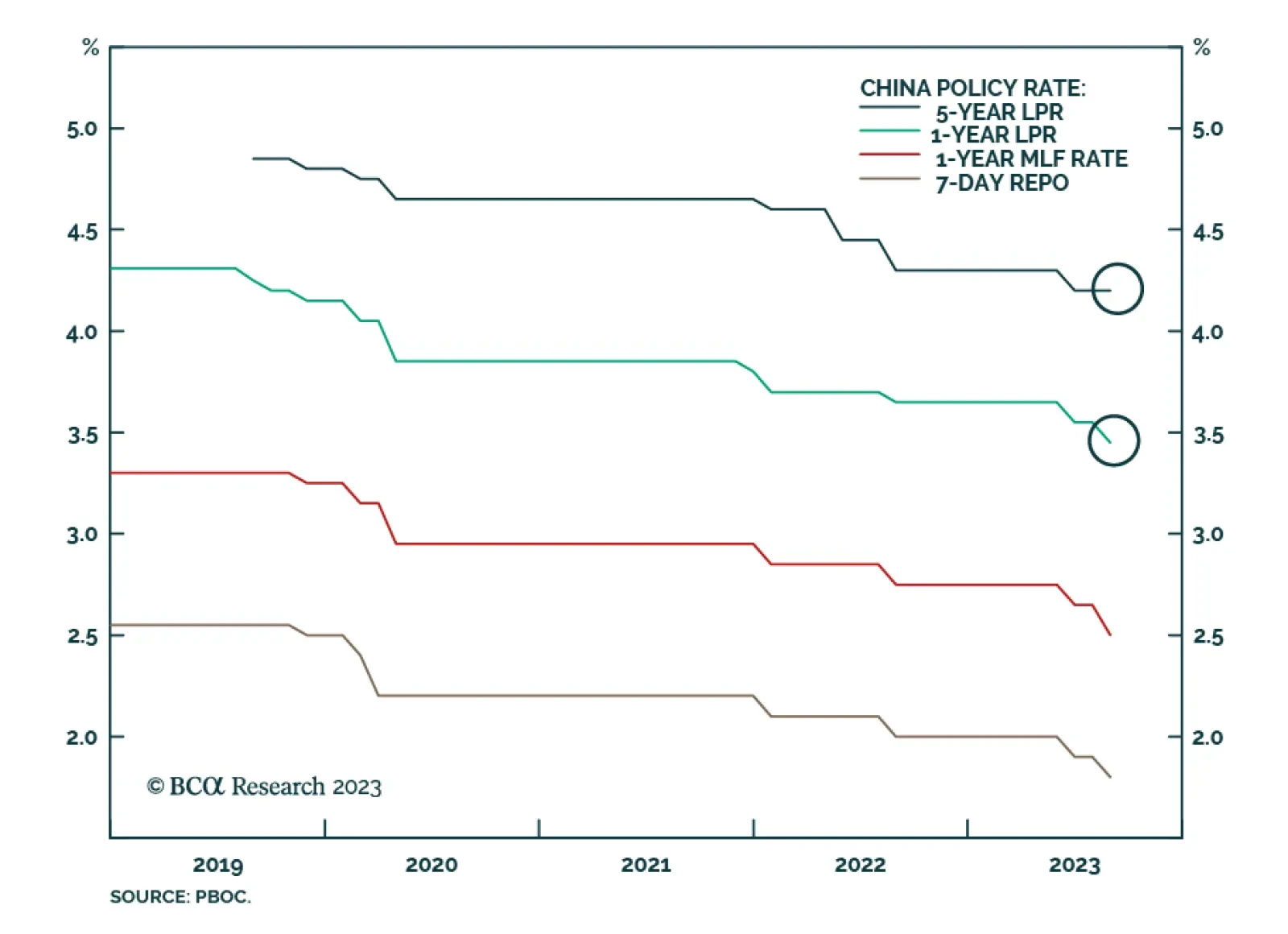

Chinese banks surprised markets with a more modest-than-anticipated rate cut on Monday. The one-year loan prime rate (LPR) was reduced by 10 basis points to 3.45% – slightly above expectations of a bigger cut to 3.40%.…

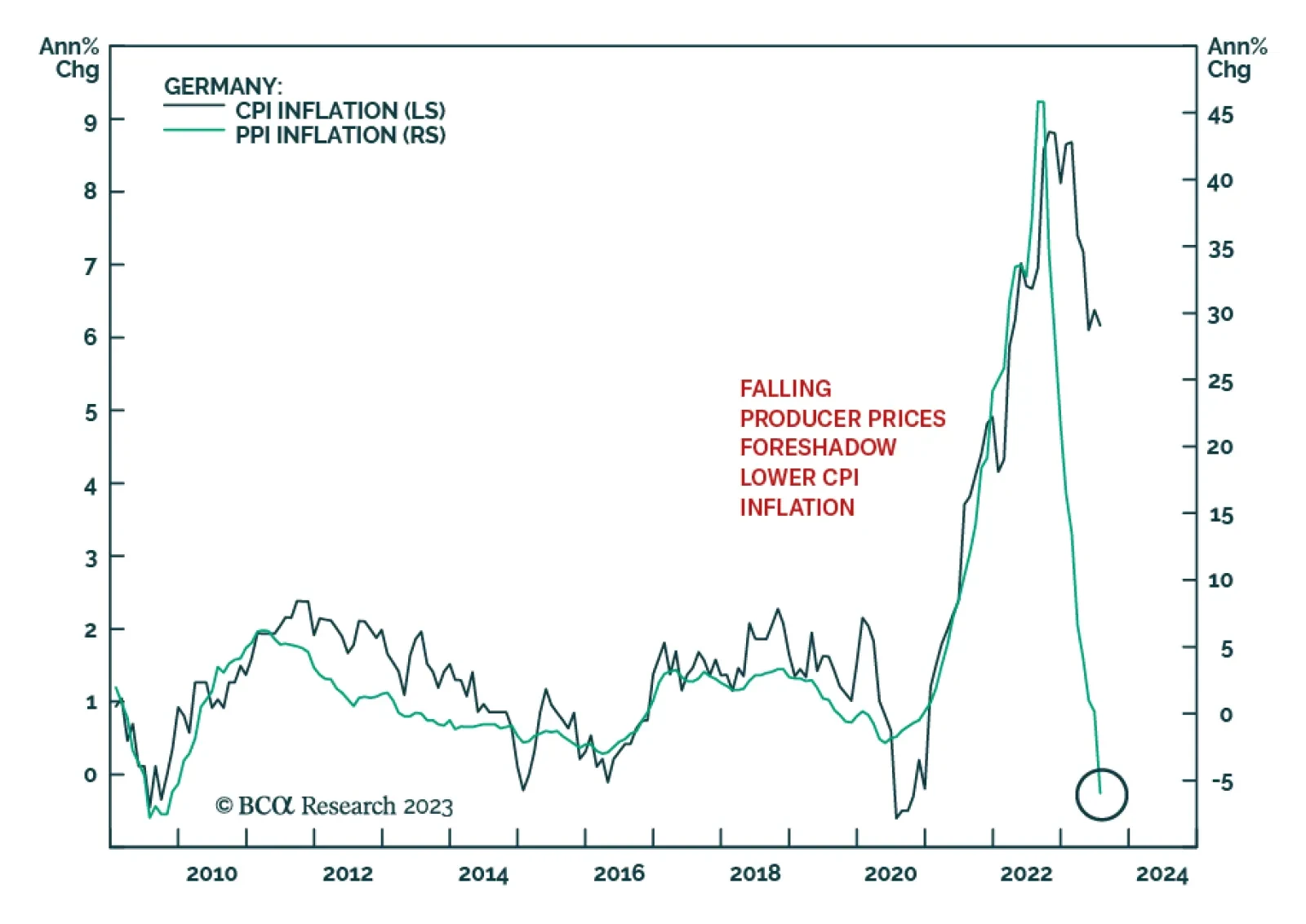

German producer prices indicate that inflationary pressures continue to moderate. The producer price index’s 6.0% y/y drop in July is more pronounced than the anticipated 5.1% y/y decline and marks the first annual decrease…

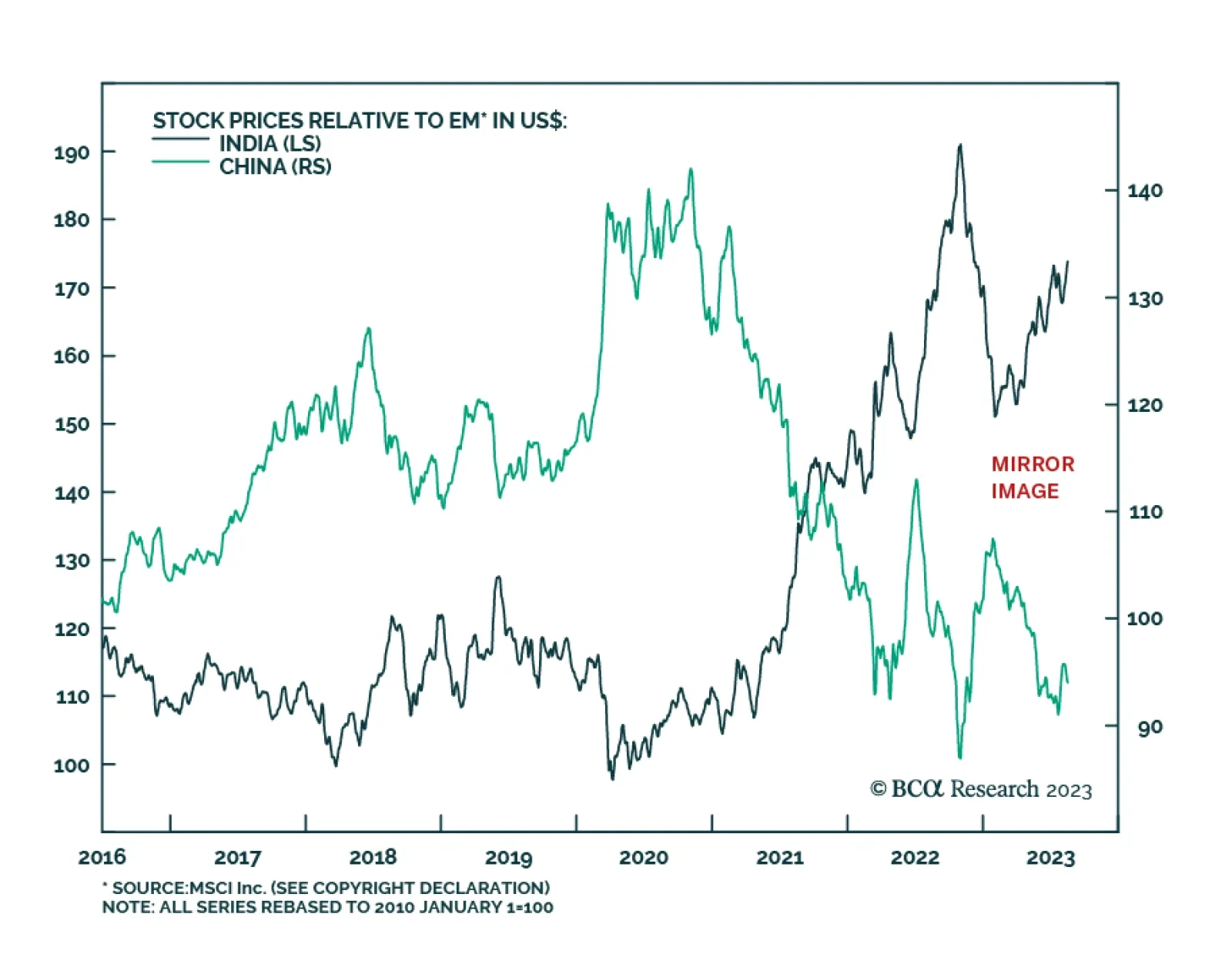

Our Emerging Markets Strategy team expects a further decline in Indian stocks. Foreign equity inflows have been instrumental in the recent rally, but they will likely reverse in the coming months as risk-off sentiments pervade…

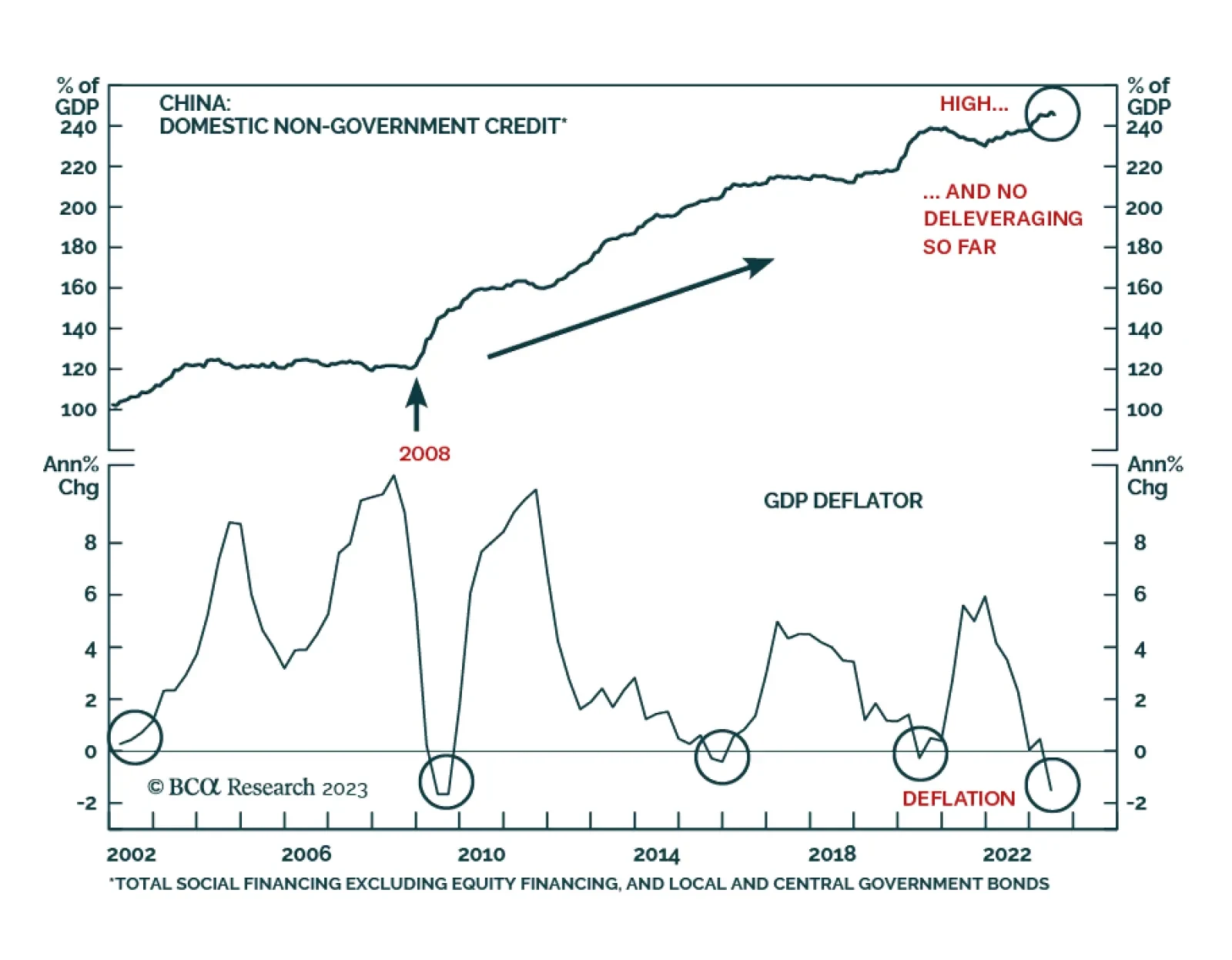

Before doctors prescribe treatments to a patient, they first make a diagnosis. The success of the treatment is contingent upon the accuracy of the diagnosis. The same is true for a country’s economy. Many commentators…

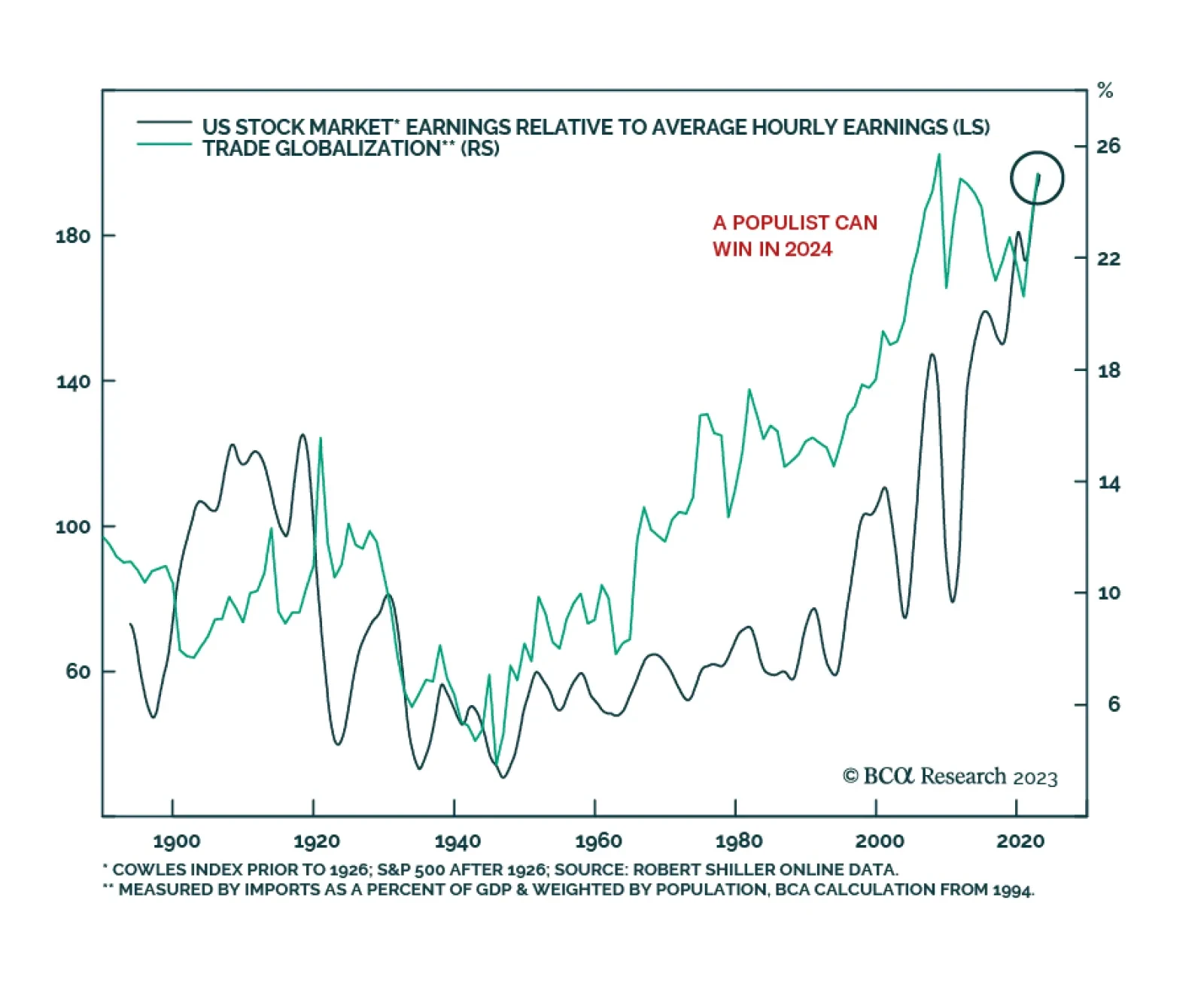

The chief question of the 2024 election is whether US anti-establishment or populist politics is a viable electoral strategy, according to BCA’s US Political Strategy. That will have domestic and global effects not only in…

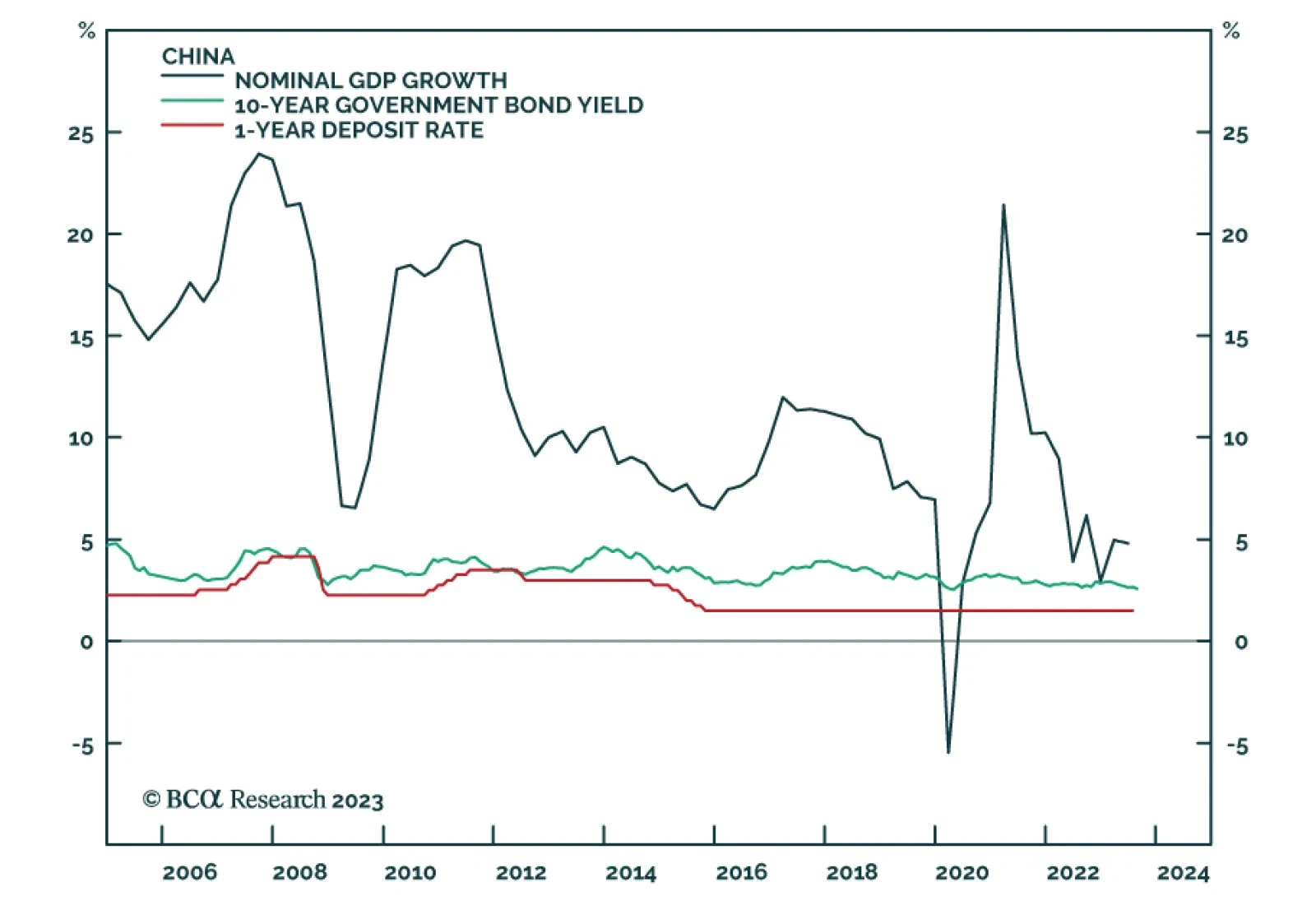

The conventional wisdom is that China’s economy is overly indebted and too reliant on residential construction and exports as drivers of growth. While there is much truth to these claims, they ignore the underlying…

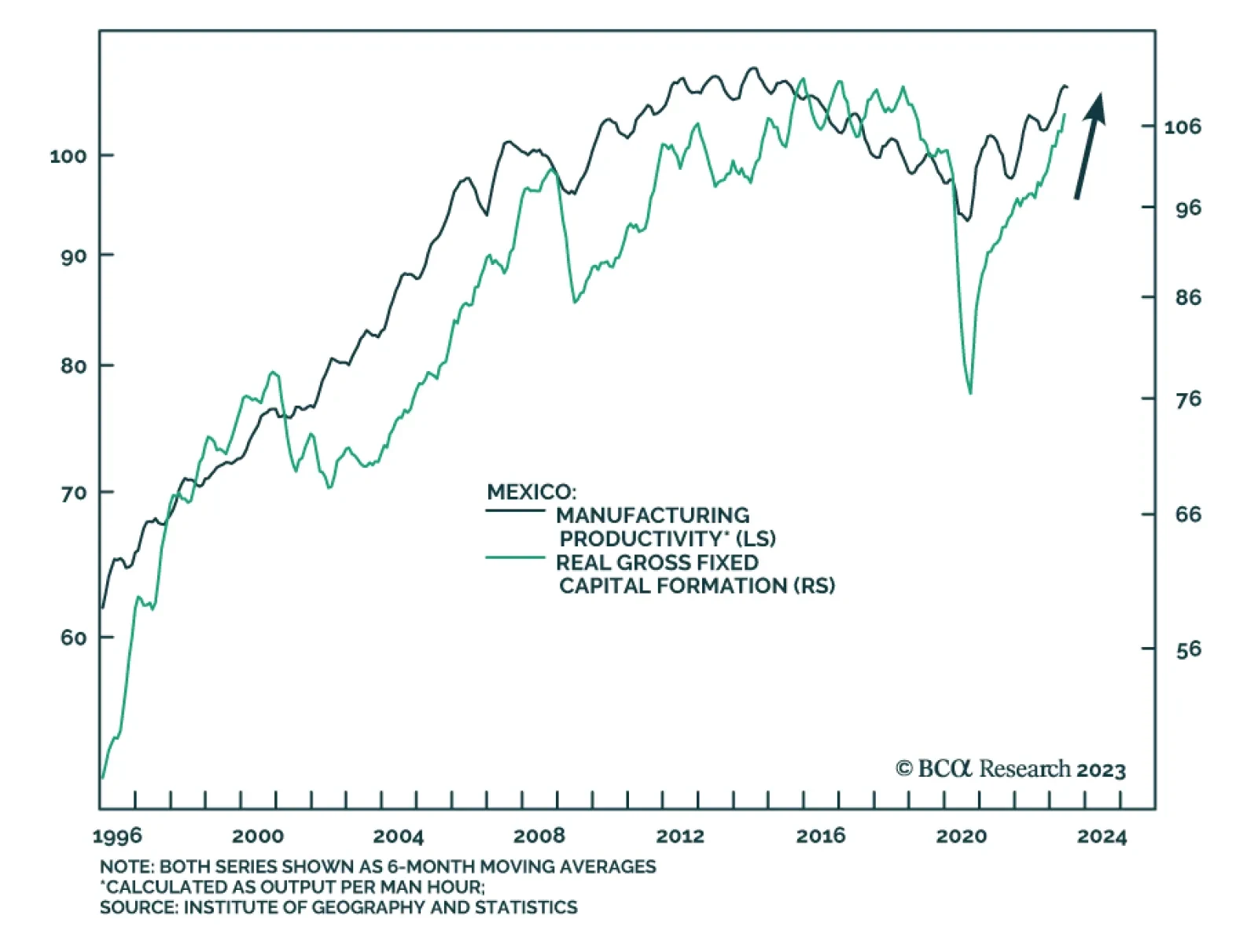

Mexican financial markets have been this year’s stellar outperformers, both in absolute terms and relative to their EM peers. Naturally, the question arises: how sustainable is this rally? According to our Emerging…