The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

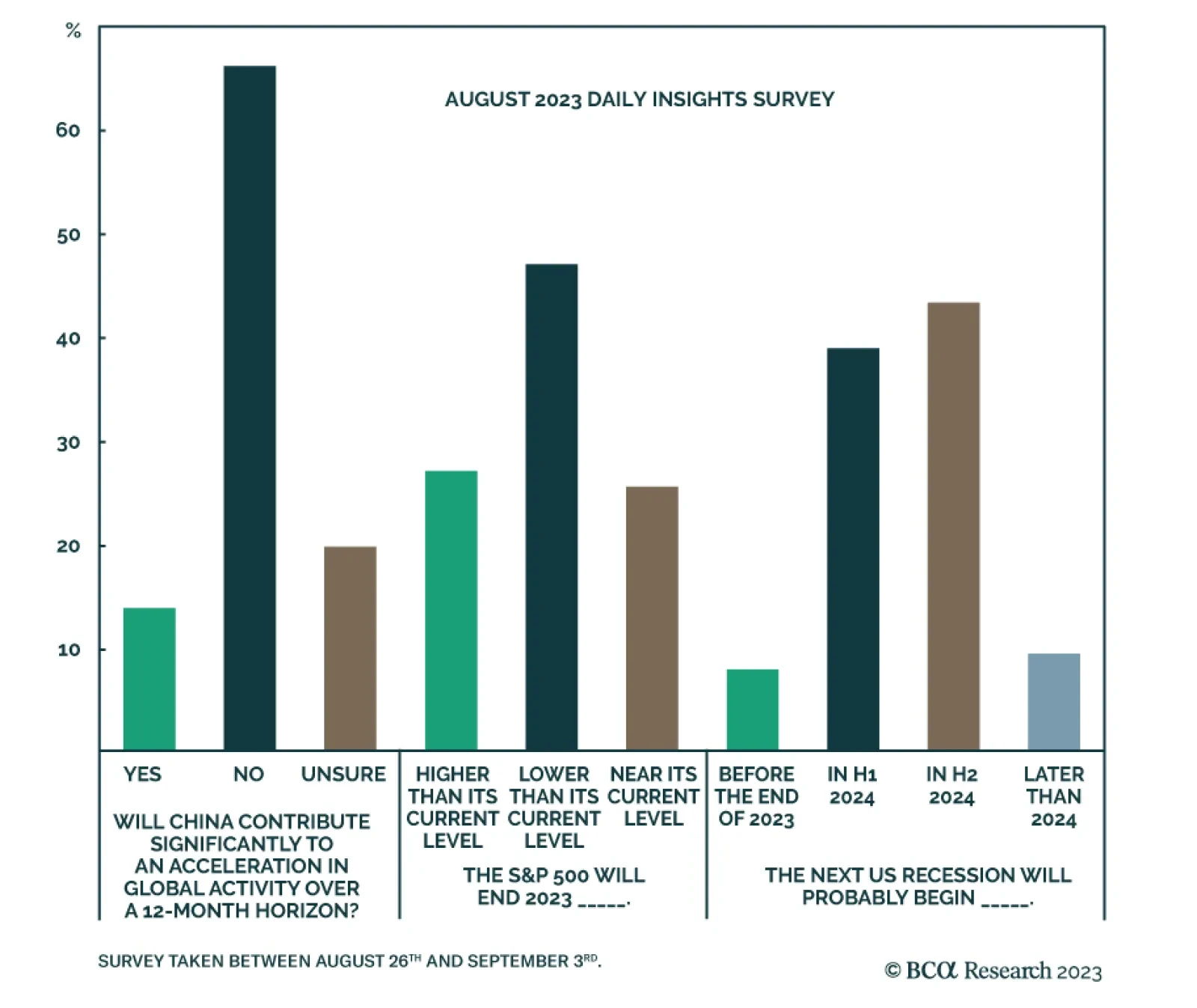

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for the US economy, US stocks, and China’s contribution to global growth. On the outlook for the US economy…

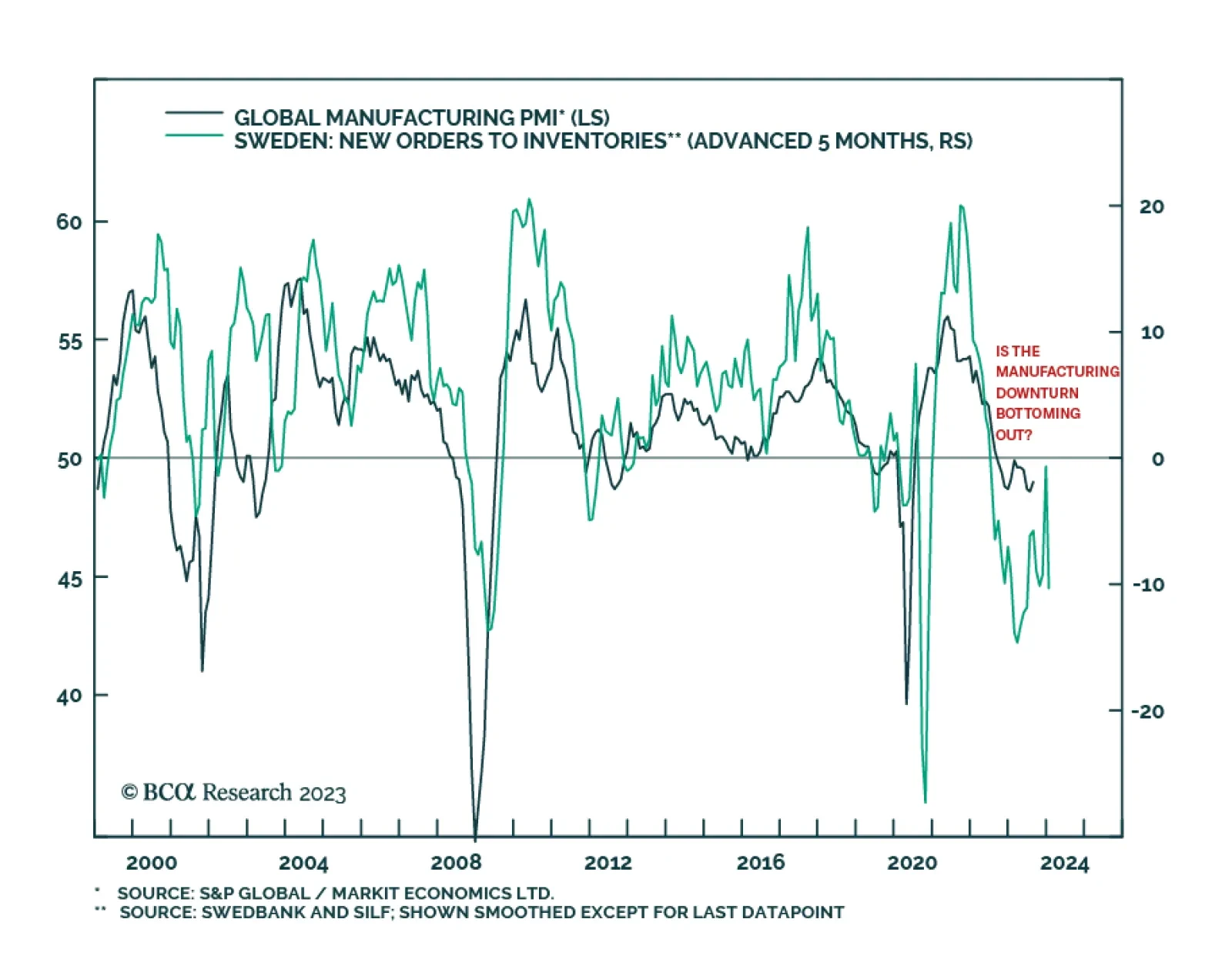

The Global Manufacturing PMI suggests that although the global manufacturing downturn remains intact, the pace of deterioration slowed in August. The headline PMI index ticked up by 0.4 points to 49. In particular, the Output,…

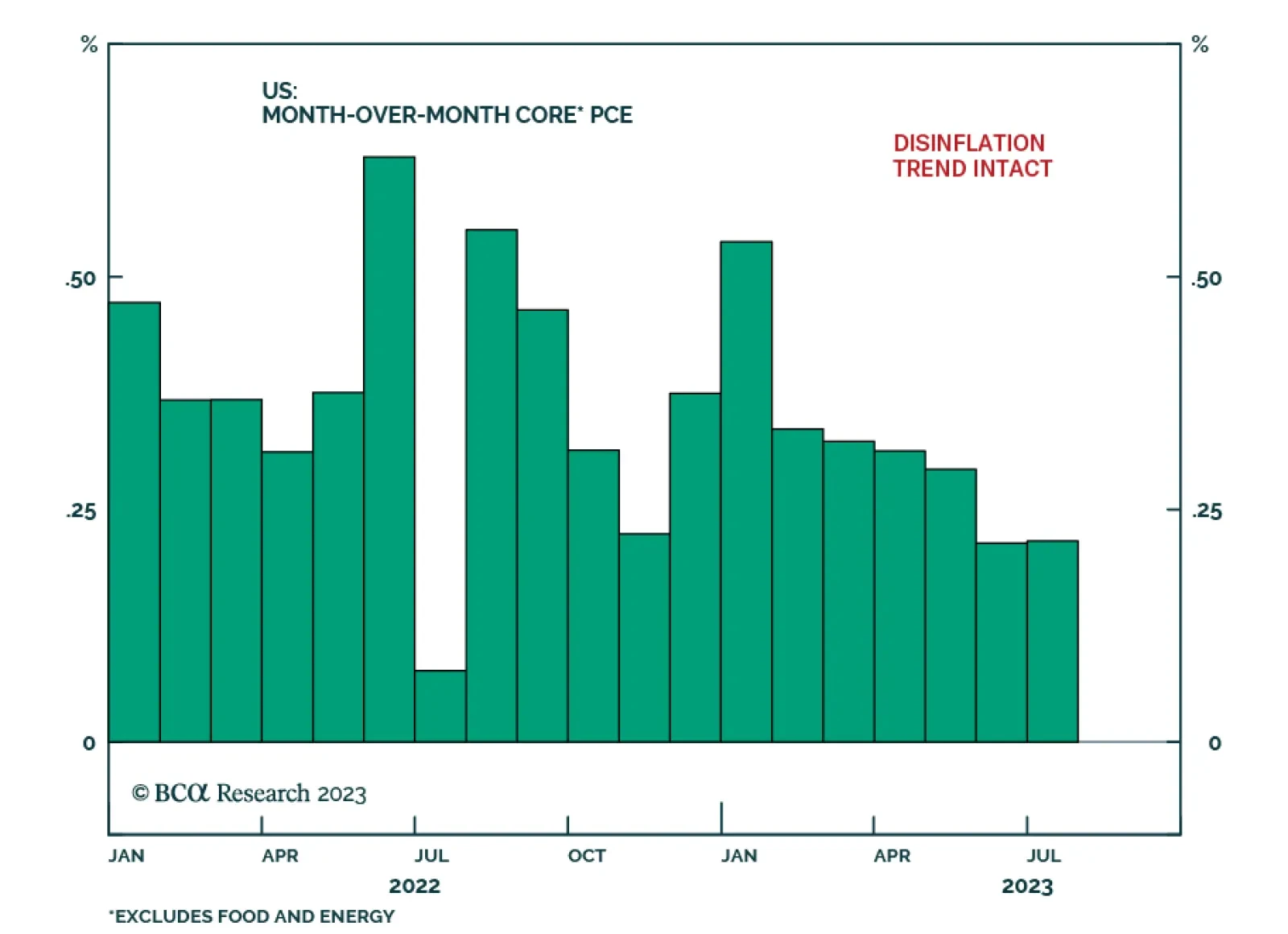

The US Personal Income and Outlays report shows consumption remained resilient in July. Although personal income growth decelerated from 0.3% m/m to 0.2% m/m, spending accelerated from an upwardly revised 0.6% m/m to 0.8% m/m…

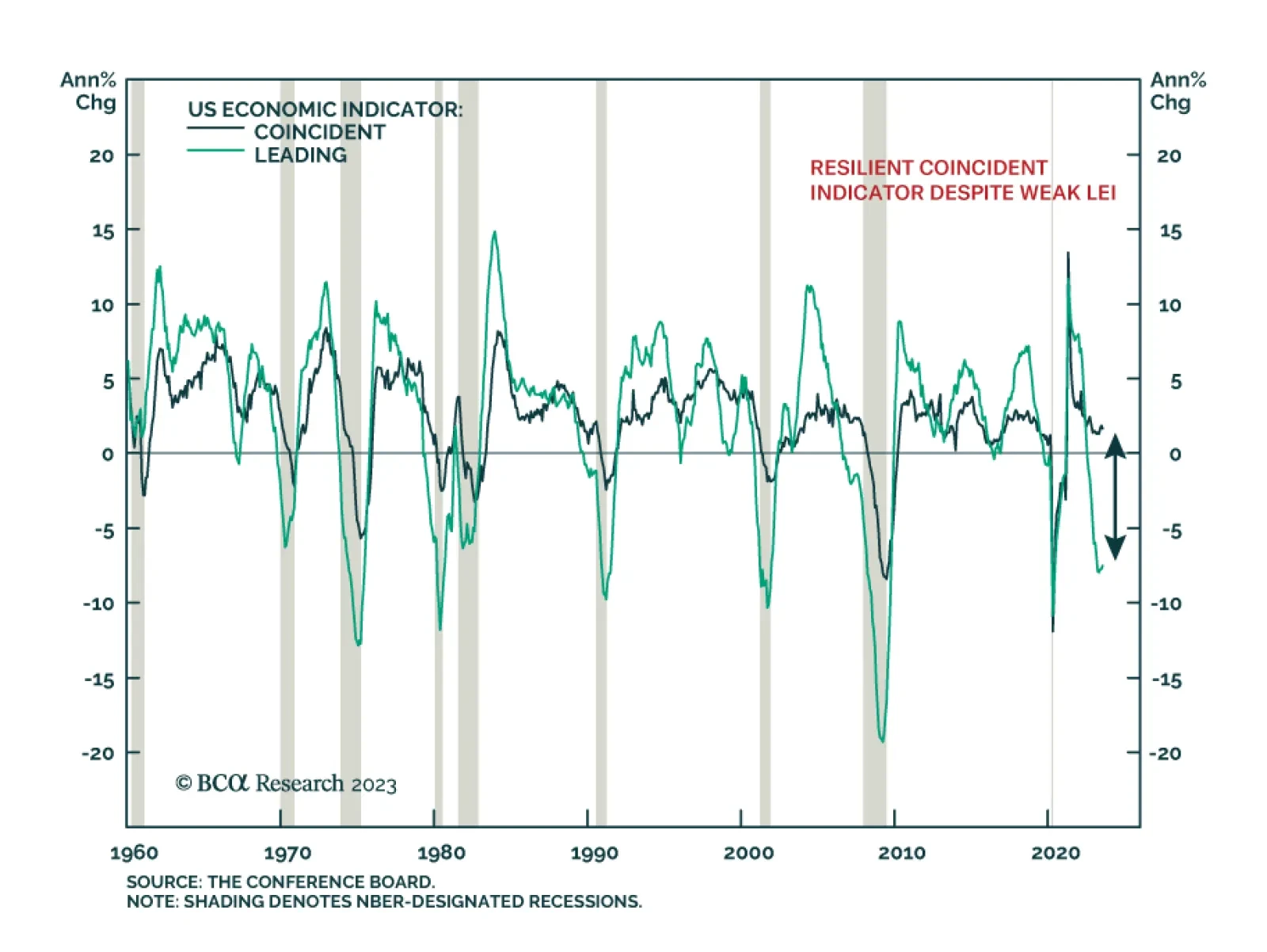

In Section I, we respond to the ongoing challenge to our view that the US economy is on a recessionary path. The available evidence overwhelmingly supports the notion that US monetary policy is tight, which argues against the “no…

Consensus expectations for the US economy were bleak at the start of the year. In hindsight, this pessimism was excessive: real GDP expanded in the first two quarters of the year (see Country Focus). Similarly, the US Conference…

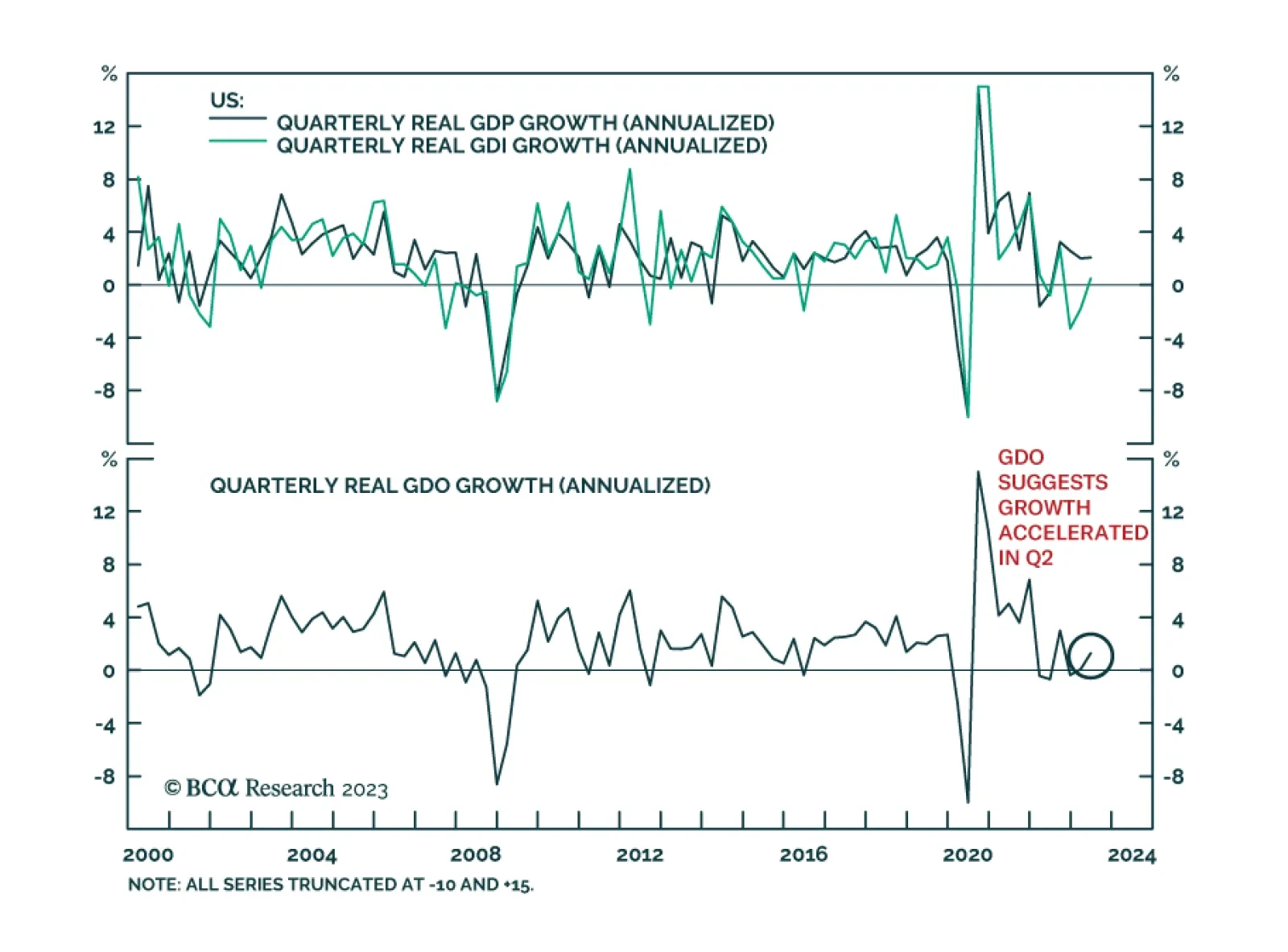

US Q2 GDP growth was revised down from 2.4% to 2.1% on a quarterly annualized basis, only slightly above Q1 growth of 2.0%. Although consumption was revised up by 0.1 percentage points to 1.7%, business spending grew at a slower…

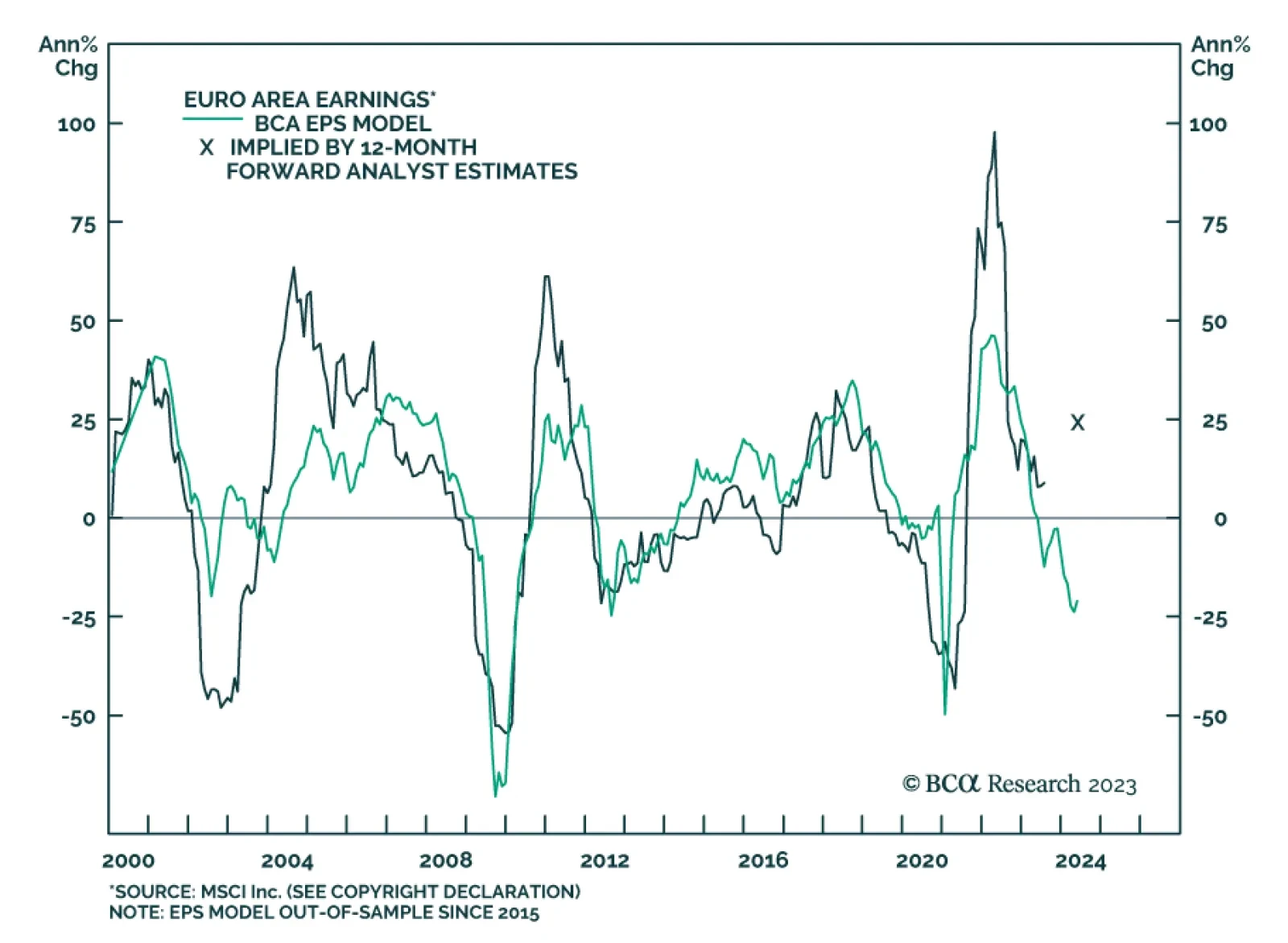

According to BCA Research’s European Investment Strategy service, the profit outlook for Eurozone earnings continues to deteriorate. The team’s earnings model for Eurozone equities continues to point to a deepening…