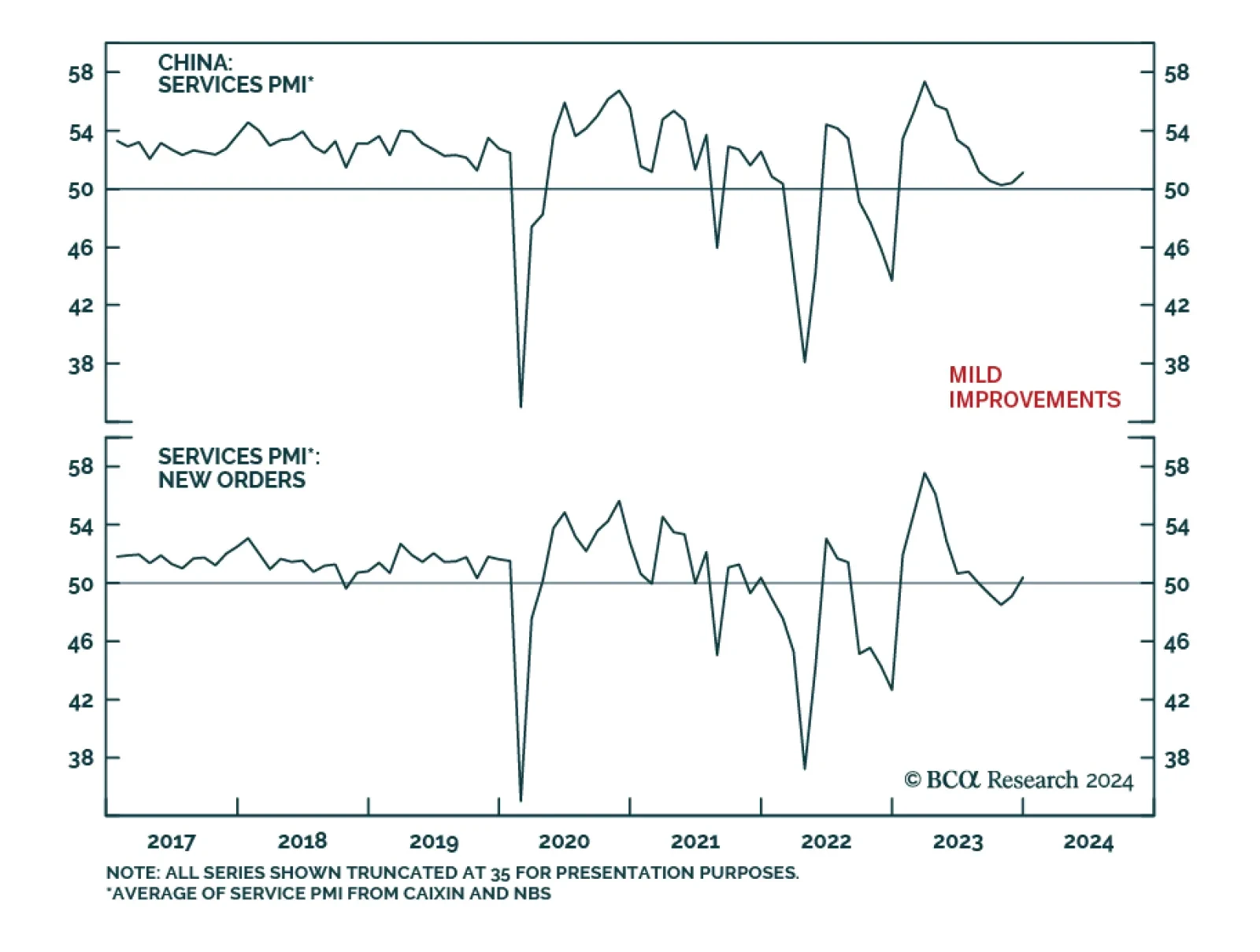

China’s Caixin PMI delivered a positive signal on Thursday. The Services index climbed from 51.5 to 52.9 in December, beating expectations it would remain more or less unchanged. The improvement in the Services PMI lifted…

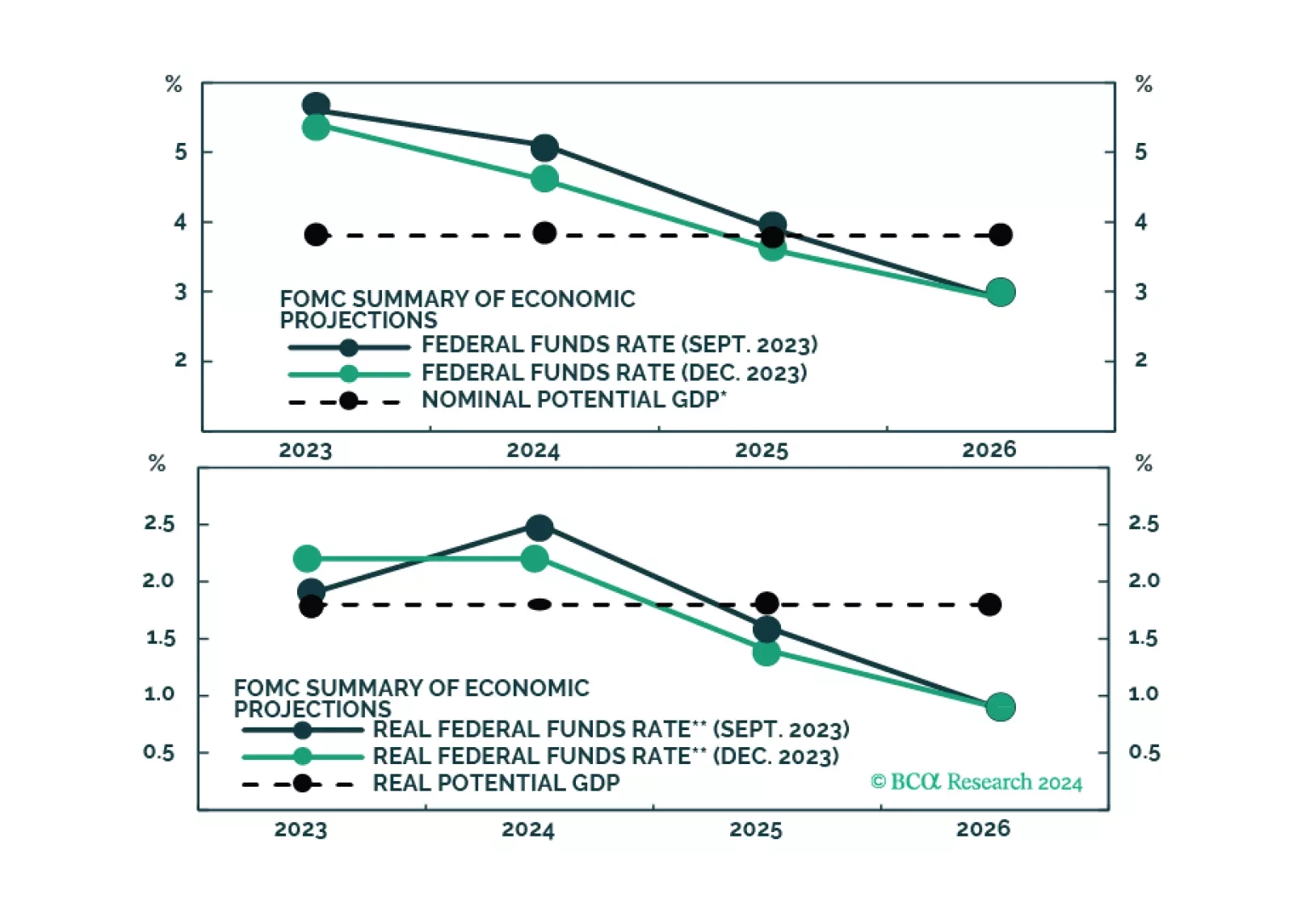

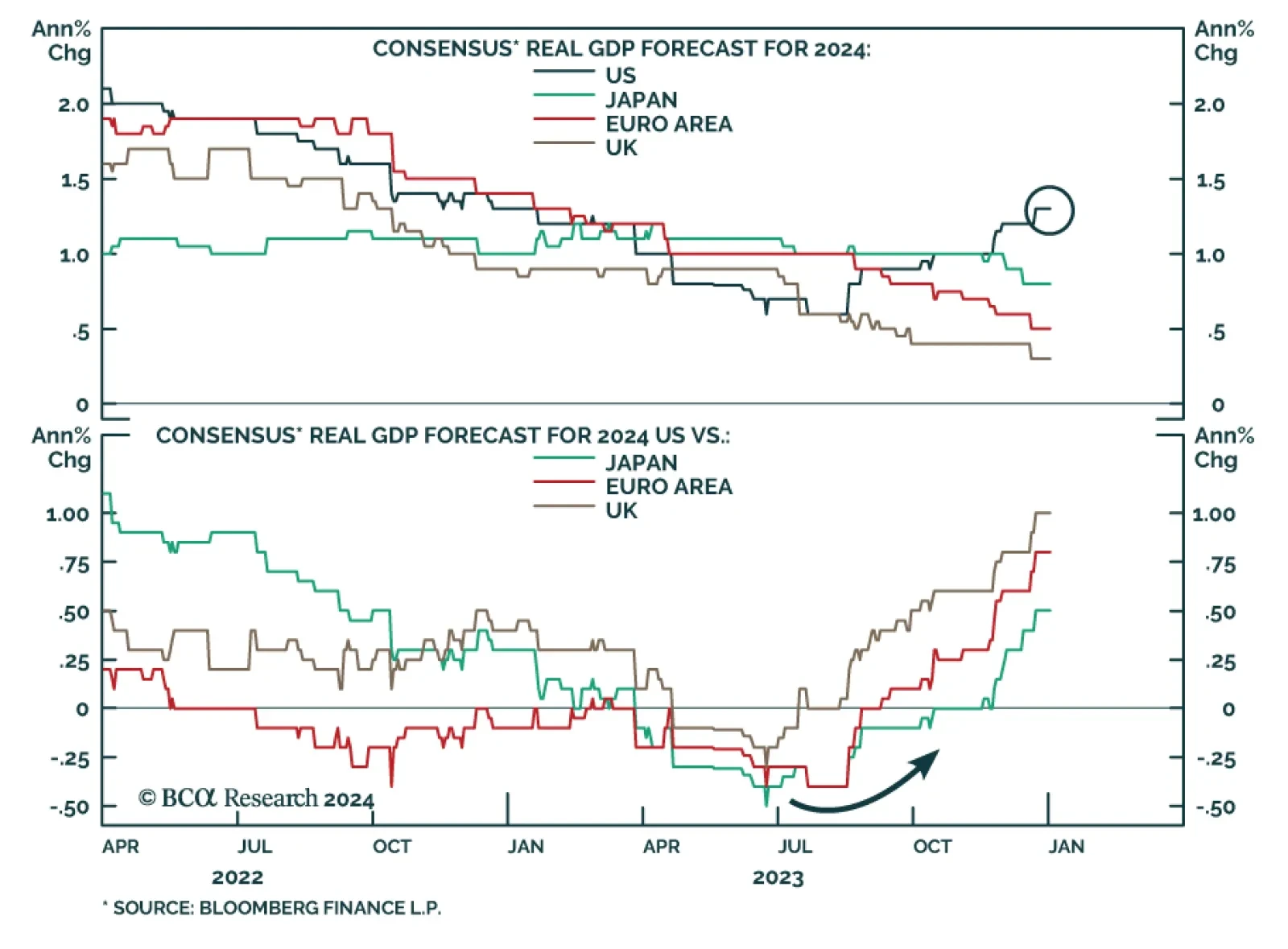

The market is excited by the idea that the Fed will cut rates early this year, even without a recession. But is that likely, with inflation still set to be around 2.8% mid-year?

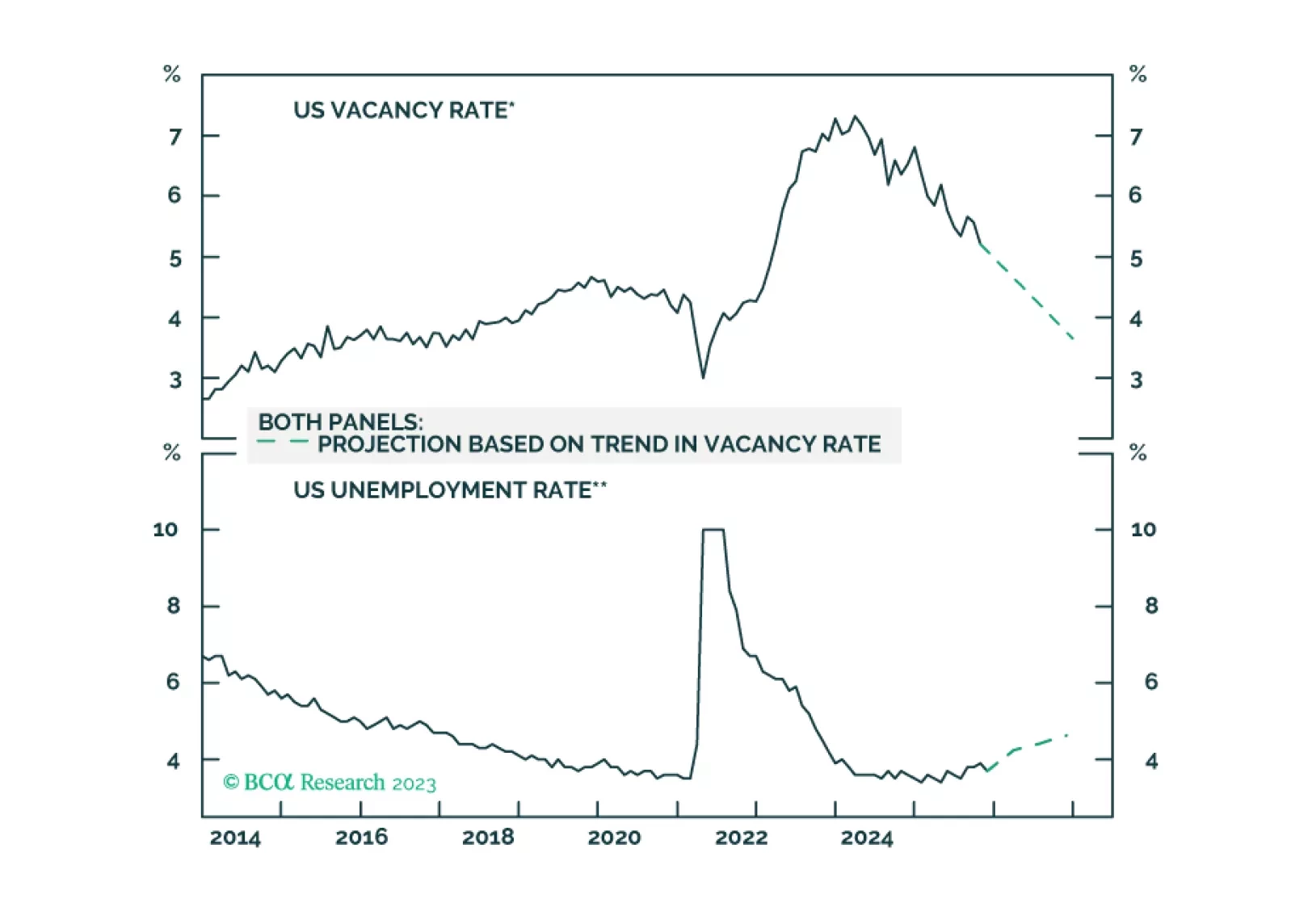

Economists have been consistently revising up their 2024 US GDP forecasts over the past 4 months. The consensus now anticipates US growth to clock in at 1.3% this year. According to the latest estimate from the Atlanta Fed’…

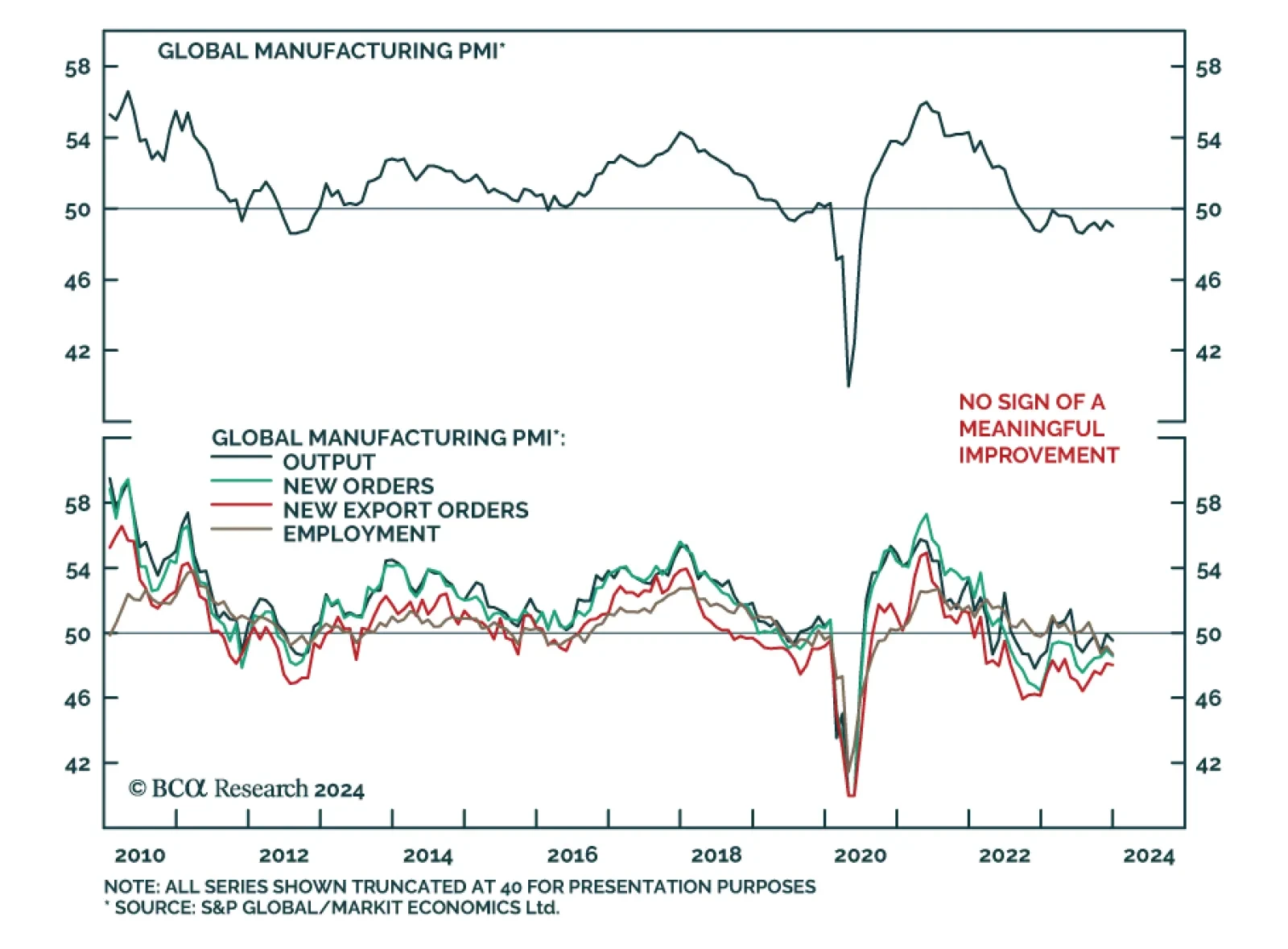

December PMIs indicate that the global manufacturing sector is not experiencing a meaningful rebound. The Global Manufacturing PMI declined from 49.3 to 49.0 in December, marking the sixteenth consecutive month of a sub-50…

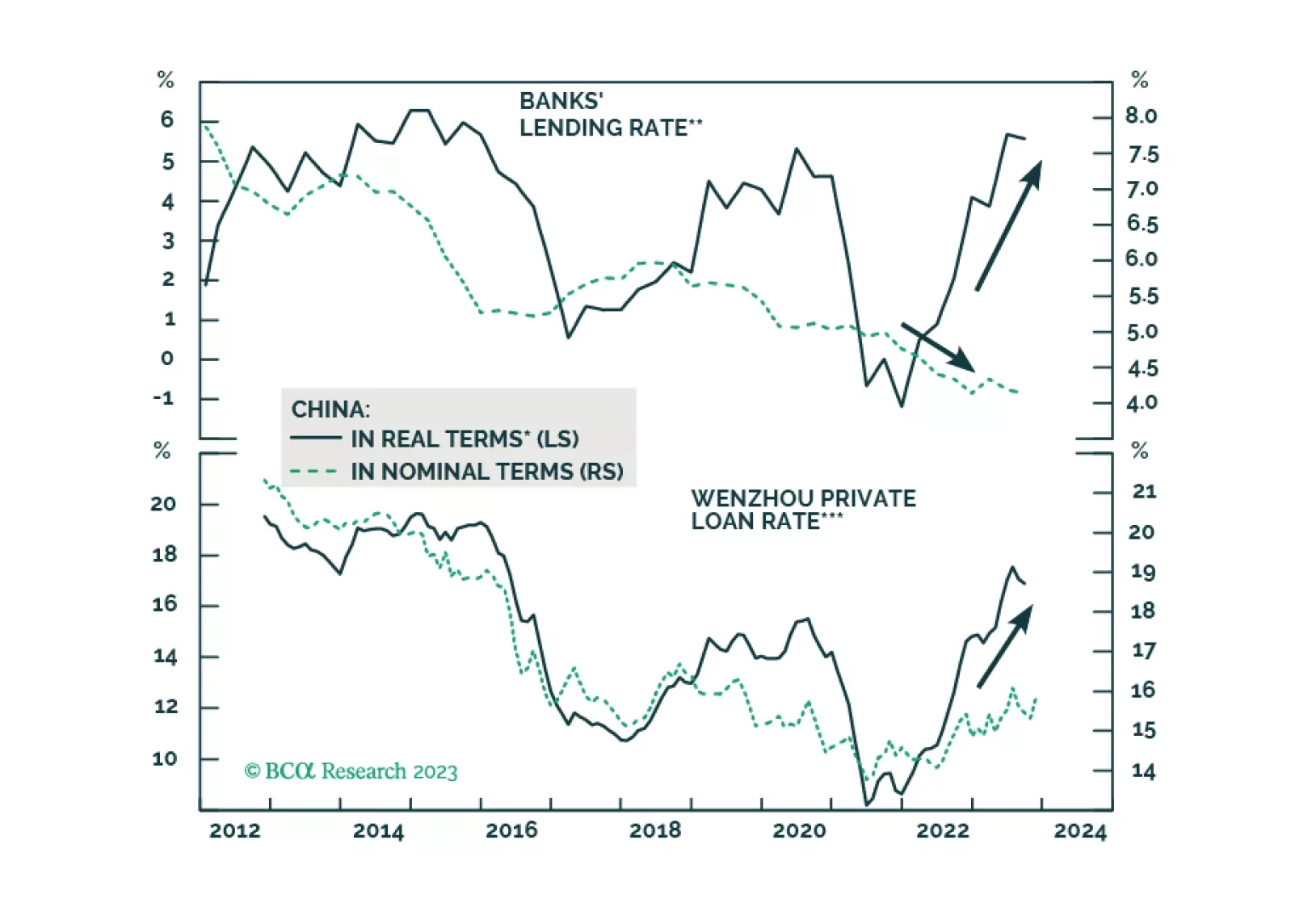

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

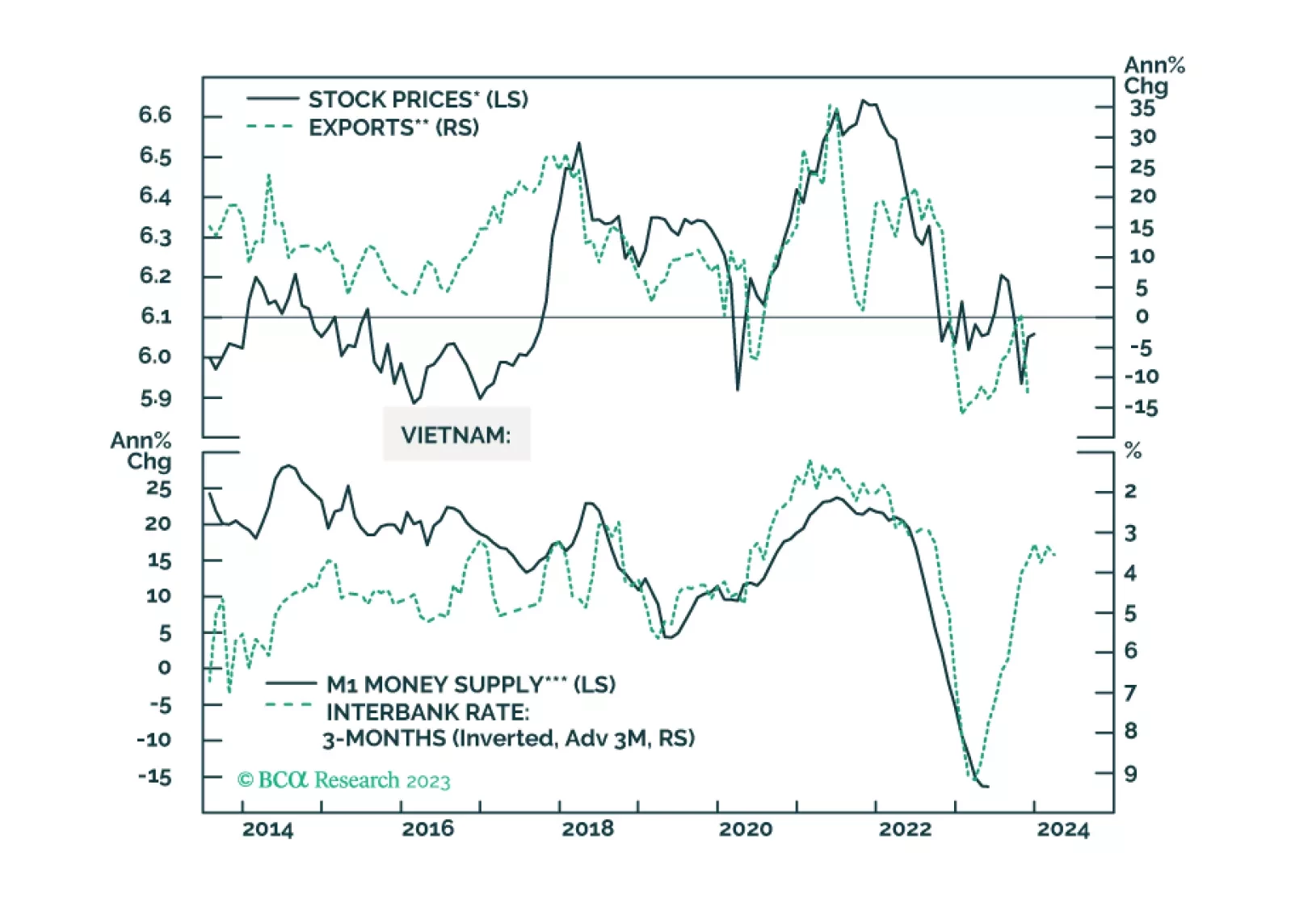

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.

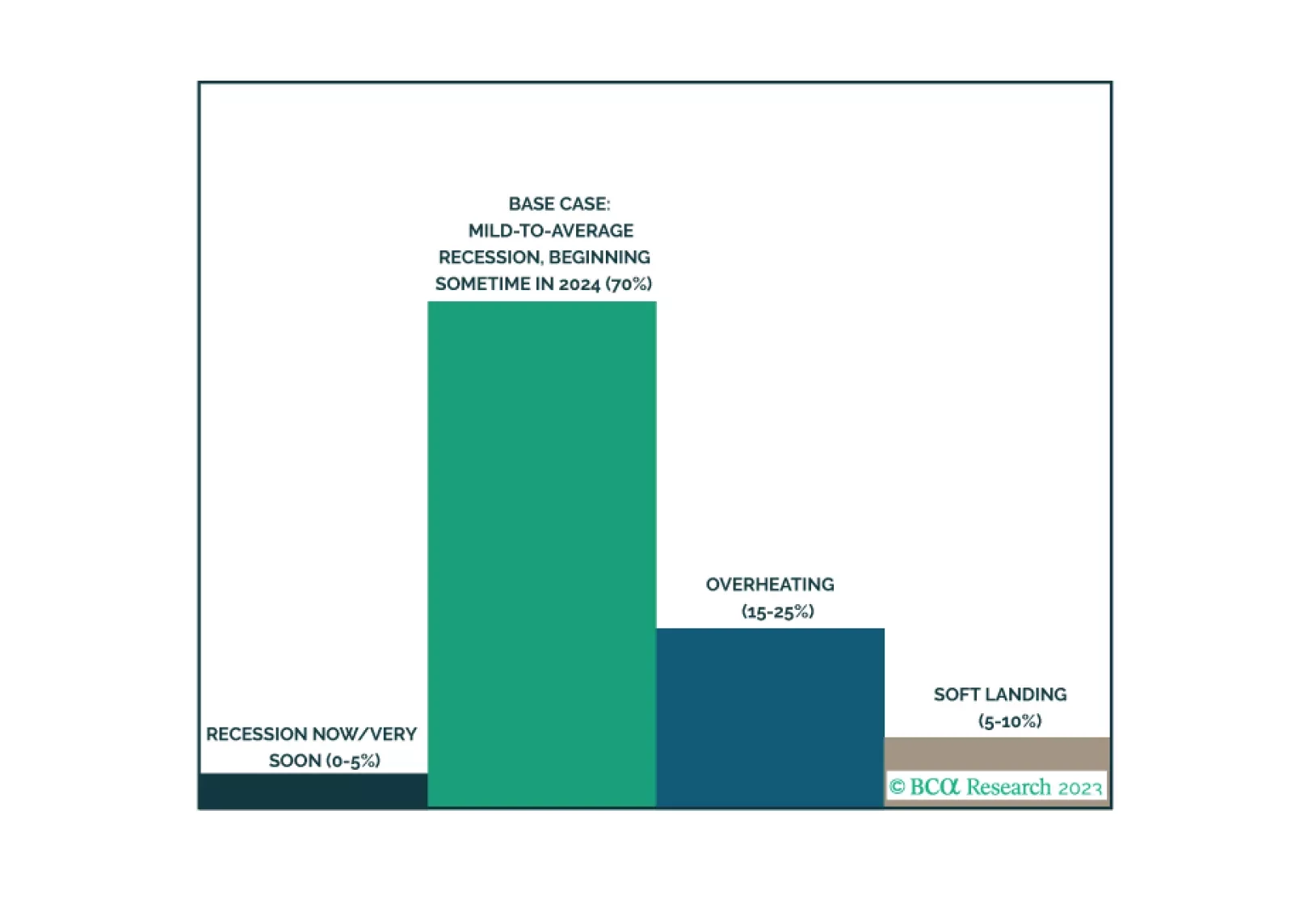

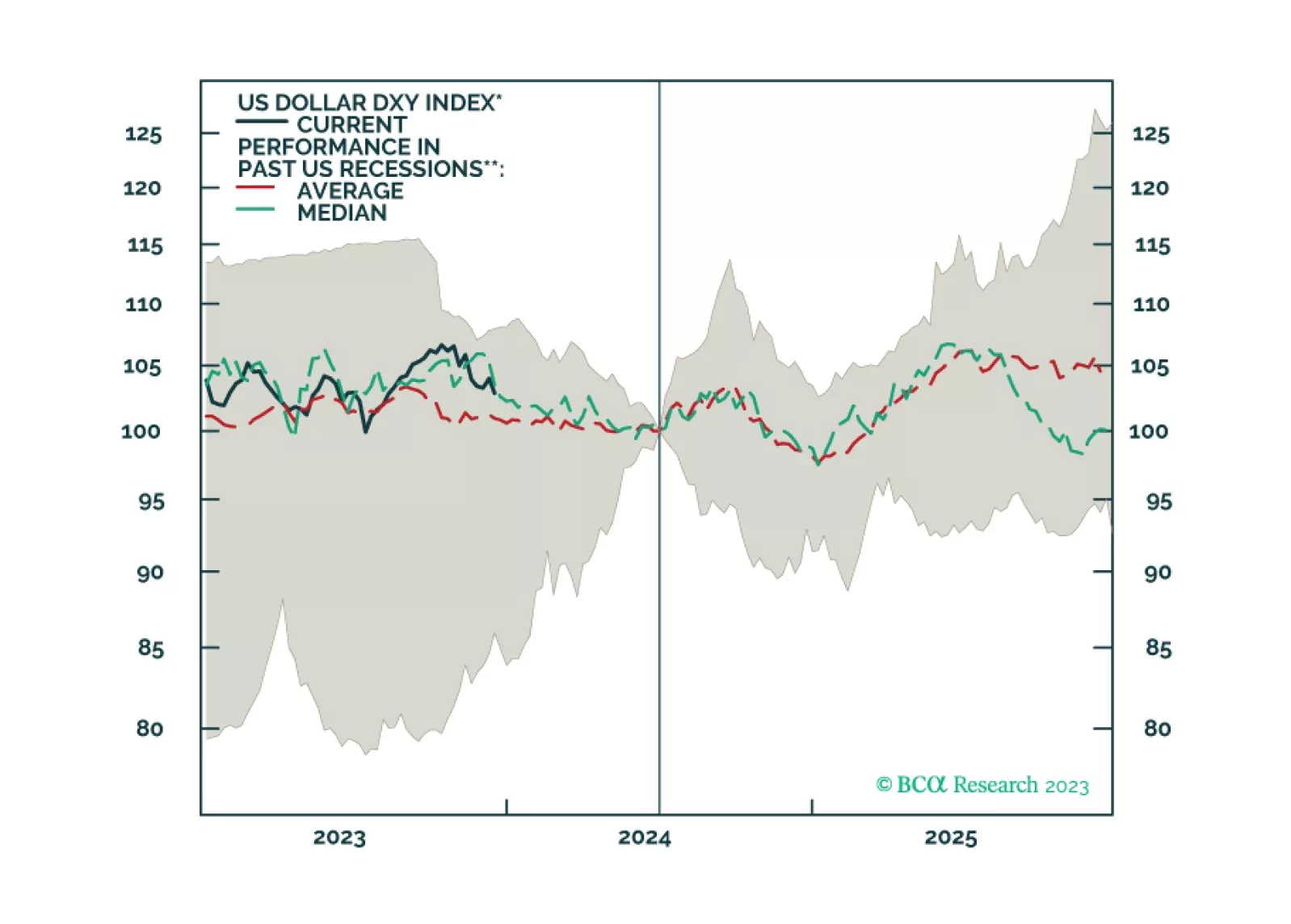

Our last publication of 2023 is an illustrated guide to our view that the economy will enter a recession around midyear. We expect equities will underperform Treasuries and cash over much of 2024, but we are waiting to turn…

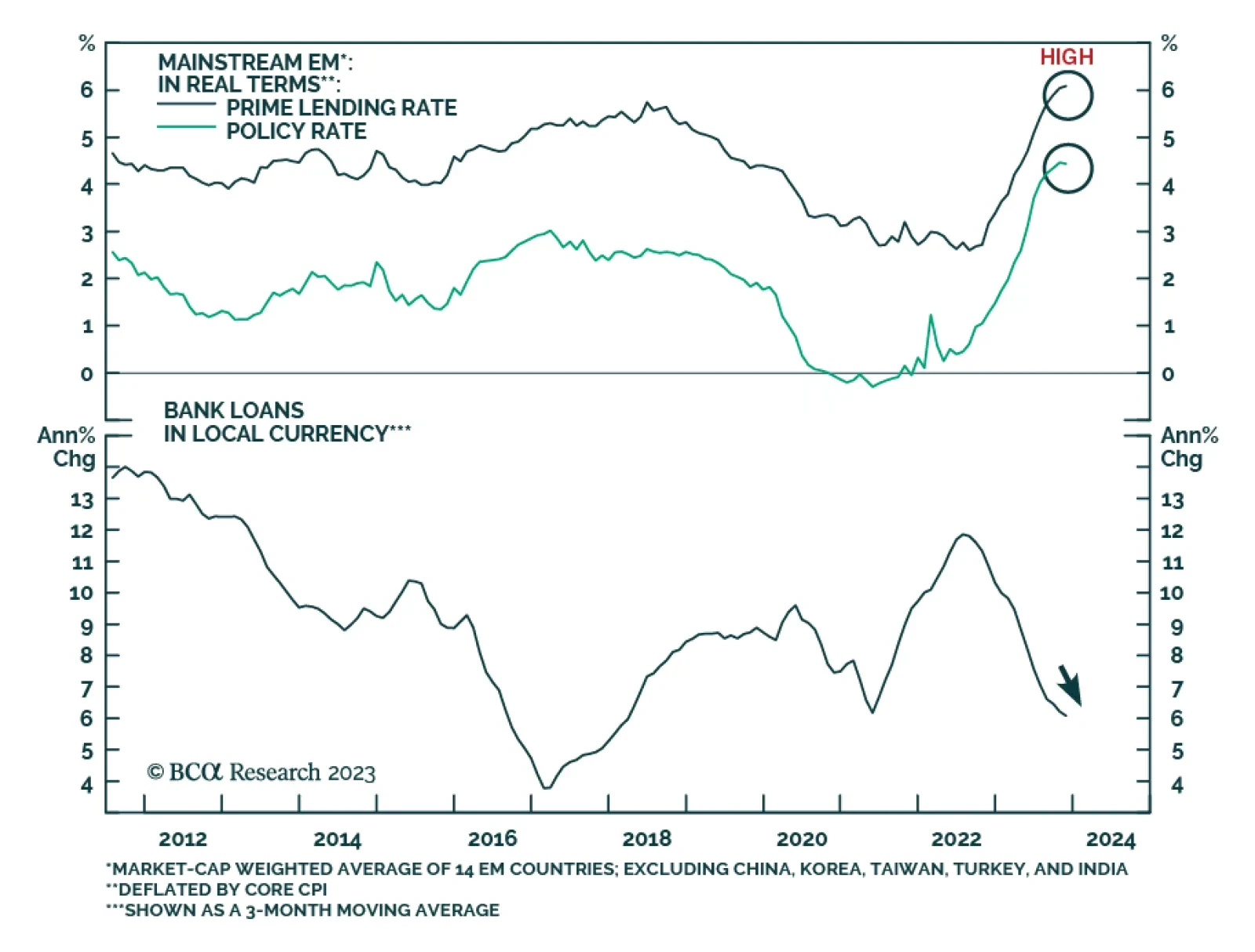

According to BCA Research’s Emerging Markets Strategy service, domestic demand and corporate profits will disappoint across mainstream Emerging Market economies (excluding China, India, Korea, and Taiwan) in H1 2024.…