Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

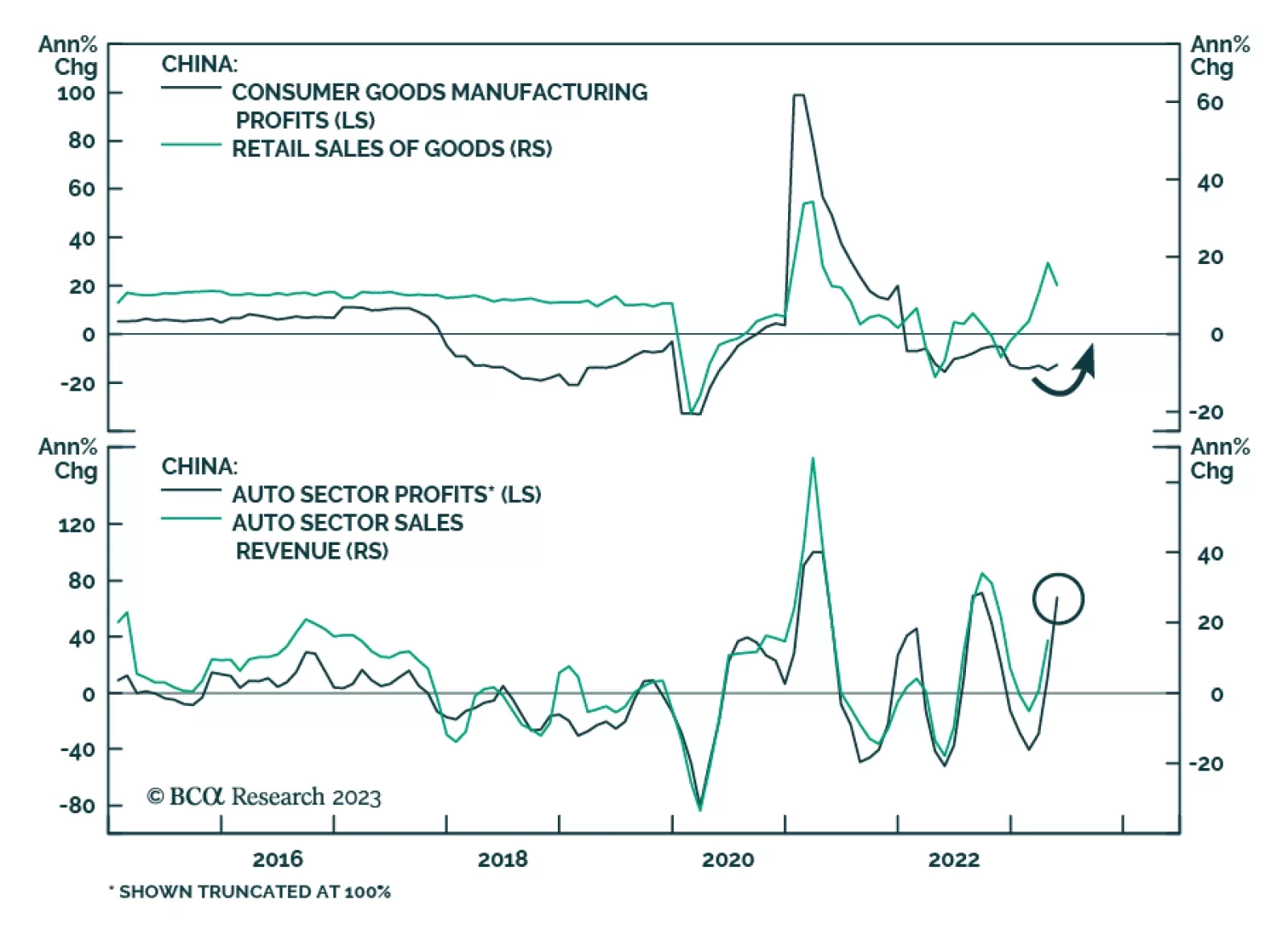

According to BCA Research’s China Investment Strategy service, although the recovery in overall Chinese industrial profits will be subdued, there will be a silver lining among China’s consumer goods producers, autos…

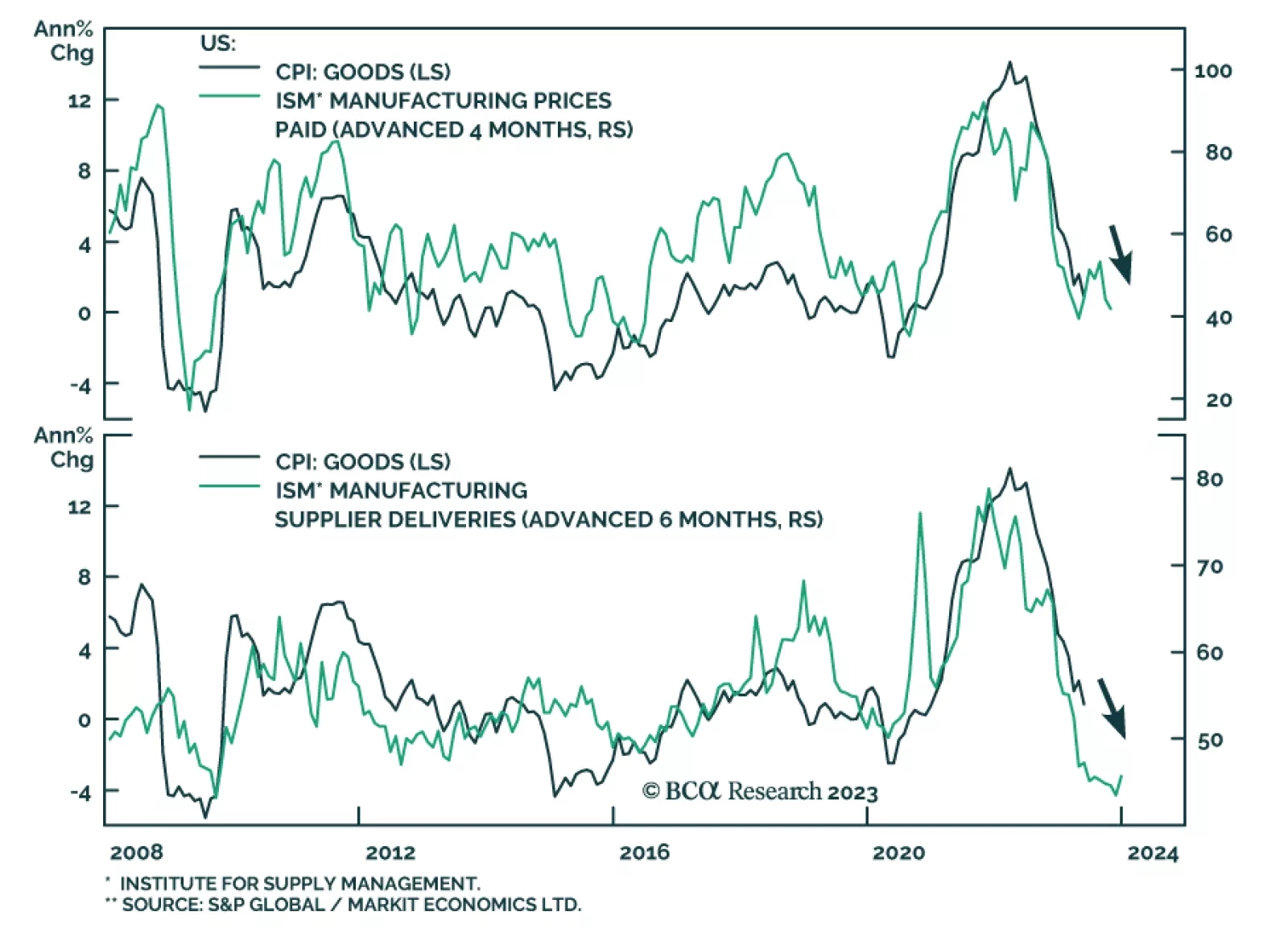

The ISM PMI sent a pessimistic signal about US manufacturing conditions in June. The headline index dropped 0.9 points to a 3-year low of 46.0 – it eighth consecutive month below the 50 boom-bust line. This is consistent…

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.

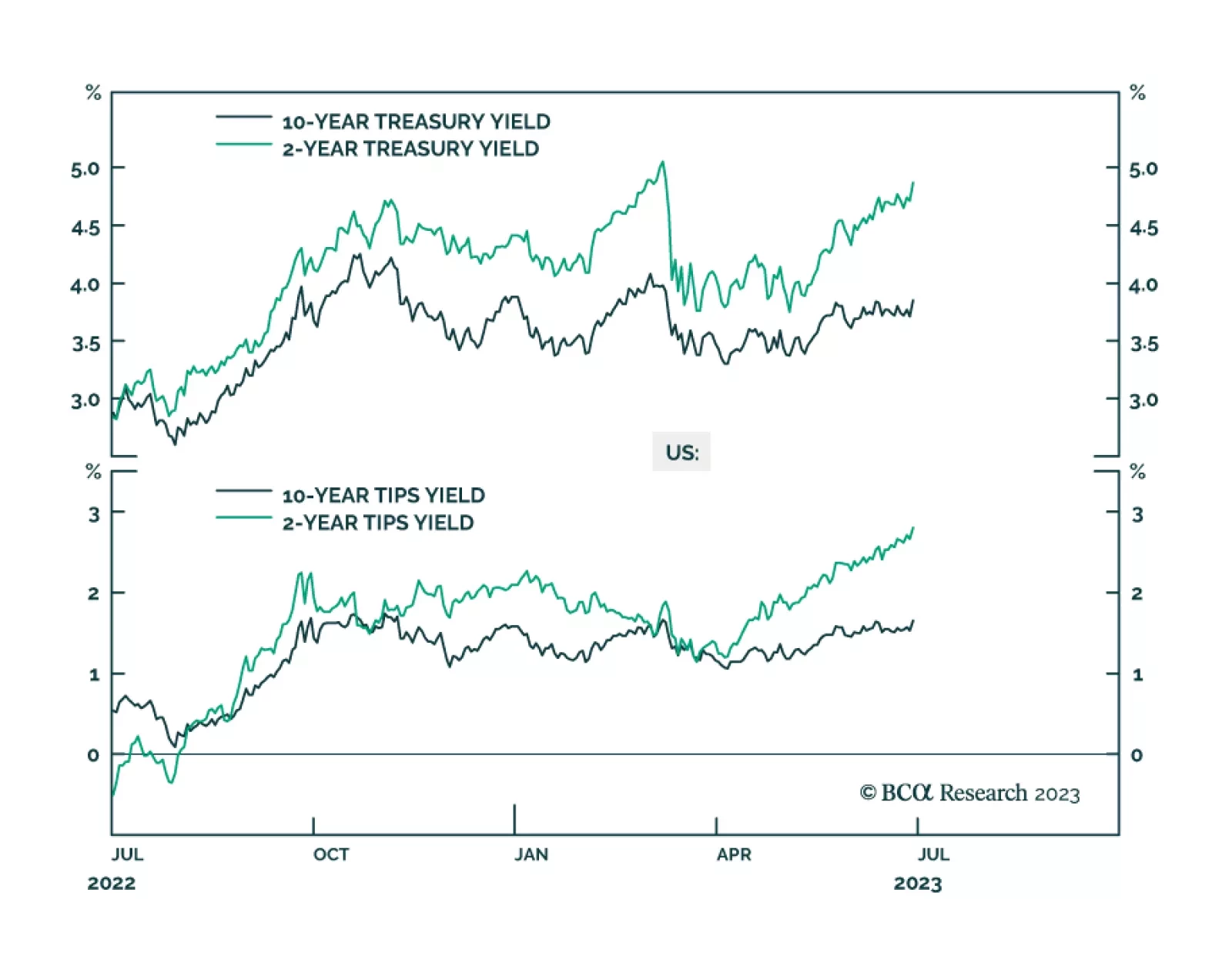

Our US Bond Strategy service responds to recent data releases which showed that real economic growth and the labor market are surprisingly resilient, while inflation pressures continued to decline. The 10-year Treasury yield…

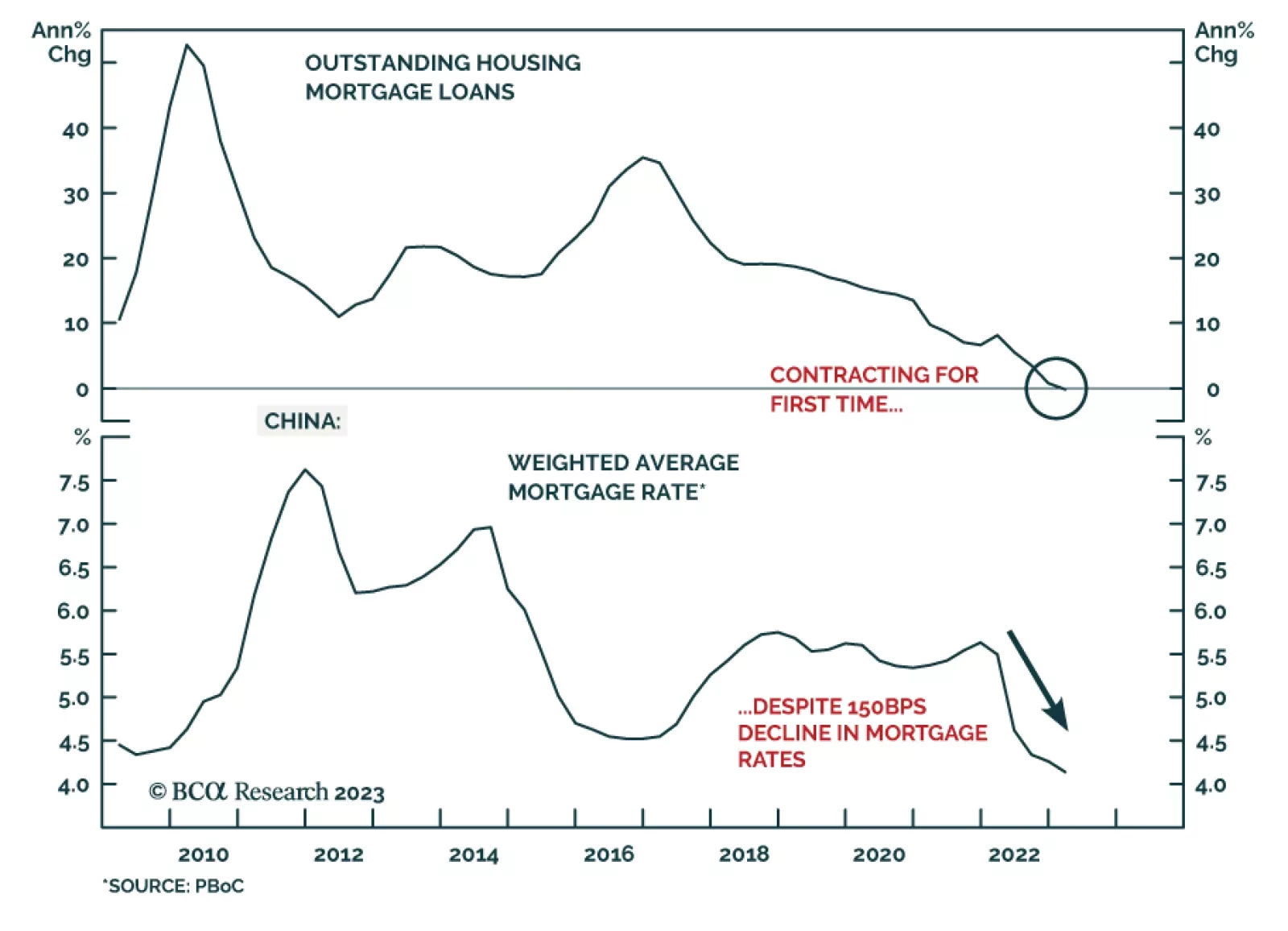

In a recently published report, our China Investment Strategy team revisited the issue of a liquidity trap in China. A liquidity trap is a condition that occurs when lower borrowing costs are unable to boost credit demand and…

In Section I, we reiterate why a soft economic landing remains improbable in the US. Some reasonable estimates of the level of excess savings point to their depletion in a year’s time, but other estimates indicate a much earlier end…

The combination of a global manufacturing recession and tight/tightening policy is raising a red flag for global non-TMT stocks. In China, households are entering a liquidity trap, and deflationary pressures are heightening.…