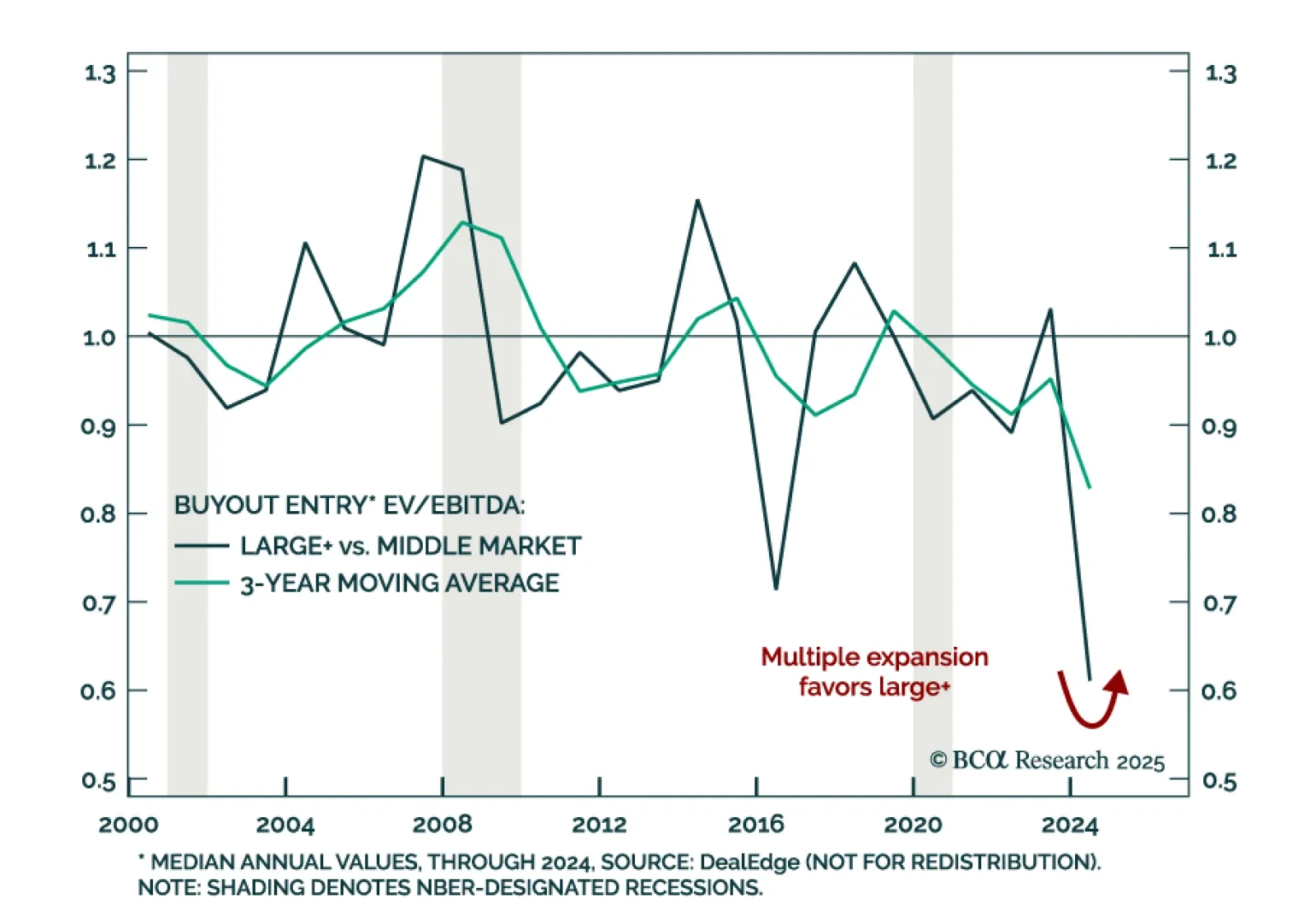

Our Private Markets & Alternatives team’s latest update to return expectations for Global Buyout yields a modest increase in projected returns, including the expectation of a greater multiple expansion tailwind in the Large…

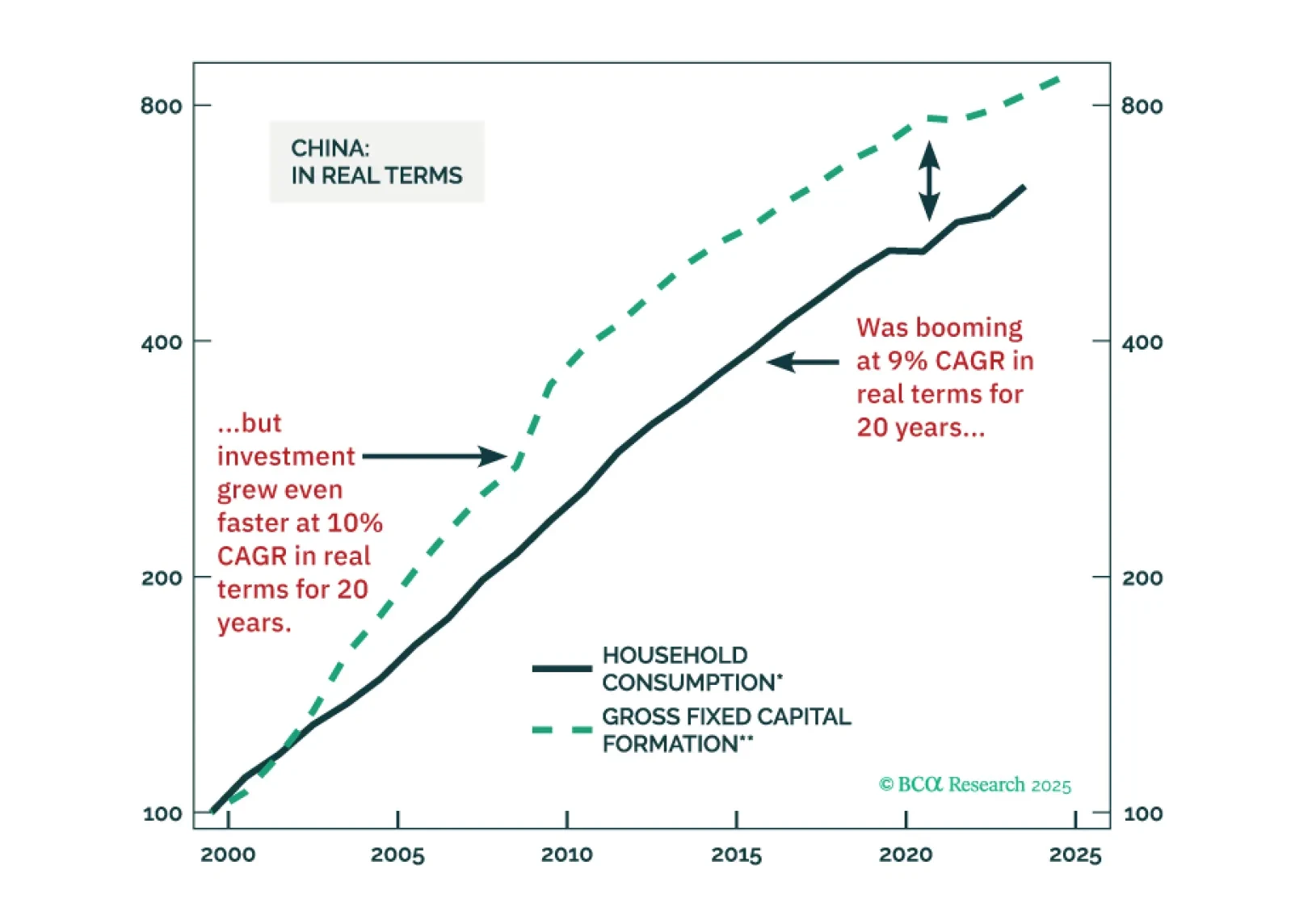

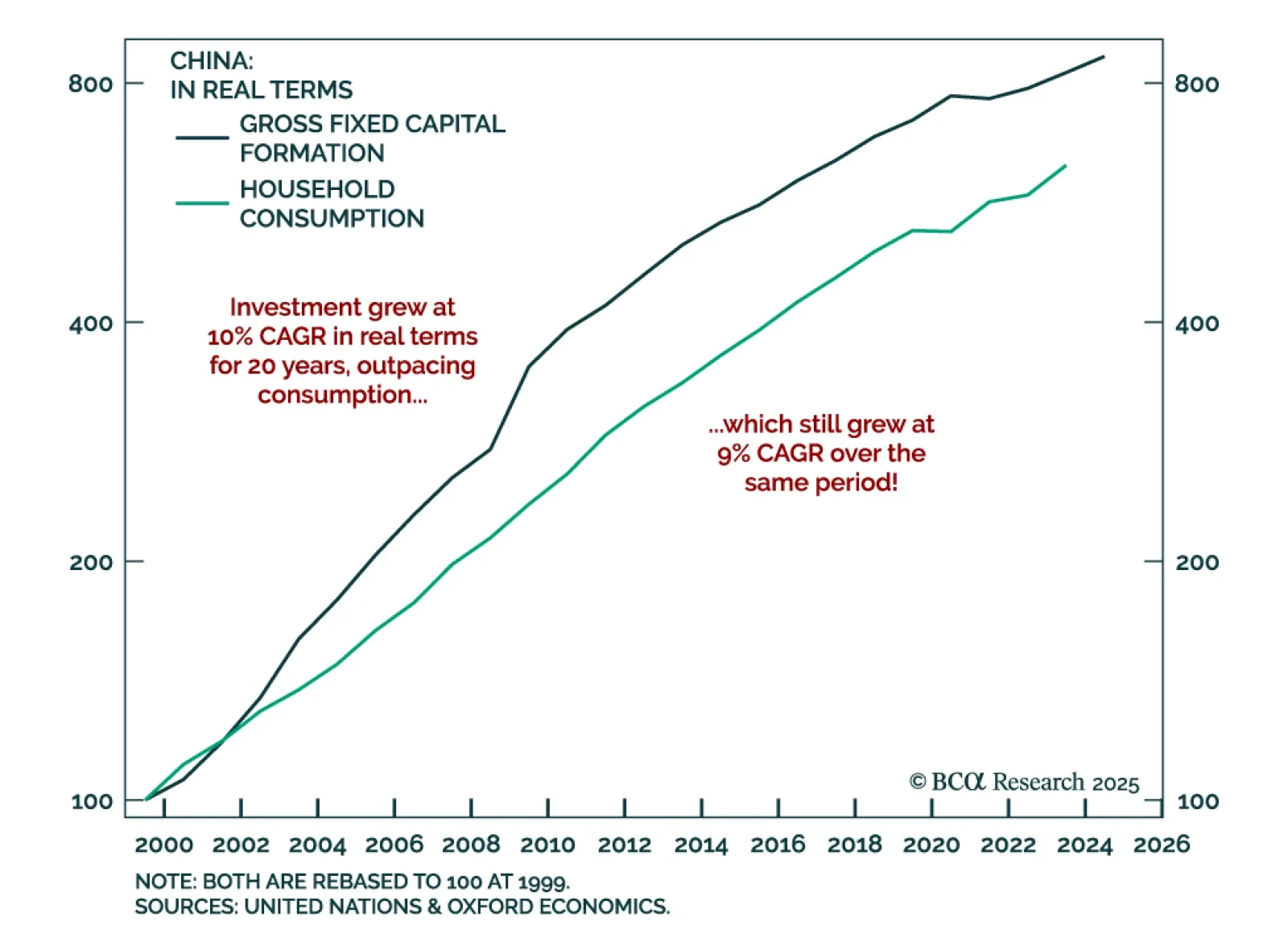

Our EM strategists warn that China’s overinvestment problem has no quick fix, keeping deflationary pressures in place and limiting upside for Chinese equities. Excessive domestic investment, driven by aggressive credit creation, is…

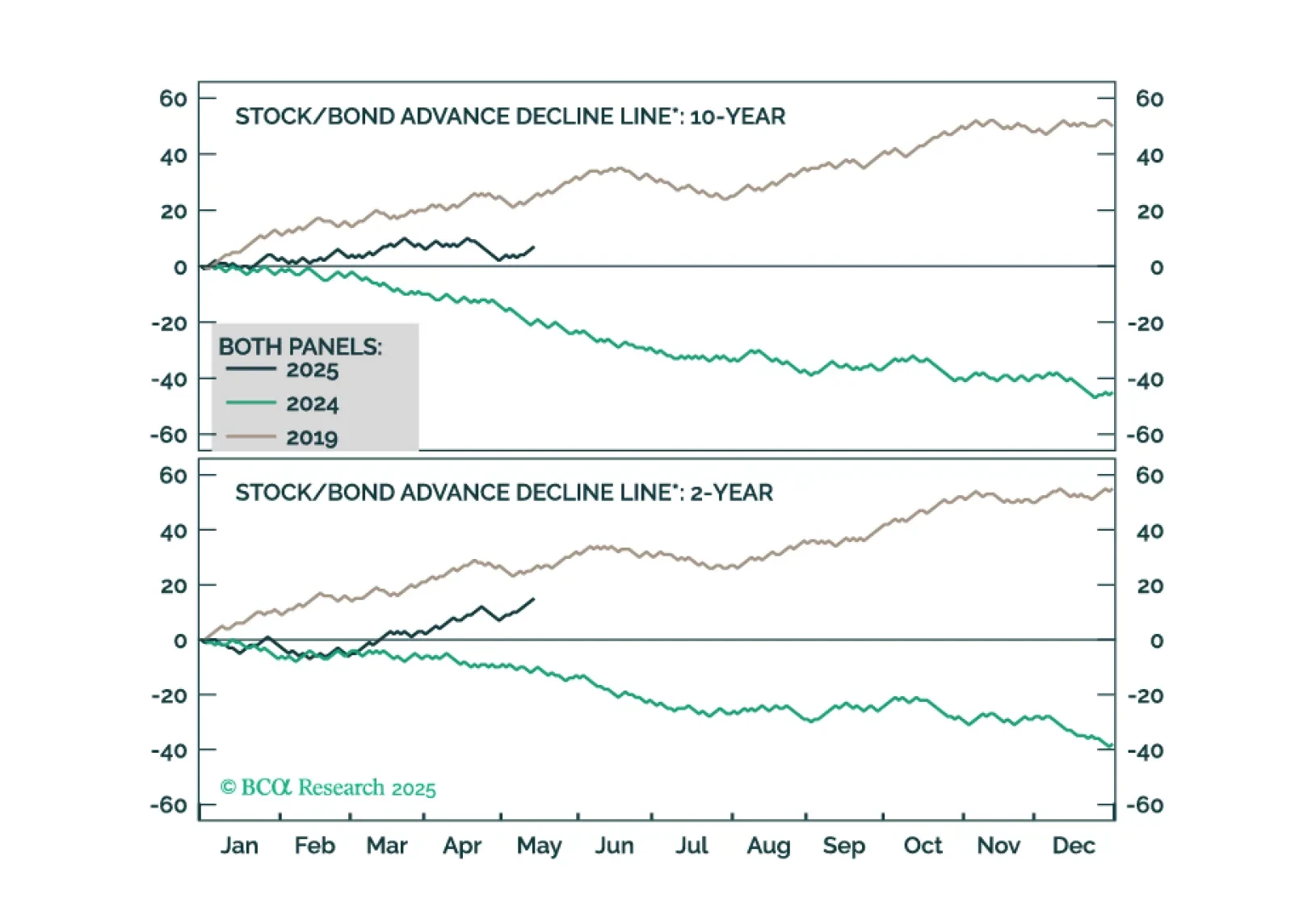

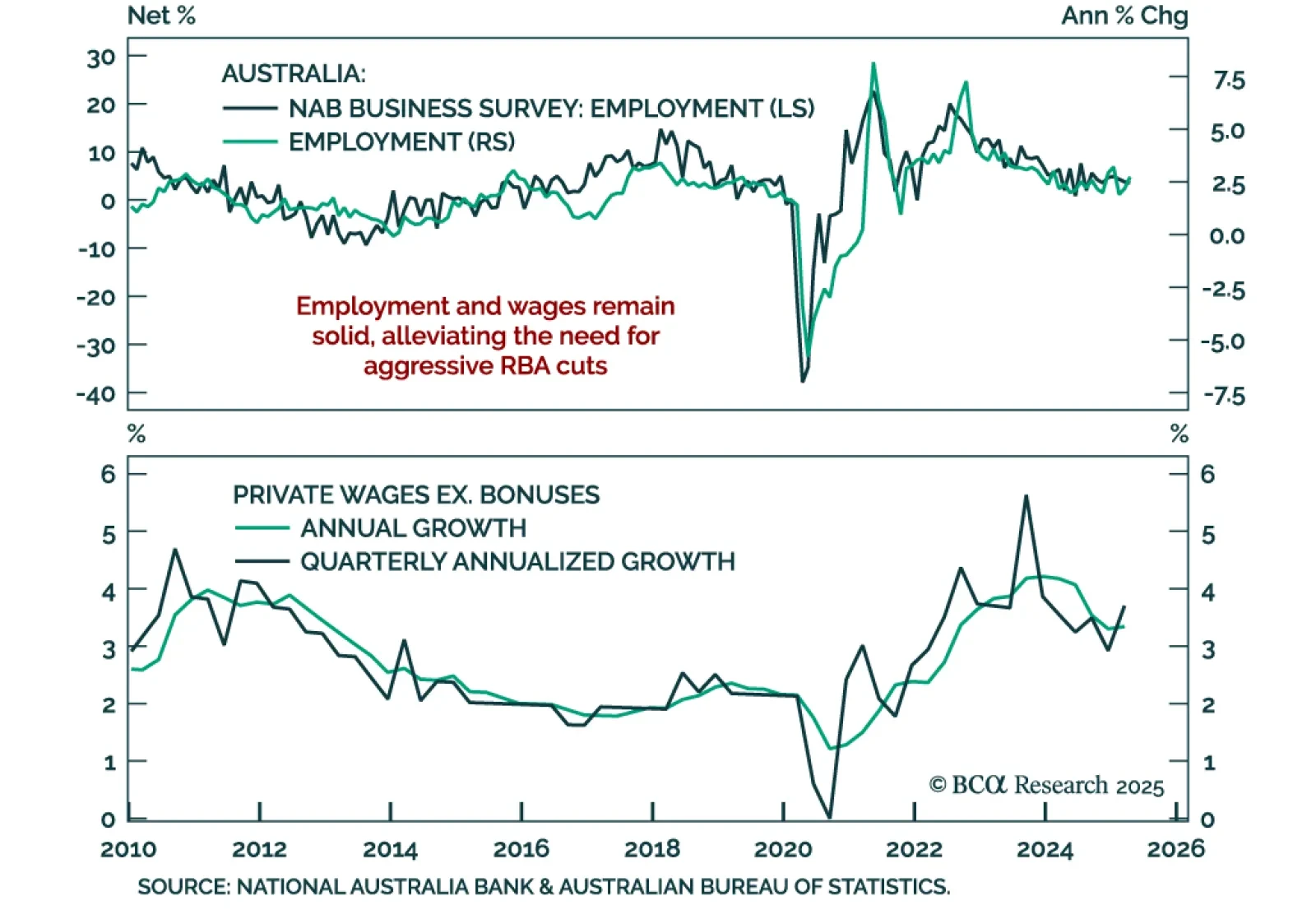

A strong Australian labor market is limiting the scope for RBA easing, reinforcing our underweight on Australian government bonds. Our Chart Of The Week comes from Robert Timper, strategist in our Global Fixed Income Strategy team.…

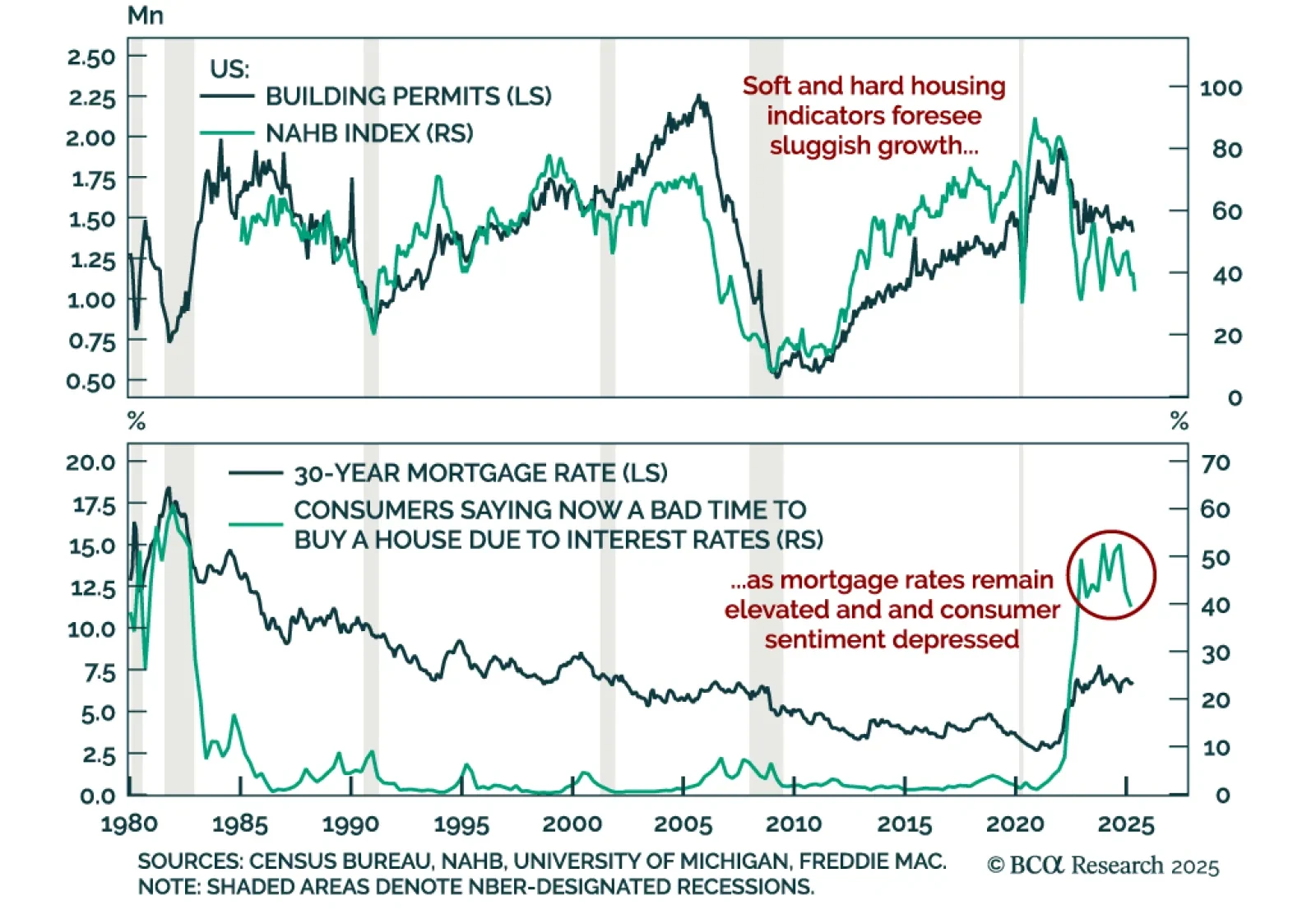

Weak April housing data and deteriorating builder sentiment reinforce our defensive stance, as recession risks remain underpriced. Housing starts rose at a 1.6% m/m annualized rate, missing expectations. Similarly, building permits,…

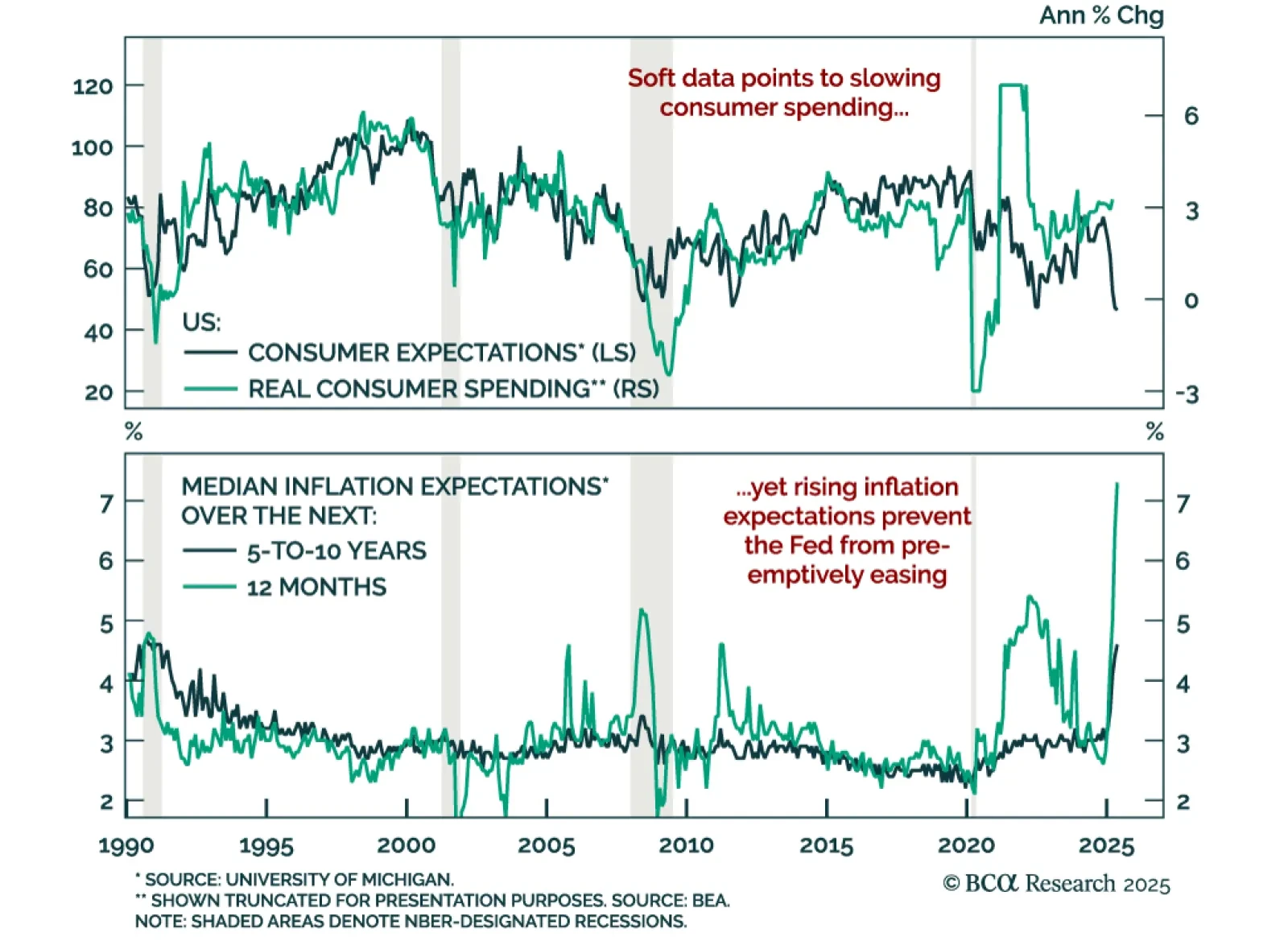

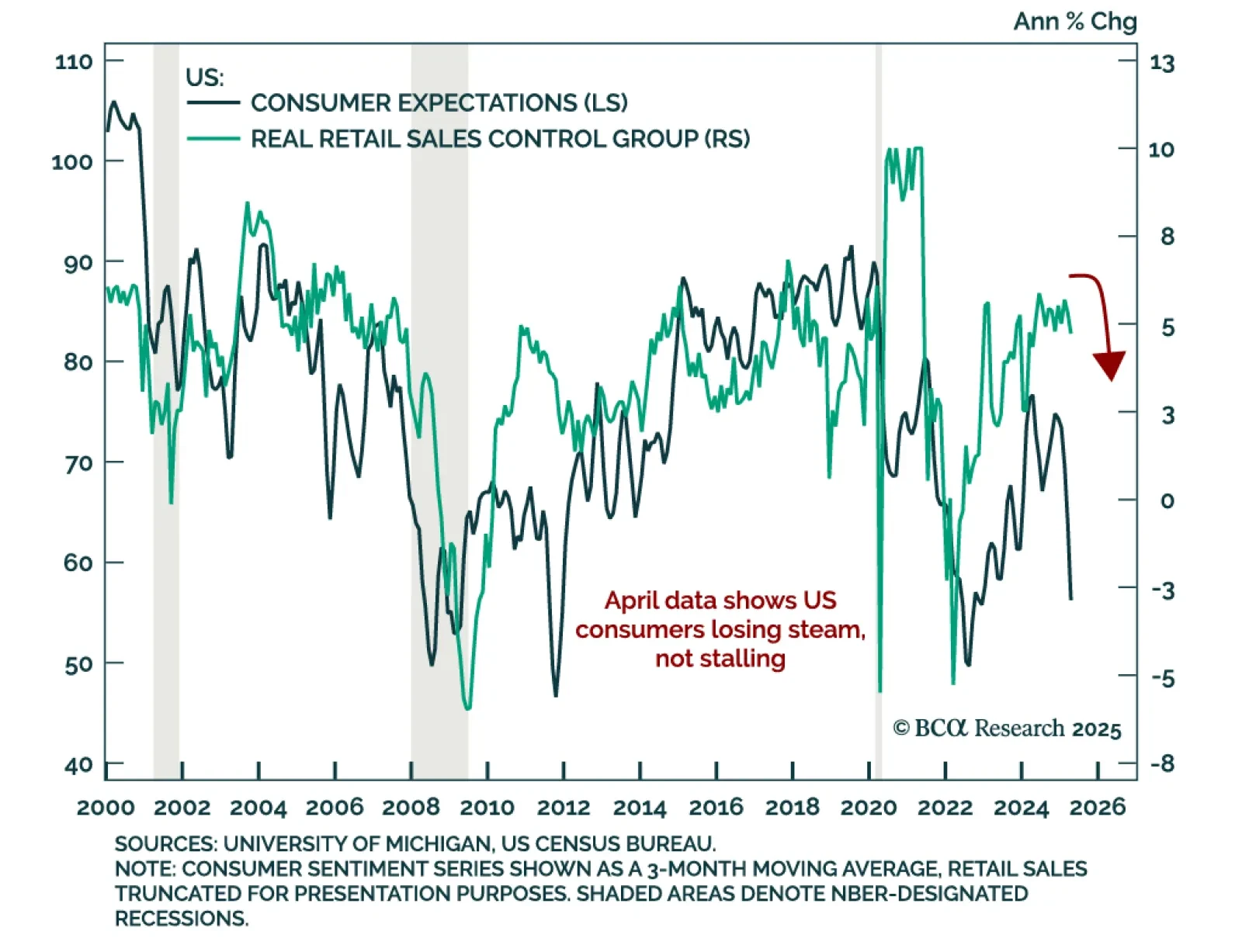

Deteriorating US consumer sentiment and surging inflation expectations add to growth concerns and reinforce our long-duration bond stance. The preliminary May University of Michigan Consumer Sentiment Index missed expectations,…

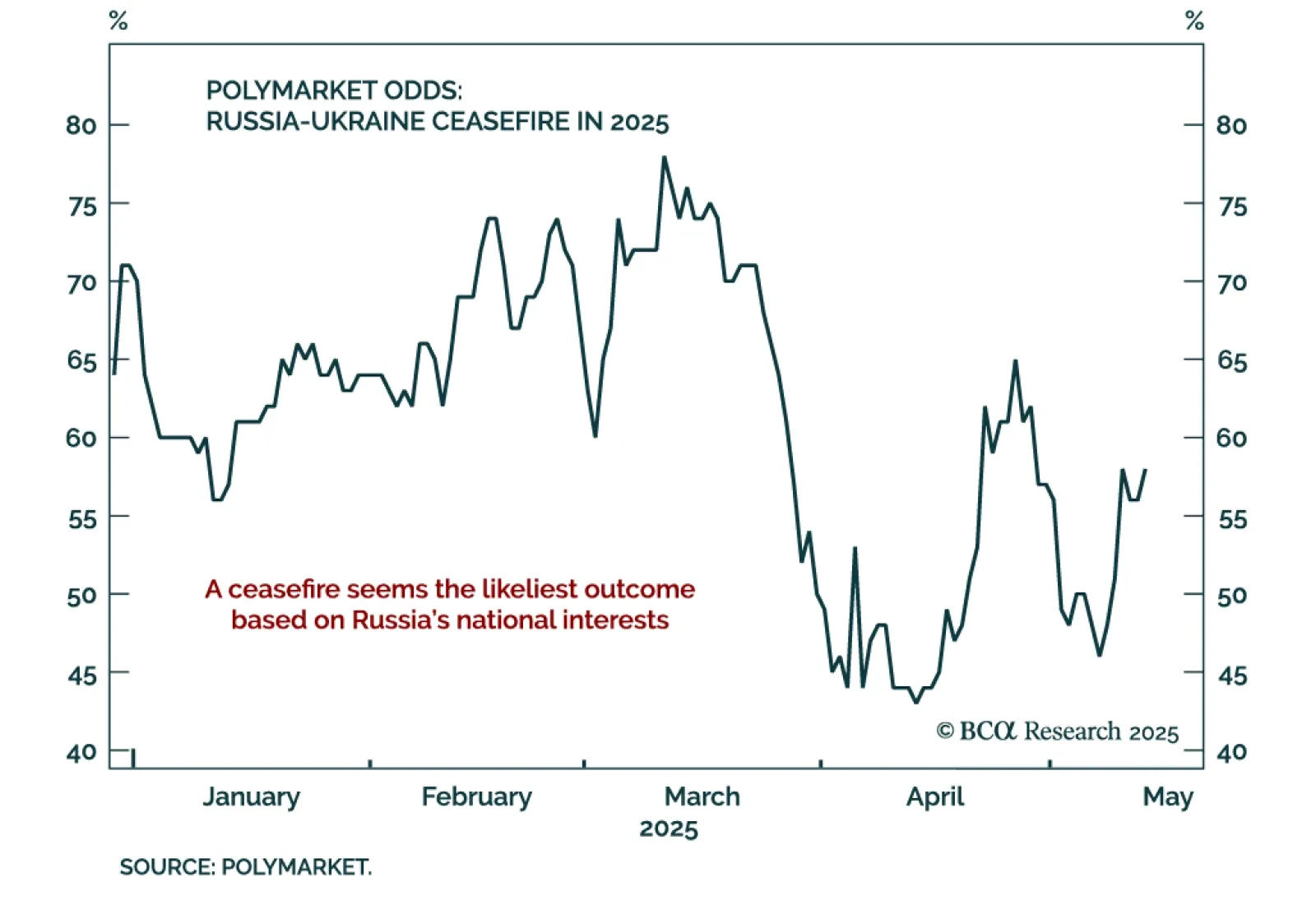

Our Geopolitical strategists expect a Ukraine ceasefire as Russia’s economic weakness compels Putin to shift focus from war to domestic stability. The likely outcome is not peace, but a frozen conflict that enables Russia to…

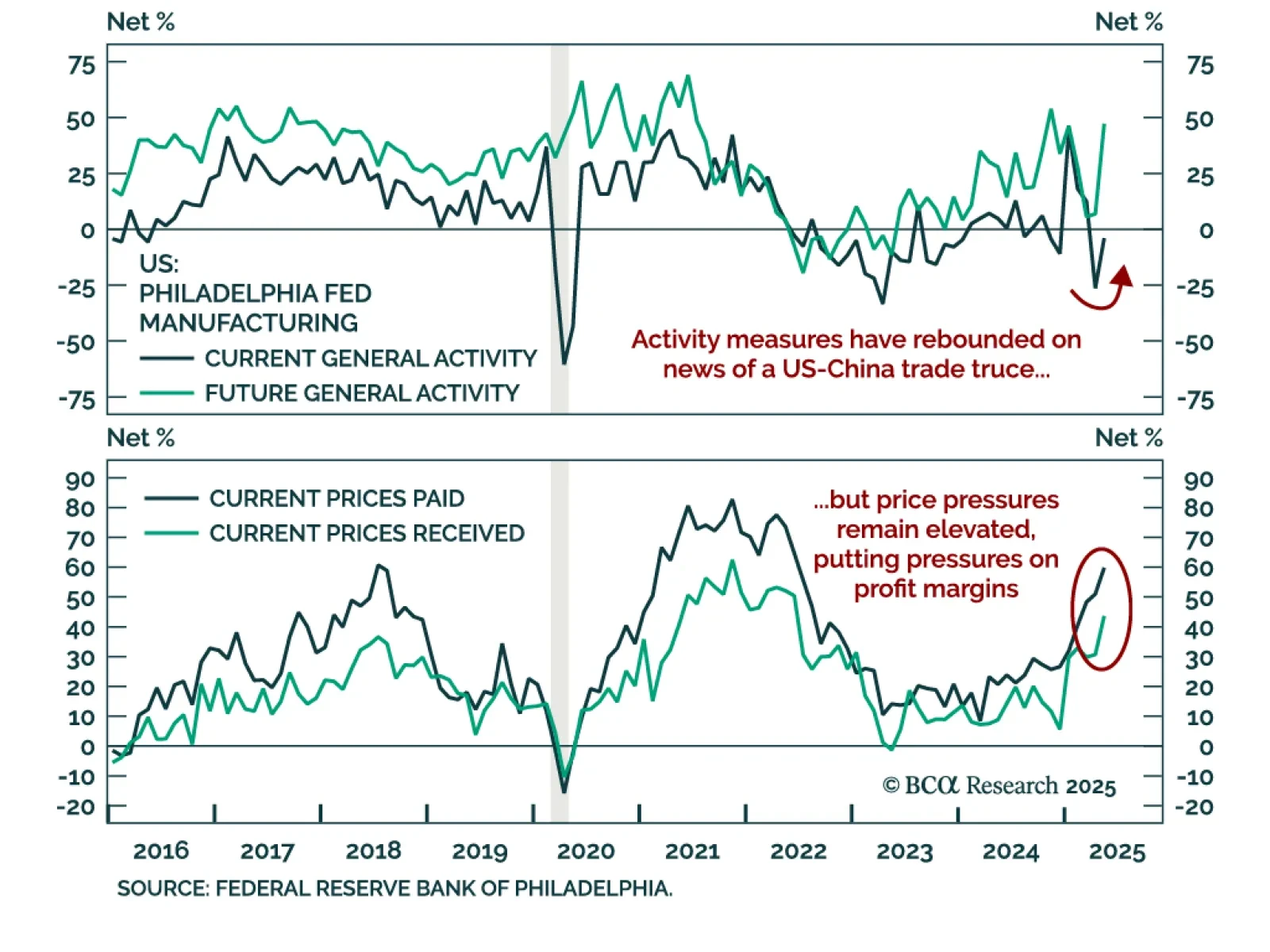

The US-China trade truce lifted short-term manufacturing sentiment in May, but margin pressures persist, reinforcing the case for defensive, domestic-focused equity positioning. The Empire and Philly Fed regional manufacturing…

April retail sales slowed, but signs of resilience in discretionary spending and labor data suggest US consumers are holding up. Headline retail sales rose 0.1% m/m, above expectations but decelerating from the upwardly revised 1.7%…

Tariff front-running behavior makes the April hard economic data difficult to interpret, but we take the strong reading from Food Services spending as a signal that the US consumer has not yet buckled.