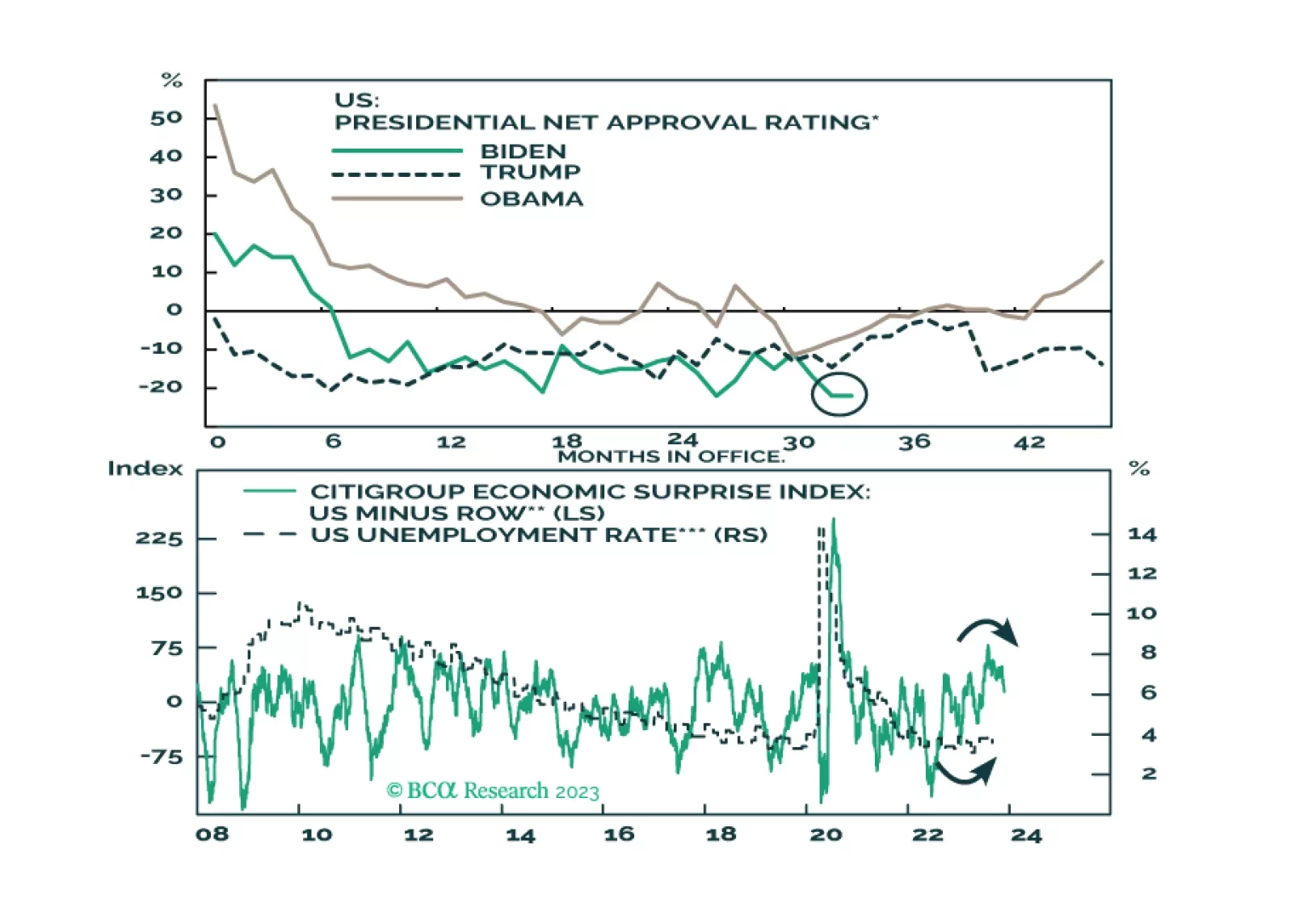

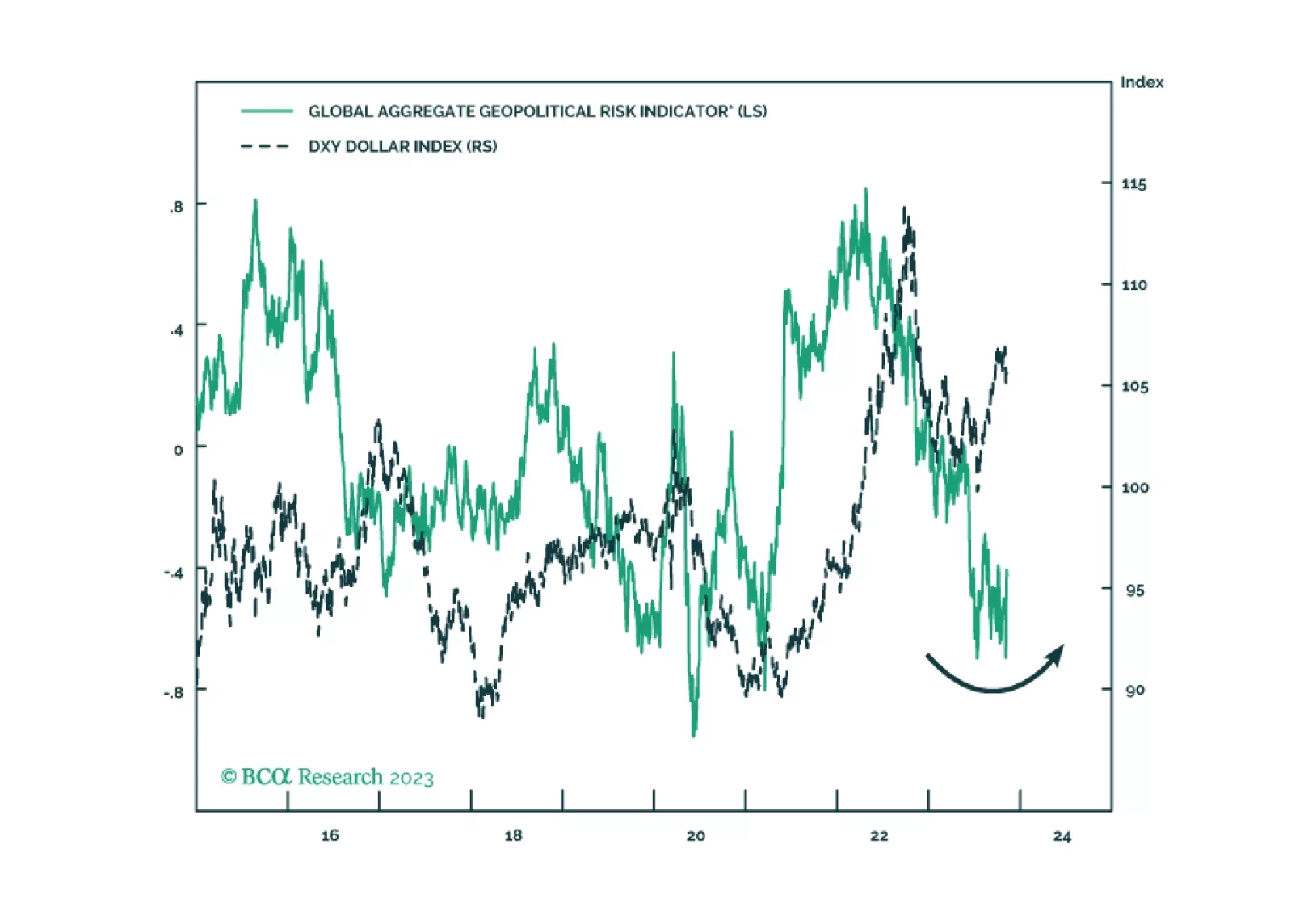

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

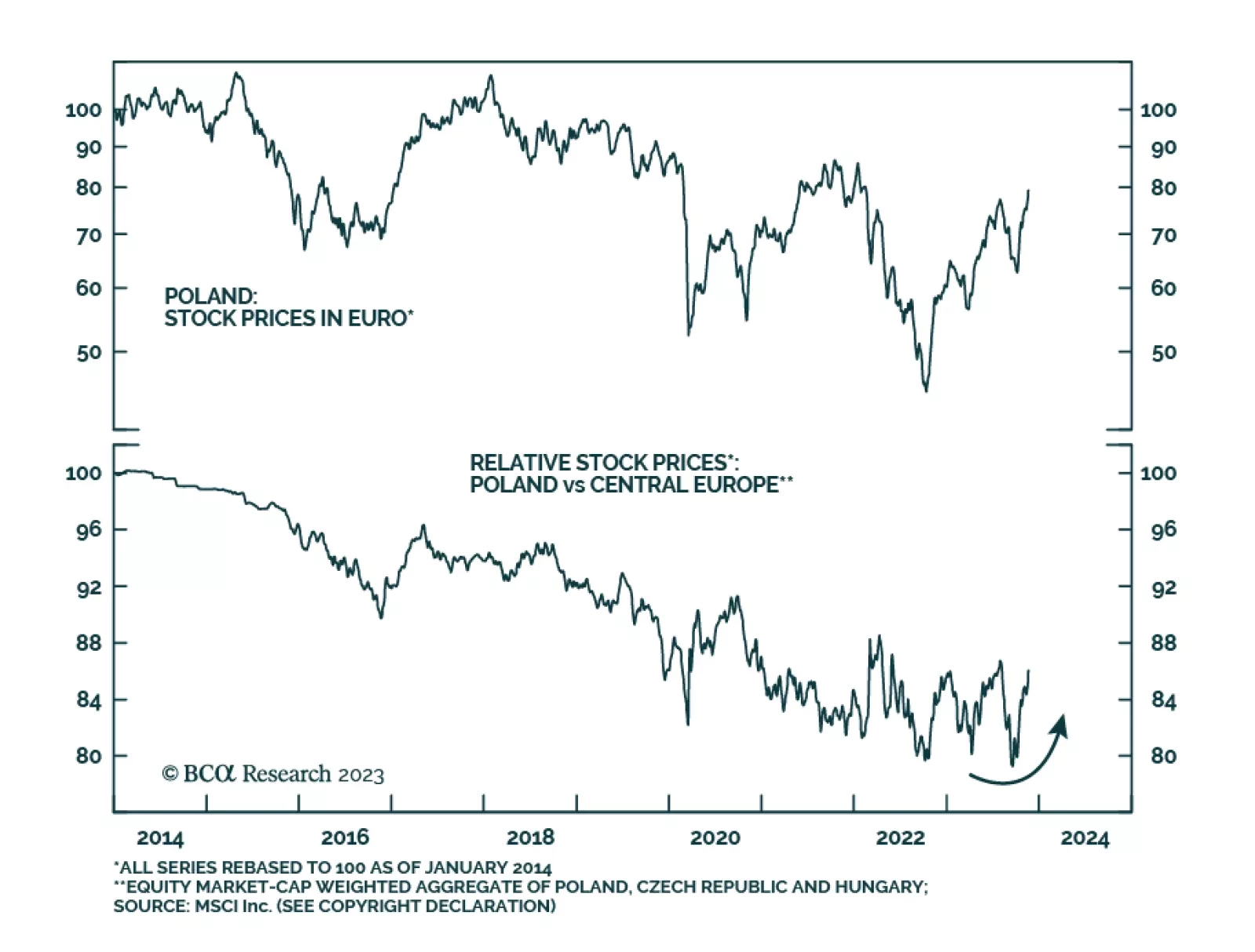

In the recently held Polish general elections, the ruling Law & Justice Party (PiS) lost power. Chances are that a coalition led by the Civic Platform party will form a government next month. The new coalition ran on a pro…

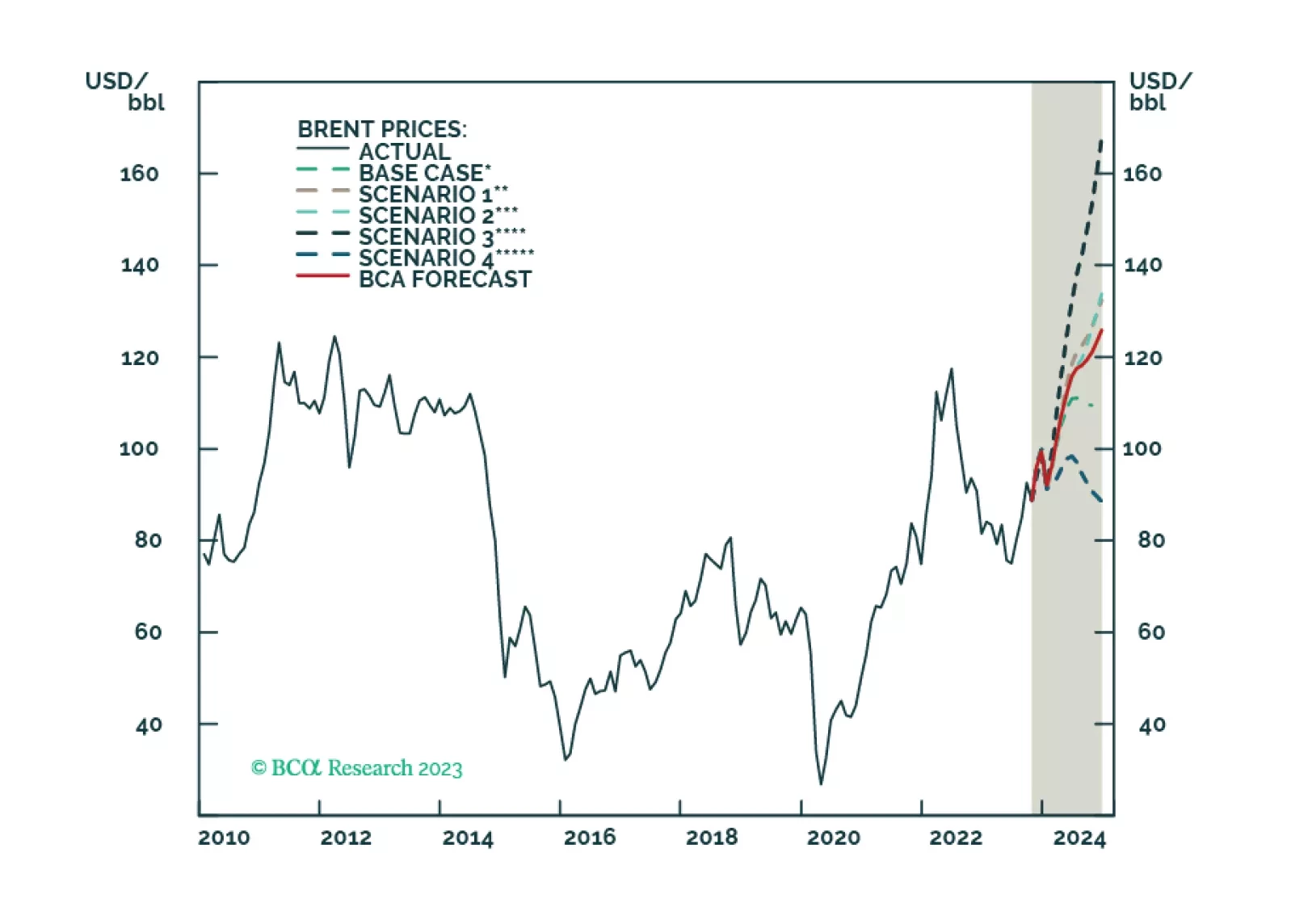

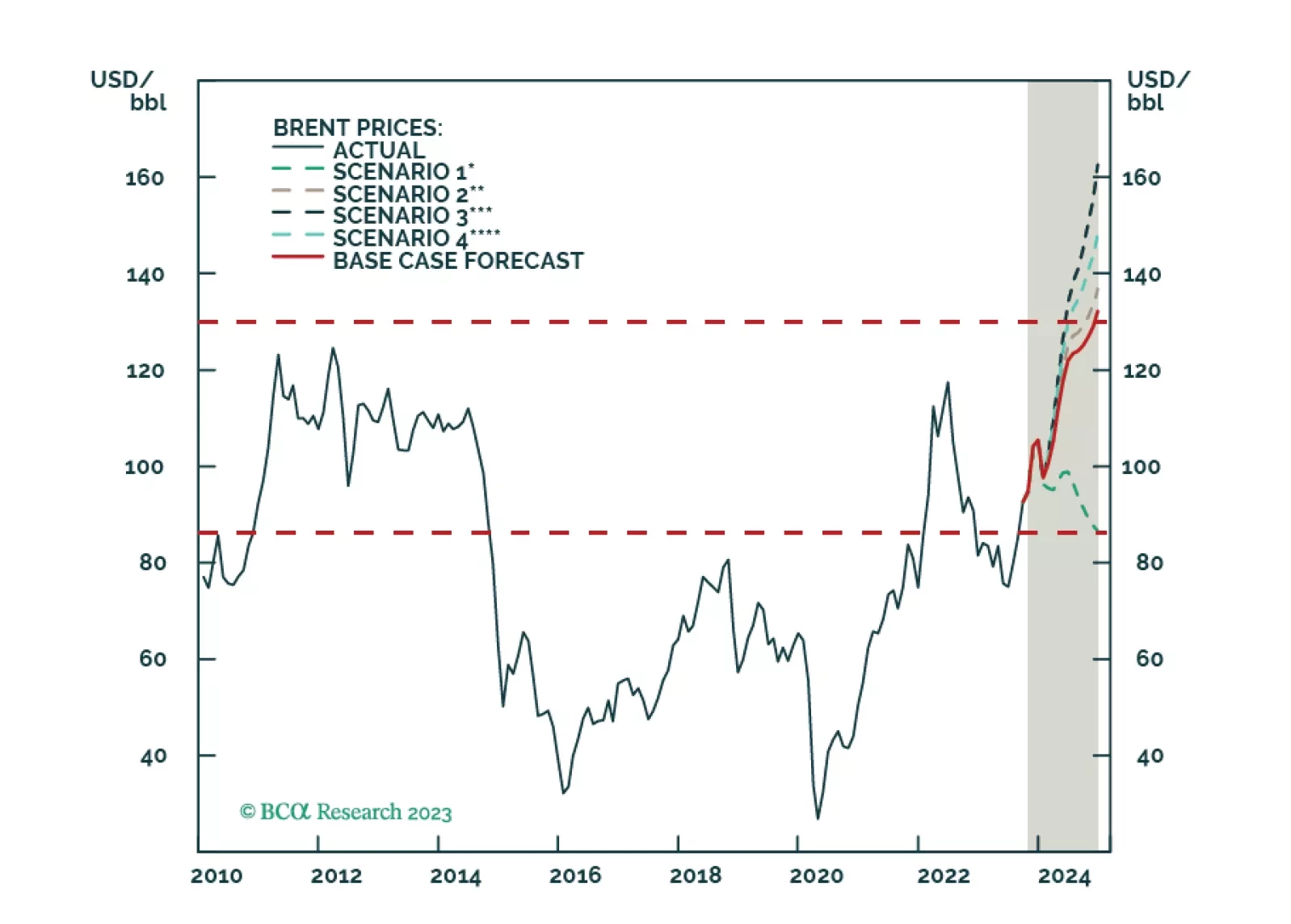

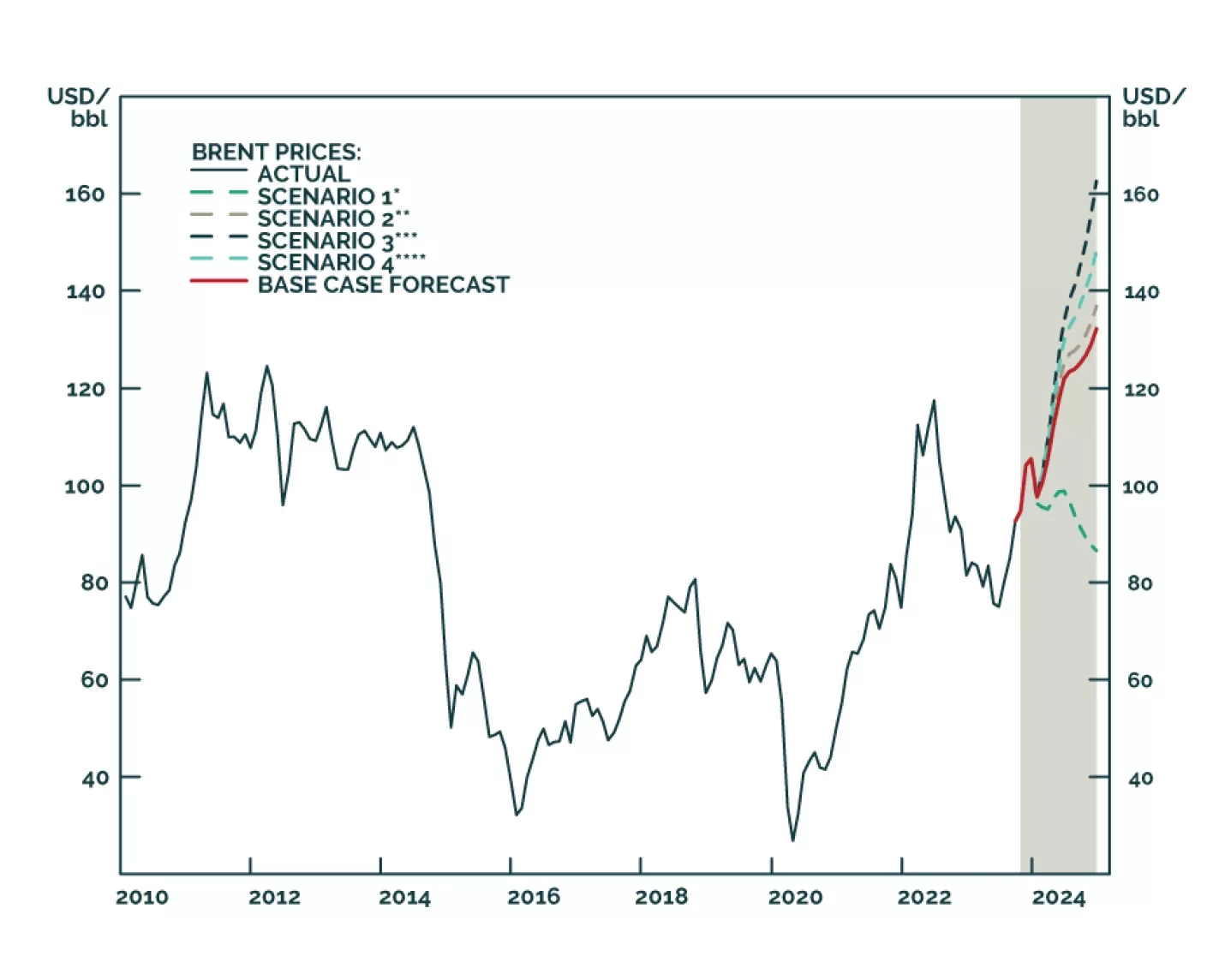

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

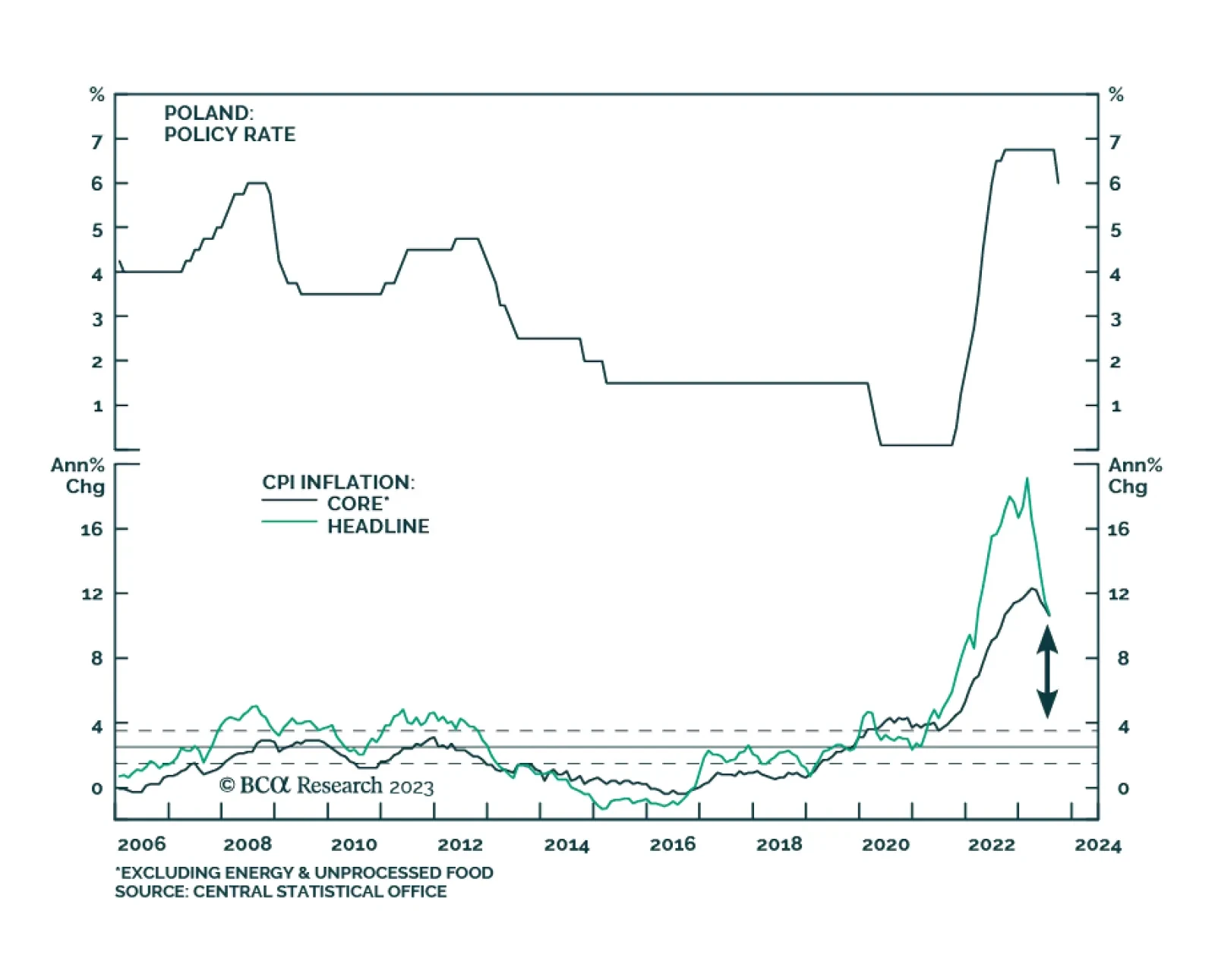

Real wages are set to rise in CE3 economies with implications for their asset markets and currencies. Of the three, Polish assets and the zloty are the most vulnerable.

The Polish central bank delivered a larger-than-anticipated 75 basis point rate cut on Wednesday – slashing the policy rate to 6%, versus expectations of 6.5%. The aggressive move marks the first rate cut following a 11-…