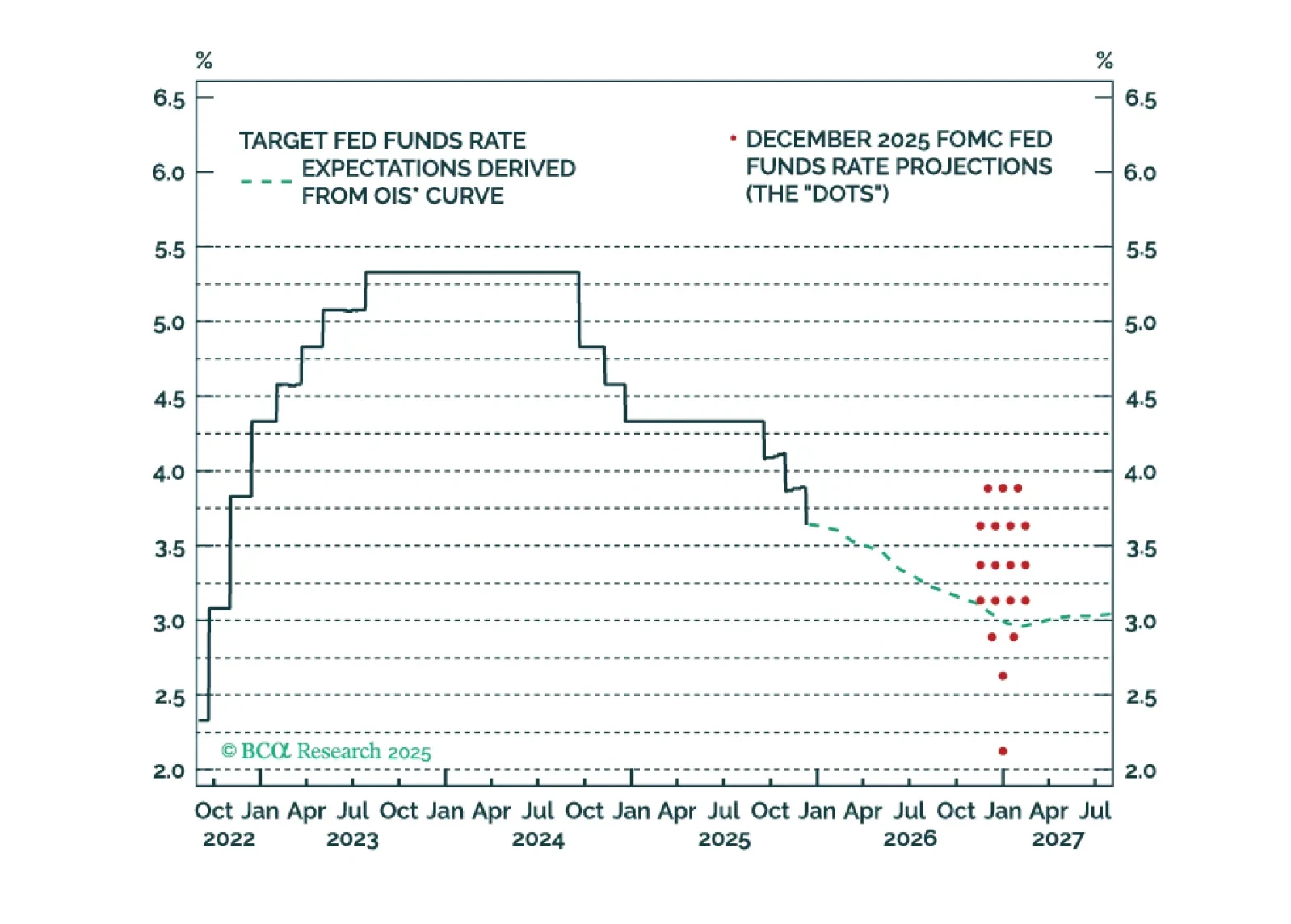

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.

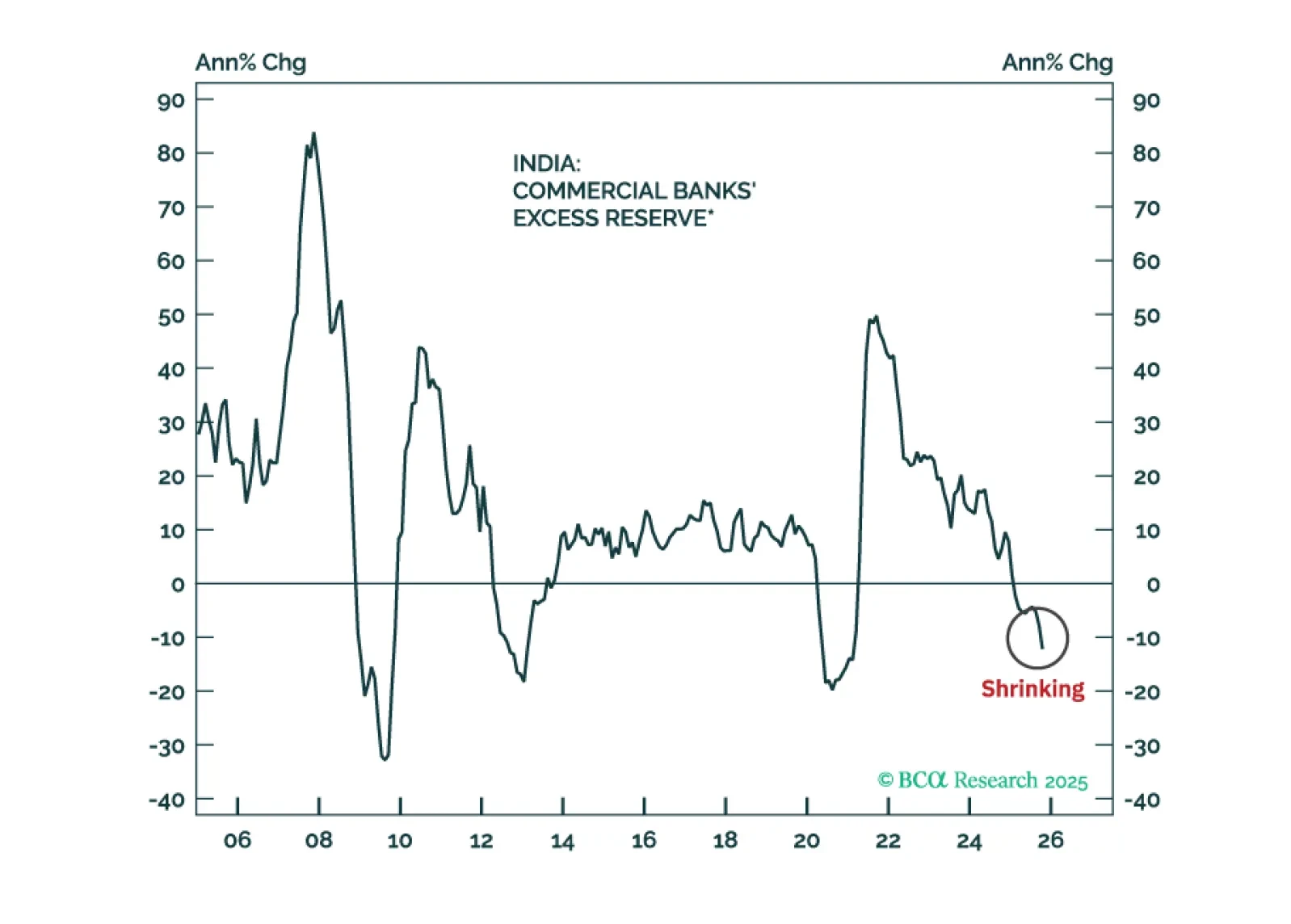

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

Understanding asset performance across Growth and Inflation regimes helps investors construct and manage balanced portfolios. Our first G&I Catalog report examines Hedge Fund strategies. Global Macro and Managed Futures offer the…

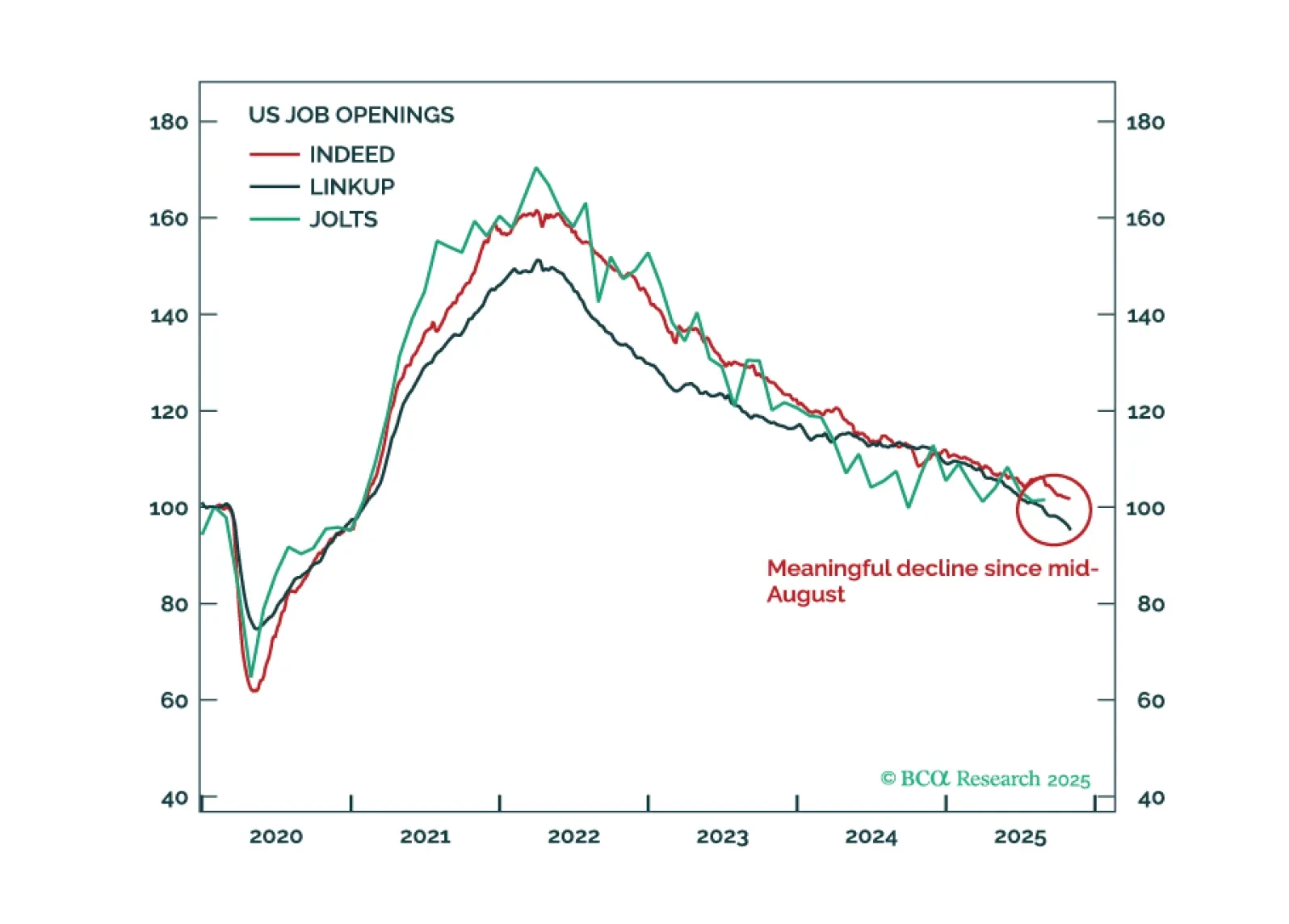

In the absence of official government data, investors are turning to alternative sources to gauge the direction of the US economy. Our analysis of this data suggests that the economy has continued to expand at a moderate pace over…

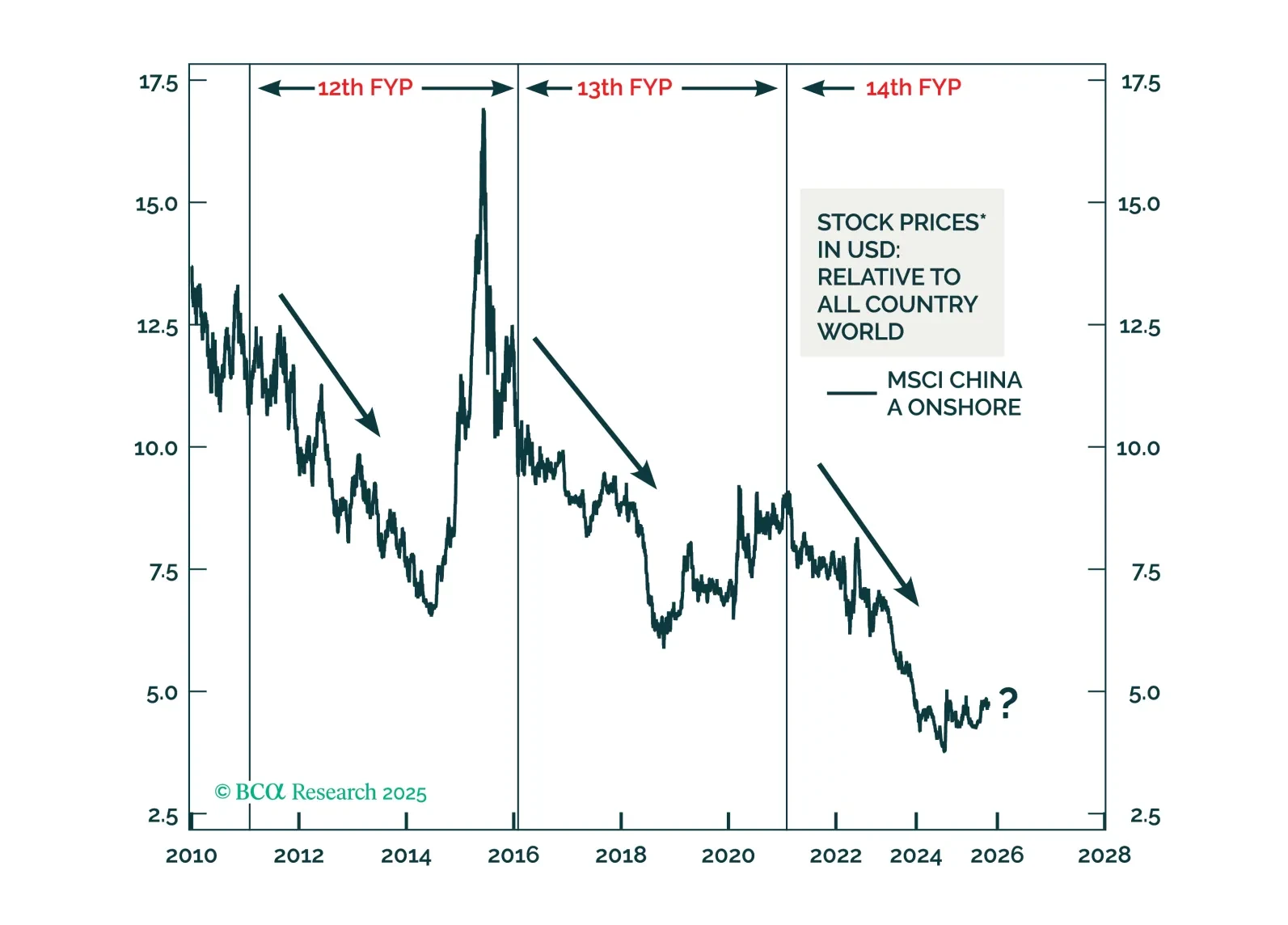

By tracing patterns across China’s past three Five-Year Plans, we reveal how policy cycles shape markets—and what investors should expect in the next five years.

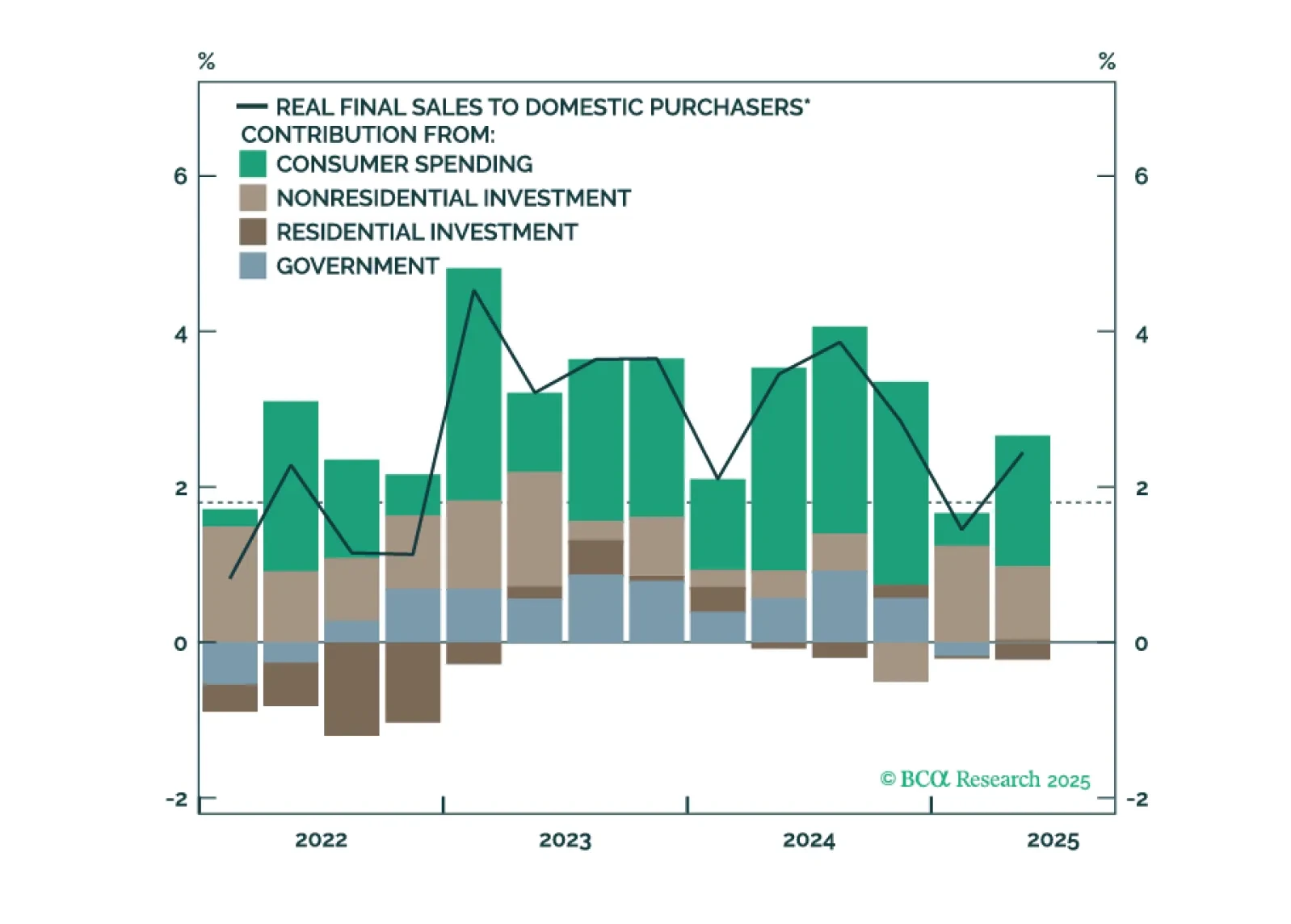

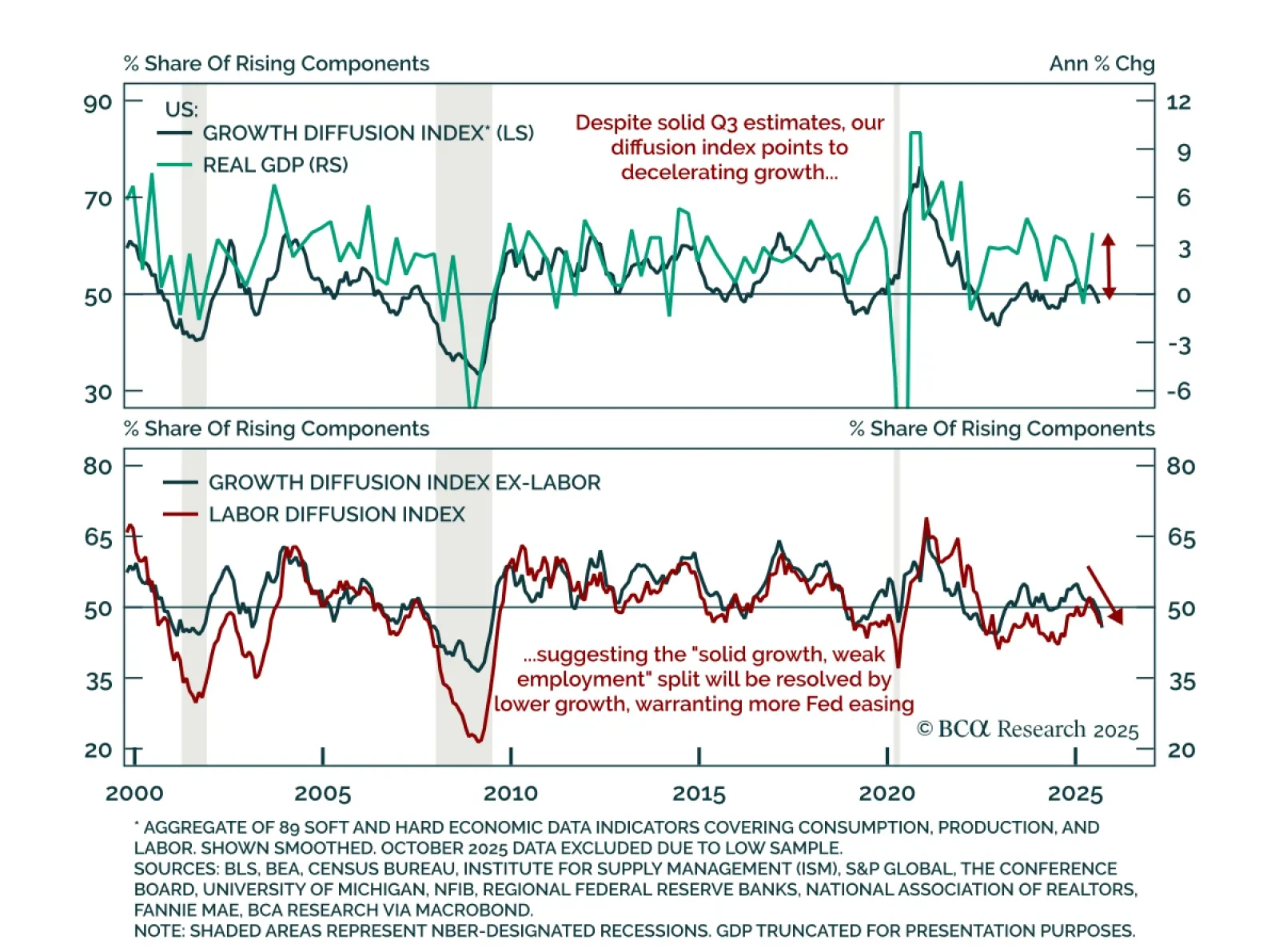

The Fed is poised to deliver a 25-basis-point rate cut this month, but a follow-up rate cut in December will depend on how the divergence between strong consumer spending and weak employment growth is resolved.

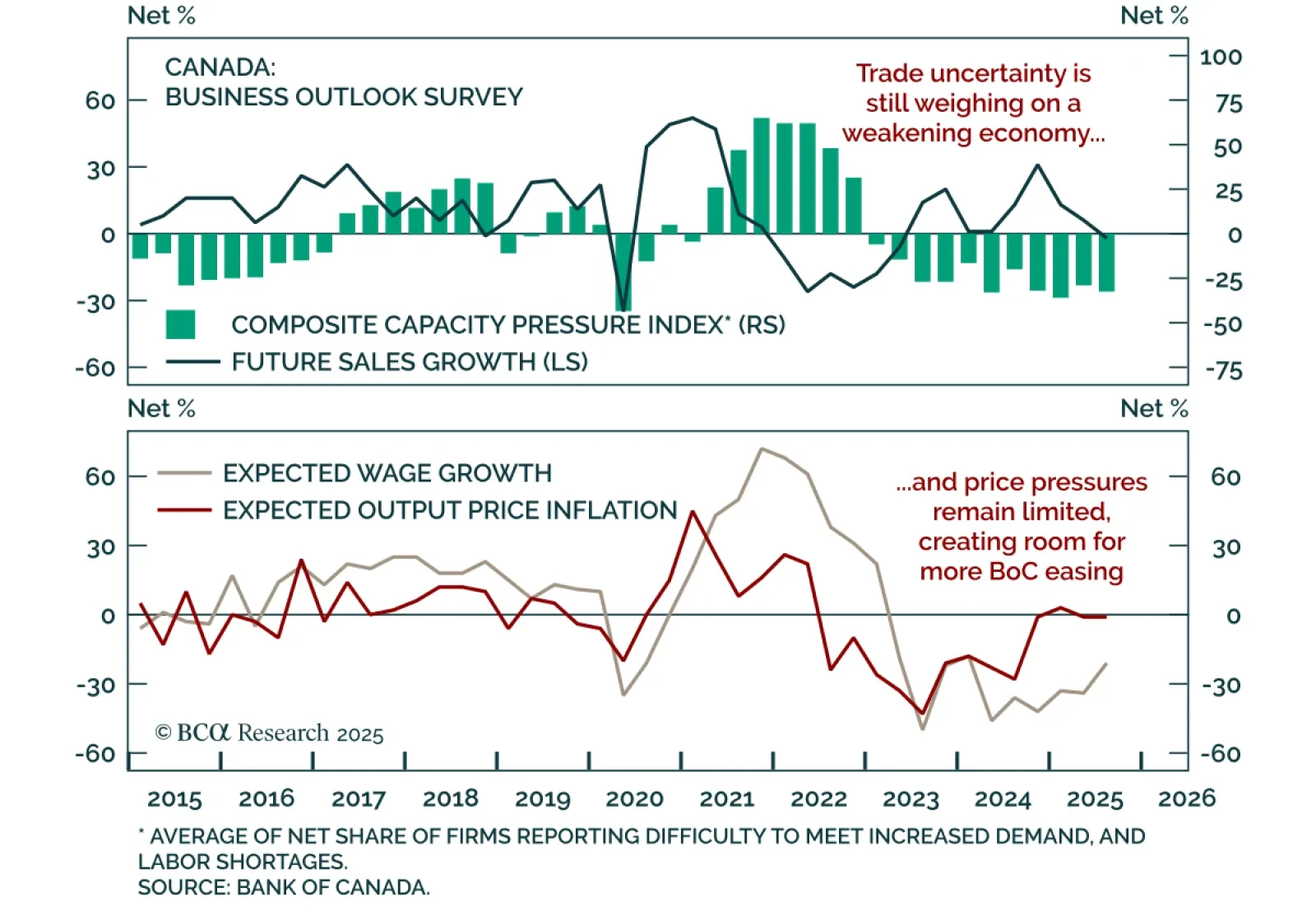

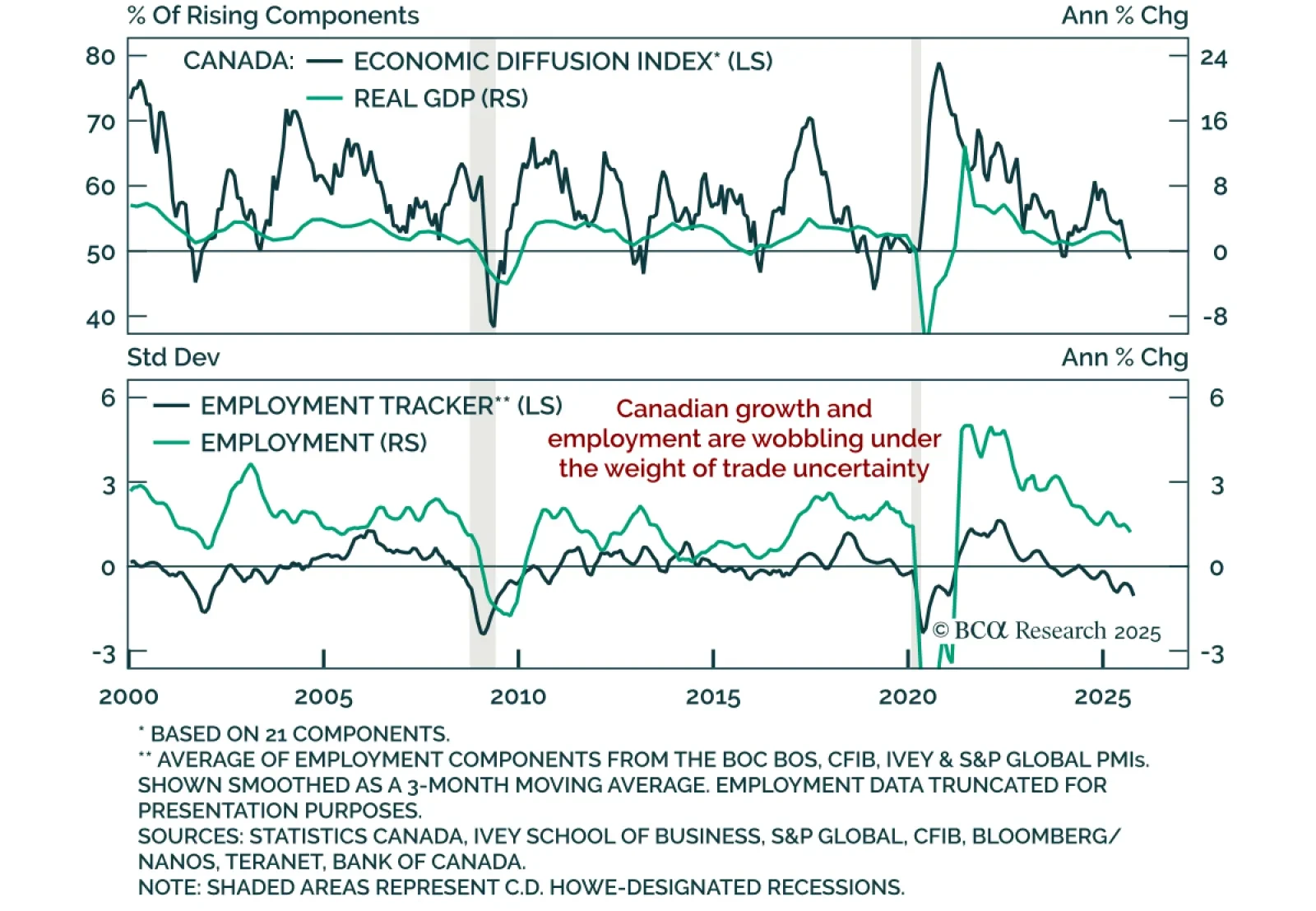

Canada’s Q3 Business Outlook Survey paints a weak macro picture with limited price pressures, supporting an overweight on CGBs and CAD 5s10s steepeners. The BOS Indicator ticked up marginally to -2.3 from -2.4, as low capacity…

We expect the divergence between resilient growth and weakening employment to be resolved by lower growth estimates, supporting long duration and steepeners. Economic activity and employment usually move together in a circular…

Recent Canadian data confirm slowing growth, reinforcing support for government bonds and steepeners. The October CFIB Business Barometer fell to 46.3 from 50.2, indicating contraction and underscoring the risk posed by small…