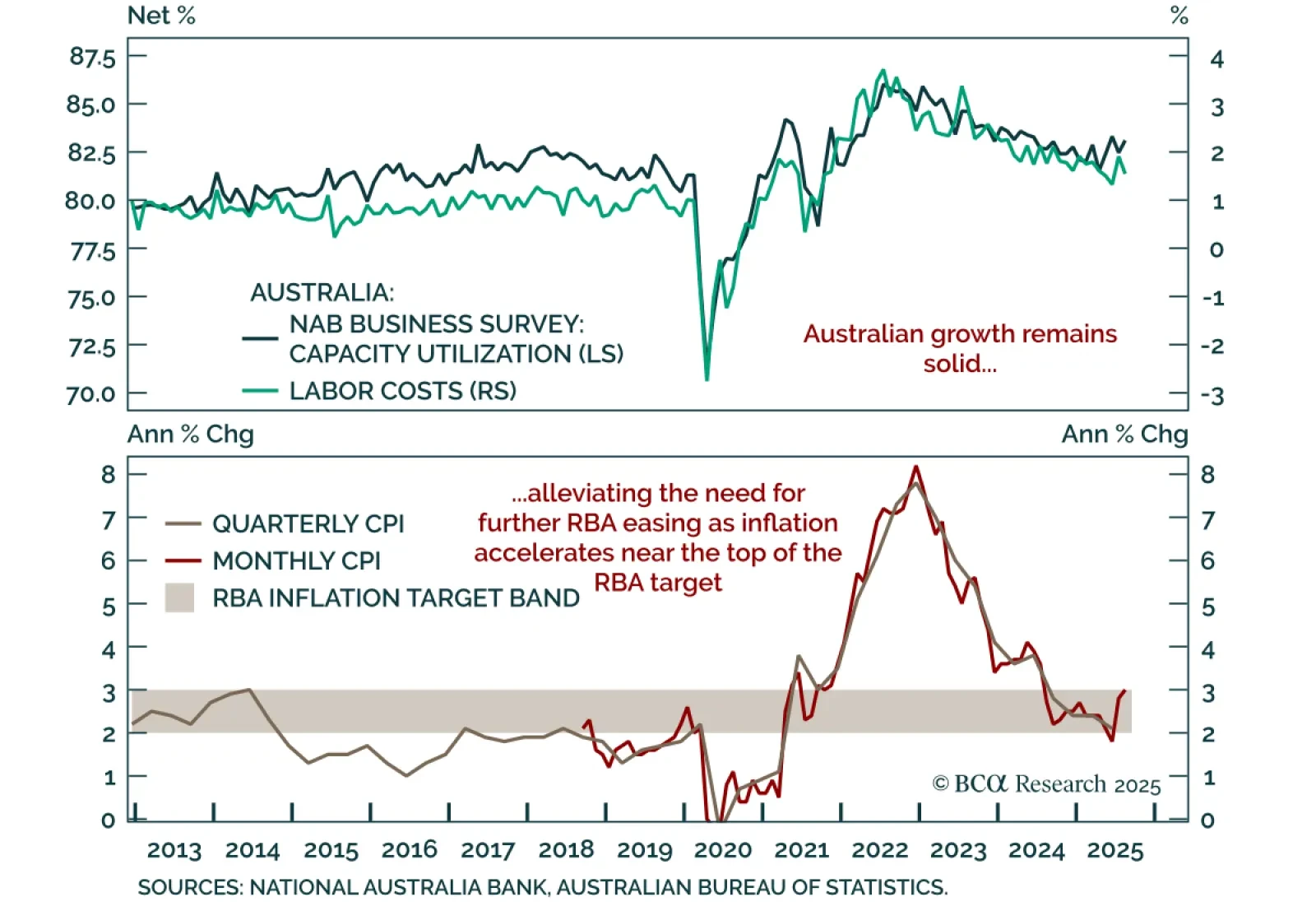

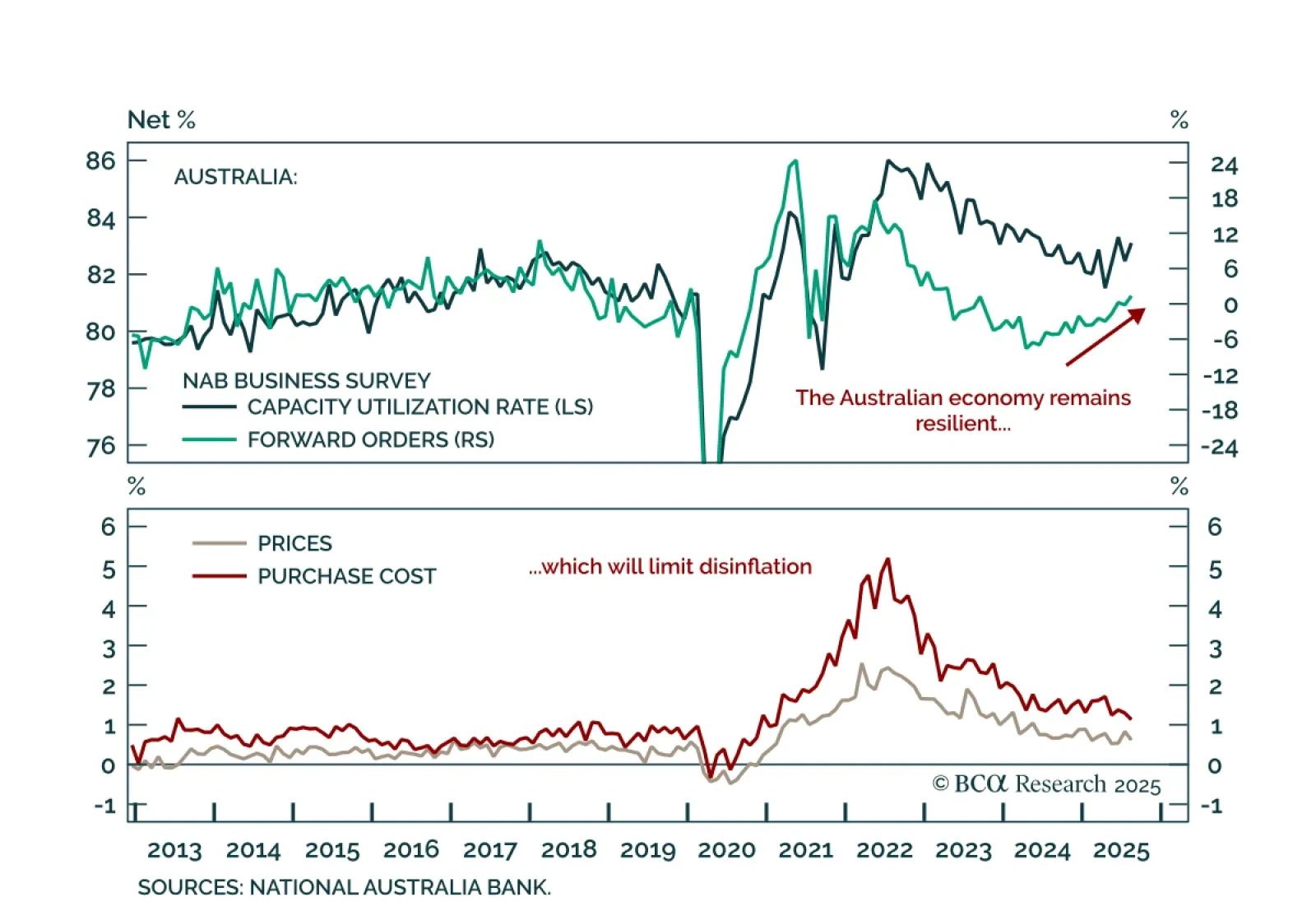

Australian inflation surprised higher in August, validating the RBA’s cautious stance and supporting an underweight on ACGBs. Headline CPI rose to 3.0% y/y from 2.8%, the highest in a year and at the top of the RBA’s 2-3% target…

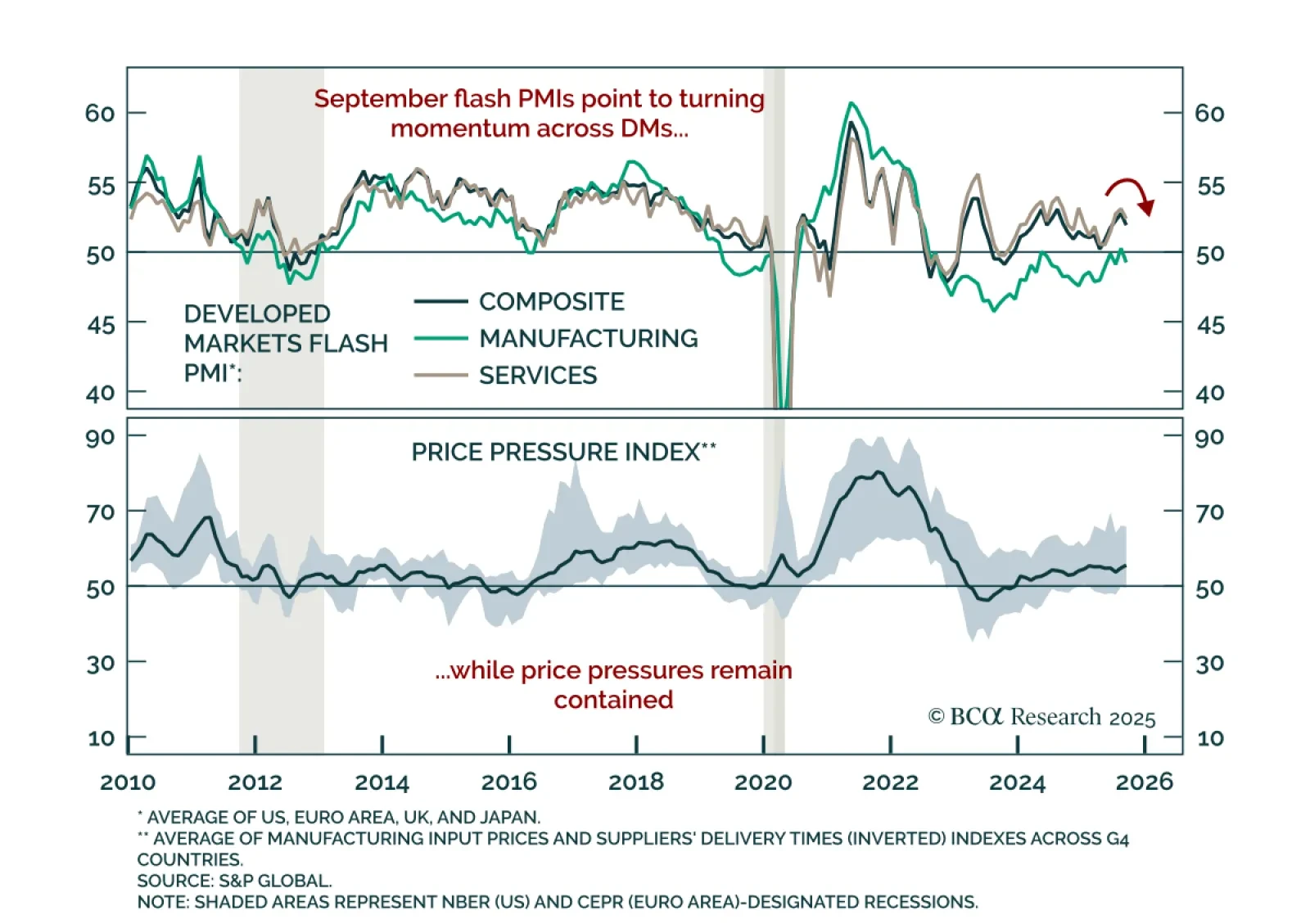

September flash PMIs show slowing global momentum, reinforcing US equity outperformance and underweights in industrial metals. The US composite slipped to 53.6 from 54.6, led by weaker manufacturing. Europe was mixed: Services…

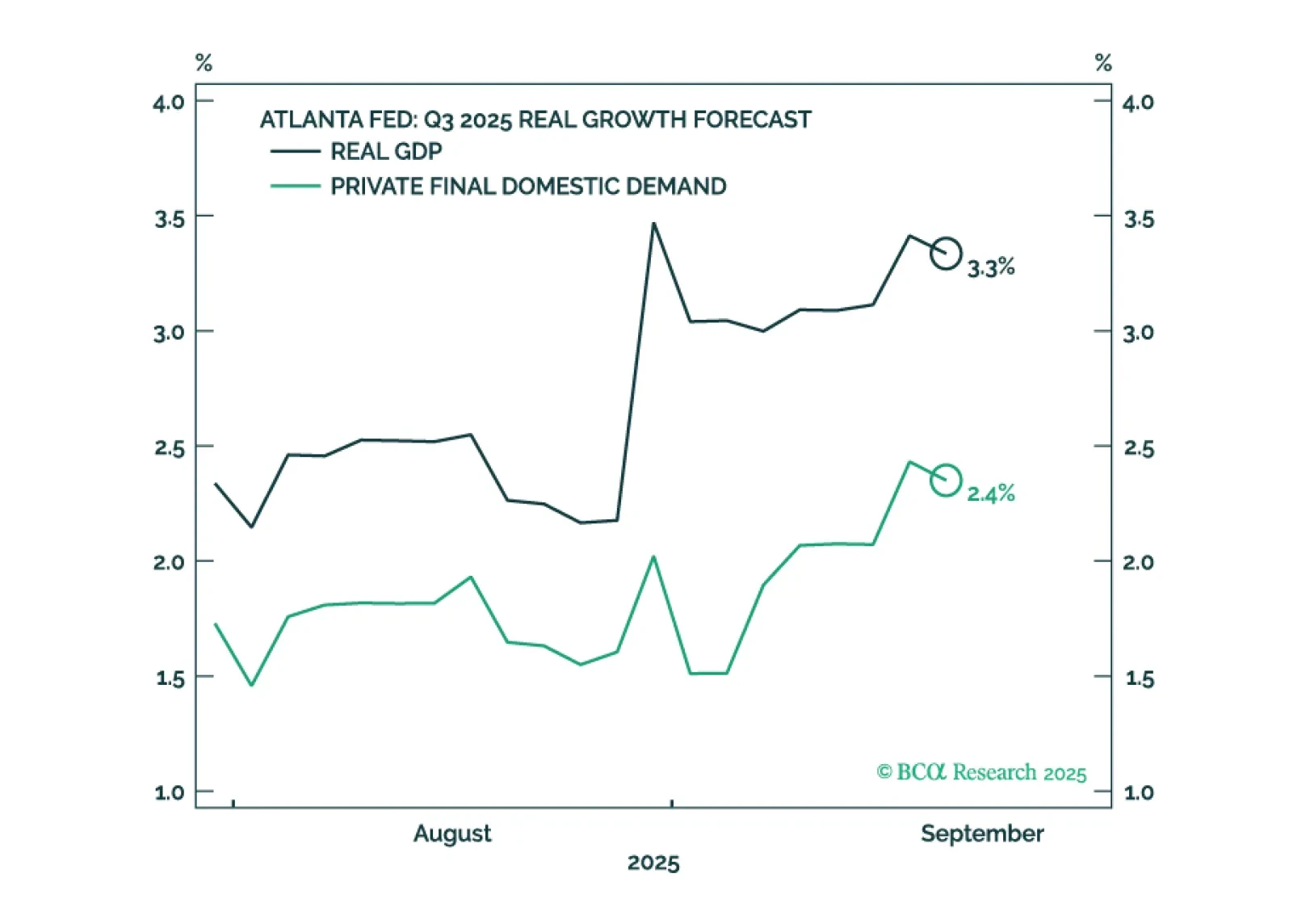

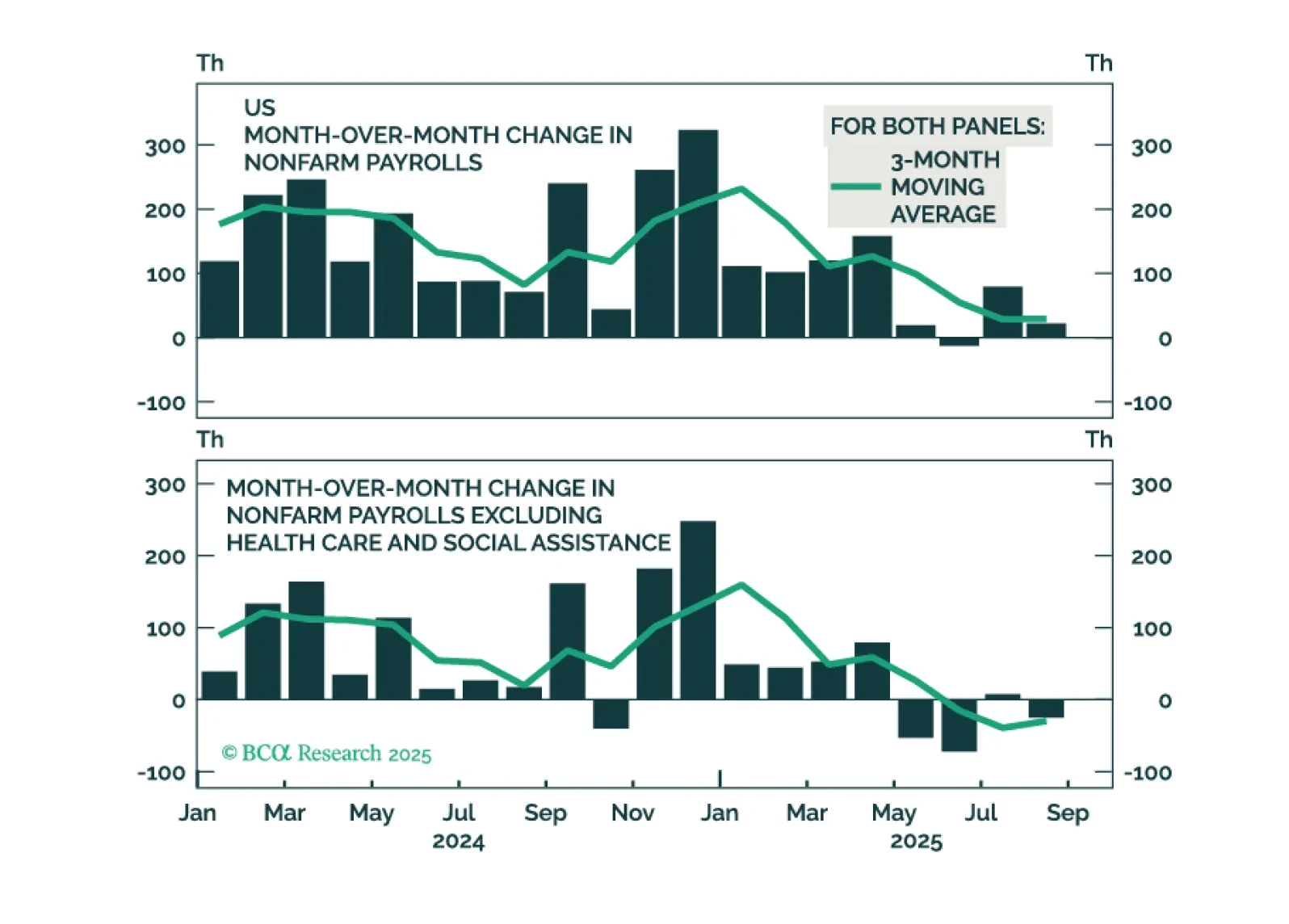

US GDP growth appears to have accelerated even as employment growth has faltered. We will make a final decision in early October when we publish our next Strategy Outlook, but most likely, we will cut our 12-month US recession…

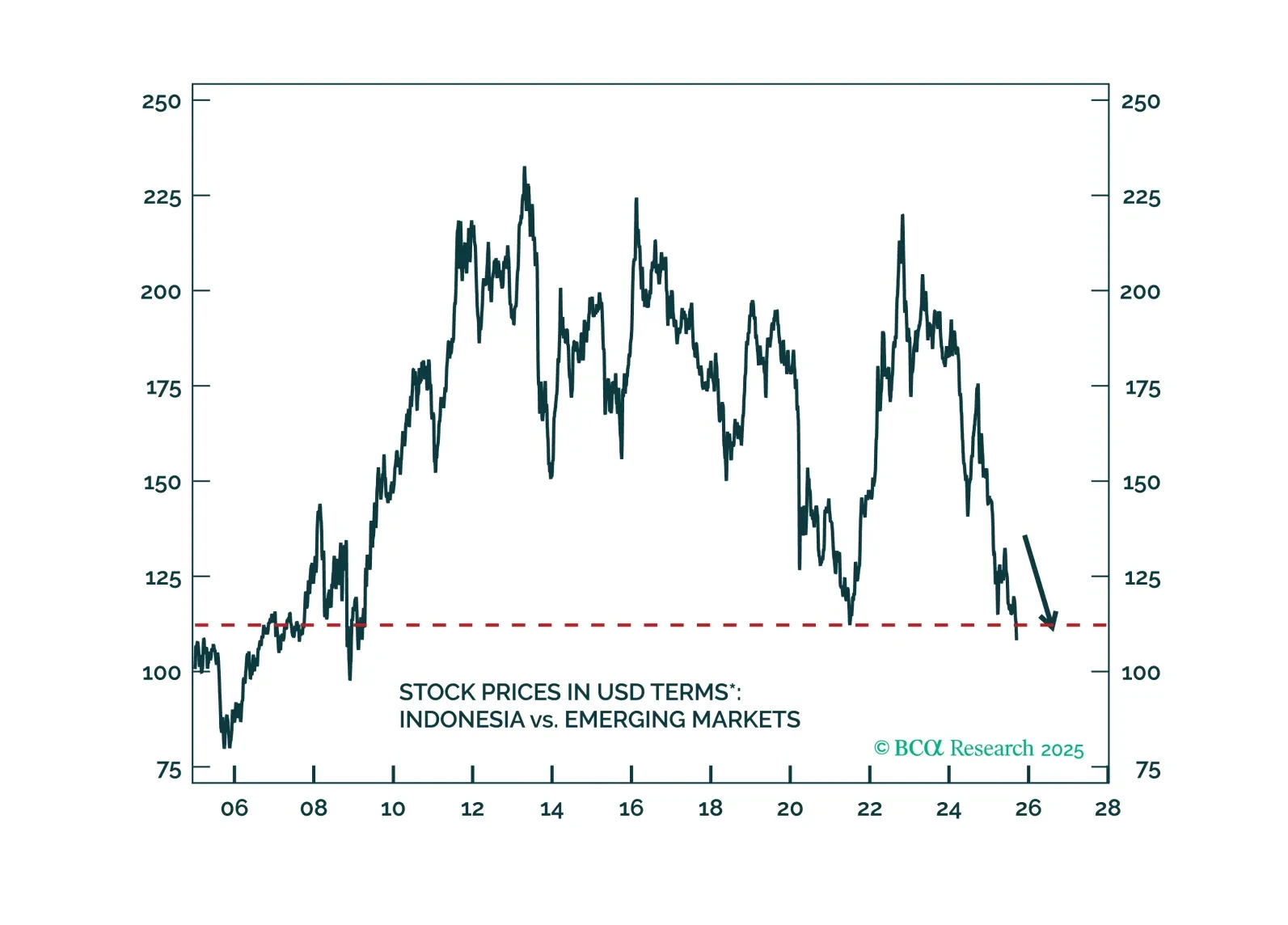

Indonesia’s policy easing will boost domestic demand, but fuel inflation. Current account deficit will widen, and the rupiah will weaken. Stay short the rupiah and go underweight Indonesian stocks, domestic bonds, and sovereign…

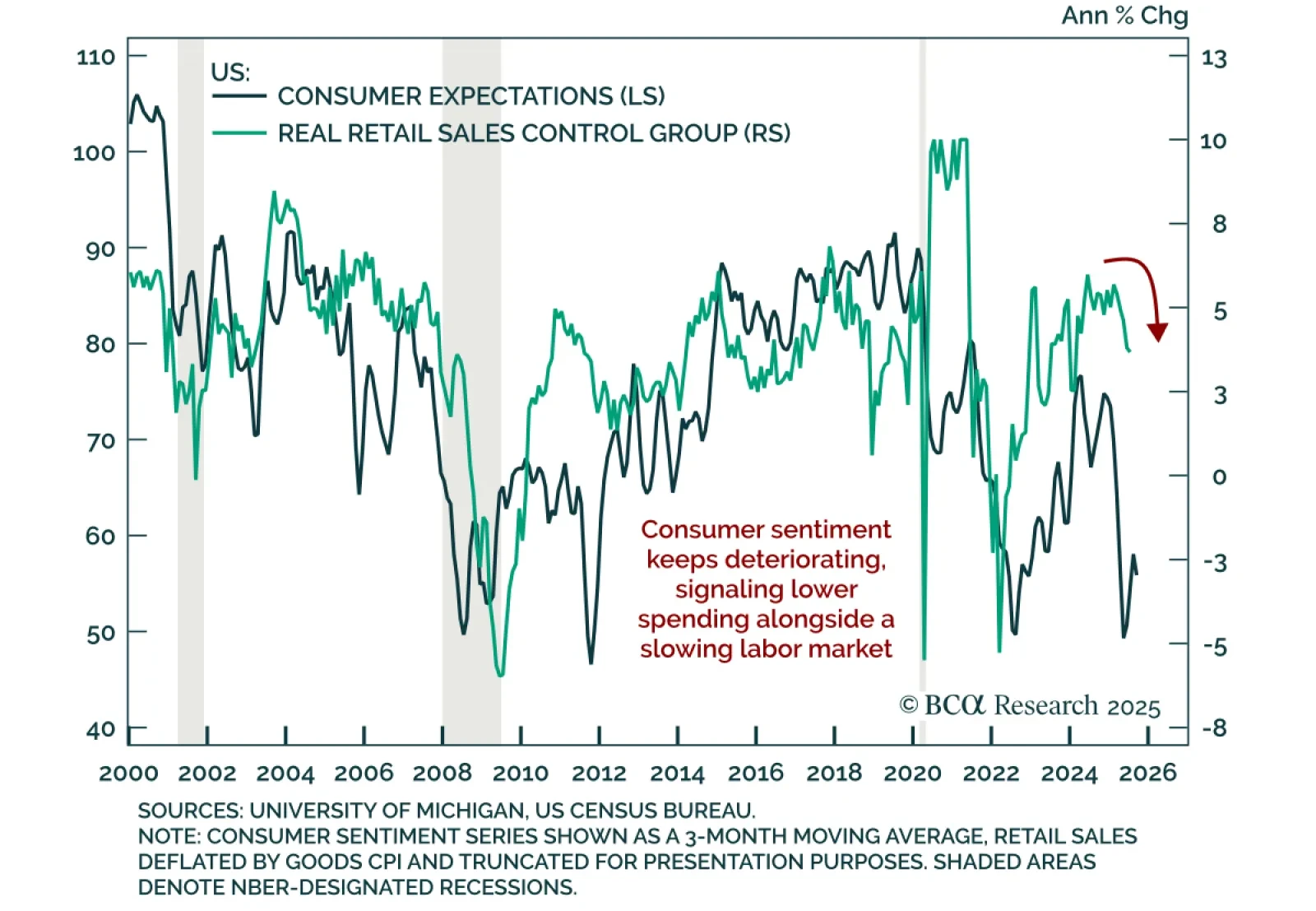

US consumer sentiment deteriorated in September, reinforcing signs of slowing consumption and supporting a defensive stance. The preliminary University of Michigan Consumer Sentiment Index dropped more than expected to 55.4 from 58.2…

While it is impossible to know exactly when global equities will peak, there are now enough vulnerabilities to justify keeping one’s finger near the eject button.

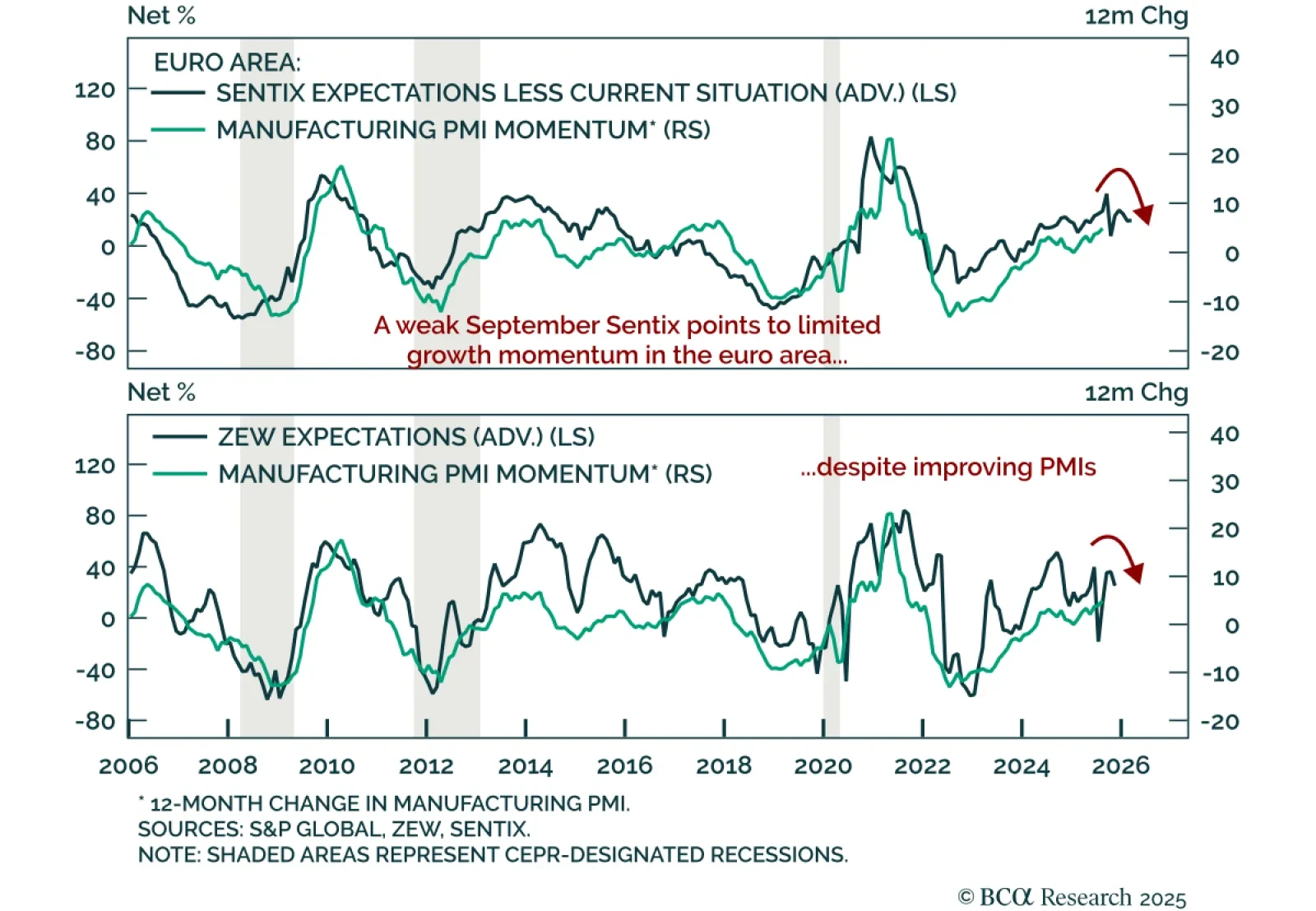

European sentiment continues to weaken, reinforcing the tactical case for US outperformance over Europe. The September Sentix Investor Confidence index fell to -9.2 from -3.7, defying expectations for an increase and signaling that…

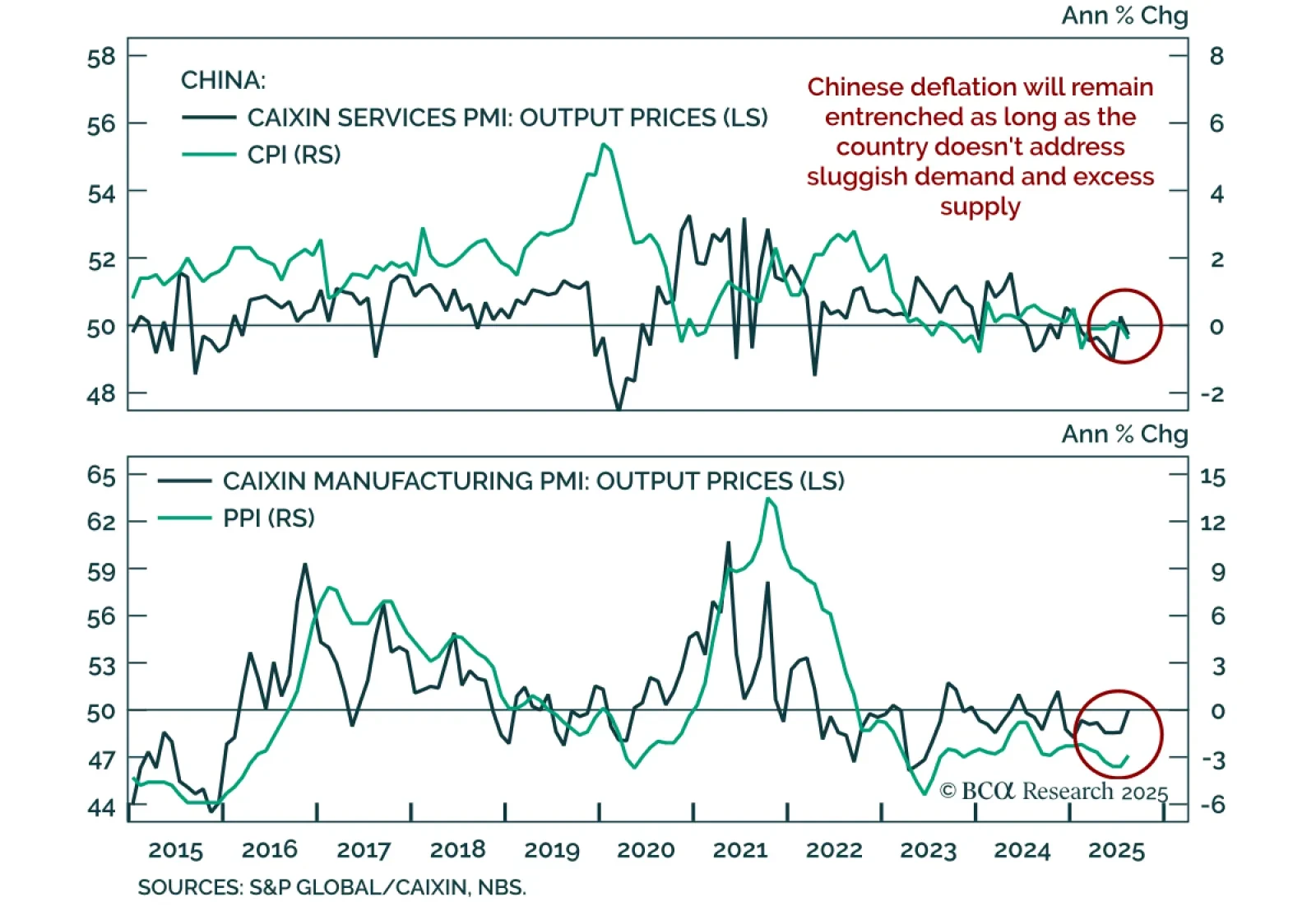

China’s August inflation data confirm entrenched deflation, reinforcing our overweight in onshore bonds and a tactical long in onshore small- and mid-caps versus large caps ahead of potential stimulus. Producer prices declined 2…

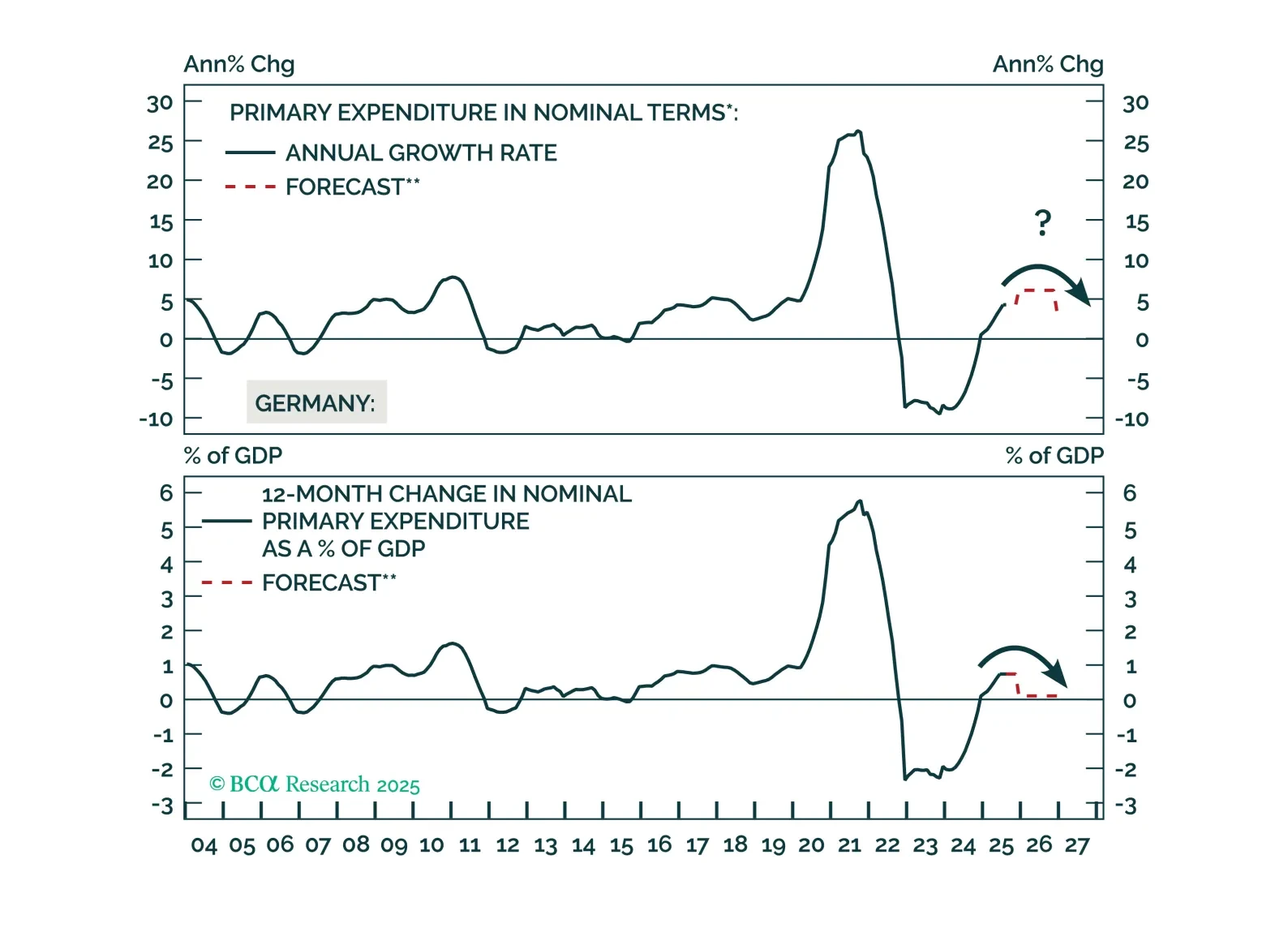

Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

Australia’s NAB survey shows underlying resilience, reinforcing our underweight on ACGBs and the case for AUD flatteners vs. CAD steepeners. The August survey was mixed, with current conditions improving to 7 from 5, while business…