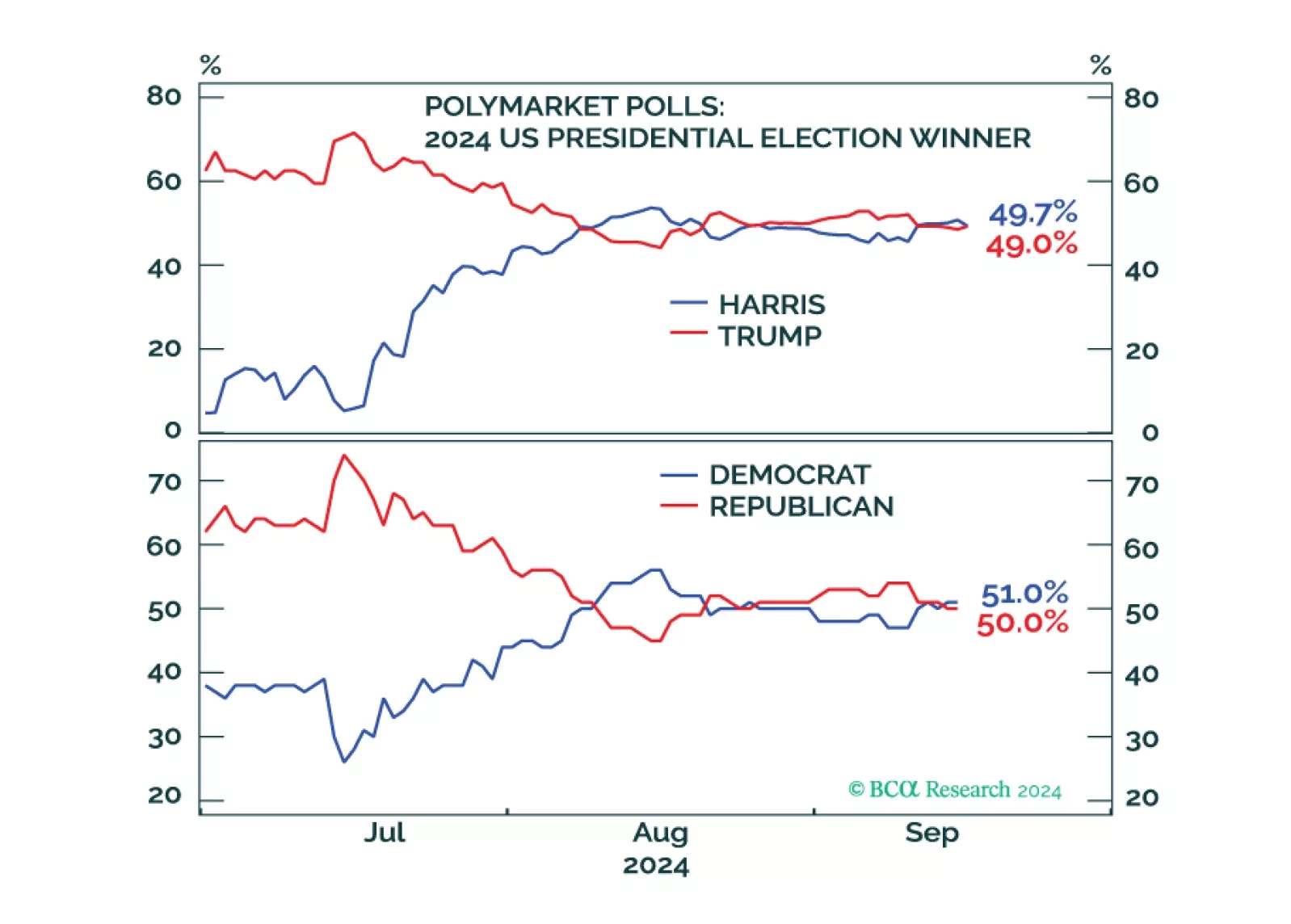

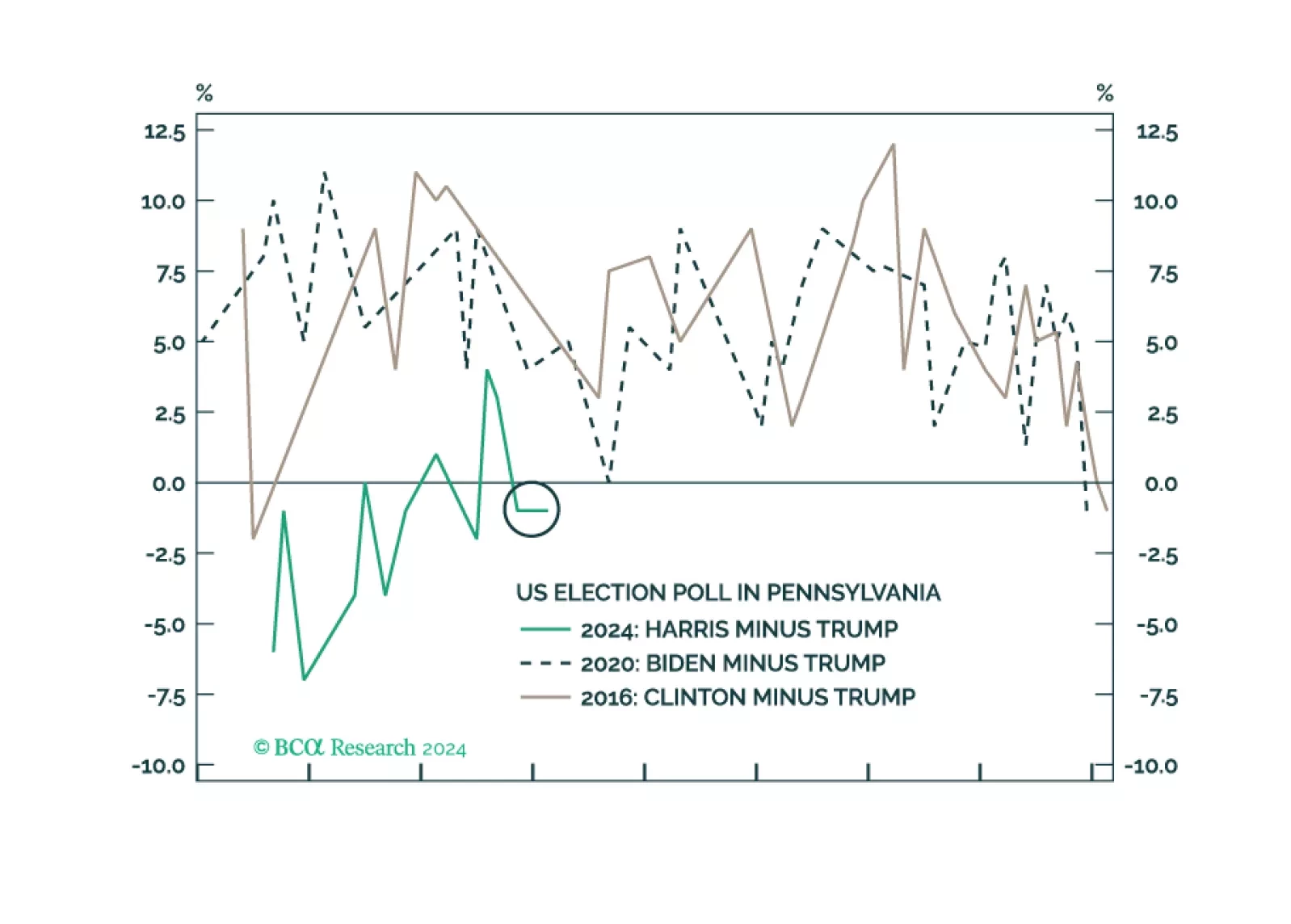

Our Emerging Markets Strategy team sees evidence of a “Trump trade” across markets, as the dollar strengthens, Treasury yields jump, and US small caps try to break out. However, the tactical and cyclical outcomes…

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

According to BCA Research’s Geopolitical Strategy service, the logic of pursuing one’s interest against US interests in the final hours of the election mostly applies to states that will suffer a significant loss to…

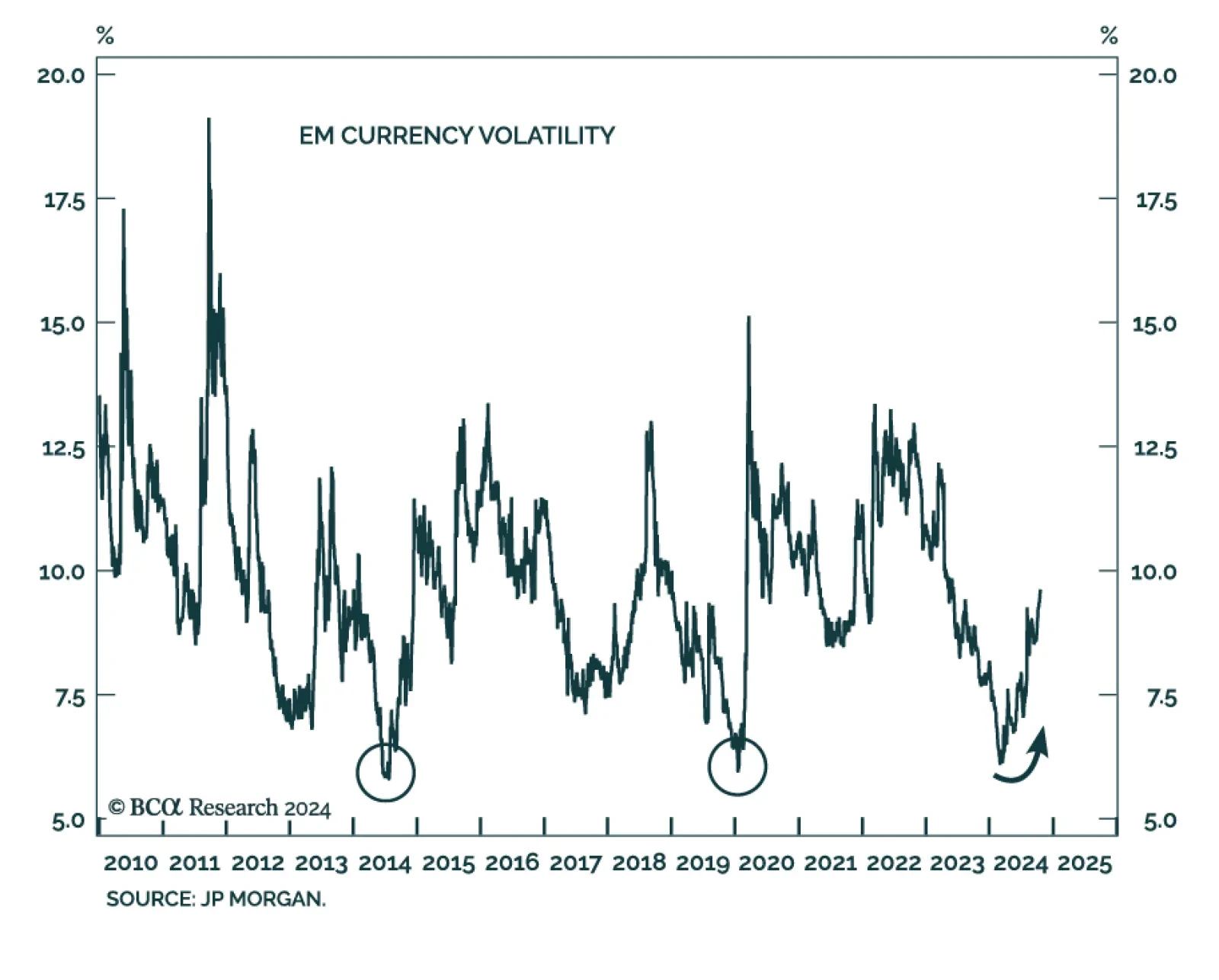

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

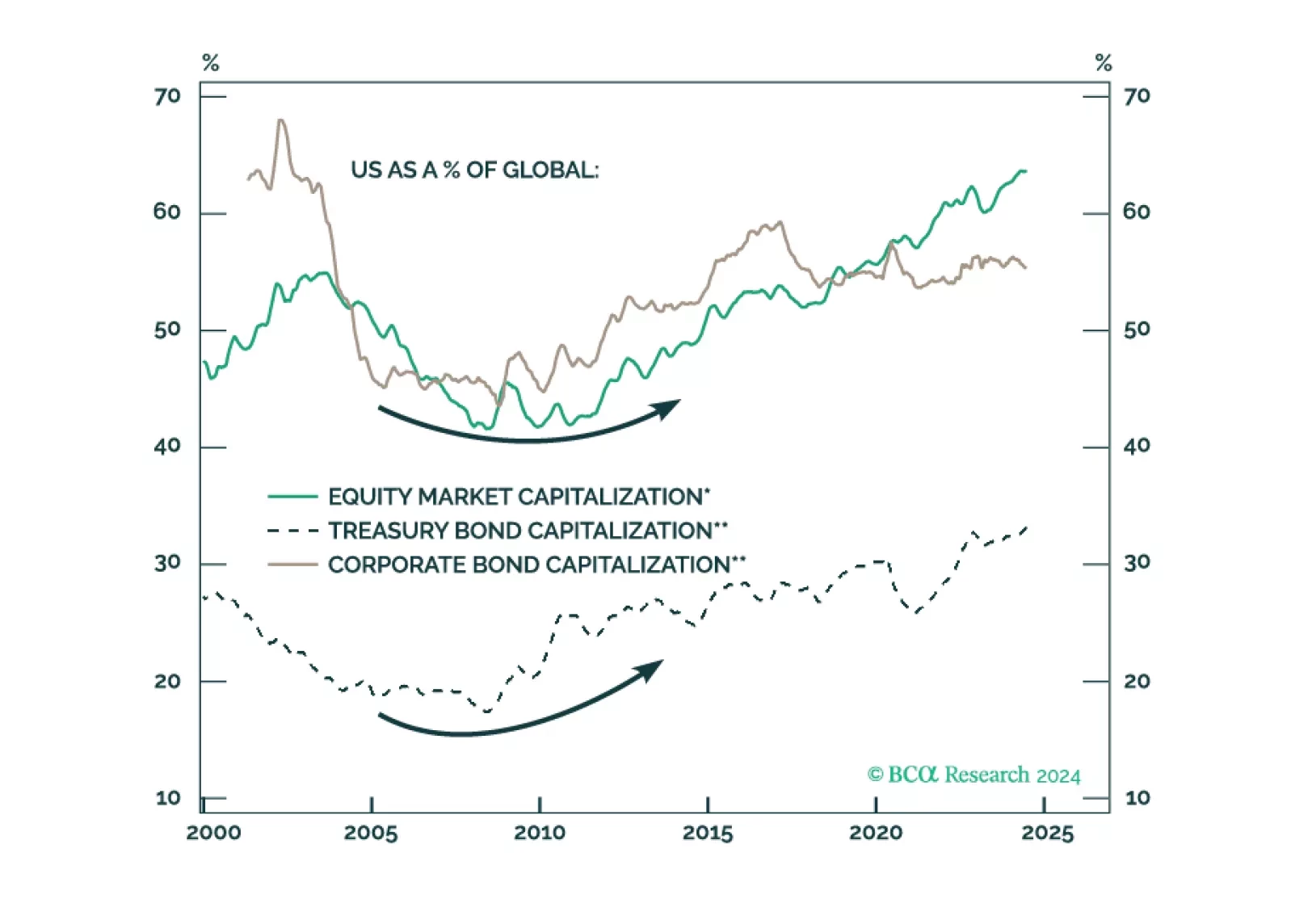

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

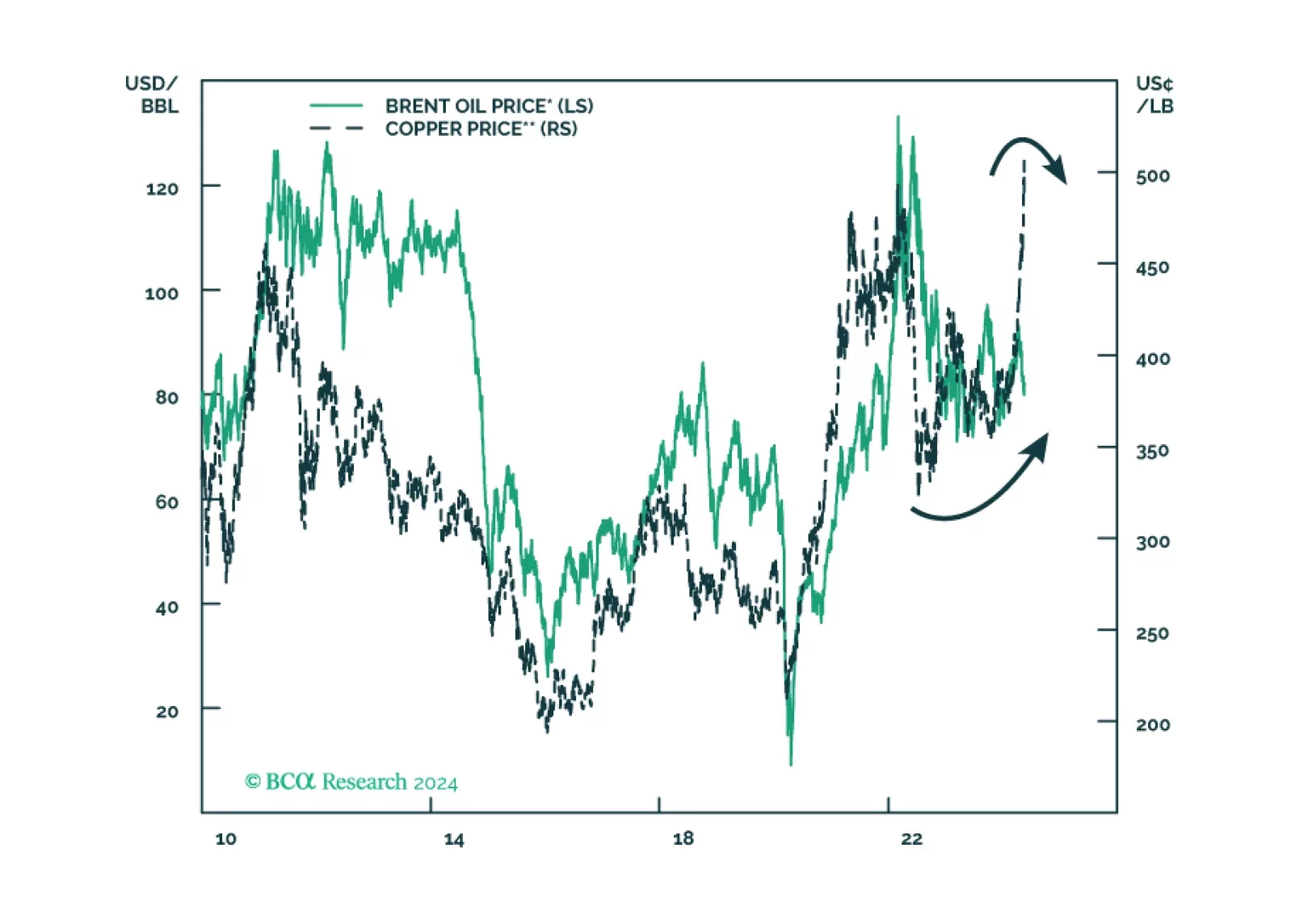

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

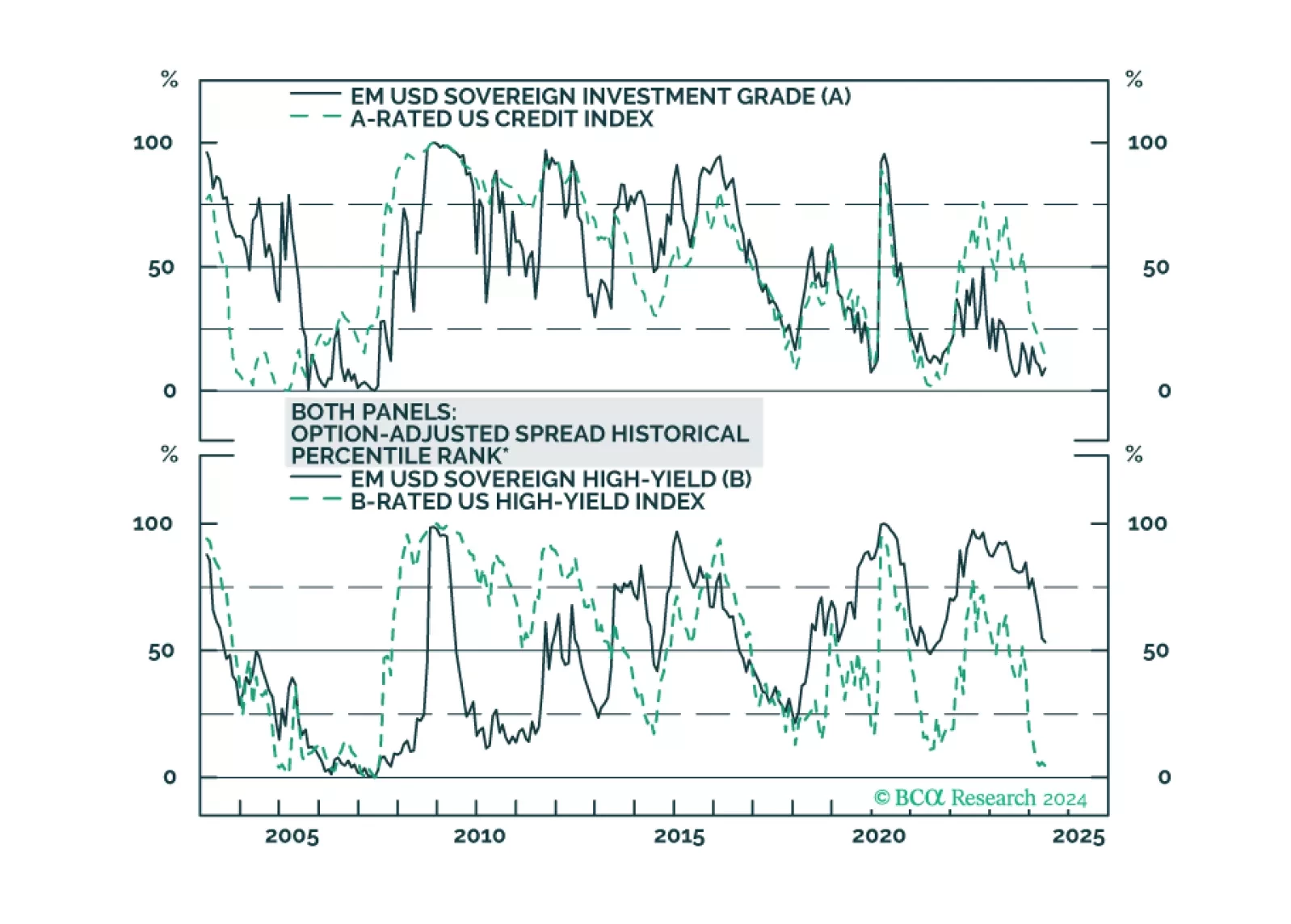

We dig into the USD-denominated Emerging Market Sovereign Index to see which credit tiers and countries offer value relative to US Credit.

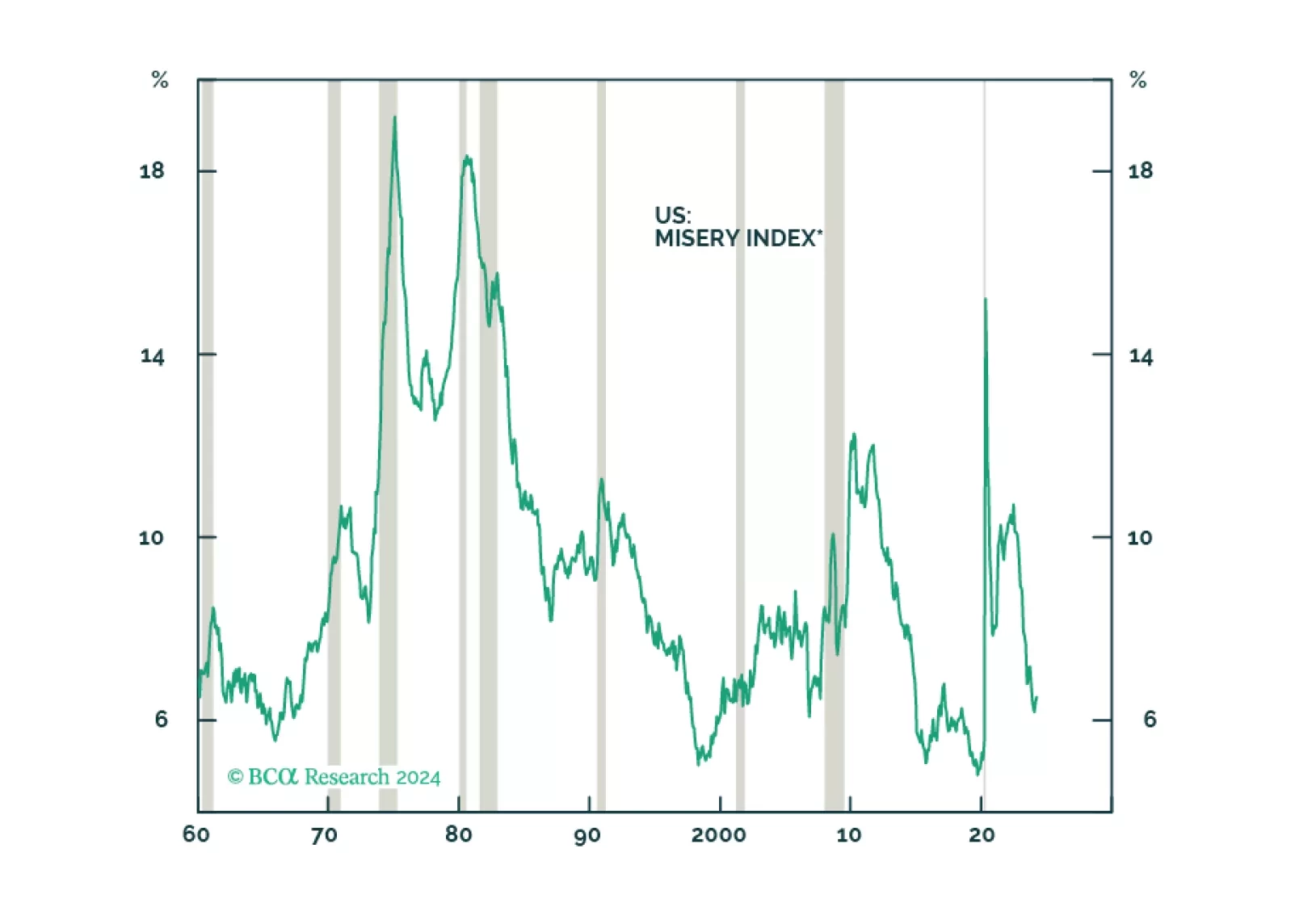

The stock market will suffer a setback from the weakening labor market and a rebound in US and global policy uncertainty.