Global consumer spending is likely to slow over the coming quarters, culminating in a major economic downturn in late 2024 or early 2025. Investors should maintain benchmark exposure to equities for now but look to turn more…

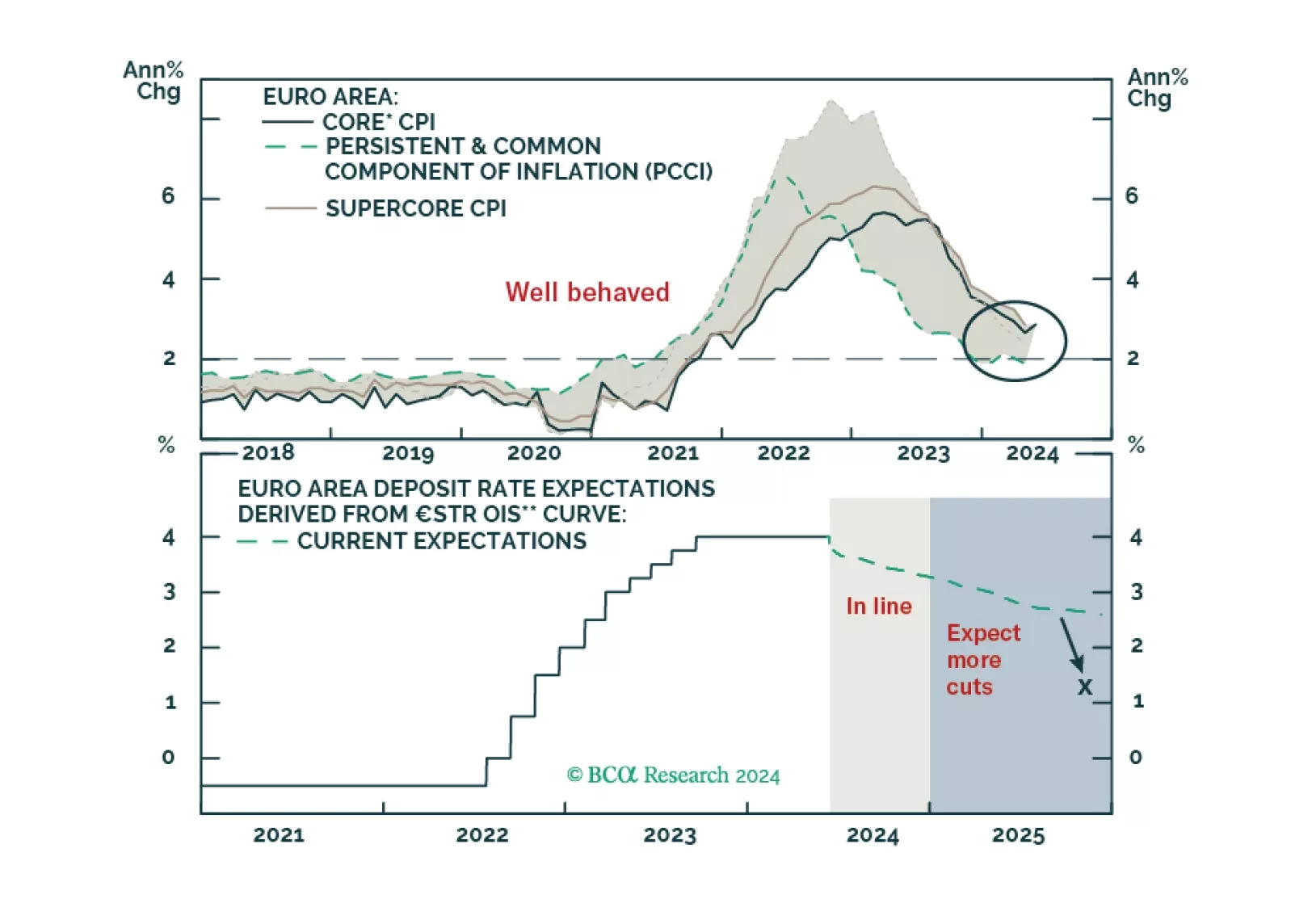

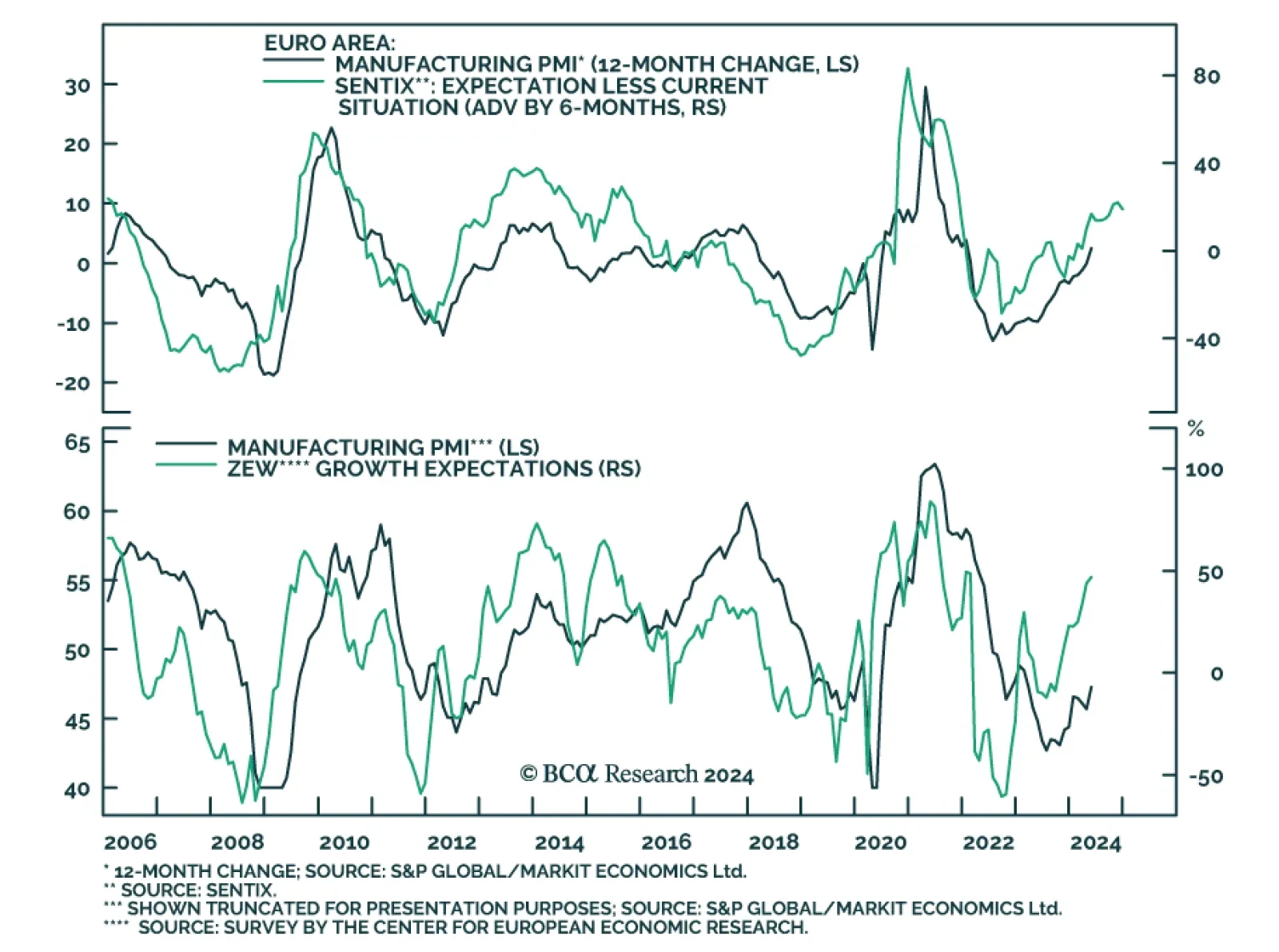

The Eurozone Sentix Economic index improved from -3.6 to 0.3 in June, easily surpassing expectations of a more muted improvement to -1.7. Notably, the Expectation and Current Situation subindices rose to 28-month and 13-month…

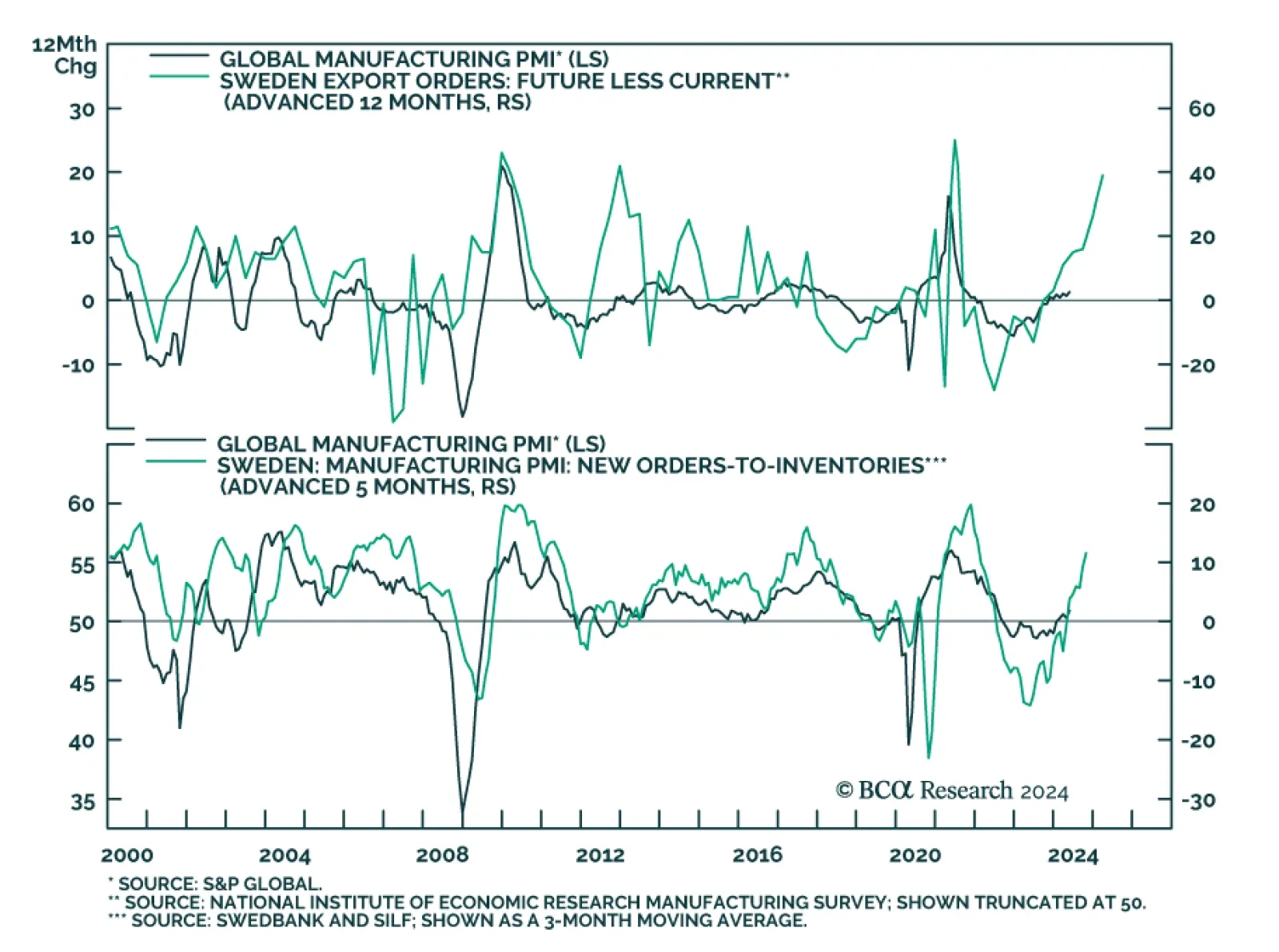

Sweden is a small export-oriented economy and its high sensitivity to global trade makes it a good bellwether of global growth developments. The headwinds from high borrowing costs are relatively more pronounced in Sweden…

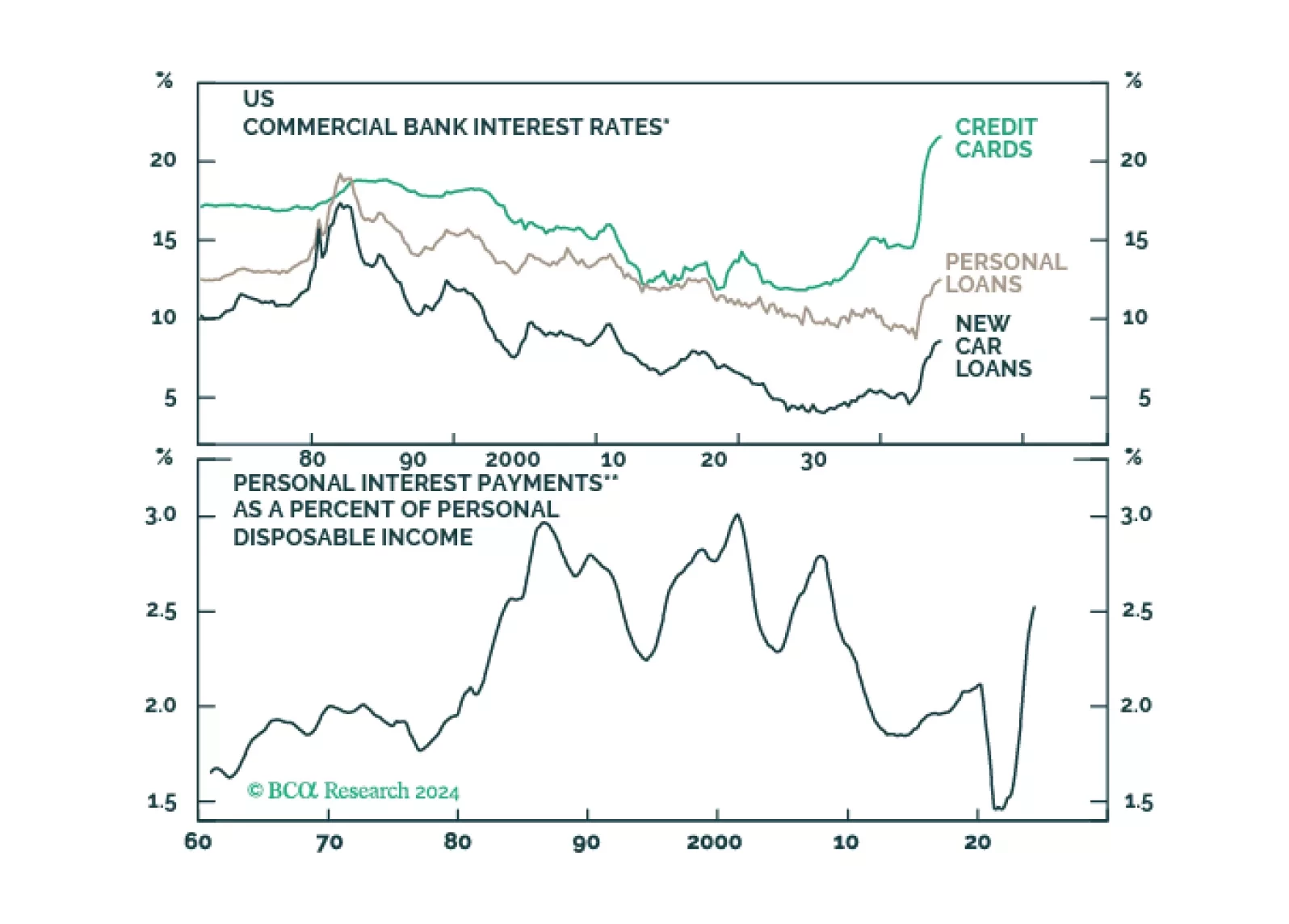

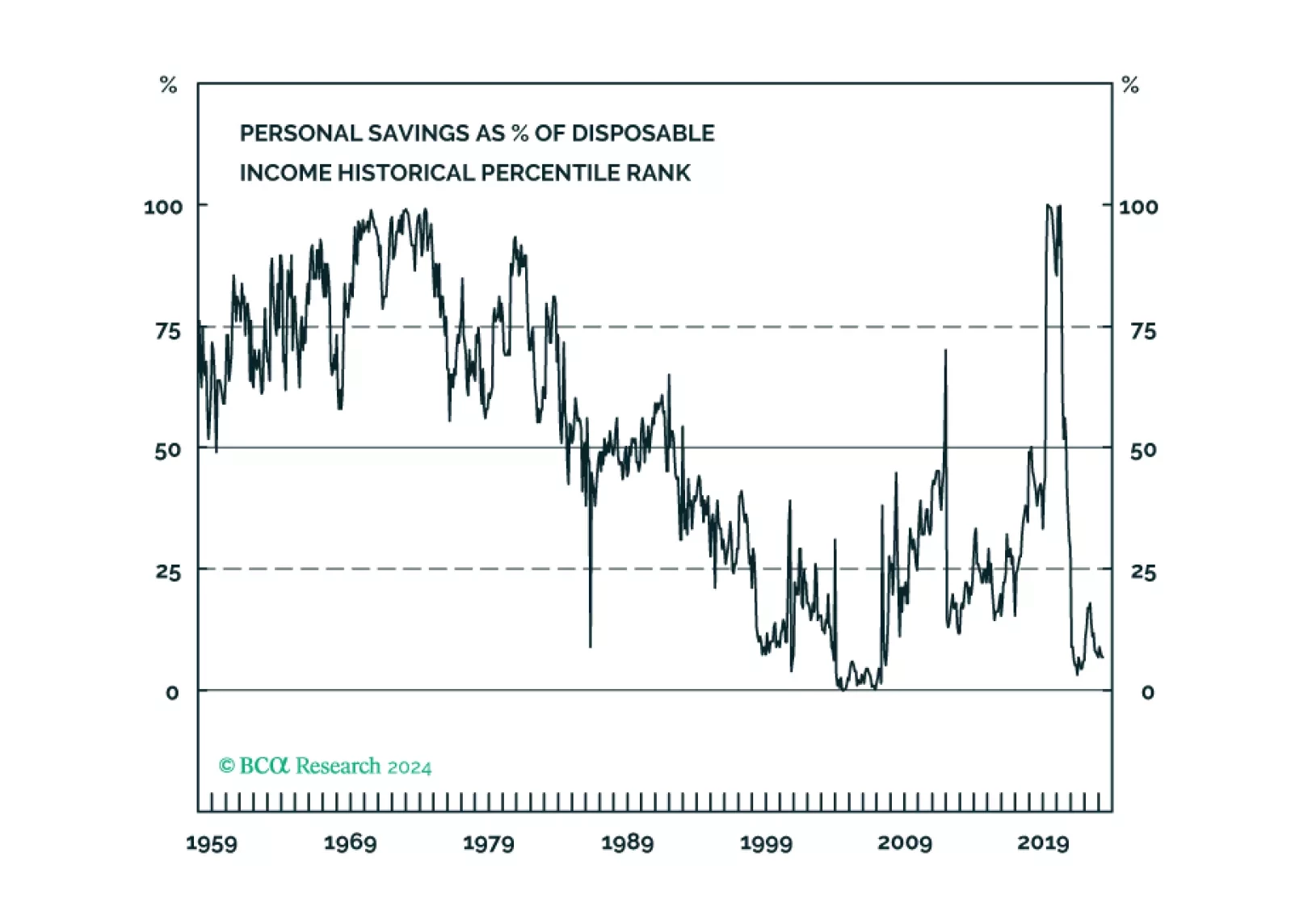

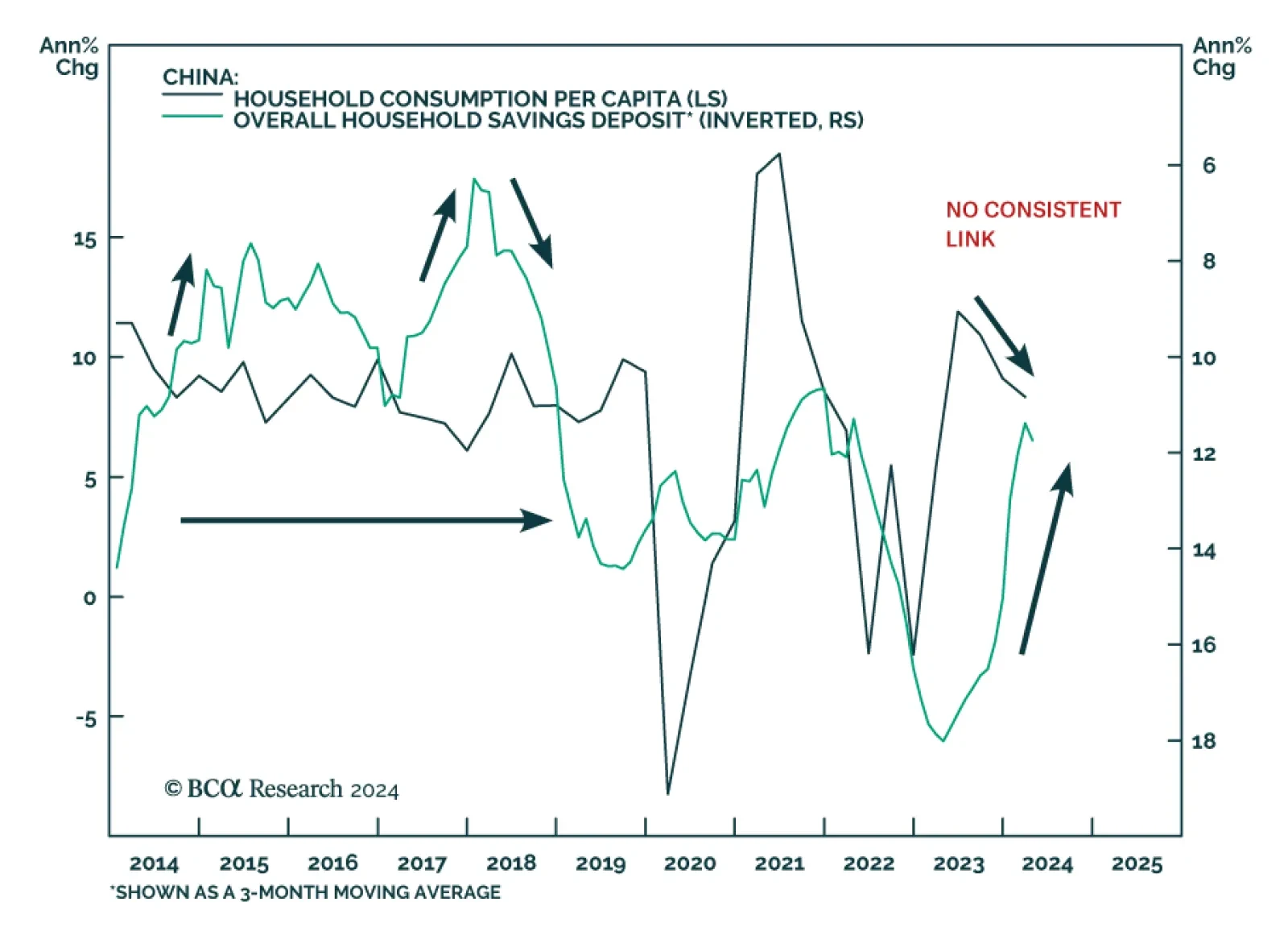

The redeployment of pandemic-era excess savings has been a significant driver of US consumption growth and helped the economy avoid a recession last year. Although pandemic-era fiscal support was less generous in China,…

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

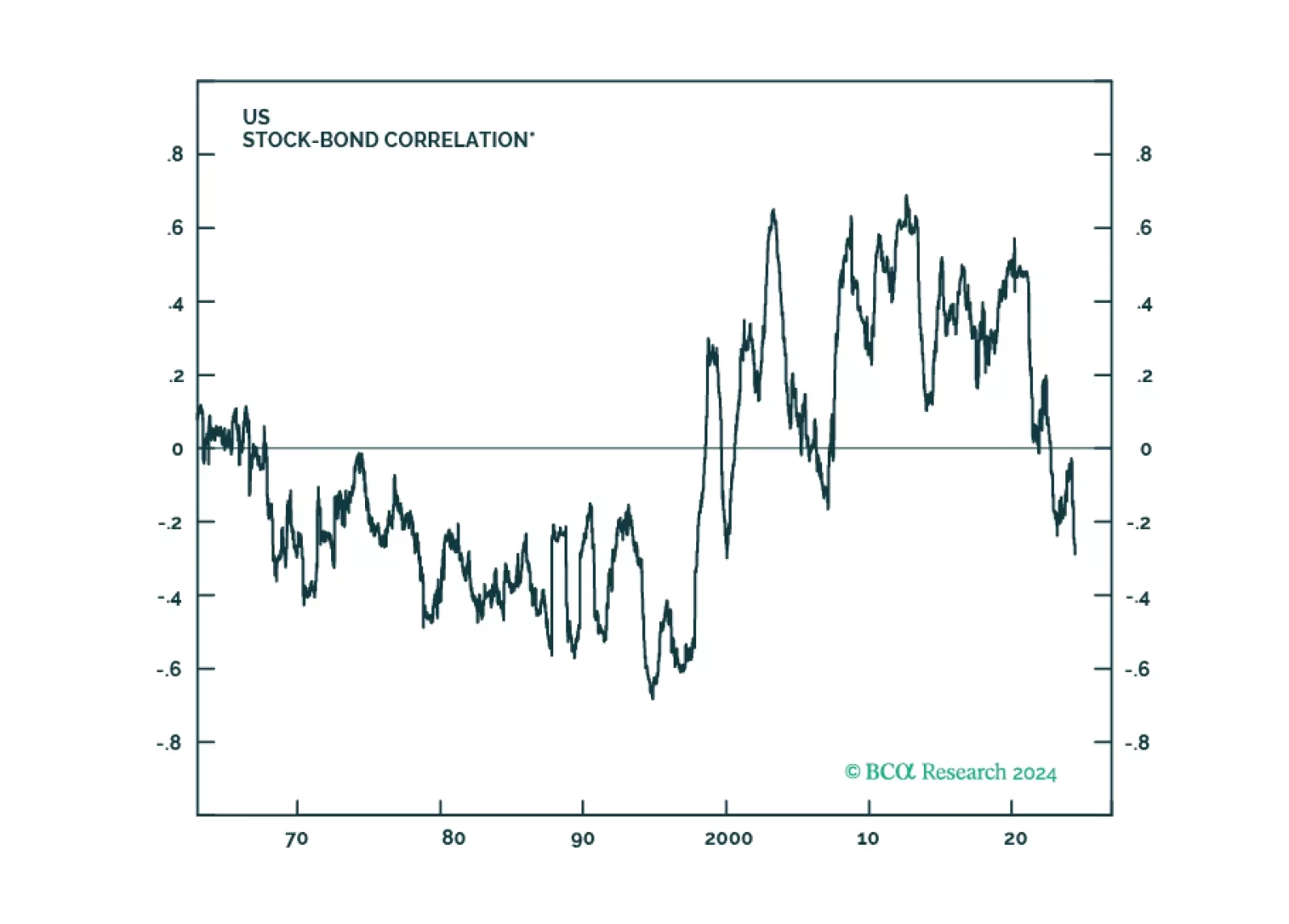

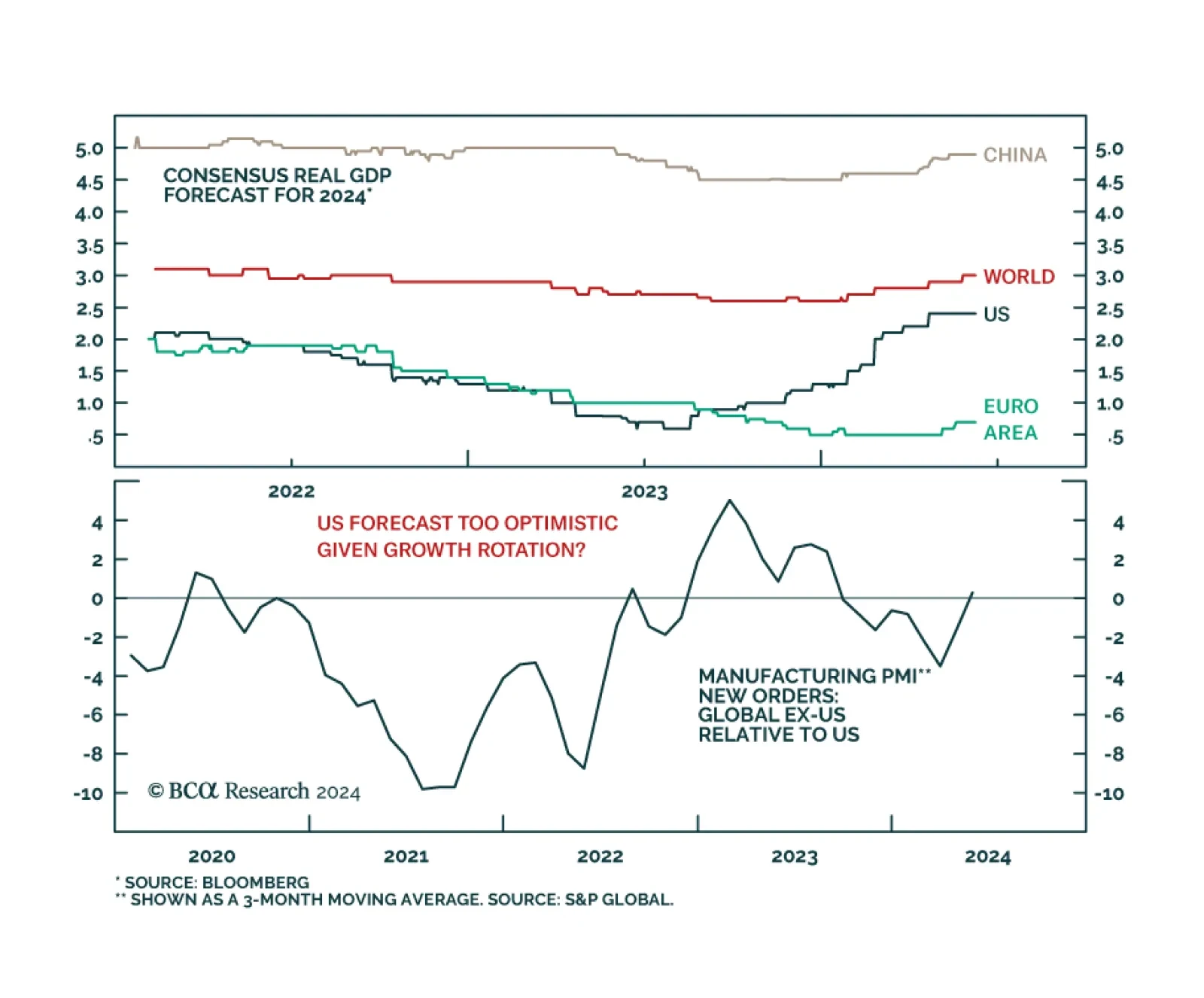

Although the comprehensive economic surprise indexes continued weakening in May, the metrics in our equity downgrade checklist haven’t softened enough to check more boxes now. While we continue to expect the US economy will enter a…

Global growth expectations for 2024 have been revised higher. Investors now forecasts 2024 GDP growth to clock in at 3%, up from 2.6% at the beginning of this year. A 1.1% upward revision in US growth expectations since January…

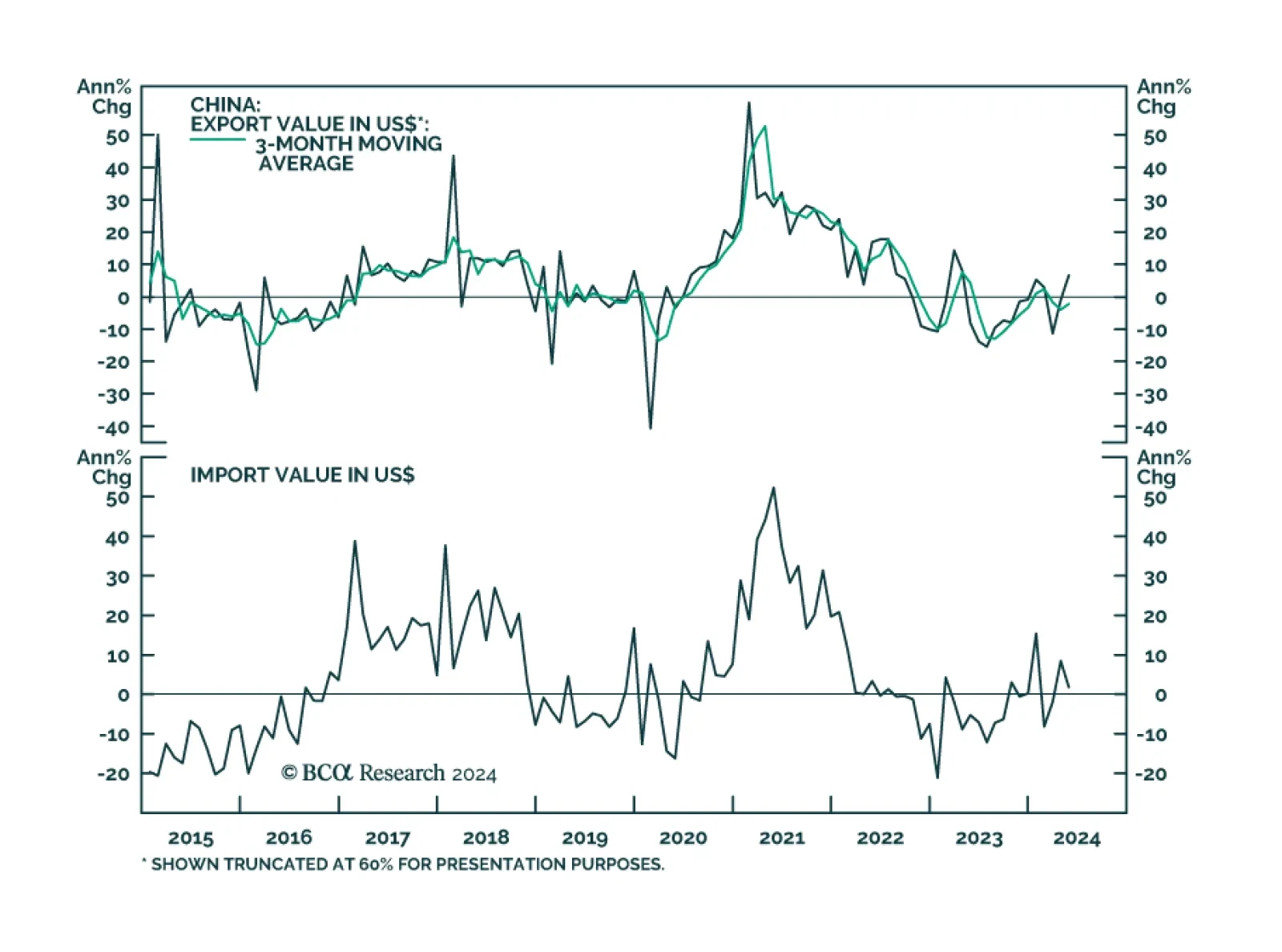

China’s exports in USD terms surged 7.6% y/y in May, from 1.5% in April, surpassing expectations of a 5.7% gain. However, base effects largely overstate the strength of Chinese exports given that they contracted by 8% y/…

The US economy remains on a path towards a recession, most likely starting in late 2024 or early 2025. For now, investors should maintain a benchmark allocation to equities, but employ a barbell strategy of overweighting defensives…

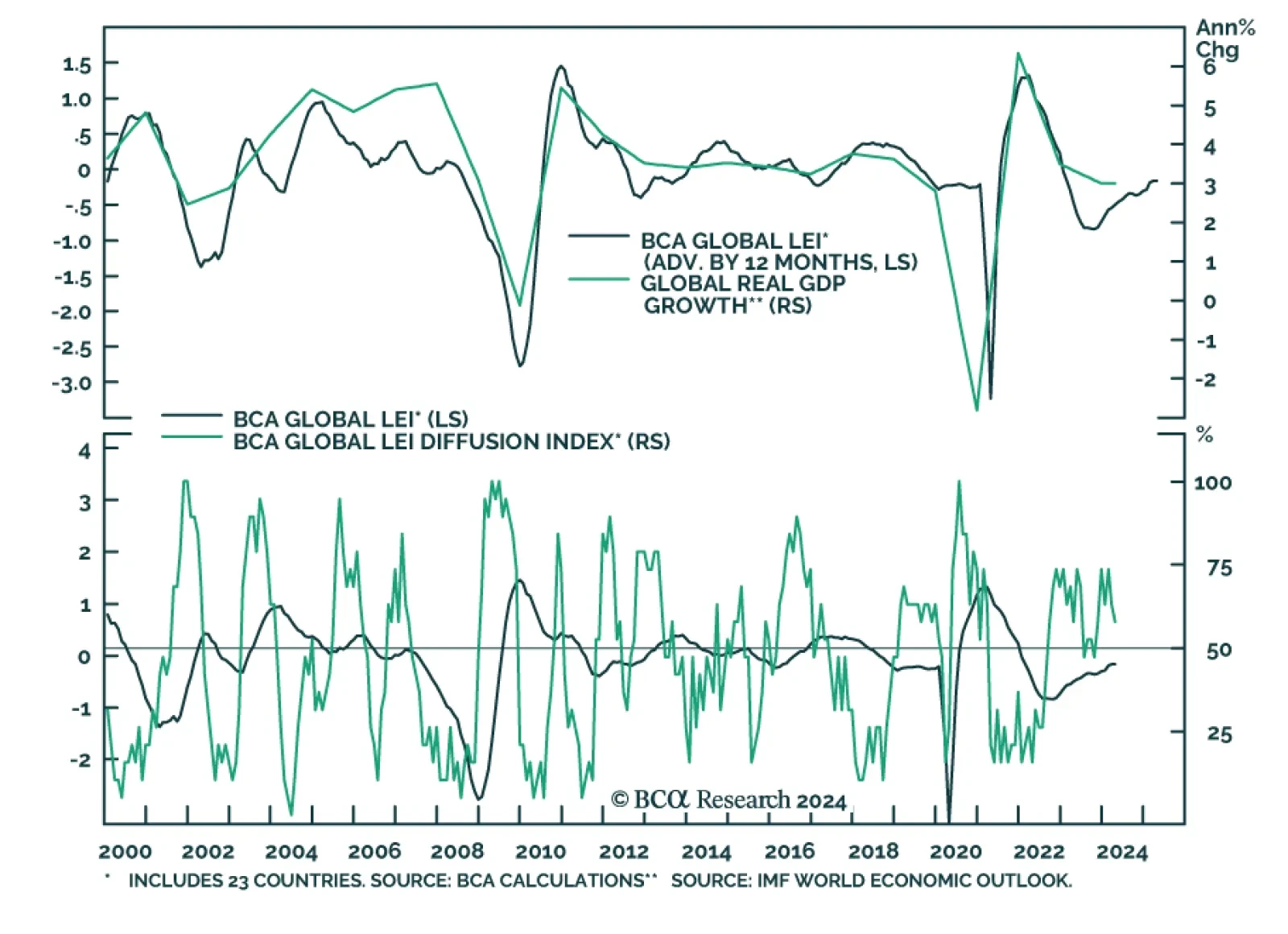

BCA’s Global Leading Economic Indicator has had a good track record of predicting year-on-year changes in the IMF global real GDP growth series. This GDP-weighted average of the standardized leading indicators of 23 DM and…