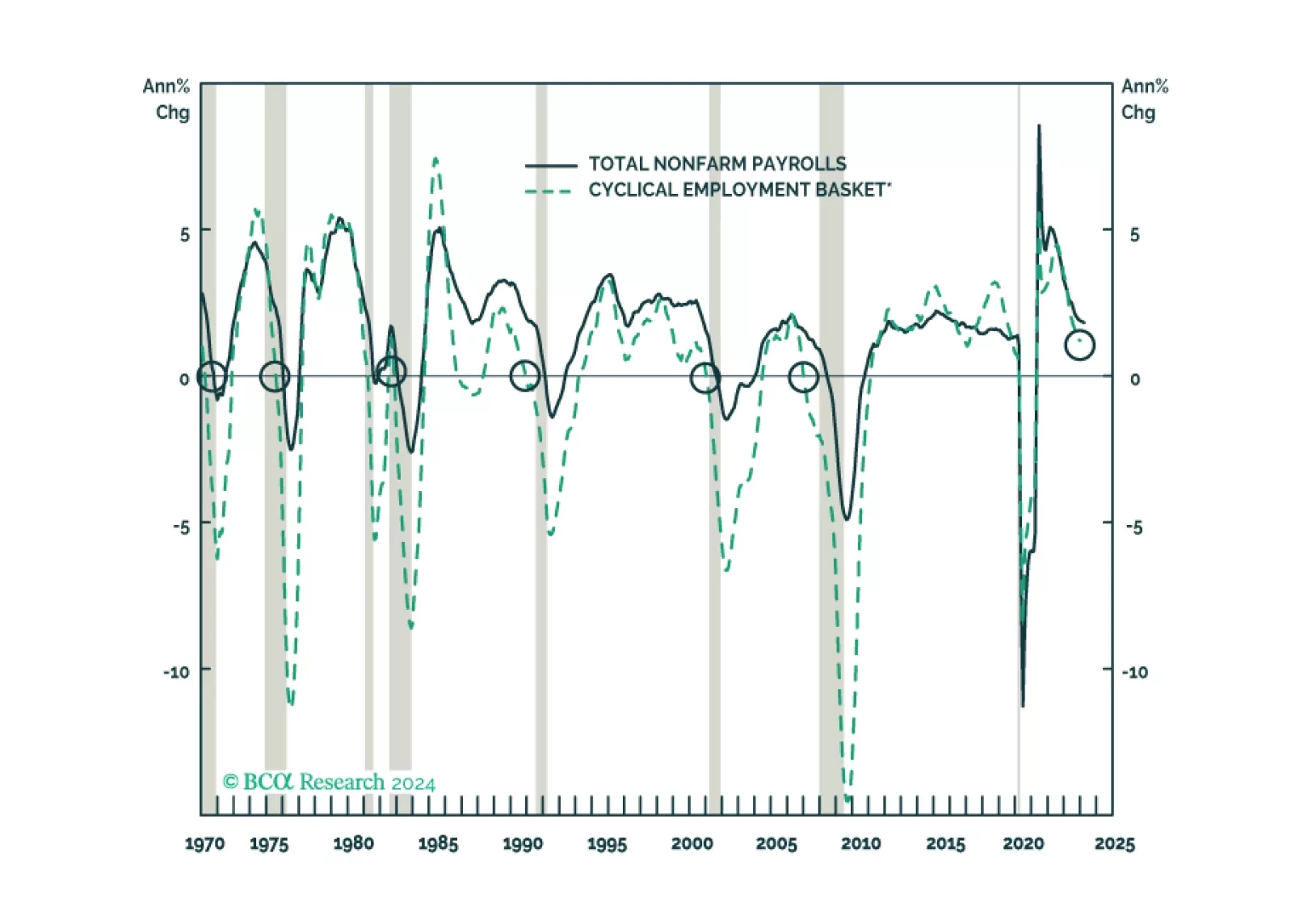

We look beneath headline data to assess the state of the labor market in cyclical goods-producing industries that have previously led overall nonfarm payrolls and in the services segments that have recently been leading the charge.…

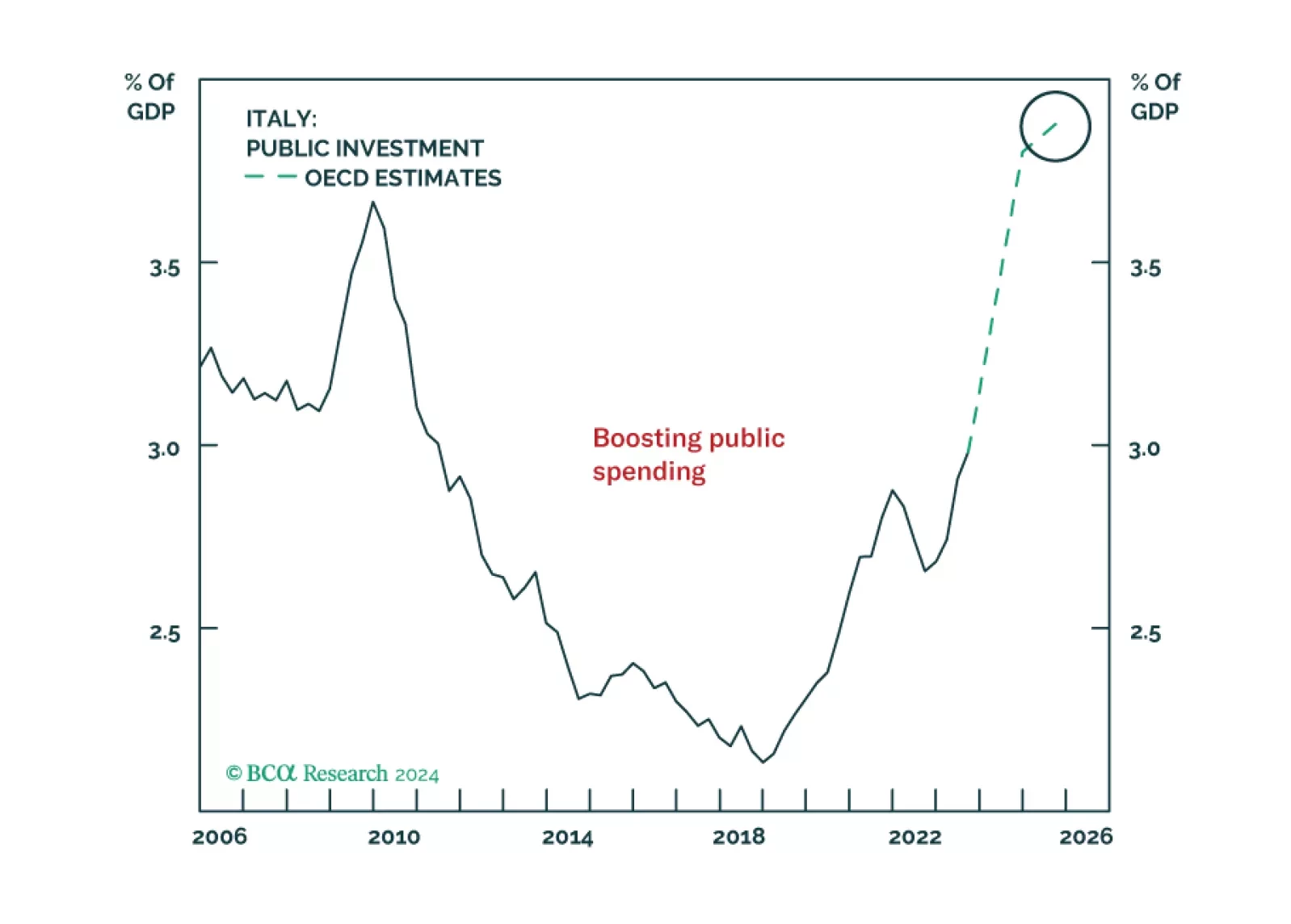

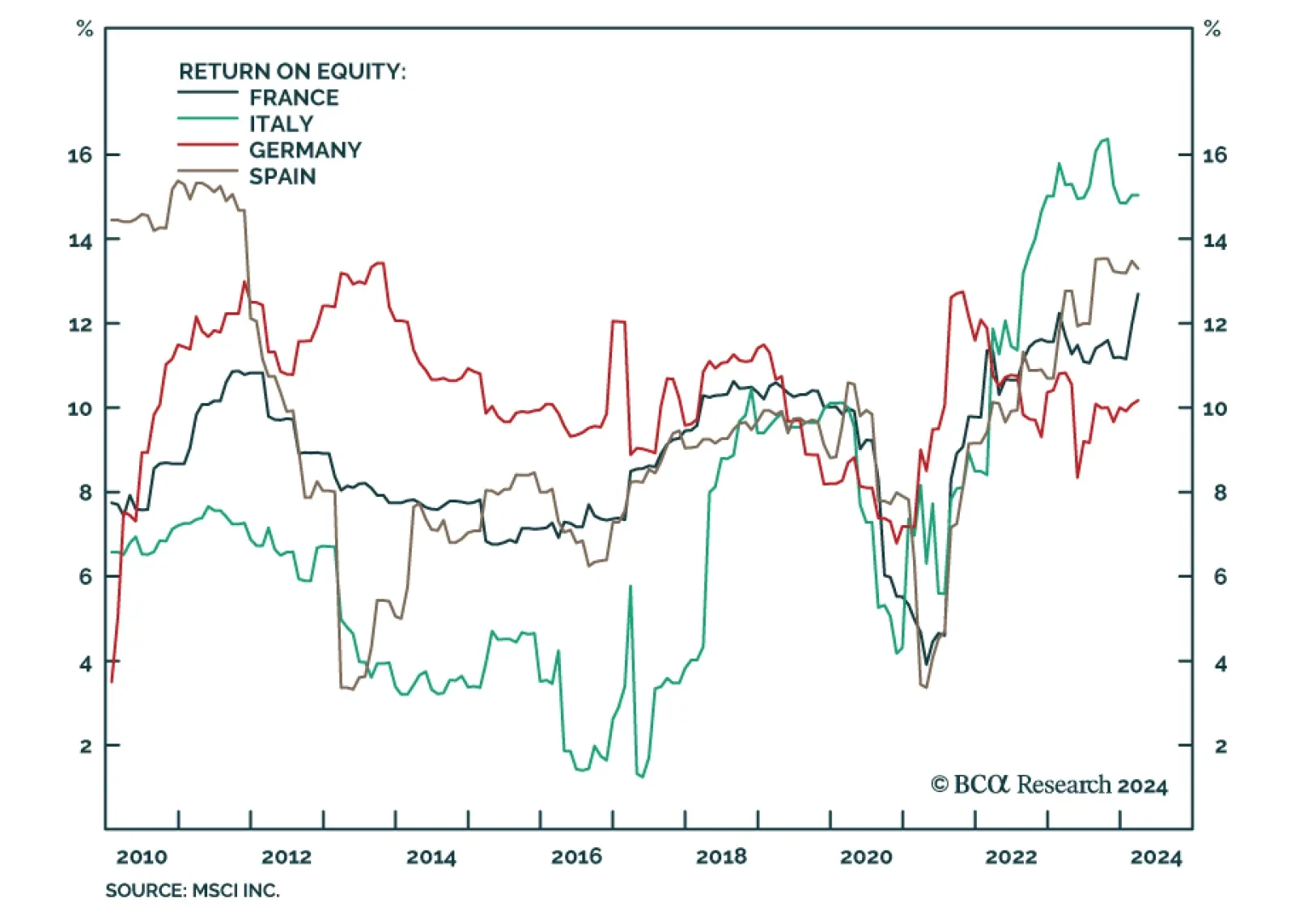

Italy and Spain have a poor reputation when it comes to their economies. The European debt crisis affected them more than other Euro Area countries. Their housing markets collapsed and debt cost soared. France and Germany, while…

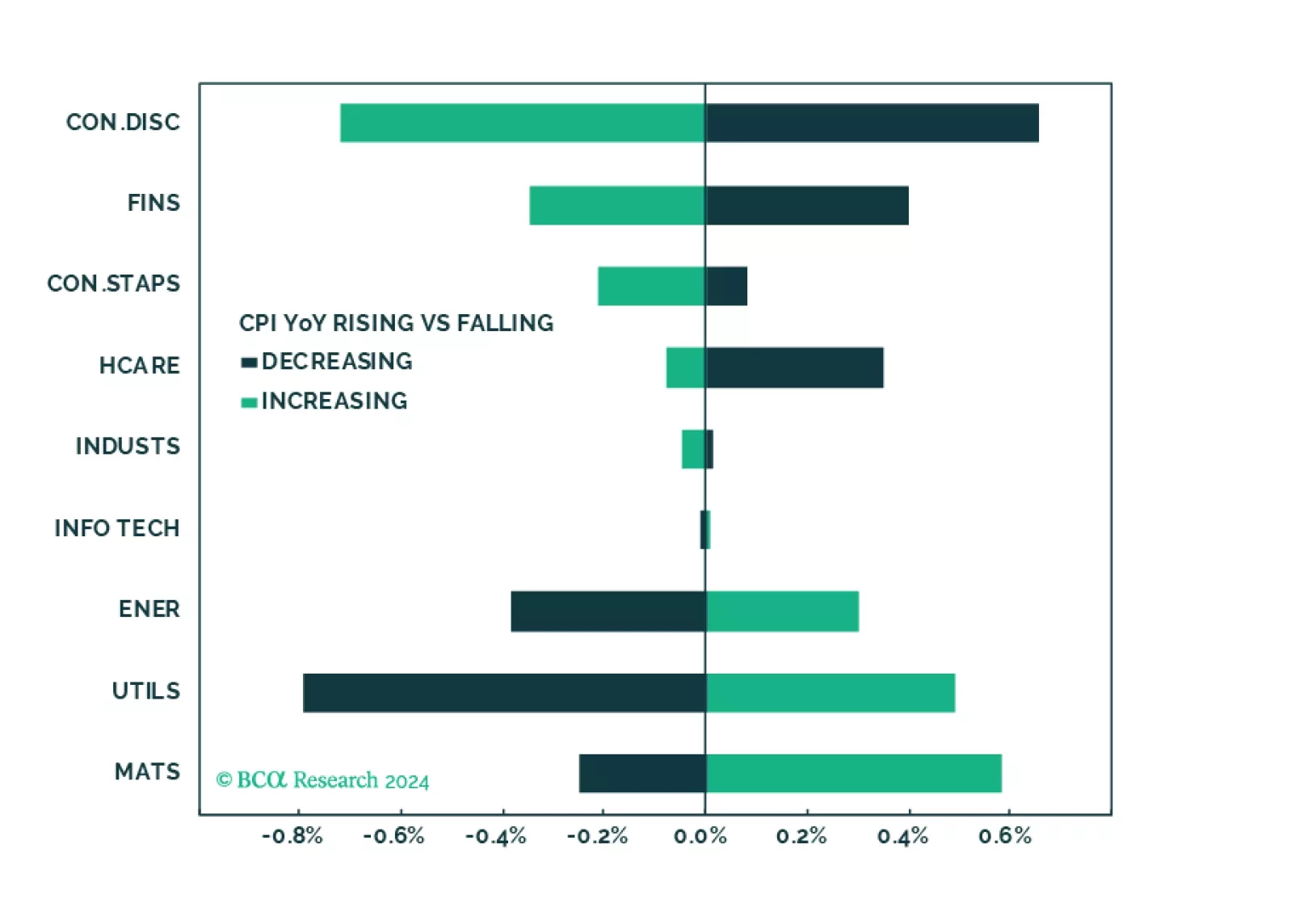

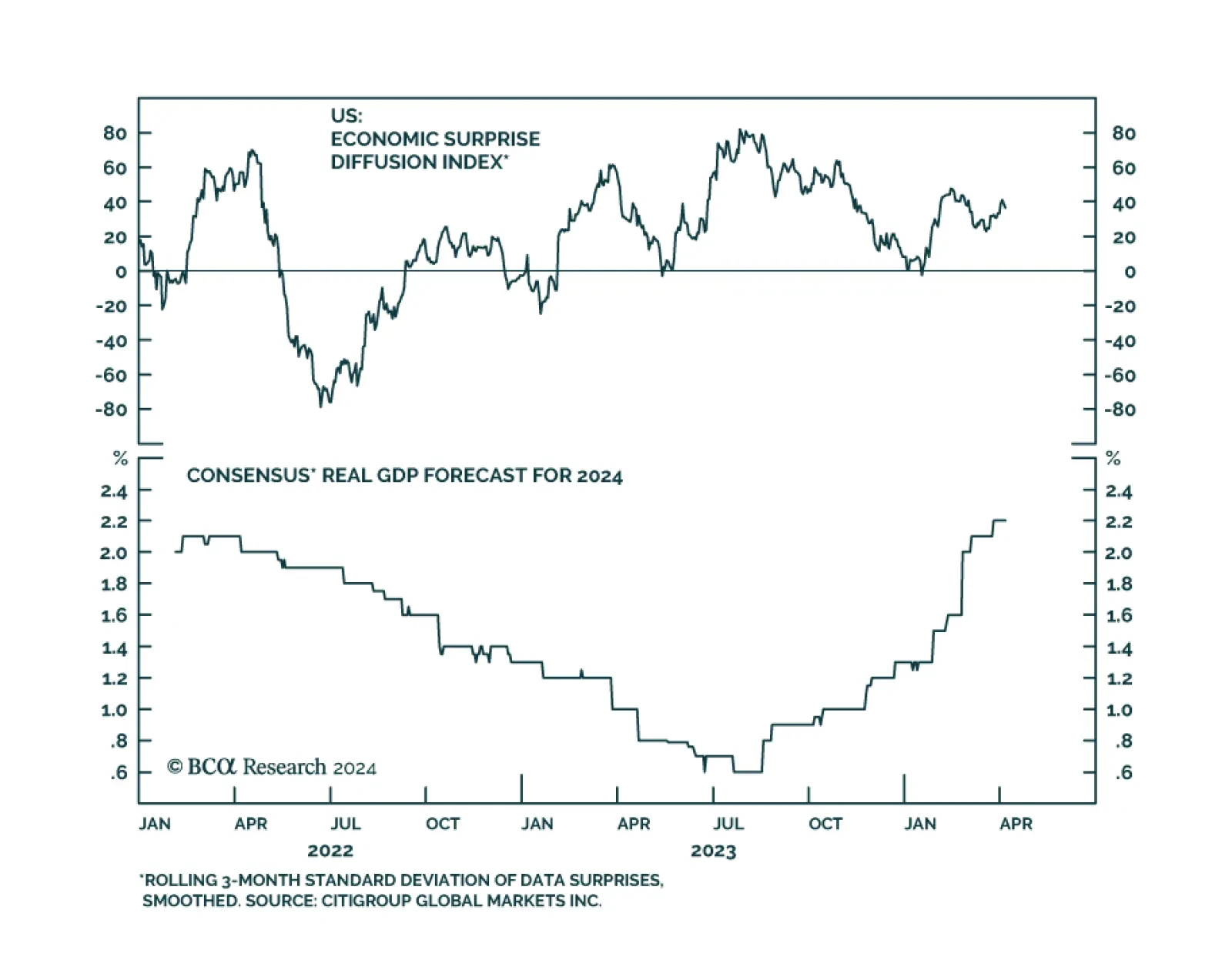

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

The past week brought a slew of positive US economic data, all suggesting that conditions remain robust and a recession is not imminent. The ISM Manufacturing PMI crossed into expansion for the first time since September 2022,…

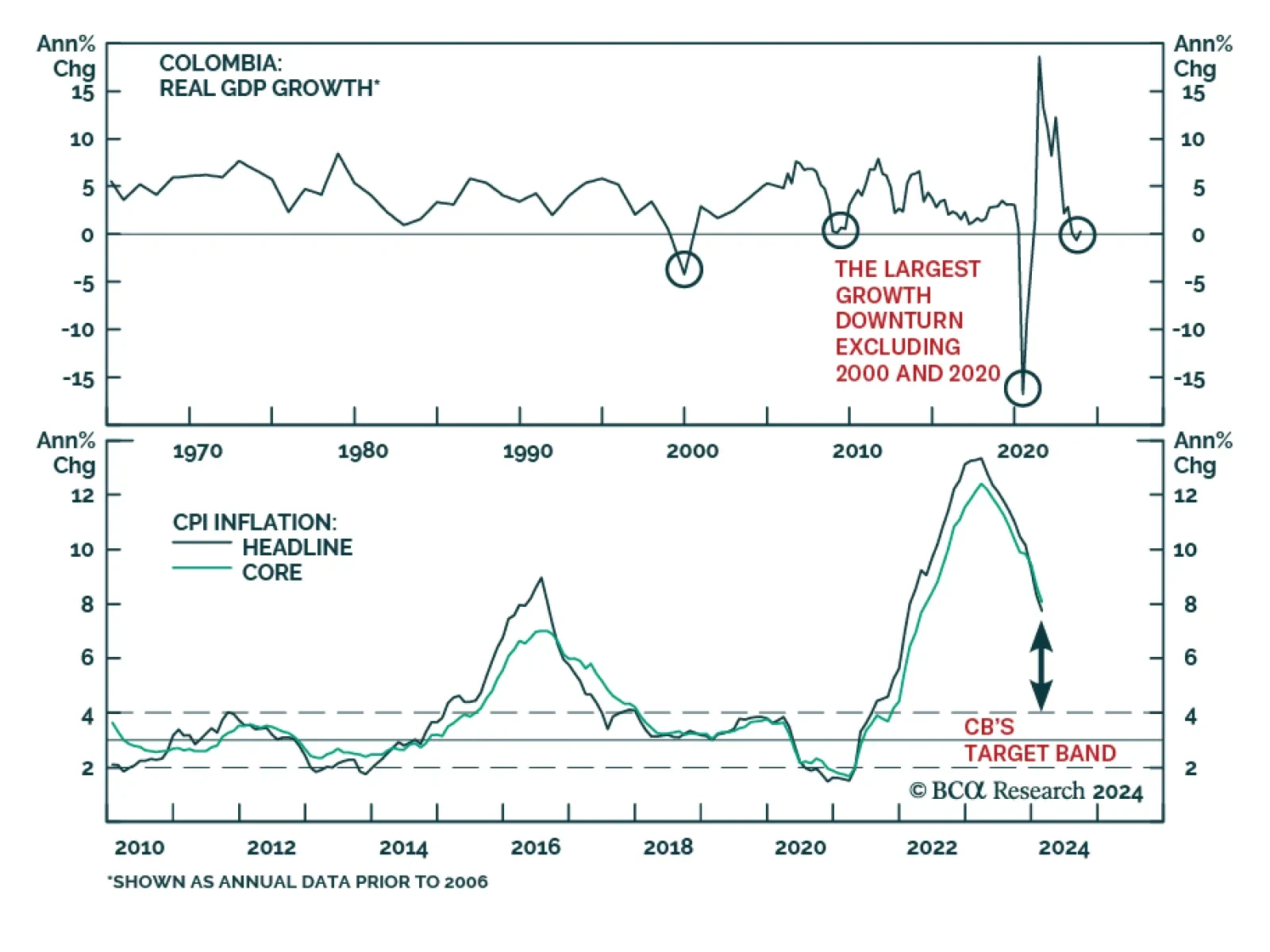

Colombia: Macroeconomic Fundamentals, Public Finances, And Political Uncertainty Warrant Underweight

BCA Research’s Emerging Markets Strategy service argues that Colombia has fallen from grace in terms of its healthy macroeconomic fundamentals, business-friendly government policies, and conservative fiscal stances.…

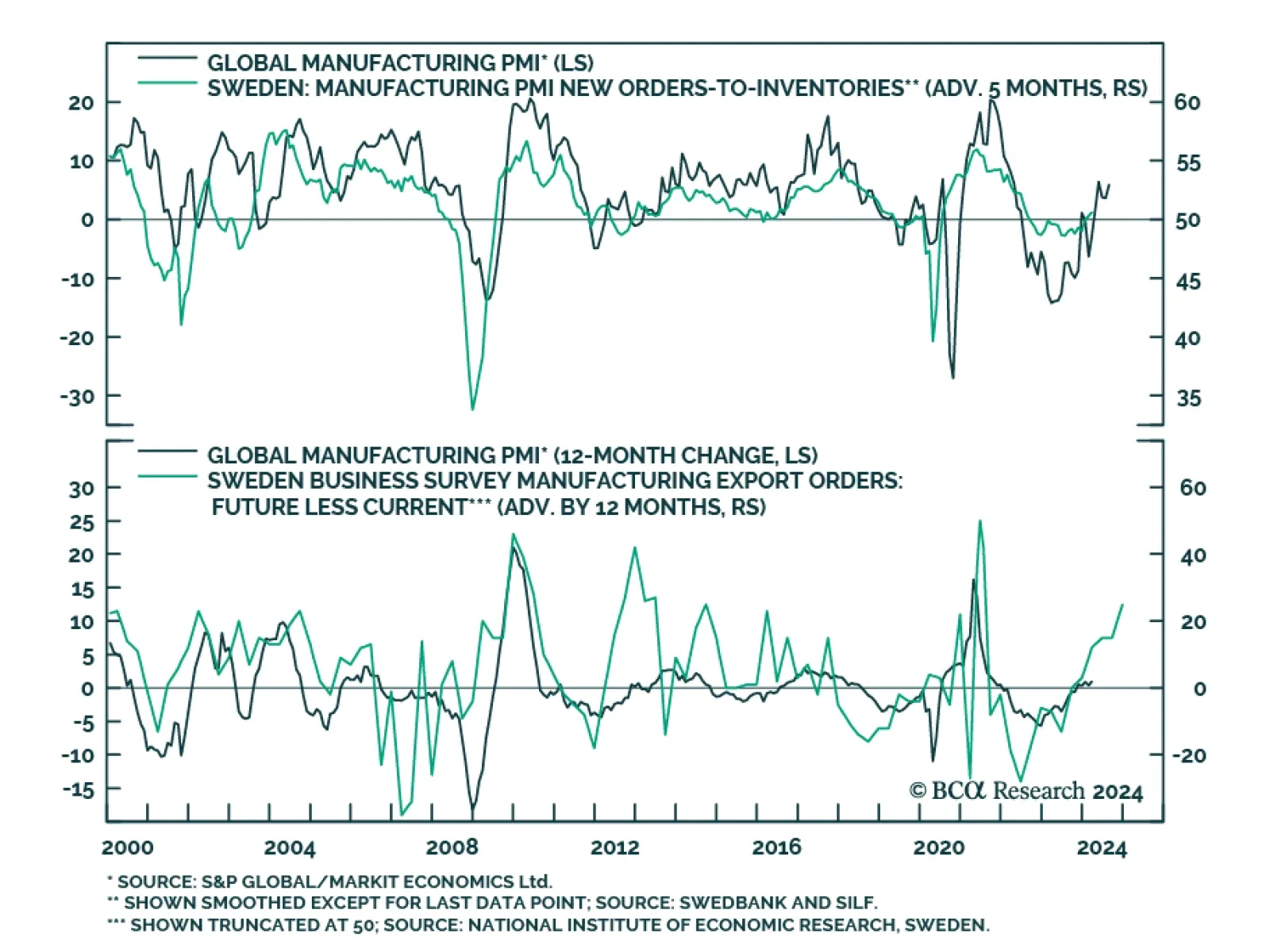

As a small open economy, Sweden’s economic performance is a good barometer of global growth developments. Swedish PMIs for March were overall positive. The Manufacturing PMI rose to the 50 boom-bust line following 19…

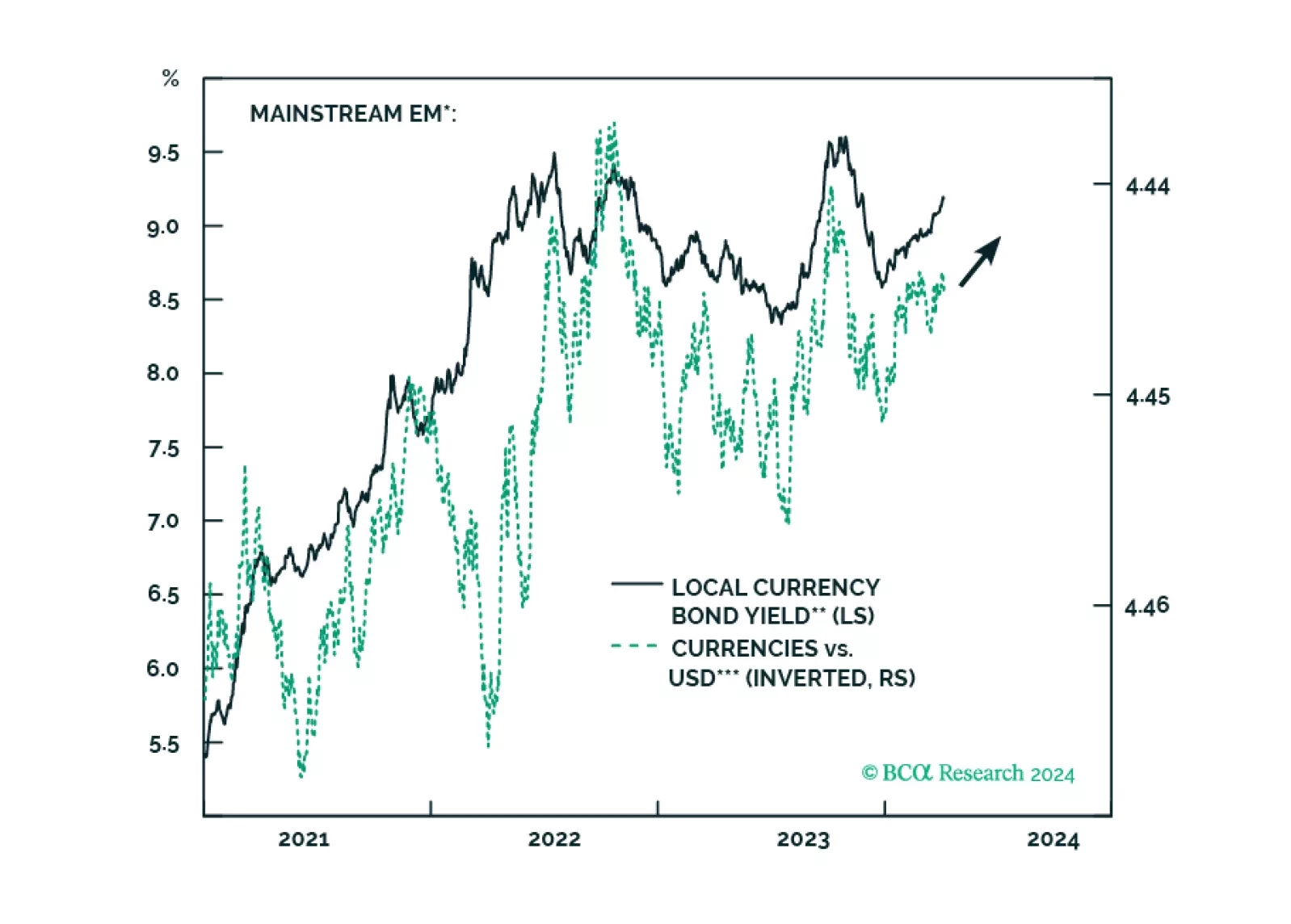

Climbing US bond yields, alongside higher oil prices, might spoil the party for global risk assets. There are budding cracks in EM domestic bonds, and even though we like this asset class in the long run, investors exposed to it…

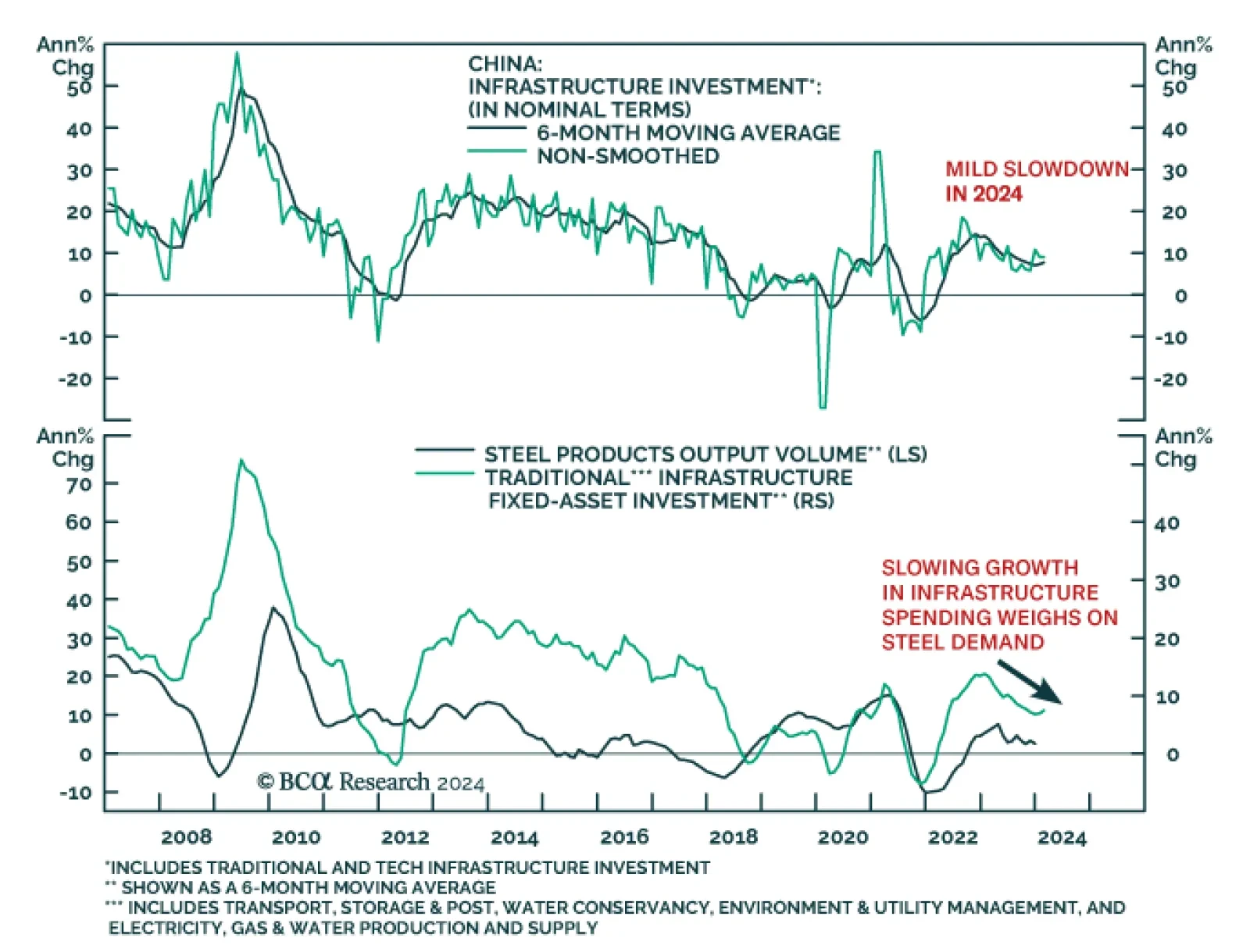

According to BCA Research’s China Investment Strategy service, the growth rate of China’s infrastructure investment will likely slow from a nominal 9% last year to about 6% this year. Funding constraints will limit…

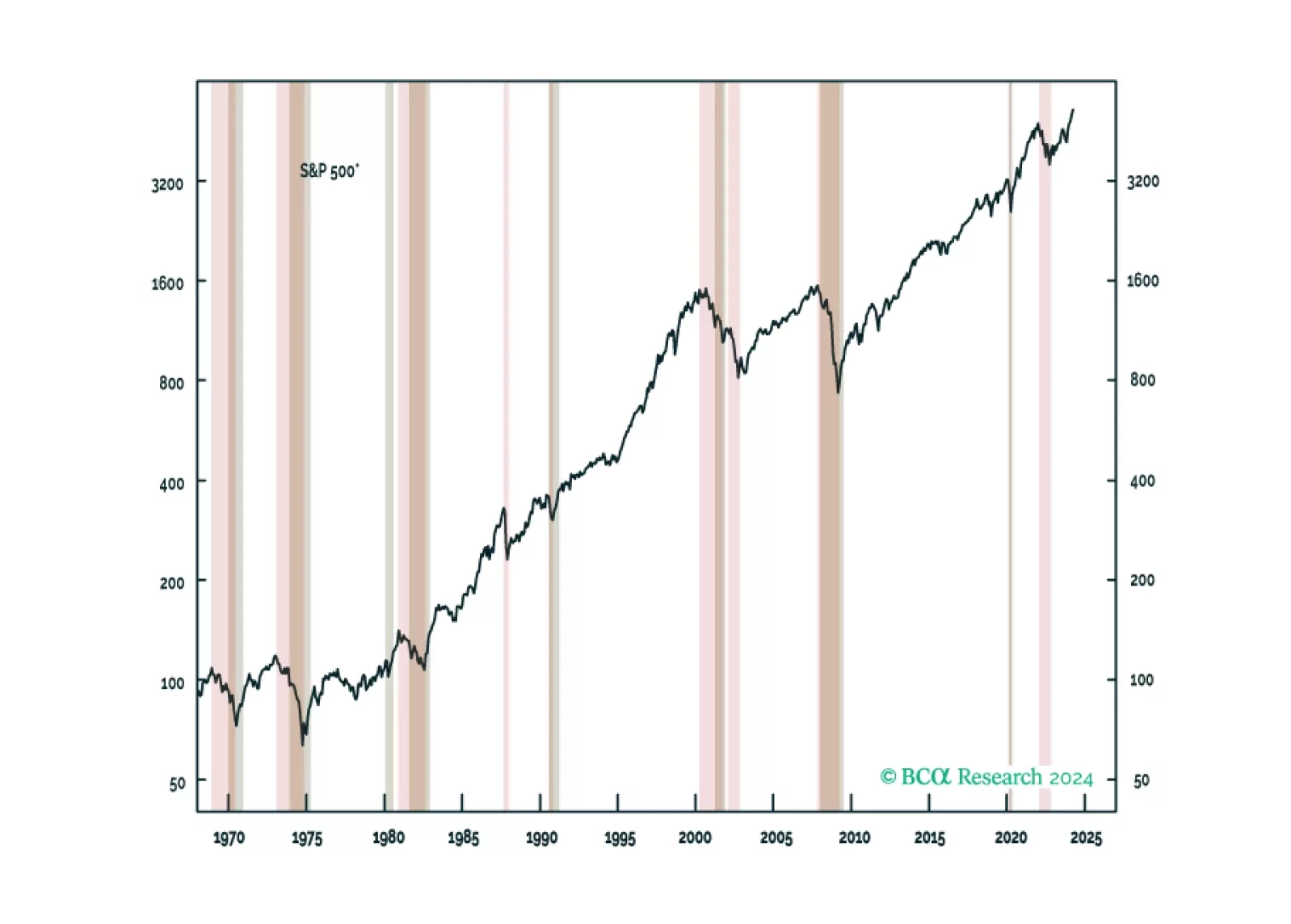

We are not yet ready to downgrade equities on a tactical basis but continue to expect we will eventually do so. We present a checklist of indicators that we are watching to determine when to de-risk.