Highlights The deceleration in global growth that began in 2018 is entering a transition phase. The bottoming out process could prove to be volatile, warning against betting the farm too early on pro-cyclical currencies. Tactical…

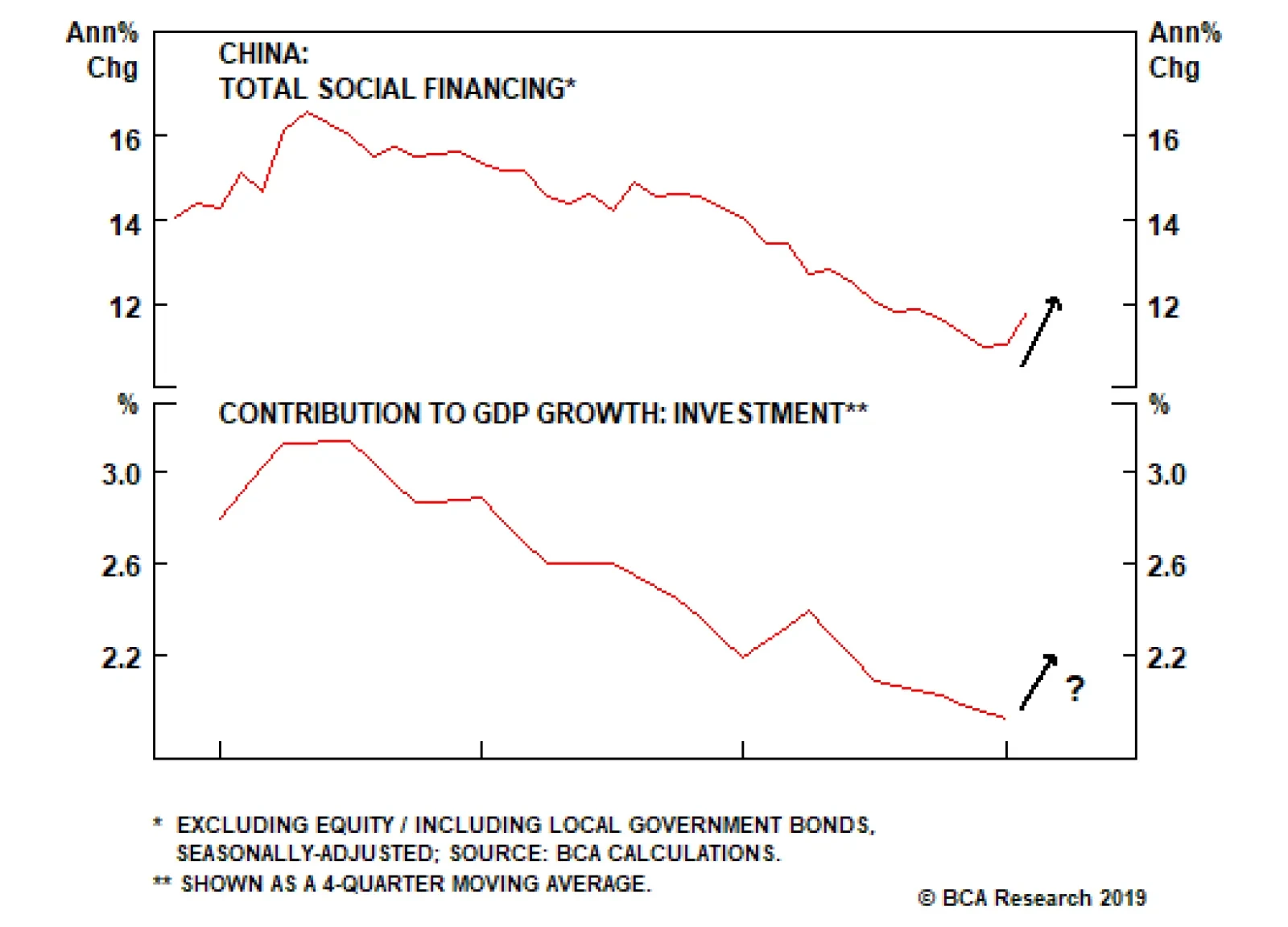

Fixed investment spending in China is generally financed through credit markets. The above chart shows that the contribution of investment spending to GDP growth has declined in tandem with decelerating credit growth. Chinese…

Highlights Analysis on Indonesia is available below. EM financial markets have diverged from the global growth indicators they have historically correlated with. This raises doubts about the sustainability of this rally. In China,…

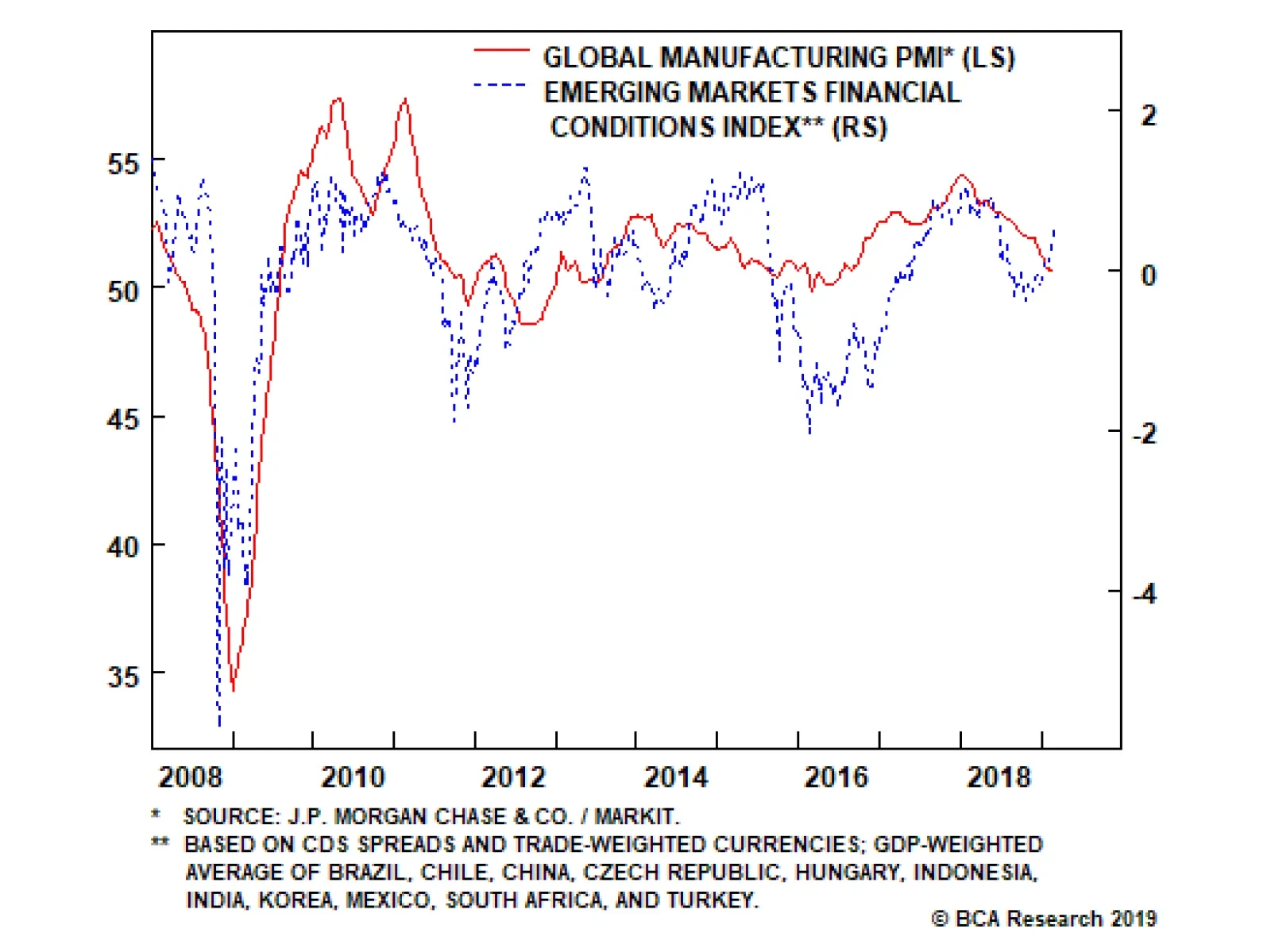

Global growth declined to 50.6 in February. This is not much of a surprise. The brutal sell off in markets in the fourth quarter of 2018 both anticipated this slowdown and worsened it as it tightened global financial conditions…

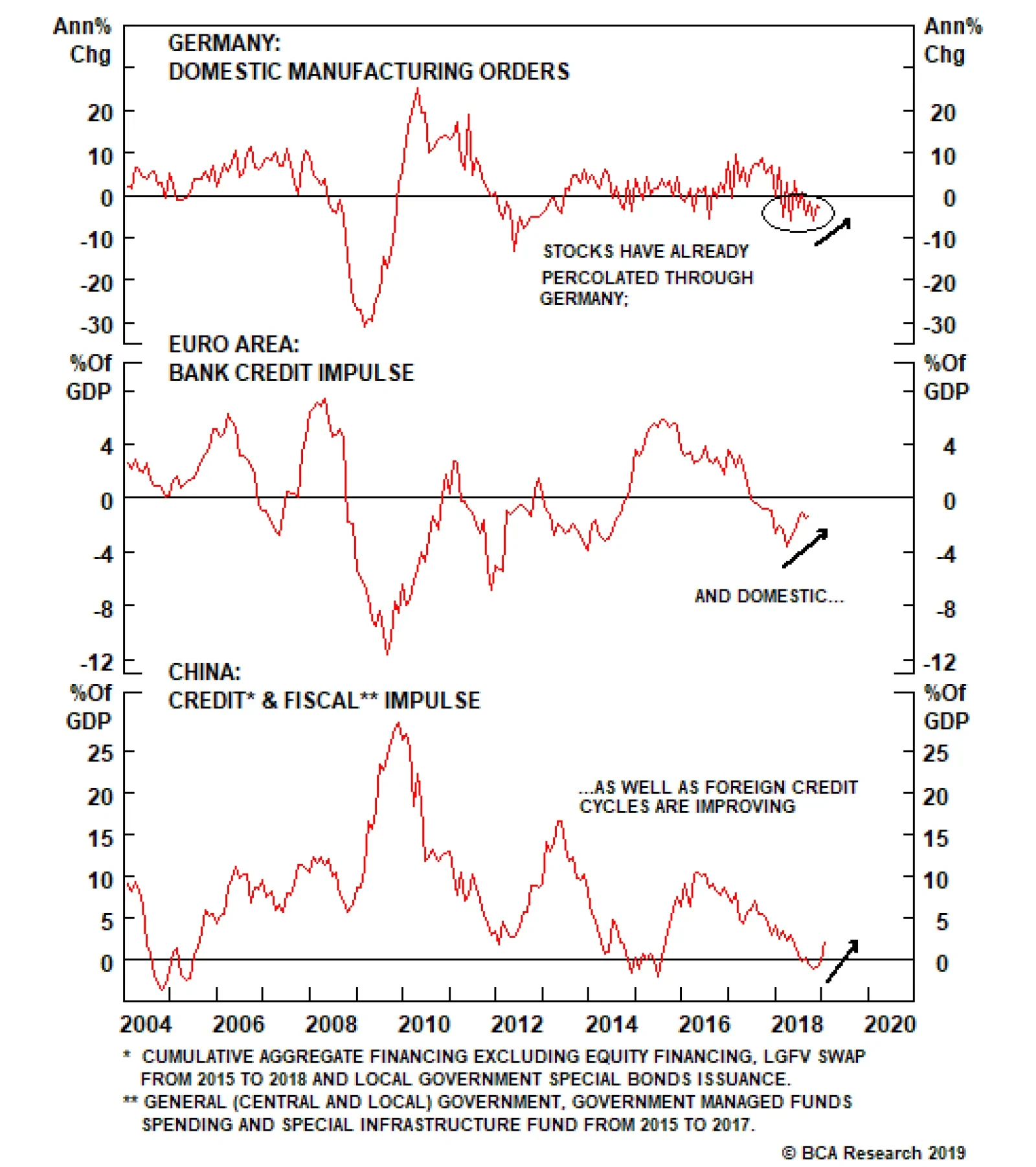

It is safe to say that the euro area is in a funk today: European real GDP growth dipped to a 1.1% annual rate in the fourth quarter of 2018, while industrial production has plunged by 3.9% on a year-on-year basis. But the…

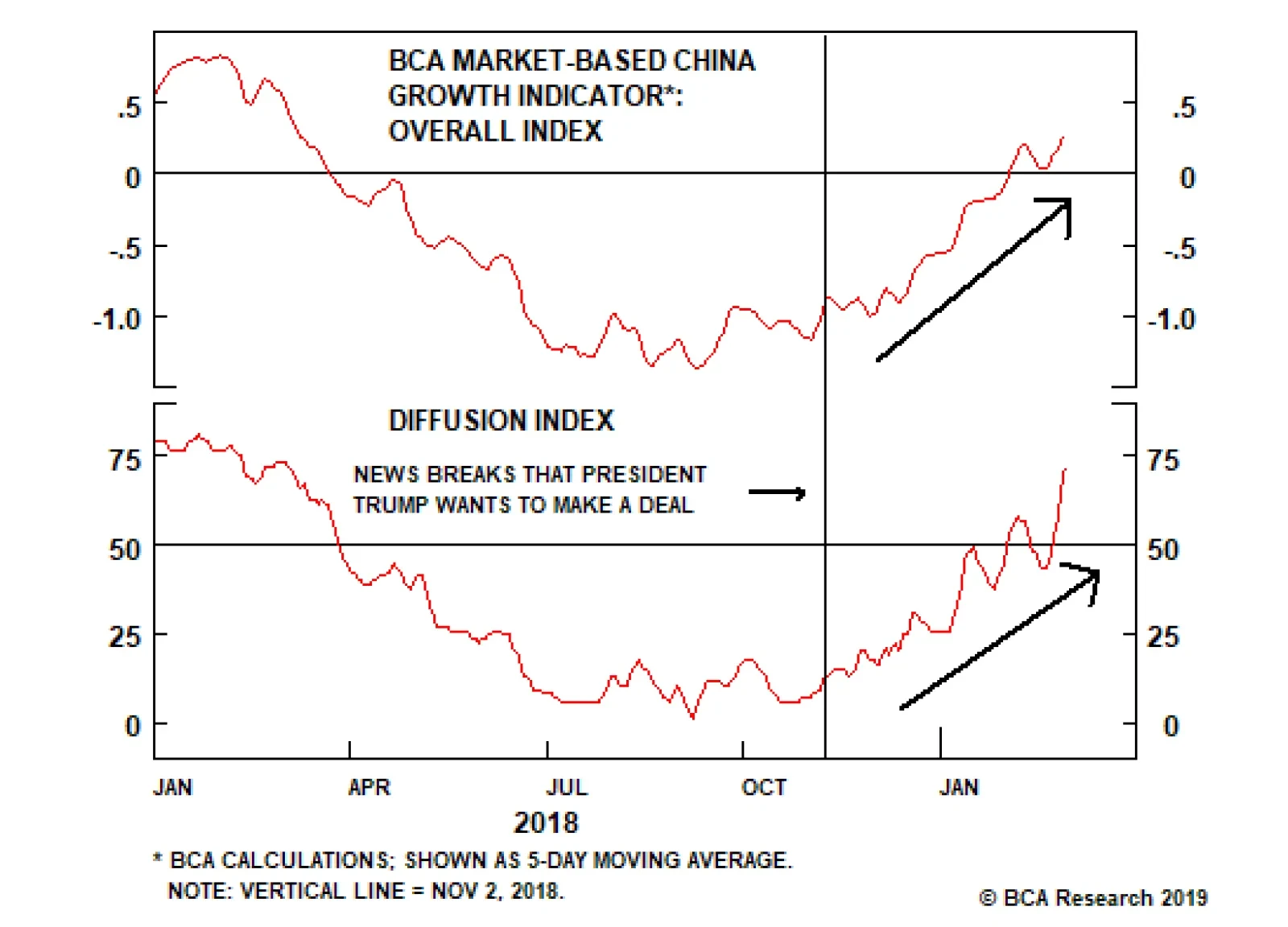

The chart above provides confirmation that trade talks have been the primary driver behind the rally in China-related assets. Both the BCA Market-Based China Growth Indicator and the diffusion index of its 17 components began to…

Highlights Fed: With financial conditions easing and core inflation more likely to rise than fall, the majority of Fed officials will feel justified lifting rates again in the second half of this year. The best way to position for the…