In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

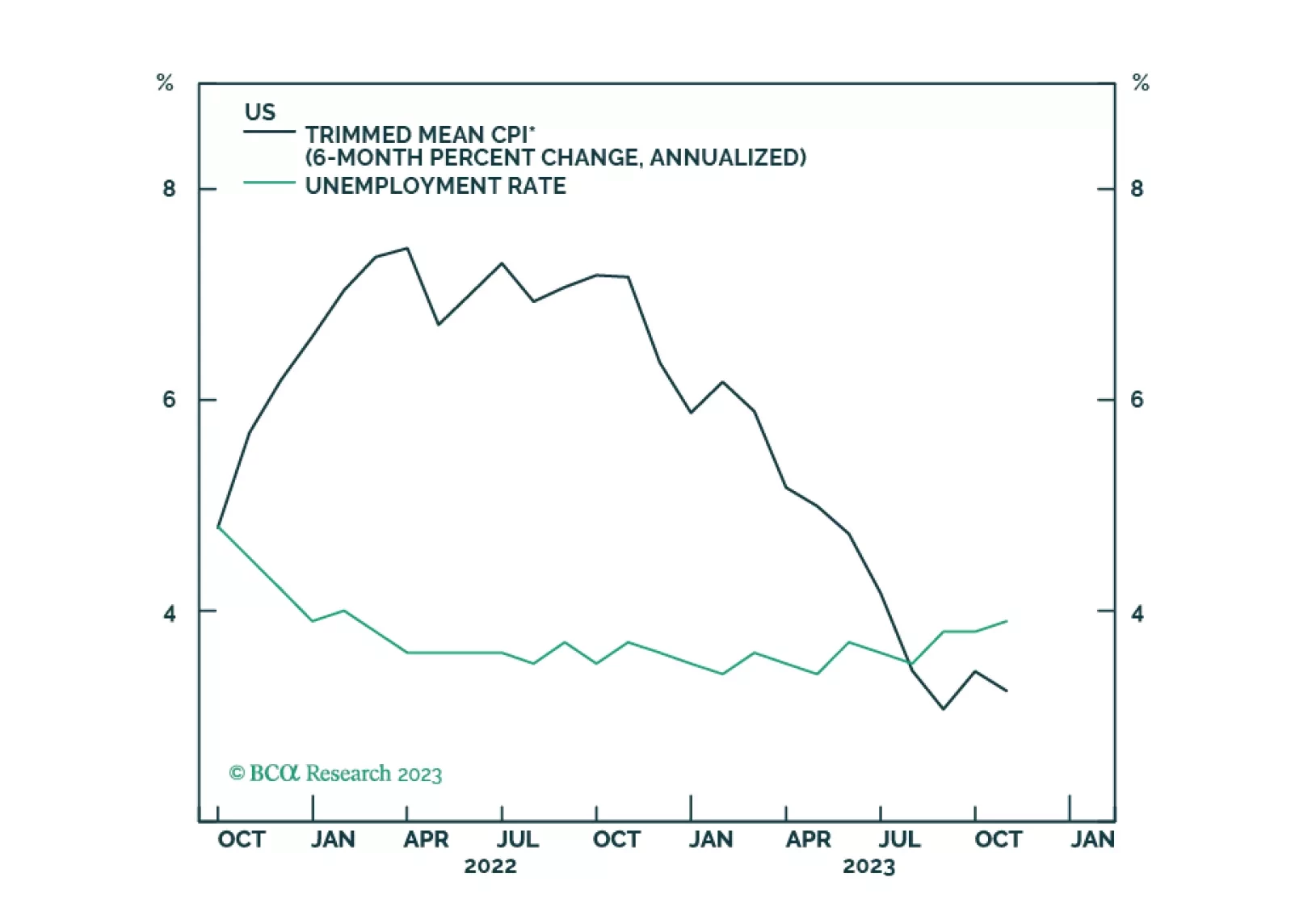

Our kinked Phillips curve framework predicted the immaculate disinflation of 2023. That same framework is now warning that the global economy is heading towards a recession in the second half of 2024.

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…

The bear market in US bonds will likely end with a bang rather than a whimper. Even during the secular US bond bull market of 1982-2021, cyclical bond bear markets ended only after an eruption of financial turmoil. It would be…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

The global downturn will be shallower than it was in 2008 and in 2020 but will last for longer. The primary reason for a more prolonged downturn is that policymakers in the US, Europe, and China will be reluctant to proactively and…

China’s extremely high savings rate is the real culprit behind its current economic woes. The authorities have been slow to stimulate the economy, and the risks of “Japanification” have increased. For now, the fact that China is…