The S&P 500 reached our 4,500 mid-year target last week, but the bears have yet to capitulate and stocks could melt up so we are placing a trailing stop on our tactical overweight instead of downgrading equities outright.

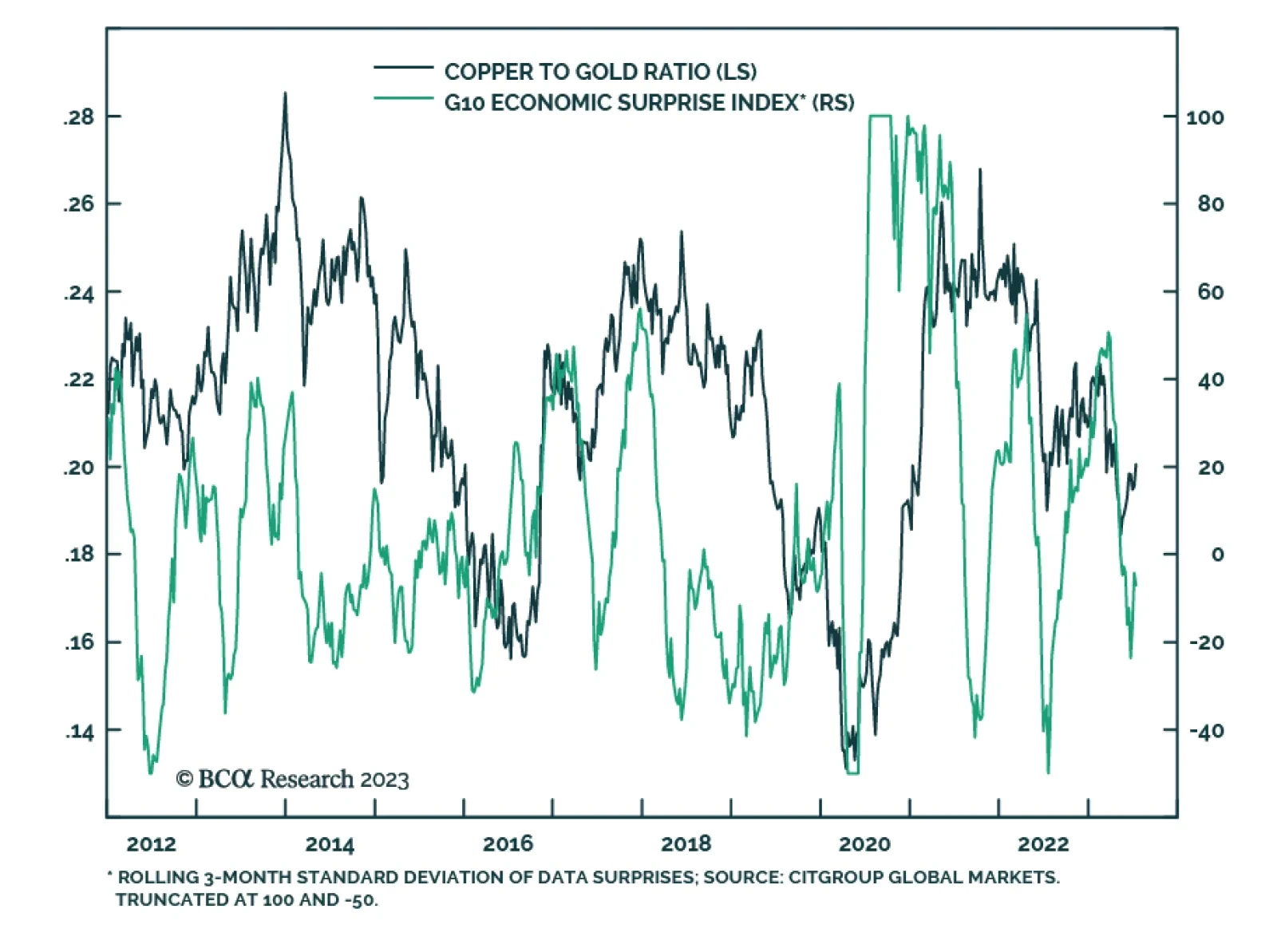

Copper rallied to a two-month high by the end of last week. Importantly, this move did not occur in isolation. It coincides with greater optimism about the prospects of a soft landing. Indeed, the US economic surprise index is…

In this report, we explore Brazil’s inflation and monetary policy outlook, the Lula administration’s back-and-forth between pragmatism and populism, and how these factors will affect Brazilian financial markets going forward. All in…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

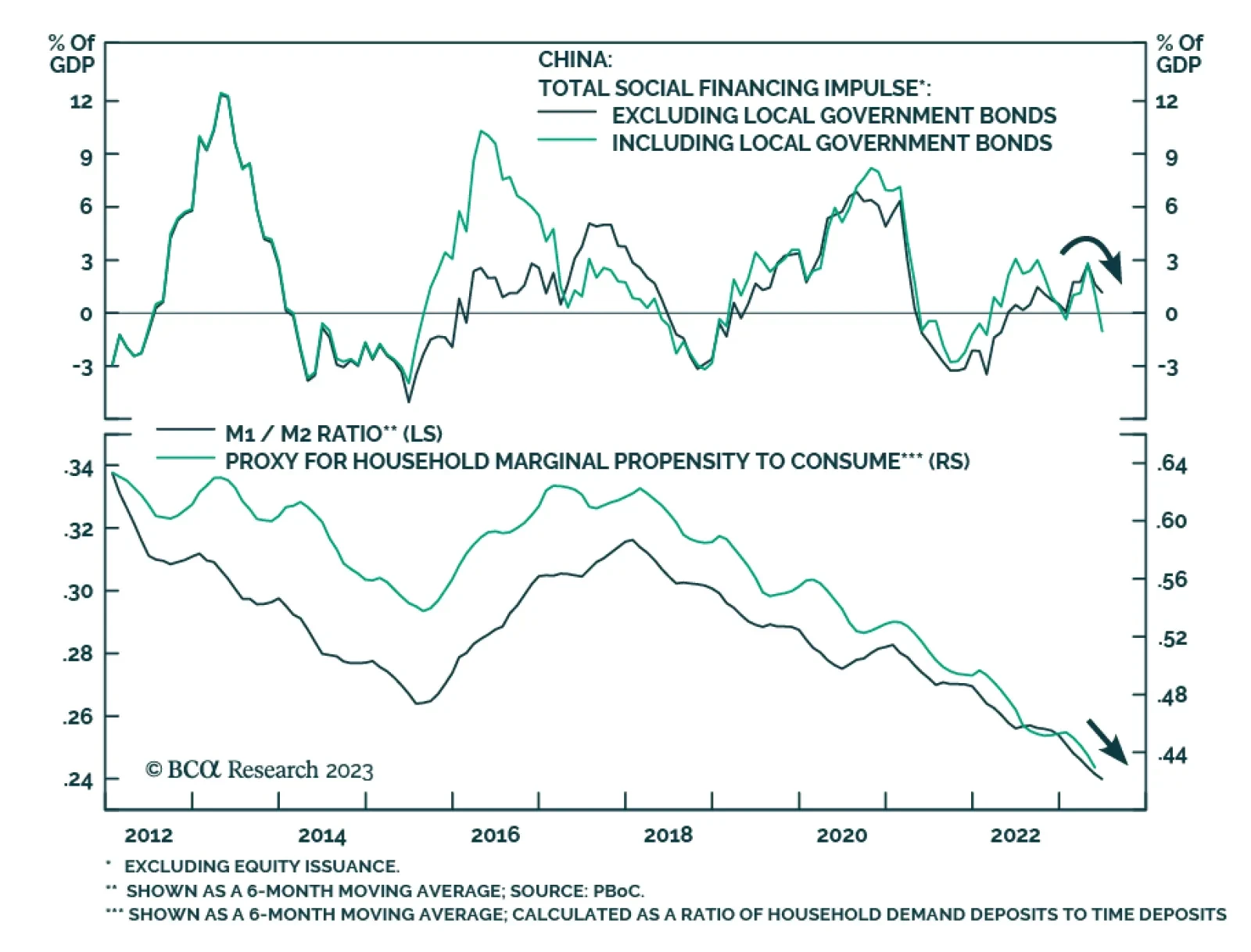

According to BCA Research’s China Investment Strategy team, China’s fiscal support will be limited due to political and economic factors. China has heavily relied on government expenditure support to sustain its…

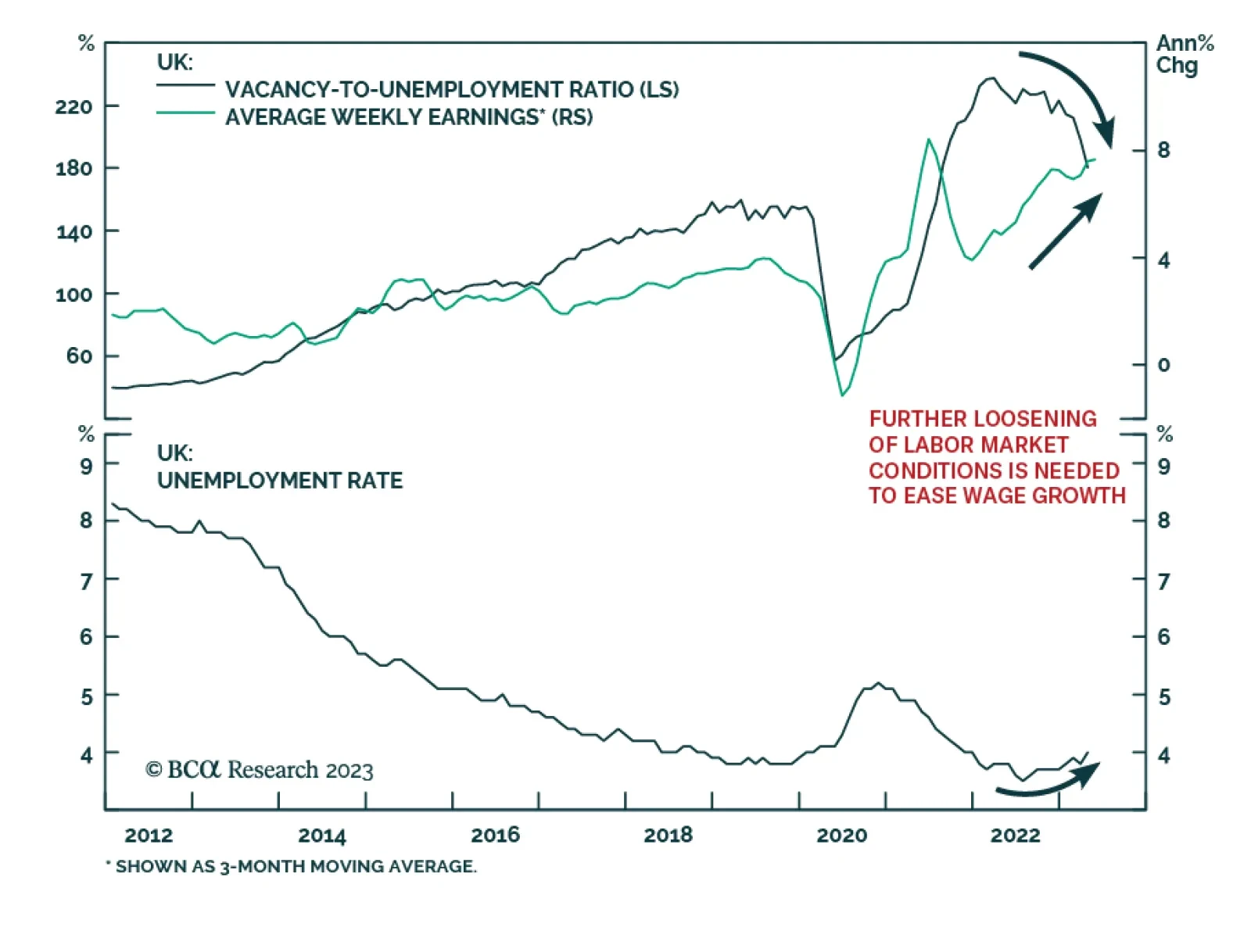

Hot UK wage data focused investors’ attention on the Bank of England’s battle against sticky inflationary pressures on Tuesday. The 7.3% y/y increase in weekly earnings (excluding bonuses) in the three months to May…

China’s credit expansion surprised to the upside in June. Aggregate social financing totaled CNY 4.22 trillion – above expectations of CNY 3.10 trillion and exceeding CNY 1.56 trillion in the prior month. Similarly,…

Investors’ positioning in the USD is not homogenous: they are short some currencies but long others versus the greenback. Market commentators often refer to the US dollar. They implicitly mean the US currency is moving…

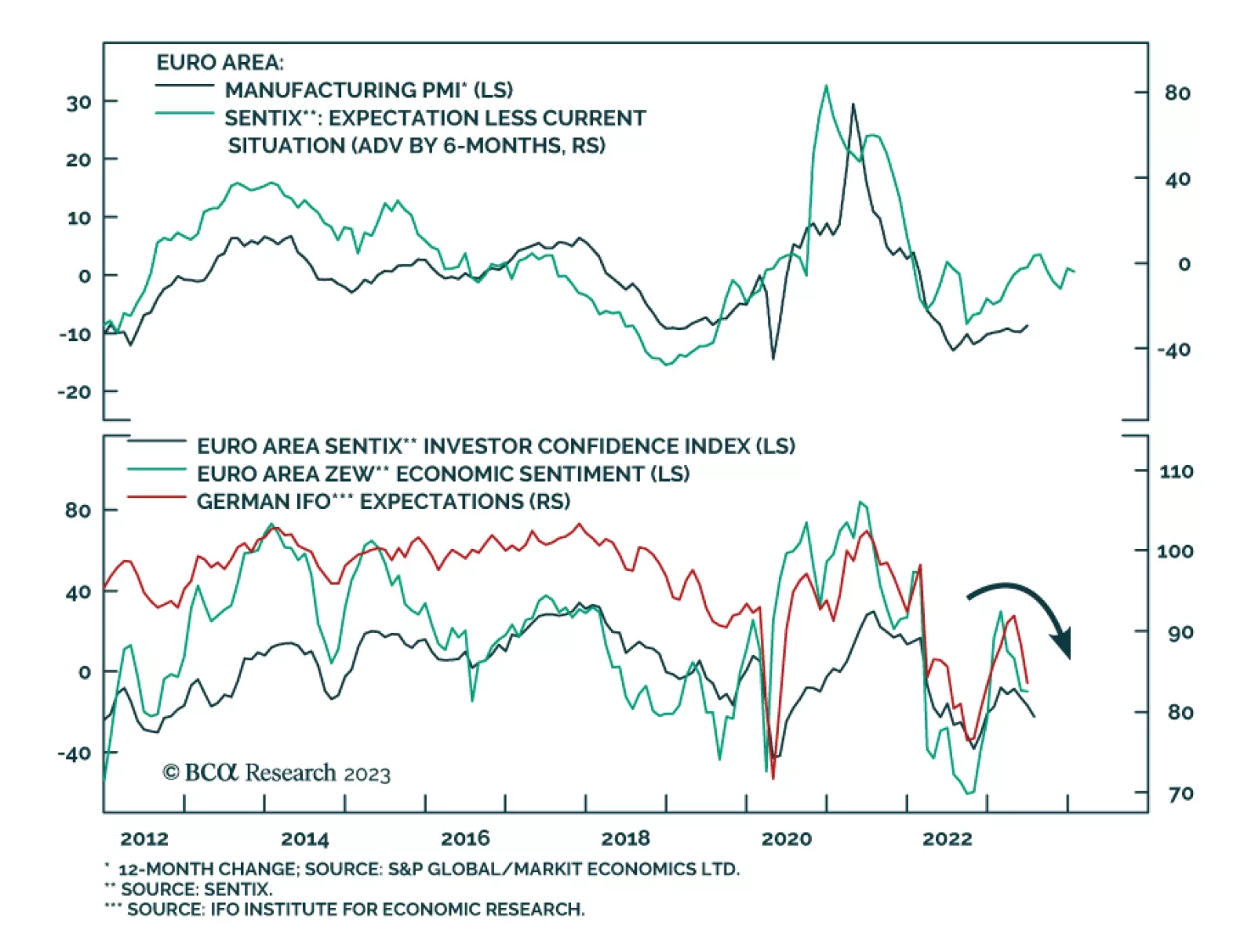

On Monday, the Eurozone Sentix sent a pessimistic signal about investor confidence in the Eurozone economy. The headline index dropped from -17.0 to -22.5 in July, significantly below expectations of a more muted deterioration to…

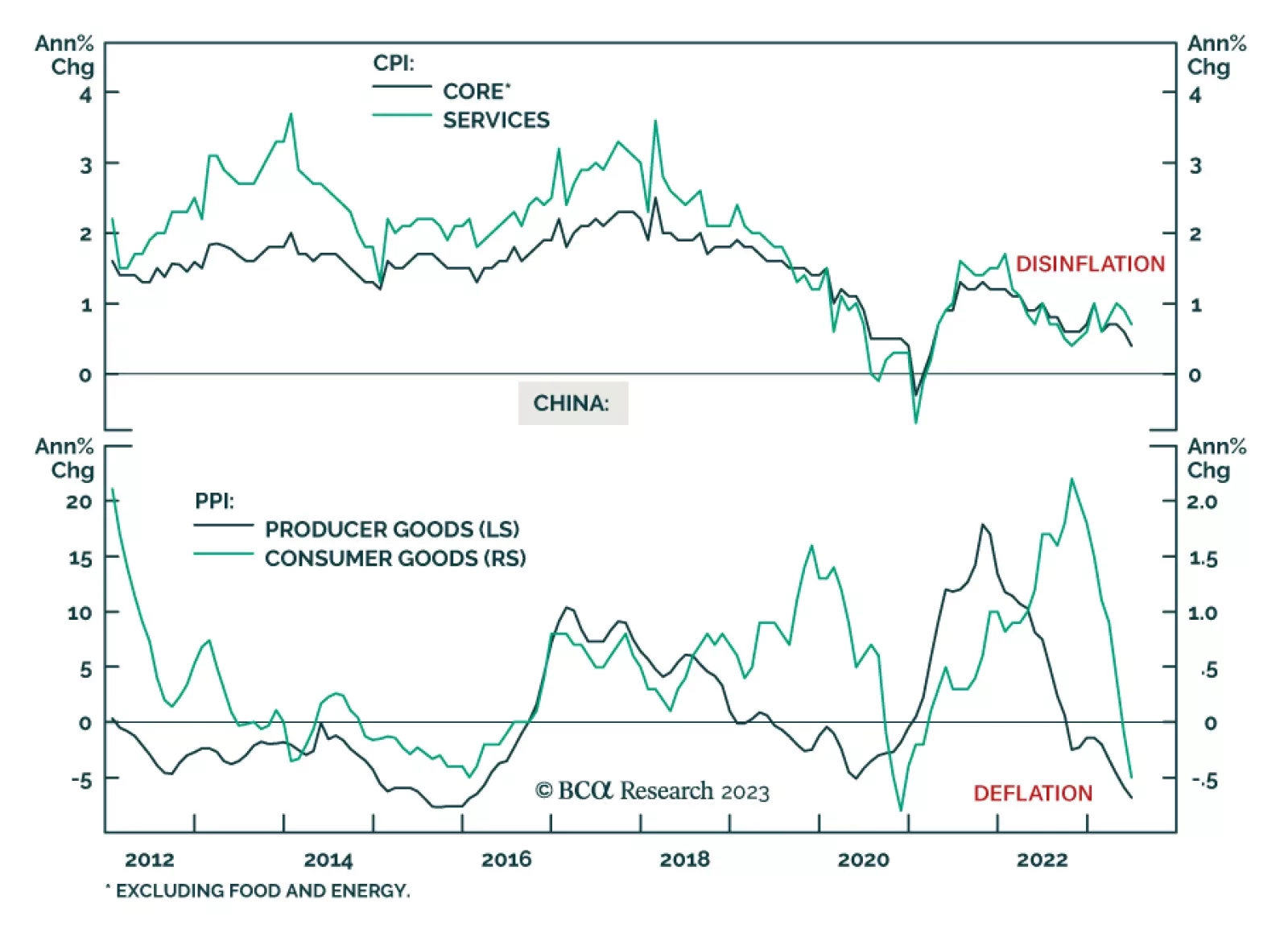

China’s CPI and PPI inflation updates indicate that deflationary pressures continue to dominate the domestic economy in June. Producer prices declined at a faster pace than in the prior month, falling by -5.4% y/y following…