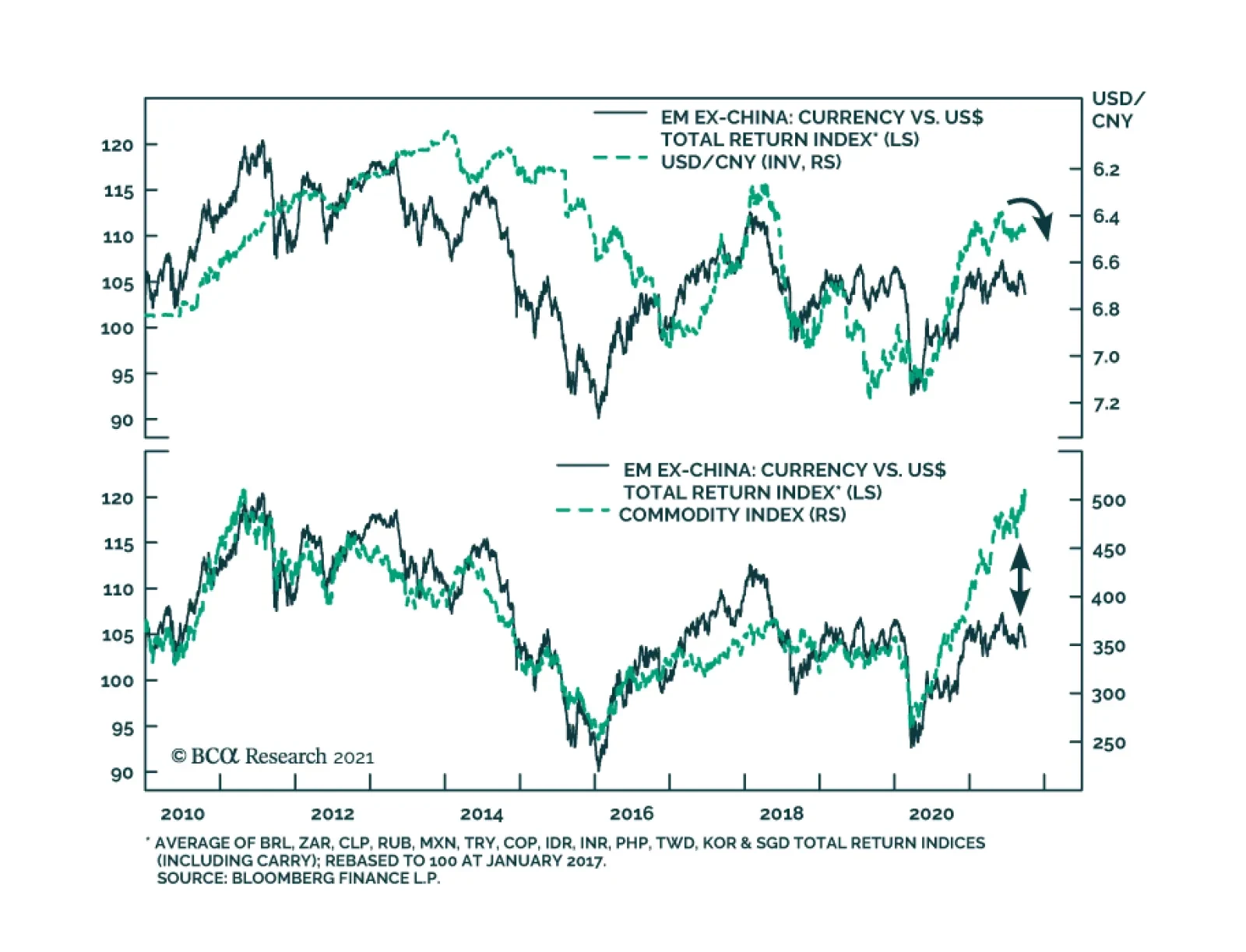

Emerging market currencies have recently rolled over in early-June and are depreciating sharply vis-à-vis the US dollar. Odds are that this downtrend will continue. On the domestic front, it is true that many Emerging Market…

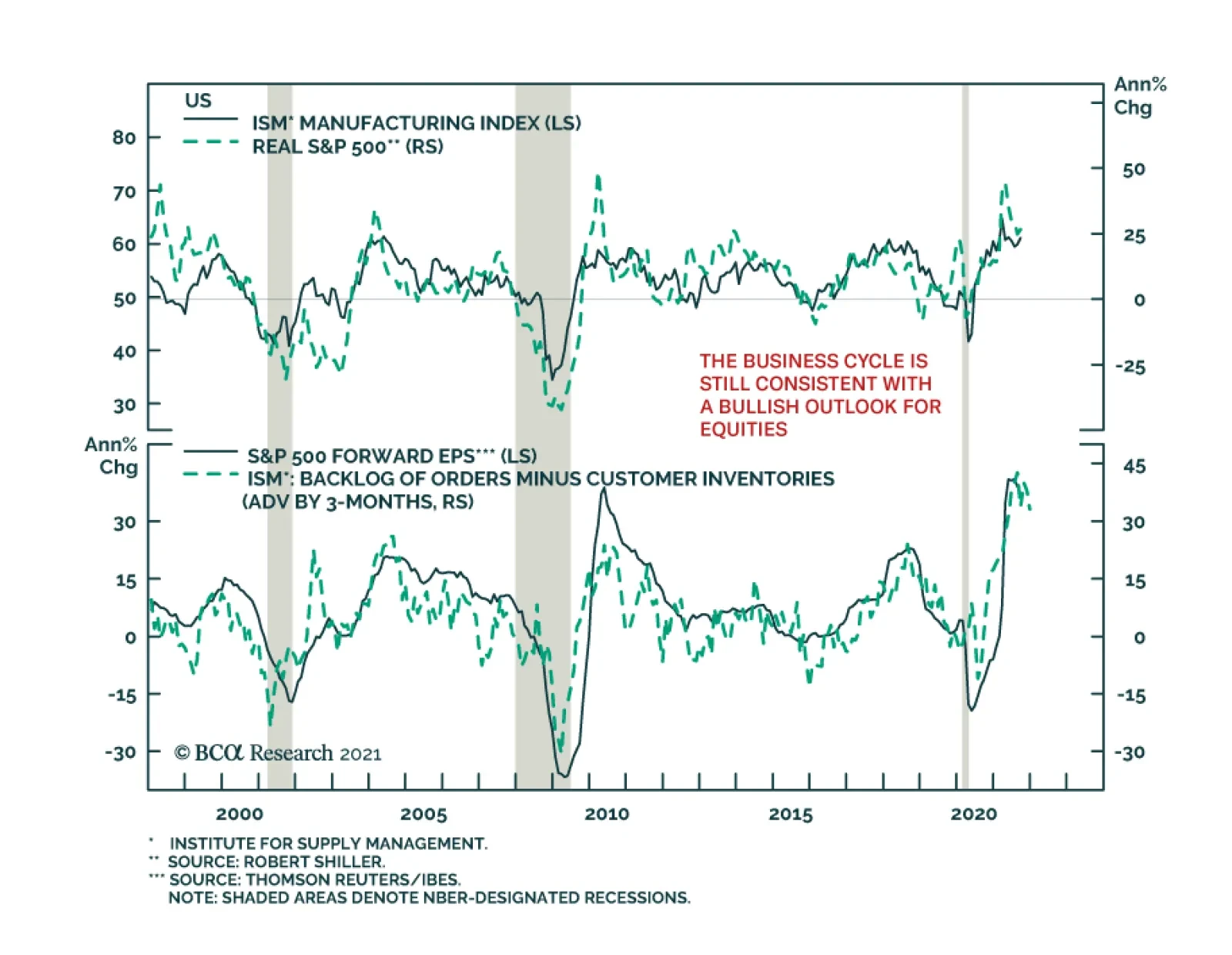

Both the ISM and Markit PMIs suggest that US manufacturing activity accelerated in September. The ISM index increased 1.2 points to a four-month high of 61.1, surprising expectations of a decline. Similarly, the Markit measure…

Highlights The fourth quarter will be volatile as China still poses a risk of overtightening policy and undermining the global recovery. US political risks are also elevated. A debt default is likely to be averted in the end. Fiscal…

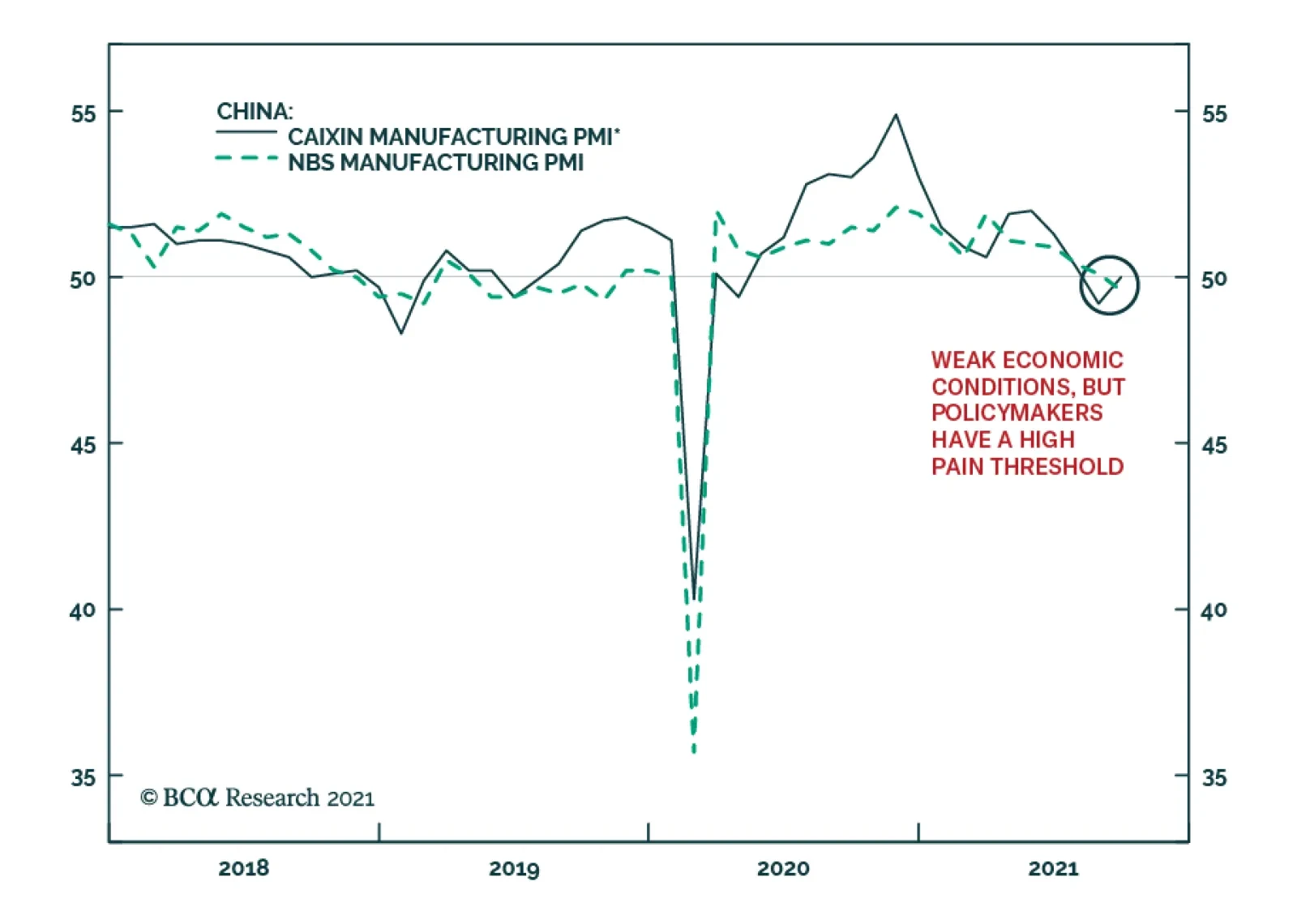

China’s NBS and Caixin Manufacturing PMIs sent a contradictory signal for September. The official manufacturing index slipped into contractionary territory after declining 0.5 points to 49.6. Consensus estimates anticipated a…

Highlights The global fight against the Delta variant of COVID-19 continued to show progress in the month of September, but not without cost. Growth in services activity slowed meaningfully, which has likely delayed the return to…

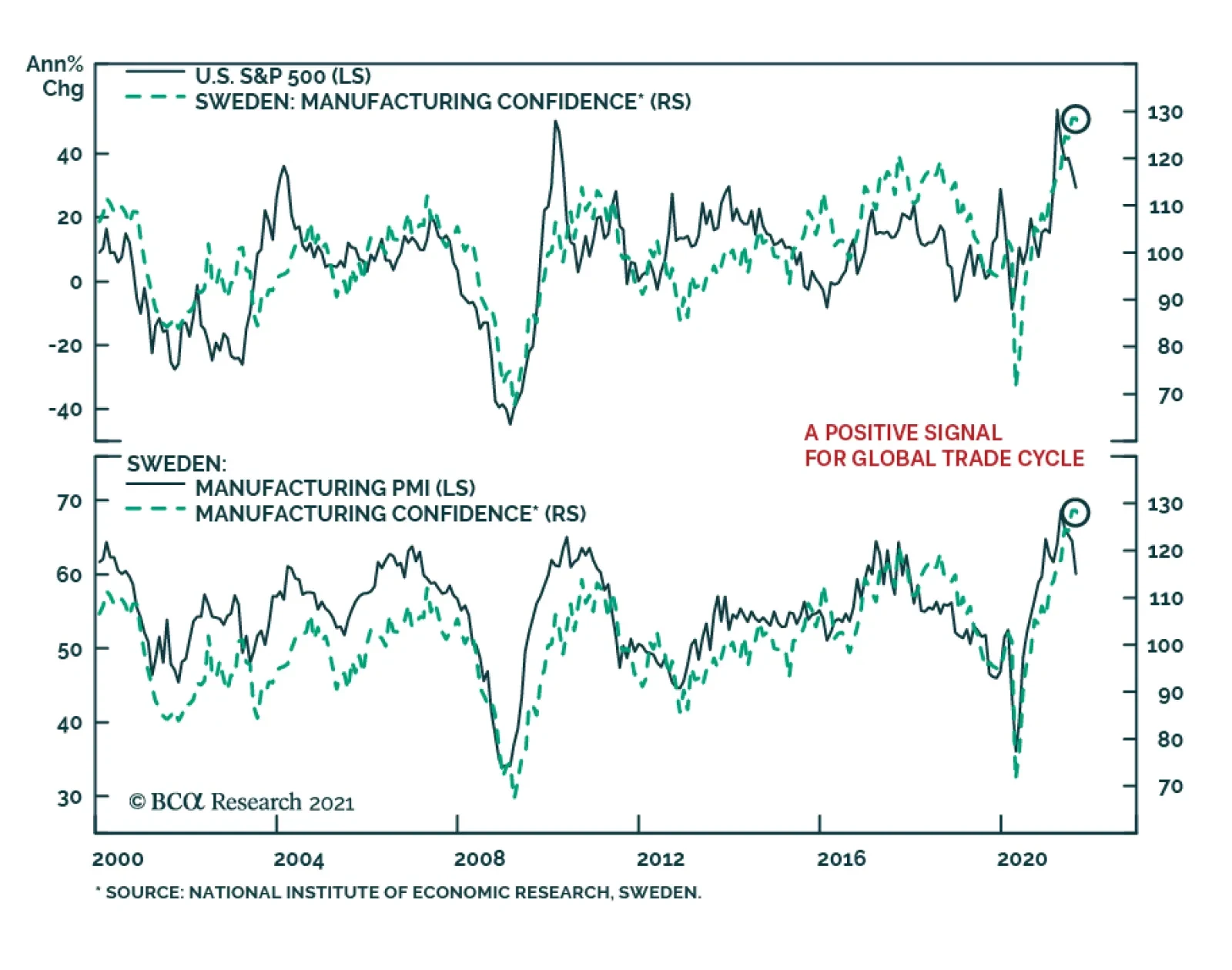

Results from Sweden’s September Economic Tendency survey were a minor disappointment. The headline indicator slipped 0.7 points to 119.9. The confidence indicators for both the manufacturing industry and consumer declined…

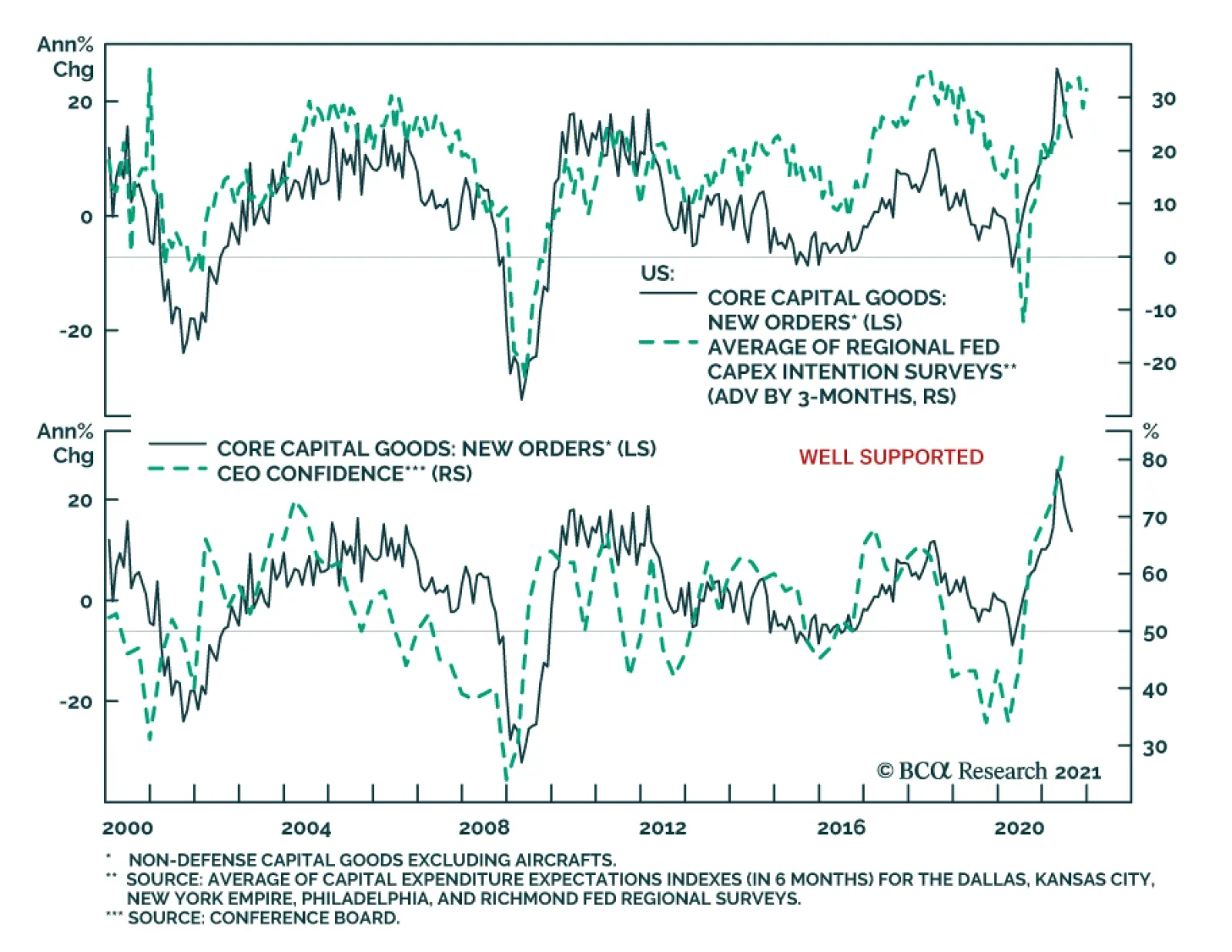

New orders for US durable goods grew 1.8% month-on-month to a record $263.5 billion in August. The increase follows an upwardly revised 0.5% and is more than double expectations of a 0.7% rise. However, a 5.5% month-on-month…

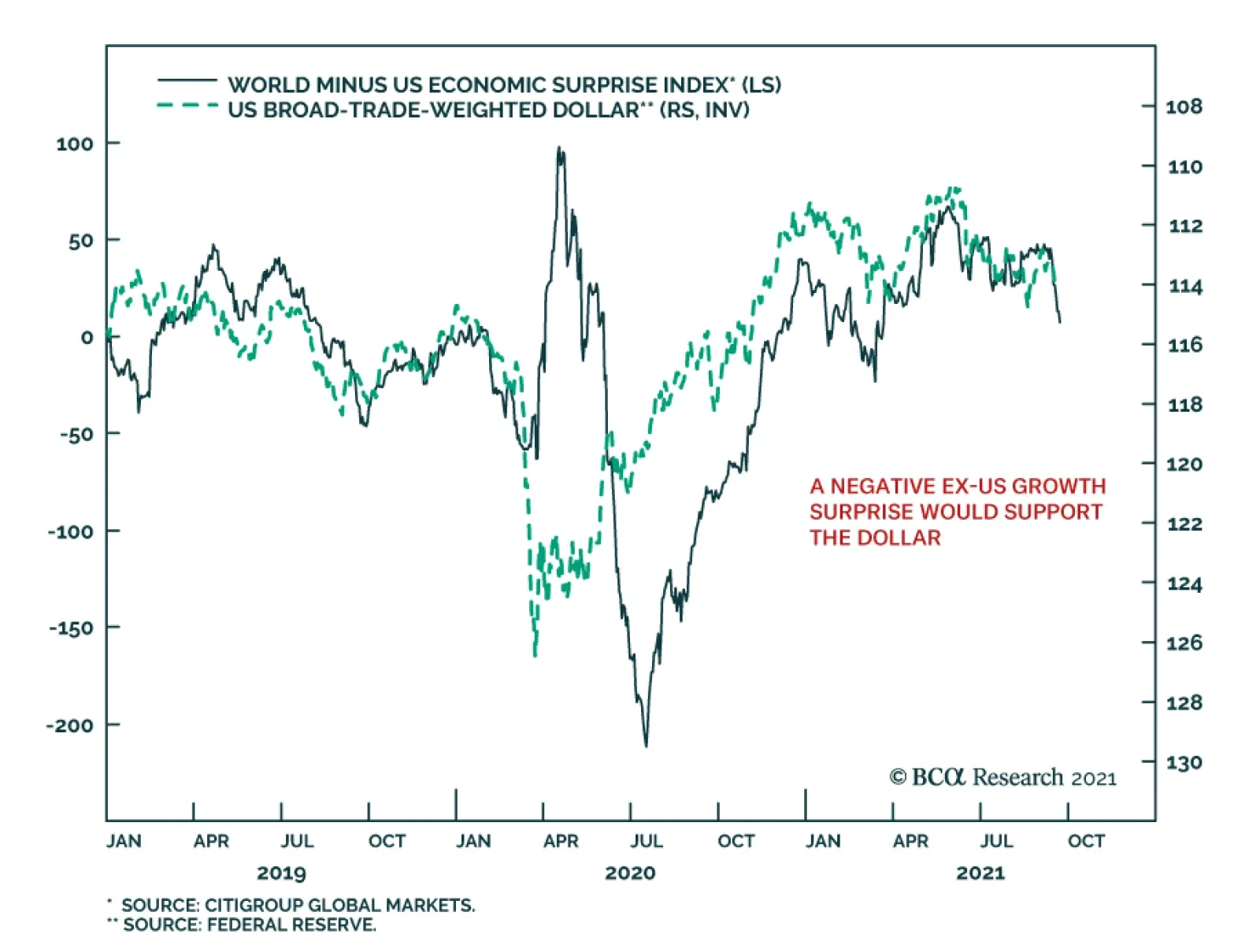

Although the US dollar has appreciated this year, our foreign exchange strategists highlight that from a big picture perspective, dynamics remain tilted against the dollar. True, the DXY is off its May low of 89.6. However, it…

Highlights Economy – We find the leading arguments for why households’ excess savings won’t be spent to be wanting: US households do not commonly demonstrate the detached foresight that Ricardian equivalence takes as…