This week we preview the July FOMC meeting, provide an update on the Fed’s balance sheet and recommend a new TIPS trade.

Although not our base case, there is a path for the US economy to avoid a recession over the next few years. We see the risks to stocks as tilted to the upside in the near term but to the downside over a 12-month horizon.

BCA Research’s Emerging Markets Strategy service concludes that the failure of EM stocks, Asian currencies and commodities to stage a broad-based outperformance is consistent with their macro thesis that global trade/…

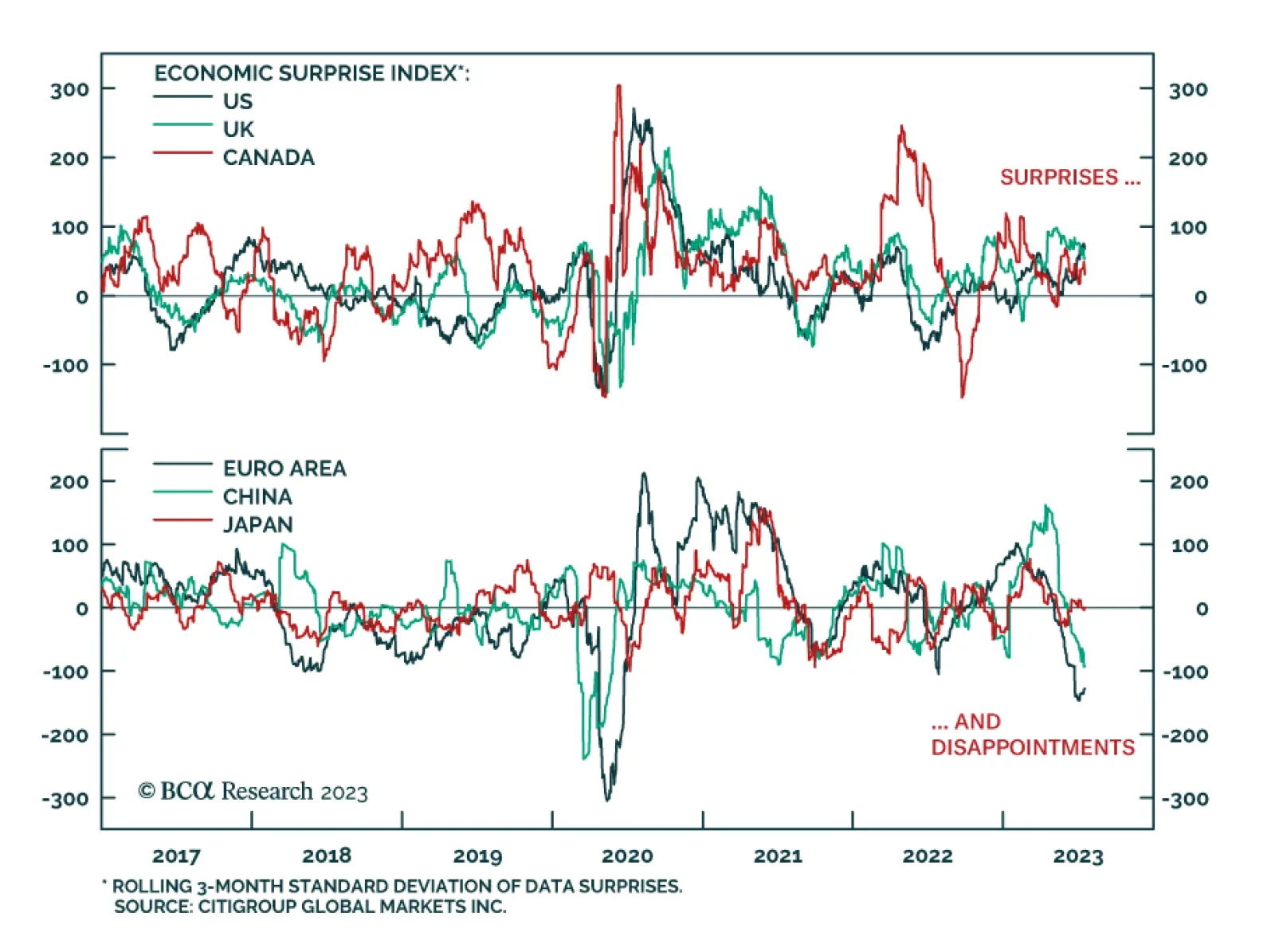

Citigroup’s global economic surprise index has fallen sharply over the past few months and is now slightly negative – indicating that economic data have surprised to the downside. Yet beneath the surface, there is…

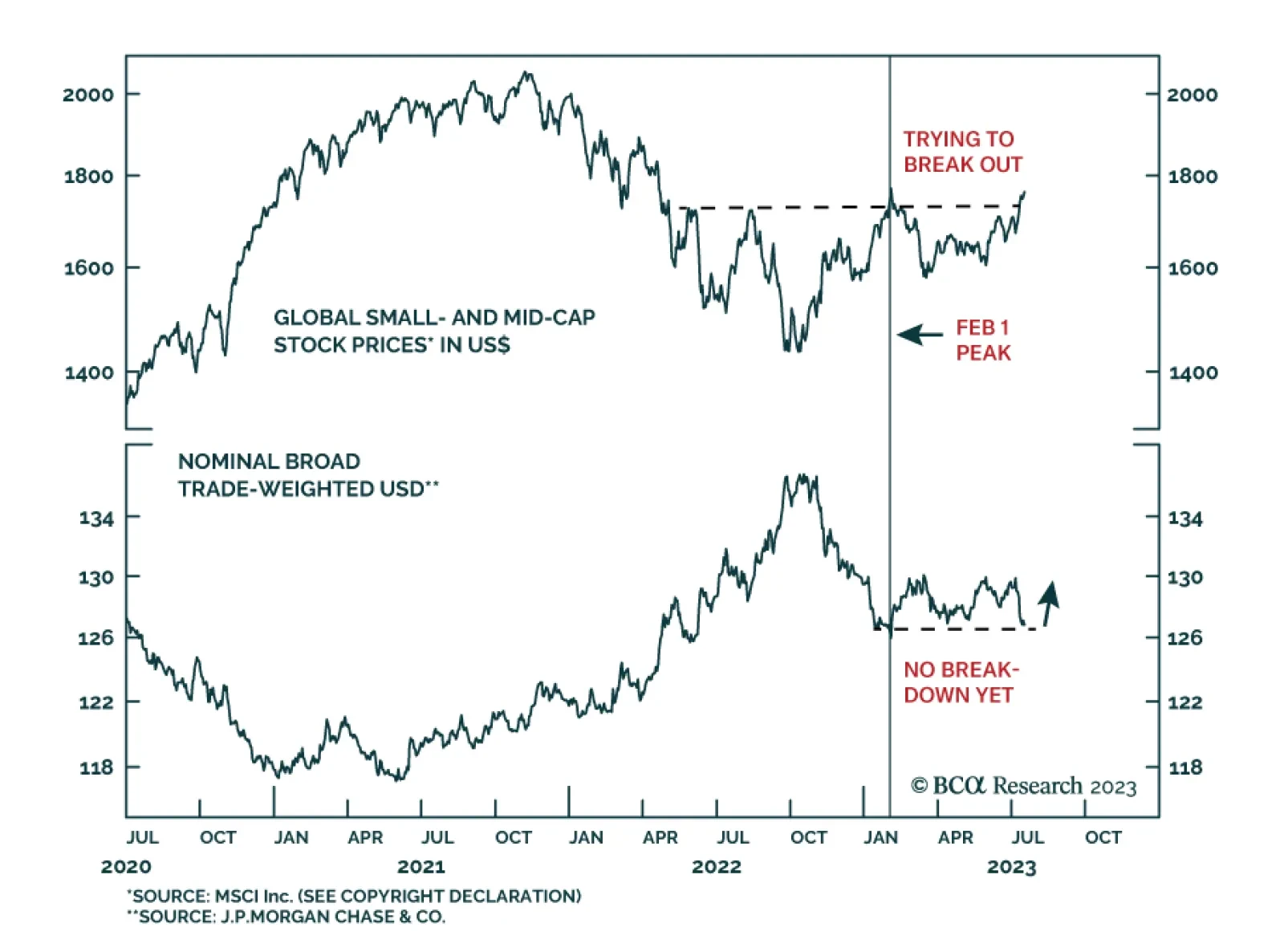

In this report, we dissect which markets have broken out and which ones have not, and reflect what this entails for our global macro view. Also, we analyze how the S&P 500 has been taking its cues from a change in the inflation…

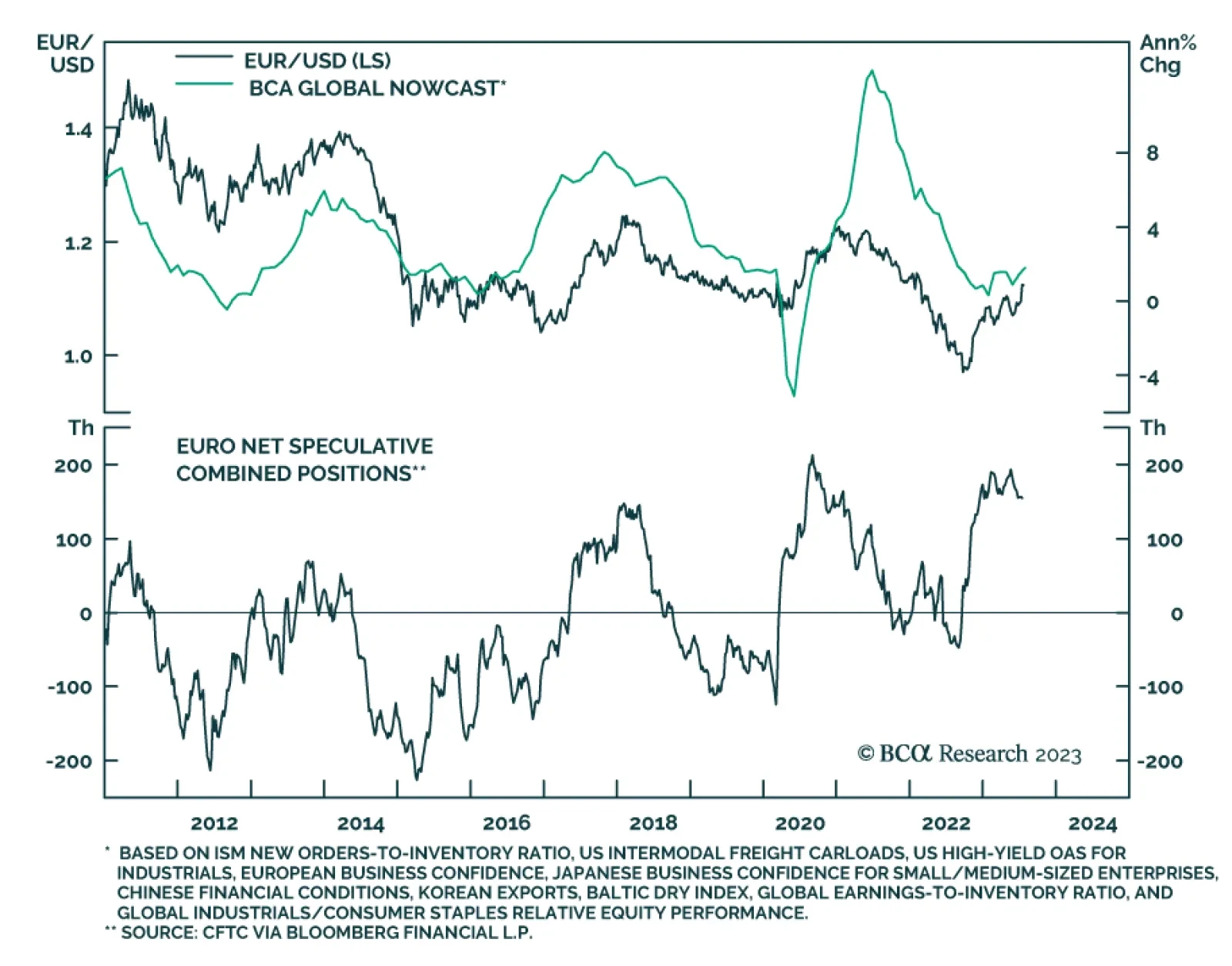

After US inflation slowed down markedly, EUR/USD broke out to 1.12, which constitutes a 16-month high. The euro is benefiting from the market expectation that the Fed will soon be done with its hikes while the ECB’s…

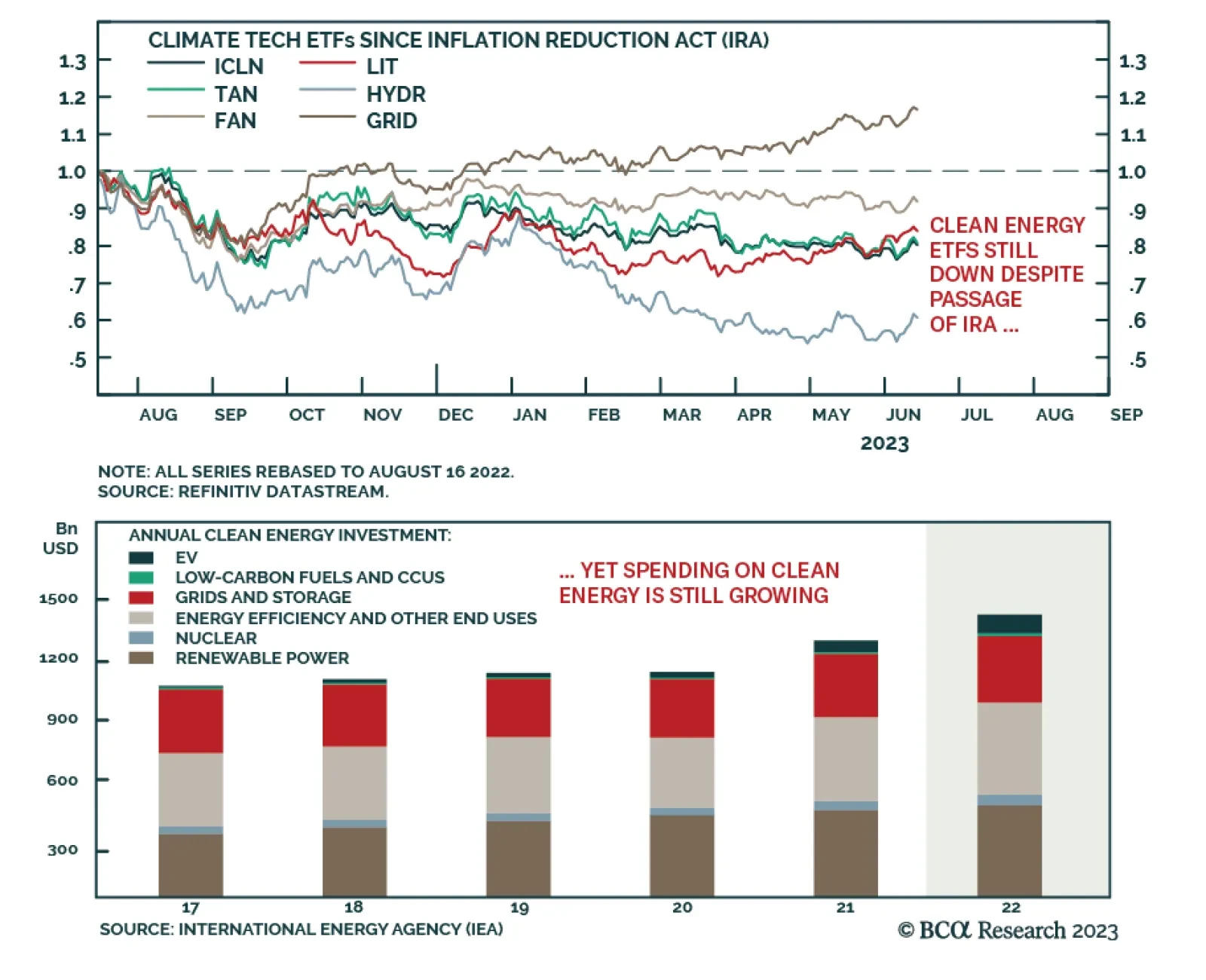

According to BCA Research’s US Equity Strategy, clean energy is well poised for a sustained bull market over the long term. Governments around the world are enthusiastically lending their support to the clean energy…

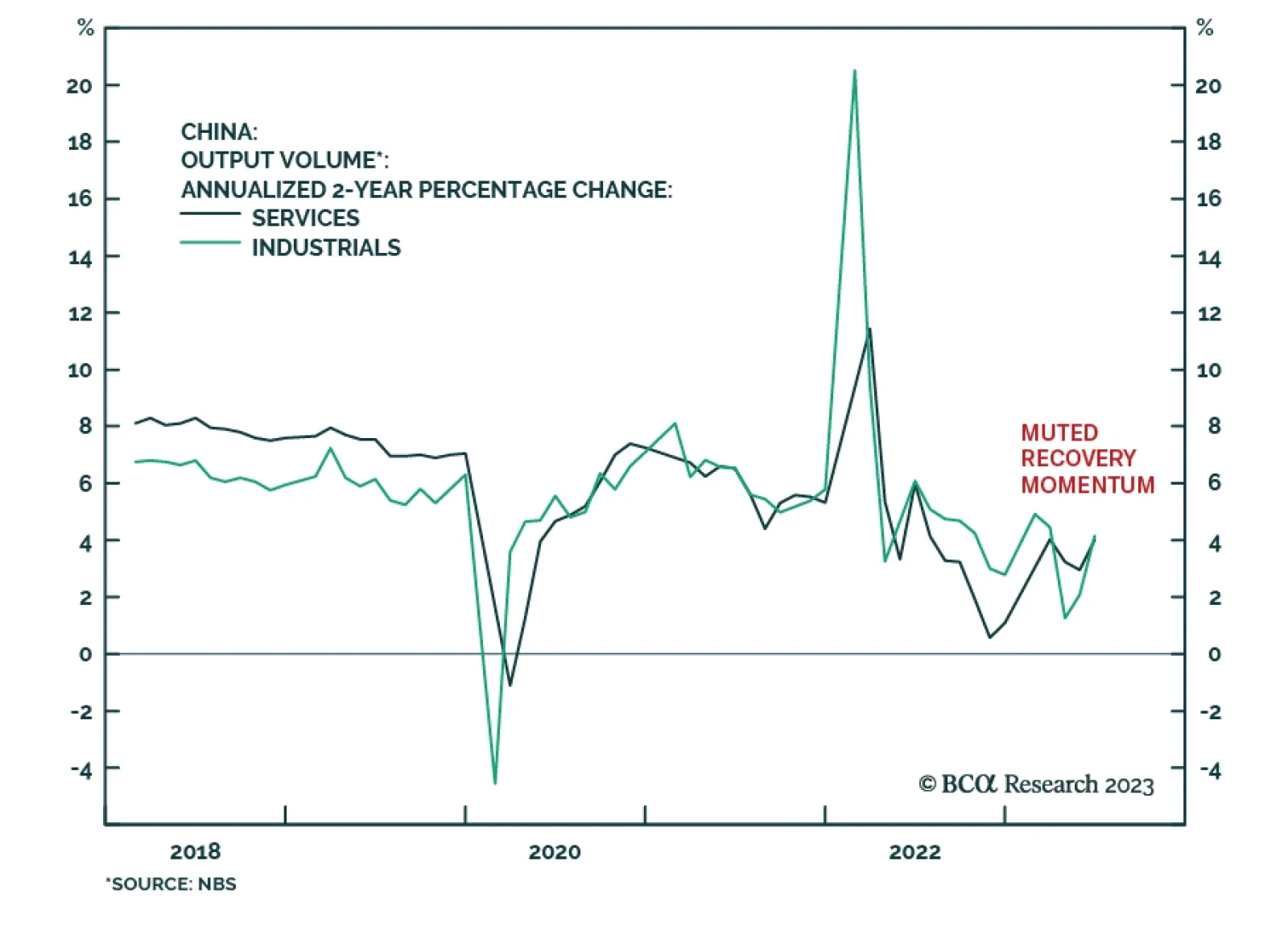

On the surface, the latest batch of Chinese economic data released on Monday shows a deterioration in consumer spending with retail sales growth slowing sharply from 12.7% y/y to 3.1% y/y in June – slightly below consensus…

In recent months, the European and US economies have greatly diverged, with the Euro Area massively disappointing while the US has surprised to the upside. Can this dichotomy continue or is it Europe’s turn to shine?