Dear Clients, This is the final publication for the year. The Emerging Markets Strategy team wishes you a very happy holiday season and a prosperous New Year! Best regards, Arthur Budaghyan Highlights The recent EM outperformance…

Highlights A progressing Sino-U.S. trade truce, rallying commodities and EM FX as well as improving Swedish economic activity point to a respite in the global growth slowdown. This should support commodity currencies and cause a…

Highlights The dollar will continue to rally despite the trade truce agreed upon last weekend between U.S. President Donald Trump and China President Xi Jinping. Not only is this truce far from a permanent deal, but global growth…

Highlights Deep-seated economic and political forces will undermine the trade truce between China and the United States. U.S. economic momentum is strong enough to allow the Fed to deliver more rate hikes next year than what the…

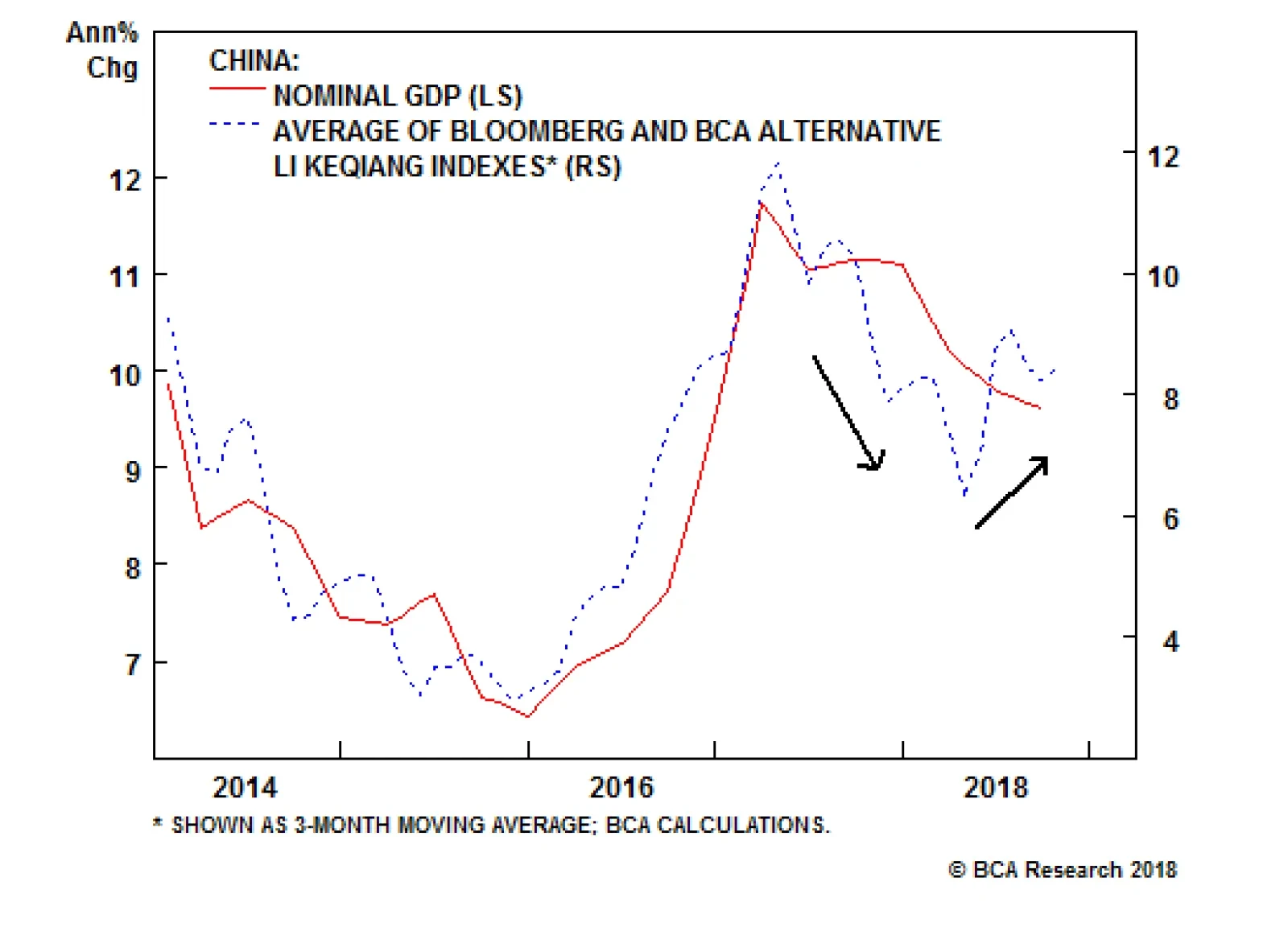

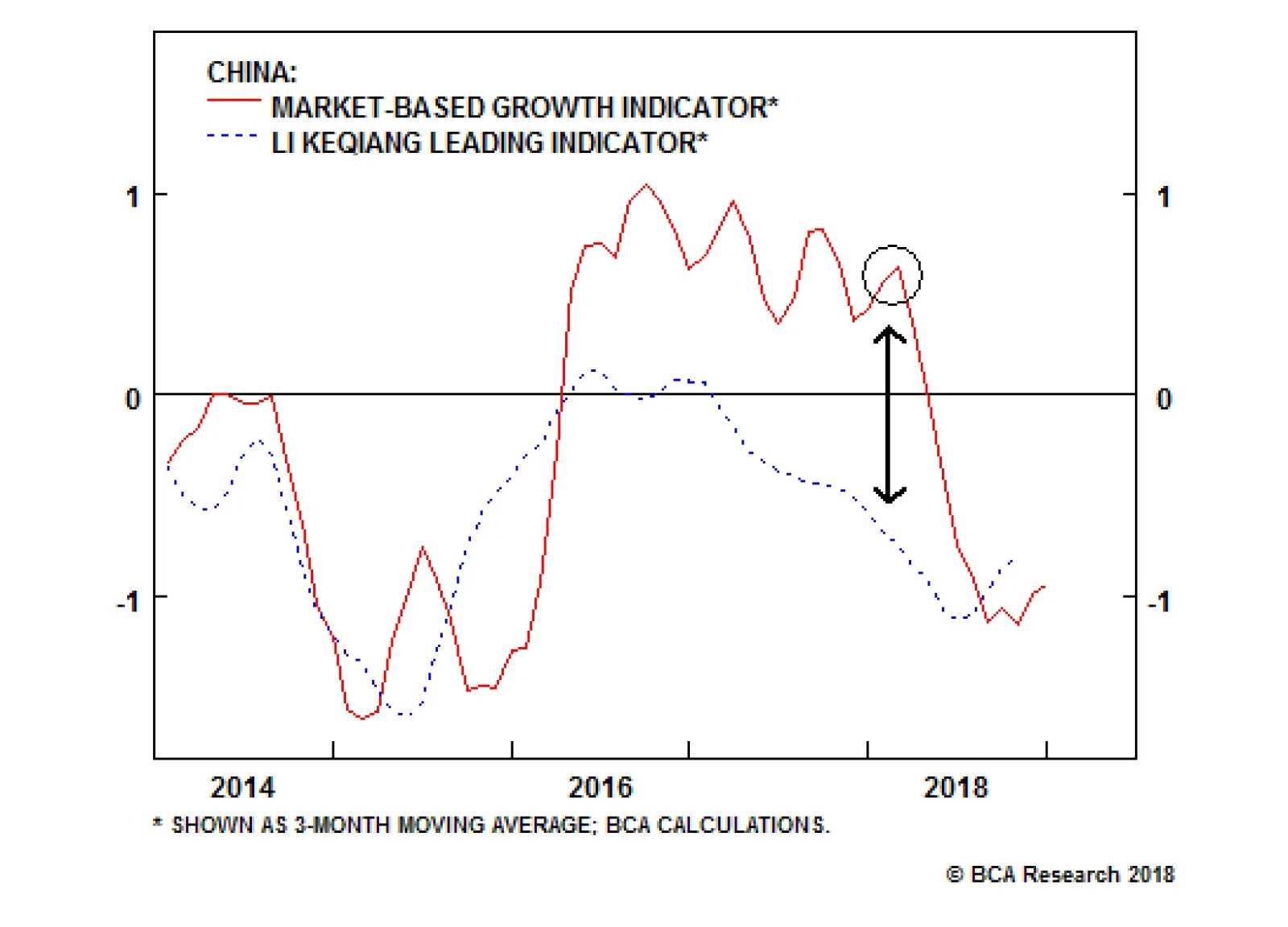

Earlier this year our EM, China, and geopolitical strategists highlighted that 2018 would be a year of weaker Chinese growth. This view has broadly panned out (see chart), although the trade war with the United States has…

Like in 2018, risk asset returns next year will be influenced by how much further the Chinese economy will slow and when it will ultimately bottom. Also like in 2018, the answers to these questions are subject to the battle…

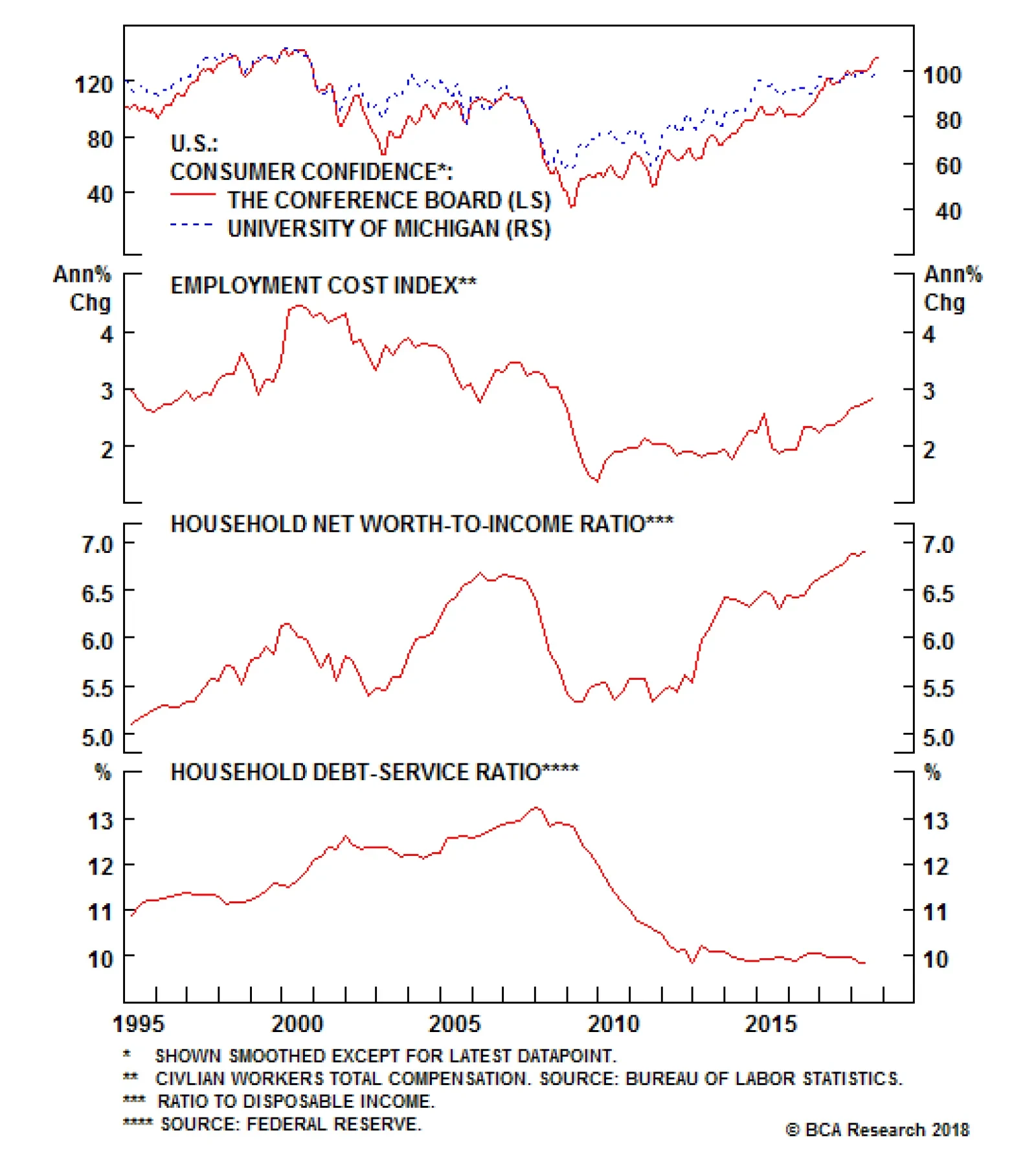

Although recent trends in housing have been disappointing, this sector is unlikely to contract much more from here. Unlike in 2006, the home vacancy rate and the level of inventory of homes both stand near record low levels.…

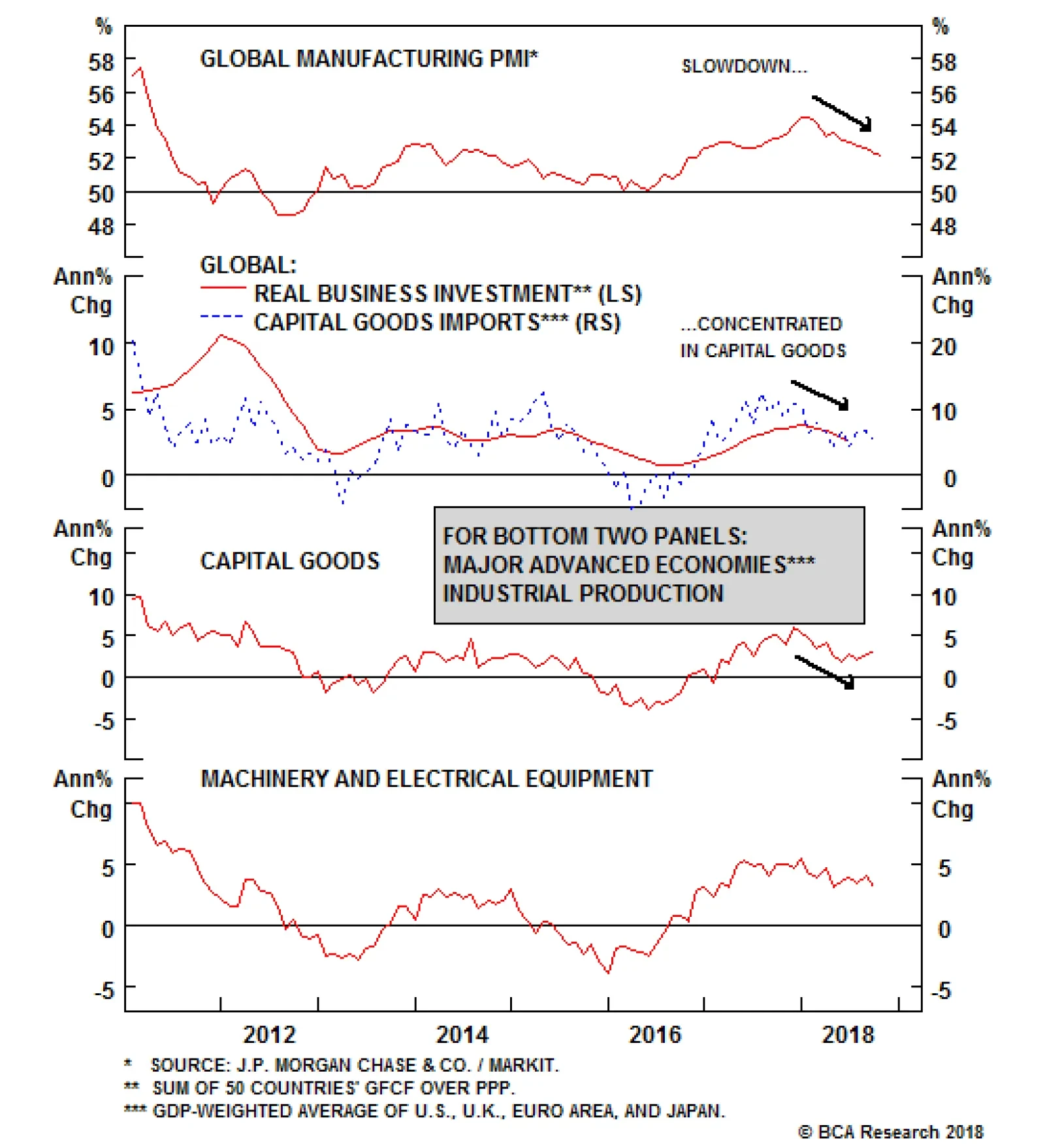

Several factors have weighed on business confidence outside the U.S. Among the chief worries, trade wars, a strong dollar, higher oil prices, emerging market turbulence, the return of Italian debt woes, and a slowdown in the…

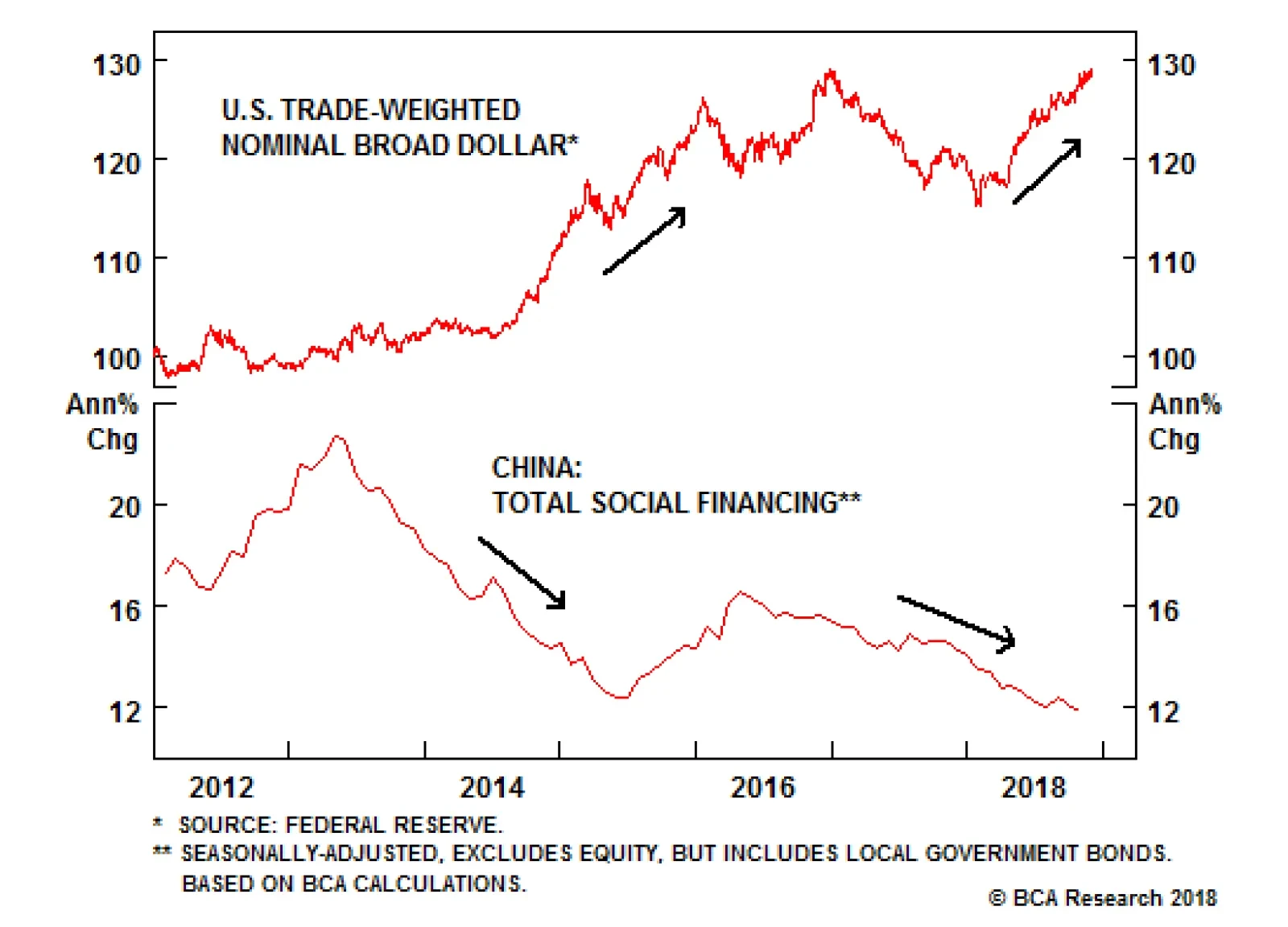

In 2014, the Fed was gearing up to raise rates while other central banks were still in full-out easing mode. The divergence in monetary policies between the U.S. and the rest of the world caused the U.S. dollar to surge. The…