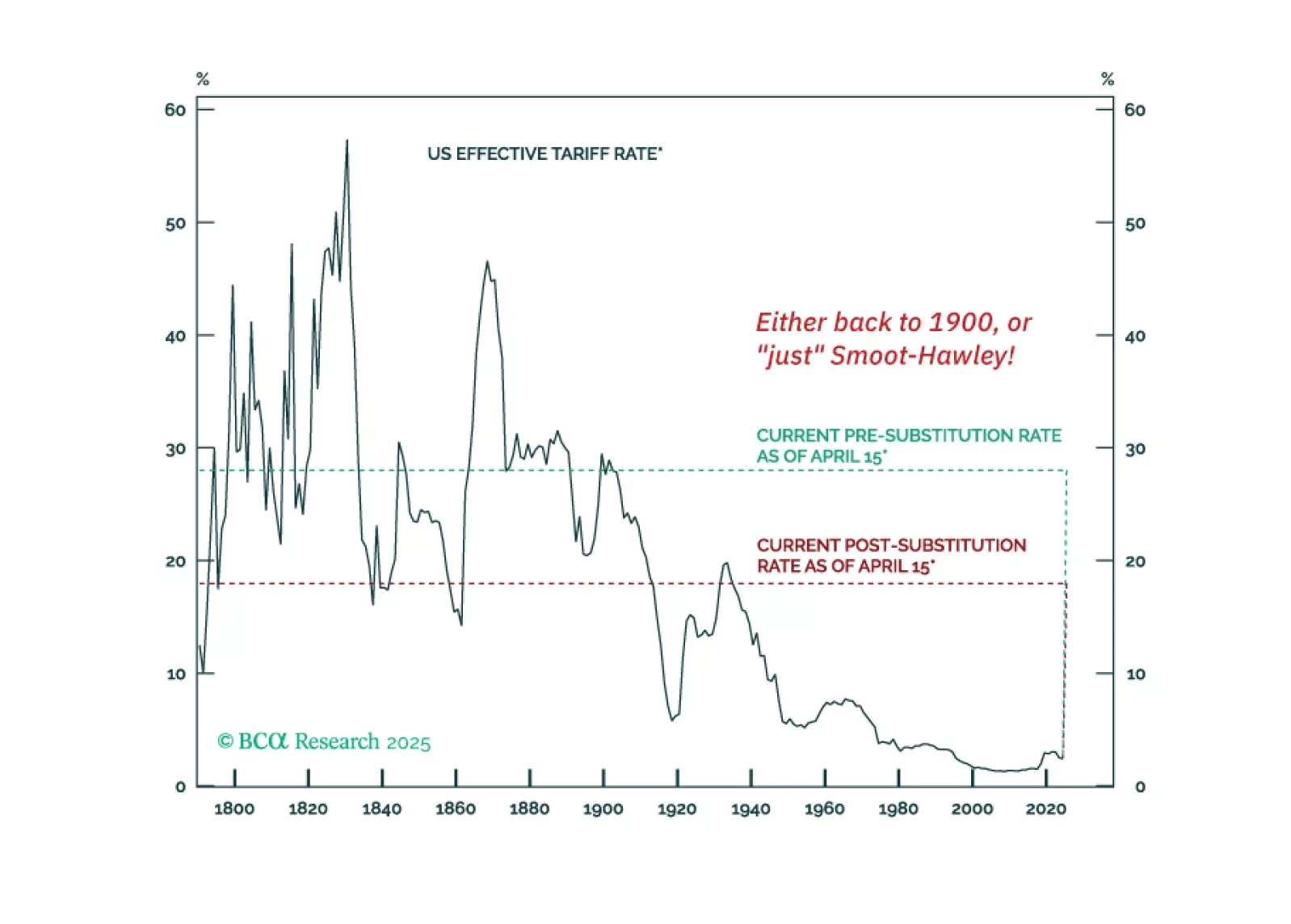

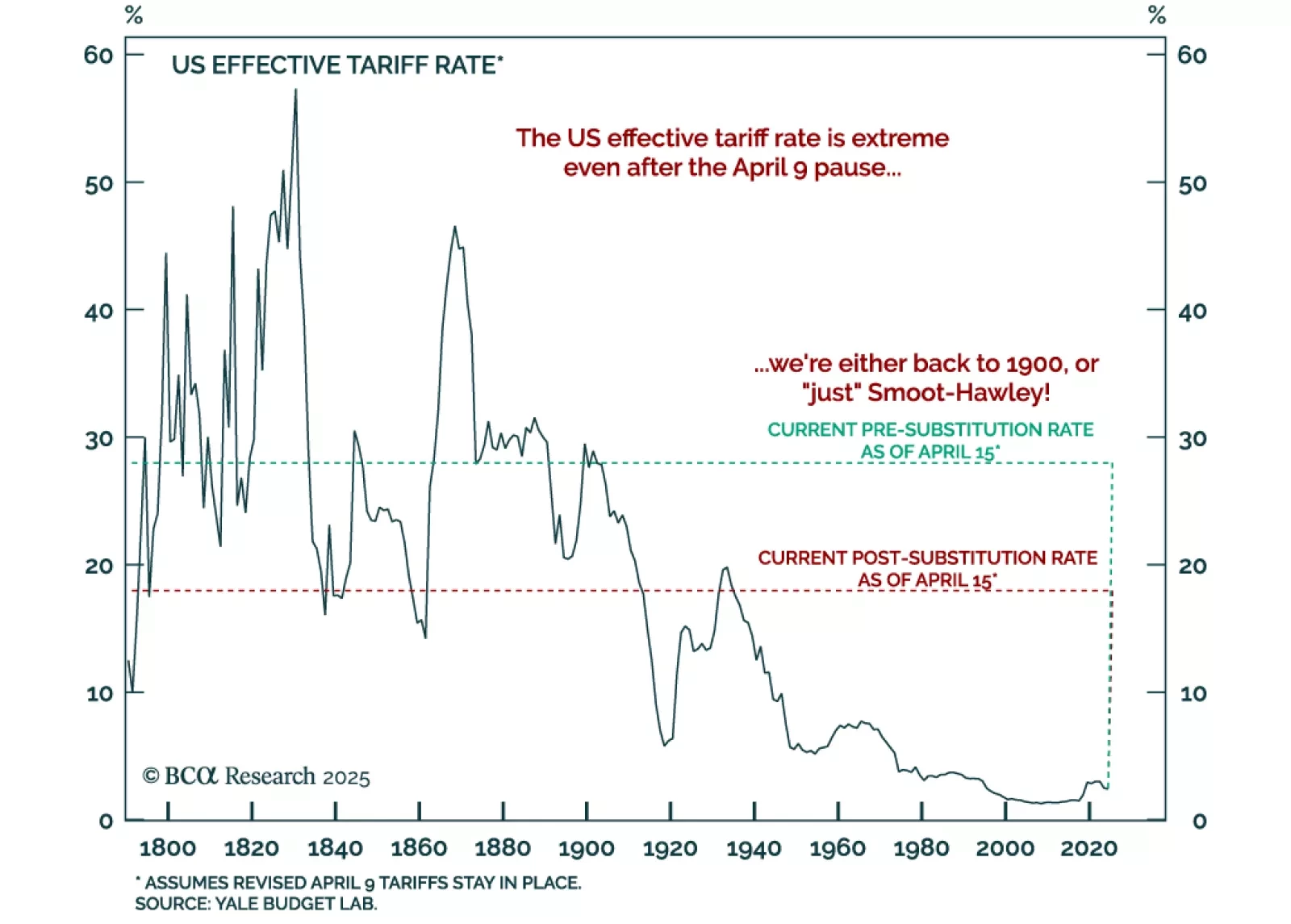

BCA’s House View recommends staying underweight stocks versus bonds, even in a stagflationary scenario. The US and global economies are likely to enter a recession this year unless tariffs are swiftly reversed or meaningful fiscal…

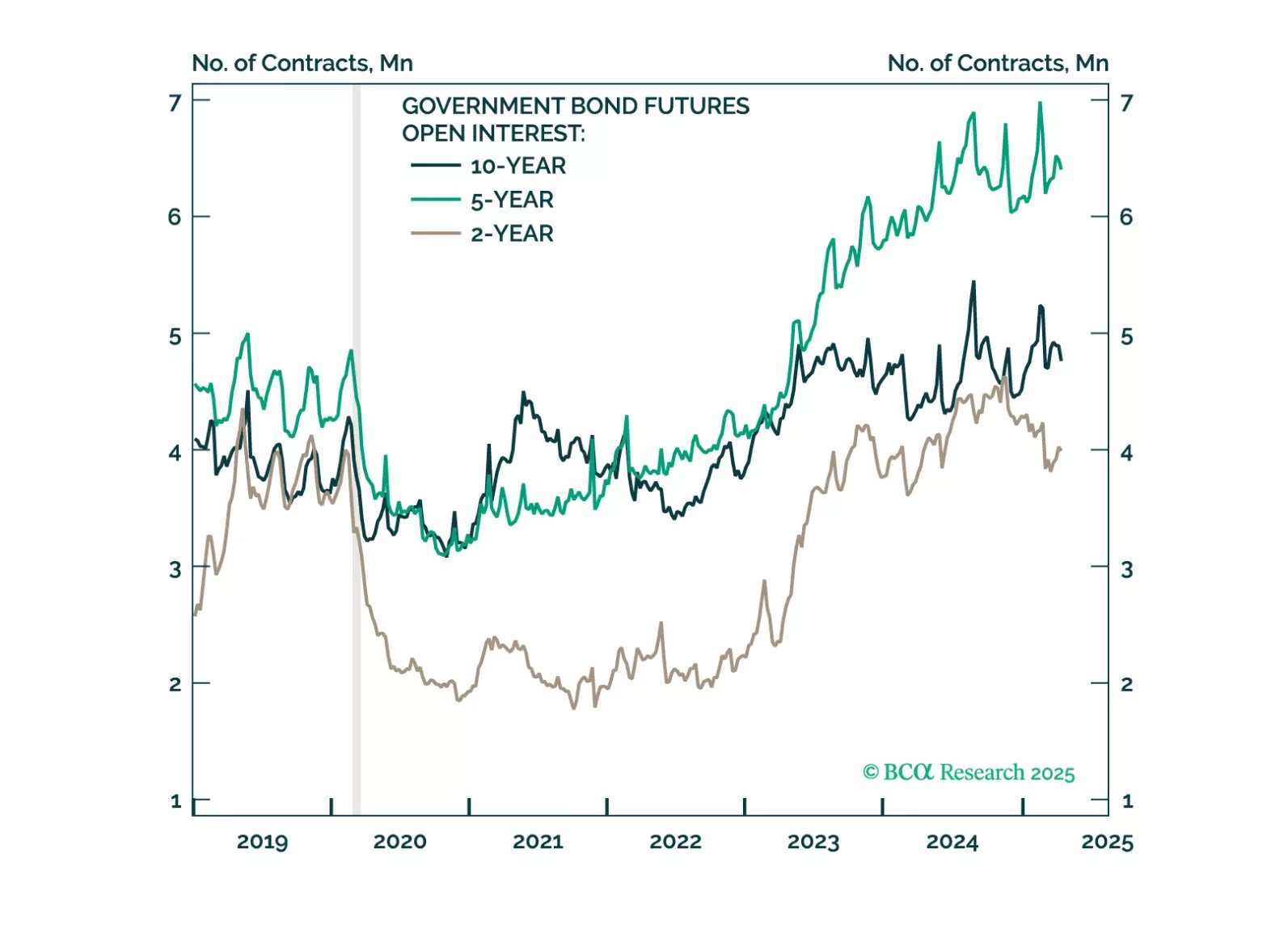

US Treasuries typically outperform both equities and global government bonds during downturns. Recent political shifts could lessen that outperformance this cycle, but we doubt it will disappear completely.

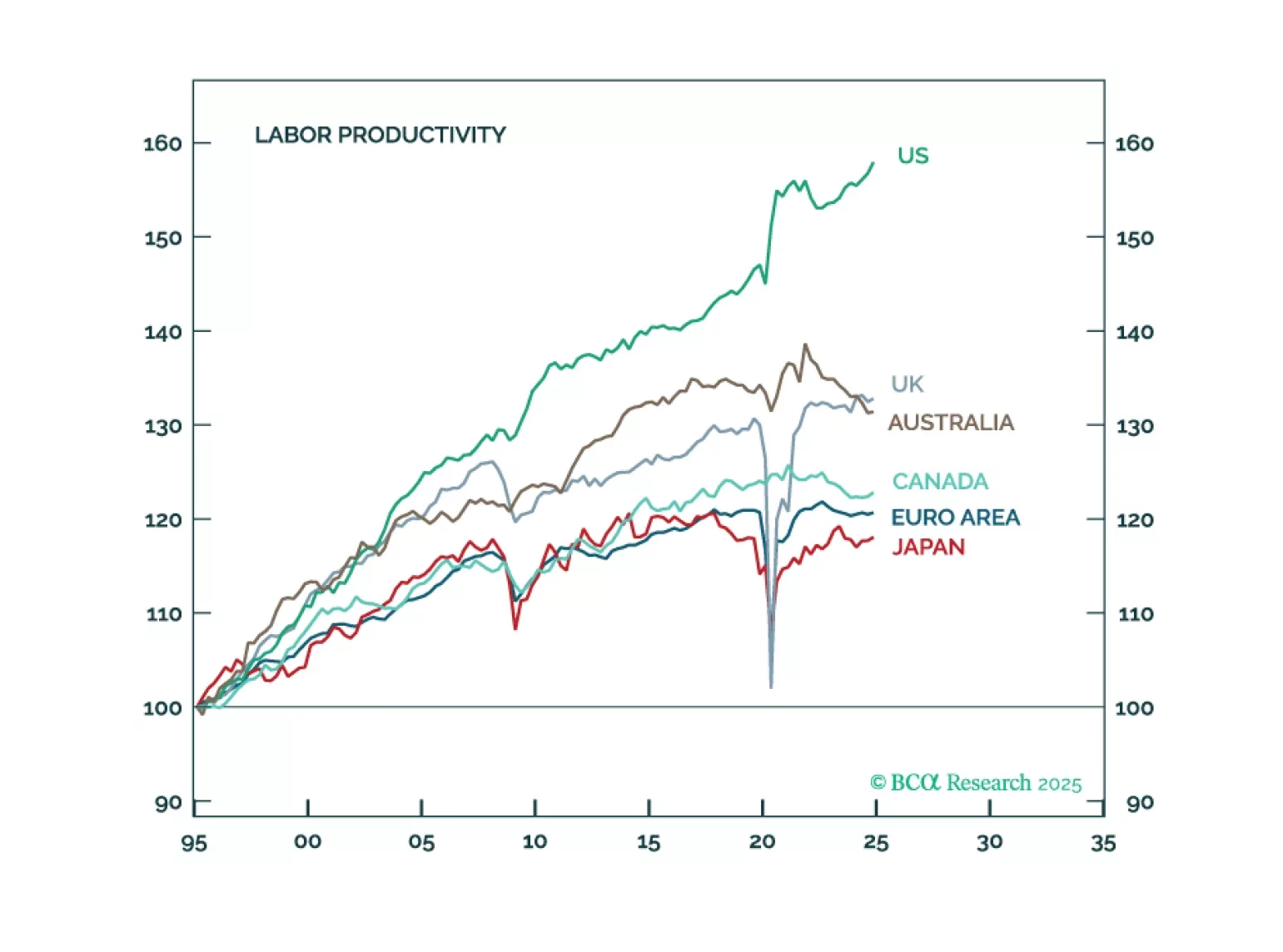

Although the sell-off in the US dollar and relative outperformance of non-US stocks will pause over the coming months as a global recession begins, the fading of US exceptionalism will still cause the dollar to weaken and US stocks…

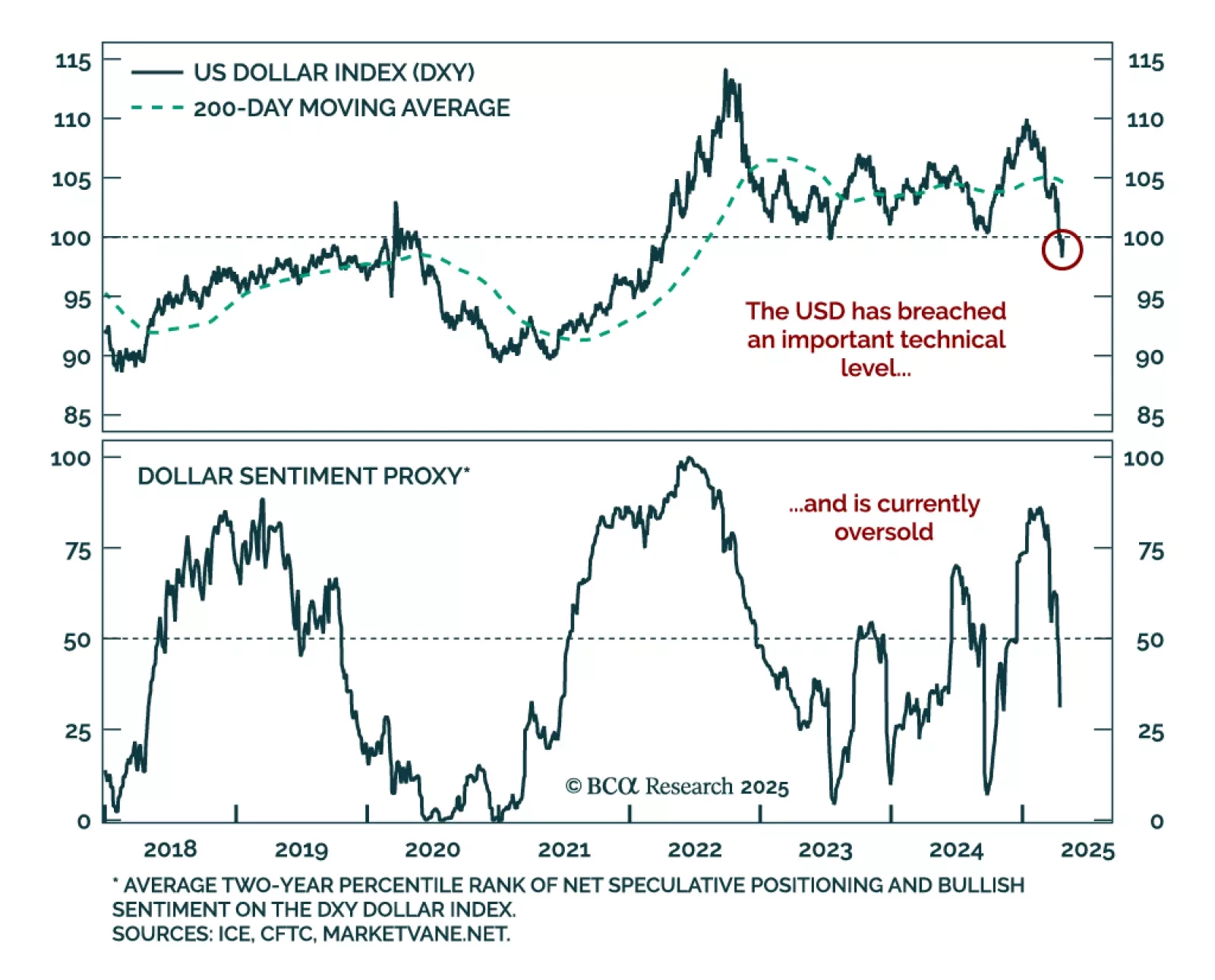

The US dollar’s underperformance since Liberation Day highlights shifting dynamics in global markets, but the recent “Sell America” move is overdone. During April’s market turmoil, the dollar failed to act as a safe haven, with US…

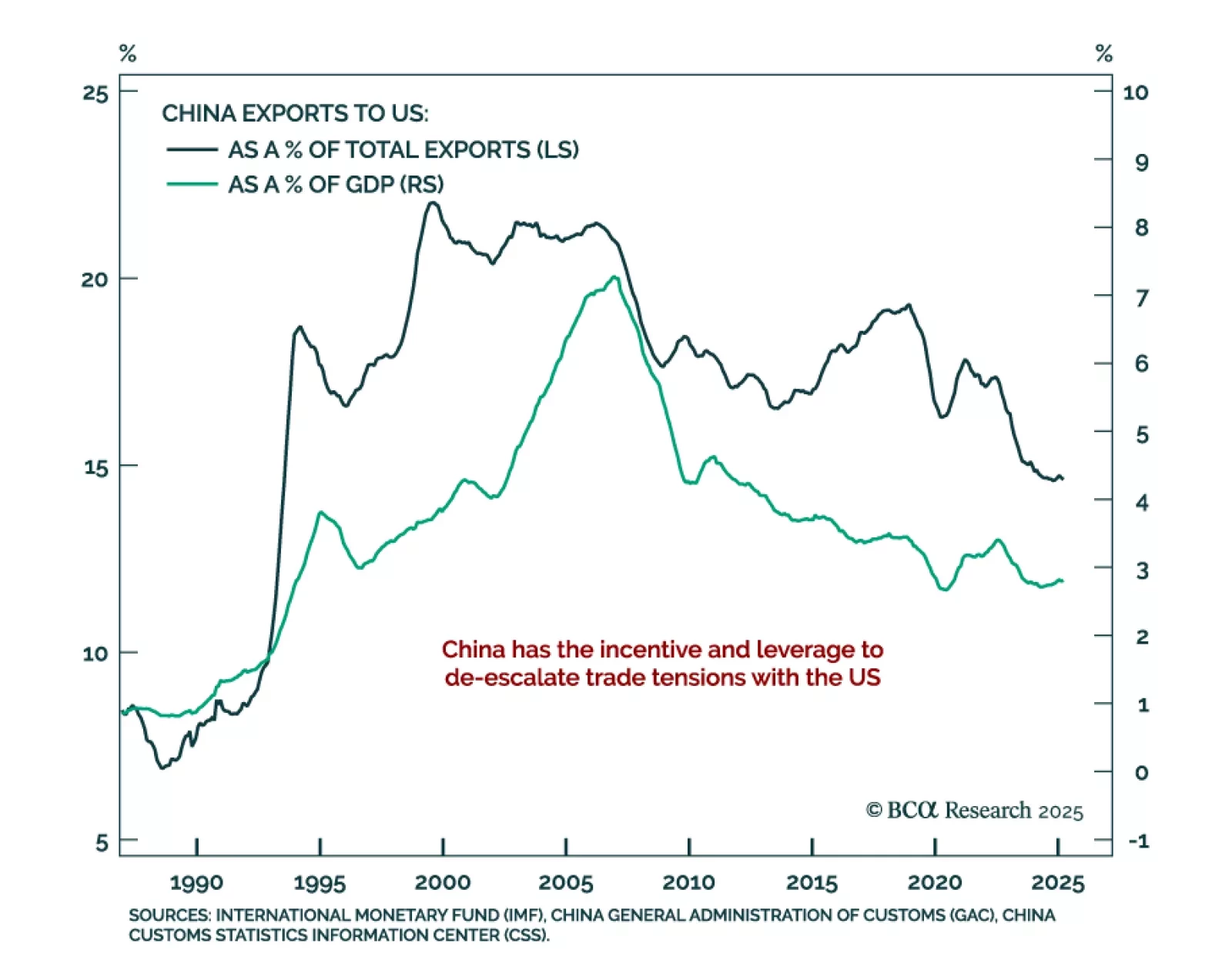

Trade headlines shift too fast to interpret reliably, but cutting through the noise reveals the US is pivoting from escalation to de-escalation. As the equity and bond selloff intensified, the tone from Washington softened,…

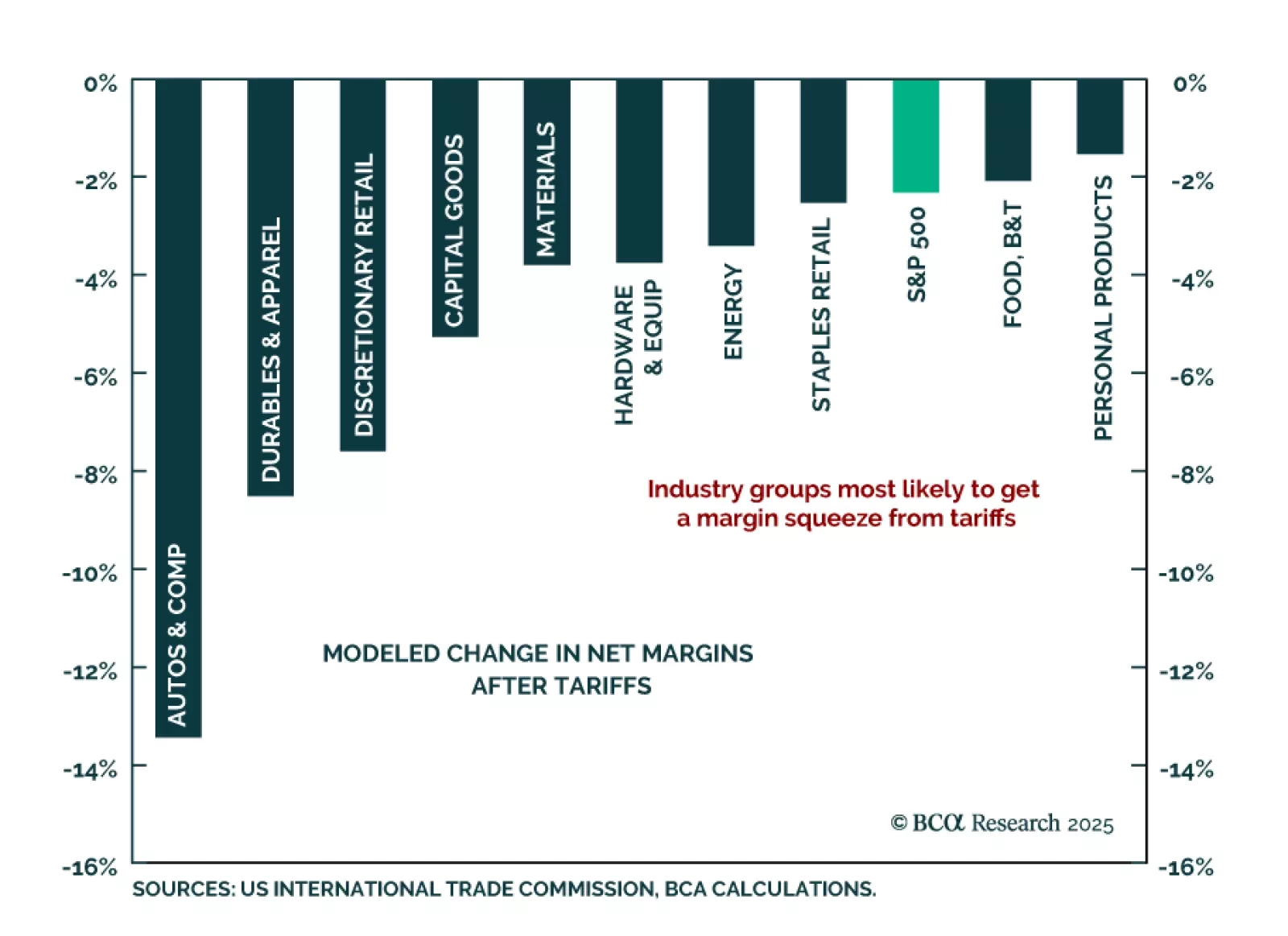

Our US Equity strategists warn that tariffs will meaningfully compress S&P 500 margins, with little pricing power to offset rising input costs. A two-point hit to net margins and falling multiples will drive earnings downgrades…

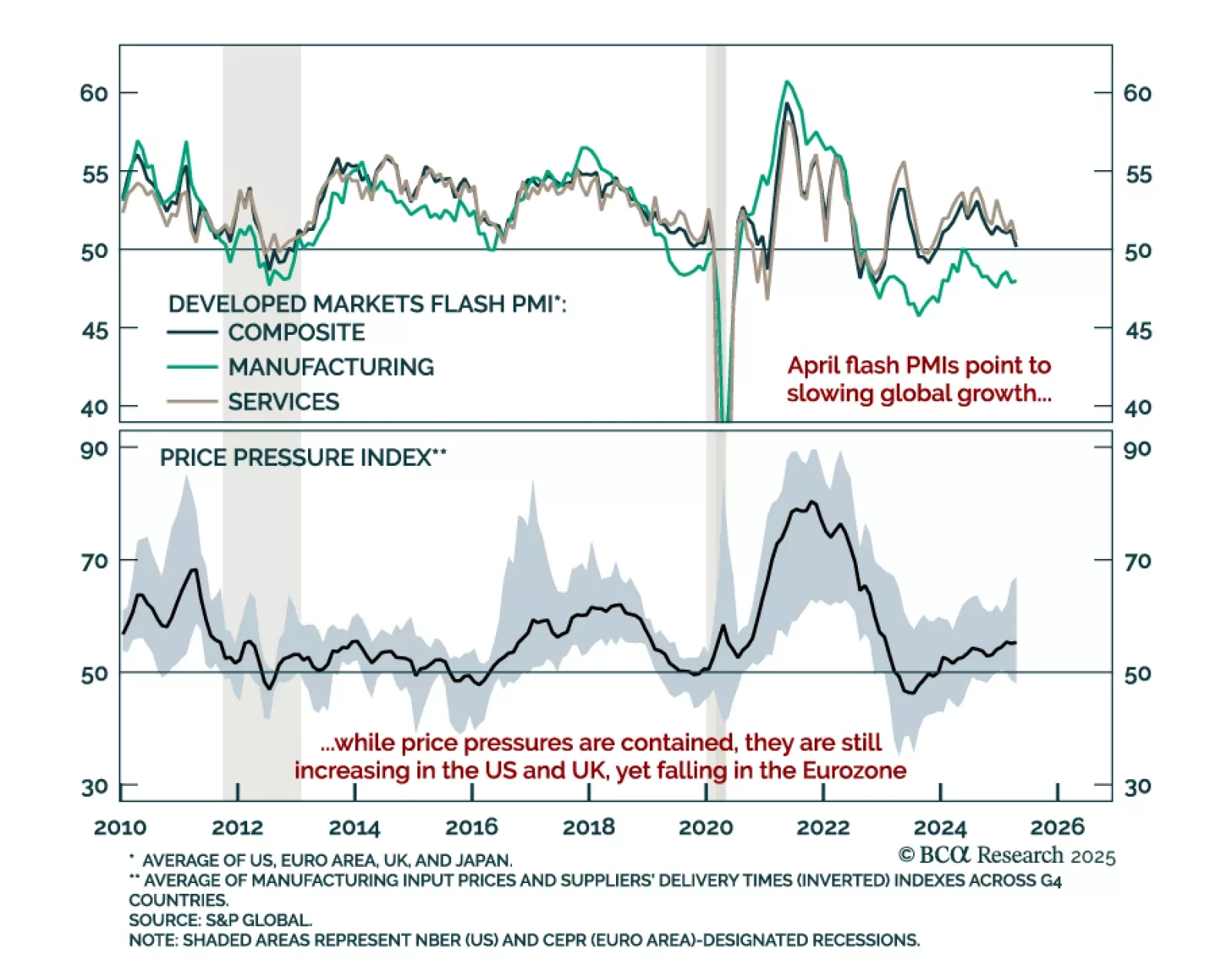

April PMIs confirm global growth is stalling, reinforcing our overweight in government bonds and underweight in risk assets. Services witnessed the worst deterioration, but manufacturing is still contracting even if broadly stable.…

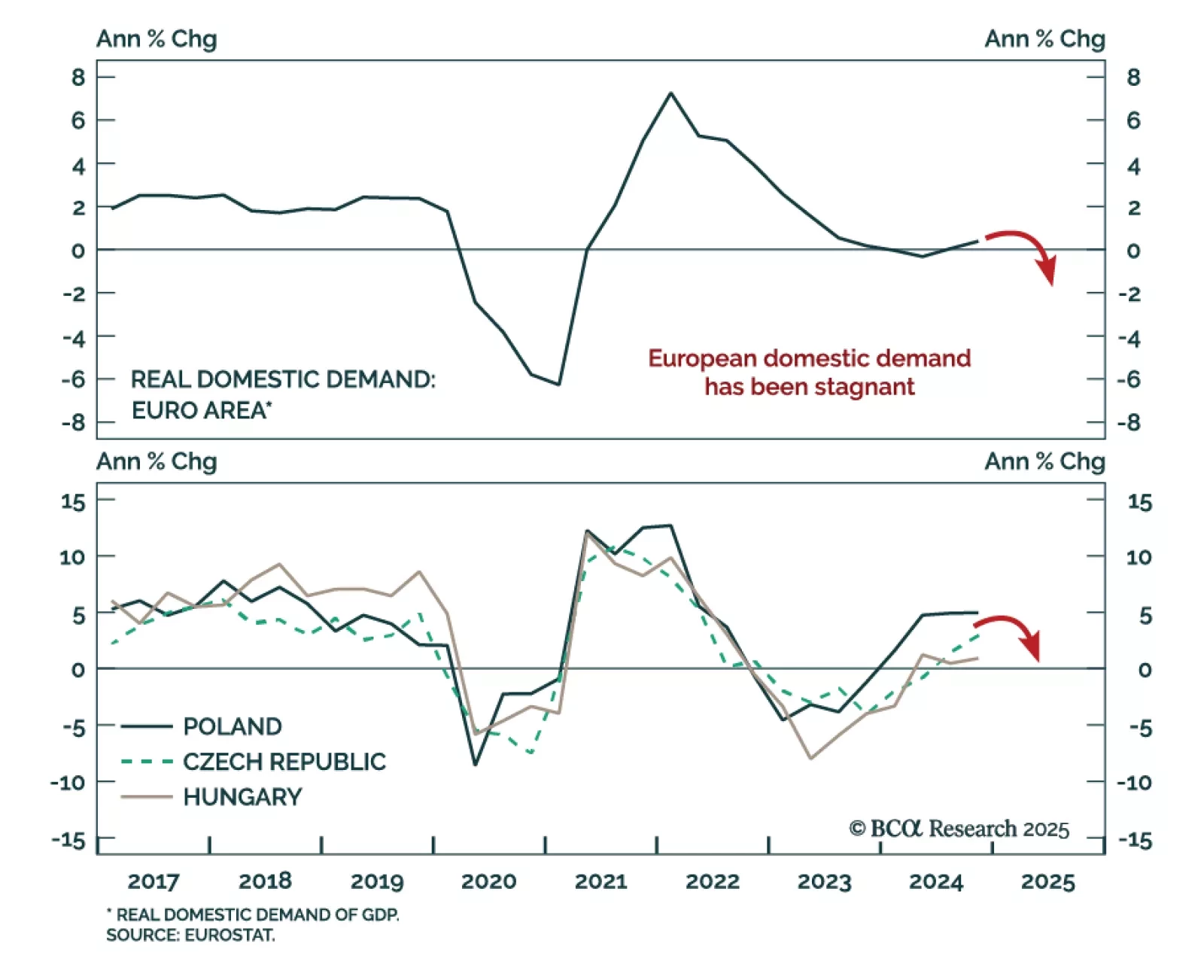

Our EM strategists recommend upgrading CE3 assets within EM portfolios, as a structural shift in the global currency regime is underway. They expect the greenback to depreciate against the euro amid a global downturn, supporting…