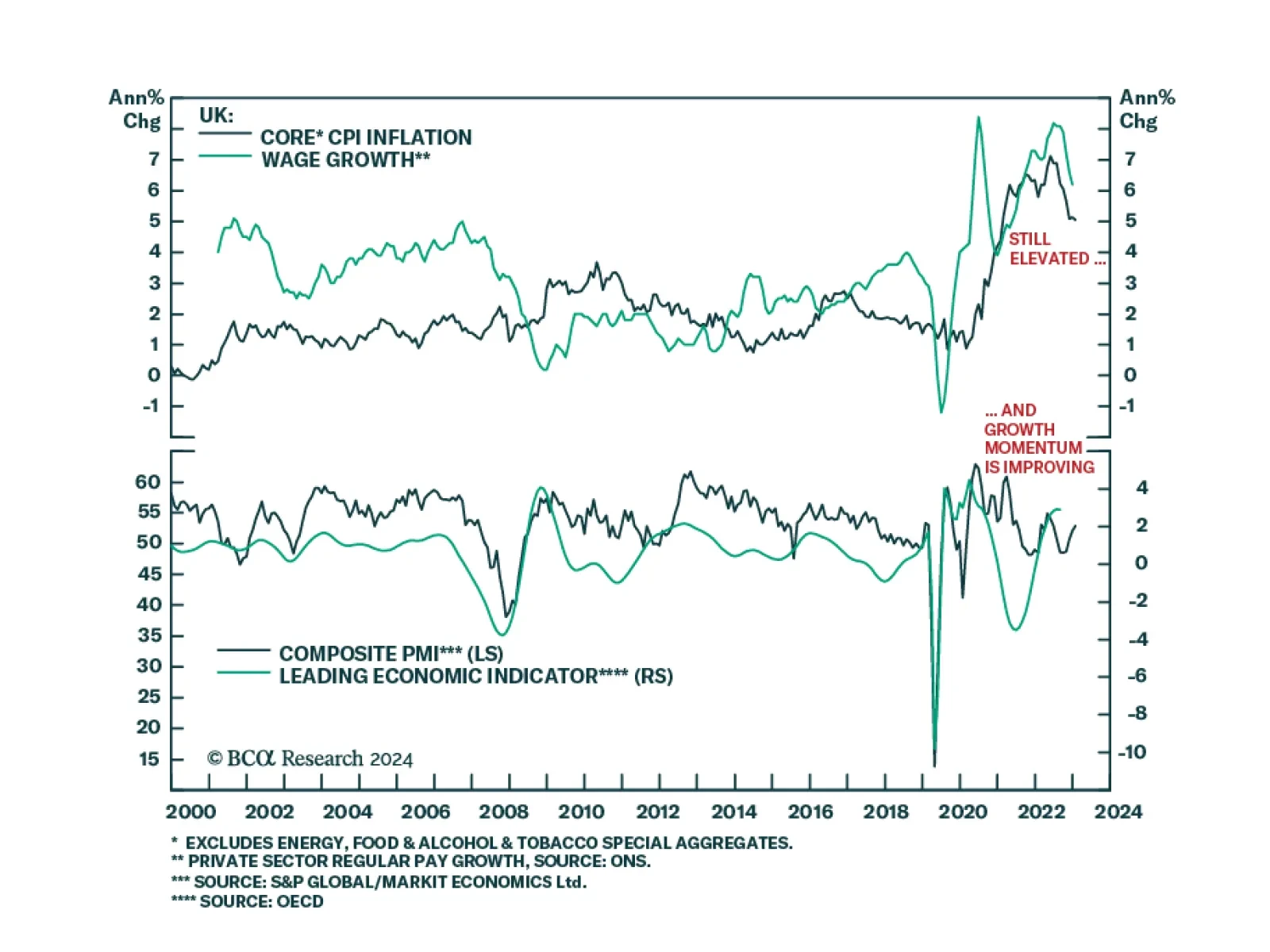

The UK inflation release for January came in slightly softer than anticipated. Both headline and core CPI were unchanged on year-over-year basis at 4.0% and 5.1%, respectively – below expectations of slight accelerations.…

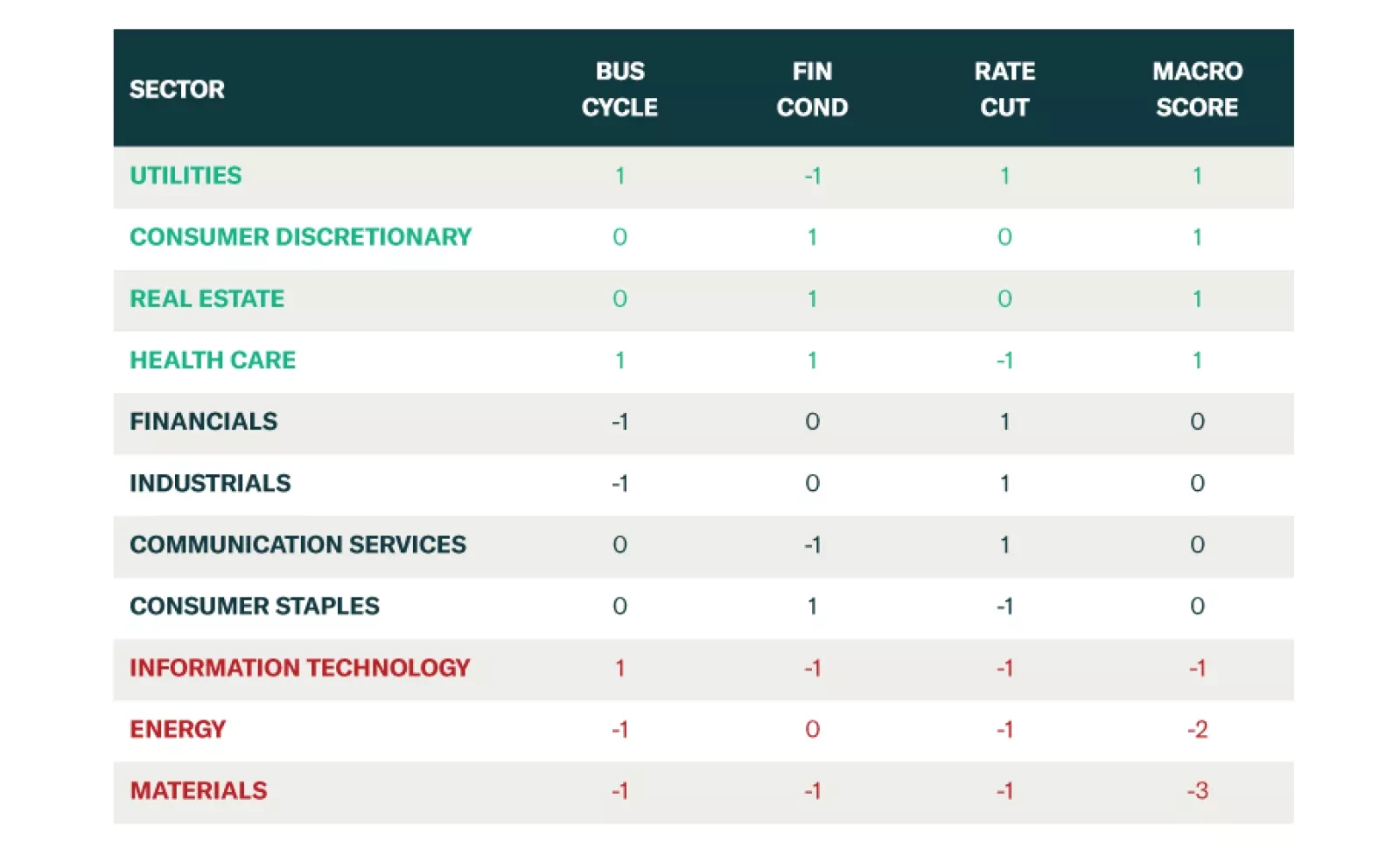

BCA Research’s US Equity Strategy service created a sector selection scorecard based on performance of sectors under various macroeconomic regimes. The current macroeconomic backdrop is characterized by the following…

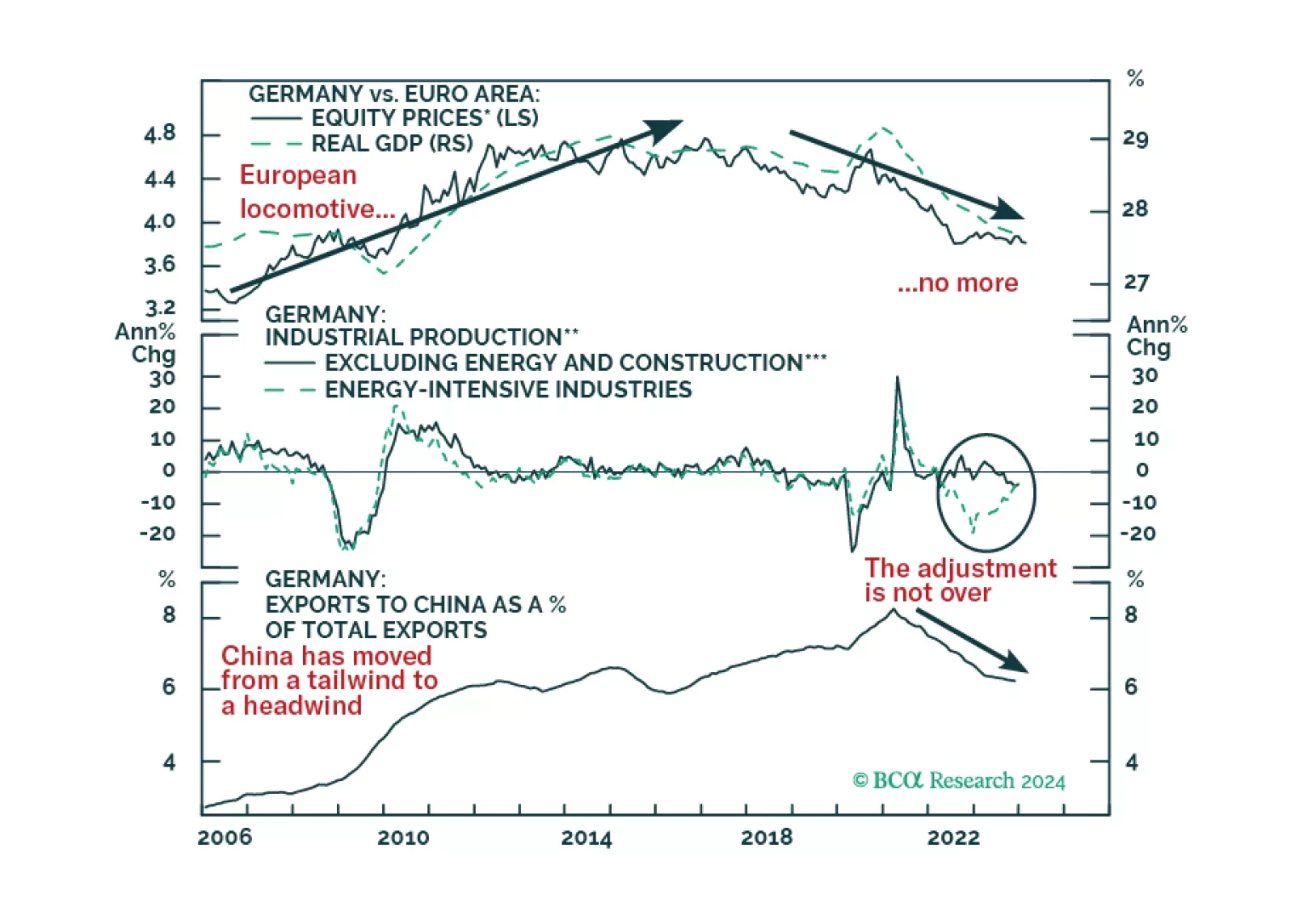

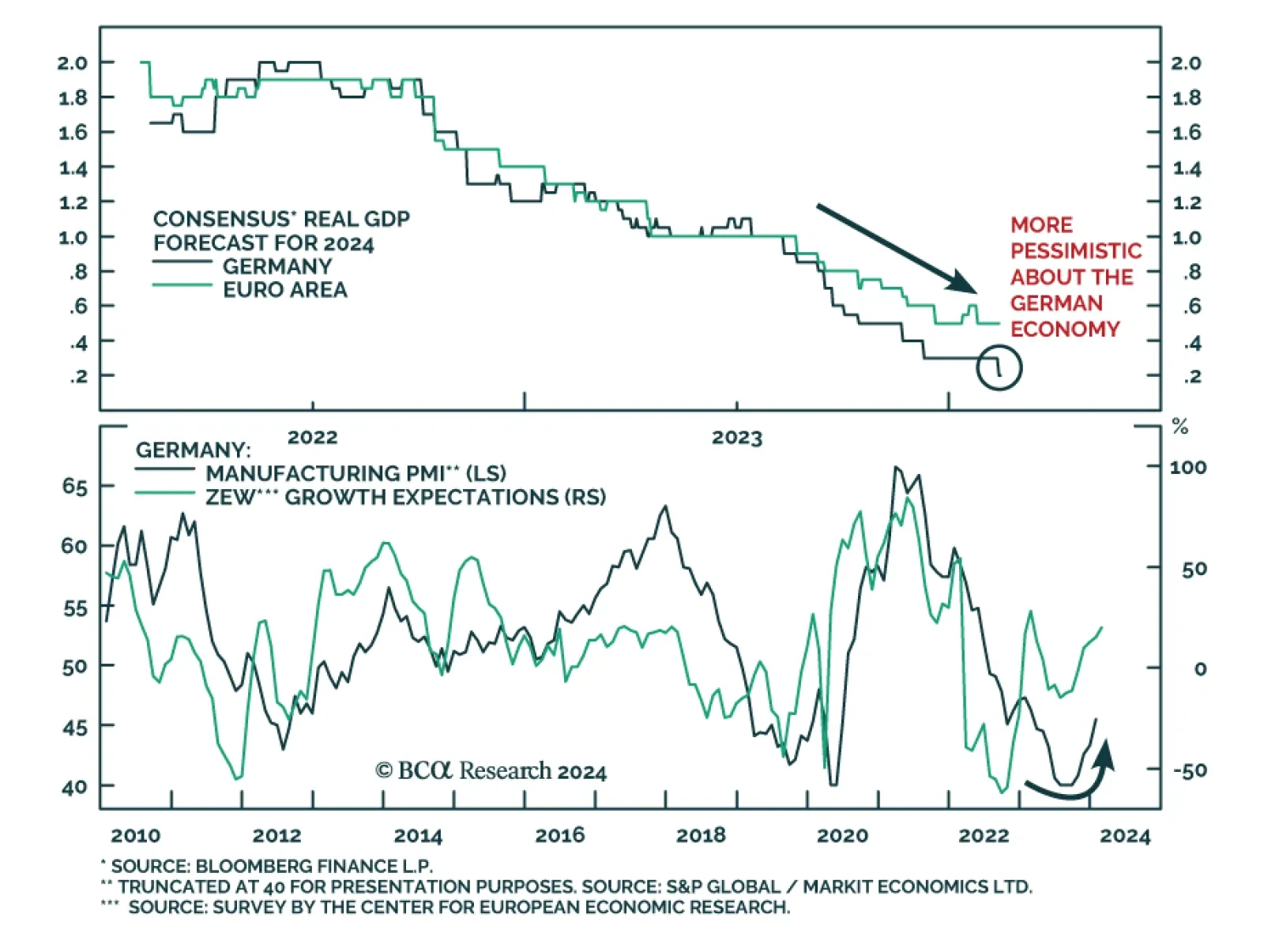

The German economy was a laggard at the end of last year, posting a 0.3% q/q real GDP contraction in Q4 2023 while the broader Eurozone economy stagnated. Importantly, while economists have been revising up their 2024 forecasts…

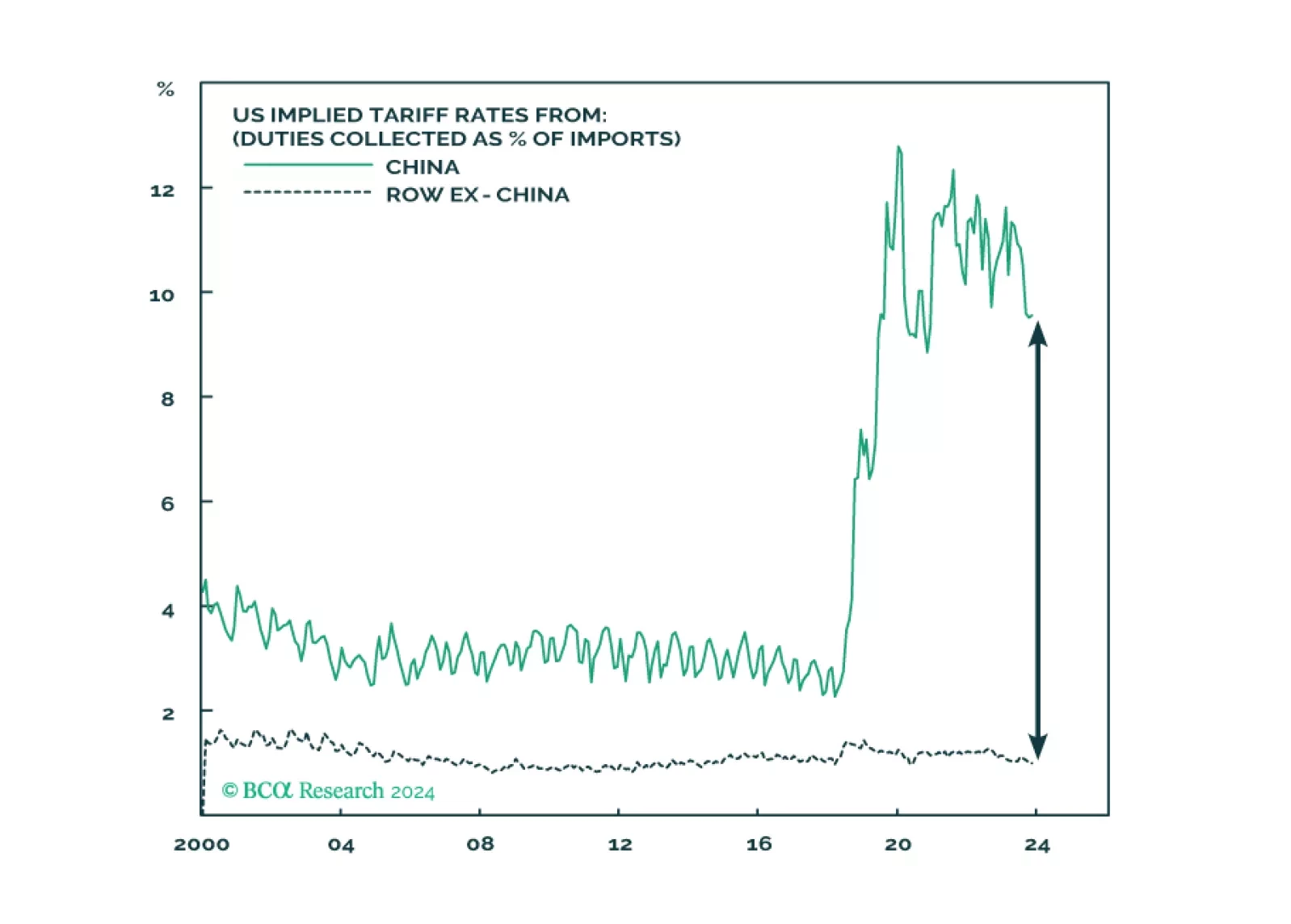

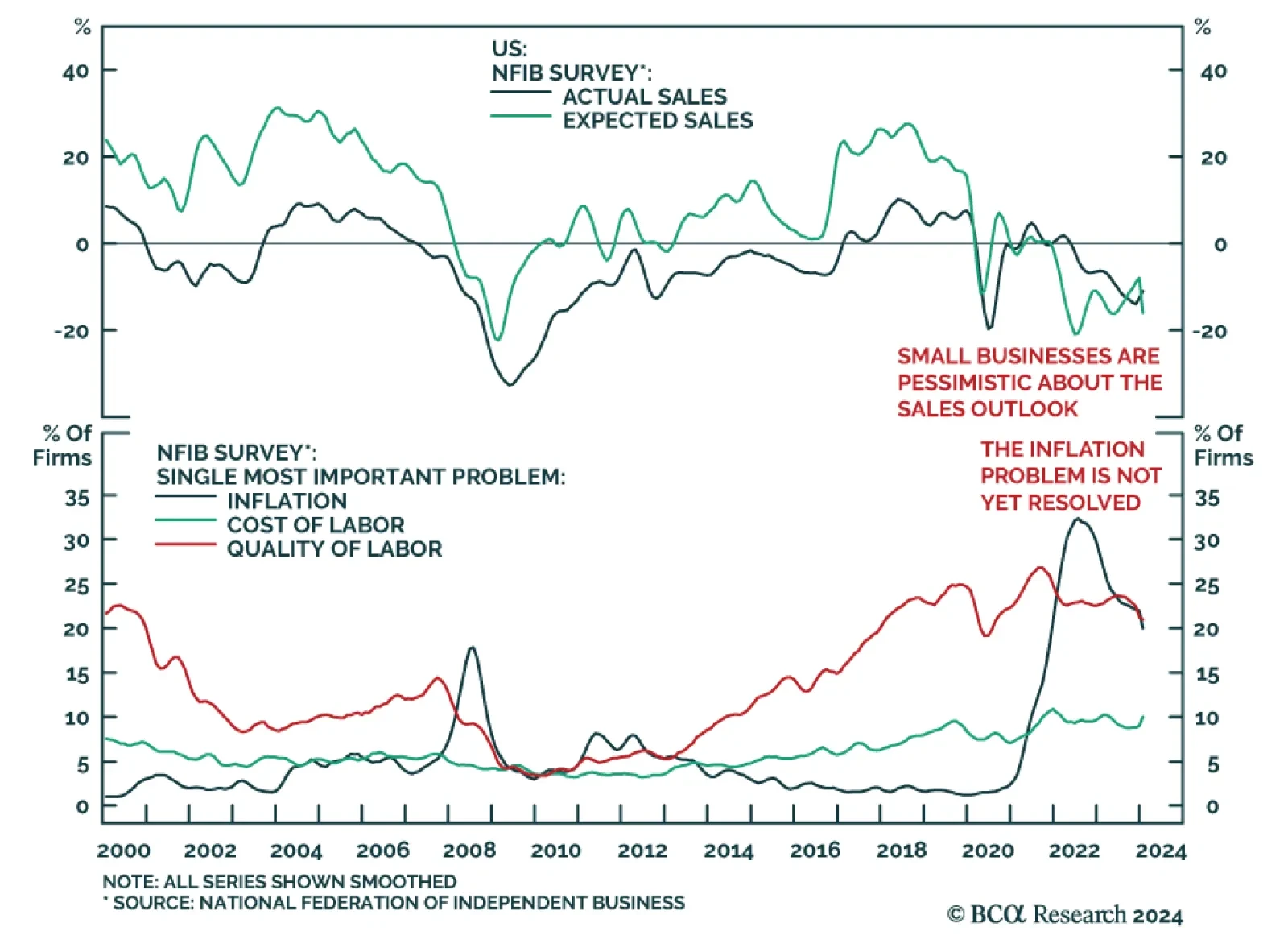

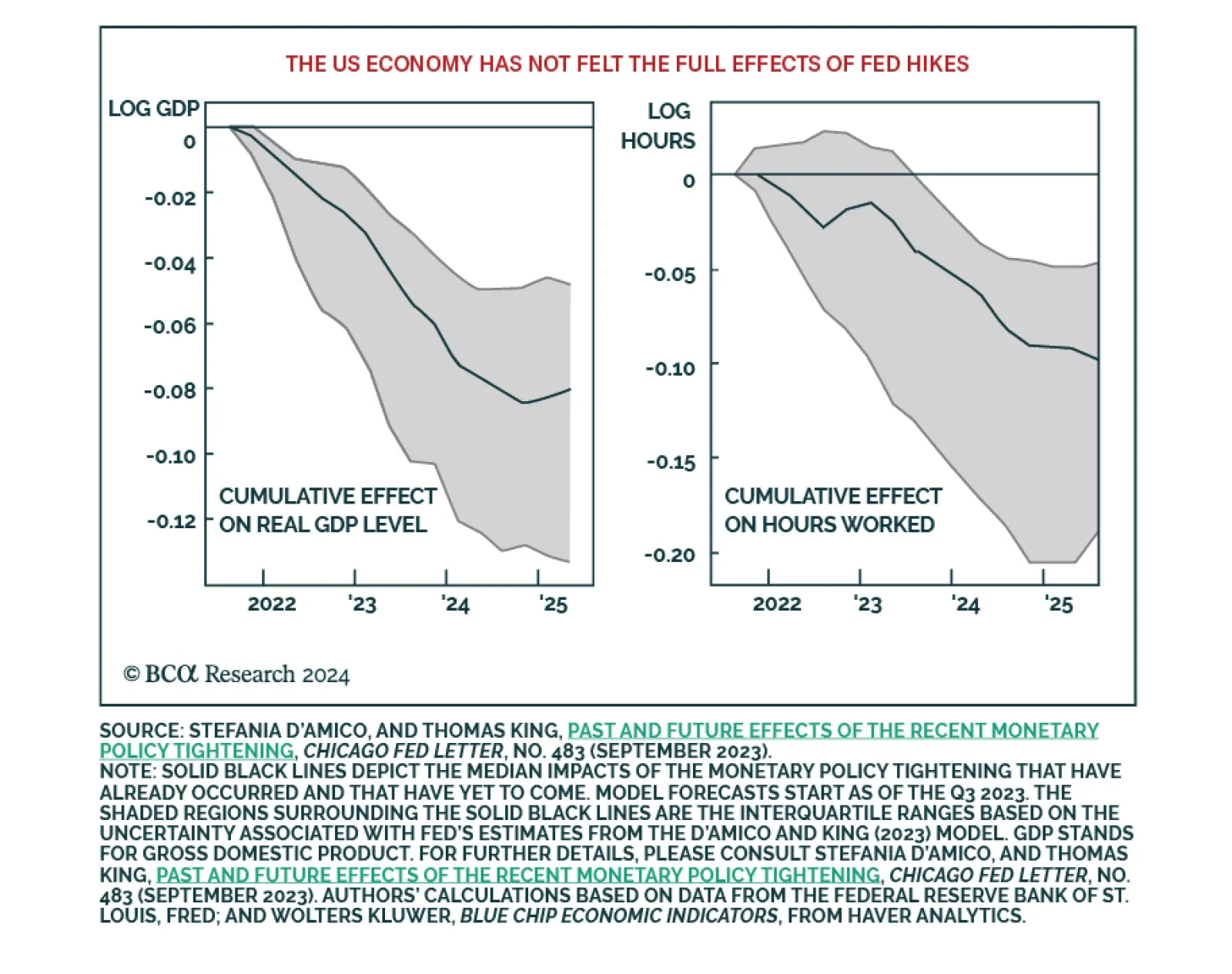

We highlighted in a recent Insight that positive economic surprises are prompting economists to revise up their US economic growth expectations. The Goldilocks narrative is supporting the rally in risk assets. However, results of…

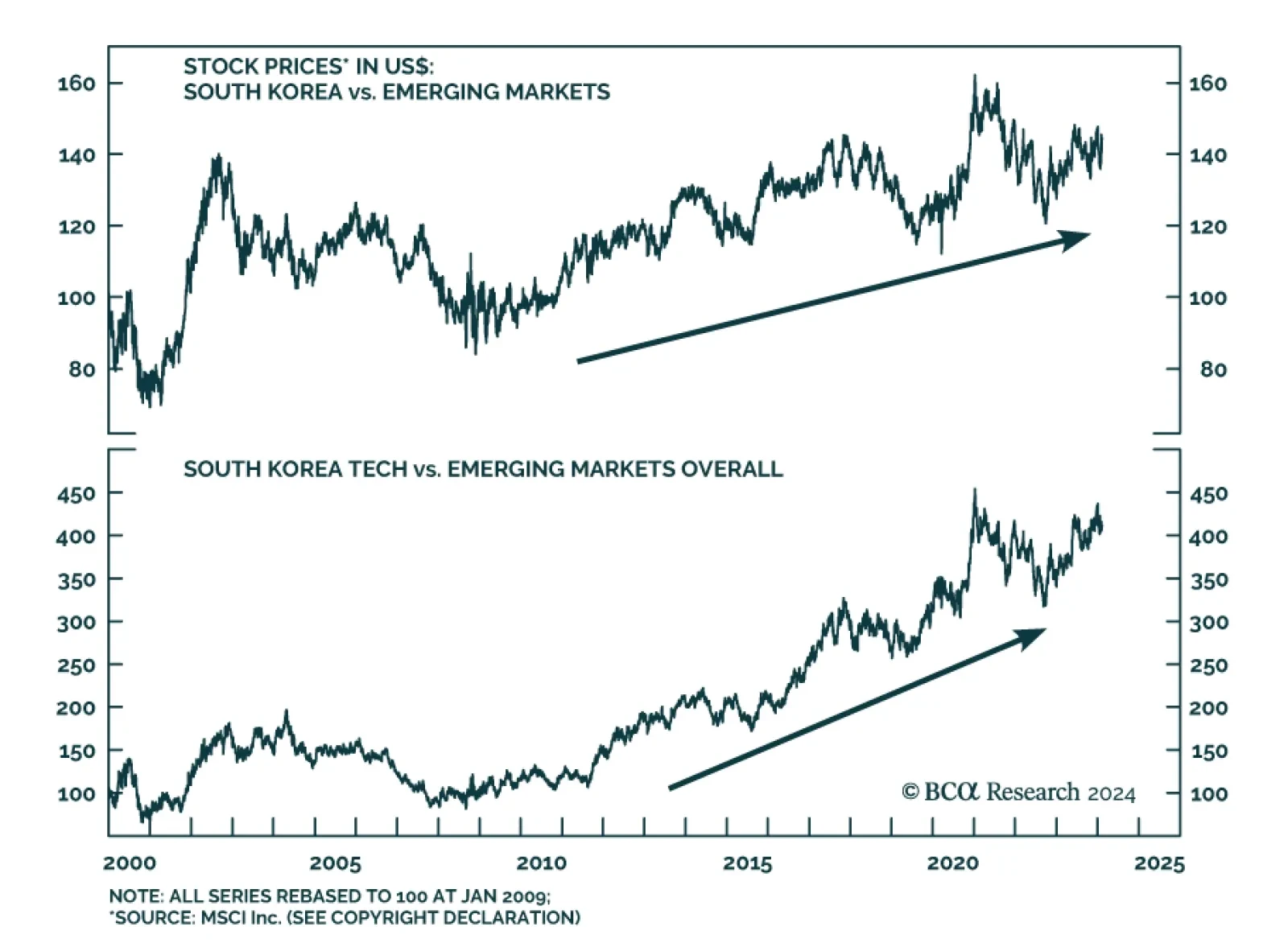

According to BCA Research’s Emerging Markets Strategy service, barring a pullback in global share prices, Korean tech stock prices will likely have more upside this year. The memory chip market will improve in 2024,…

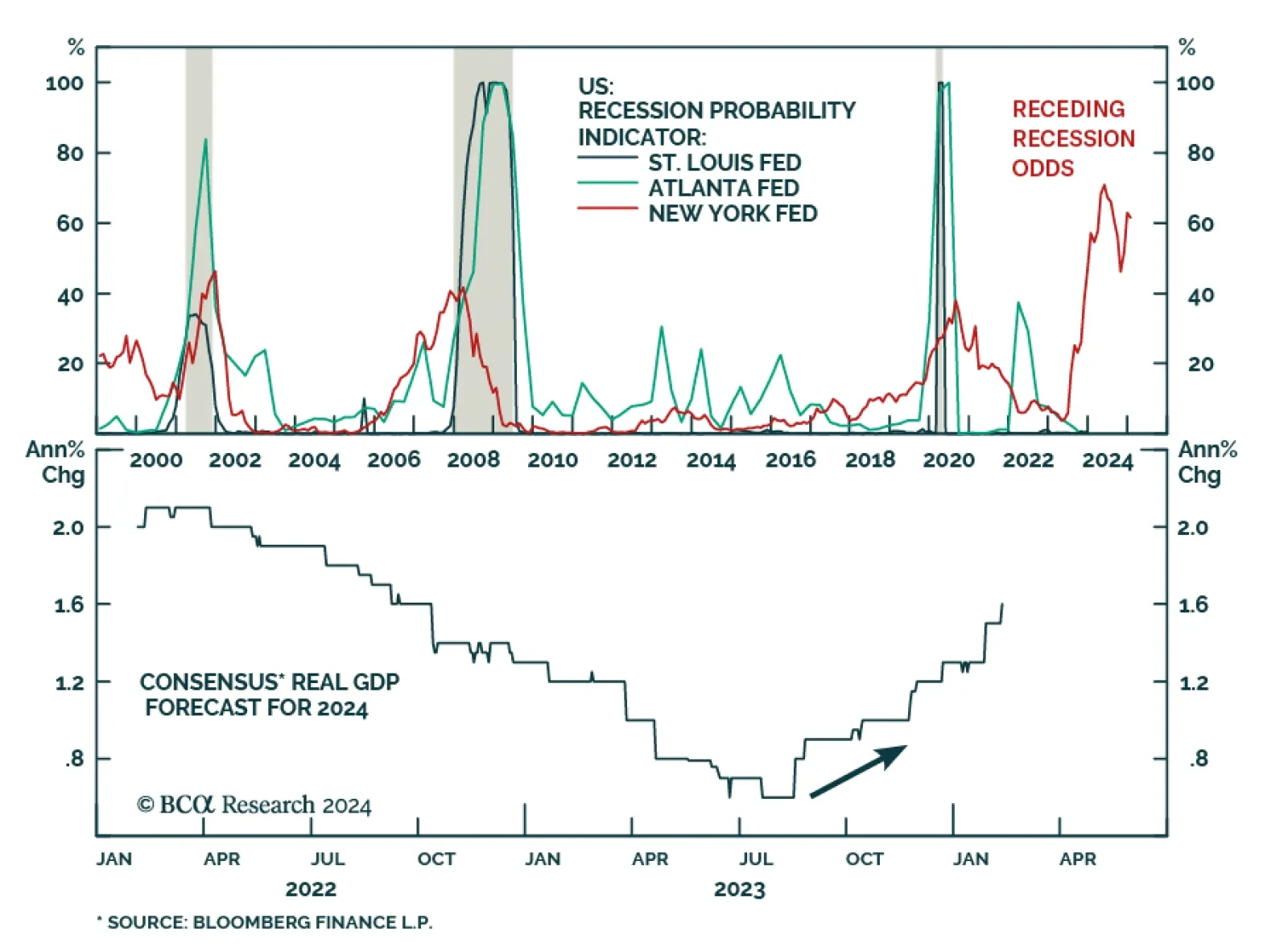

Expectations that the Fed will successfully deliver a soft landing for the US economy remains the dominant narrative. Since August, economists have been revising up their 2024 US GDP forecasts with the consensus now anticipating…

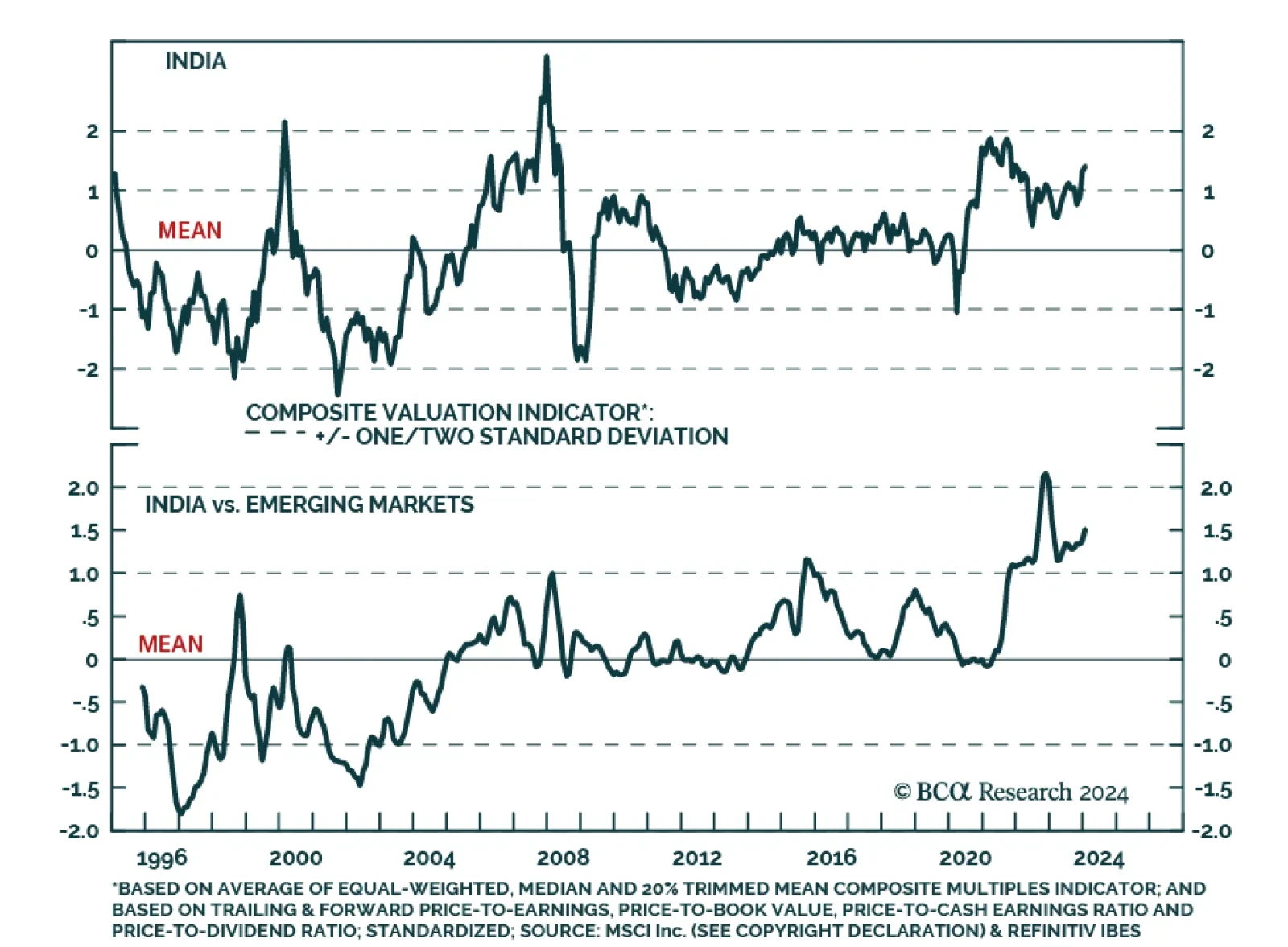

Indian economic data releases delivered a positive signal on Monday. CPI inflation slowed from 5.7% y/y to 5.1% y/y in January – within the Reserve Bank of India’s (RBI) 2-6% target range. Meanwhile, industrial…

BCA Research’s Global Investment Strategy service’s revised forecast is centered on a recession starting in late 2024 or early 2025. The strong pace of US growth has continued into early 2024. Preliminary estimates…