According to BCA Research’s Global Asset Allocation service, recession is still on track to begin in the first half of 2024. Is it the recession that never came? Certainly, the consensus thinks so. Soft landing is now…

Inflation won’t fall fast enough for the Fed to cut rates preemptively before recession arrives. The risk/rewards balance is unfavorable for risk assets. Stay overweight bonds versus equities.

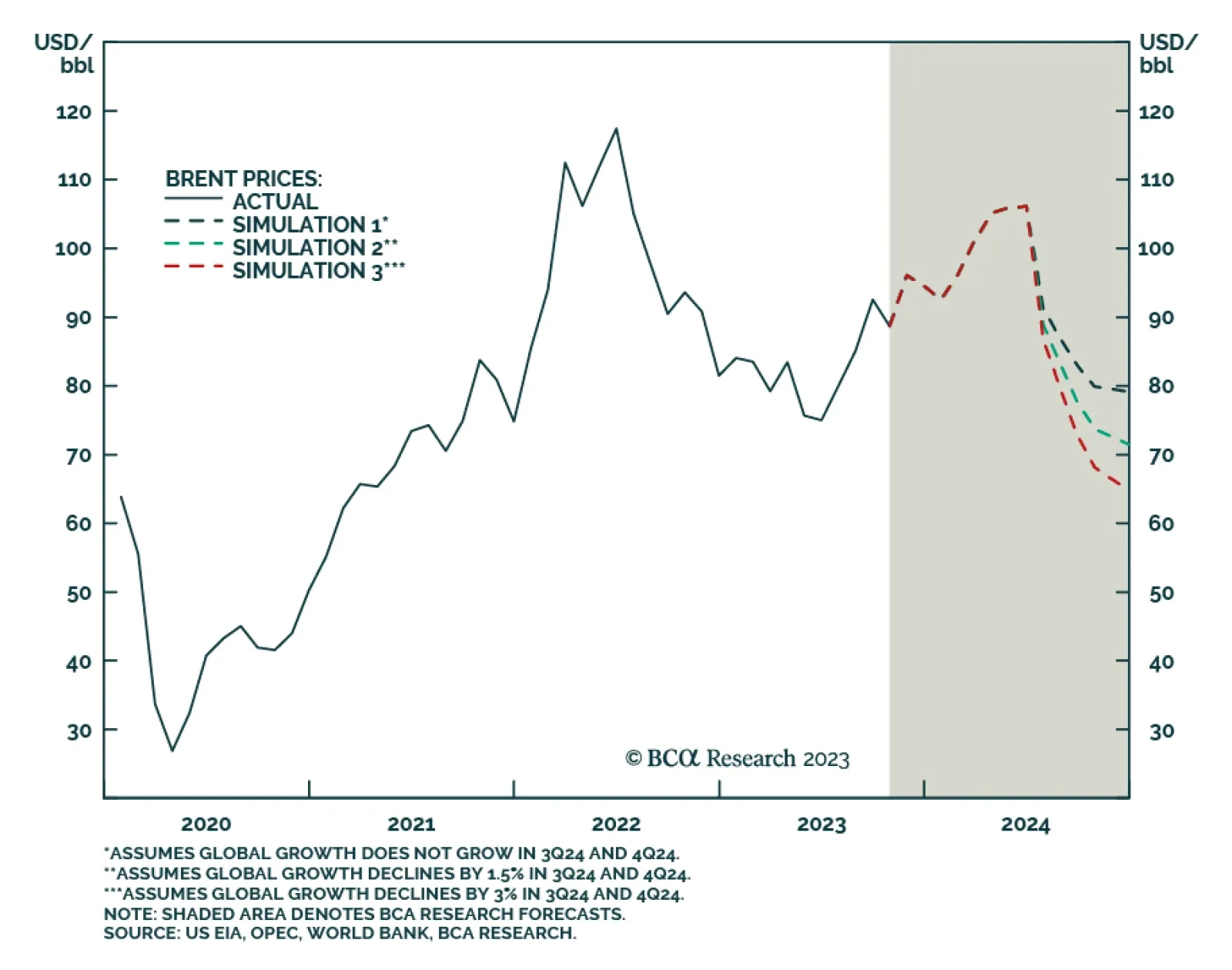

BCA’s Commodity & Energy Strategy service does not expect a global recession next year. In practical terms, this means they are more bullish on their oil-price outlook for 2024 than the consensus and also differ…

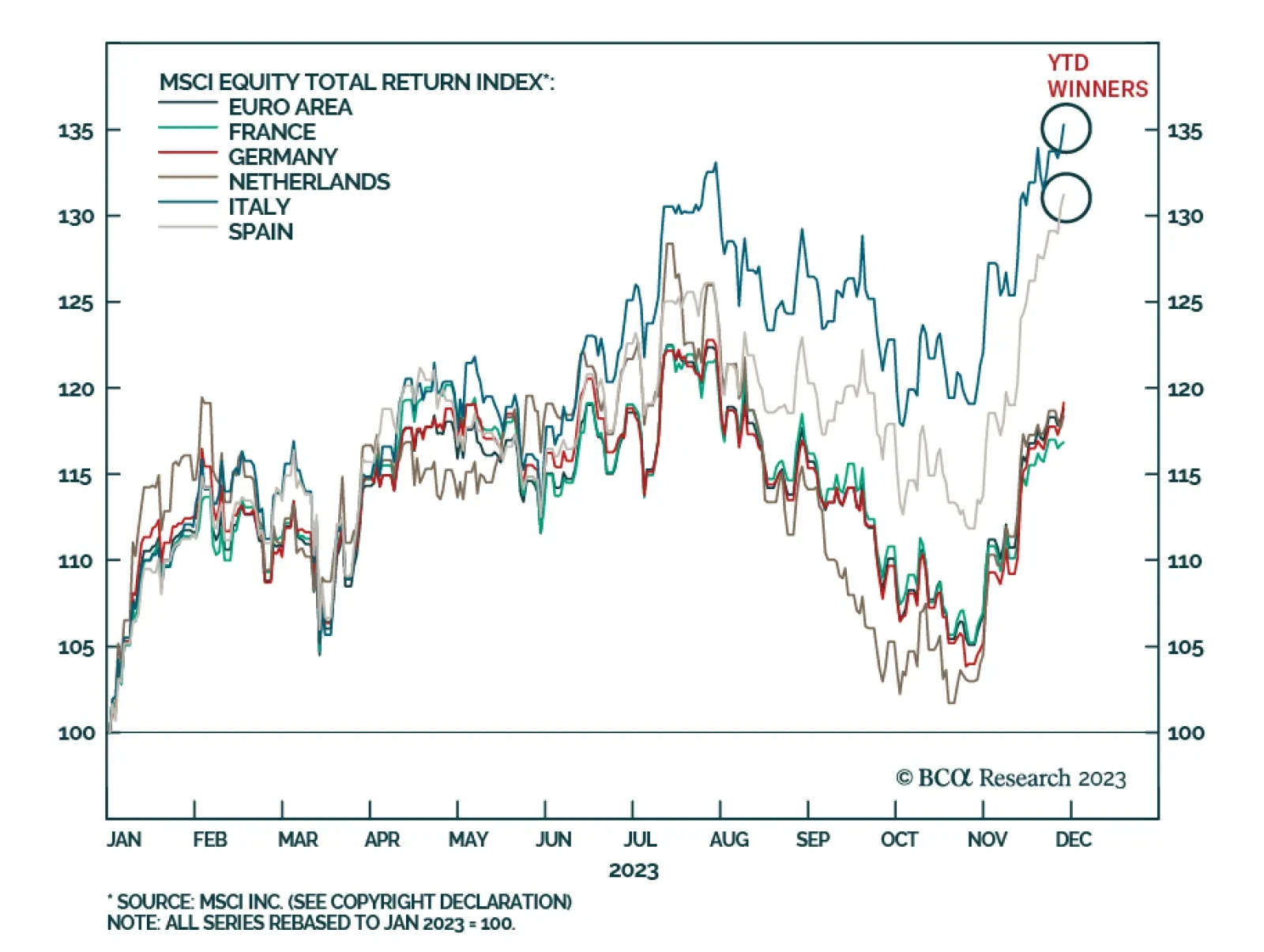

Euro Area stocks have had a strong 2023, rising by 18.8% year-to-date, only slightly behind the 19.1% gain captured by US equities, and outperforming the ACWI’s 14.3% increase. In particular, the Italian index’s 35…

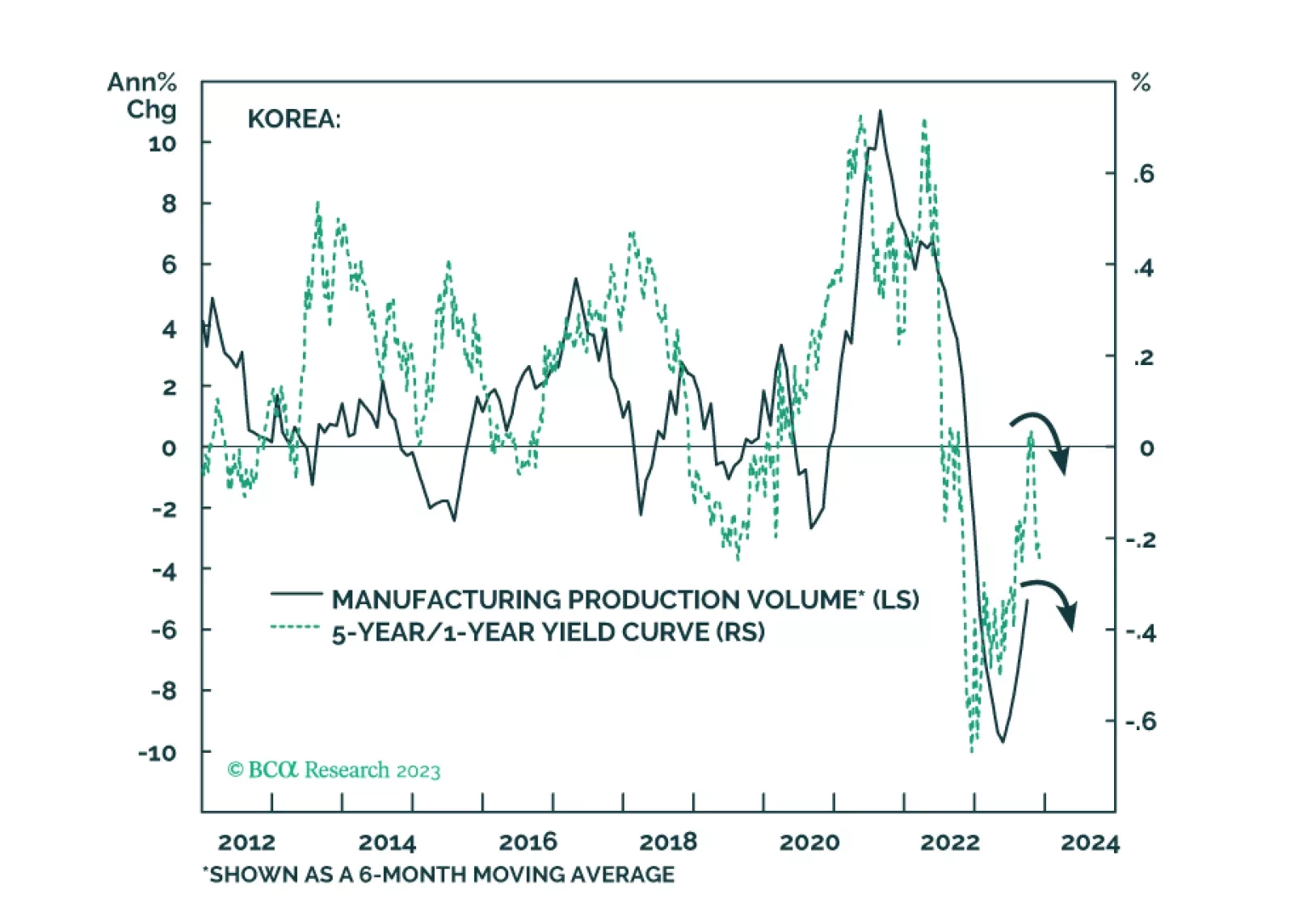

The recent increase in Korean exports will likely prove to be a mid-cycle rebound within a cyclical downtrend. Korea’s households and enterprises are among the most indebted globally, and their debt service ratio is among the highest…

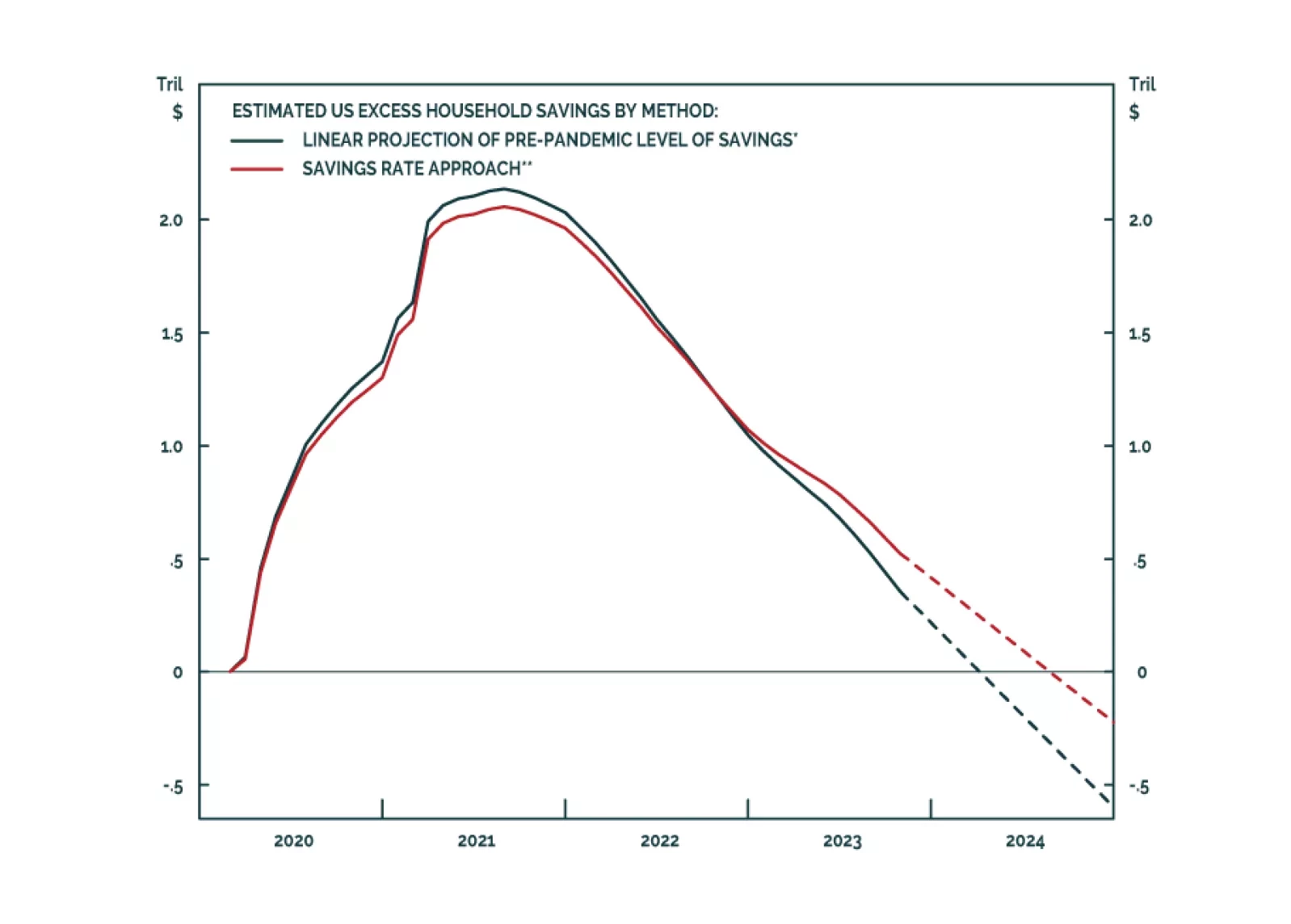

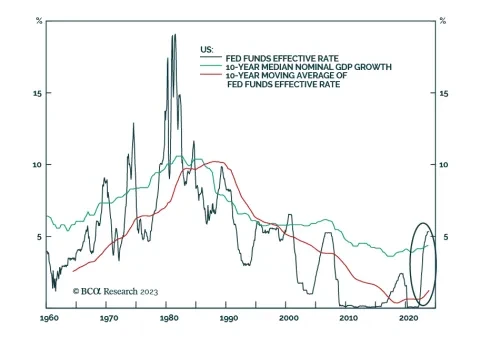

According to BCA Research’s Bank Credit Analyst service, events that have occurred since the onset of the pandemic have highlighted that the easy money era that prevailed from 2009-2021 is very likely over. The Fed will…

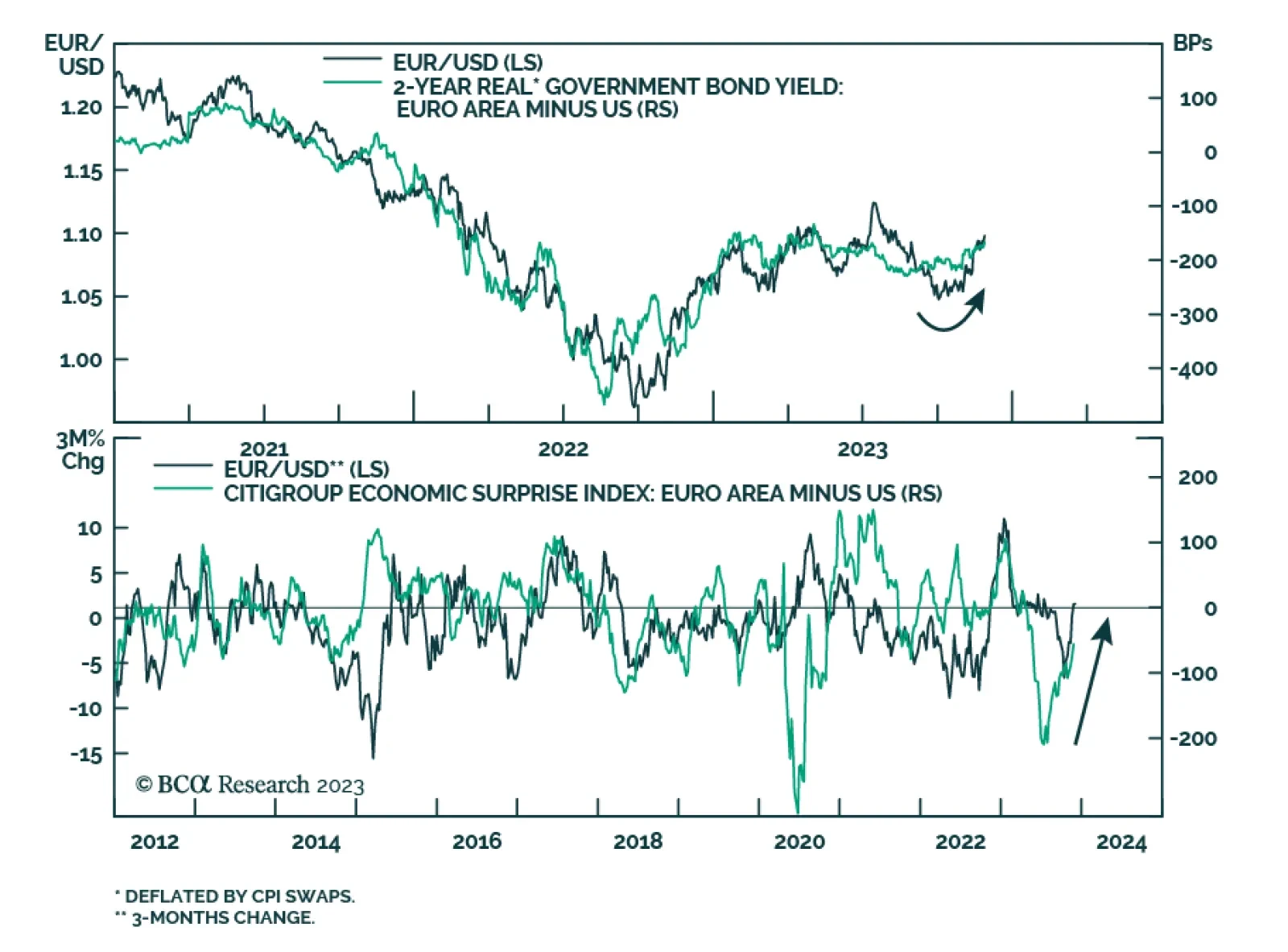

Recent Euro Area economic data have been sending a less pessimistic signal. Wednesday’s releases are in line with this trend. The European Commission’s confidence indicator shows a mild improvement in economic…

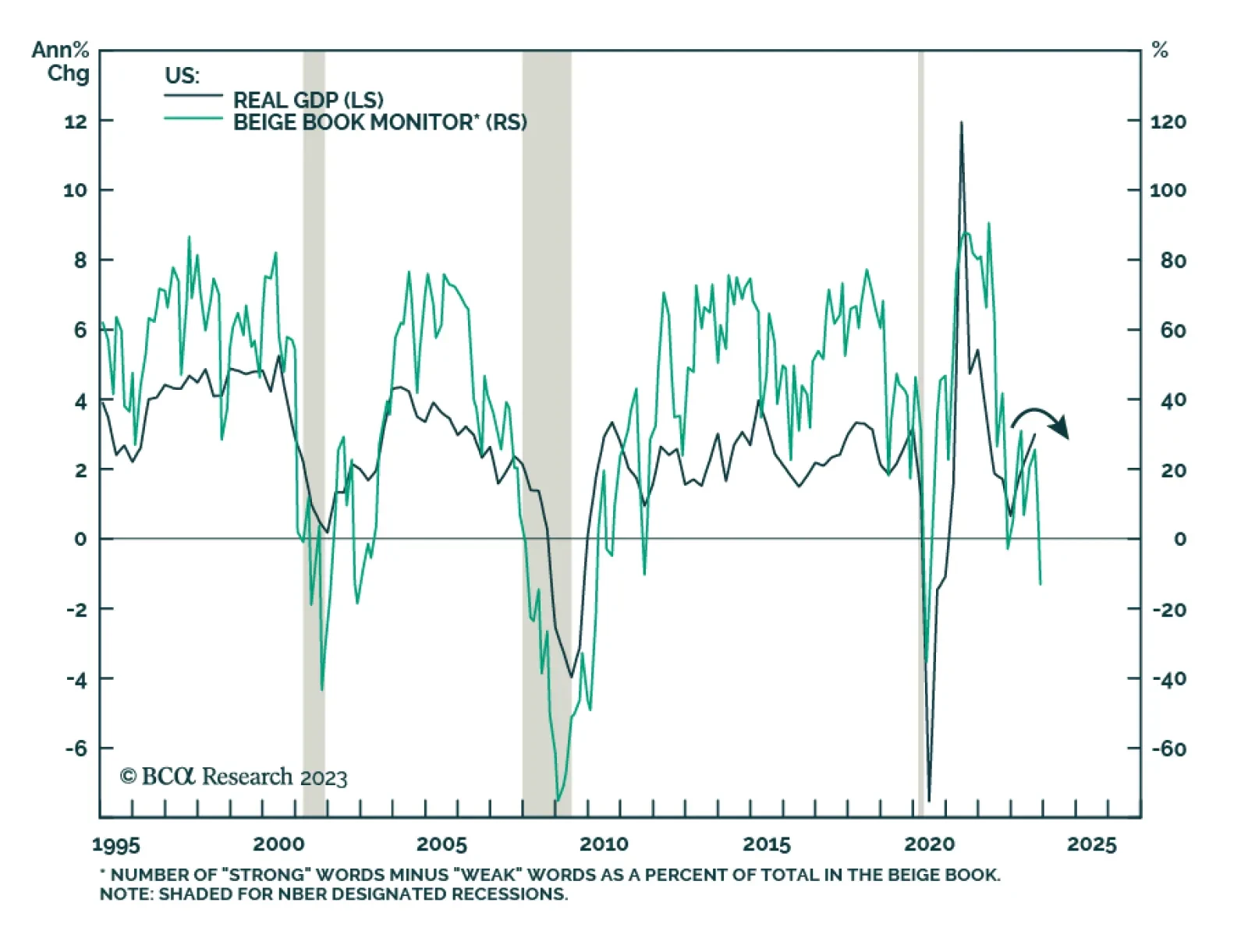

The Fed’s latest Beige Book delivered a pessimistic message for the US economy. Half of the 12 districts reported slight declines in activity, two indicated that “conditions were flat to slightly down,” and the…

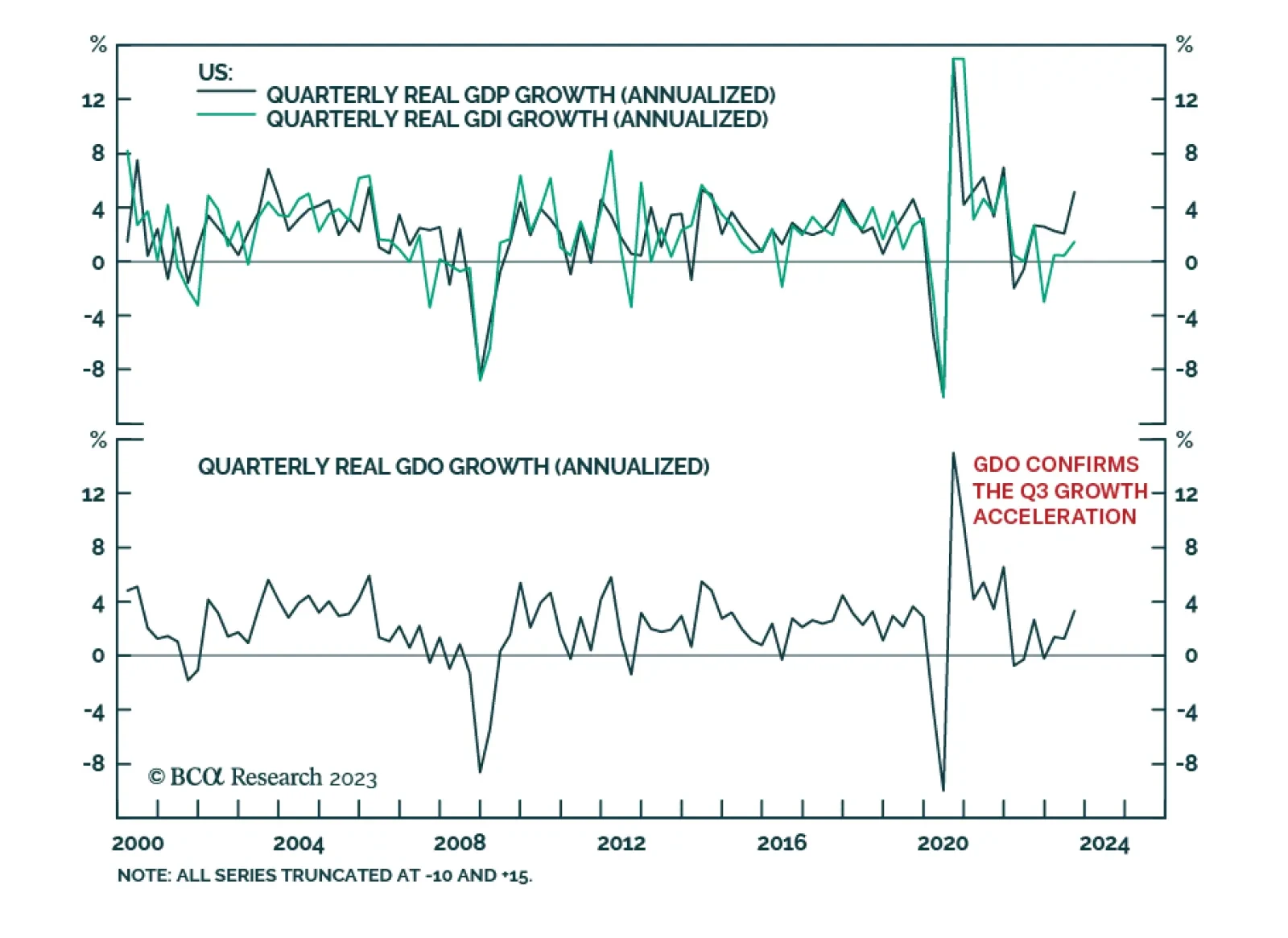

Q3 US real GDP was revised higher in the second estimate that was released on Wednesday. The 5.2% q/q annualized increase beat expectations of a more muted upwards revision to 5.0% q/q from the advance estimate of 4.9% q/q. In…