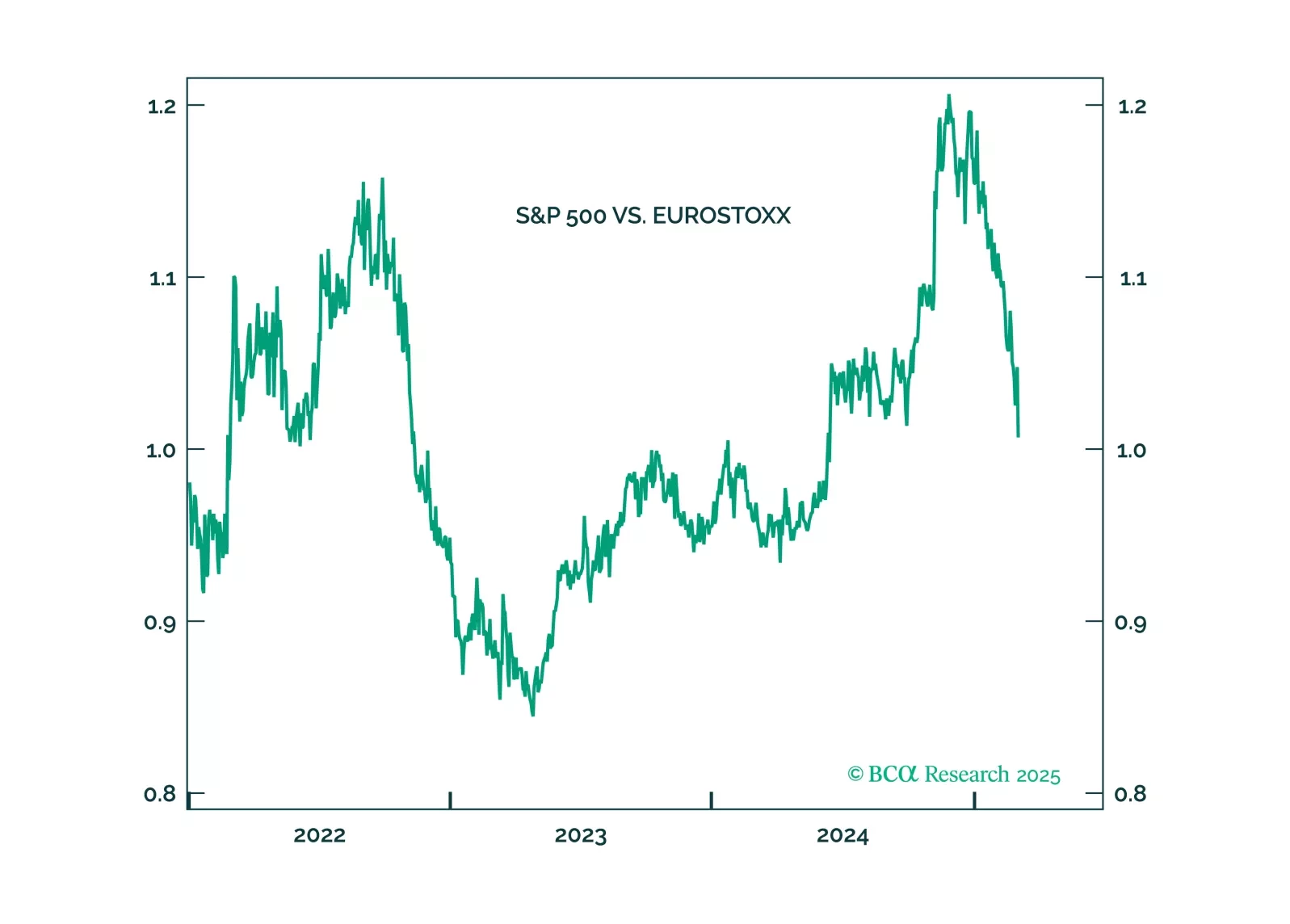

Trump will pull back from the trade war when stocks approach bear market territory. He will not withdraw from NATO. Favor European stocks on fiscal policy.

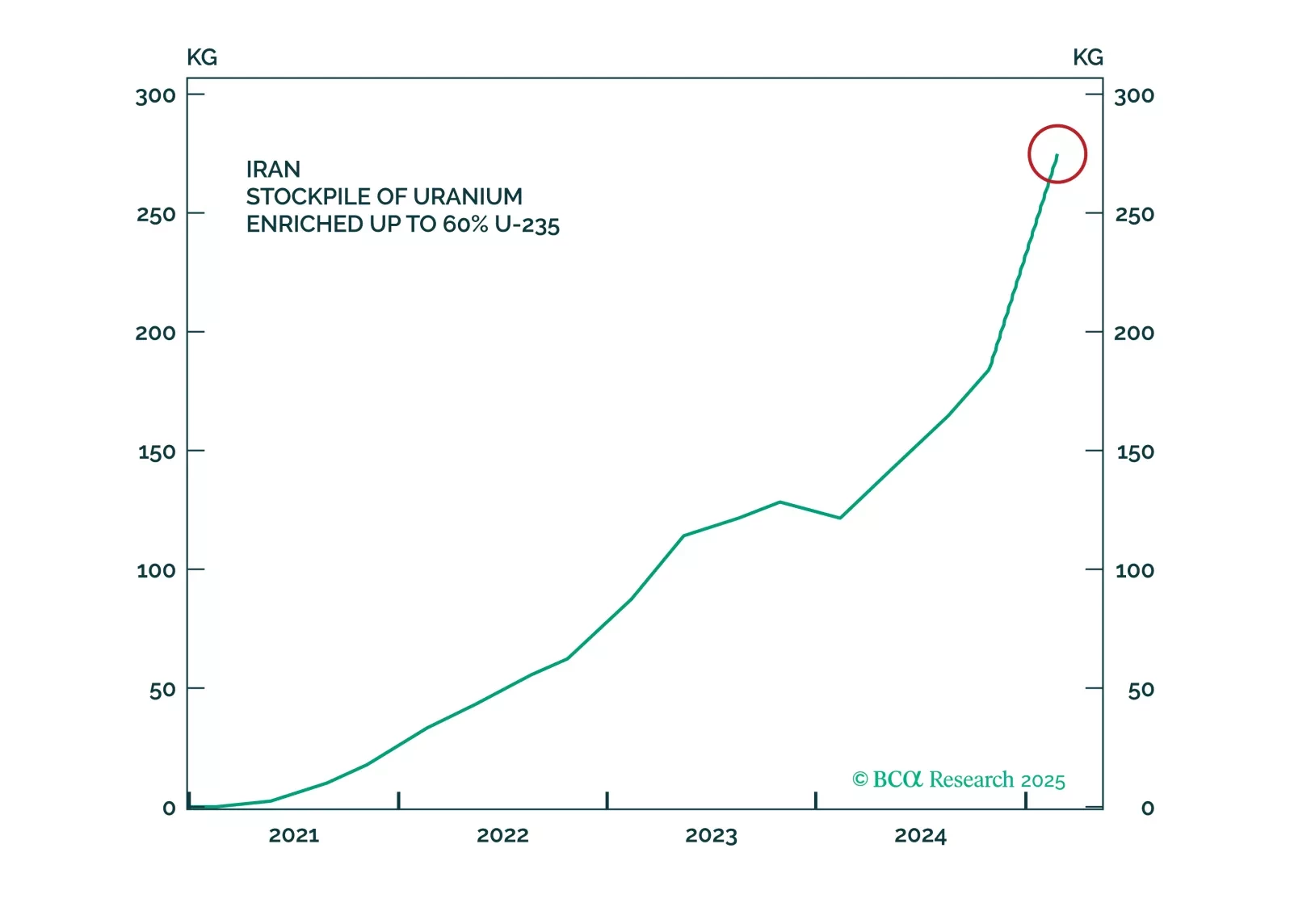

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

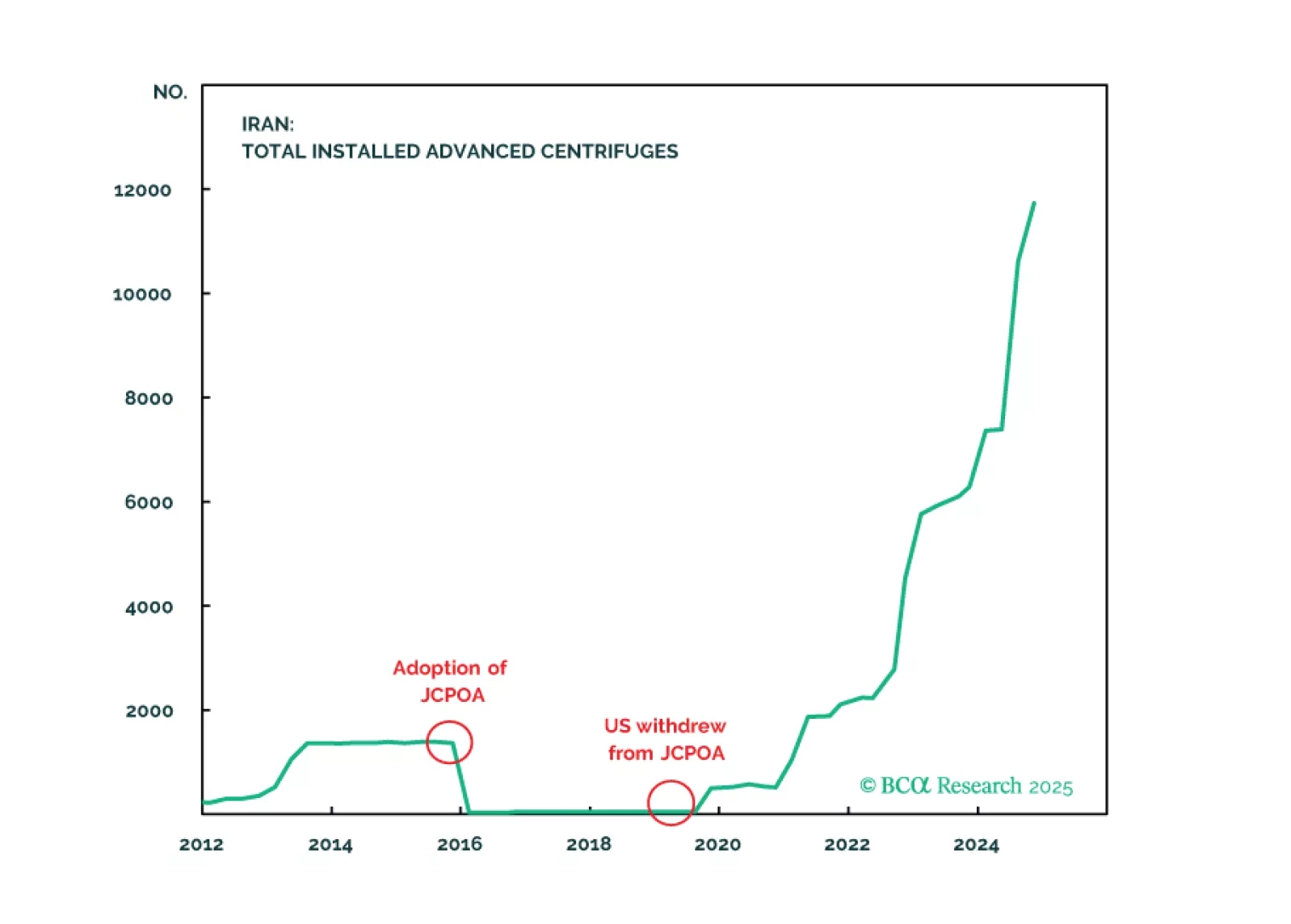

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…