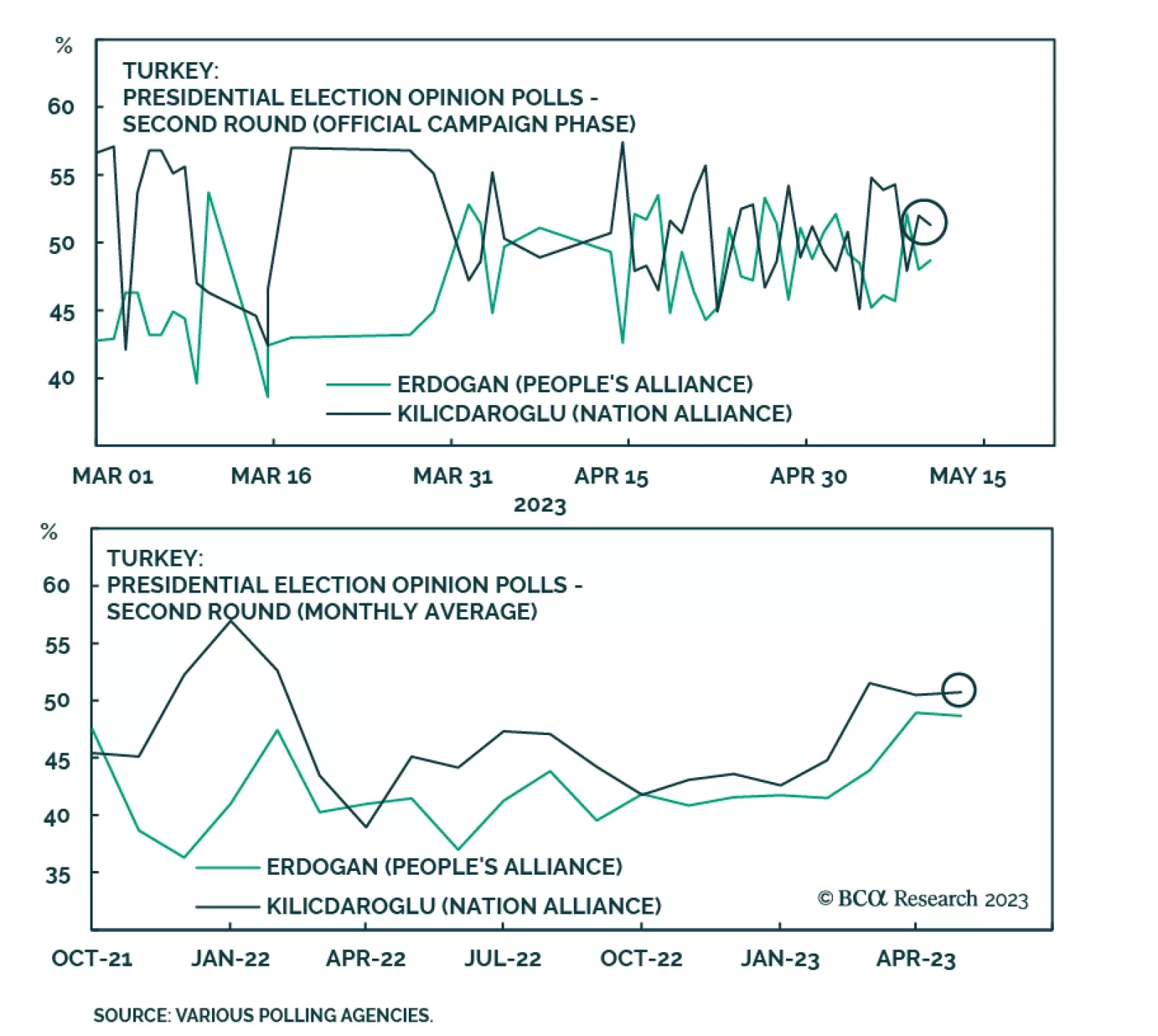

Results of Turkey’s presidential election show incumbent President Recep Tayyip Erdogan securing 49.5% of the votes in Sunday’s contest – ahead of his rival Kemal Kilicdaroglu’s 44.9%. Although Erdogan…

The Turkish presidential election will go to a runoff in two weeks, but President Erdogan outperformed his opinion polls. His party, the incumbent AKP, won a majority in parliament. This outcome rewards Turkey’s inflationary policies…

Erdogan will most likely lose the Turkish election but it could go onto a second round. A strong opposition majority in the assembly would justify a tactical overweight in Turkish equities on a relative basis. For now, go long…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…

Two developments this week reinforce our key views for 2023. First, Russia’s threat to reduce oil production by 500,000 barrels per day, while escalating the war in Ukraine, confirms that geopolitical risk will rebound and new oil…