We feel as good about spurning the soft-landing narrative today as we did about spurning the recession narrative a year ago, but we are not giving into complacency. This week’s report looks at two key ways that we may be getting it…

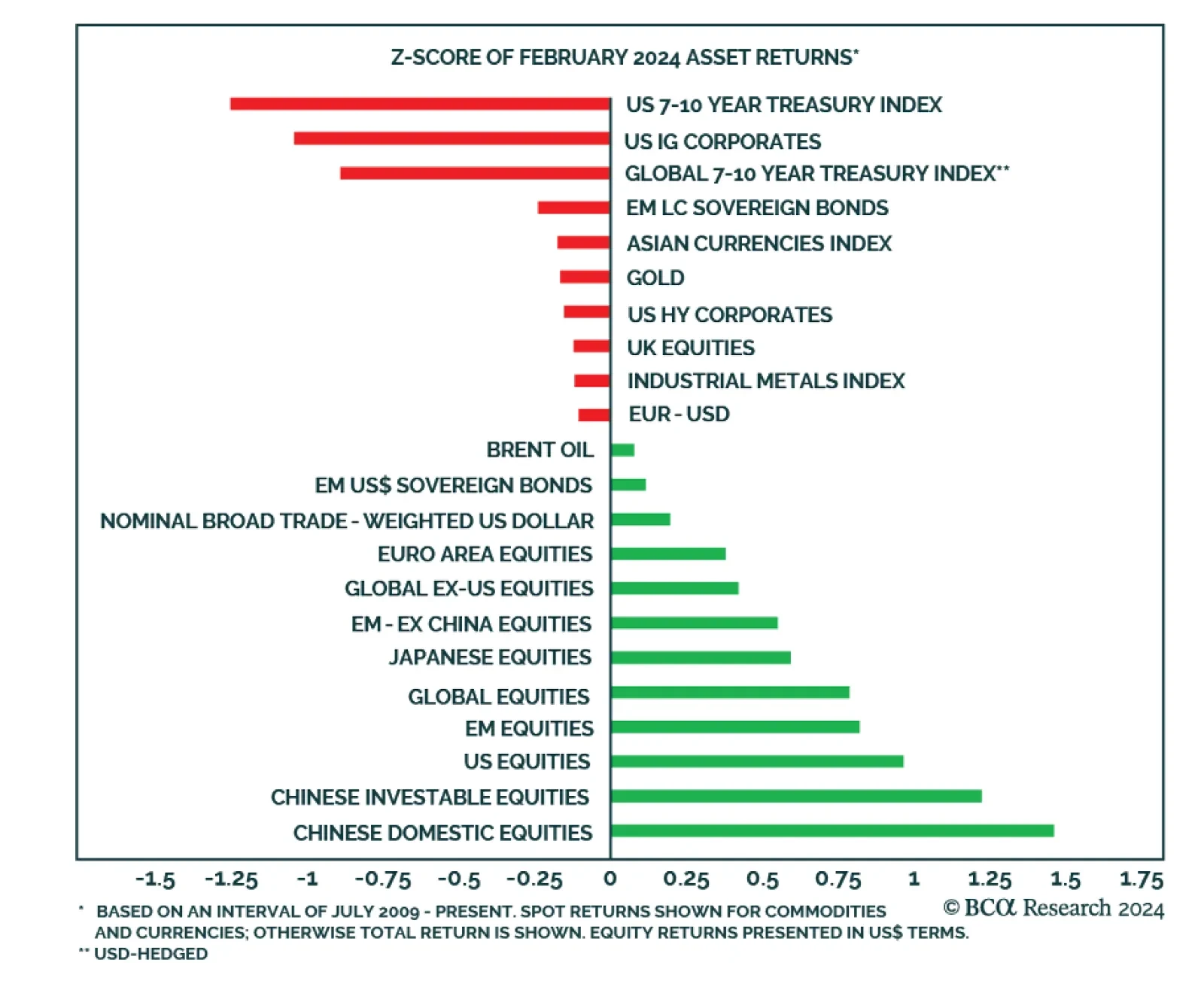

The global equity rally – which fizzled at the start of the year – picked up steam again in February with nearly all major regions posting above average returns. After having underperformed last year, Chinese stocks…

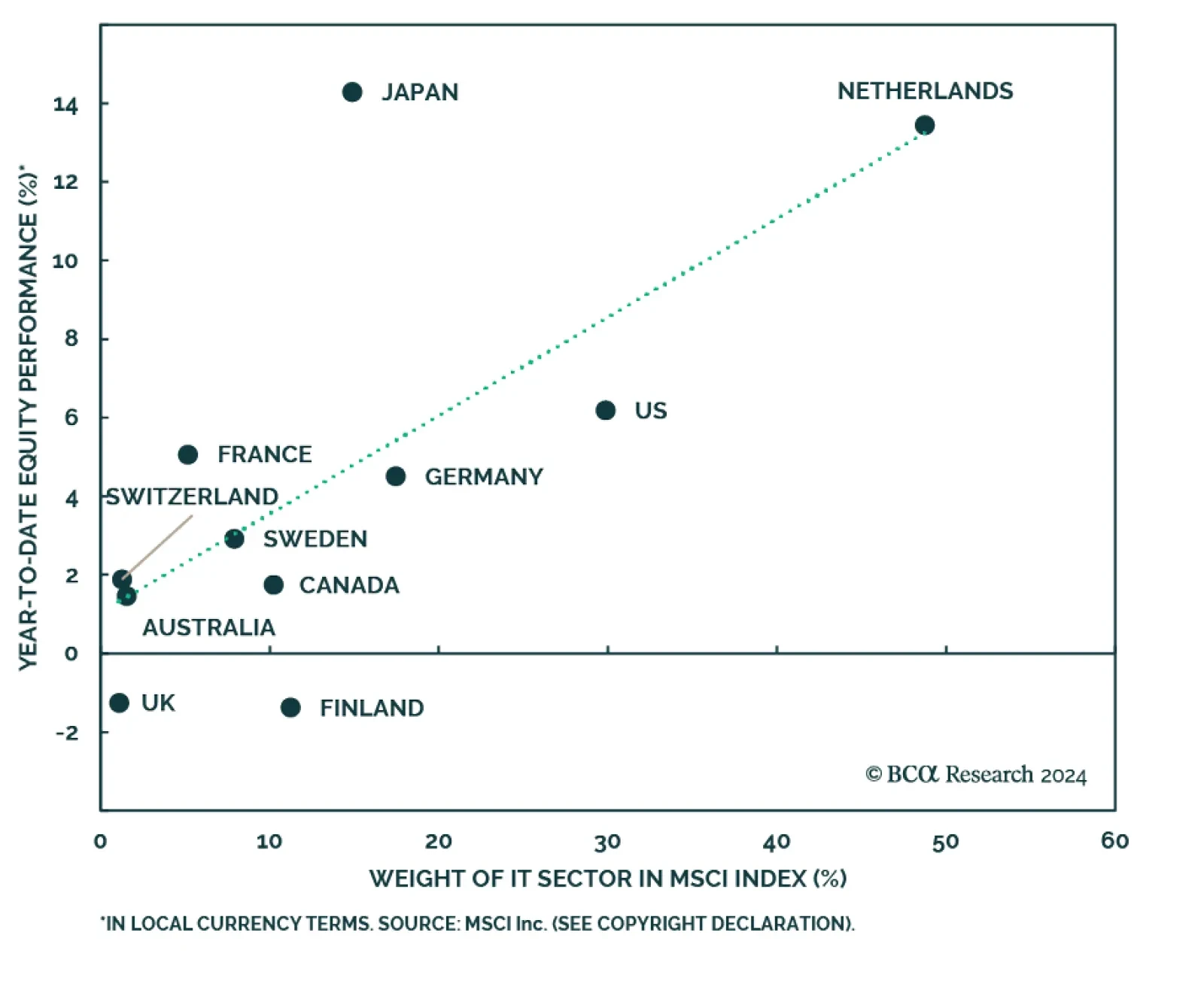

As we highlighted in a previous Insight, the breadth of the US equity rally has been relatively narrow, led by extremely strong gains among Big Tech stocks. Tech is still the best performing sector, with the S&P IT price…

Despite the economy being on the verge of a recession, the South African Reserve Bank will not ease policy meaningfully. Doing so will accentuate the currency depreciation, which, in turn, will push up bond yields – an outcome the…

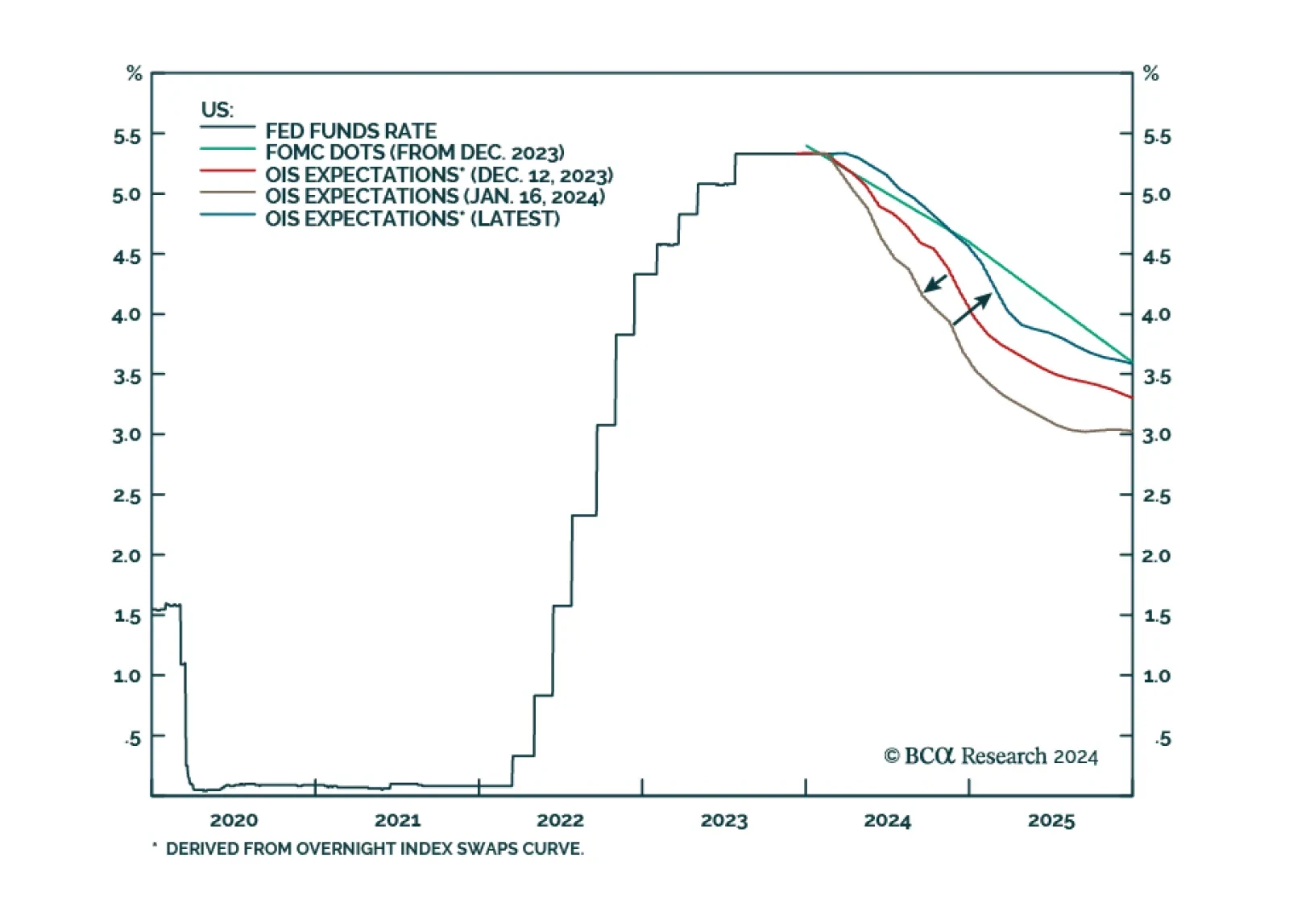

Earlier this year it looked like the spread between the rate of 10-year and 2-year Treasury notes was heading toward positive territory. Yet the 2s/10s spread peaked at -16 bps on January 16 and the inversion has been deepening…

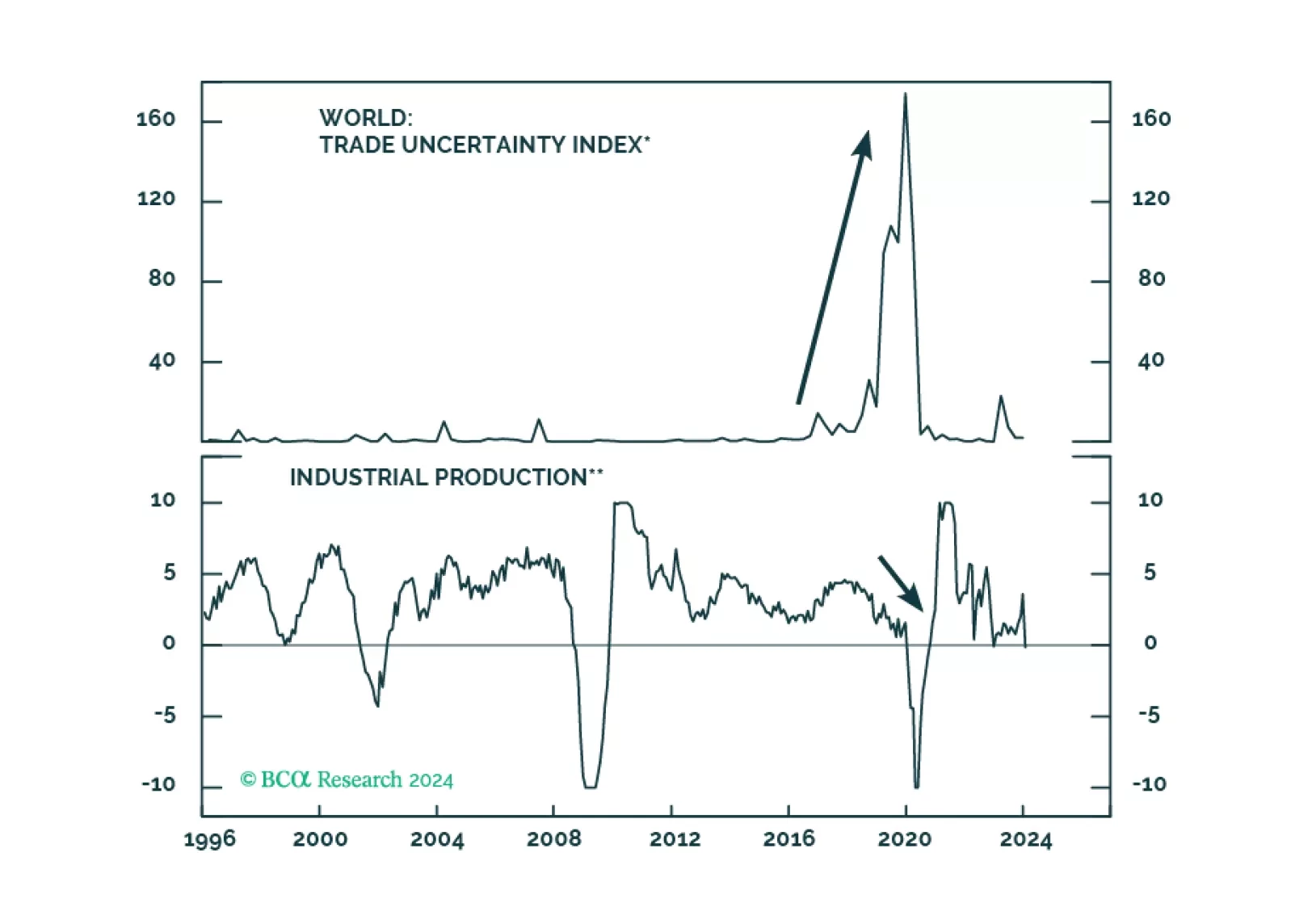

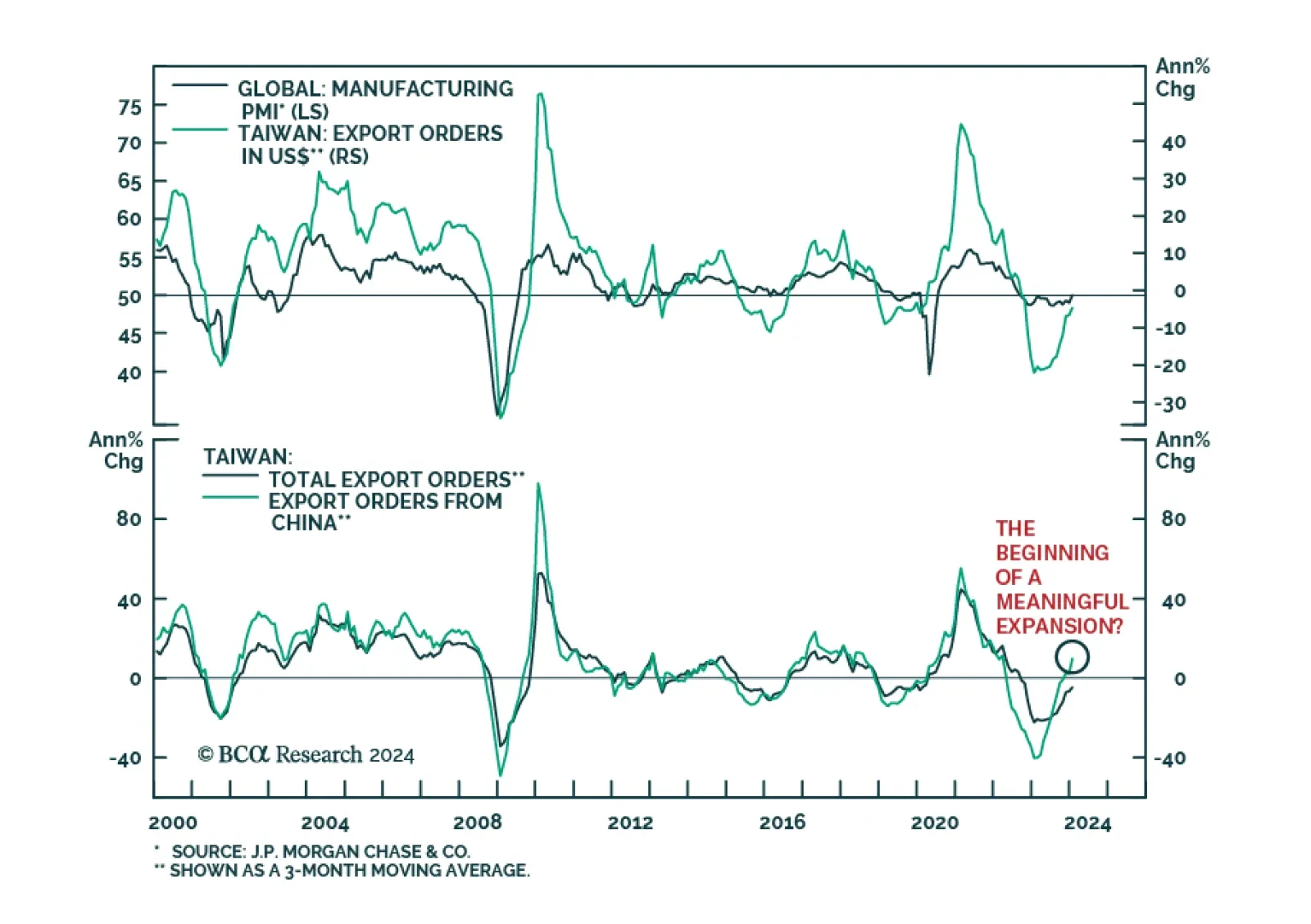

On the surface, the latest Taiwanese export orders release delivered a positive signal on the global trade cycle. The 1.9% y/y expansion in January marks a significant improvement from the 16.0% contraction in December. Moreover…

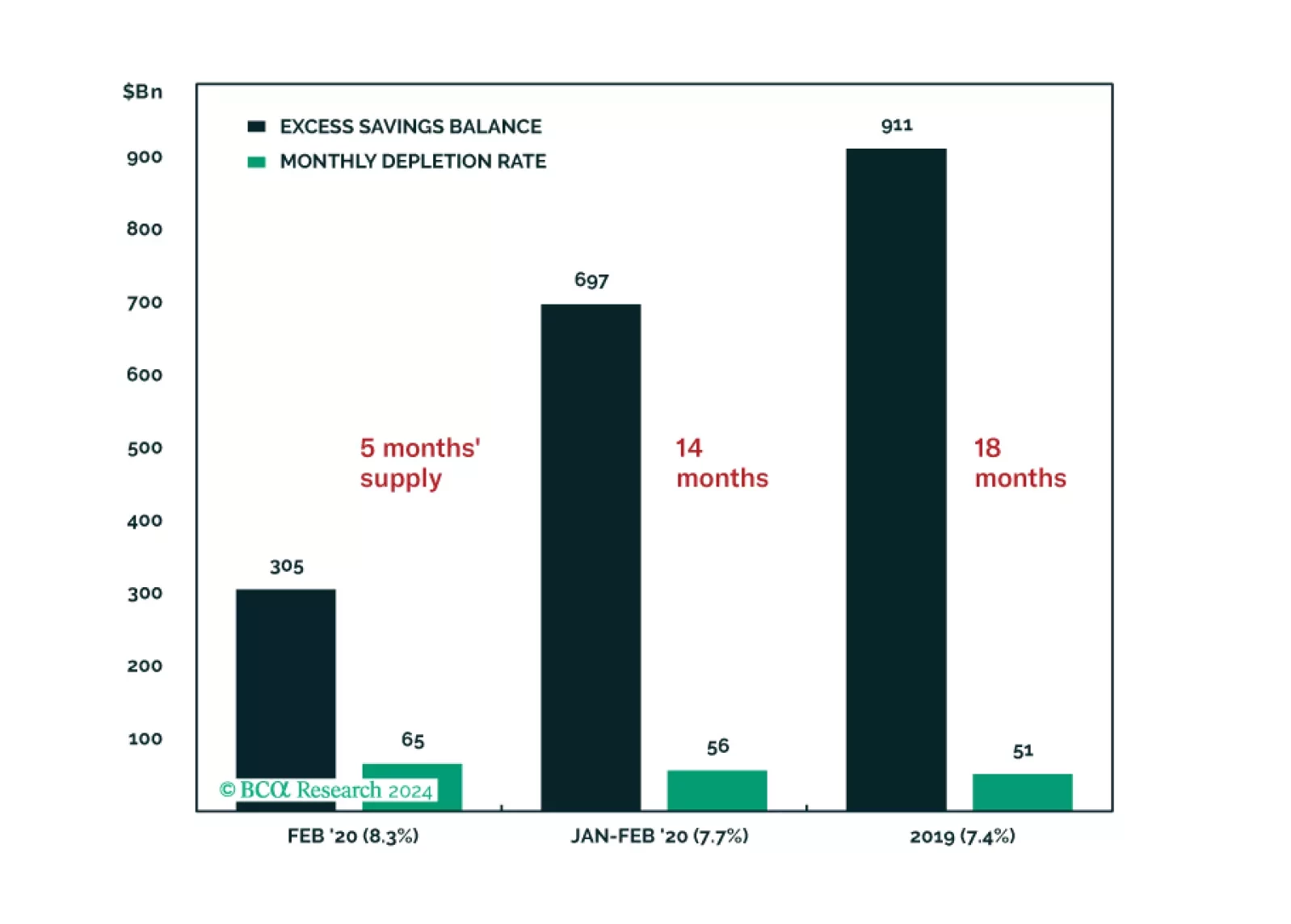

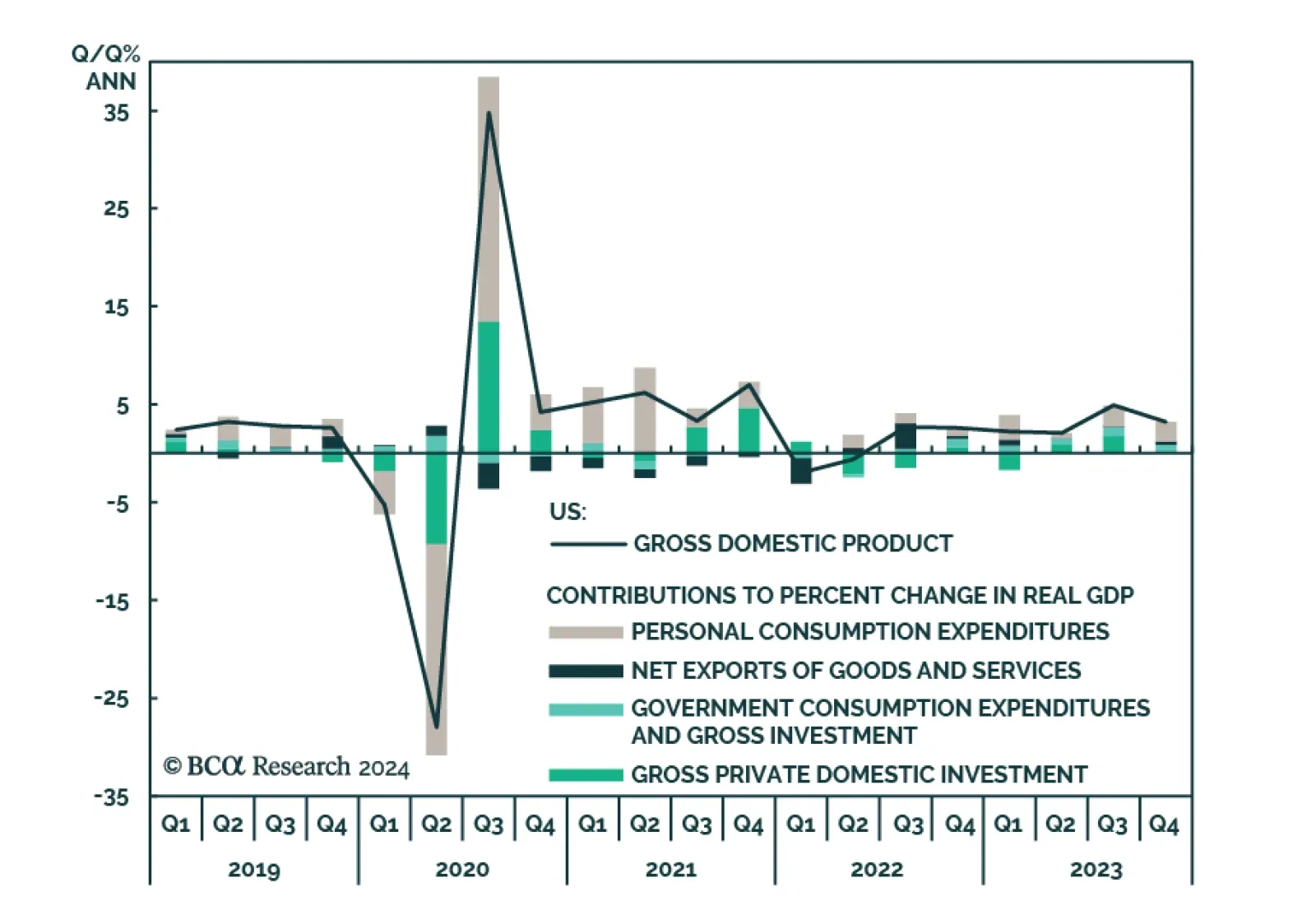

US GDP growth for Q4 was revised lower from 3.3% to 3.2% annualized, driven by a downward revision to private inventory investments (now detracting 0.27 points from a previous 0.07 contribution to GDP). However, consumer spending…

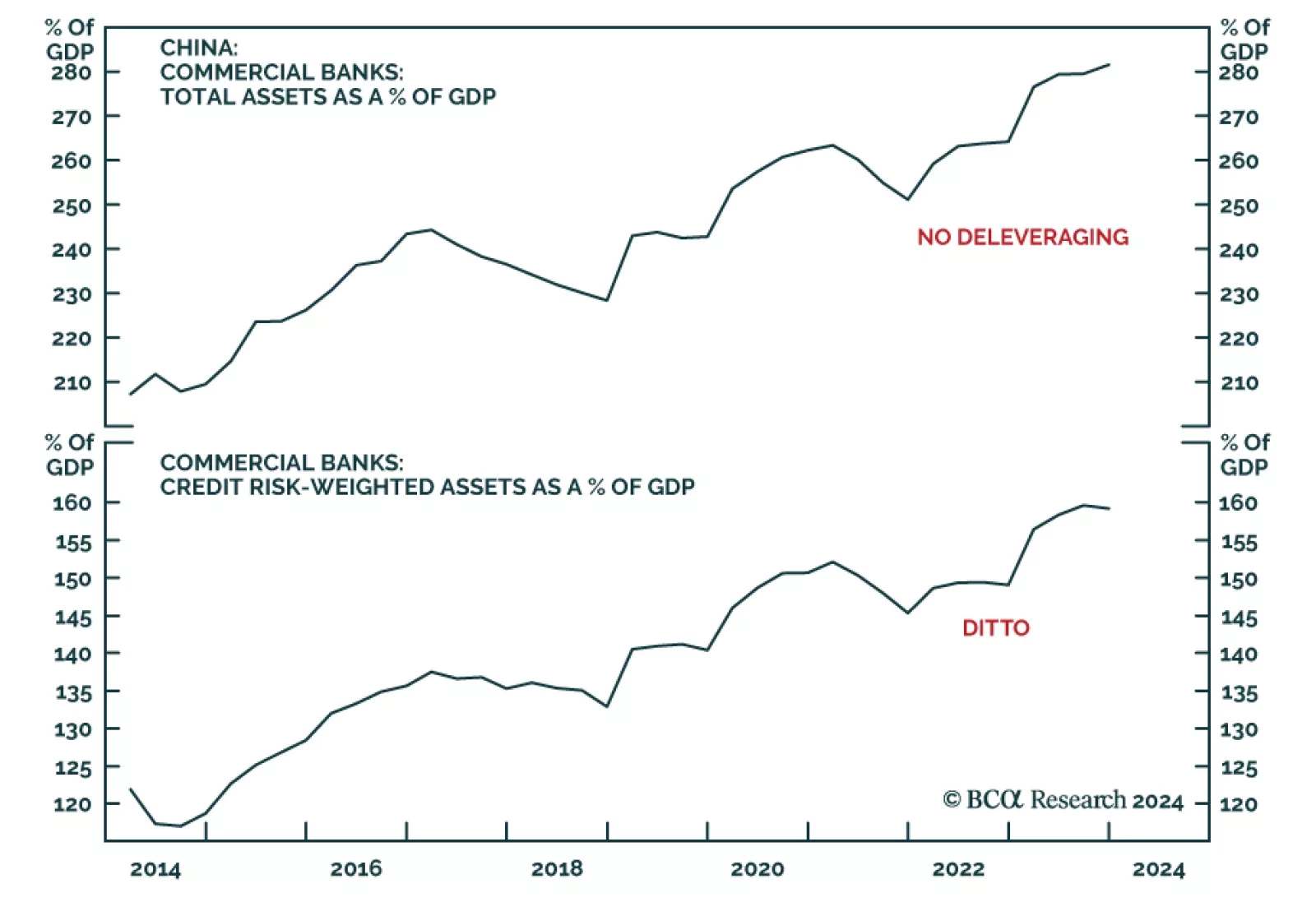

According to BCA Research’s China Investment Strategy service, the odds of a “Minsky Moment” are low for the Chinese banking sector. Chinese banks, however, will continue facing cyclical and structural headwinds…

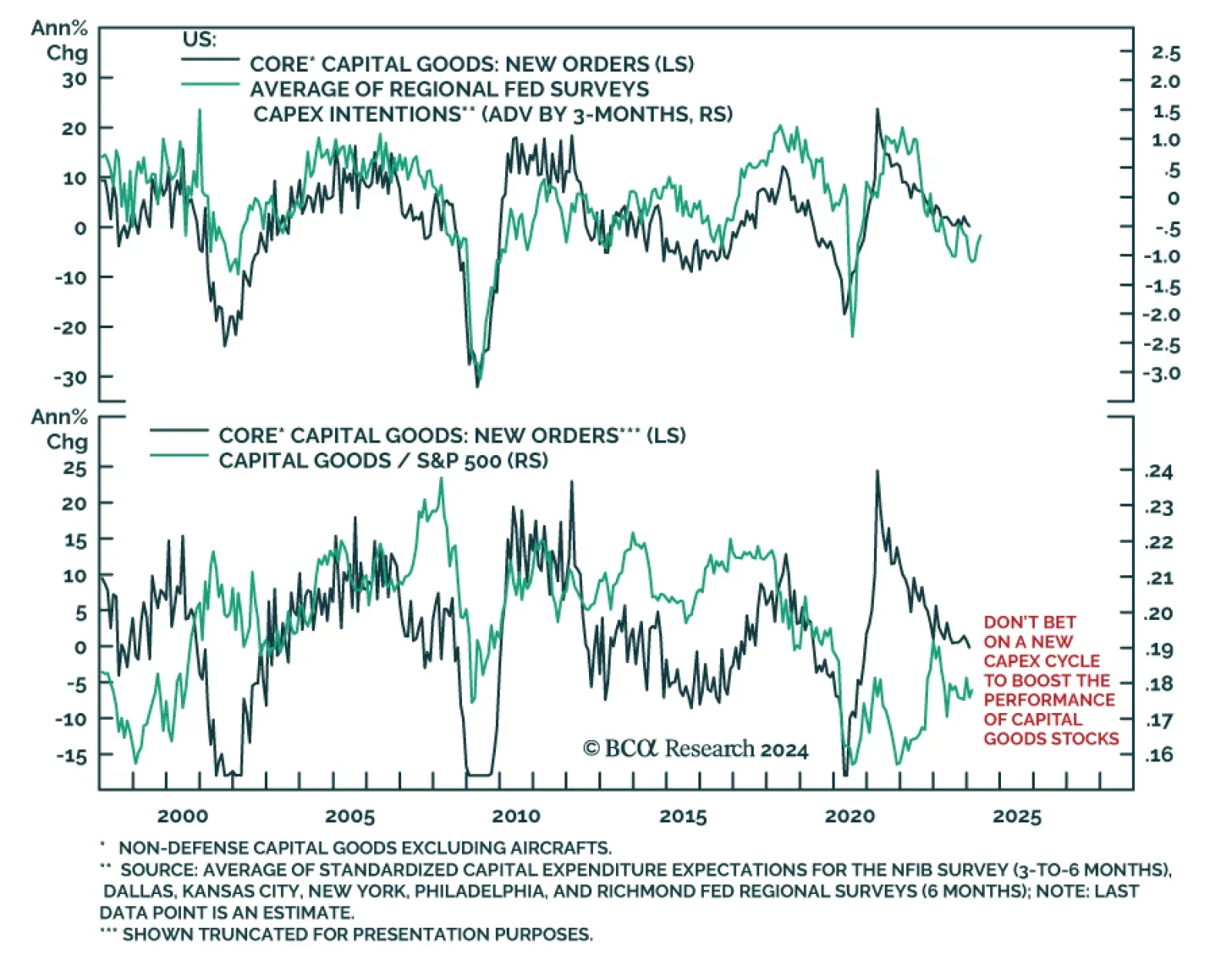

On the surface, the US durable goods report delivered a negative surprise on Tuesday. The 6.1% m/m drop in new orders in January fell below expectations and the December figure was revised down to 0.3% m/m from 0.0% m/m.…