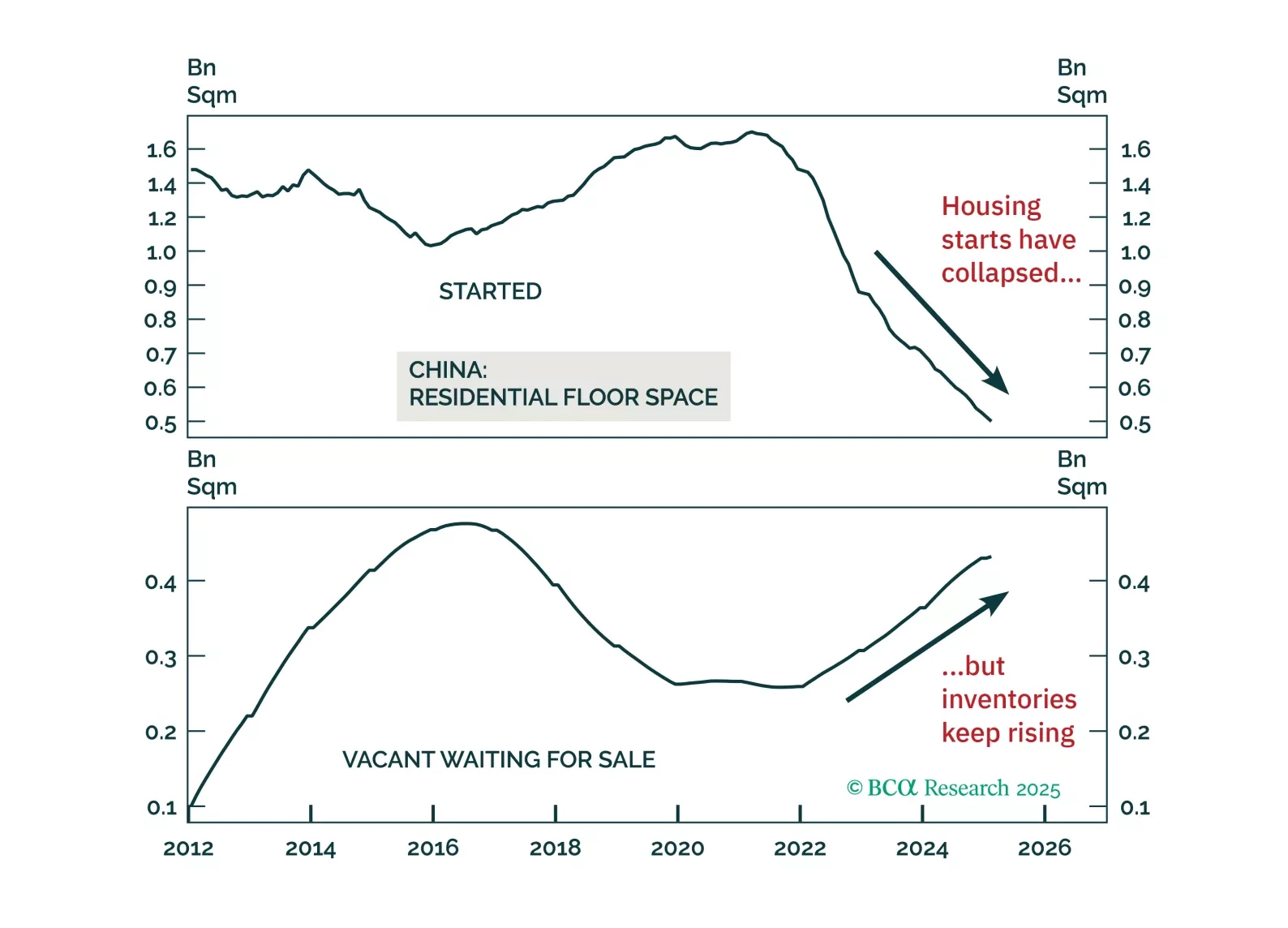

Data released this Monday suggests that while China’s housing market is no longer worsening, the secular adjustment remains ongoing. Although aggregate housing demand may be stabilizing at a low level, supply will continue to…

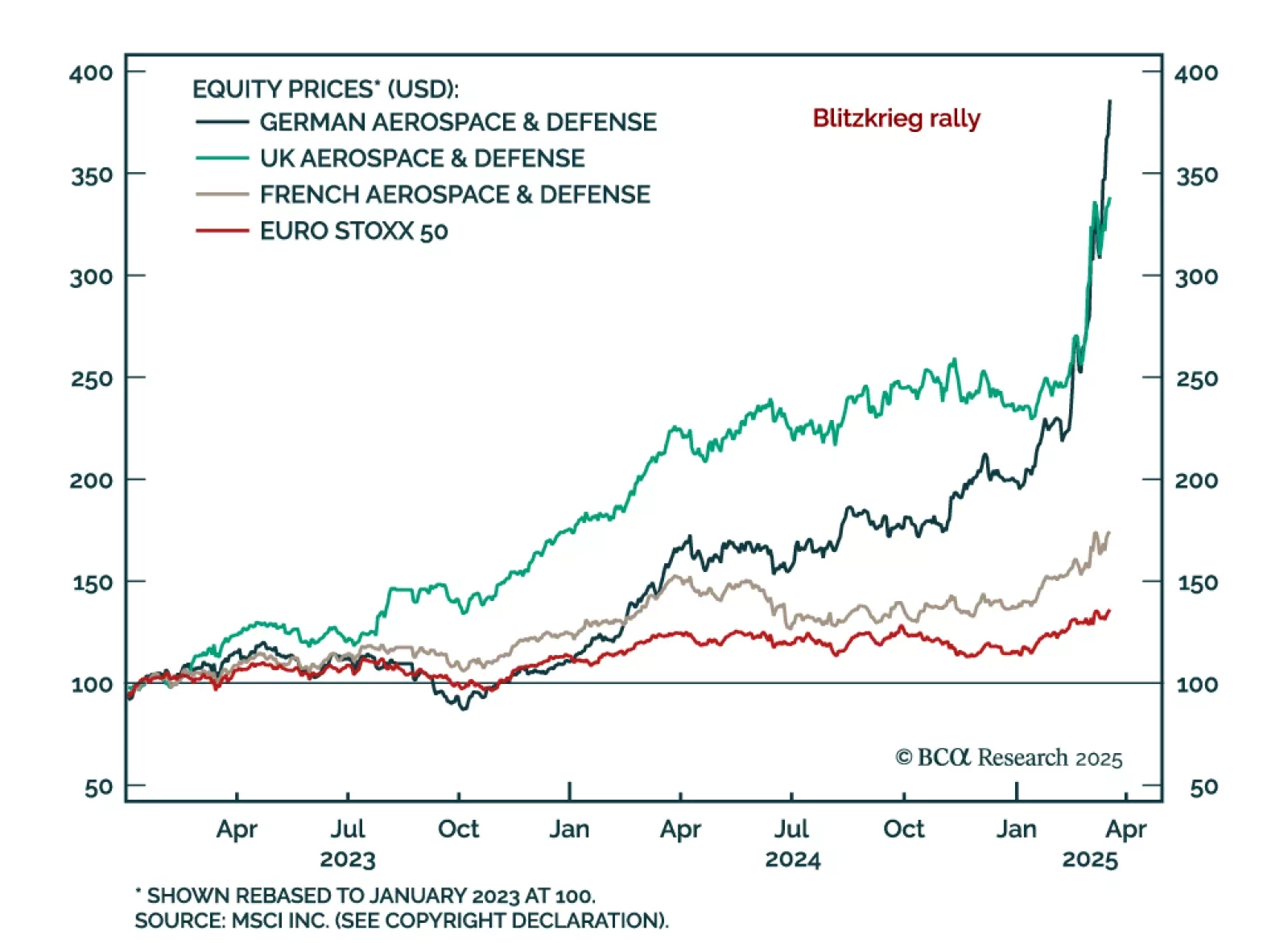

Our European strategists looked at the European defense sector after the massive rally following Germany’s fiscal turnaround. The rally in European defense stocks, up over 100% since their March 2023 recommendation, is…

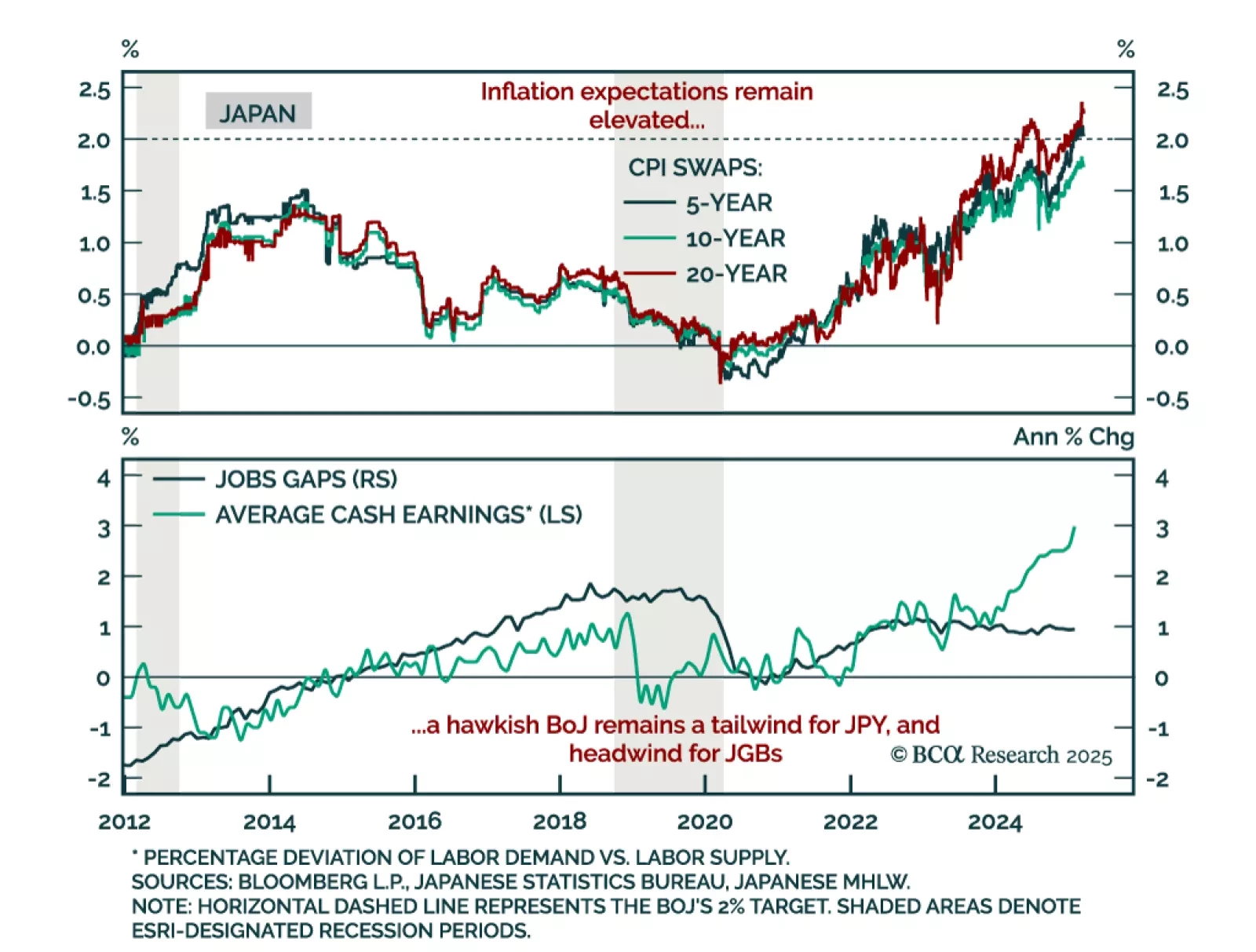

The Bank of Japan left rates unchanged at 0.50%, but maintained a hawkish bias, making it the only G10 central bank in a hiking cycle, as the hot labor market creates sustained domestic price pressures. More rate increases are…

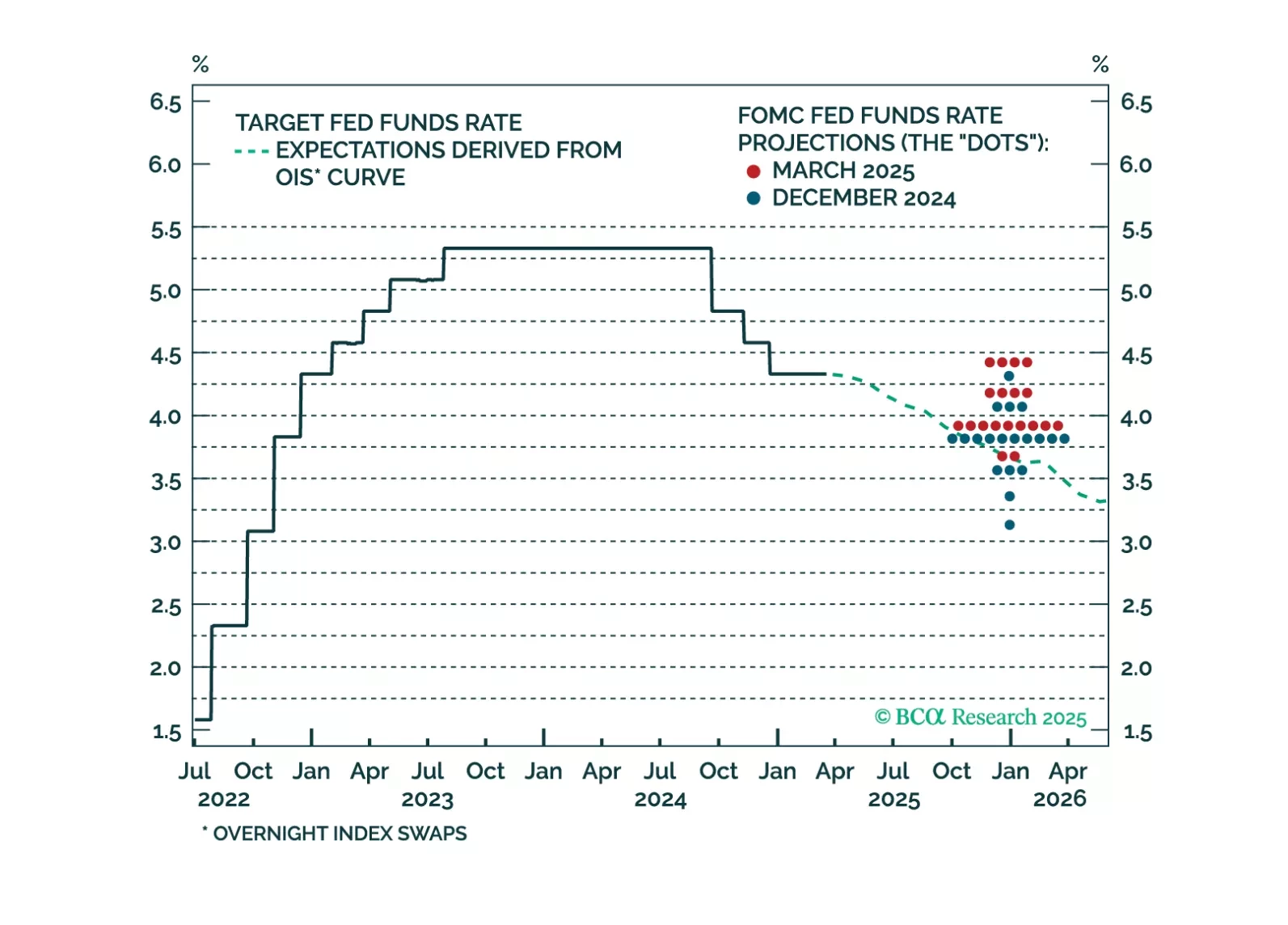

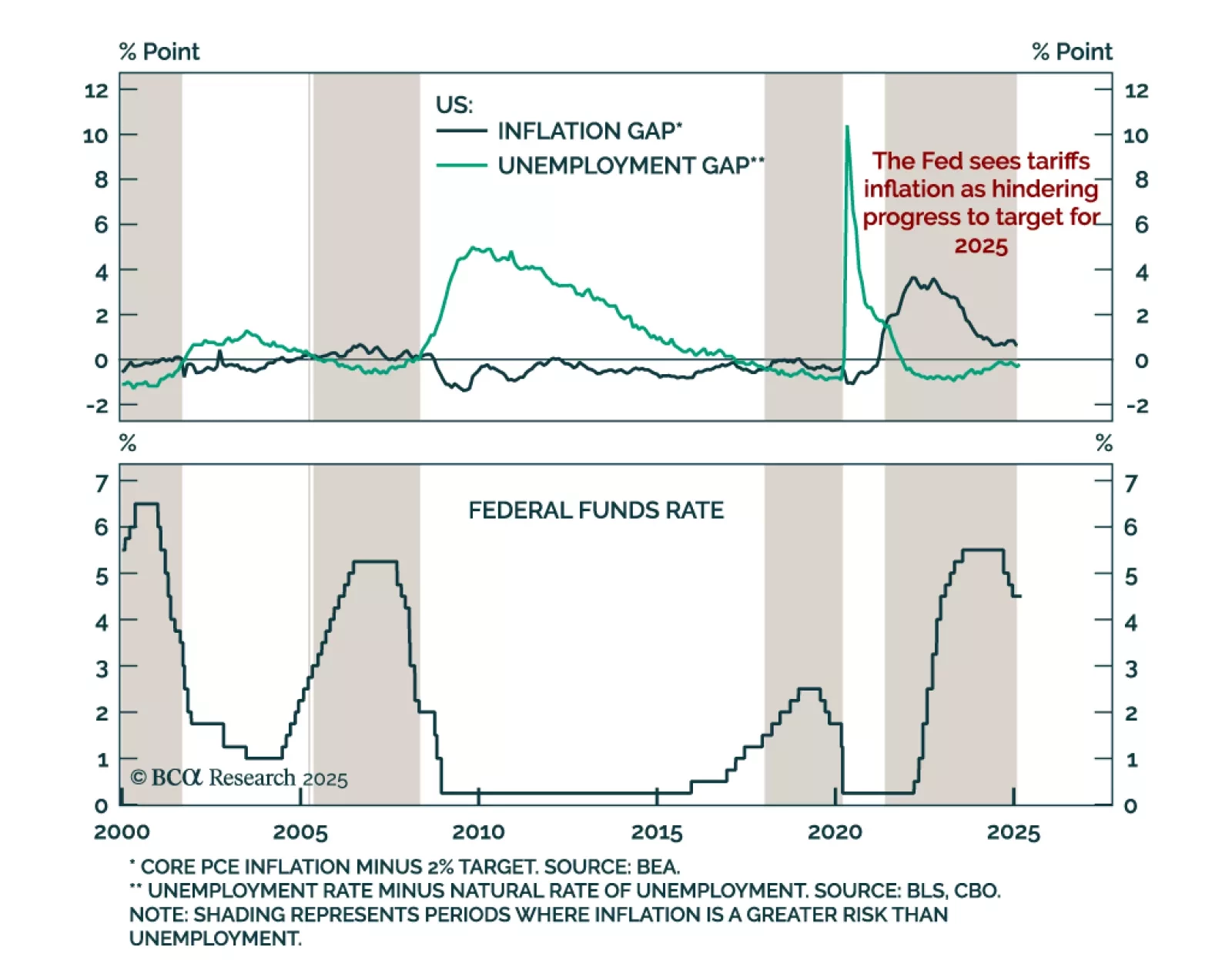

The Federal Reserve held rates at 4.25%-to-4.5% as expected, and slowed down the pace of quantitative tightening. The FOMC remains comfortable waiting and assessing the impact of recent and upcoming policy changes. The dots reflected…

The market reaction to this afternoon’s Fed meeting looks overdone. Investors could be in for a hawkish surprise when it becomes apparent that the Fed won’t ease policy into higher tariff-driven inflation prints.

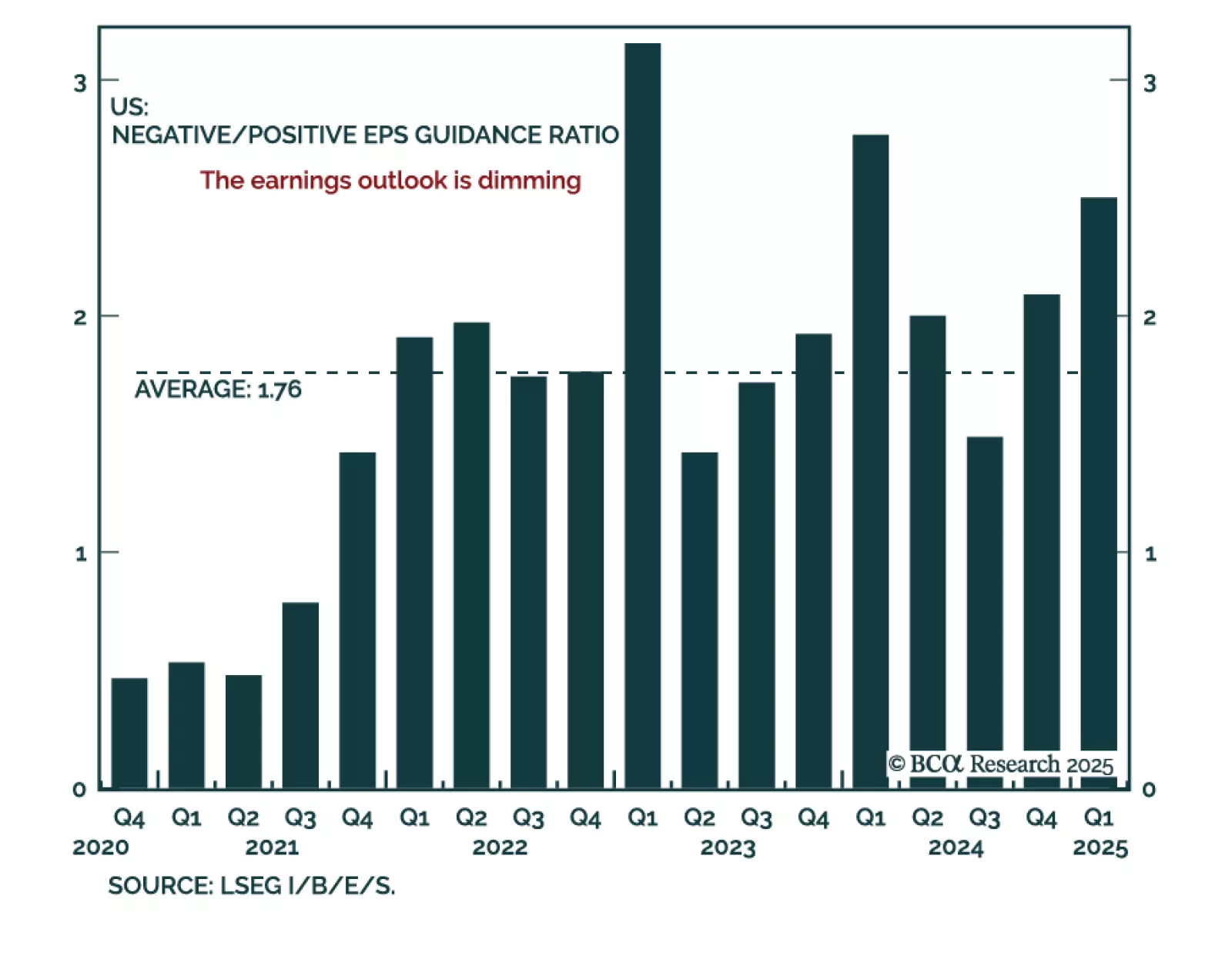

Our US Equity strategists assessed what companies are saying about tariffs, the US dollar, and the US consumer during their latest earnings calls. Q4 earnings were strong, with earnings and sales growth exceeding expectations.…

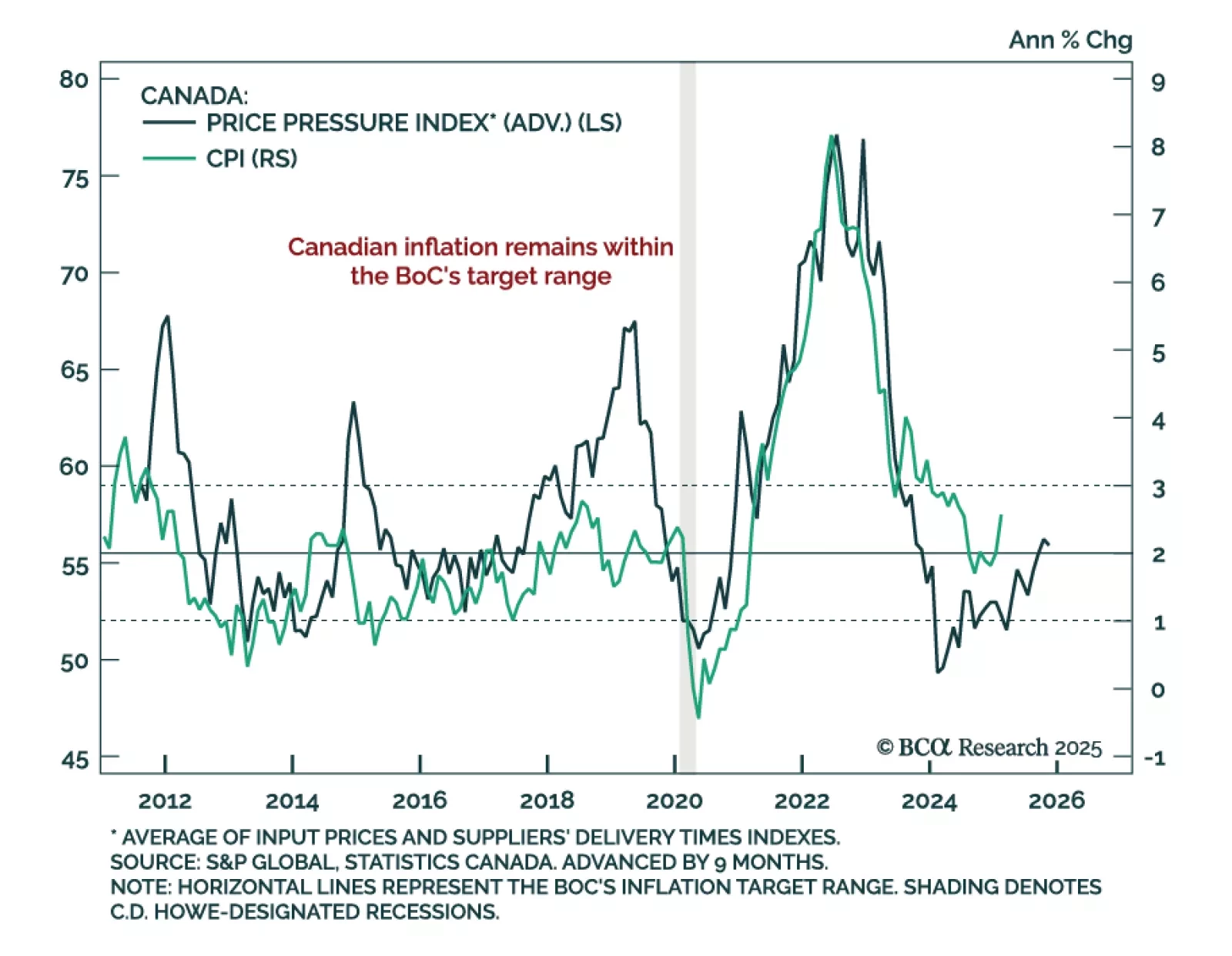

February Canadian headline inflation was stronger than expected, rising to 2.6% y/y from 1.9% in January. The Bank of Canada’s core measures were also slightly hotter than expected, both rising to 2.9% from 2.7% a month prior, near…

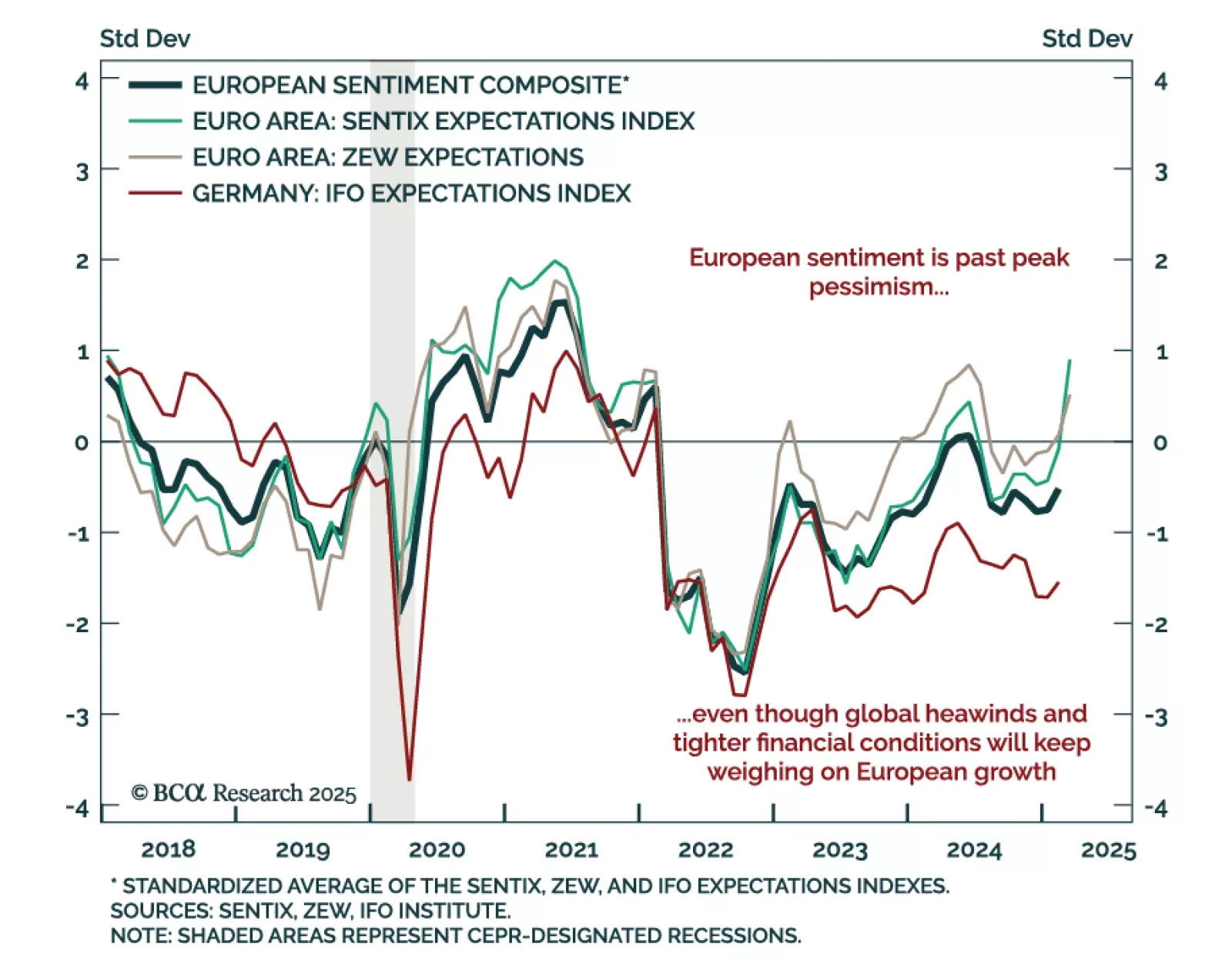

The March ZEW index for Germany and the eurozone beat estimates, with the expectations component rising to 51.6 from 26.0 in February. The current situation assessment only marginally improved yet remains deeply negative at -87.6.…