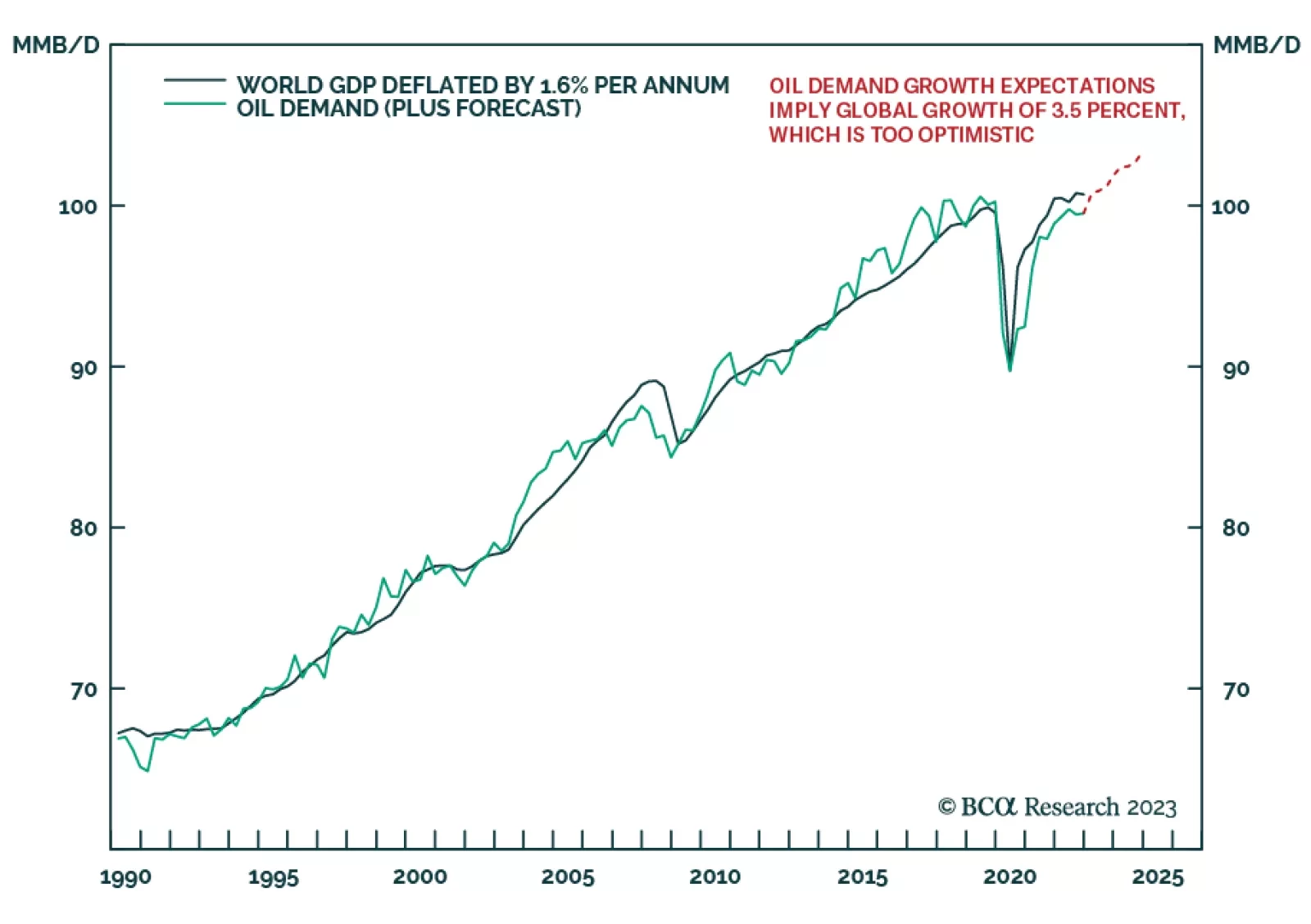

Our Counterpoint strategists believe that that the oil price has further downside, likely to a cycle low of $55 – because expectations for oil demand growth through 2023-24 are much too optimistic. Oil demand tracks…

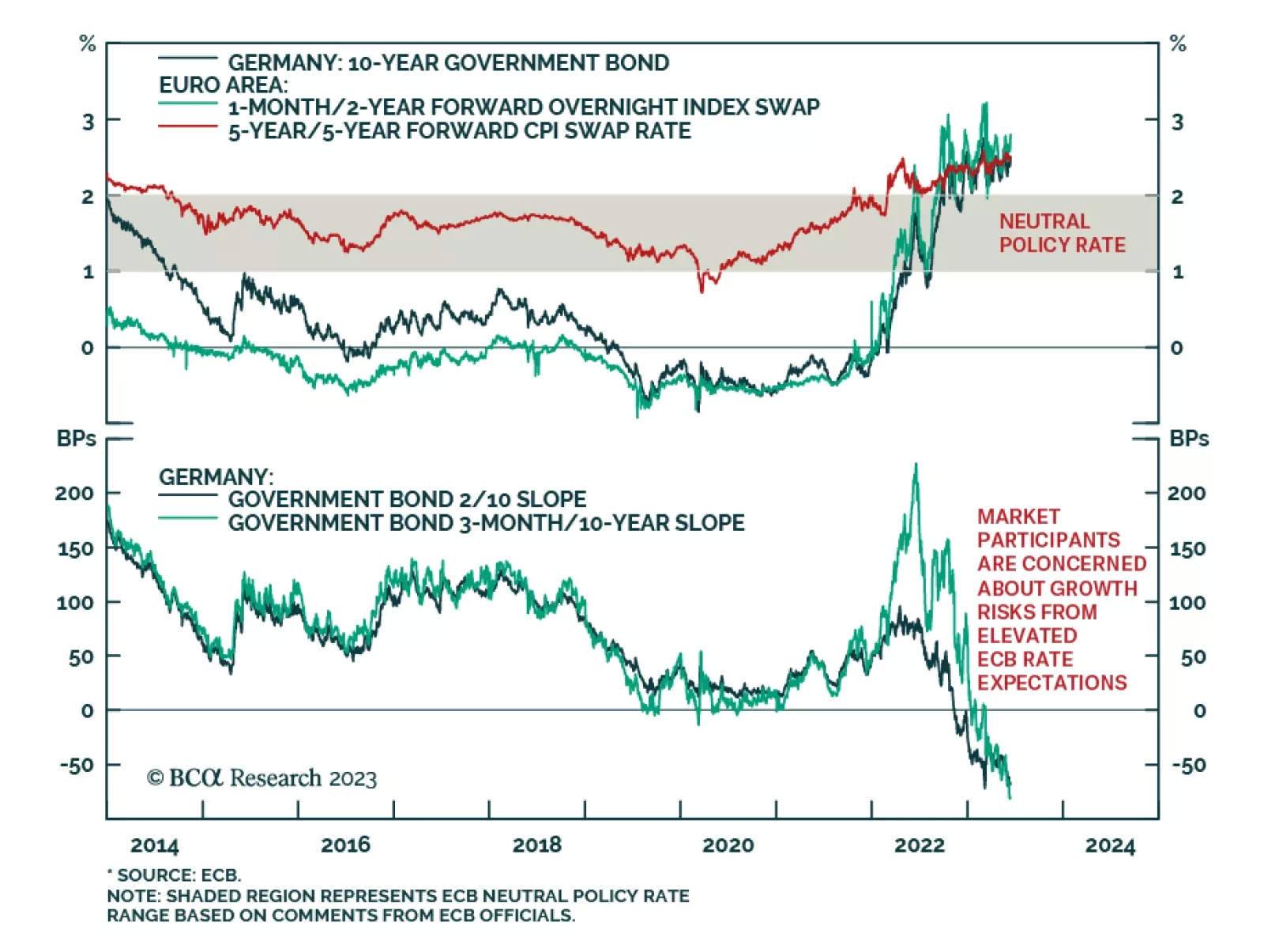

As expected, the European Central Bank (ECB) delivered a 25bps rate hike on Thursday, raising the policy rate to 3.5% — the highest since August 2001. Moreover, the central bank maintained a hawkish bias, signaling…

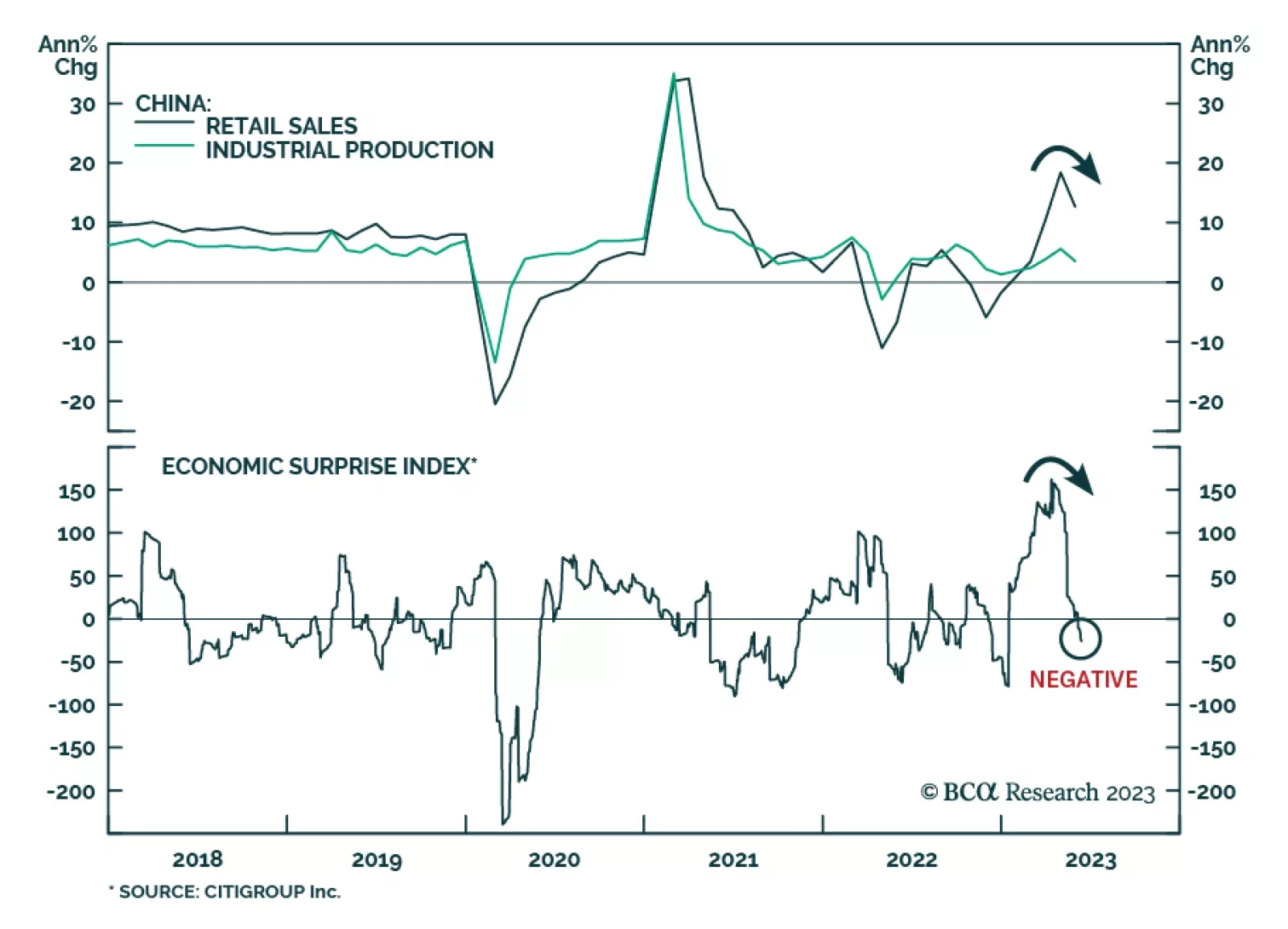

China’s economic data releases for May fell below consensus estimates. The 7.2% y/y contraction in property investment in the first five months of the year was worse than the expected 6.7% decline. The deceleration in…

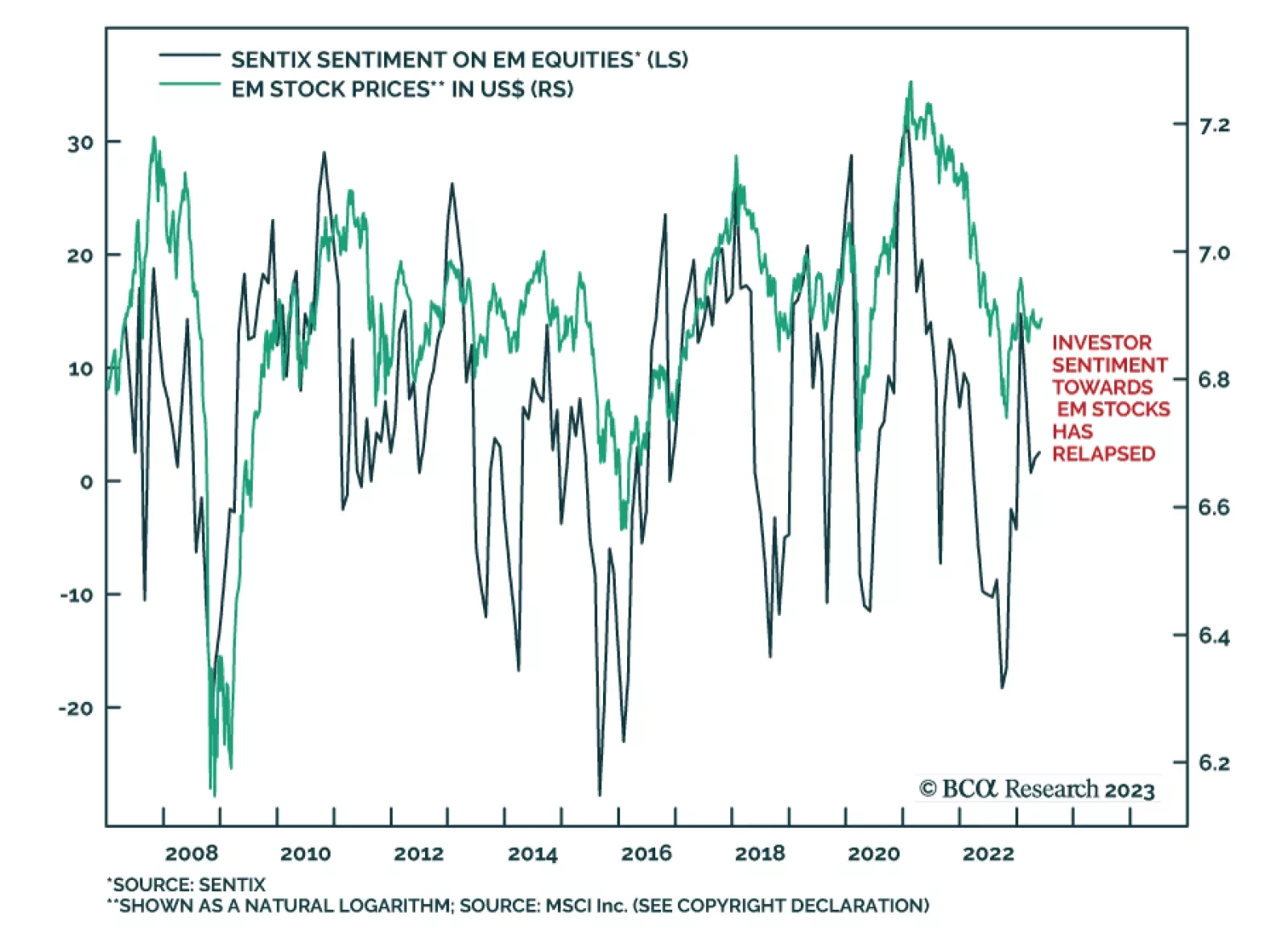

After a brief period of outperformance in late-2022/early-2023, Emerging Market stocks have been underperforming their Developed Market counterparts since January 19. While the DM equity benchmark is up 6.9% over this period, the…

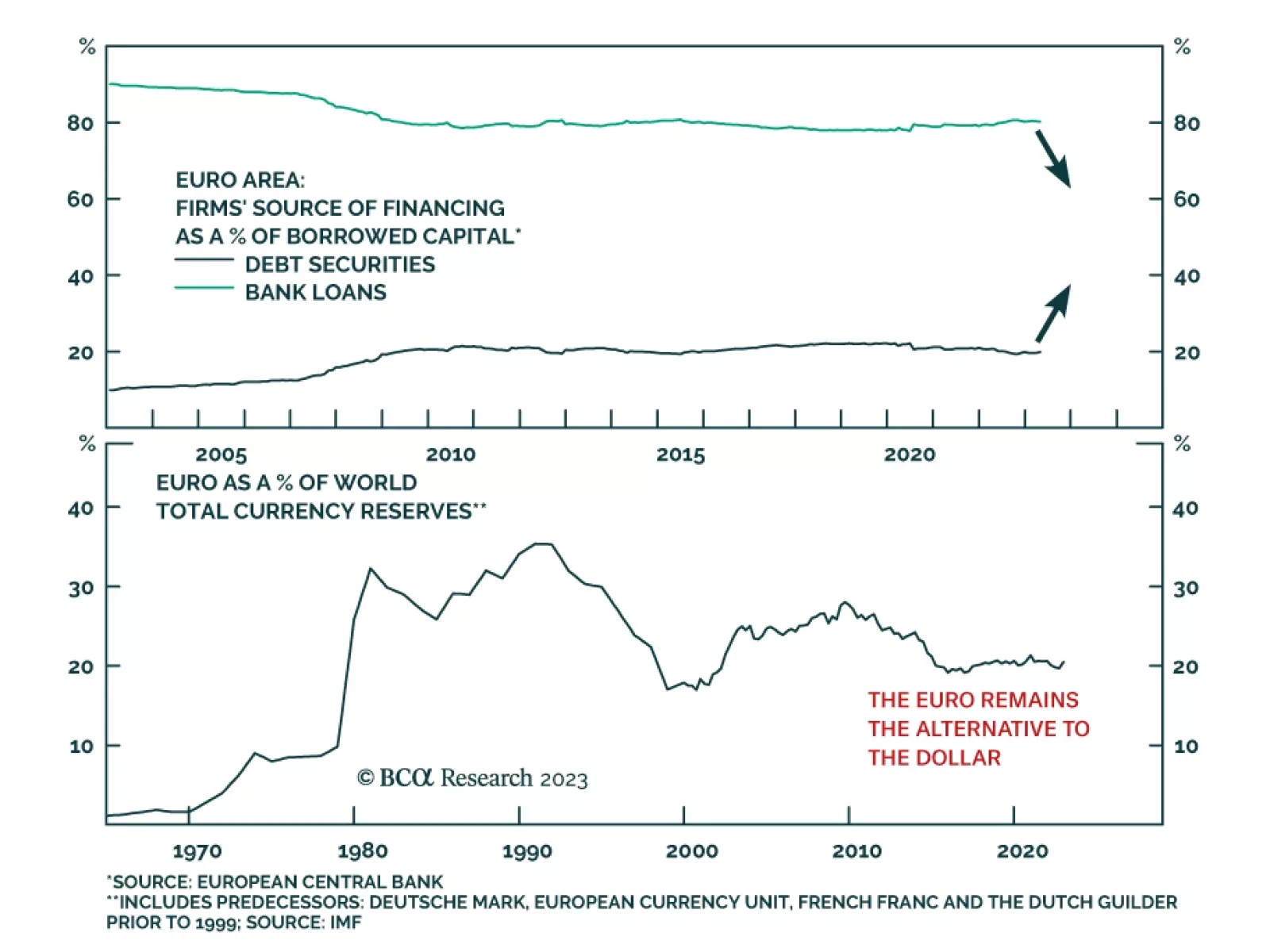

According to BCA Research’s European Investment Strategy service, although the ECB faces important challenges in the coming year, its success in maintaining price stability and in preserving the euro’s integrity are…

In this report, we follow up on the upgrade to our US duration stance from last week with a review of our rates views and government bond allocations outside the US. We conclude that while we now find US Treasuries to be more…

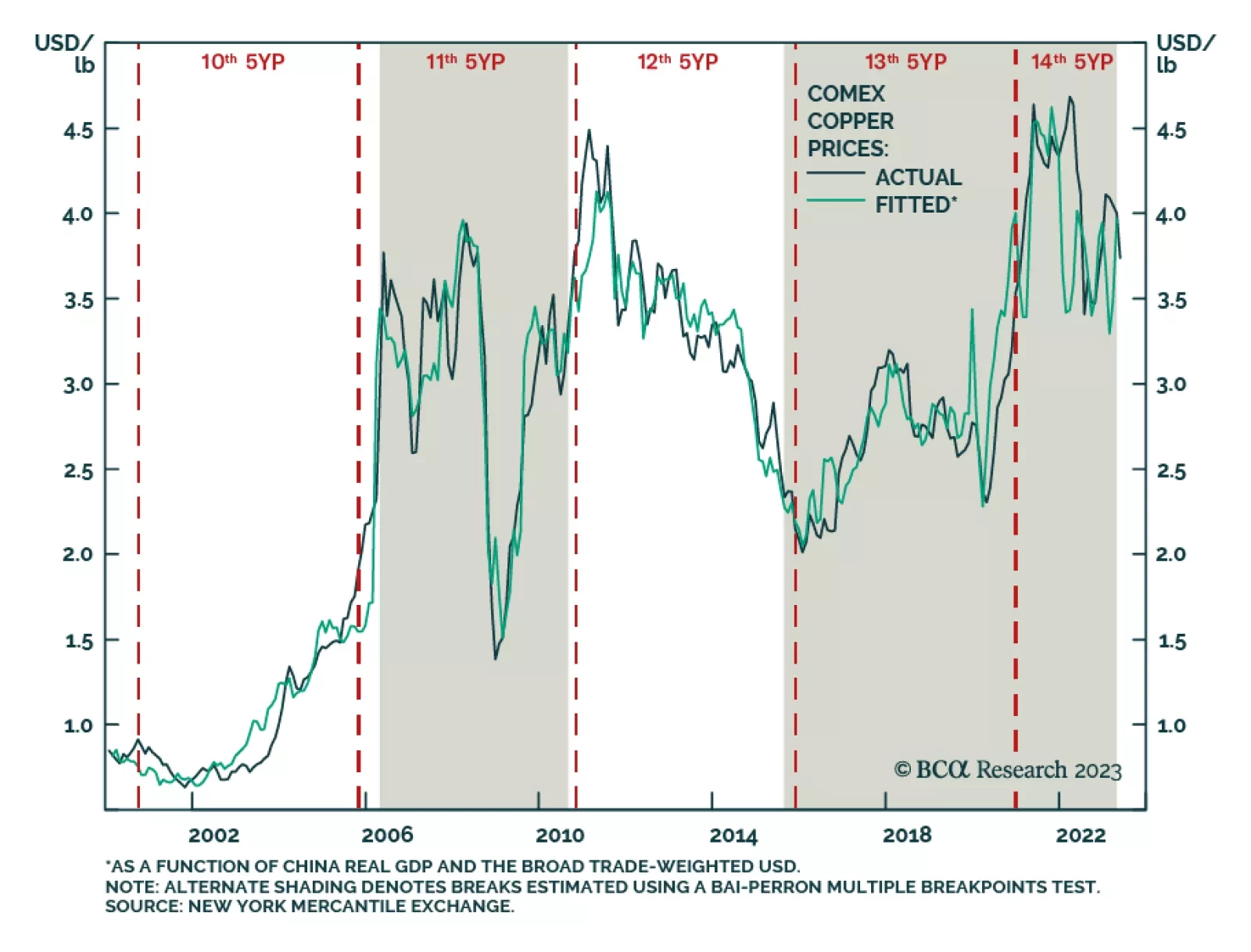

Our colleagues in BCA's Commodity & Energy Strategy (CES) service expect the Chinese Communist Party (CCP) to announce a new round of policy stimulus to re-boot the economy, in an effort to escape a prolonged liquidity…