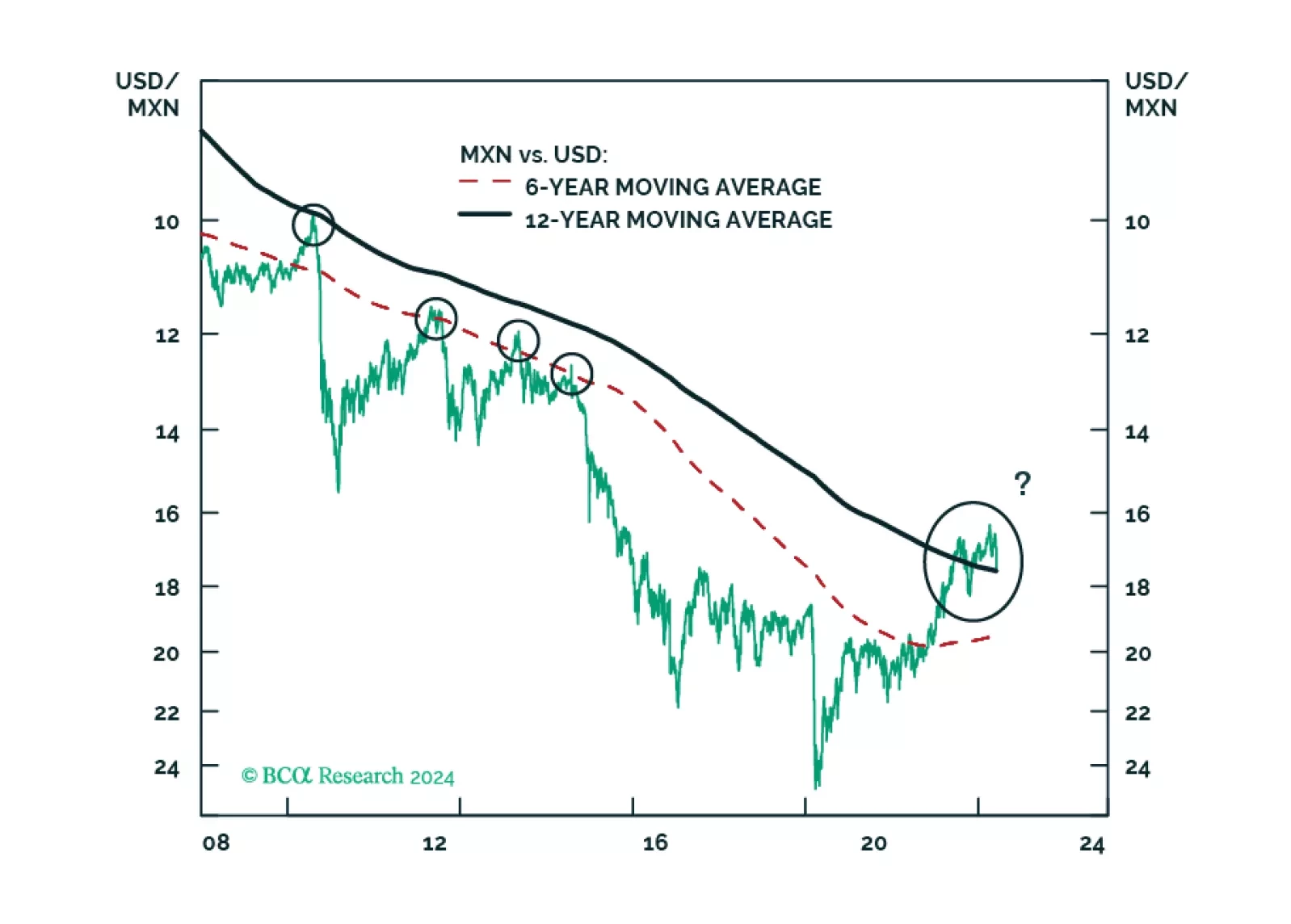

MORENA has once again swept the Mexican election: Claudia Sheinbaum will be president, with little to no constraint in Congress. All in all, Mexican politics will remain stable and overall supportive of markets. In the medium term,…

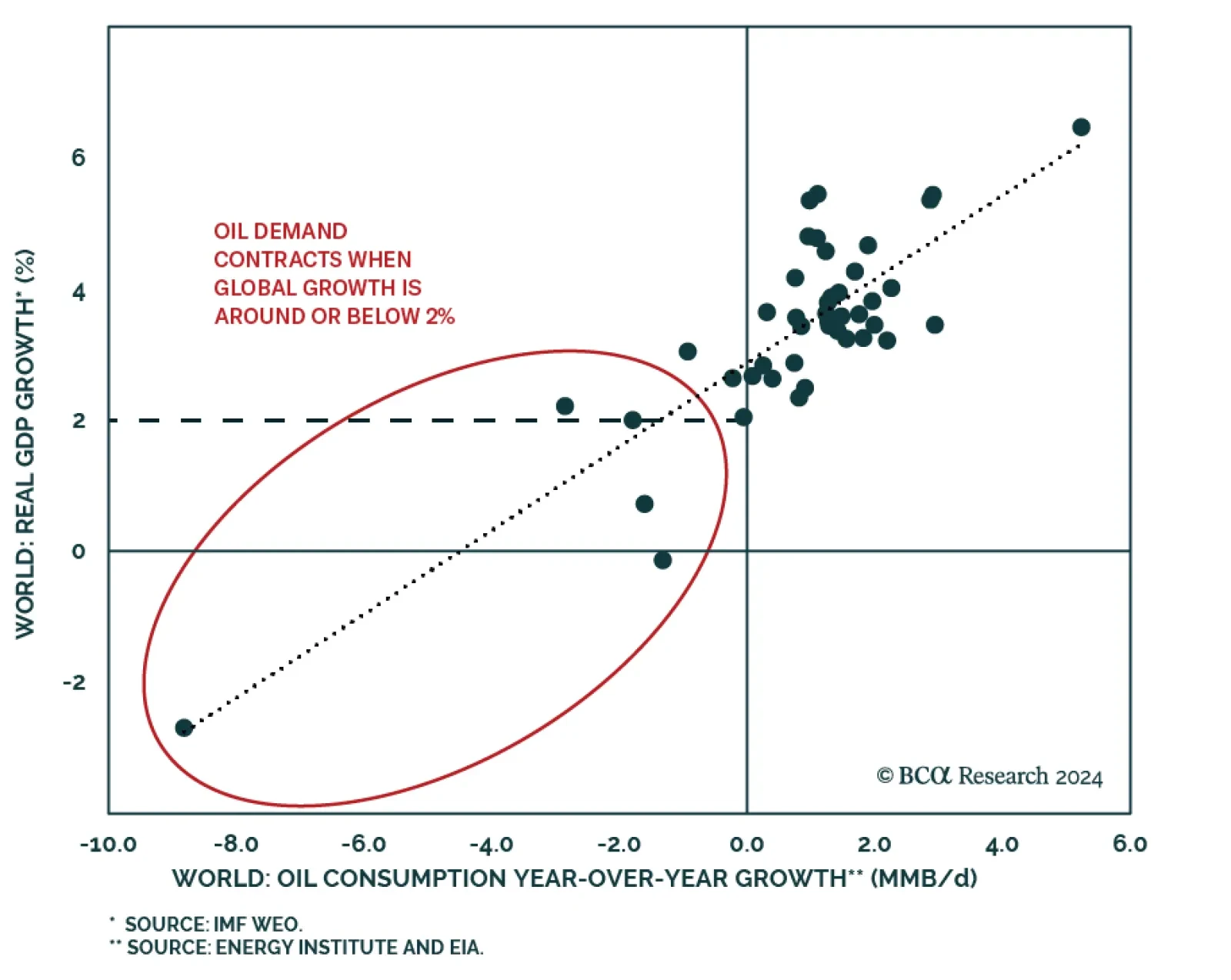

According to BCA Research’s Commodity & Energy Strategy service, the oil demand forecasts from the IEA, EIA, and OPEC are too optimistic. The IEA, EIA, and OPEC all anticipate oil demand growth to slow this year…

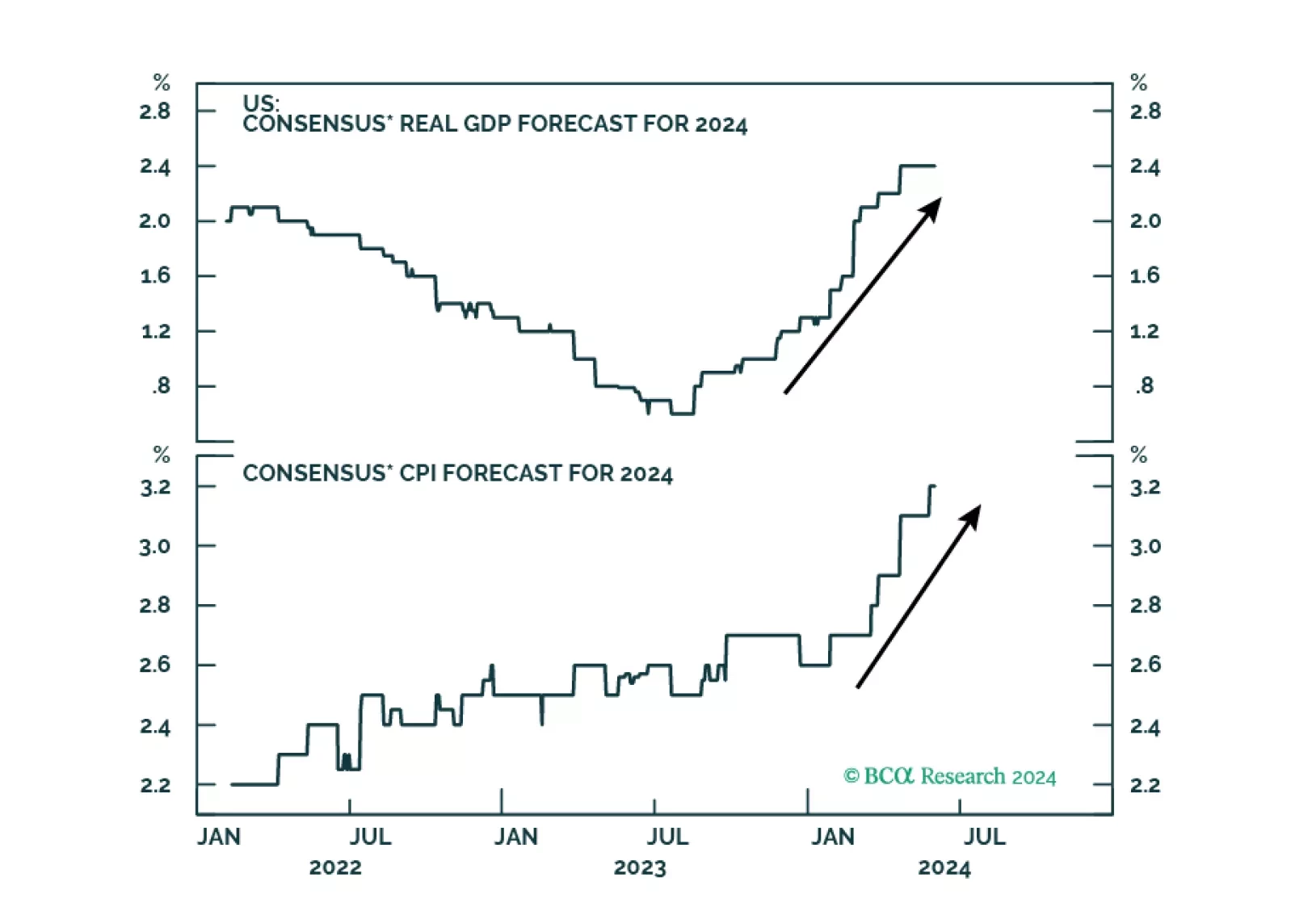

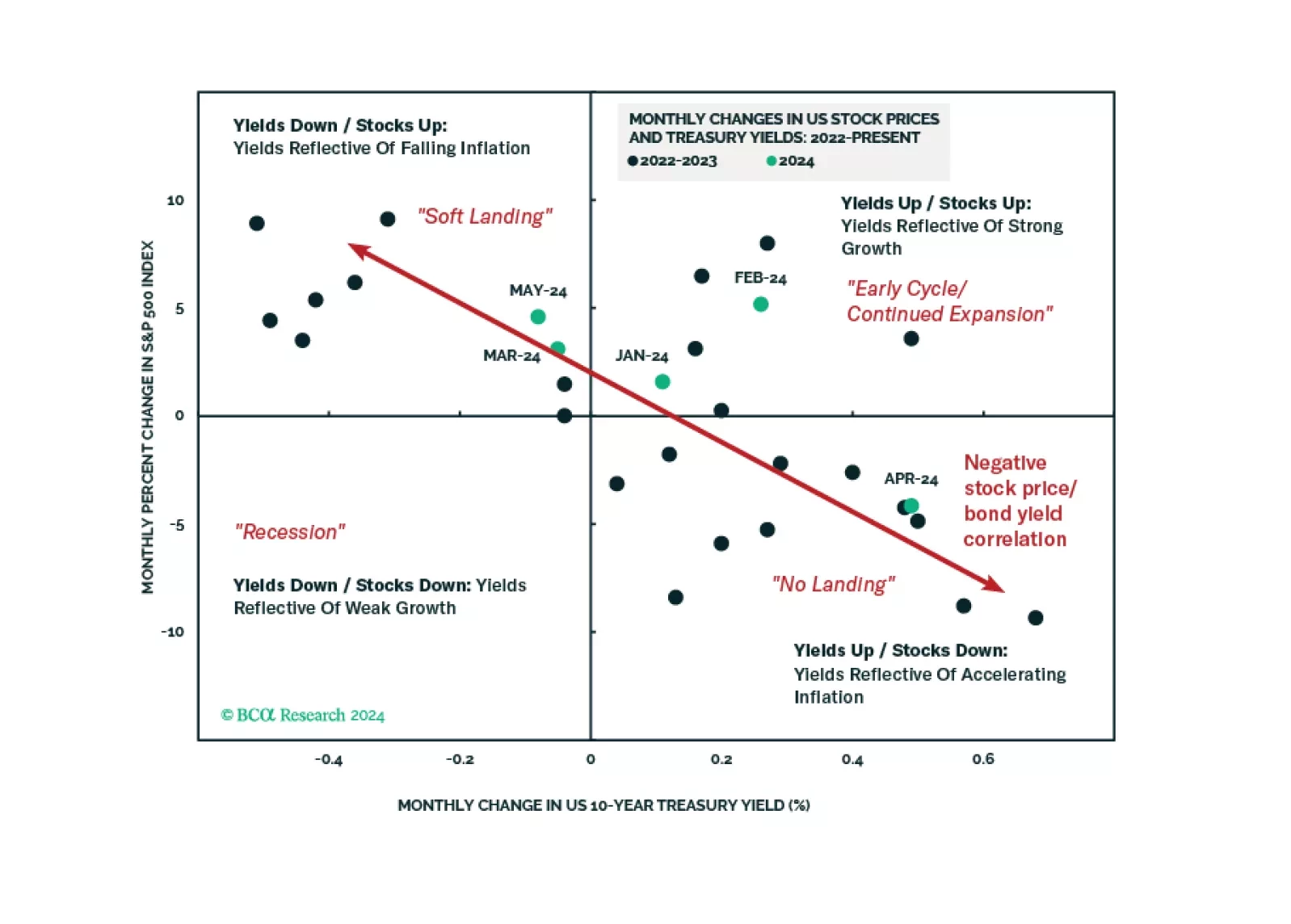

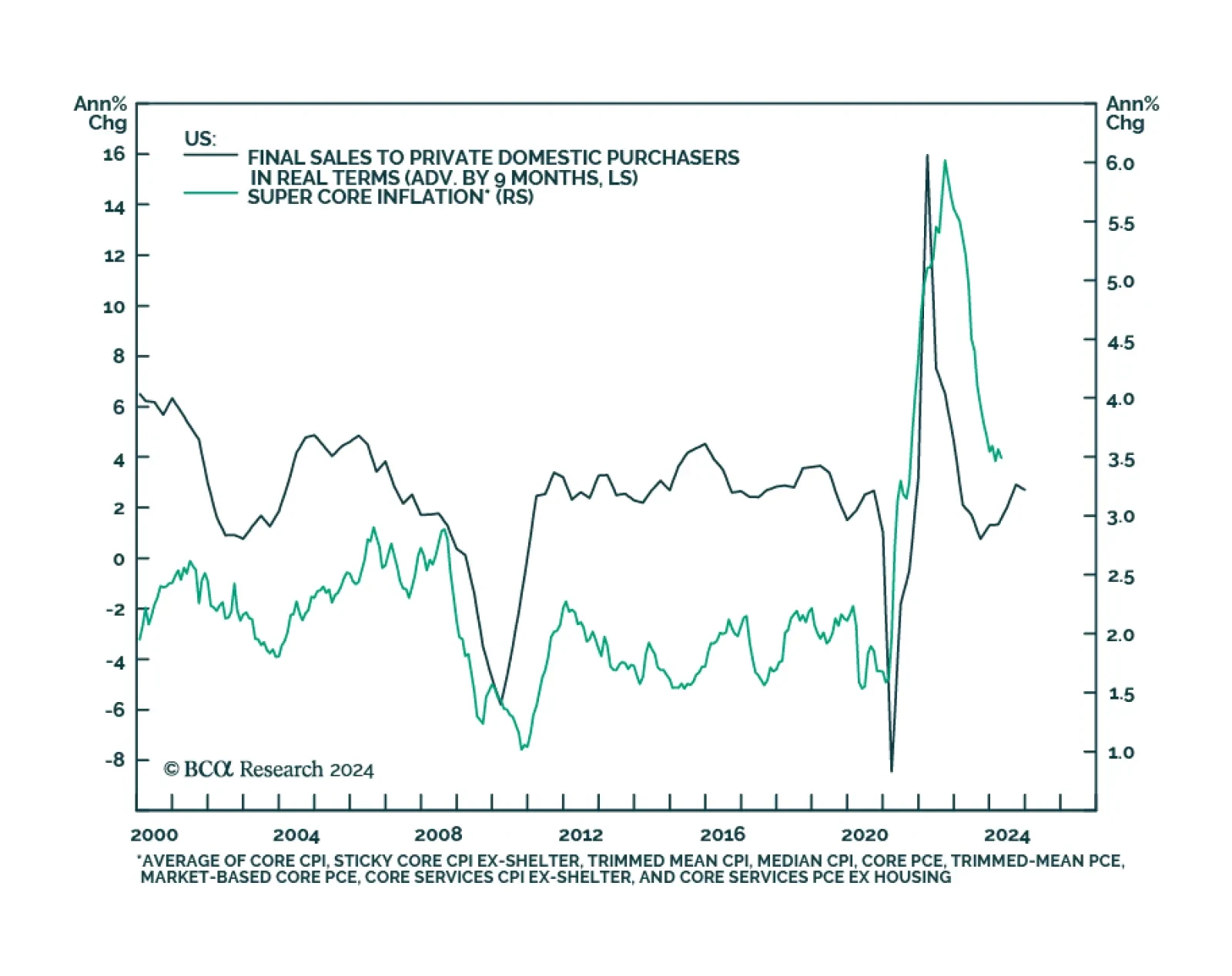

The US economy is in the “Overheating” phase, so stronger growth brings higher inflation. Tight monetary policy means recession is still likely over the next 12 months. Stay defensive.

US Q1 GDP was revised lower from 1.6% q/q annualized to 1.3%. Notably, the downward revision to personal consumption was higher than expected, from 2.5% q/q annualized to 2.0%. Investment and government spending were revised…

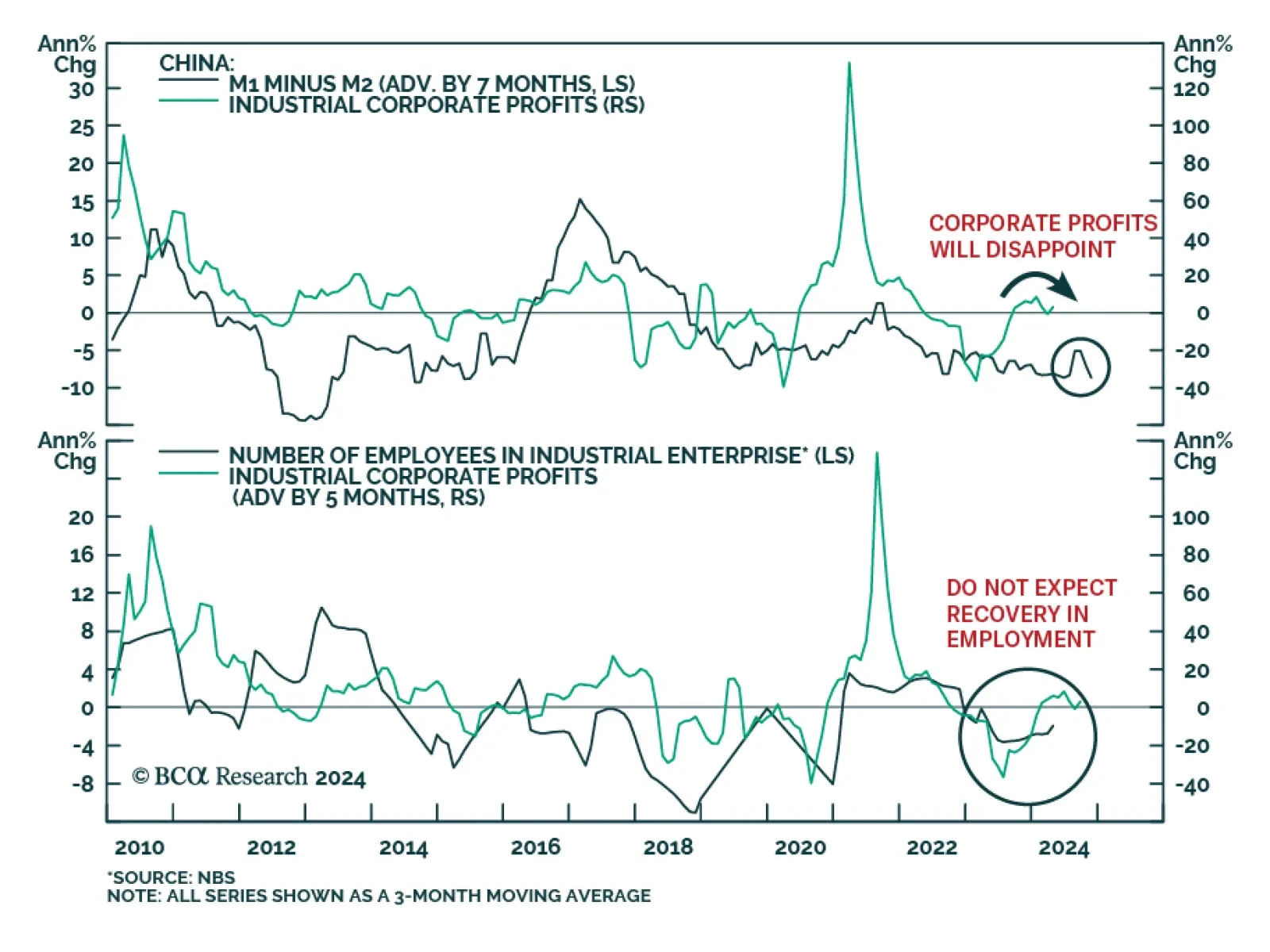

As in many other countries, China’s cyclical consumption growth is primarily driven by labor market conditions, income, and borrowing. BCA Research’s China Investment Strategy service maintains the view that these…

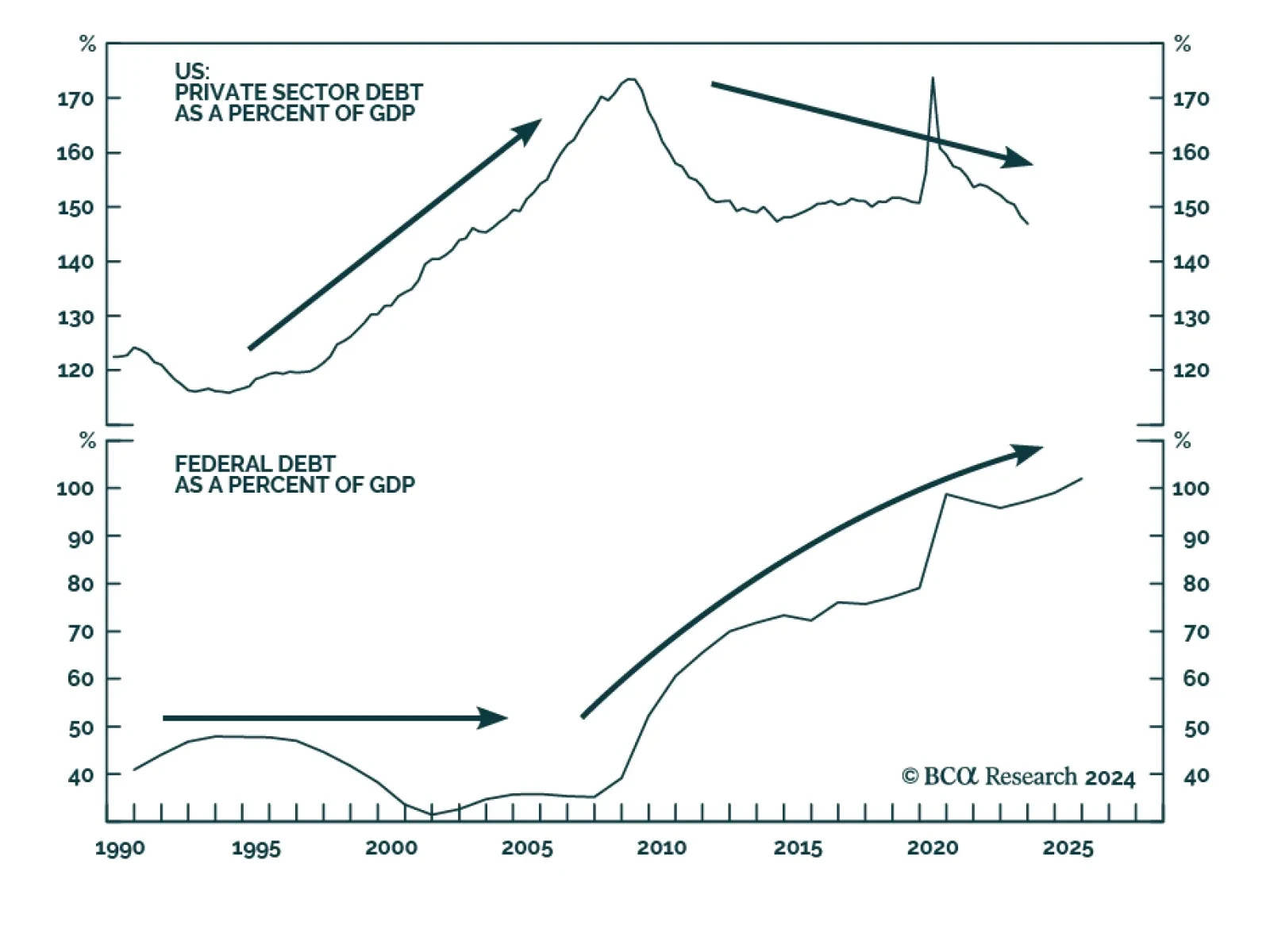

BCA developed the Debt Supercycle thesis in the 1970s to characterize the postwar surge in private sector indebtedness. Because rising debt burdens increased economic vulnerability, policymakers were forced to pursue increasingly…

In Section I, we argue that global investors have been lulled into a false sense of security concerning the resiliency of the US economy. Tight monetary policy means that something must change for a recession to be avoided, and…

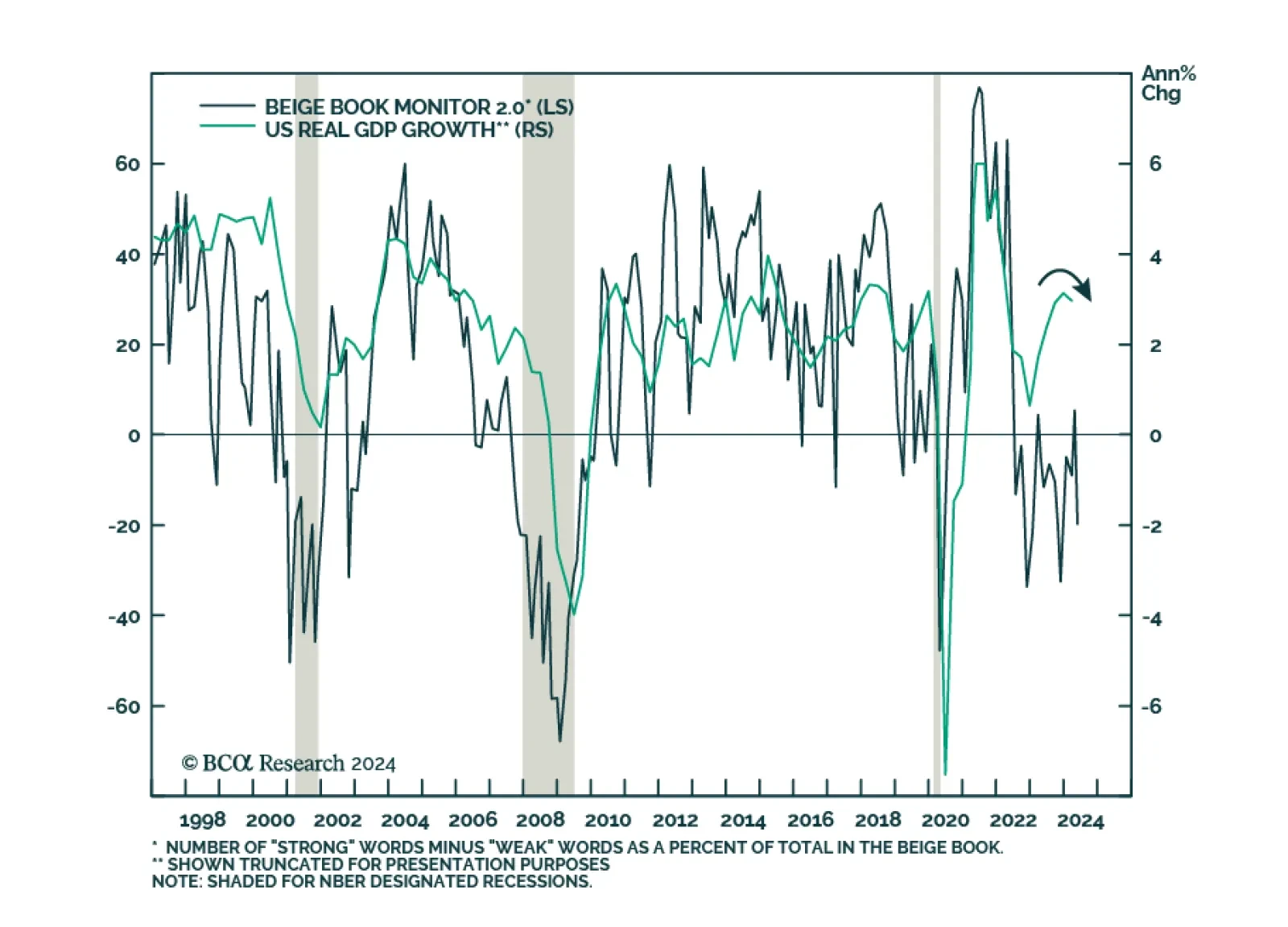

The message from the latest Beige Book release is confirming that US demand is showing signs of slowing down. Of the 12 Federal Reserve districts, 2 reported modest economic growth, 8 reported economic activity was slightly up,…

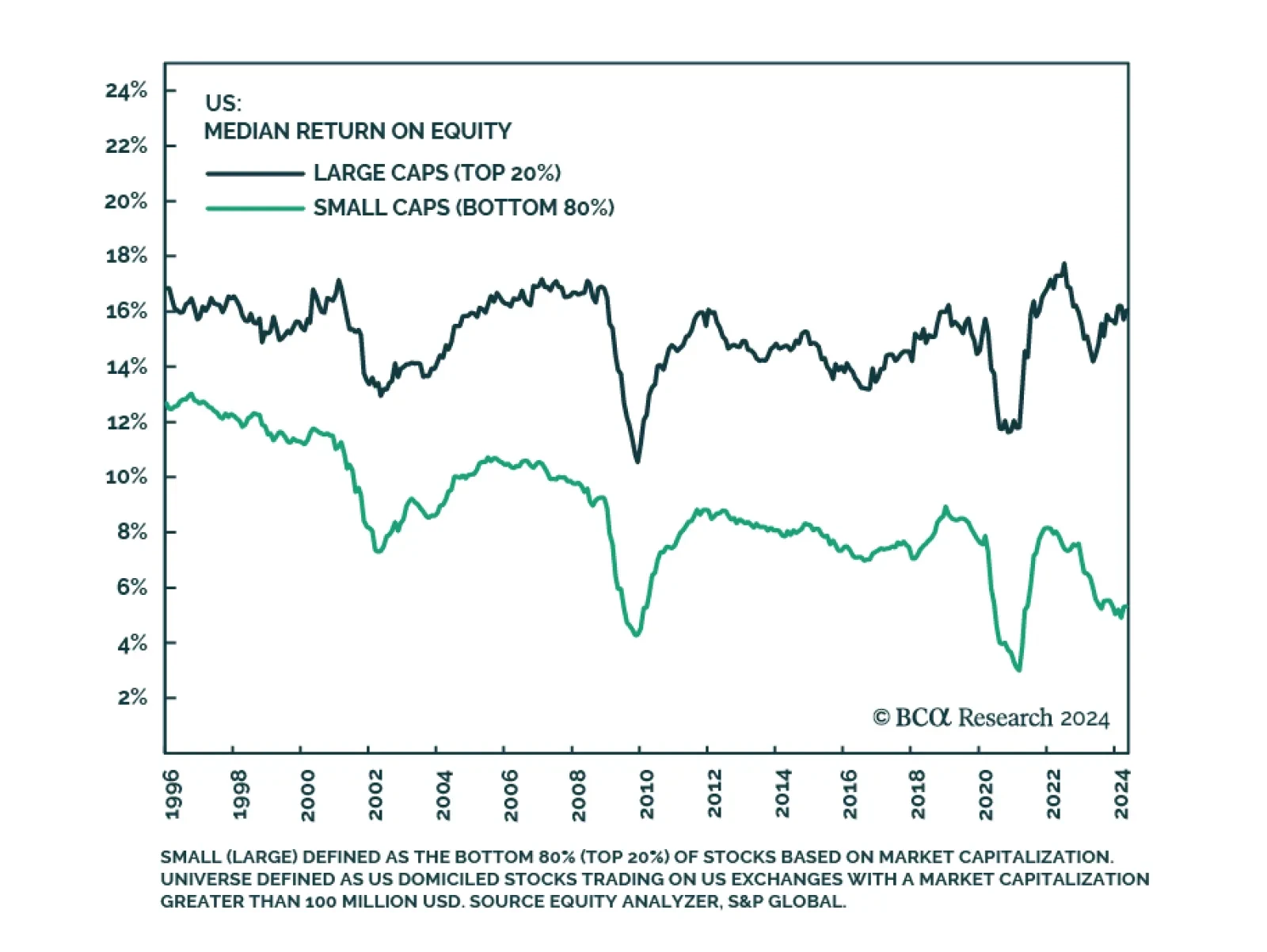

Our Global Asset Allocation strategists caution that US small-cap stocks’ deep discount relative to the S&P 500 is not the generational buying opportunity it may appear to be on its face. While the size premium…

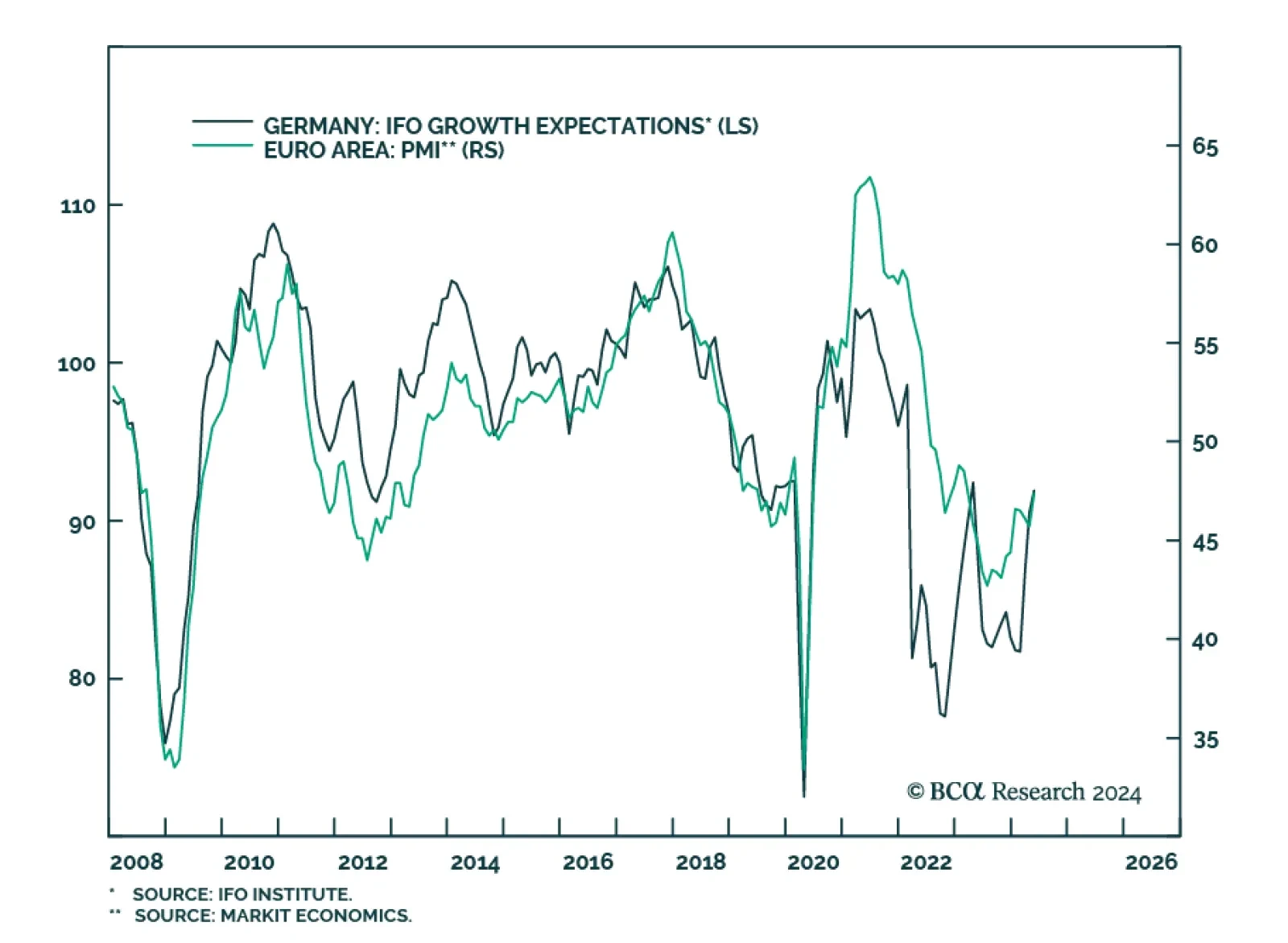

Sentiment among German companies stalled in May, after having firmed for 3 consecutive months. The IFO Business Climate came in at 89.3, unchanged from April, disappointing expectations of further strengthening to 90.4. Although…