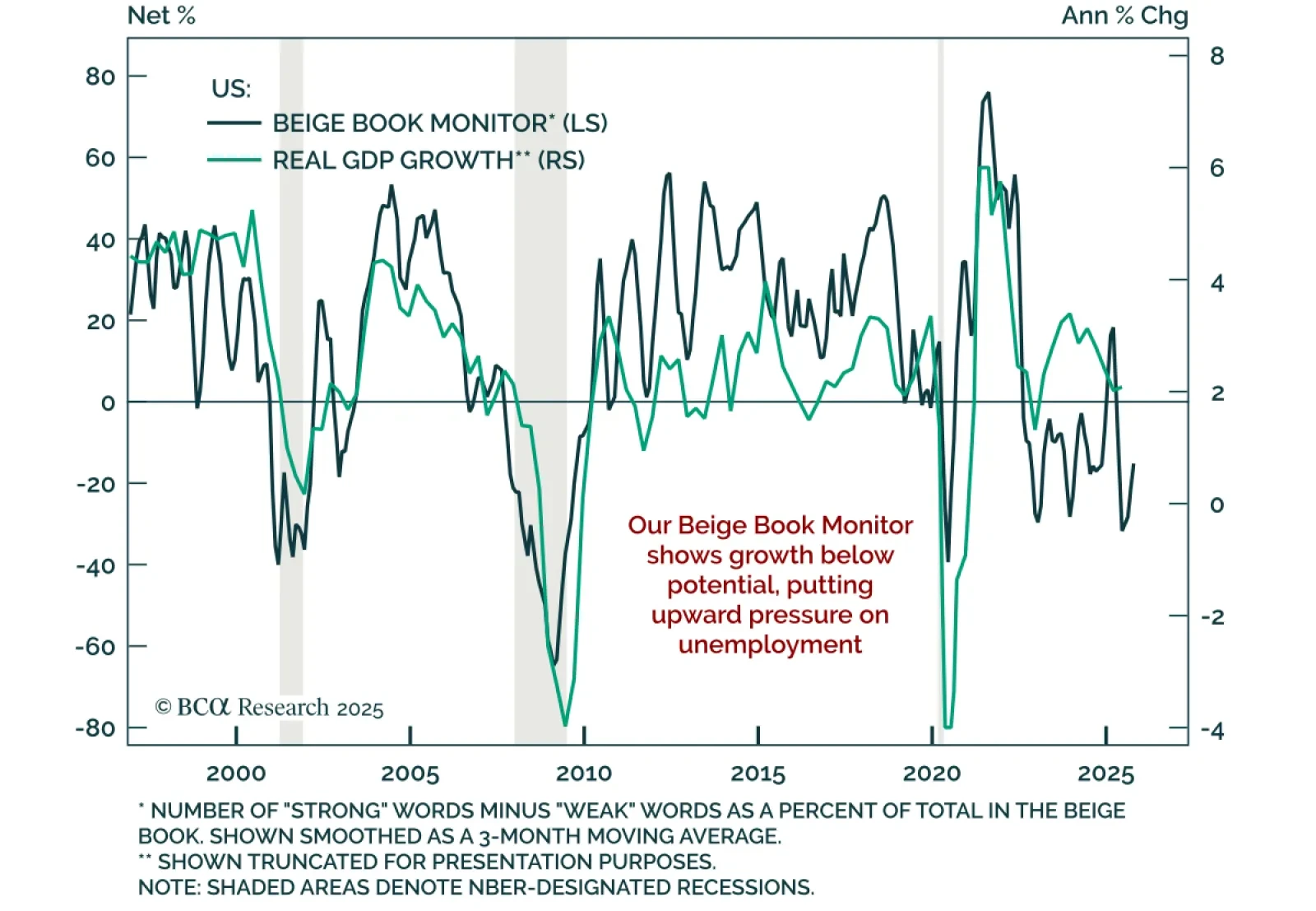

The October Fed Beige Book points to slowing growth as uncertainty continues to weigh on activity. Fed contacts reported consumer spending recently decreased, though auto sales were supported by EV purchases ahead of the expiration…

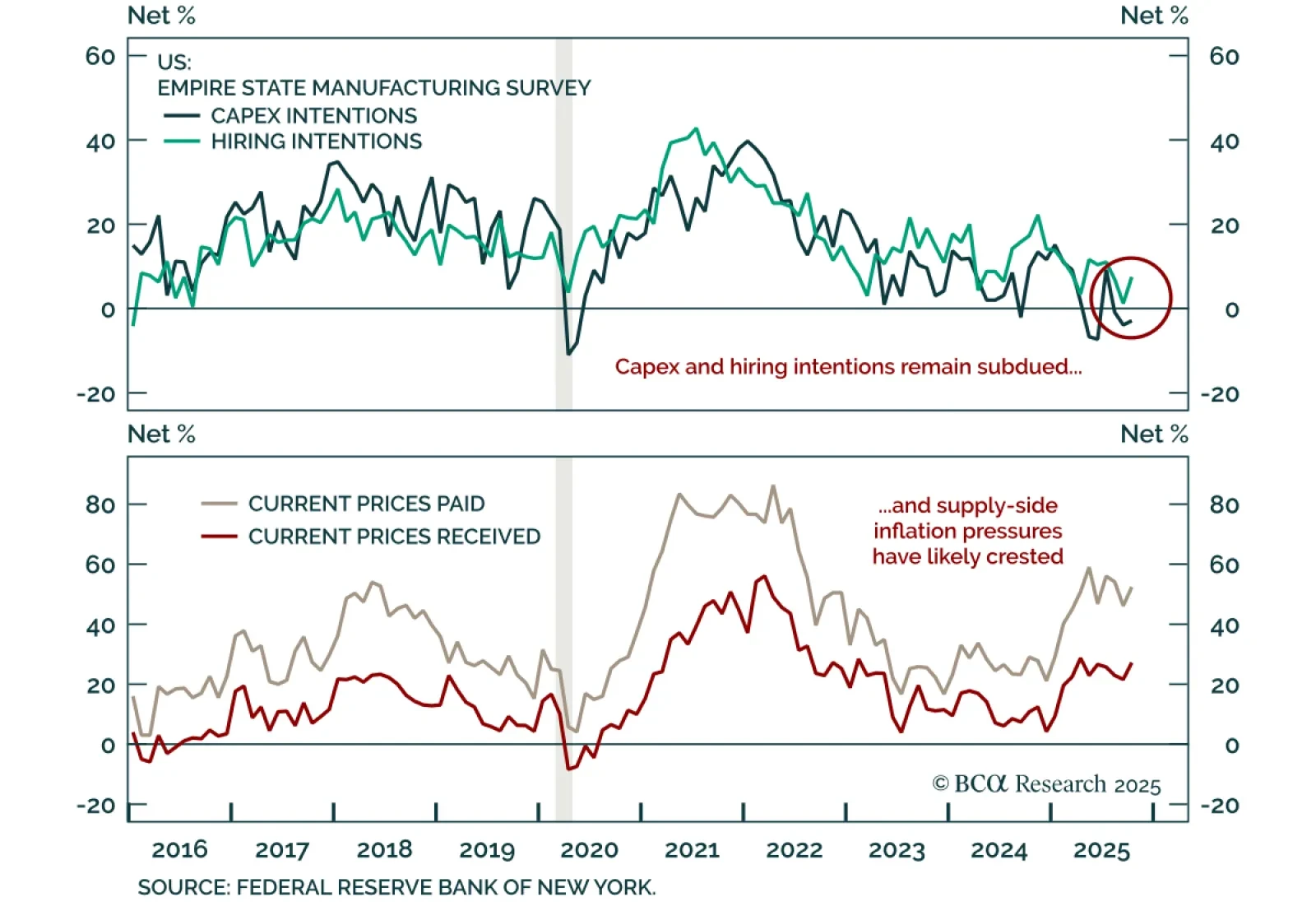

The October Empire Manufacturing survey beat estimates, but weak investment and hiring intentions temper its positive signal. The index rose to 10.7 from -8.7, indicating modest activity growth. New orders ticked up, and shipments…

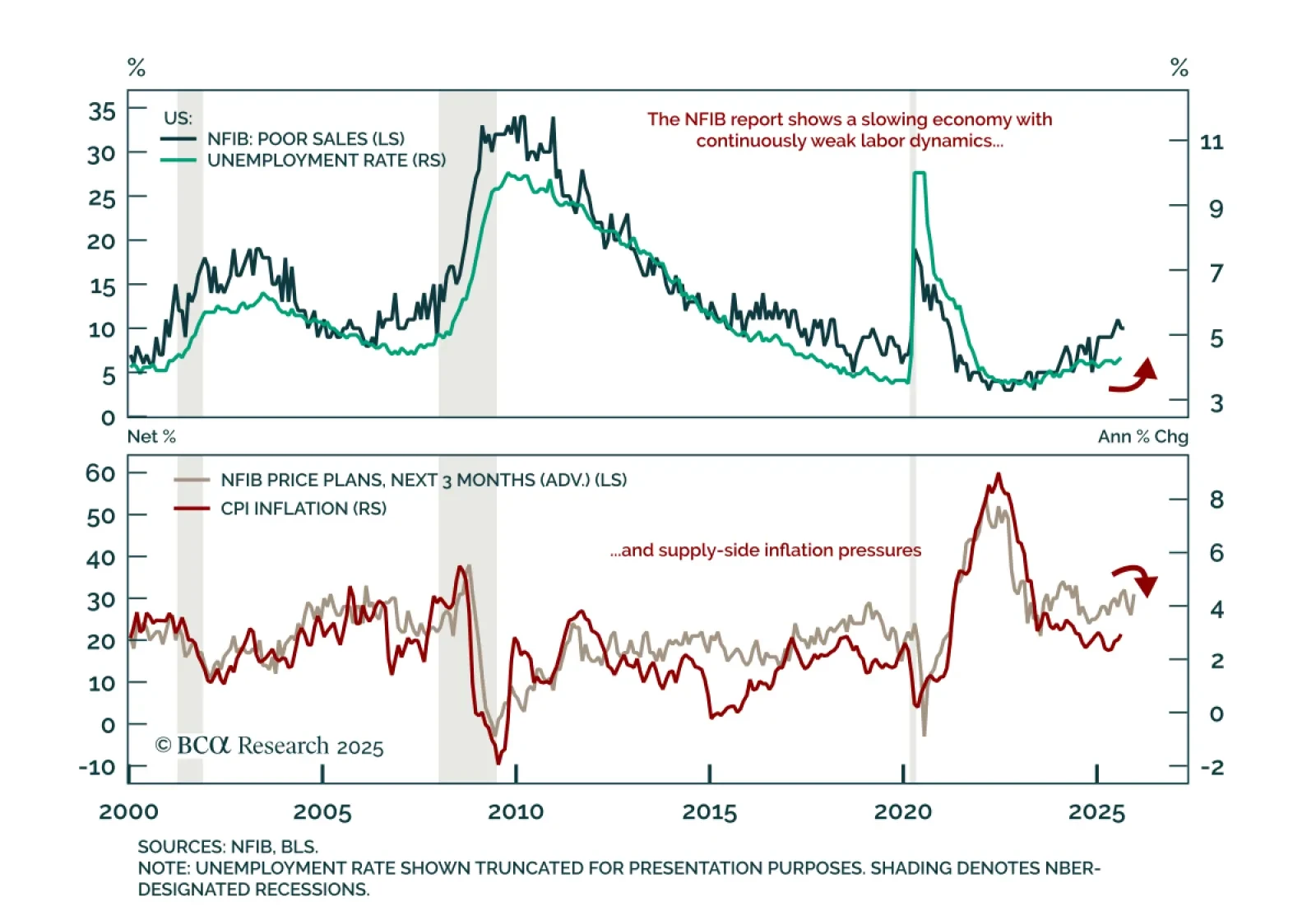

The September NFIB Small Business Optimism Index missed estimates, falling to 98.8 from 100.8. The decrease was driven by expectations, as fewer small businesses expect the economy to improve or real sales to rise. Firms also…

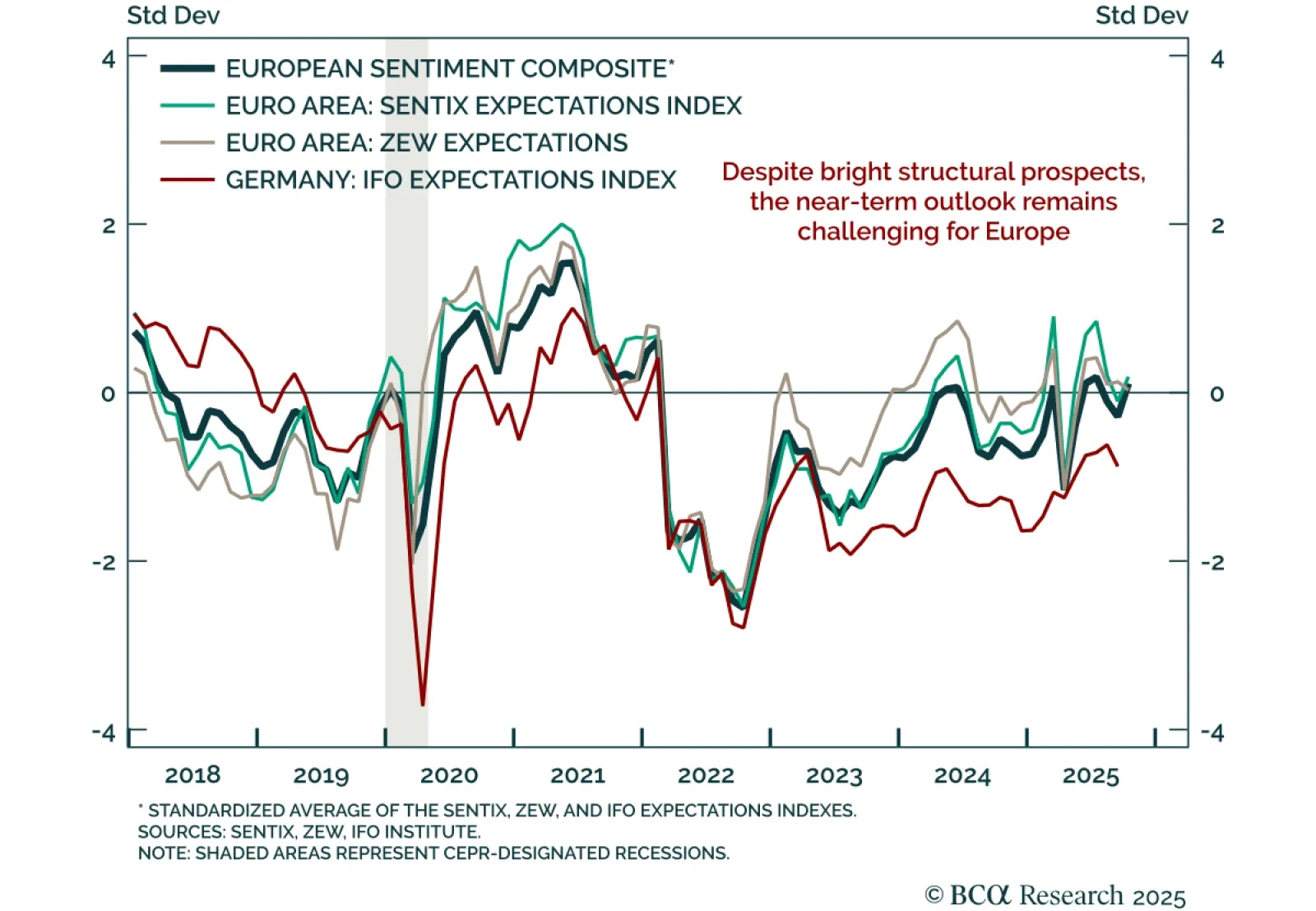

The October ZEW survey sent a mixed signal on near-term European growth, confirming limited growth momentum. Euro area growth expectations fell to 22.7 from 26.1, while German expectations missed estimates but rose slightly to 39.3…

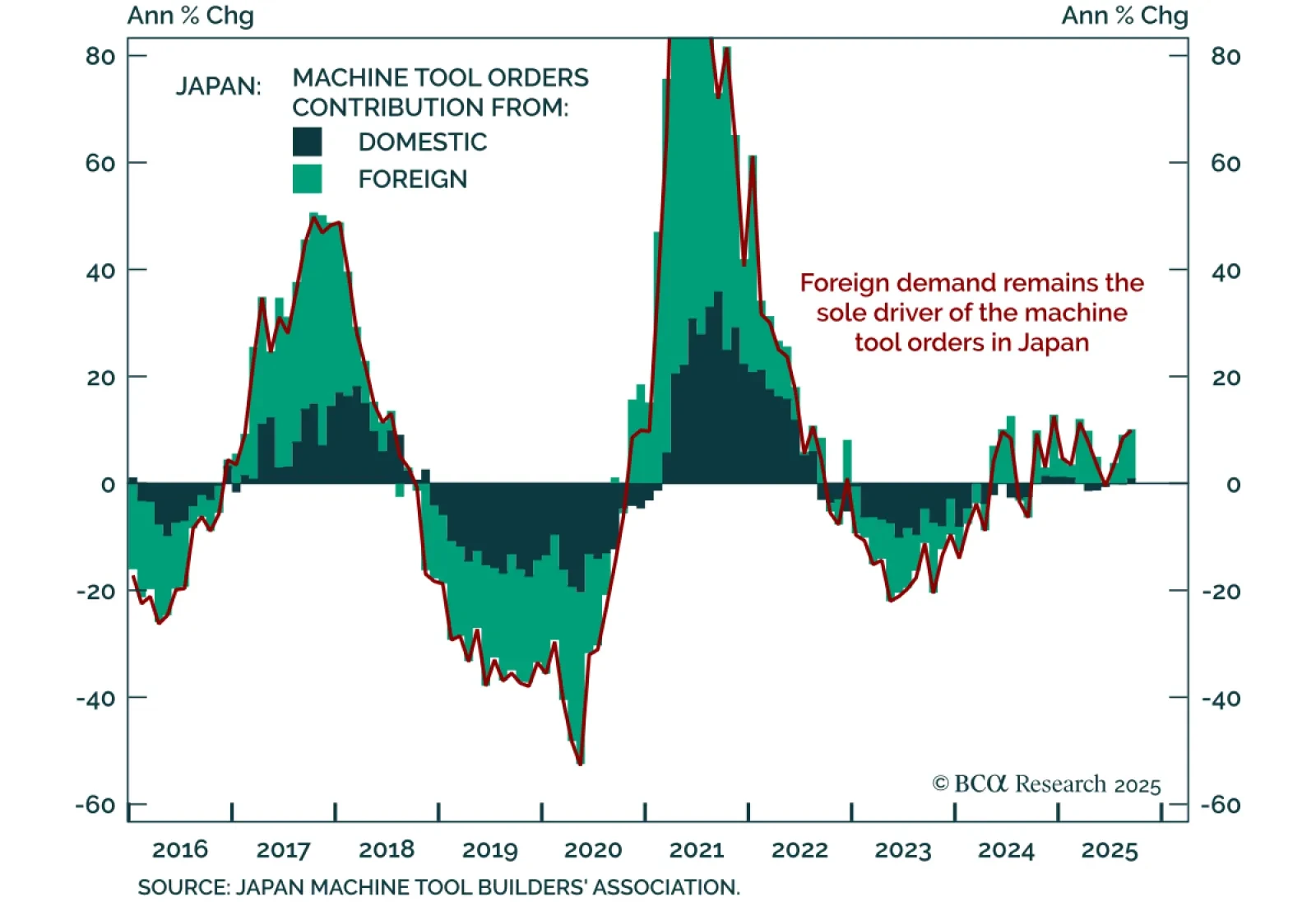

Japan’s September machine tool orders rose 9.9% year-on-year to a six-month high, led by a 13% jump in foreign exports, reinforcing the growing tailwind for Japan’s industrial sector and supporting a structural overweight yen…

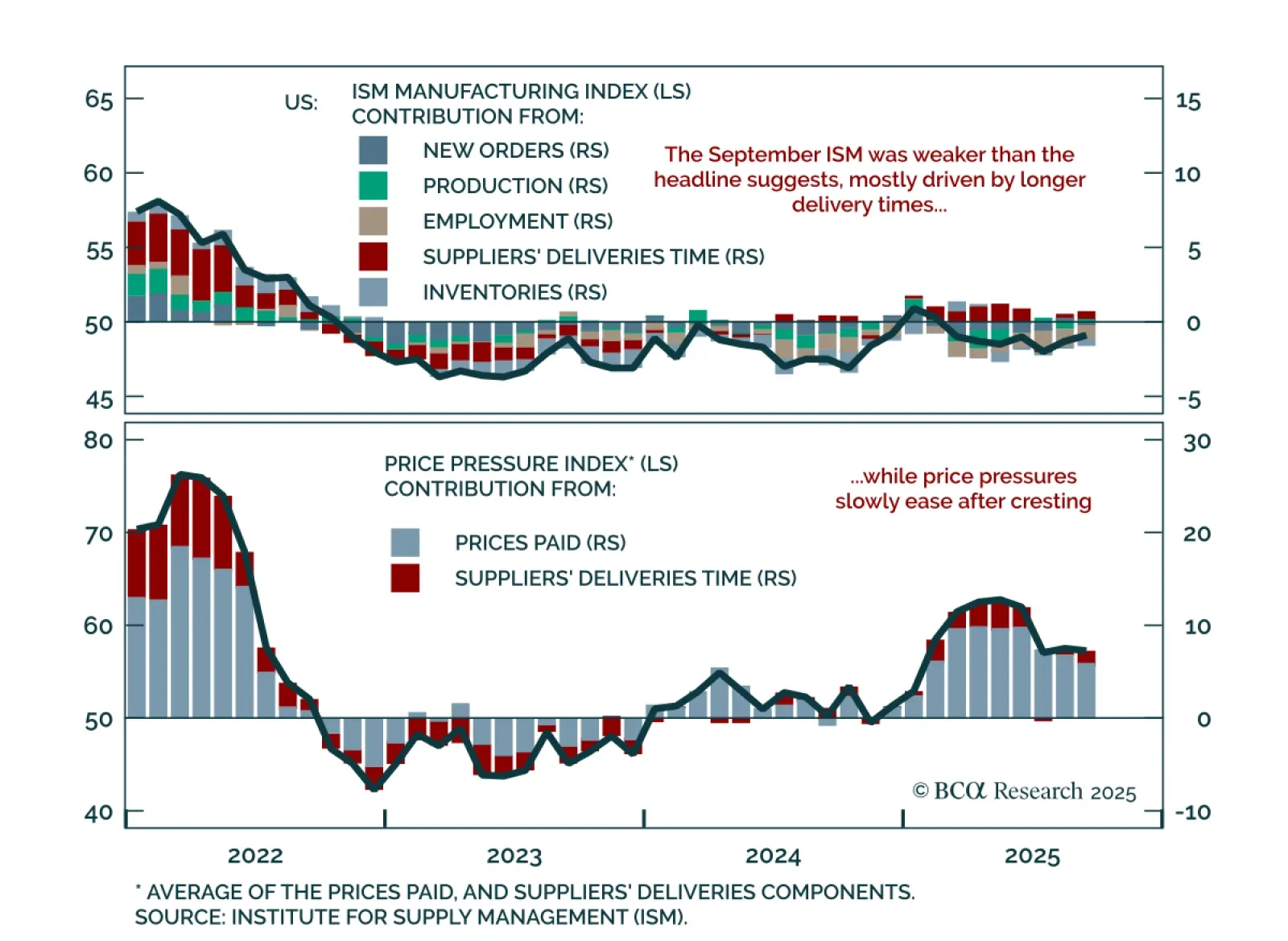

The September ISM Manufacturing index beat expectations at 49.1, but details confirm weak momentum and tariff-driven pressures. The headline improved from 48.7 in August, its second consecutive monthly gain, but the uptick came…

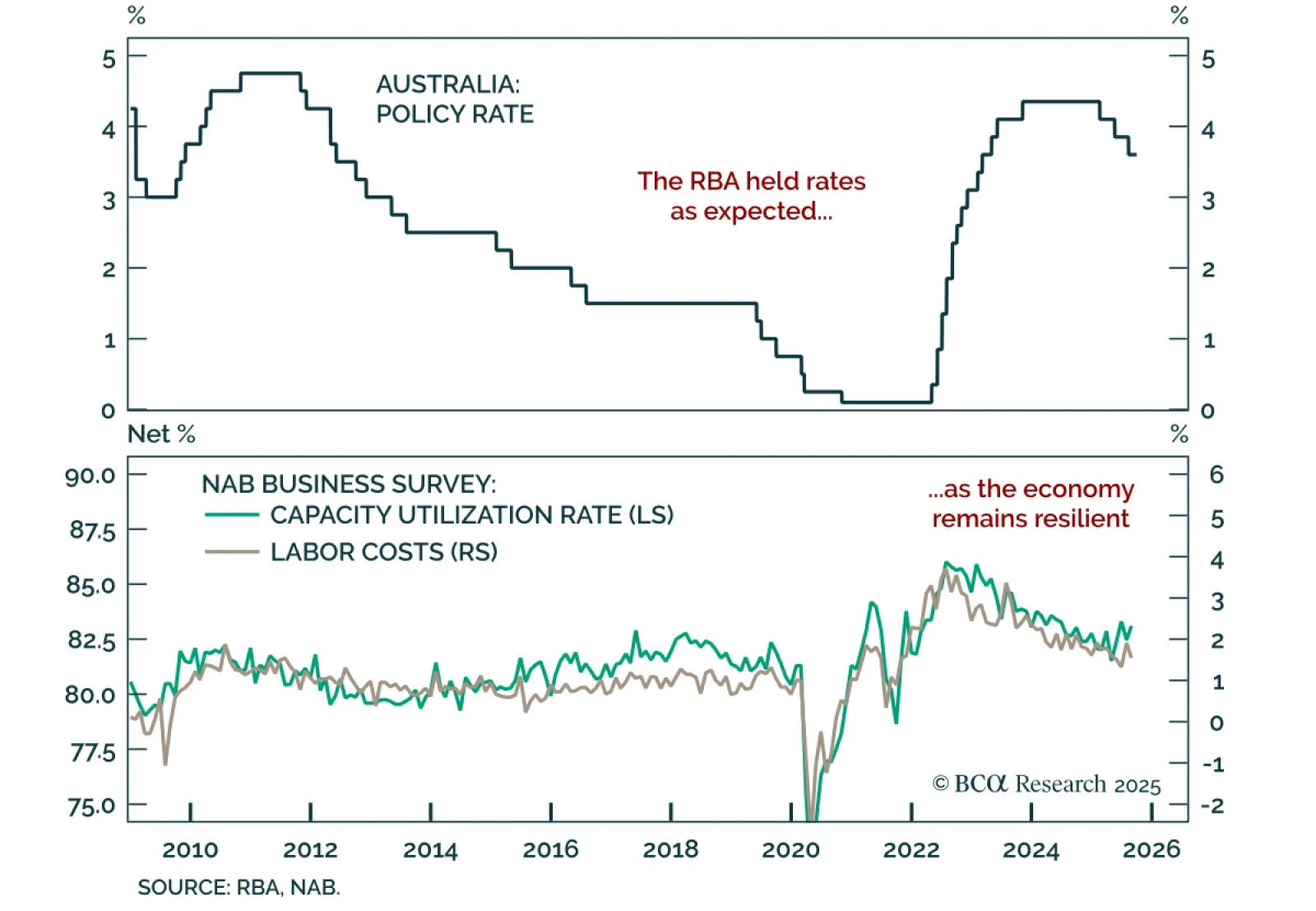

The RBA held rates at 3.6% as expected, maintaining caution as inflation could prove stronger than expected. Policy remains slightly restrictive, and at most one additional cut is on the table as the central bank has achieved a soft…

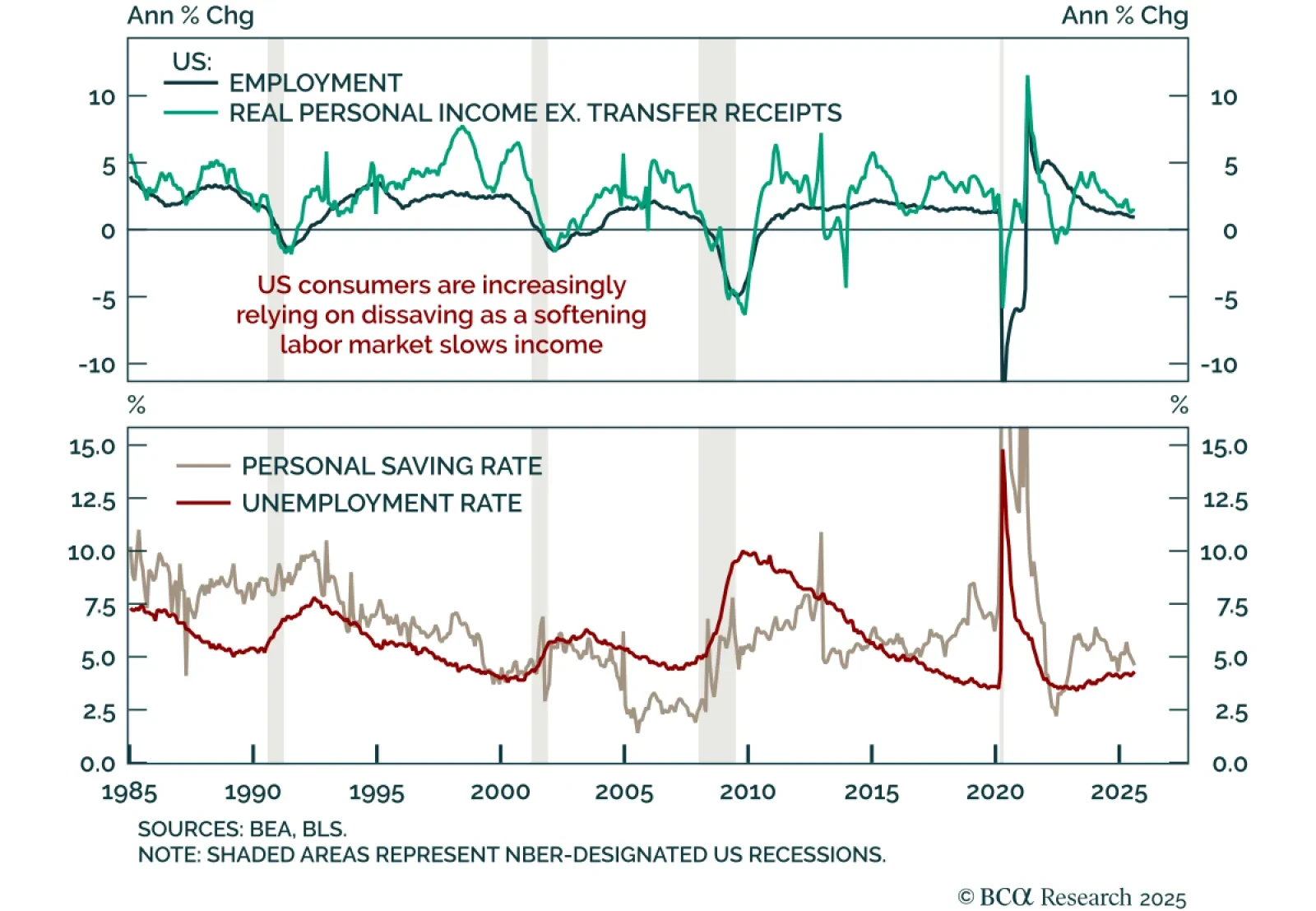

September consumption and income data beat estimates, showing a resilient US consumer but leaving the outlook fragile. Personal spending rose 0.6% m/m, outpacing income at 0.4%, pushing the saving rate down to 4.6%, its lowest level…

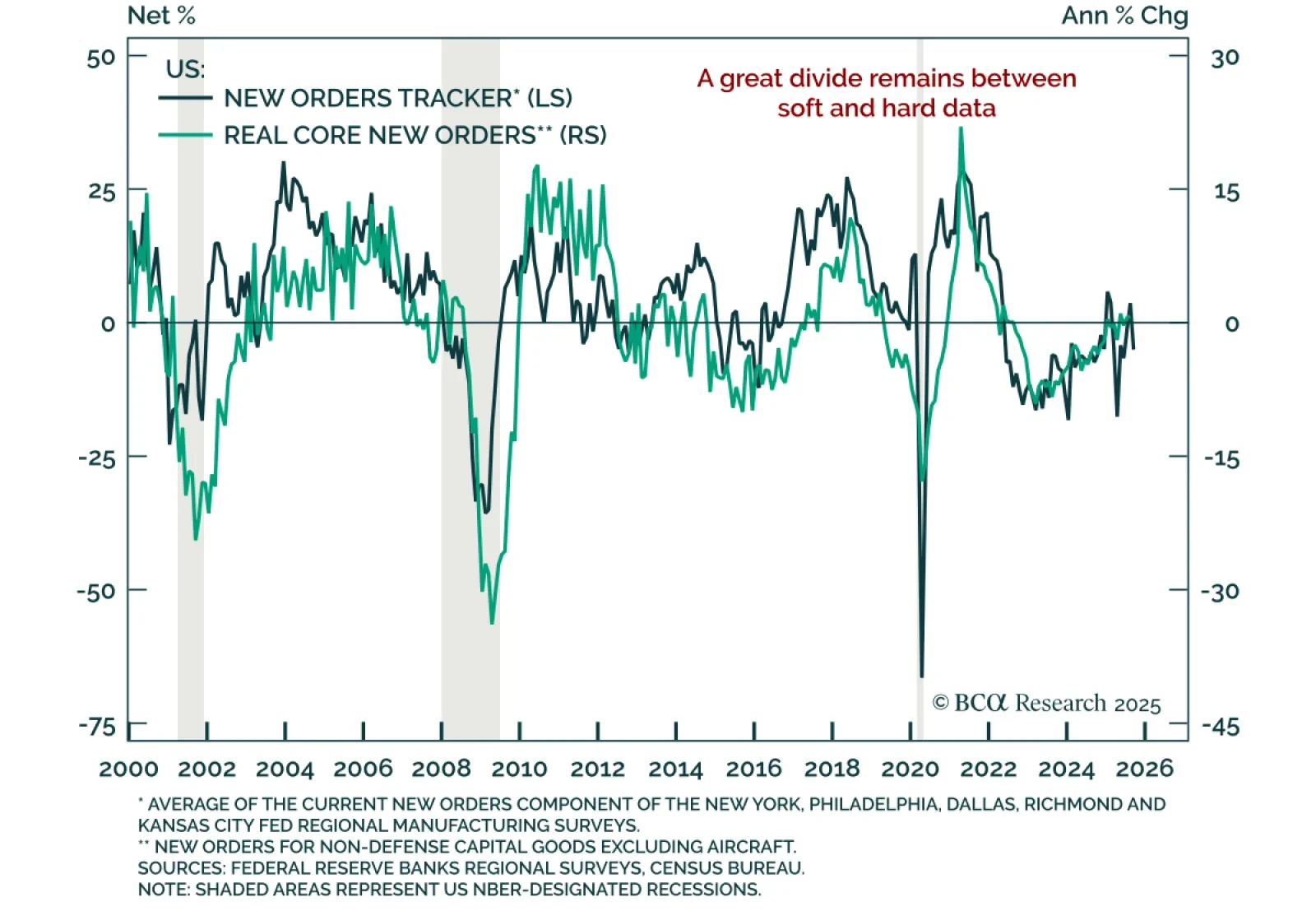

August core durable goods orders beat estimates, but weak shipments and survey data reinforce our modestly defensive stance. Core orders rose 0.6% m/m against expectations of a modest decline, though they decelerated from July’s…

Our tactical framework, which tracks the reflexive loop between financial conditions and economic surprises, points to stronger near-term growth, leaving equities vulnerable if inflation re-accelerates. Data surprises move markets,…