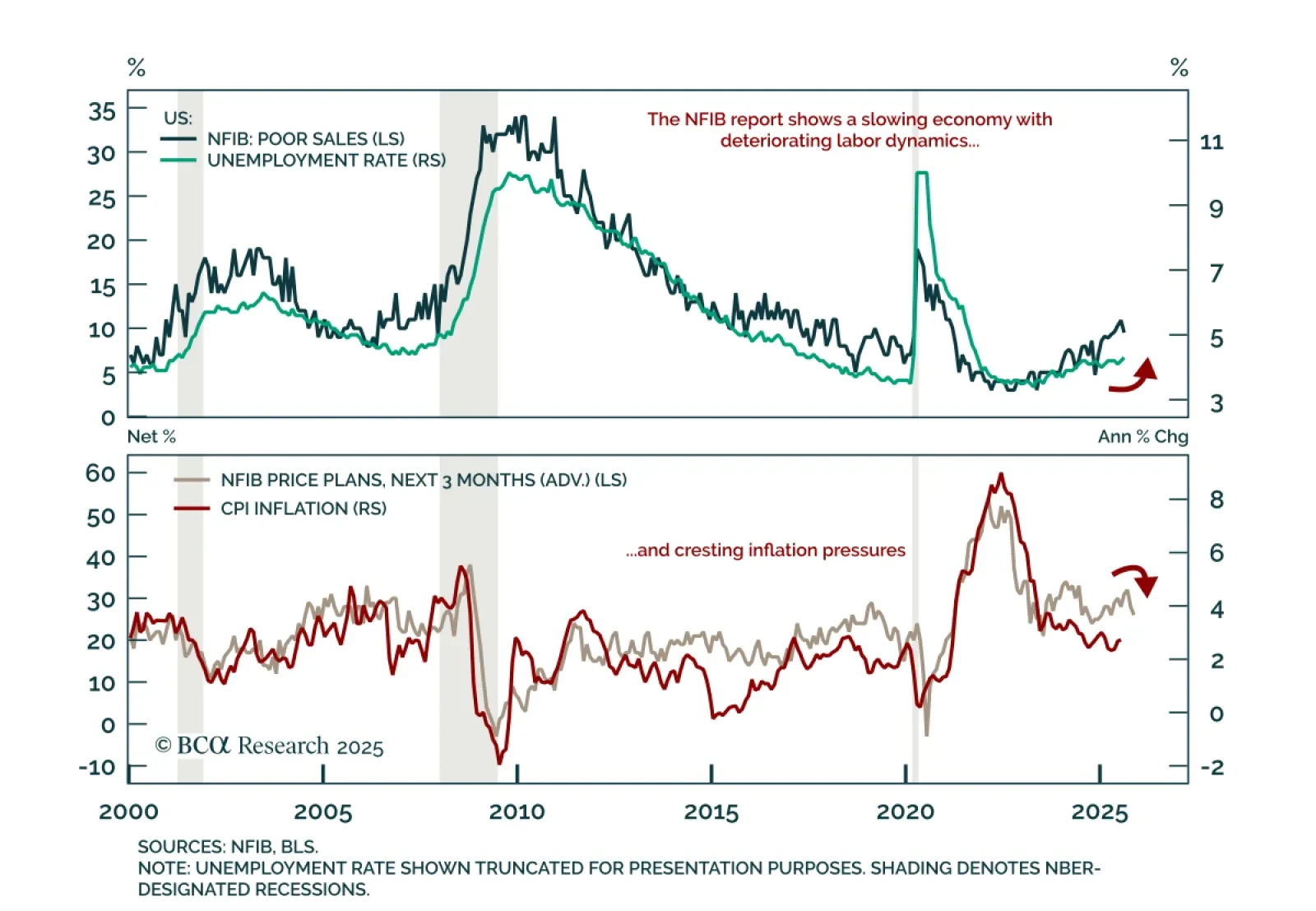

The August NFIB survey shows a fragile US economy with disinflationary signals and weak employment, supporting our defensive stance. The Small Business Optimism Index rose to 100.8 from 100.3, a six-month high, though still below…

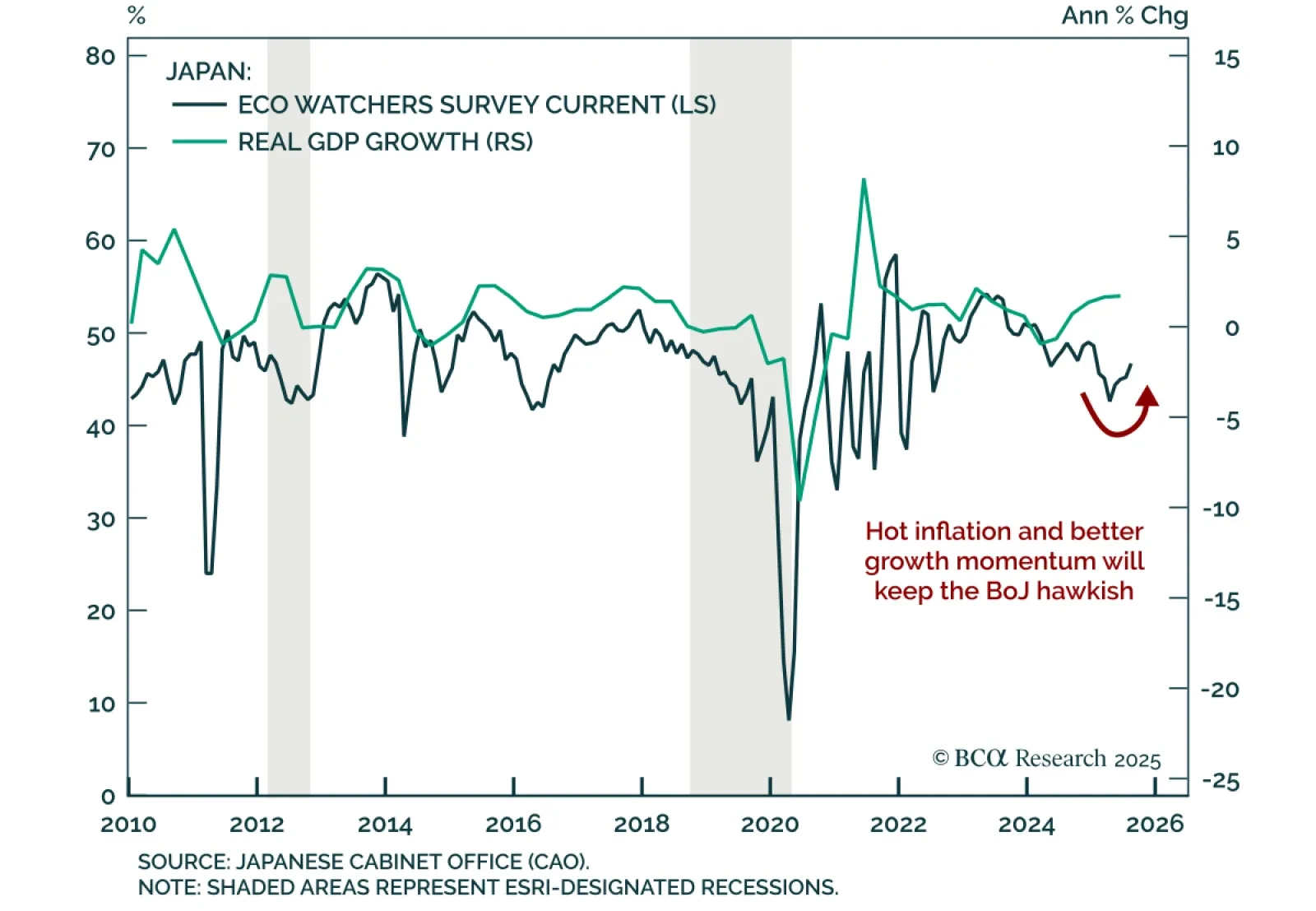

Japan’s Eco Watchers Survey points to stabilization; JGBs remain unattractive and the yen’s near-term setup is less favorable versus USD. The August survey modestly beat expectations, with the current component rising to 46.7…

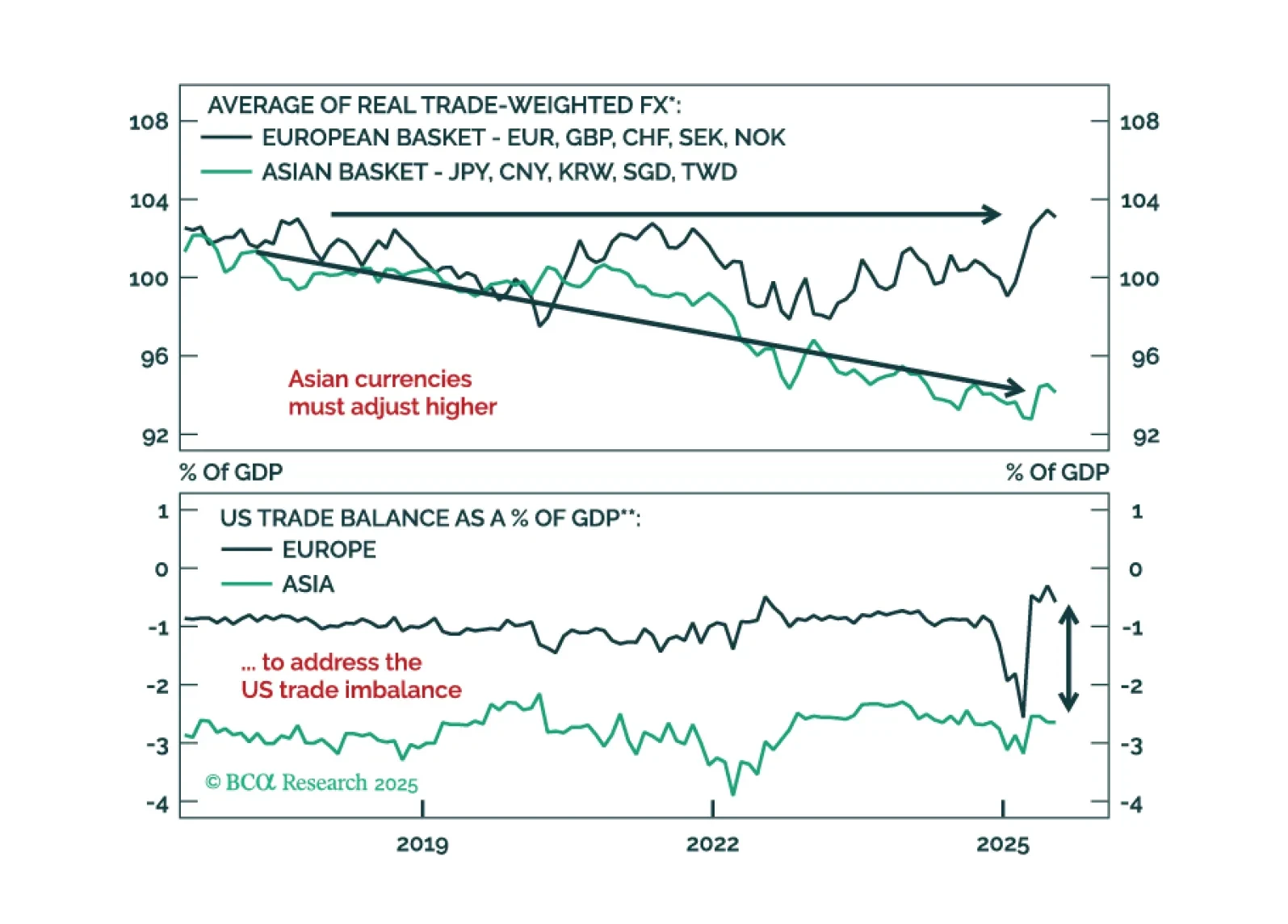

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

Although our recession conviction has risen, we conclude our strategy review by closing our equity underweight and our fixed income and cash overweights. AI momentum is too strong to have anything more than modest exposure to an…

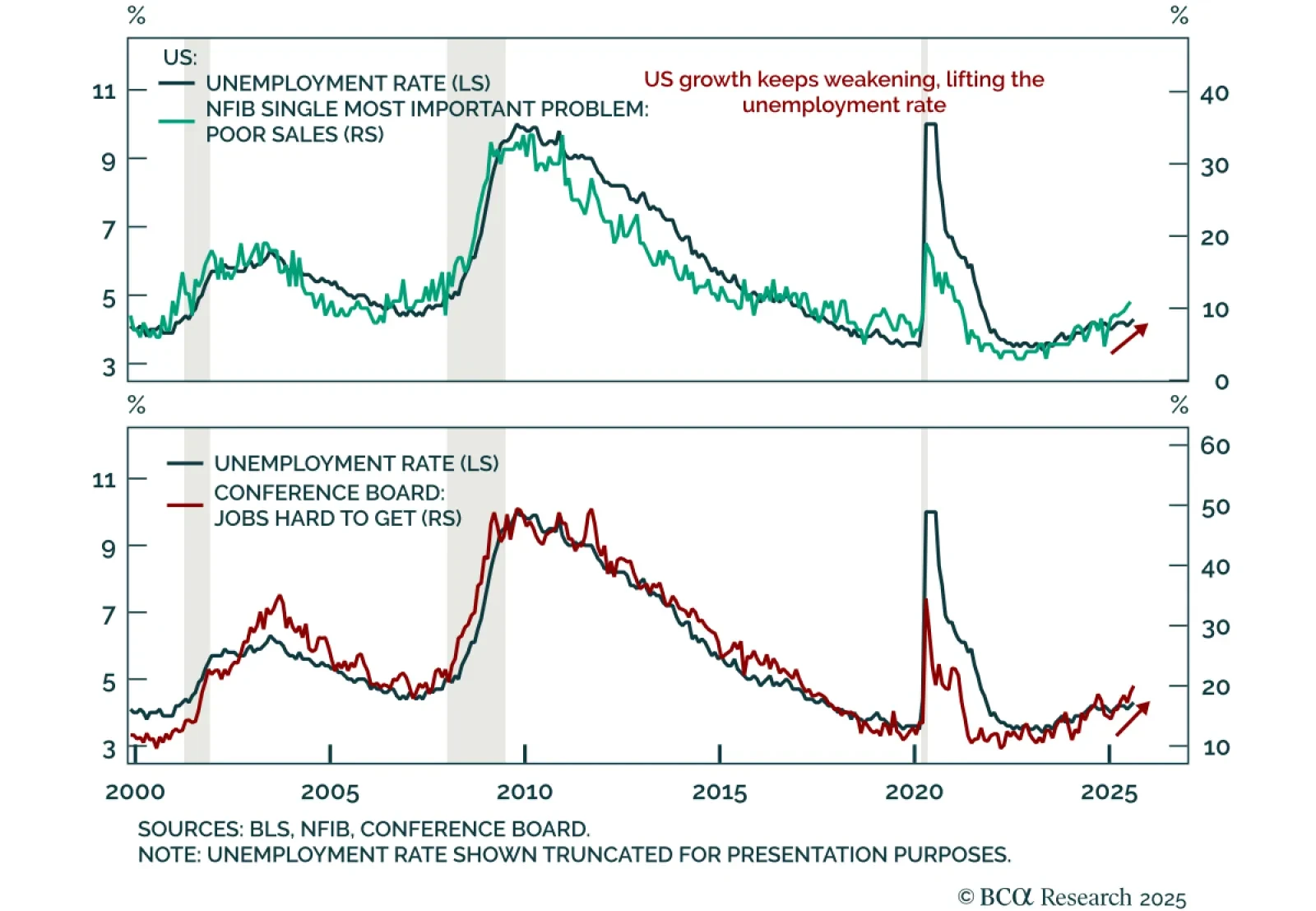

The August US employment report confirmed a significant labor market deceleration, keeping us modestly defensive. Nonfarm payrolls rose just 22k after 79k in July, while net revisions subtracted 21k from prior months. The 3-…

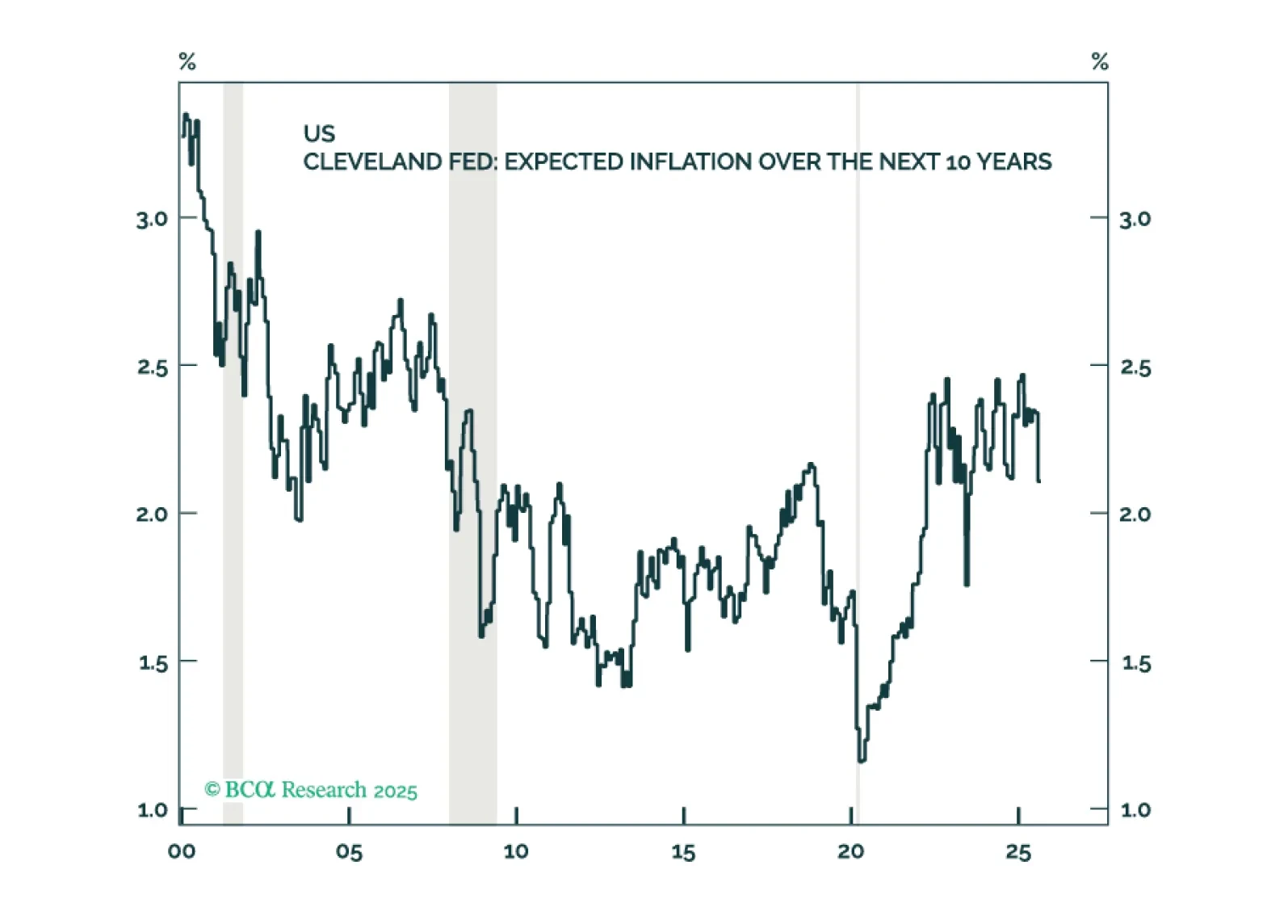

Inflation expectations in the US remain reasonably well anchored and there are few signs of a brewing wage-price spiral. Thus, the near-term risks to growth outweigh the risks of higher inflation. Looking beyond the next year or two…

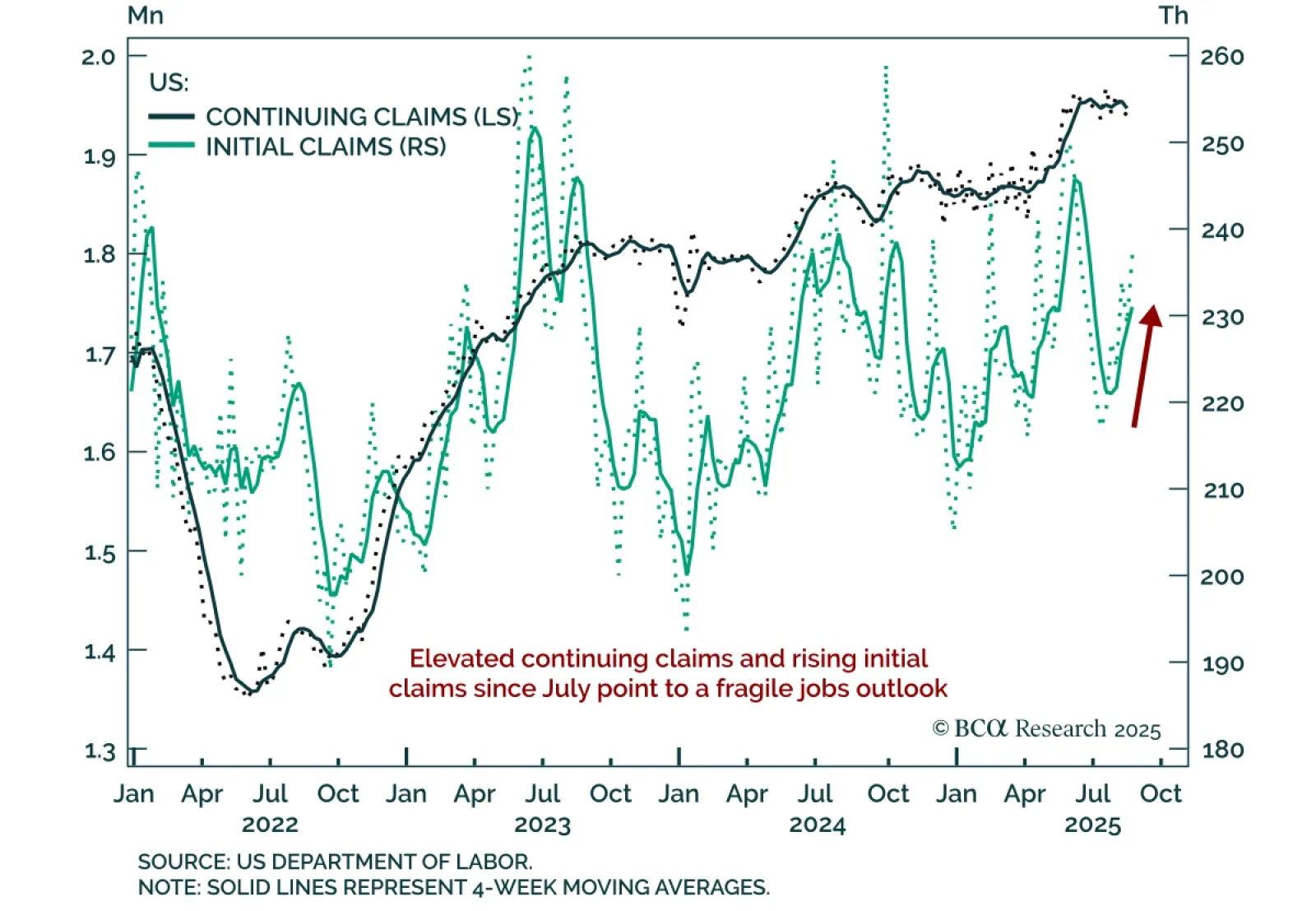

US jobless claims rose to 237k, the highest since July, underscoring fragile labor momentum. While still below the recent 250k peak, claims have been rising steadily since early July, suggesting the labor market weakness seen in…

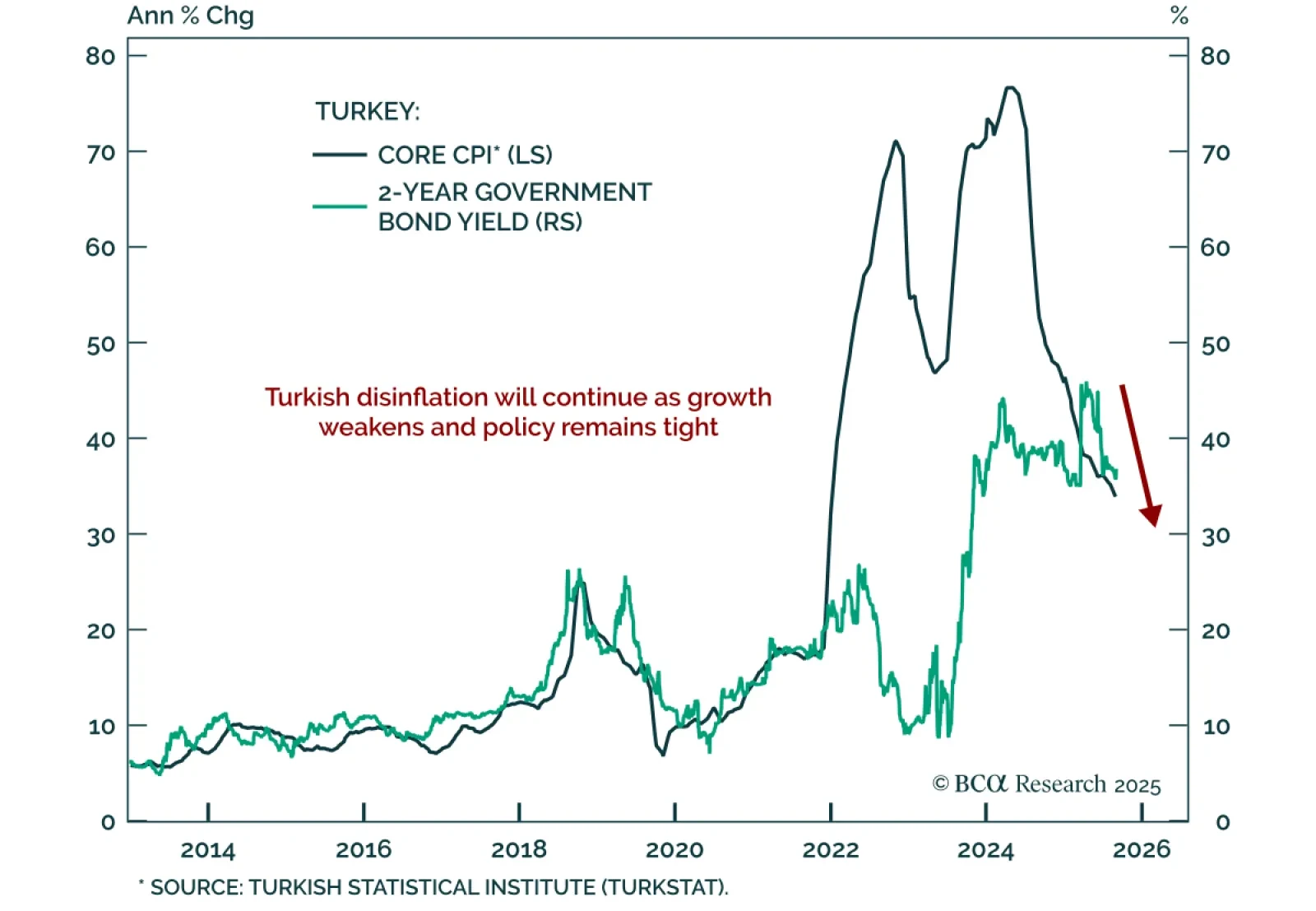

Turkey’s disinflation trend remains intact, supporting a bullish case for short-term bonds. Headline inflation eased to 33% y/y in August from 33.5% in July. Our Emerging Markets strategists expect further slowing as monetary and…

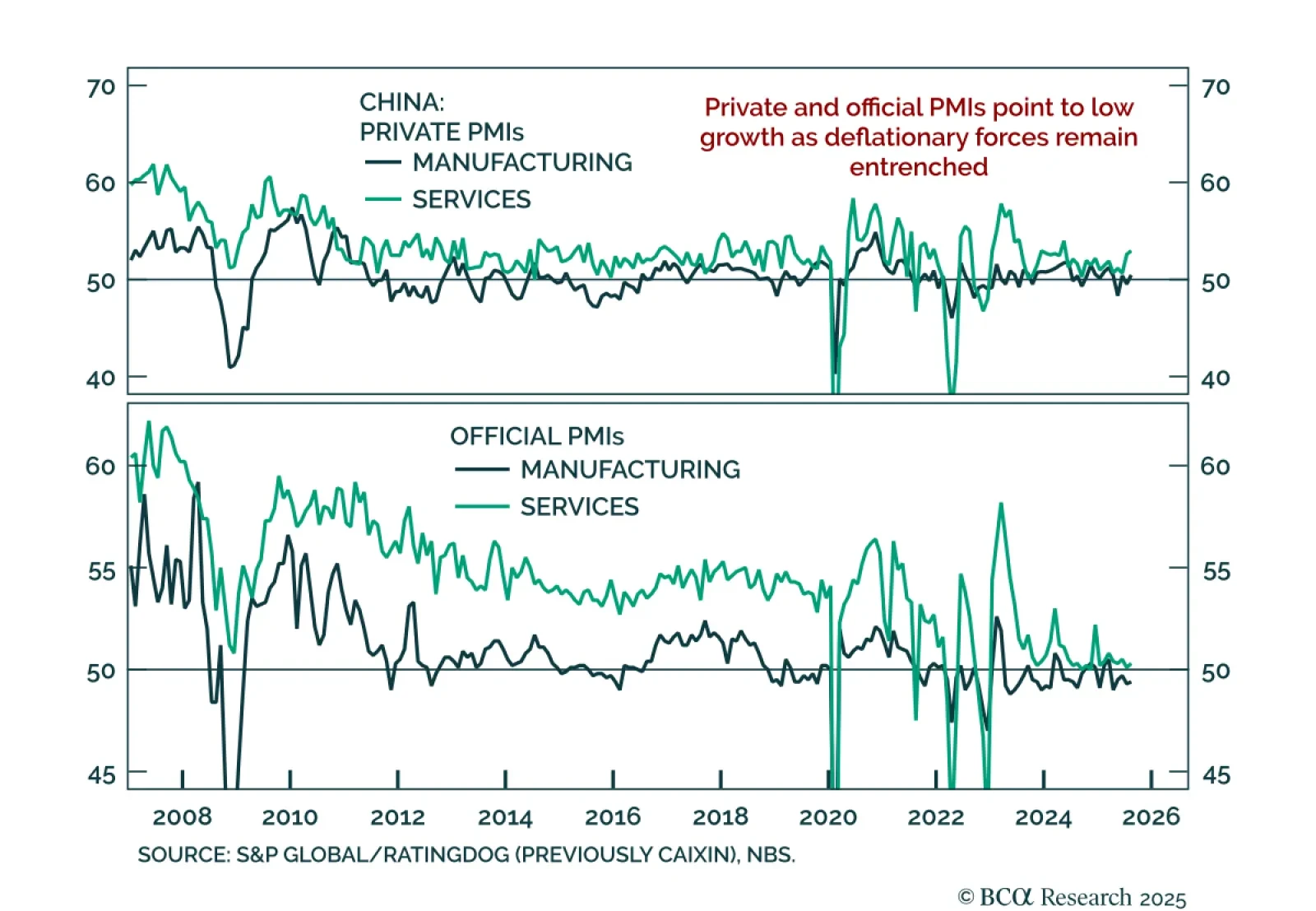

China’s August PMIs improved, but underlying data point to persistent weakness and limited momentum. The official NBS composite rose to 50.5 from 50.2, with manufacturing still in contraction at 49.4 and services edging higher to 50.…

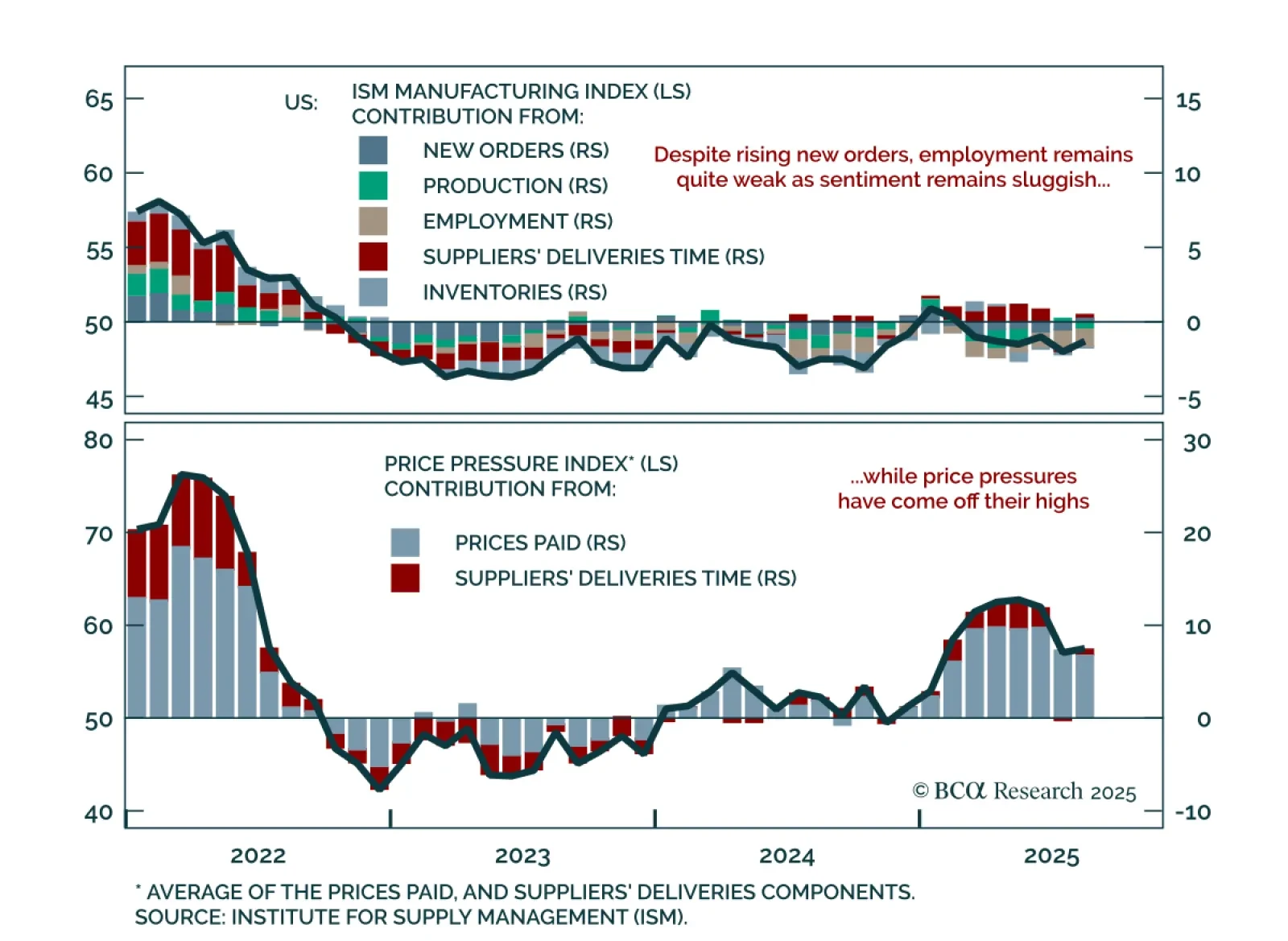

August ISM Manufacturing was mixed, with stronger orders offset by weak production and employment. The headline rose to 48.7 from 48.0, missing expectations. New orders beat estimates, rising into expansion at 51.4 and lifting…