August offers an opportunity to review our key views. European growth is turning the corner and inflation is improving, but does it guarantee an imminent breakout in European stocks?

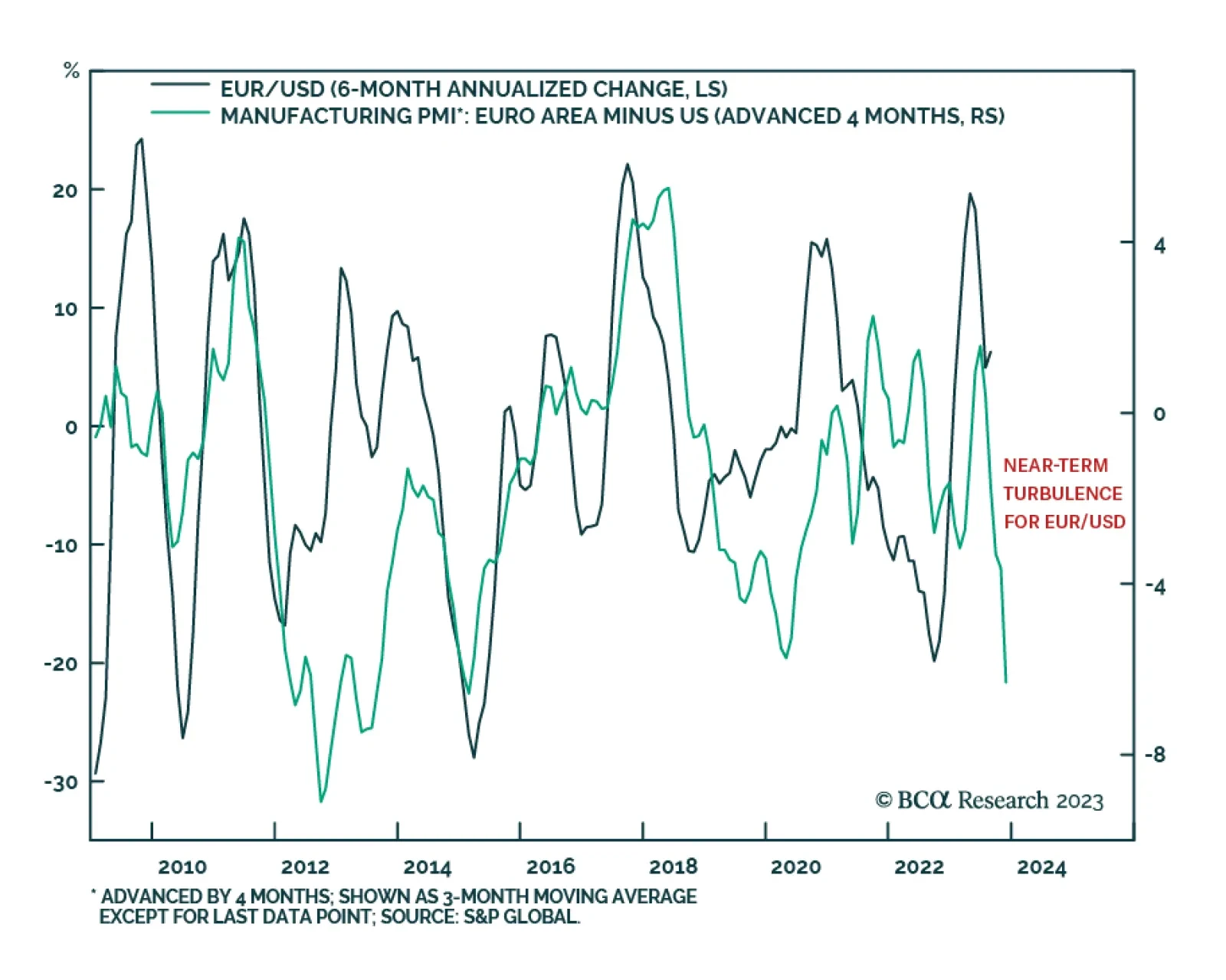

Ever since the bottom below 0.96, the euro has staged a powerful rally. At 1.1, the euro is up 14.6% from its lows. The key question going forward is if investors should chase the rally, or fade strength in the common currency…

China’s extremely high savings rate is the real culprit behind its current economic woes. The authorities have been slow to stimulate the economy, and the risks of “Japanification” have increased. For now, the fact that China is…

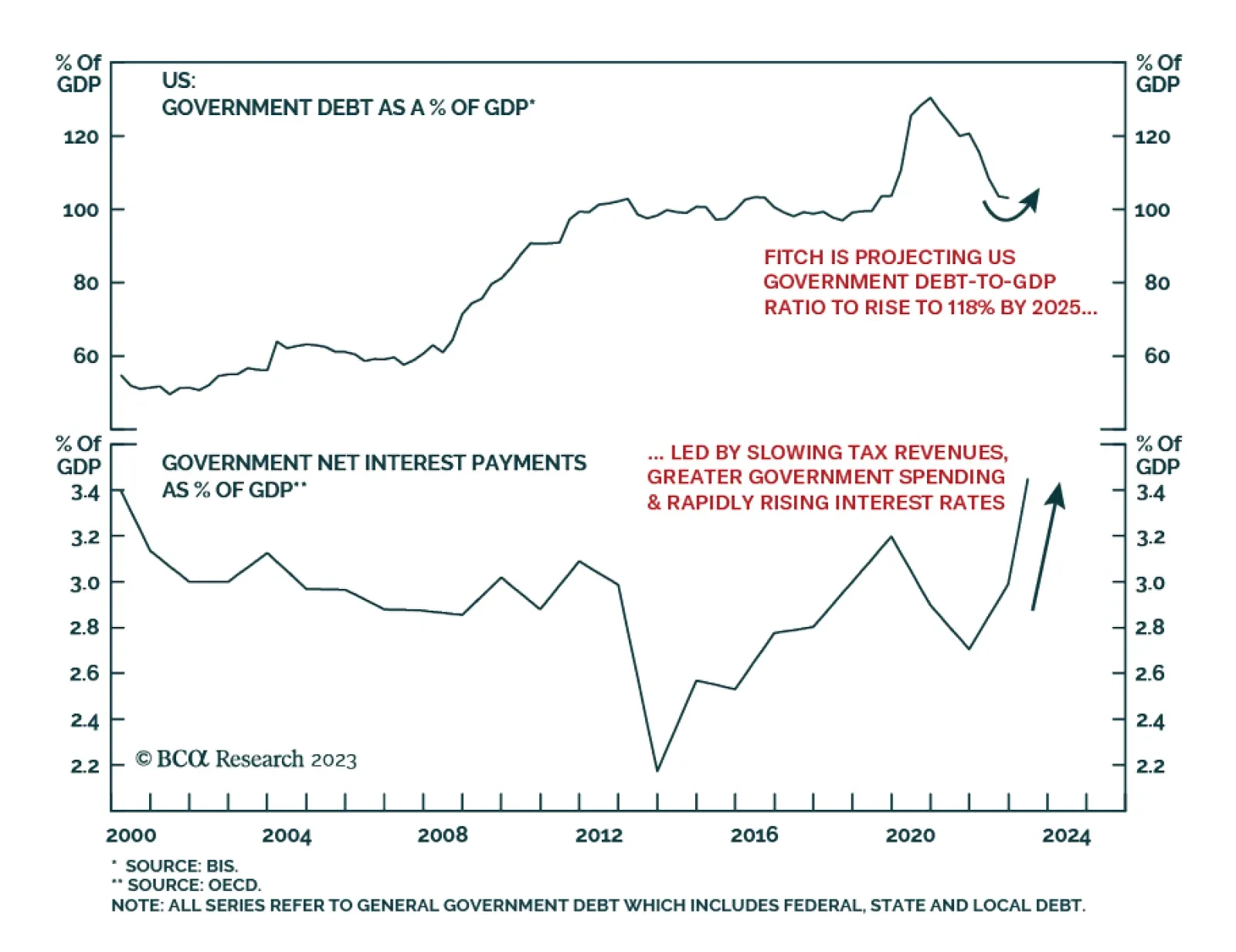

US financial markets were dealt a summer shock yesterday with Fitch Ratings lowering its sovereign credit rating on the US to AA+ from AAA. This brings the rating down to the same level as that of S&P, which announced its own…

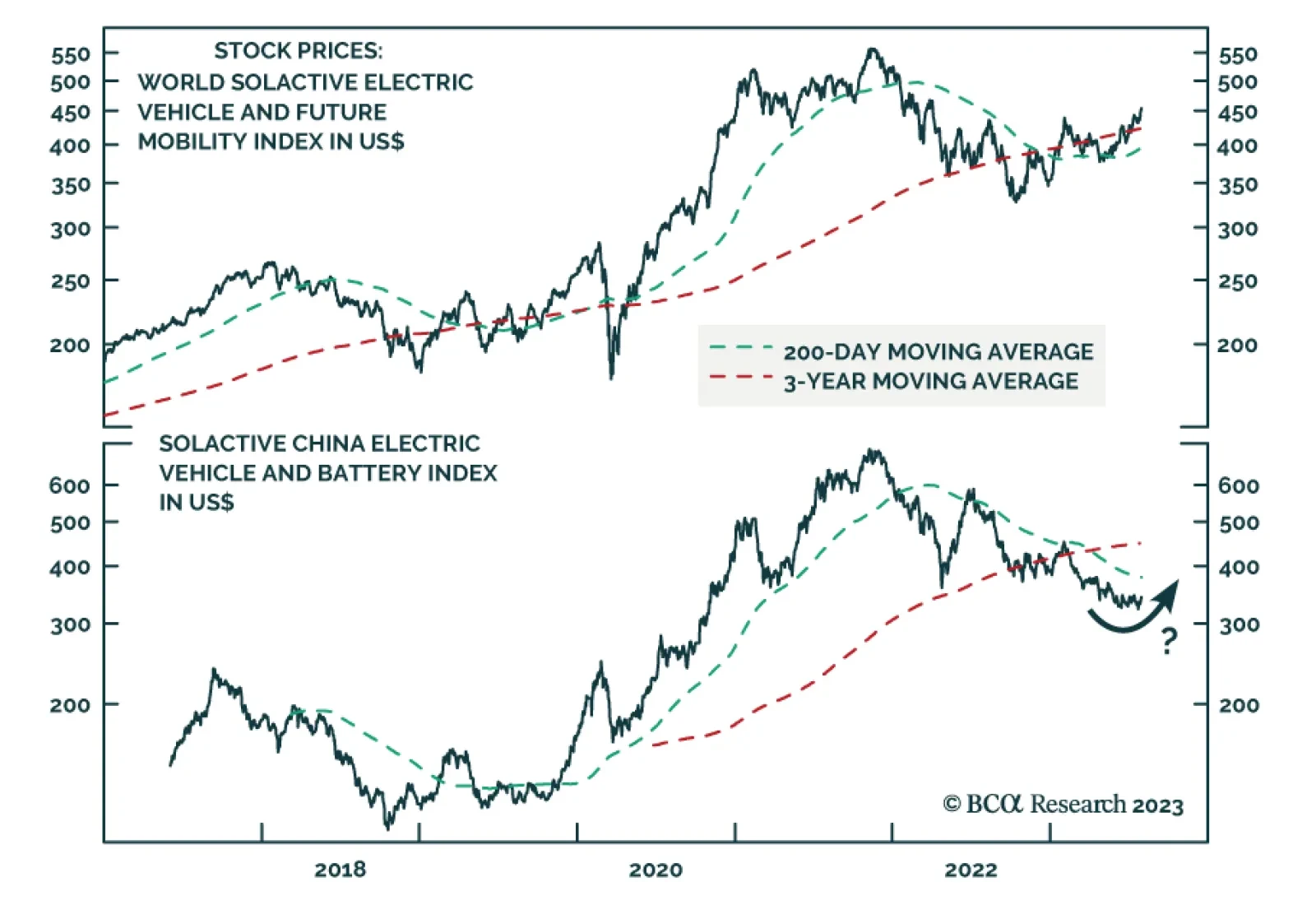

According to BCA Research’s China Investment Strategy service, Beijing’s investment focus is shifting from traditional infrastructure to new economy infrastructure, which includes clean energy and high-tech sectors…

History suggests that a “soft landing” is highly unlikely after such an aggressive Fed tightening cycle. The rally could continue for a little longer but, on the 12-month horizon, market risks are very skewed to the downside.

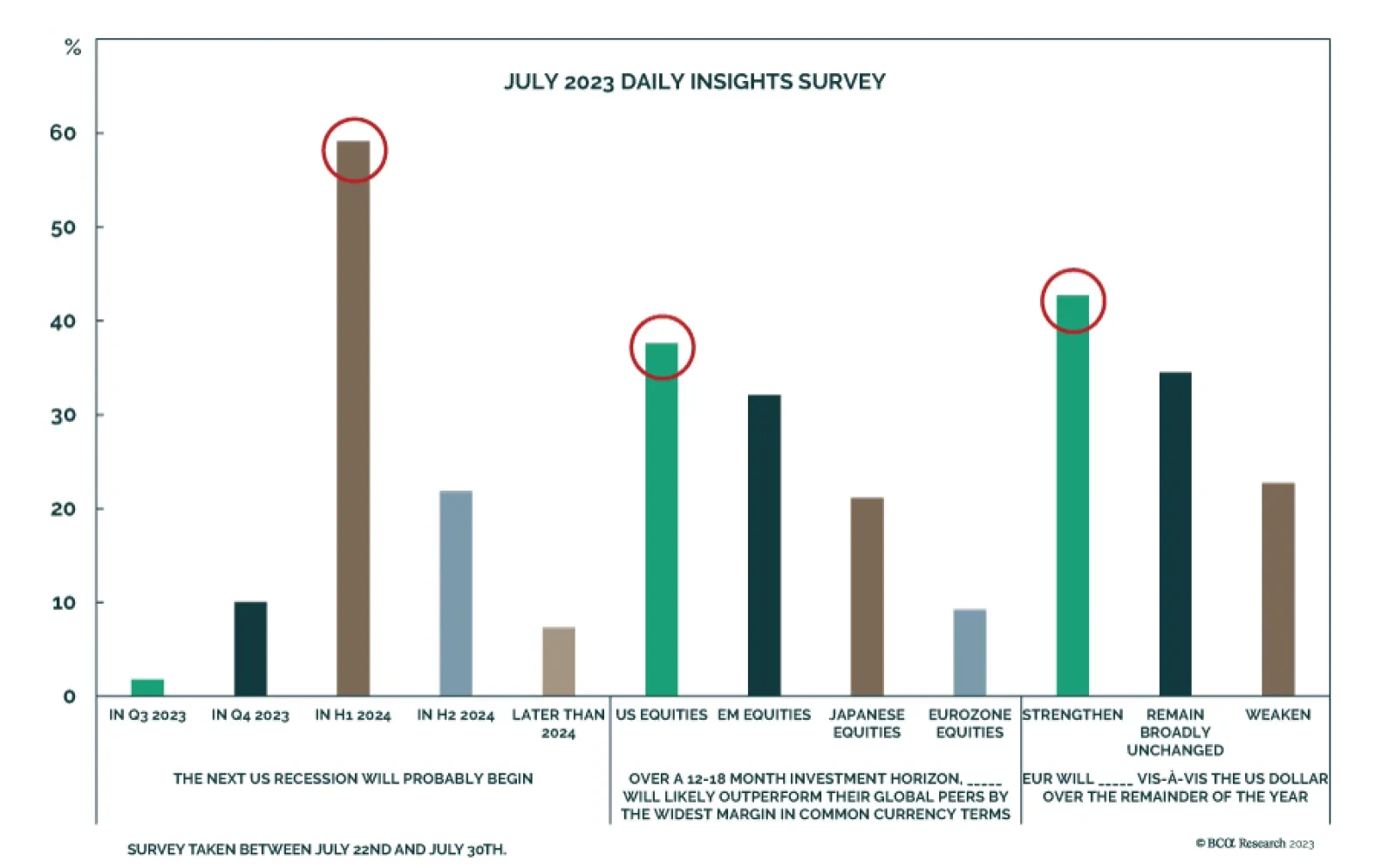

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for the US economy, regional equity allocation, and EUR/USD. On the outlook for the US economy, the majority of…

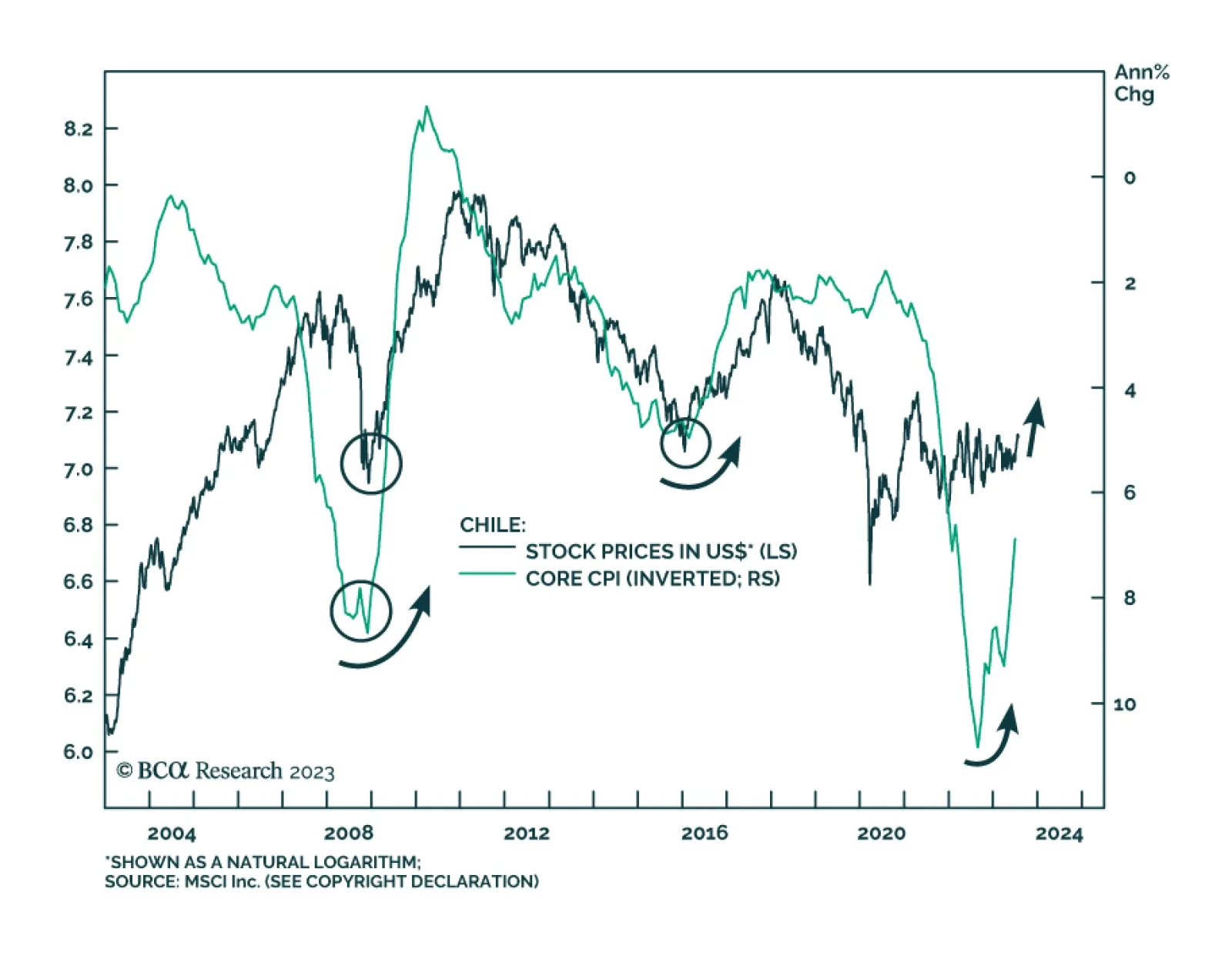

Last Friday, the Central Bank of Chile became the first major Latin American monetary authority to cut rates, thereby beginning the EM monetary easing cycle. In its latest meeting, board members decided to reduce the policy…