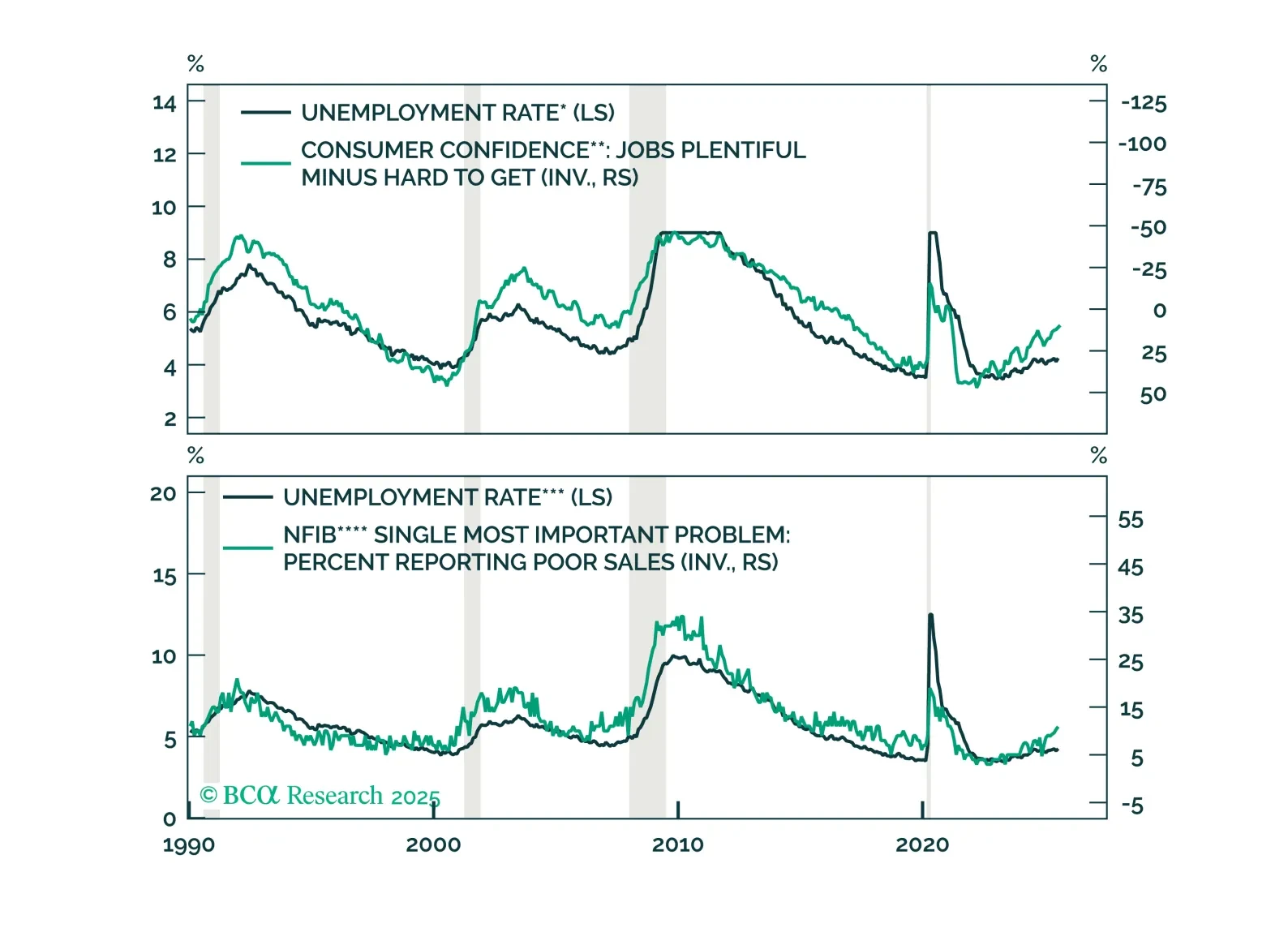

US job openings fell to a 10-month low in July, underscoring continued labor market weakening. Openings declined to 7.18m from 7.36m. The decline was led by non-cyclical sectors such as education and health services, which had…

Our Portfolio Allocation Summary for September 2025.

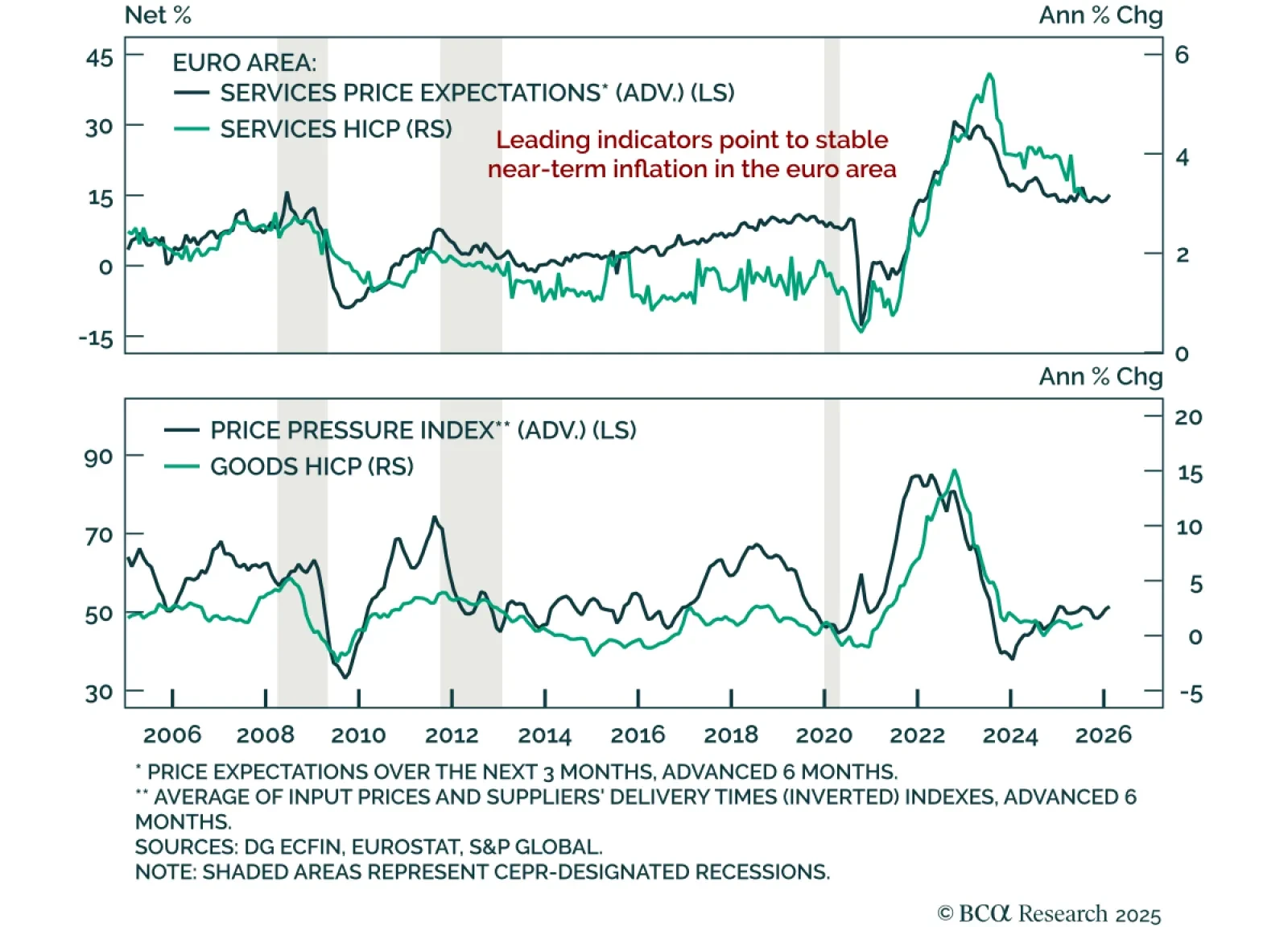

Euro area August flash HICP was slightly hotter than expected, reinforcing the case for the ECB to stay put in September. Headline inflation rose to 2.1% y/y from 2.0%, with the monthly print surprising at 0.2% m/m. Core inflation…

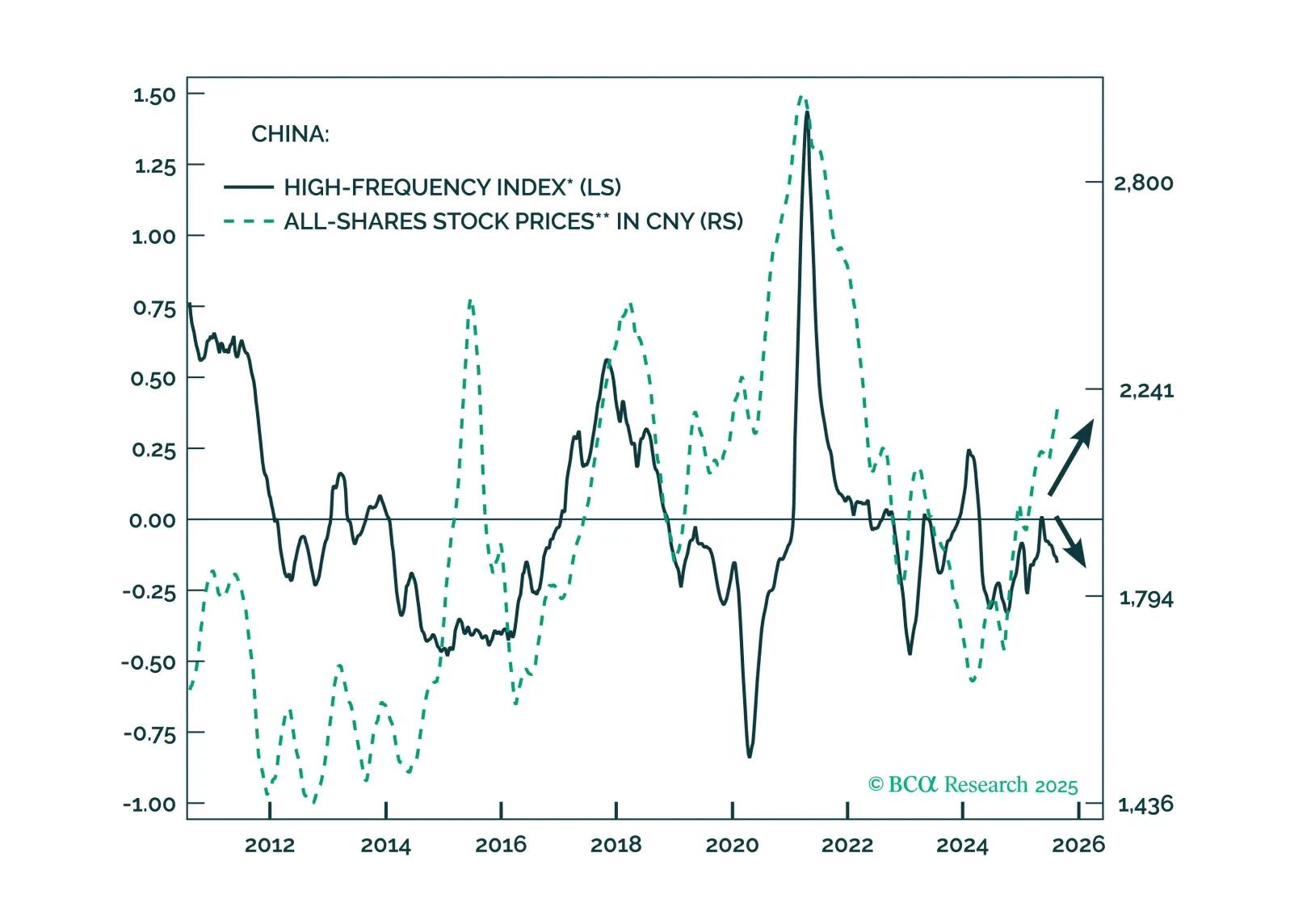

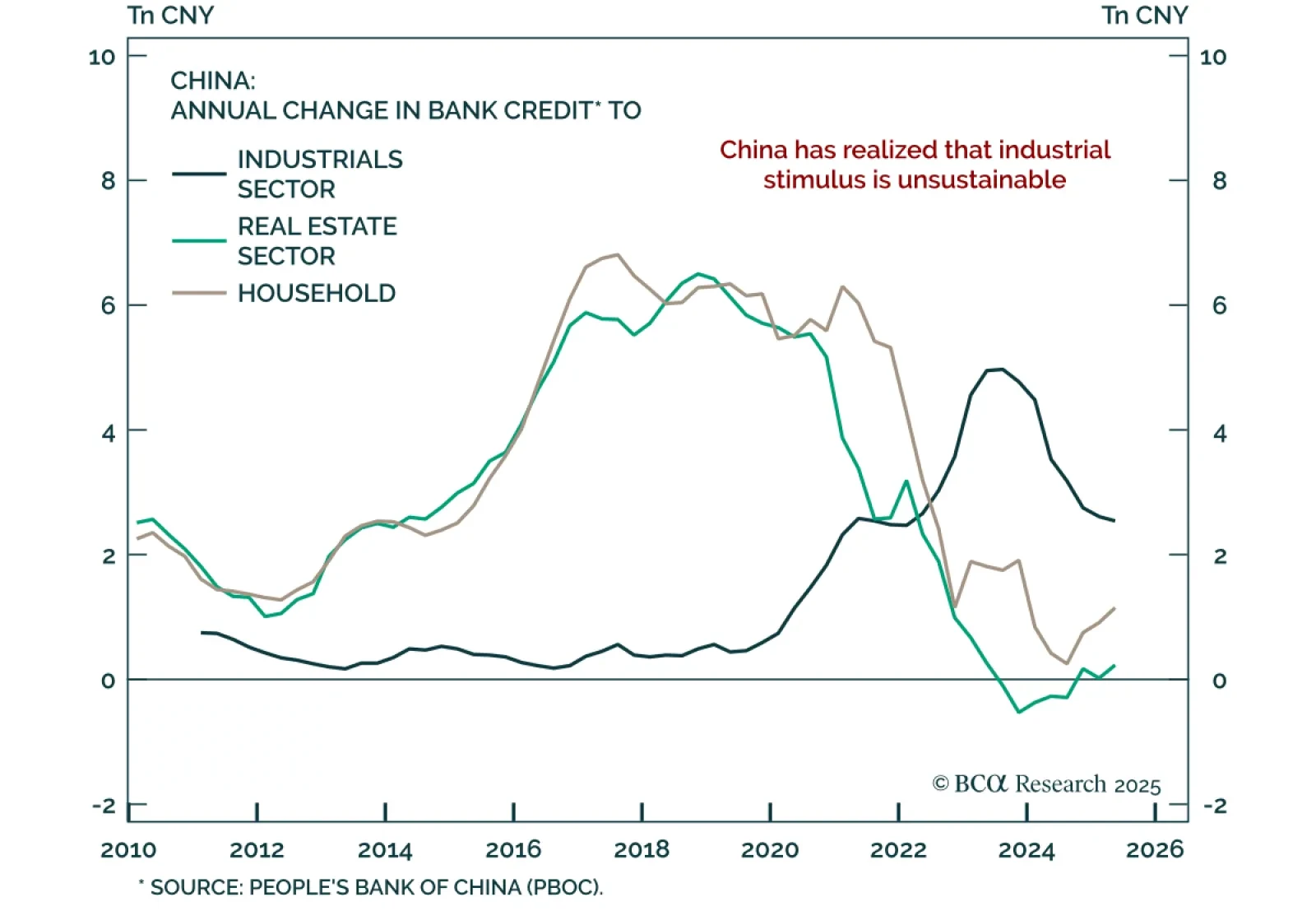

Our Global Asset Allocation strategists upgrade the Chinese yuan to overweight as global imbalances between production and consumption begin to reverse. The US continues to overconsume and underproduce, while China overproduces and…

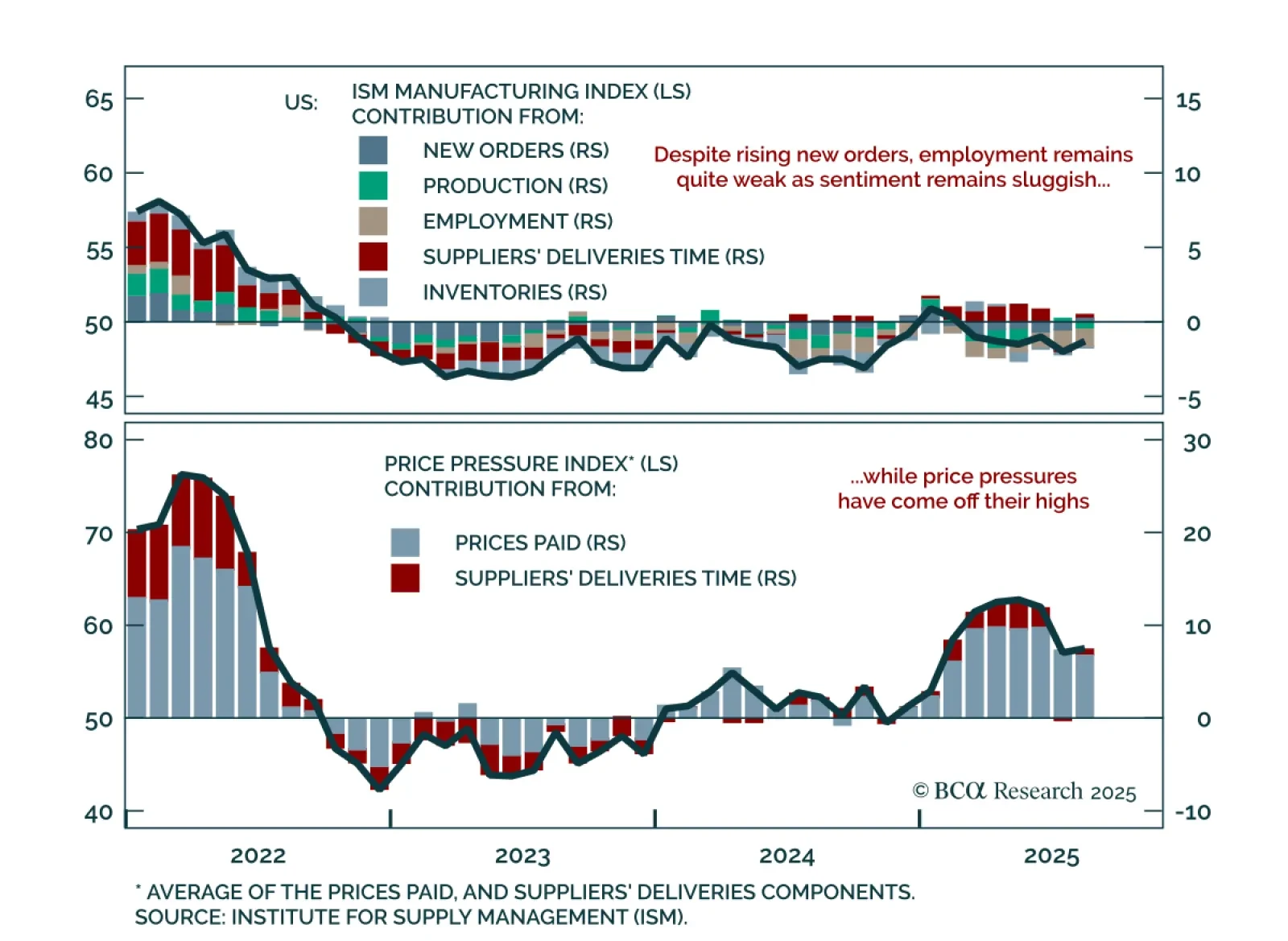

August ISM Manufacturing was mixed, with stronger orders offset by weak production and employment. The headline rose to 48.7 from 48.0, missing expectations. New orders beat estimates, rising into expansion at 51.4 and lifting…

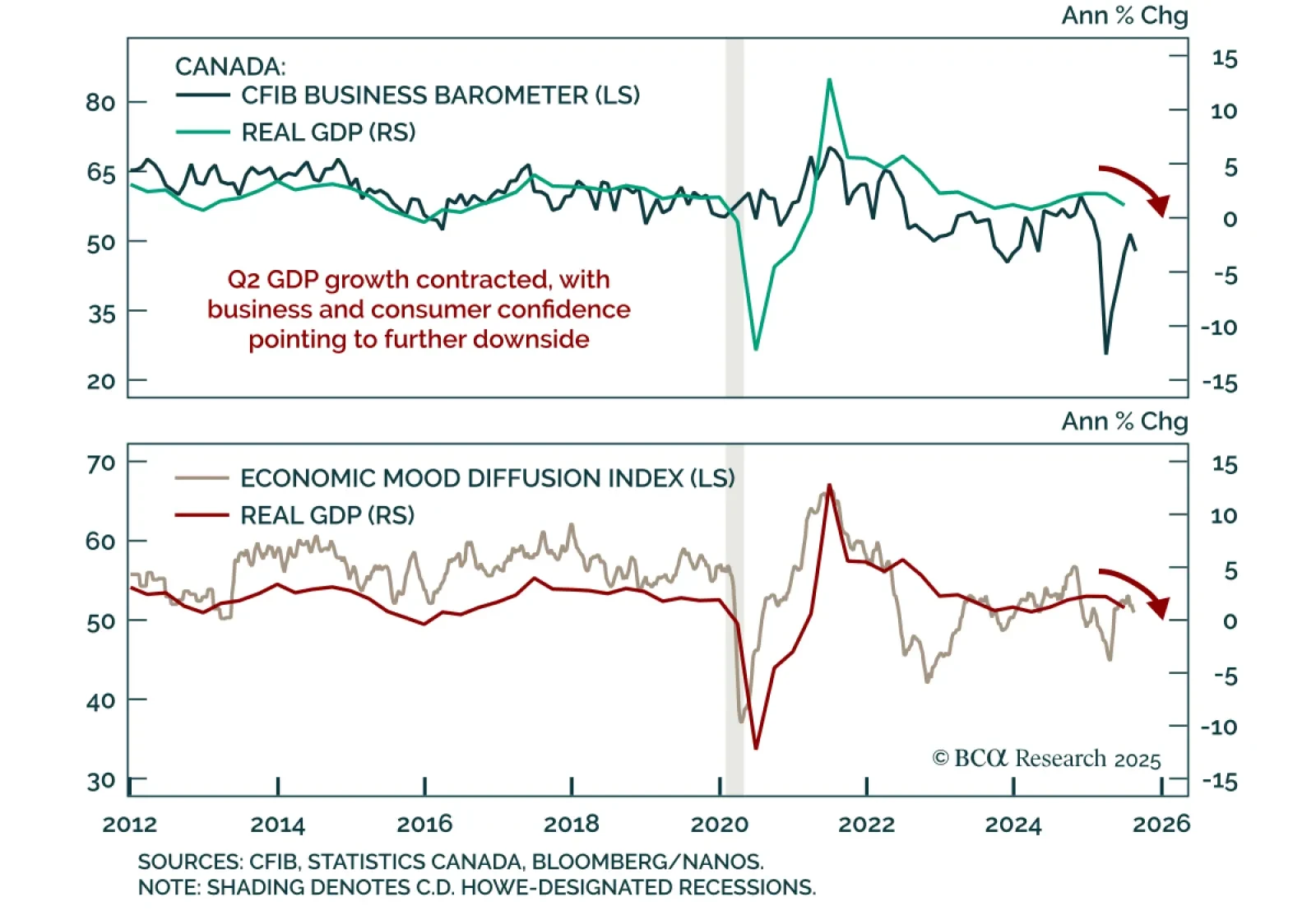

Canada’s Q2 GDP contraction underscores a fragile backdrop where growth risks will outweigh inflation, supporting further BoC easing. Real GDP contracted at an annualized 1.6% after expanding 2.2% in Q1, consistent with survey data…

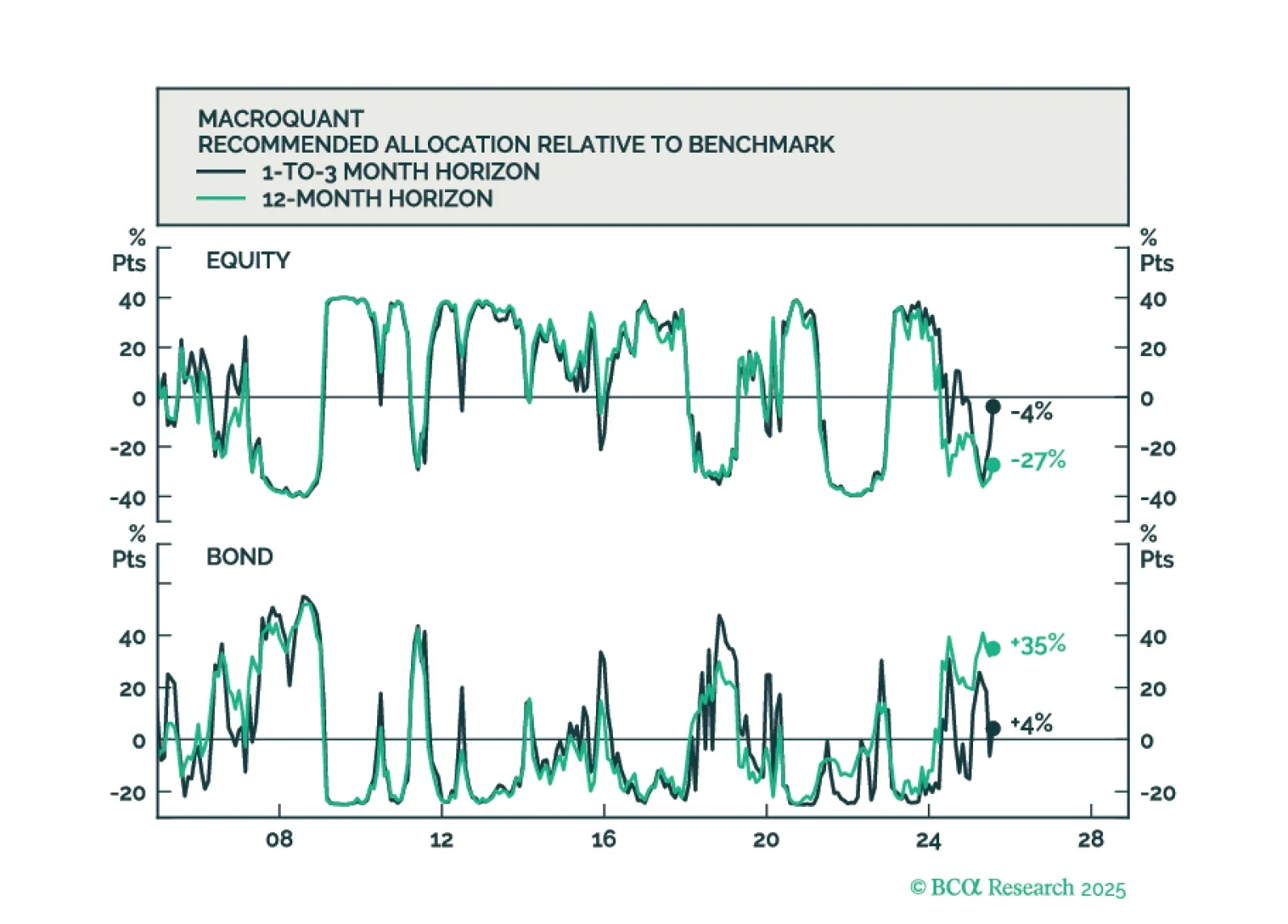

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

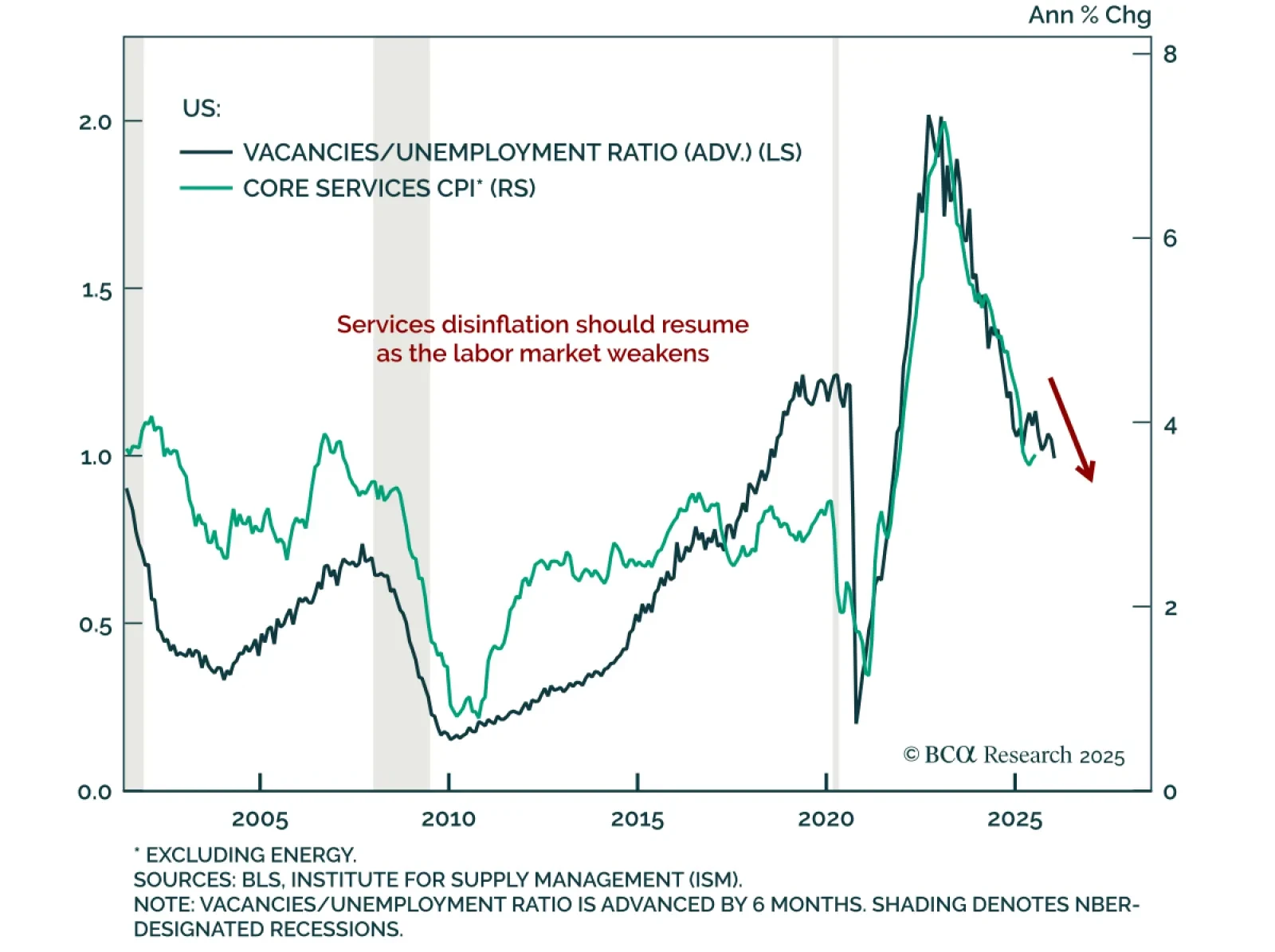

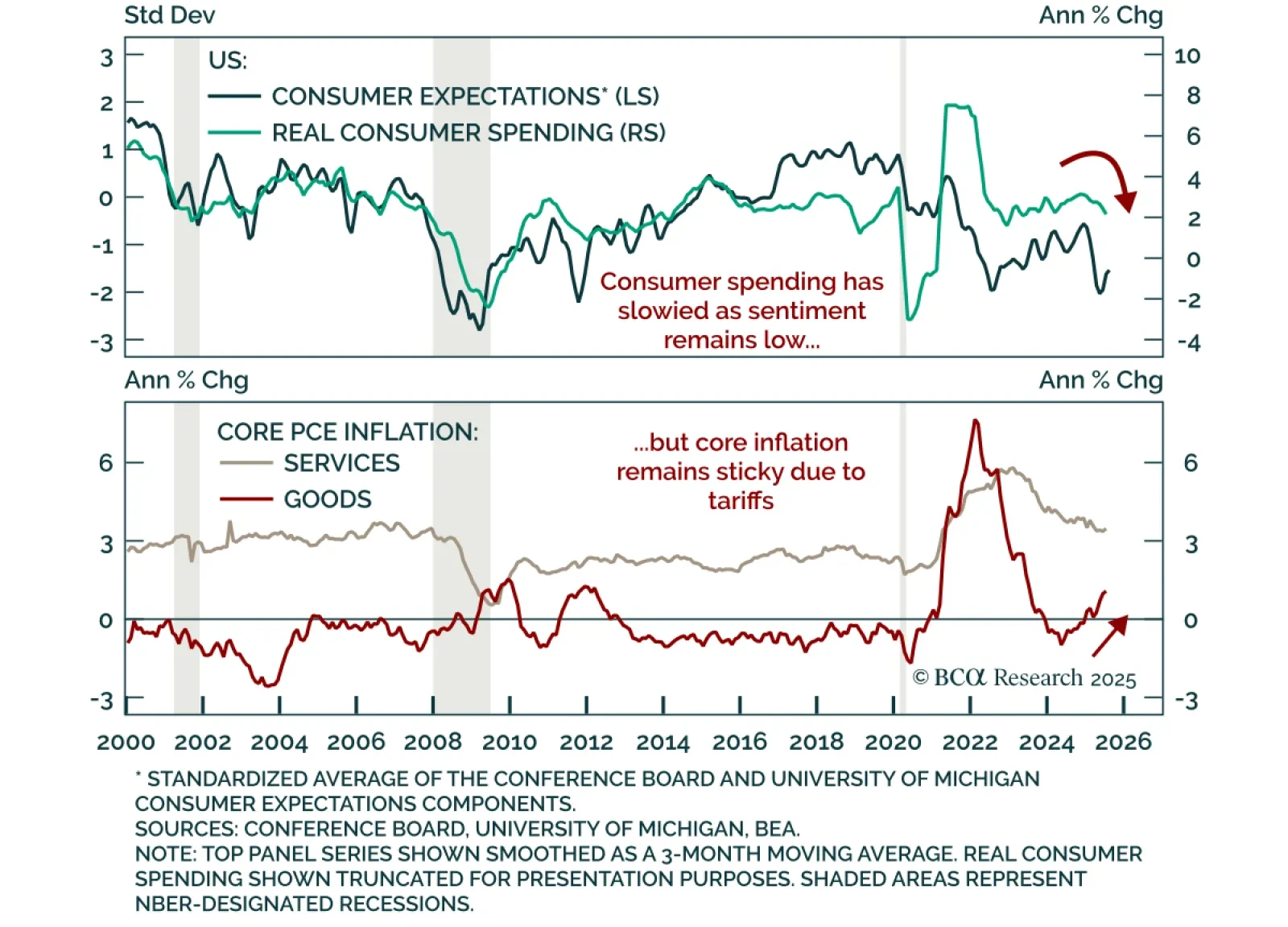

July income and spending data confirmed resilient consumption and sticky inflation, however, slowing labor momentum keeps us defensive. Real personal spending increased 0.3% m/m. Personal income rose 0.4% m/m, with real income…

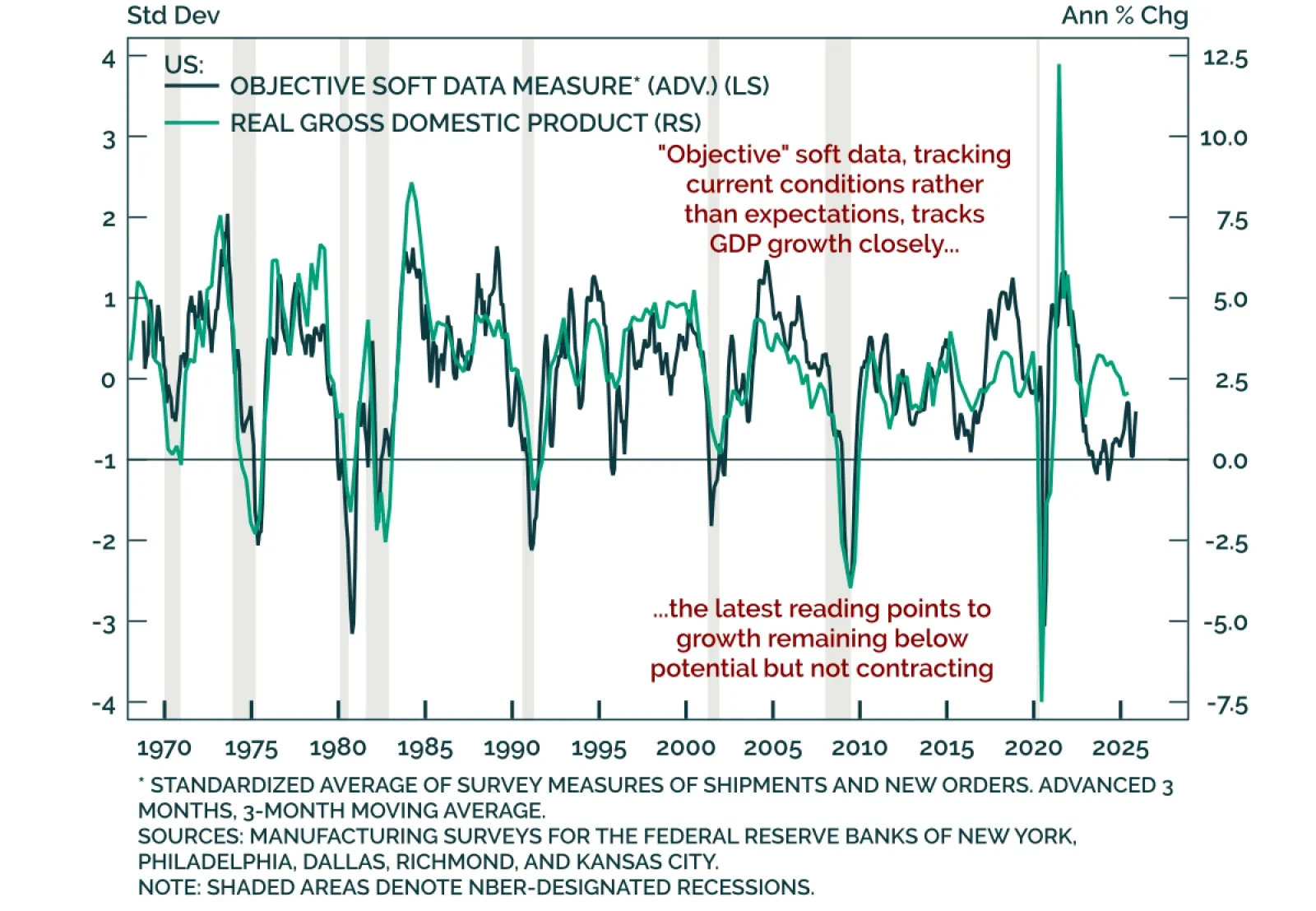

Regional Fed surveys point to low GDP growth, not an outright recession, which tactically supports low growth plays such as duration and tech. These timely surveys provide a snapshot of current month activity, combining “…