Highlights U.S. growth will soon rebound thanks to robust drivers of domestic activity, and strengthening money and credit trends. The U.S. Federal Reserve will maintain an easing bias and will expand its balance sheet again. A…

Highlights The U.K. economy has been holding up fairly well, despite the overhang of political uncertainty. However, even before the actual withdrawal of the U.K. from the E.U. has occurred, Brexit has left a lasting mark on the U.K.…

Dear Client, Owing to BCA’s 40th Annual Investment Conference in New York City next week, we will not be publishing a report on Friday, September 27. We will return to our regular publishing schedule on Friday, October 4, when we…

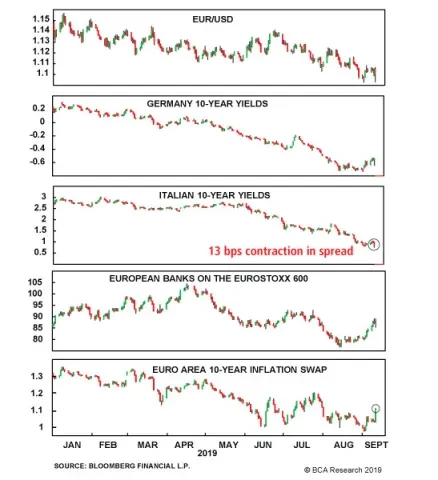

ECB President Mario Draghi managed to achieve his last “whatever it may take” moment. Interest rates on the ECB Deposit Facility have been cut to -0.5% from -0.4%, which is slightly less than traders anticipated.…

Highlights The fundamental backdrop continues to be mixed, but last week’s key data releases were encouraging on balance: While the U.S. manufacturing ISM survey entered contraction territory, and European manufacturing PMIs…

Highlights Global bond yields have closely tracked the trajectory of global growth. While the global economy remains fragile, some positive signs are emerging: Our global leading economic indicator has moved off its lows; global…

Highlights The lingering global manufacturing recession and the substantial drop in U.S. bond yields have been behind the decoupling between both EM stocks and the S&P 500, and cyclical and defensive equities. Neither the most…

As the summer holidays become a memory, central banks globally are mobilizing to fight mounting recession risks. More than 30 at last count are busily easing financial conditions to boost growth (Chart of the Week). Going into 4Q19, this…