European real GDP growth is stabilizing, so why would European equities continue to trade sideways for the remainder of the year? The answer lies with nominal growth and its impact on earnings.

Inspired by a client’s questions, we examine the rationale behind the implementation of the trailing stop governing our near-term asset allocation recommendations.

According to BCA Research’s Emerging Markets Strategy service, the gap that has formed between the S&P 500 price and its operating profit margins, as well as the divergence between the S&P 500 Forward P/E ratio and…

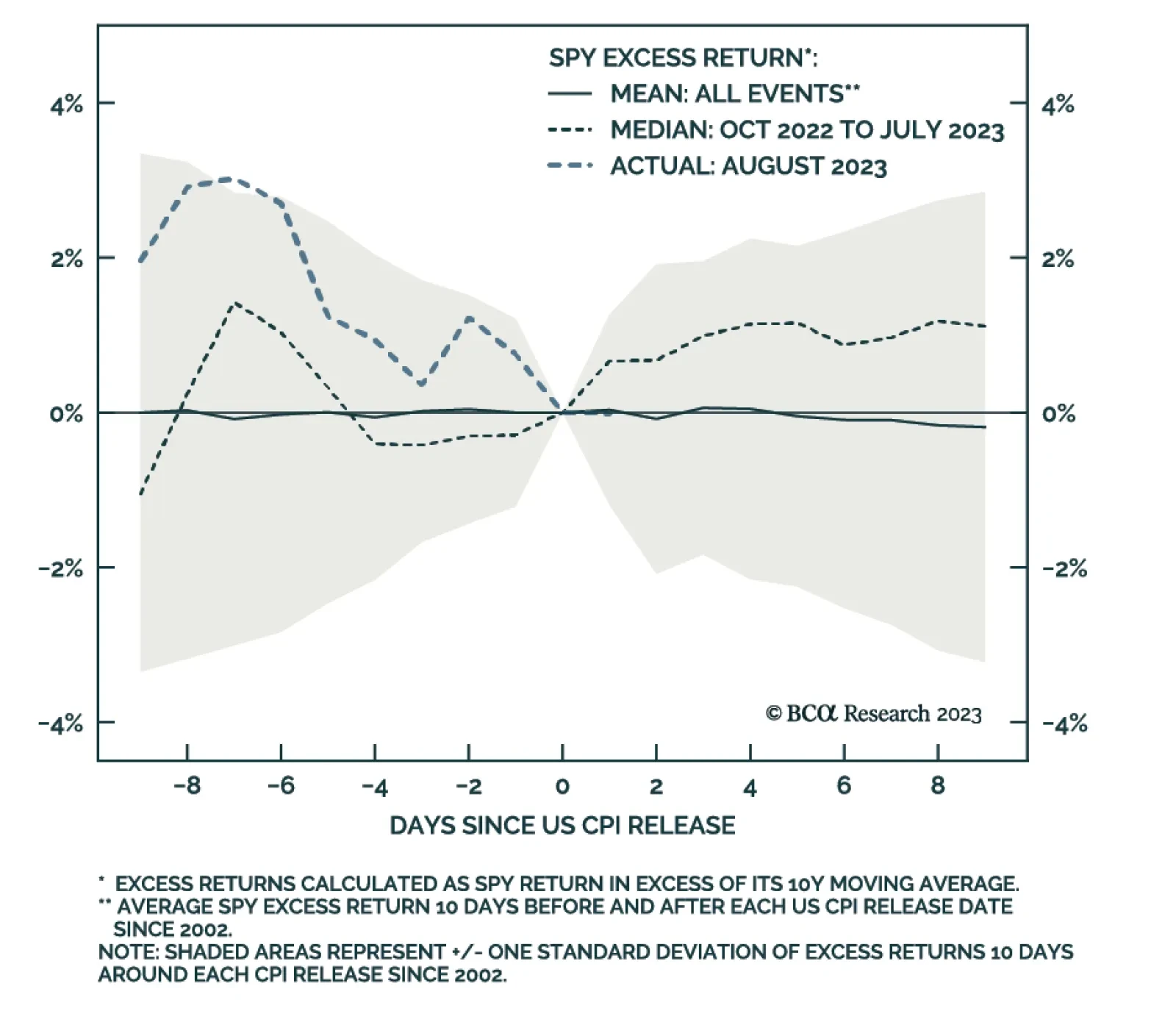

Thursday’s US CPI release showed that the disinflation trend remains intact with the monthly print remaining soft at 0.2% m/m, slightly lower than expected. The SPY initially rallied on the downside inflation surprise but…

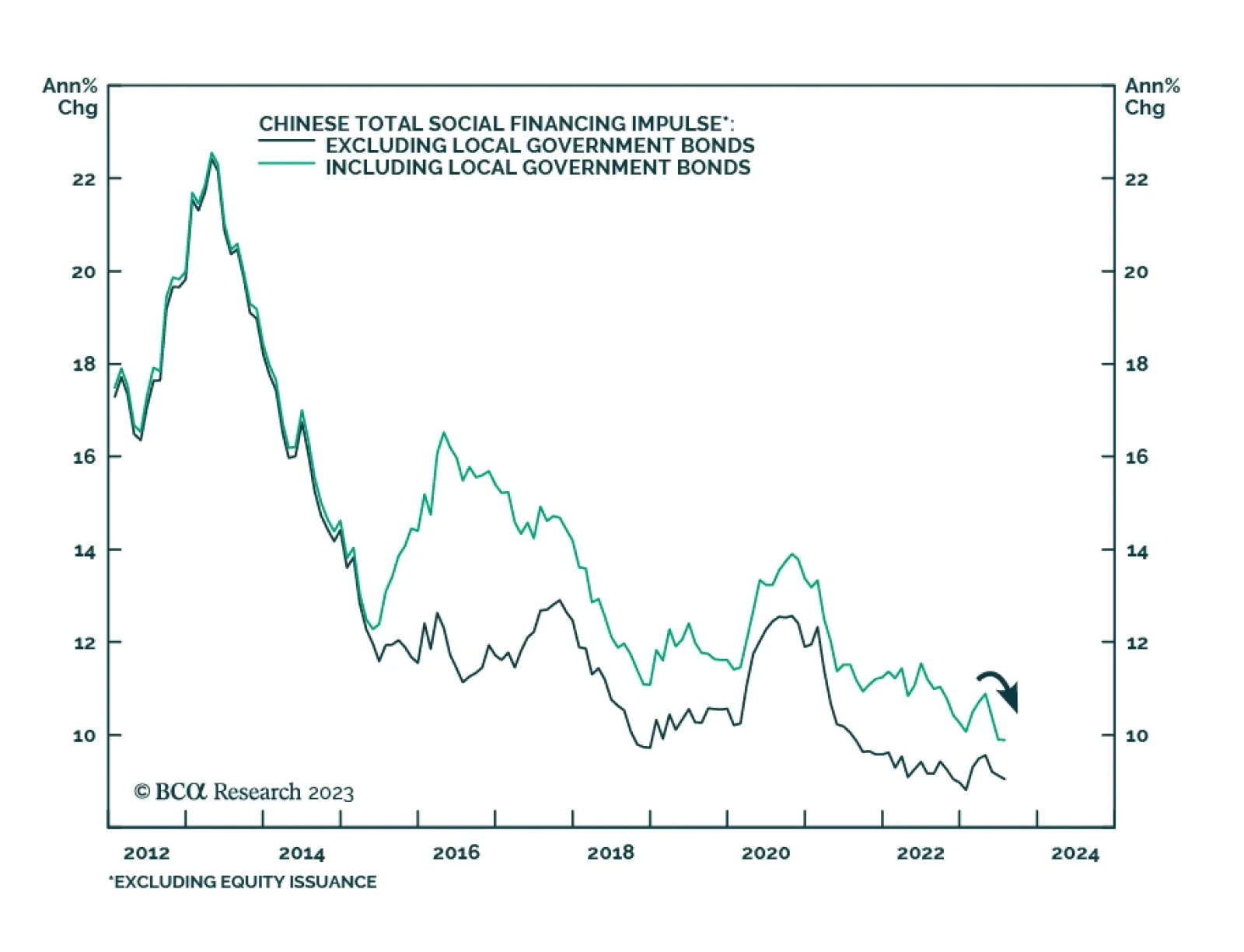

Chinese credit and money data fell significantly below expectations in July. The CNY 0.53 trillion increase in aggregate social financing marks a significant slowdown from CNY 4.22 trillion in June and came in significantly below…

Numerous divergences have opened up between global risk assets and global business cycle variables. These gaps are unsustainable, and odds are that the recoupling will occur to the downside with risk assets selling off.

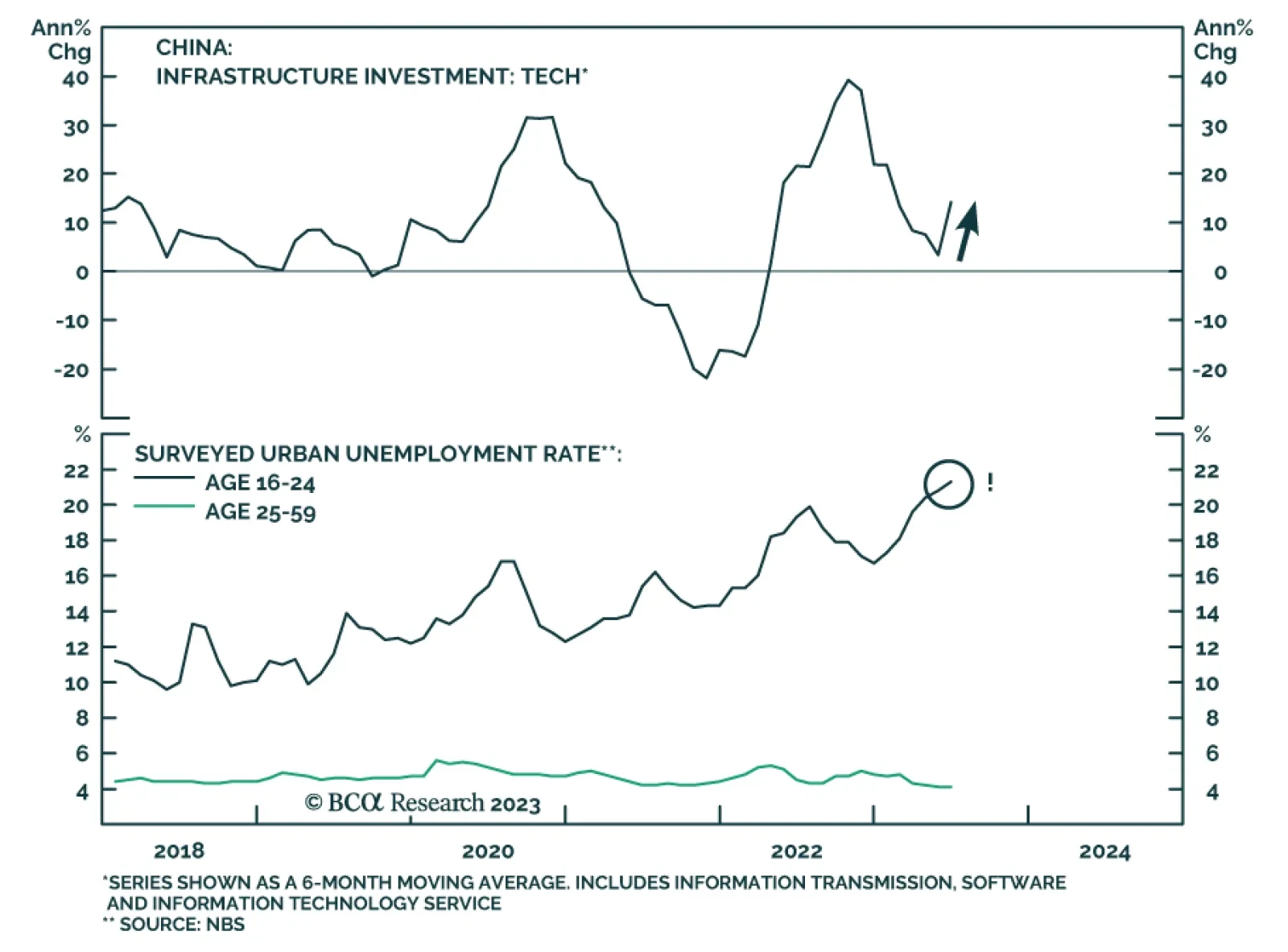

On Wednesday, President Joe Biden announced that a new ban on some US investment into China’s quantum computing, advanced chips and artificial intelligence sectors will come into force next year. This latest escalation is…

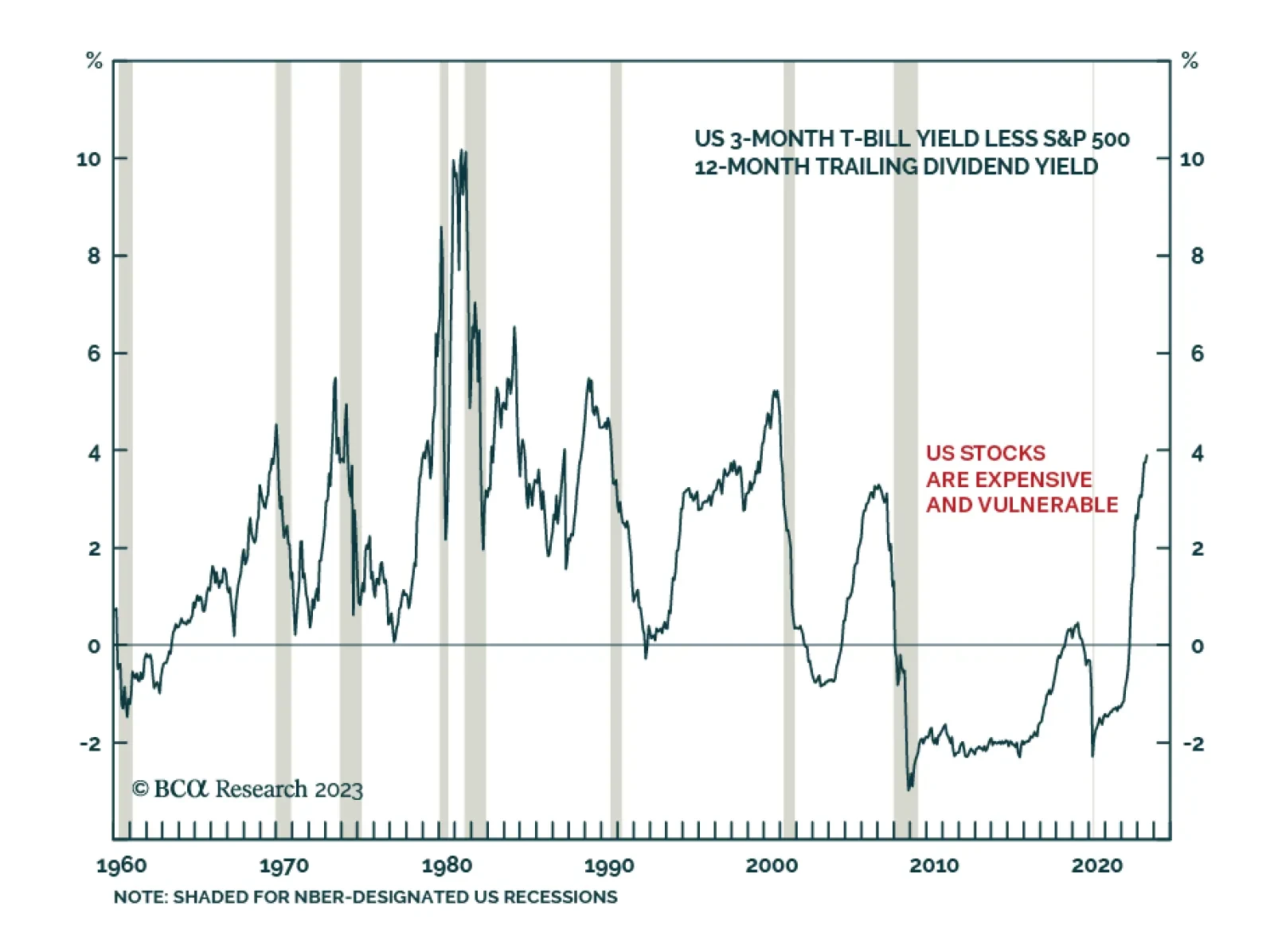

During the last economic expansion, a structurally overweight allocation to stocks was at least partially warranted by the idea that “There Is No Alternative” – or “T.I.N.A.” During the last…

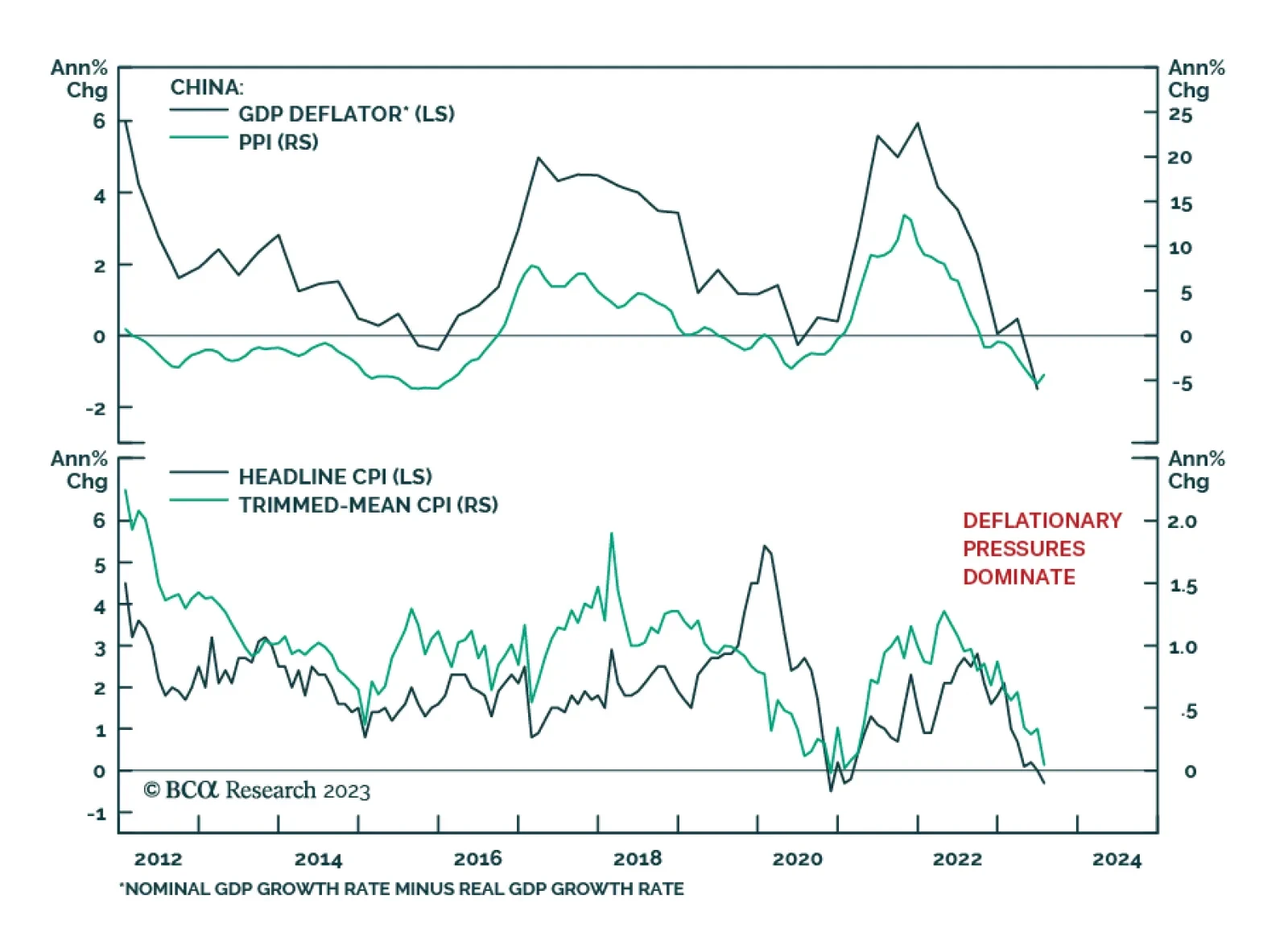

China’s CPI and PPI inflation release for July indicates that deflationary pressures dominate the domestic economy. After remaining unchanged in June, consumer prices fell by 0.3% y/y. Meanwhile, the 4.4% y/y drop in…