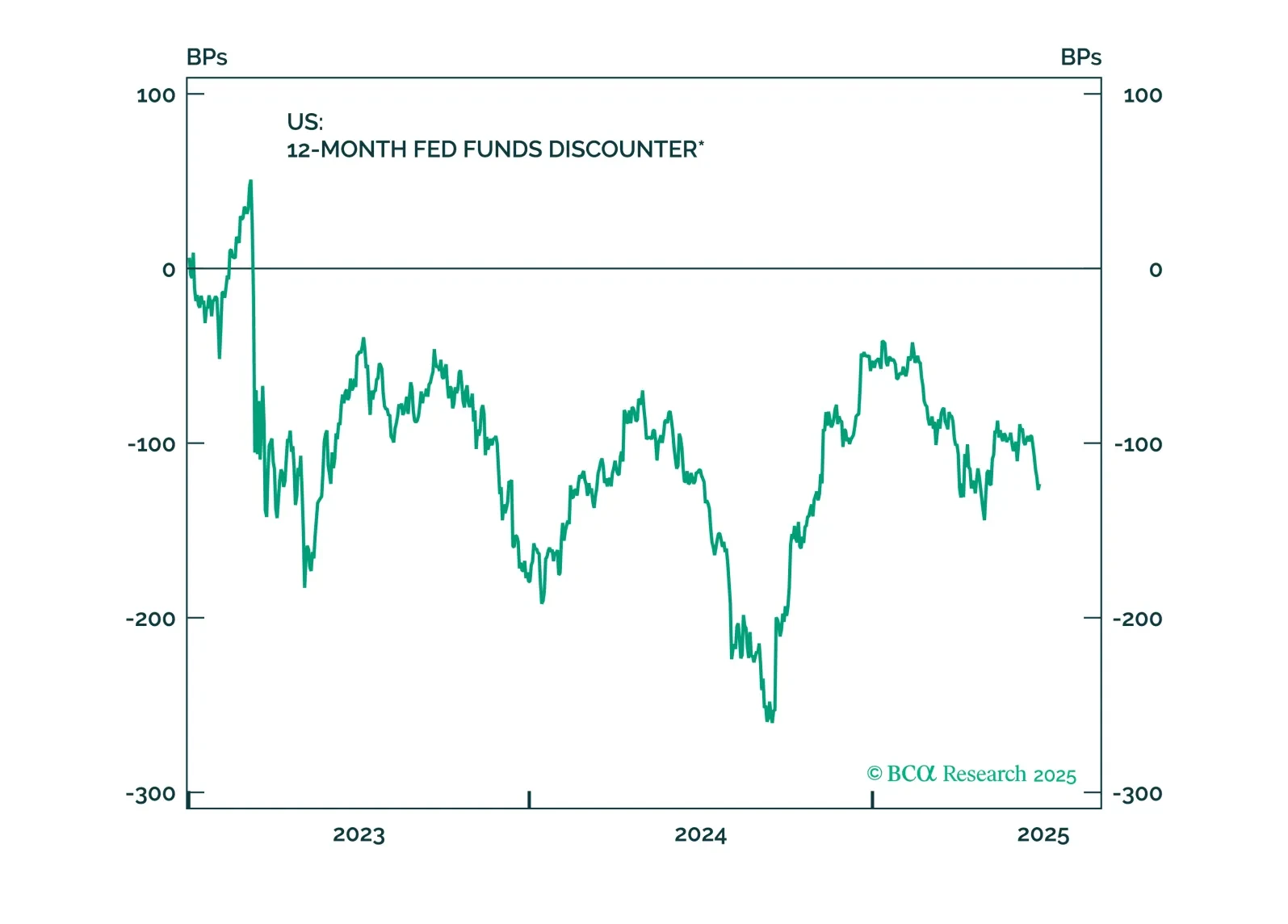

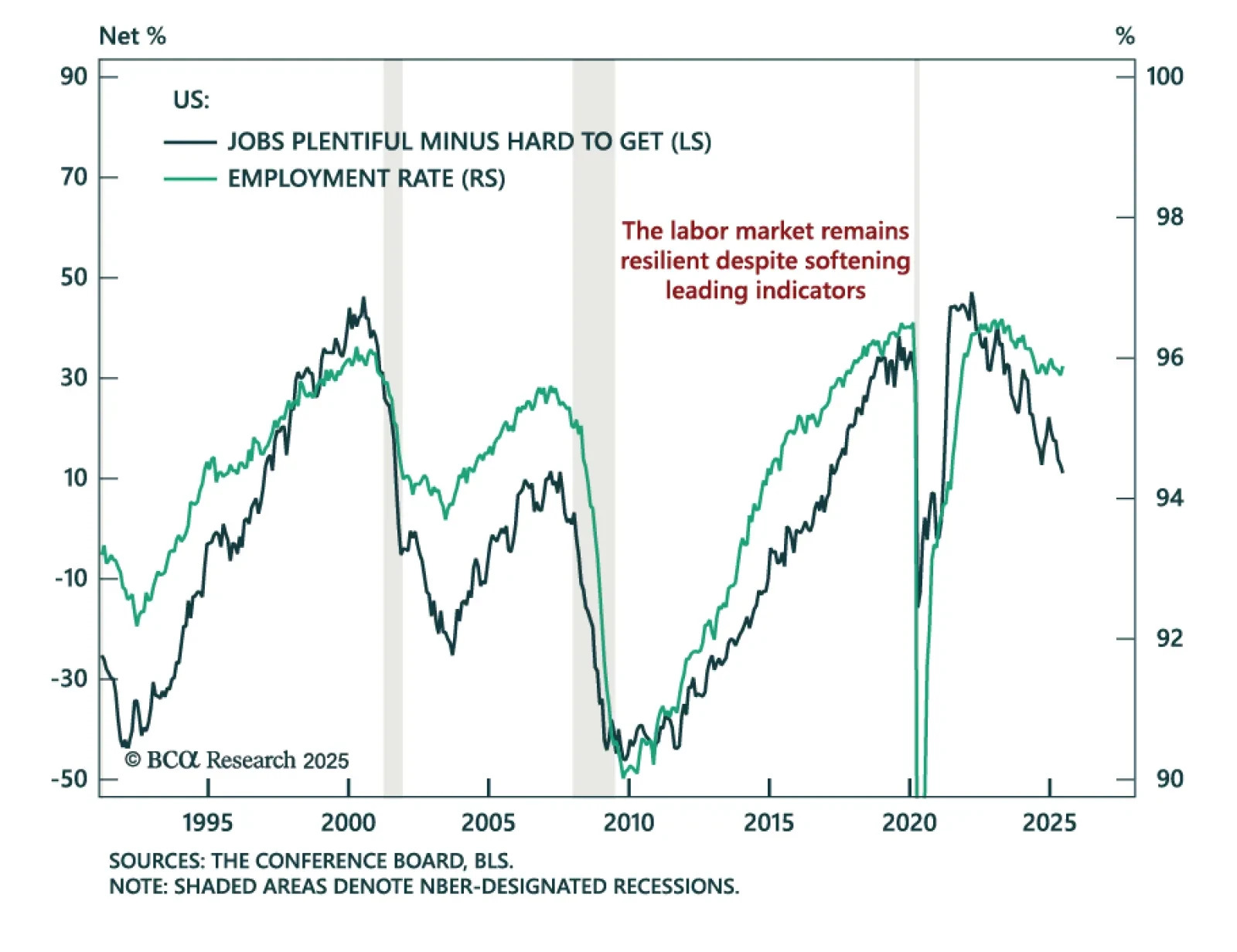

Stronger-than-expected June payrolls rule out a July Fed cut, but the report does not derail the case for long duration and curve steepeners. Nonfarm payrolls printed at 147k, with the two prior months revised up by 16k, leaving the…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

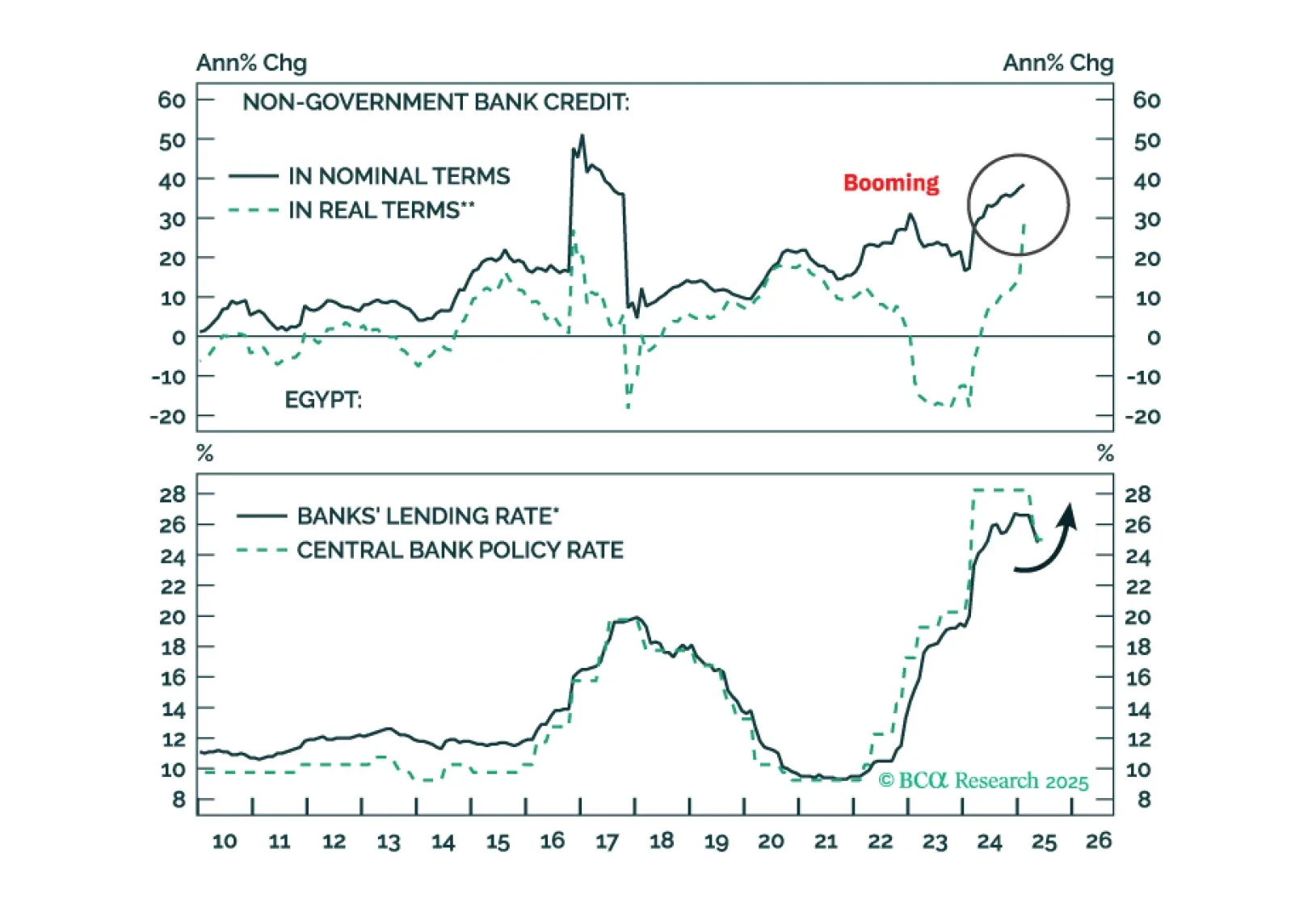

Downward pressure on the pound will rise in the coming months. Inflation will go up, so will bond yields. It’s time to book profits on Egyptian domestic bonds.

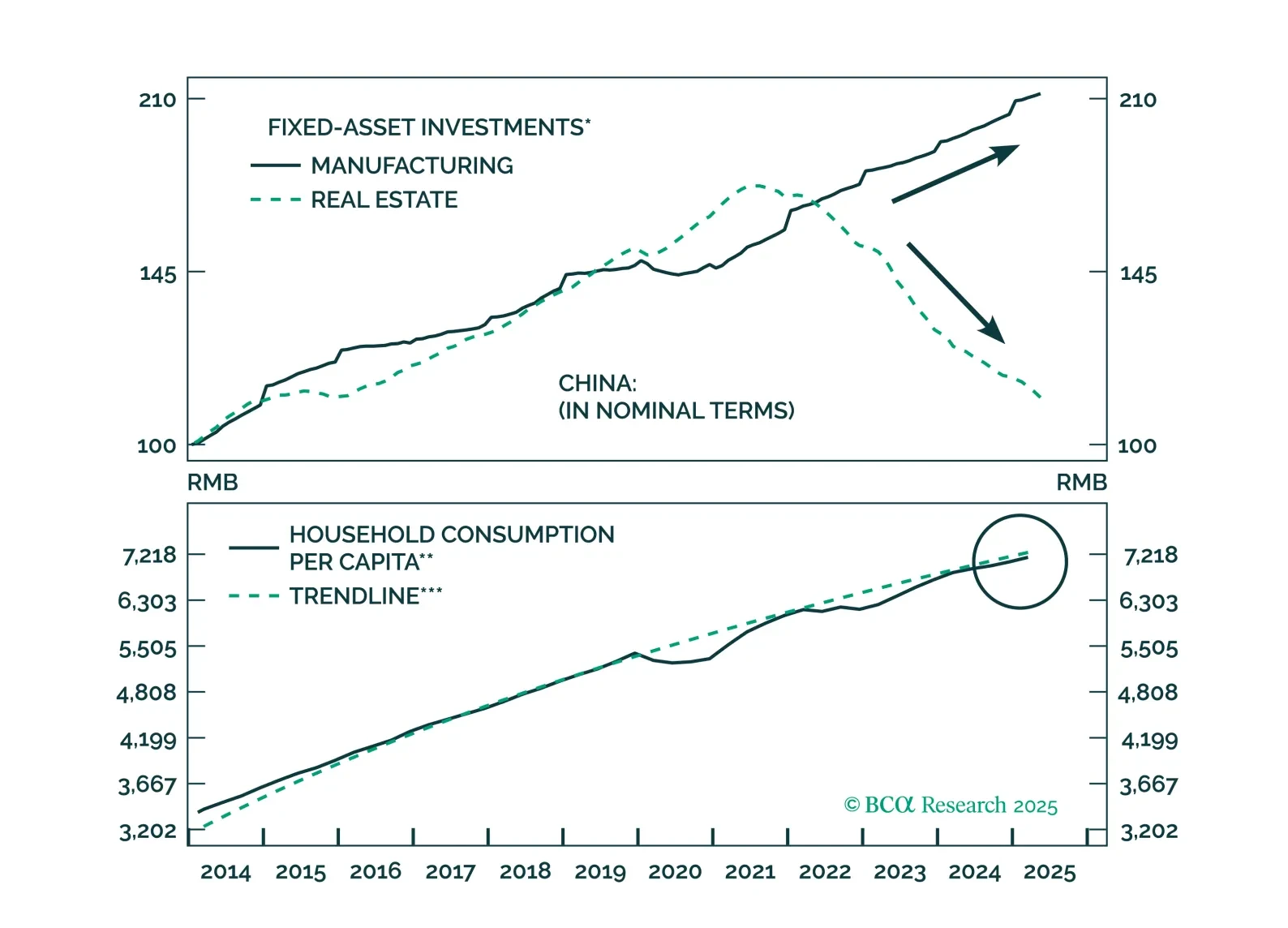

This report analyzes China’s persistent deflation, which is rooted in supply-side forces. Consumption support will be slow and incremental, keeping deflationary pressures elevated for the next 6–12 months.

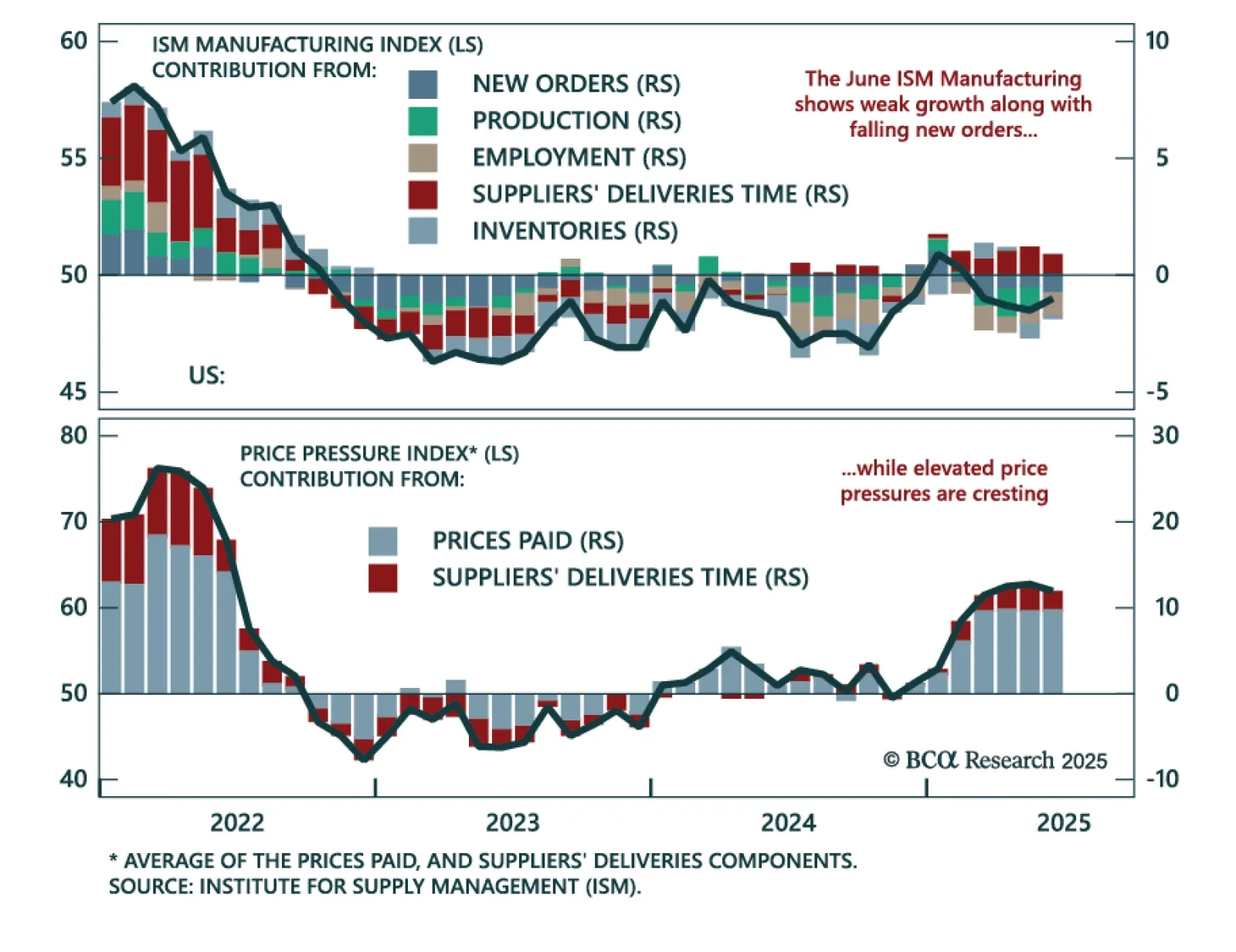

The June ISM points to sluggish US manufacturing and reinforces long duration positioning amid peaking price pressures. The index rose modestly to 49.0 from 48.5 in May, with the rebound driven by slightly higher production and…

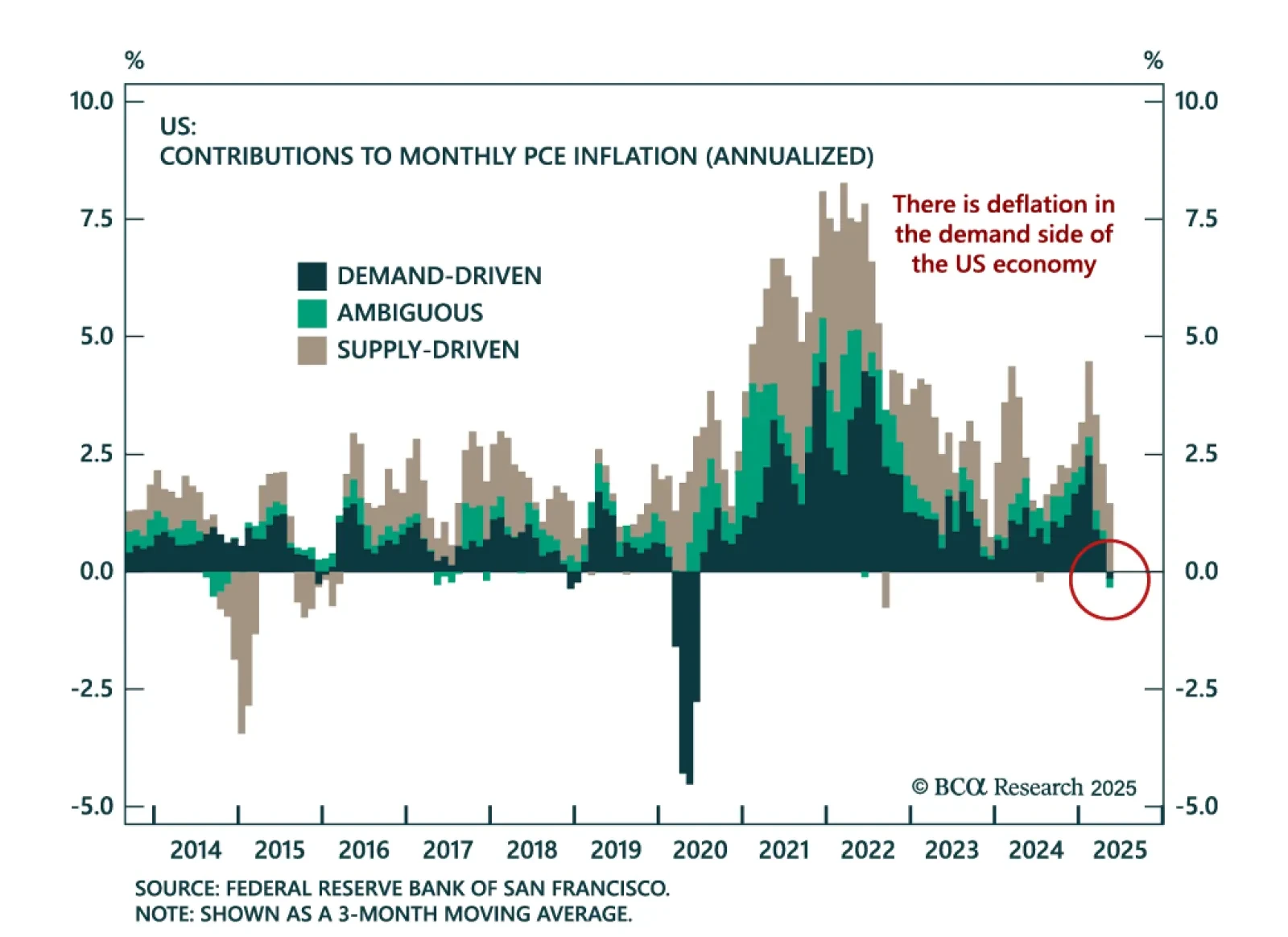

Our Global Asset Allocation strategists expect lower interest rates to revive a sluggish US economy, prompting upgrades to duration and equities. Although not in recession, the US is enduring one of the weakest non-recessionary years…

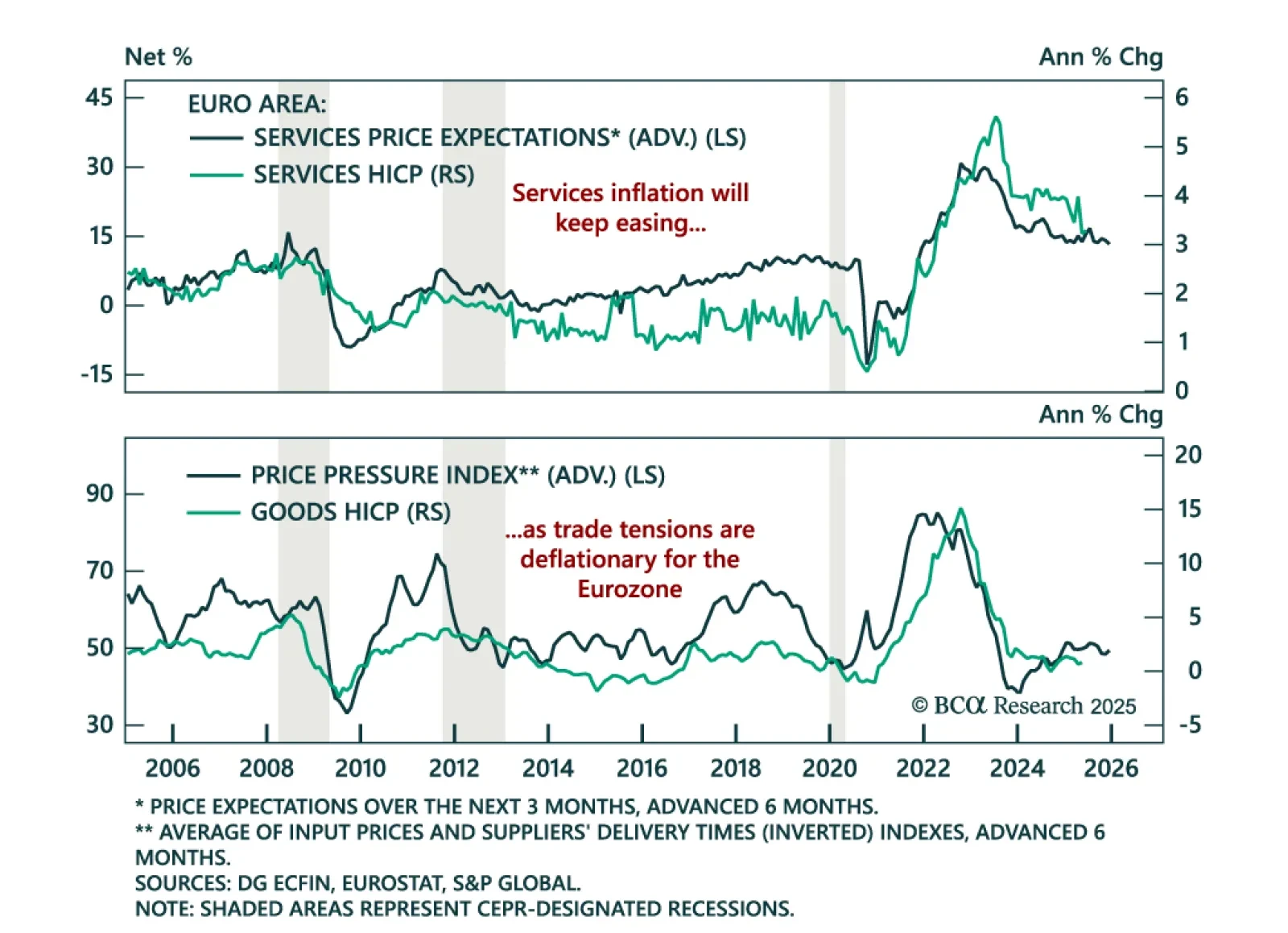

June Eurozone inflation data and soft growth backdrop support further ECB easing and reinforce the case for long European bond exposure. Flash HICP inflation ticked up to 2.0% y/y from 1.9%, while core inflation held steady at 2.3%,…

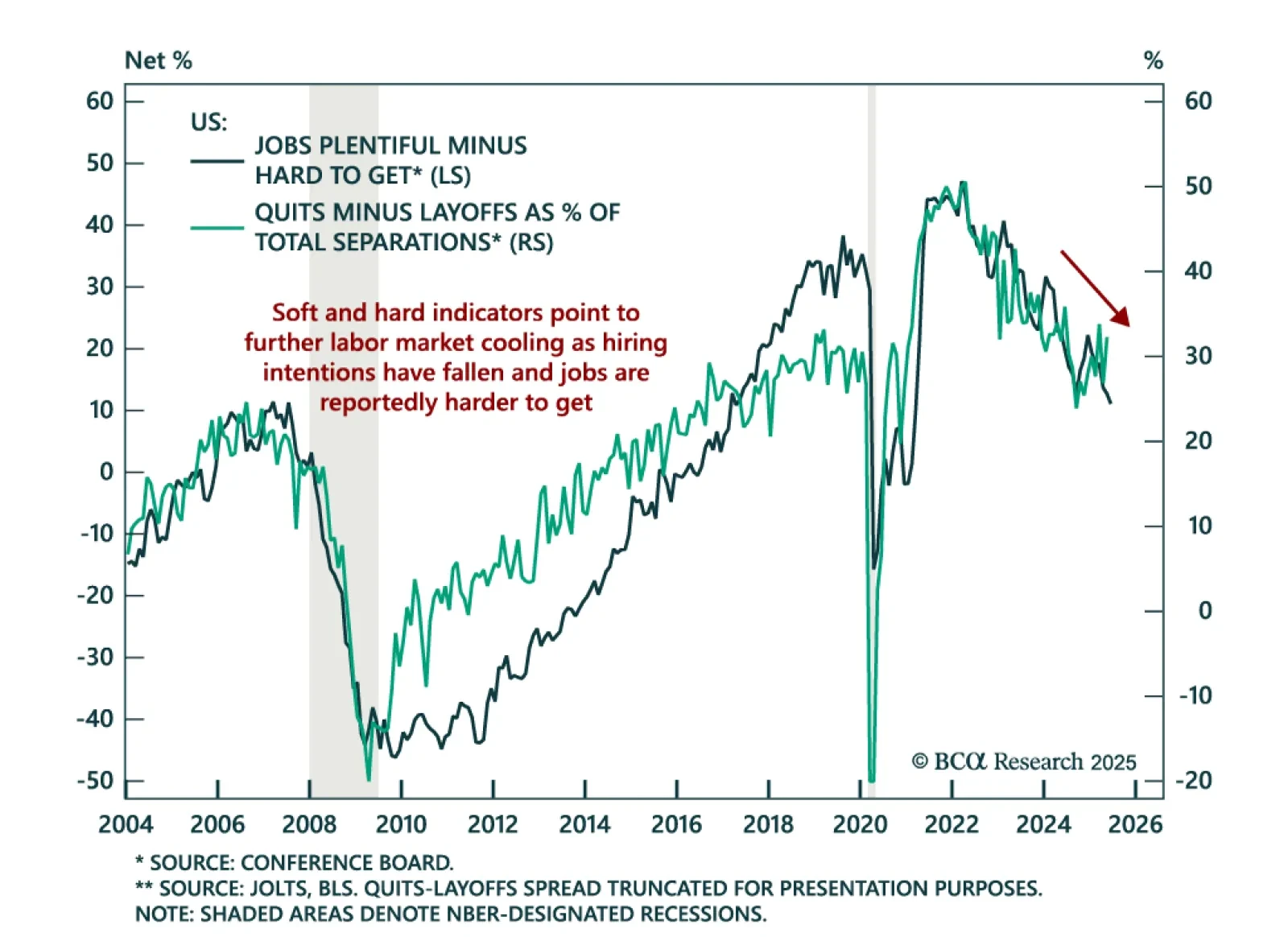

May JOLTS data suggest labor market softening beneath the surface, reinforcing a defensive stance across portfolios. Job openings rose to 7.7m from 7.4m, beating estimates, while quits ticked up to 3.3m and layoffs fell to 1.6m.…

Monetary policy is about to become a powerful tailwind to the already bullish brew that includes Trump’s repeated step-downs from a global trade war, irrelevant geopolitical risks in the Middle East, and a fiscal policy that is no…

The US economy is not in recession, but is suffering from a post-pandemic stimulus hangover. The cure: lower interest rates. We expect the Fed to start lowering rates, which will benefit both equities and bonds. We upgrade stocks to…