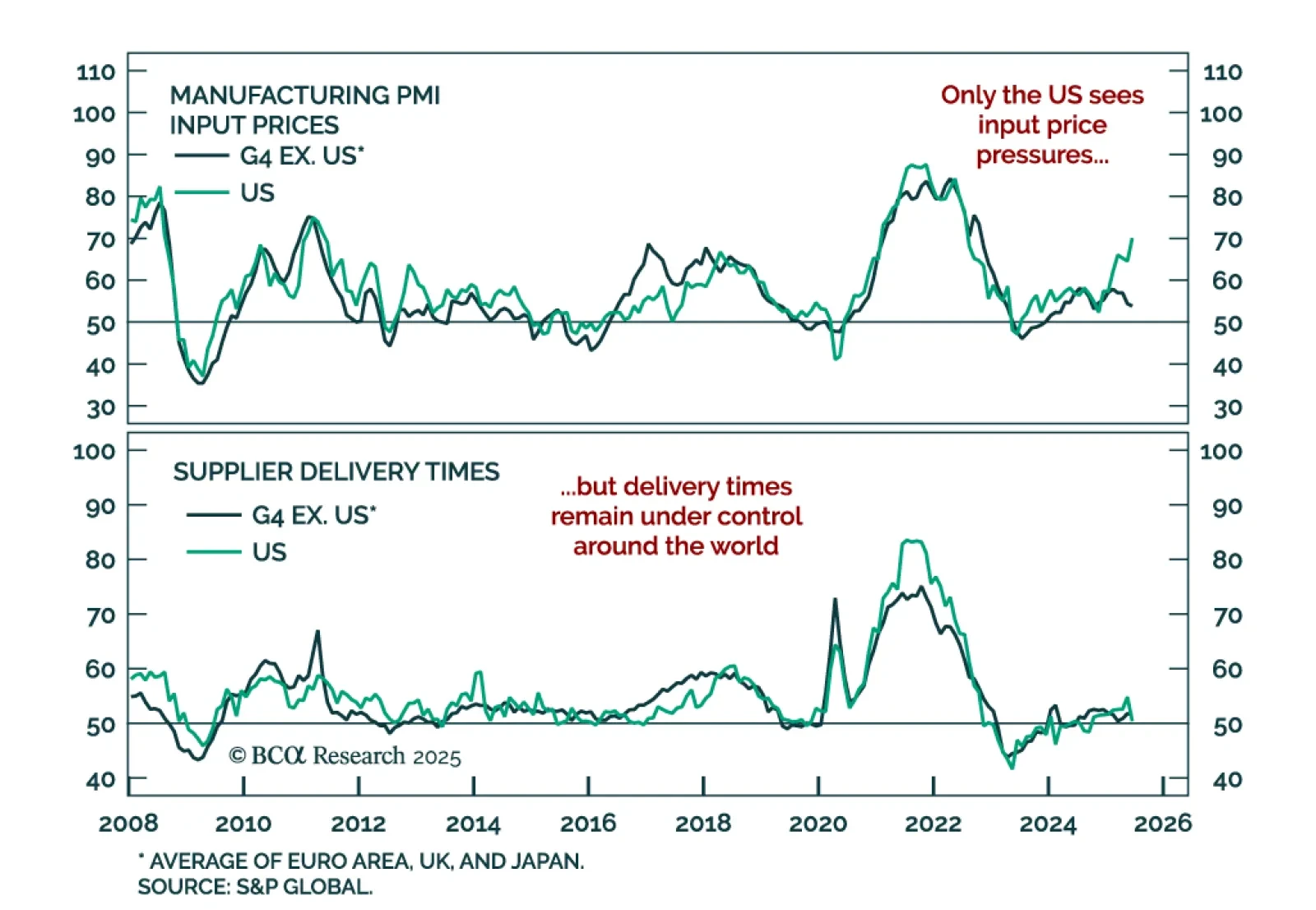

Global inflation risks remain subdued, reinforcing a long duration stance across select DM government bonds. Our price pressure index shows moderate input price inflation outside the US and stable delivery times globally.…

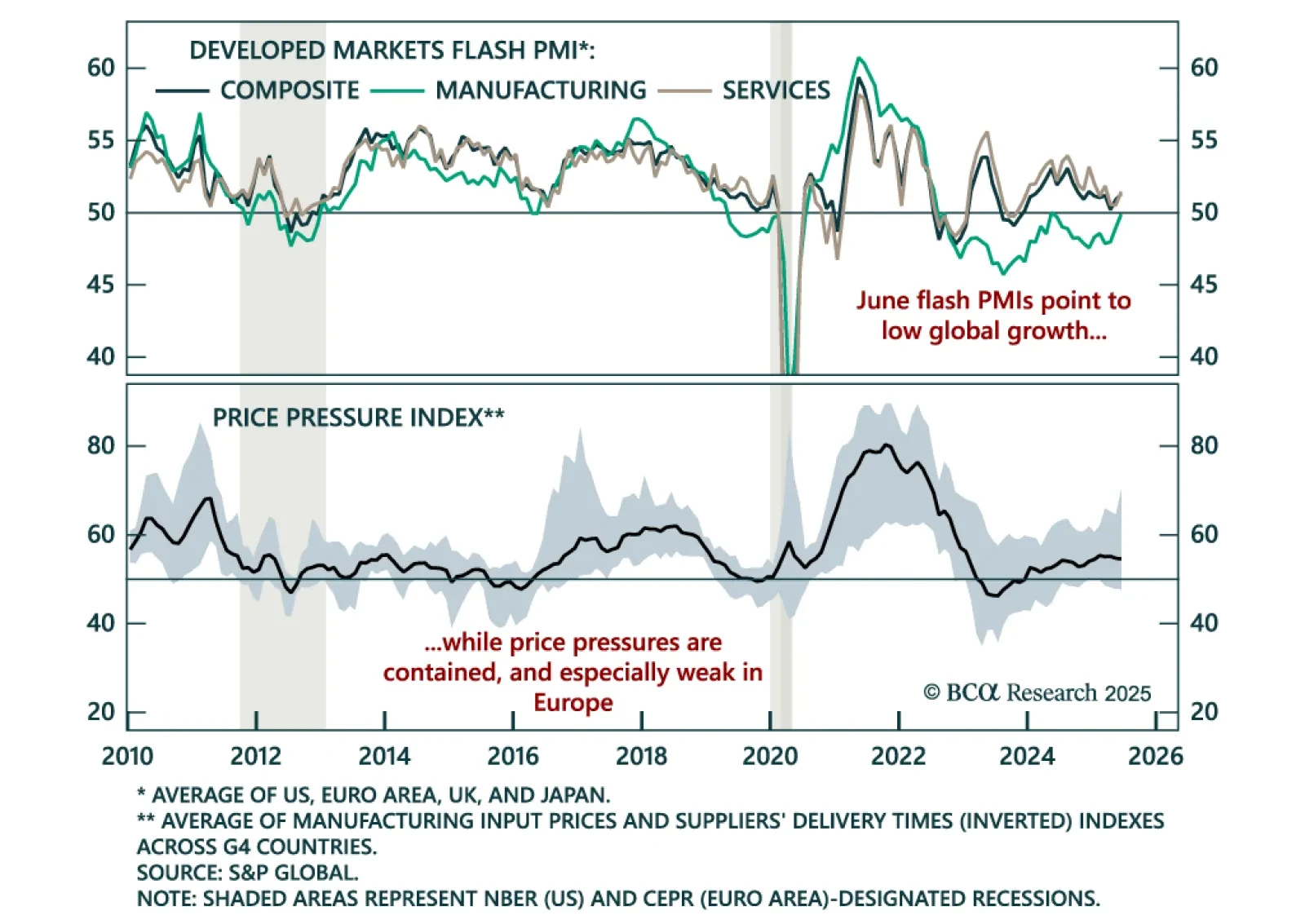

June PMIs confirm low global growth and support a long duration stance as price pressures remain contained. The flash PMIs were mixed across DMs: Sideways in the US and euro area, but firmer in the UK and Japan. Yet the overall…

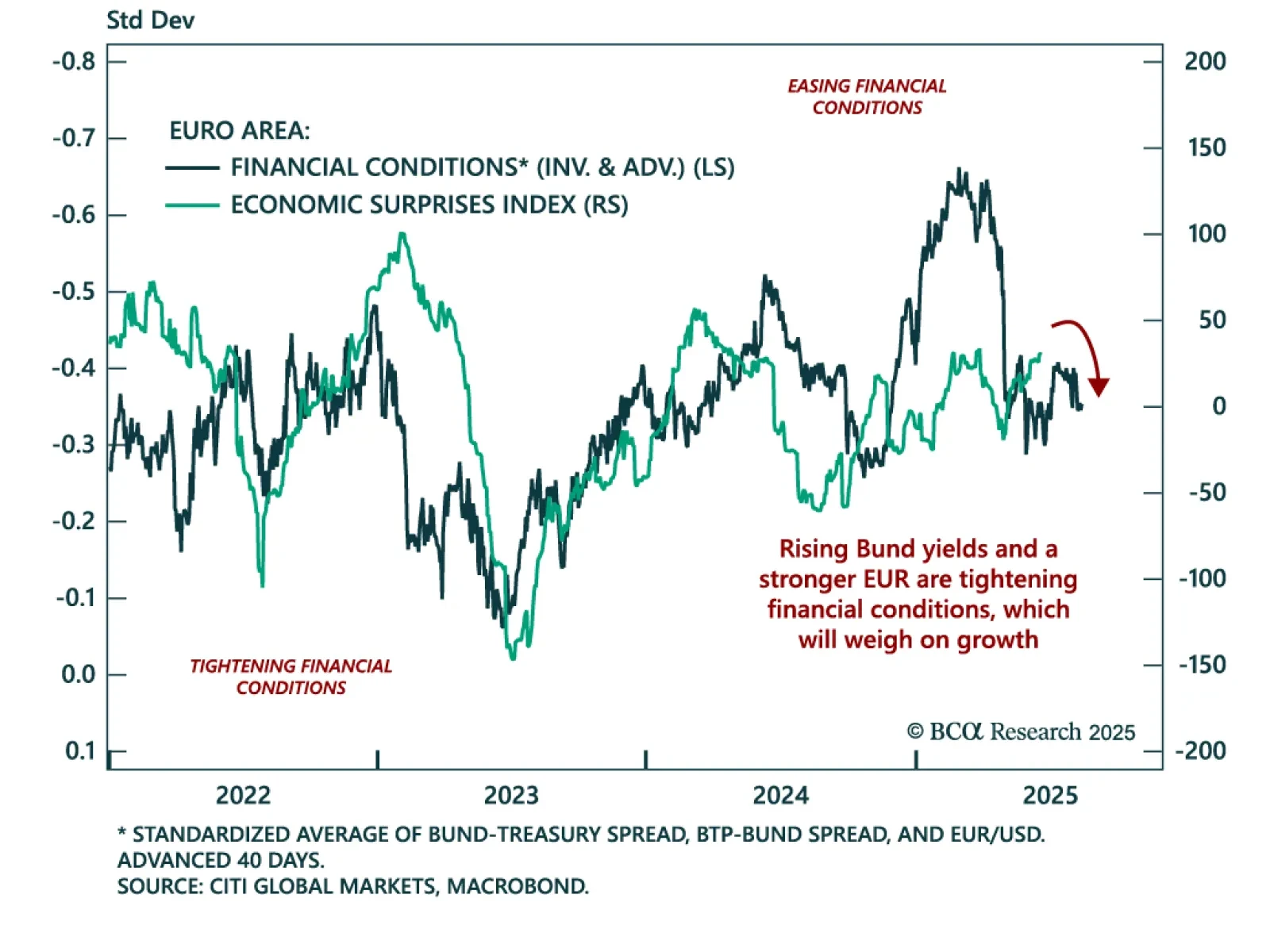

Tightening financial conditions, deflationary headwinds, and rising geopolitical risks argue for short-term caution on European assets. European equities have outperformed in 2025, with the EURO STOXX 50 beating the S&P 500 and…

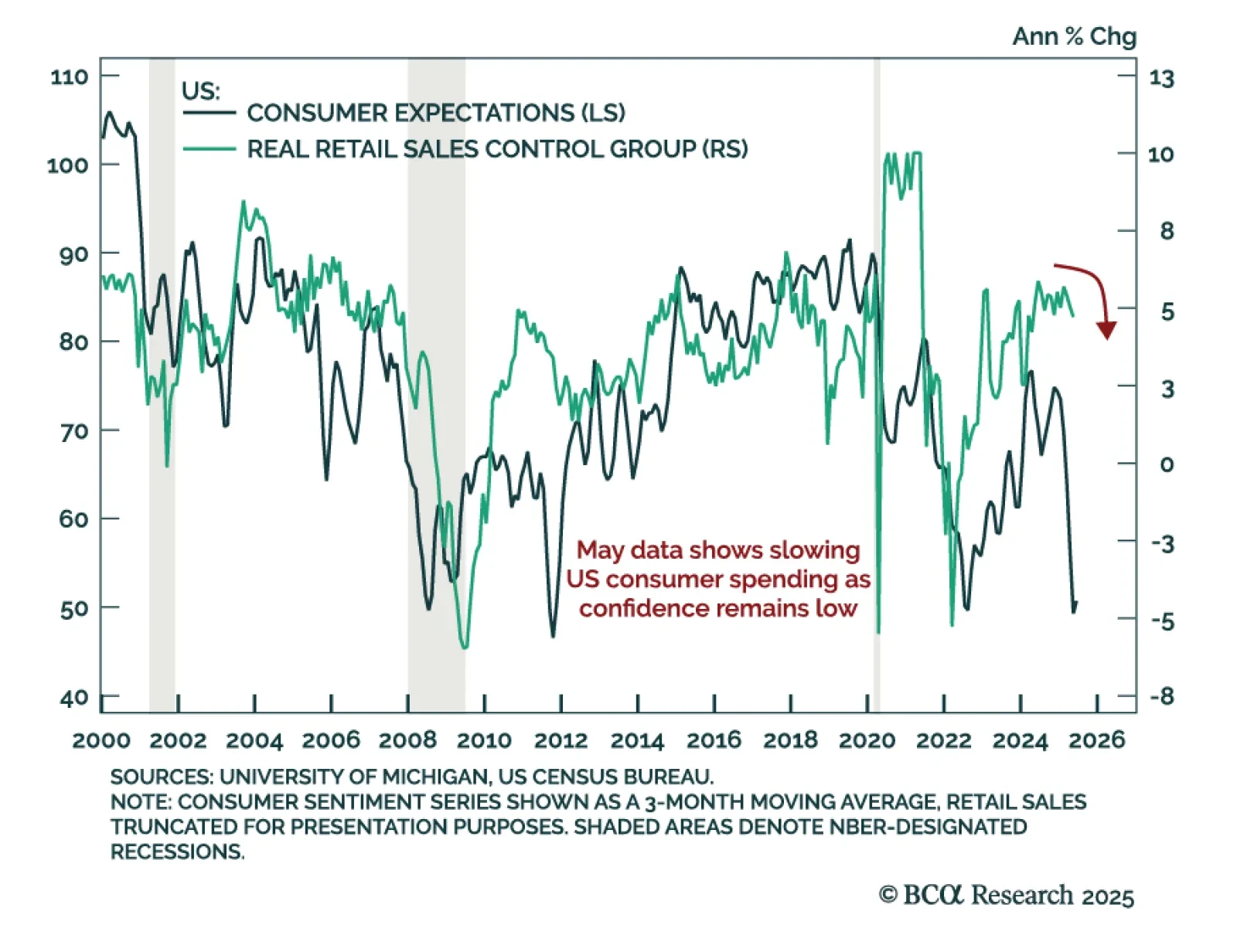

US May retail sales missed expectations, reinforcing our defensive allocation stance. Headline sales fell 0.9% m/m from a downwardly revised -0.1%. Core sales dropped 0.1%, while the control group rose 0.4%, beating estimates. Auto…

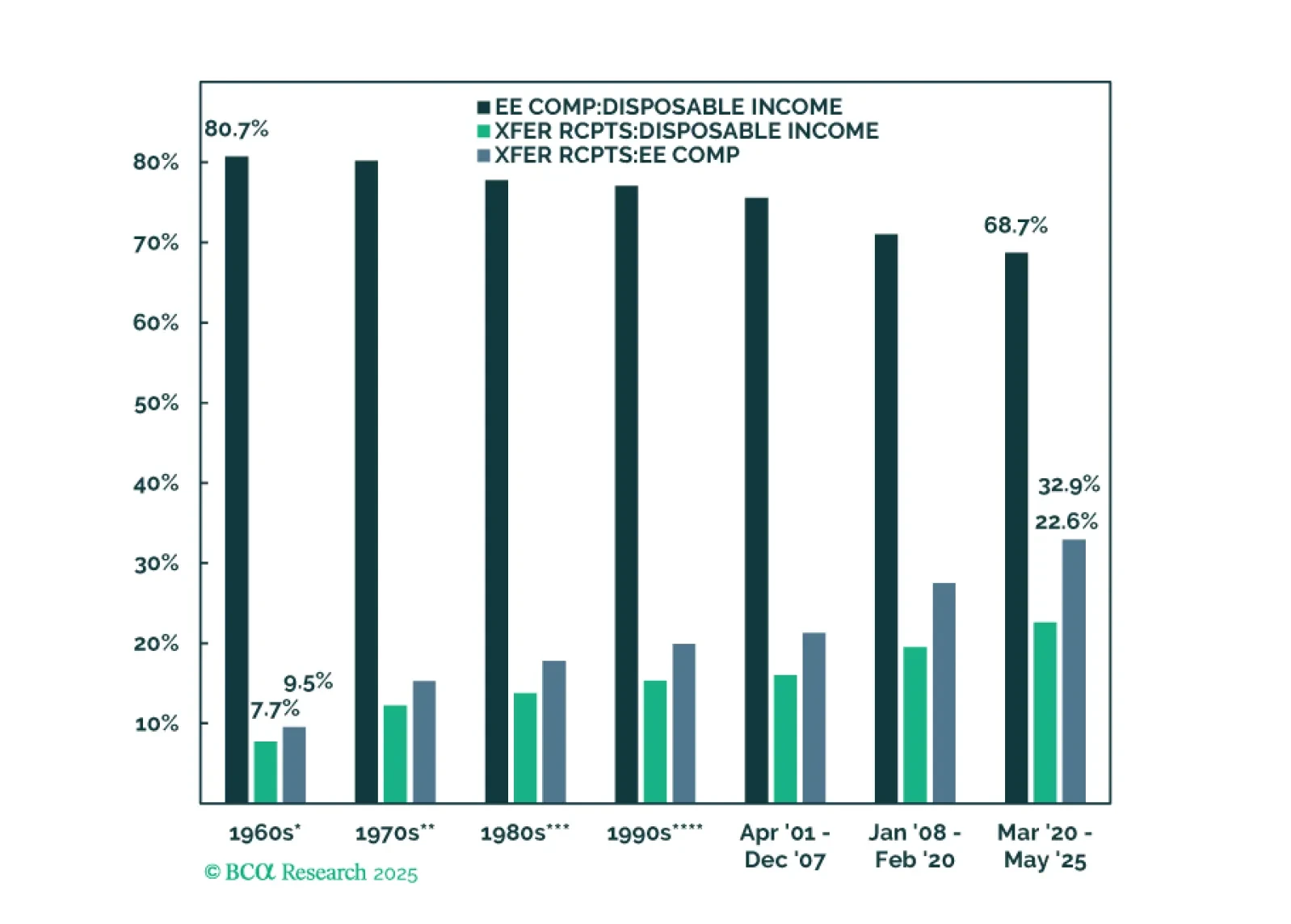

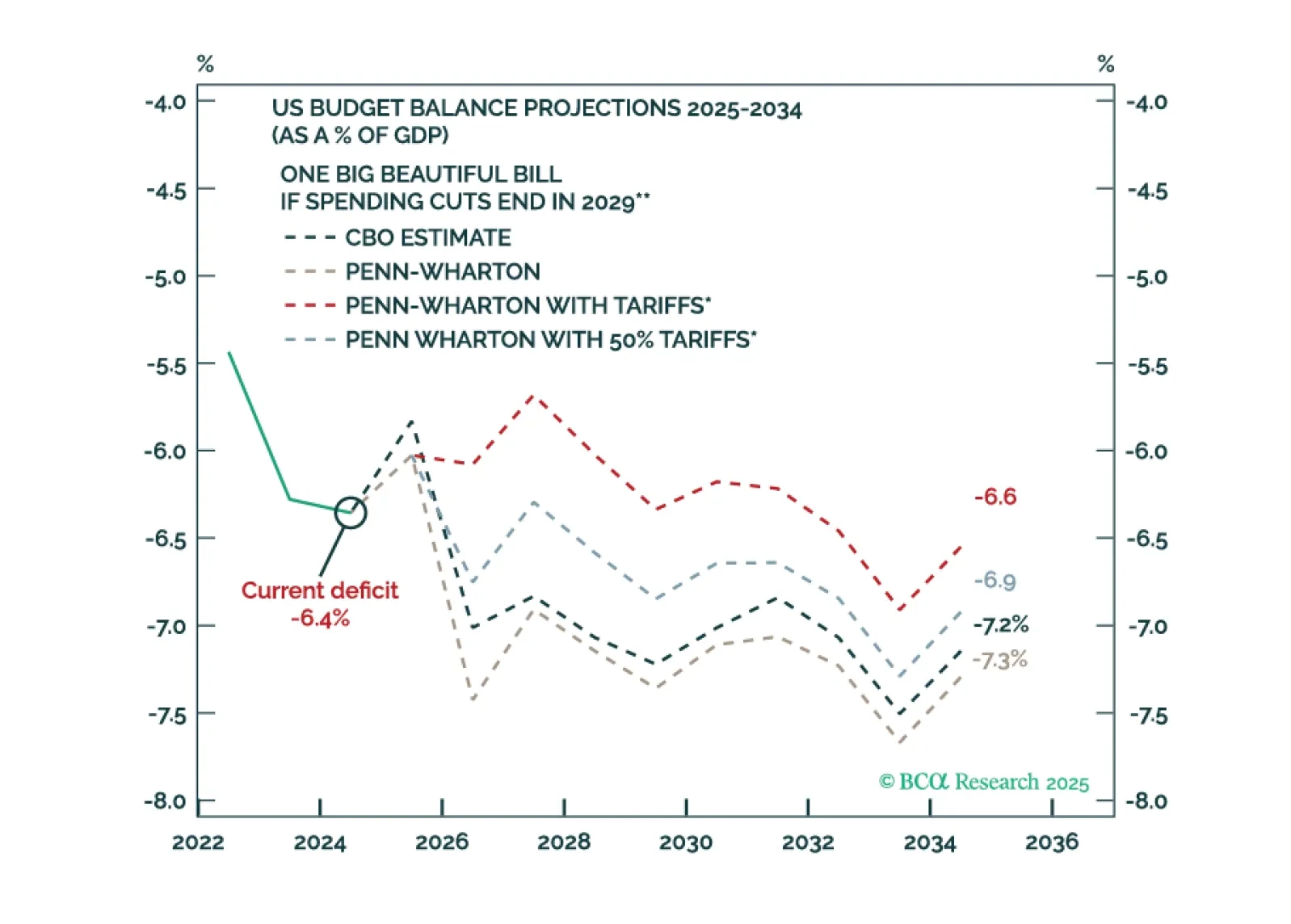

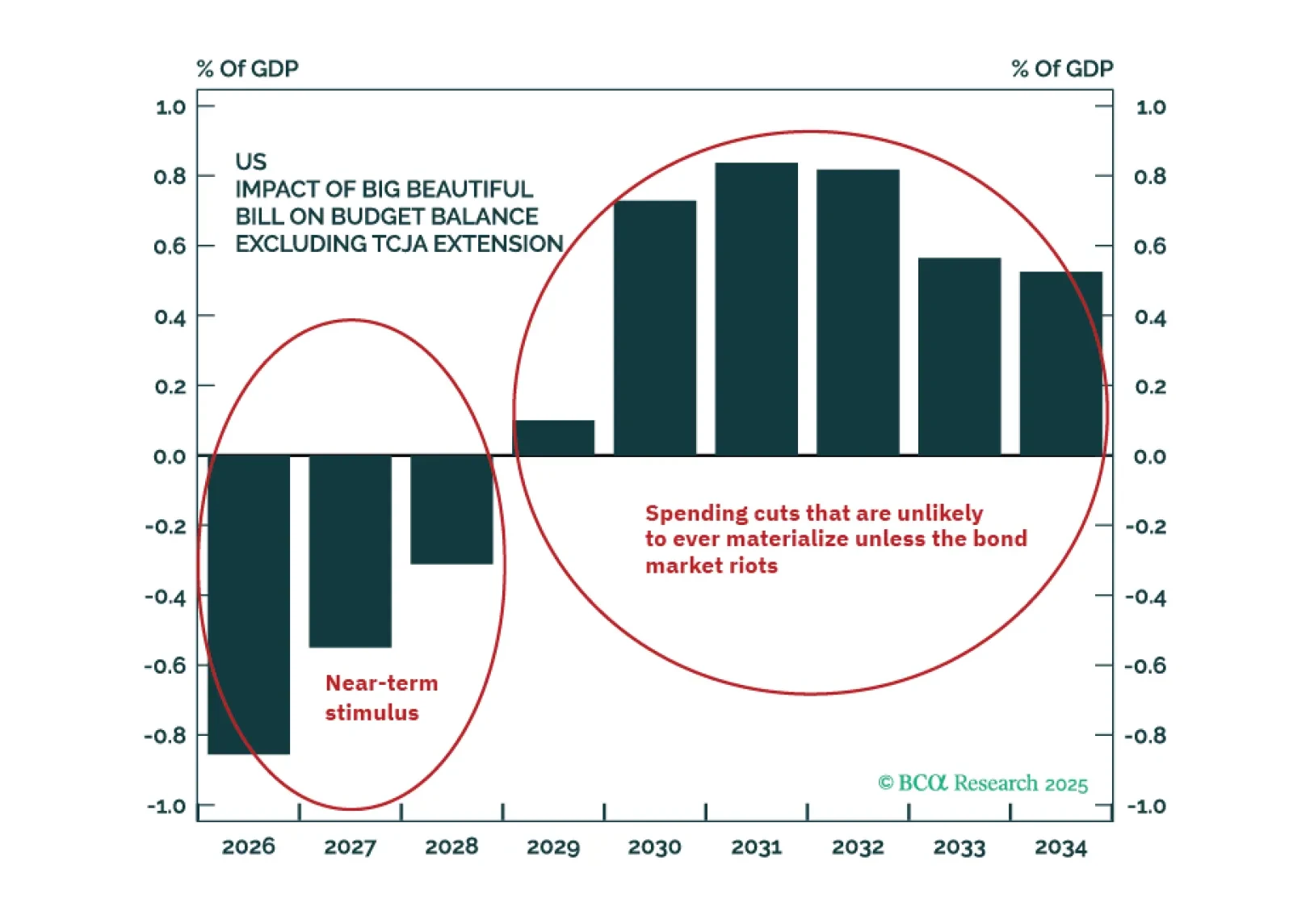

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…

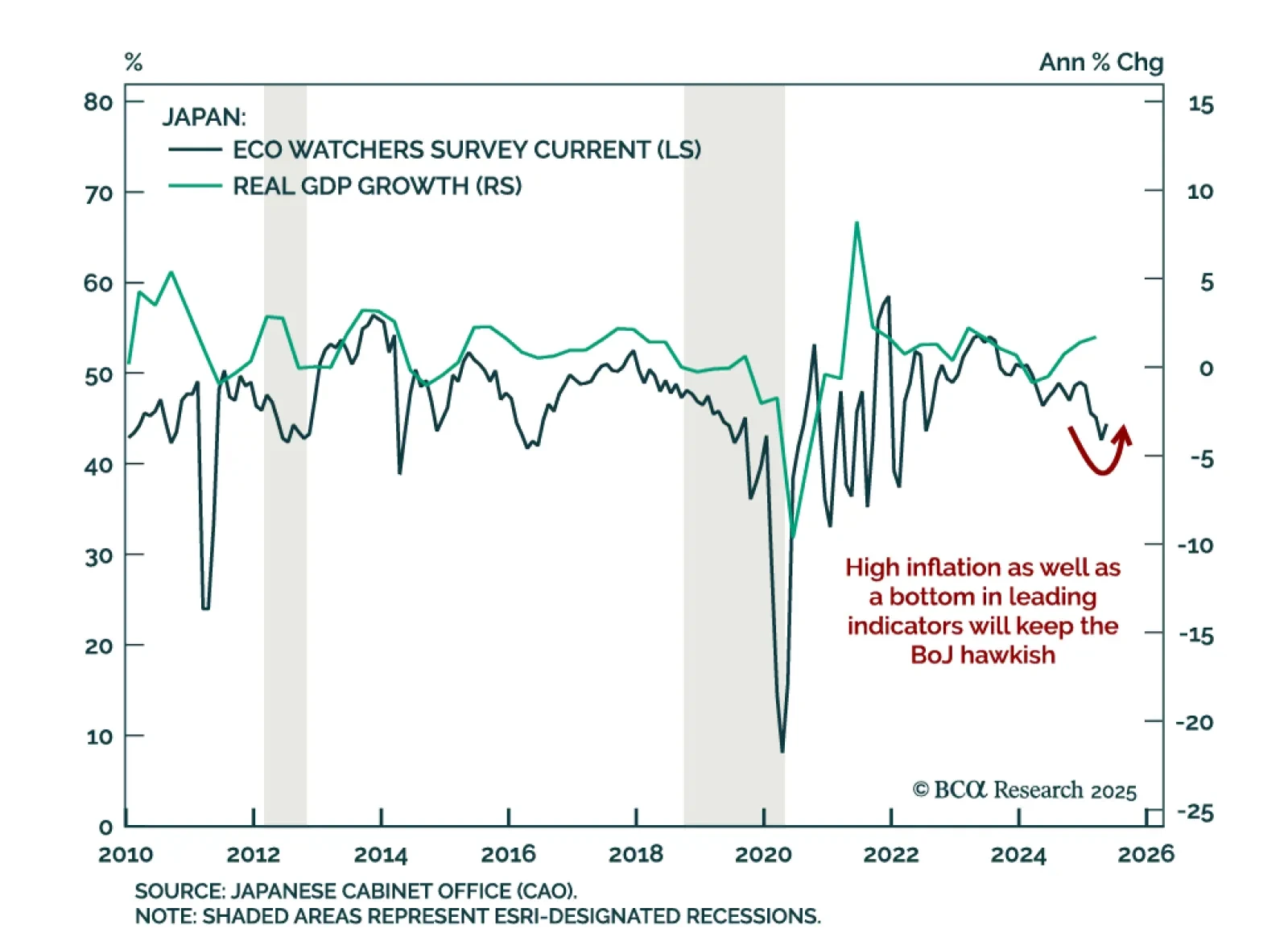

The BoJ will stay hawkish because of sticky inflation and better economic momentum. The May Eco Watchers Survey beat expectations, with current conditions rising to 44.4 and the outlook to 44.8. These levels still signal…

The US economy has held up better so far this year than we had expected. For the time being, investors should remain modestly underweight equities. A more aggressive underweight would be justified only once the “whites of the…

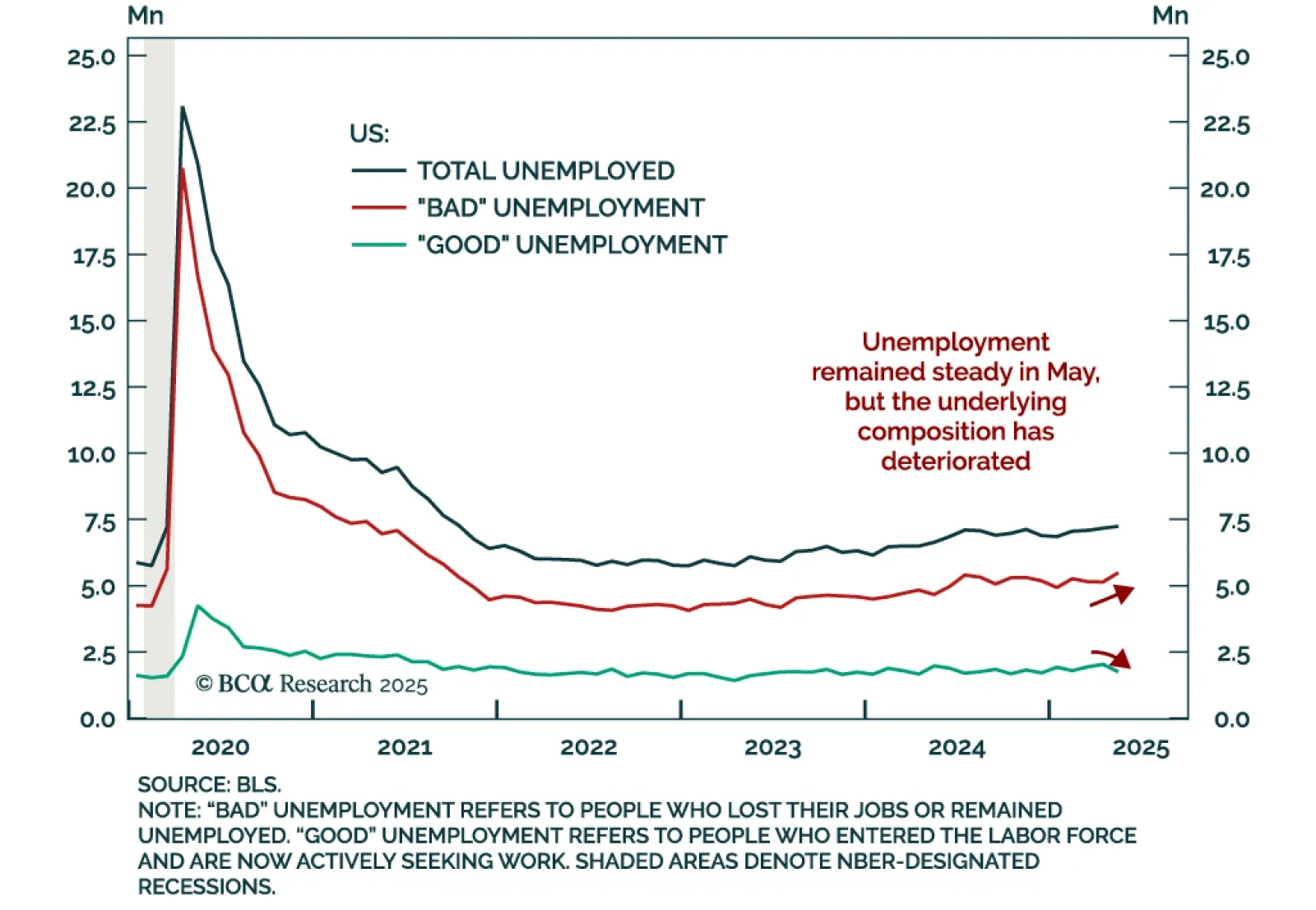

The May US jobs report reinforces our defensive stance as labor momentum is slowing even if not collapsing. Payrolls rose 139k, beating estimates, but decelerating from a downwardly revised 147k. Two-month revisions cut 95k jobs,…