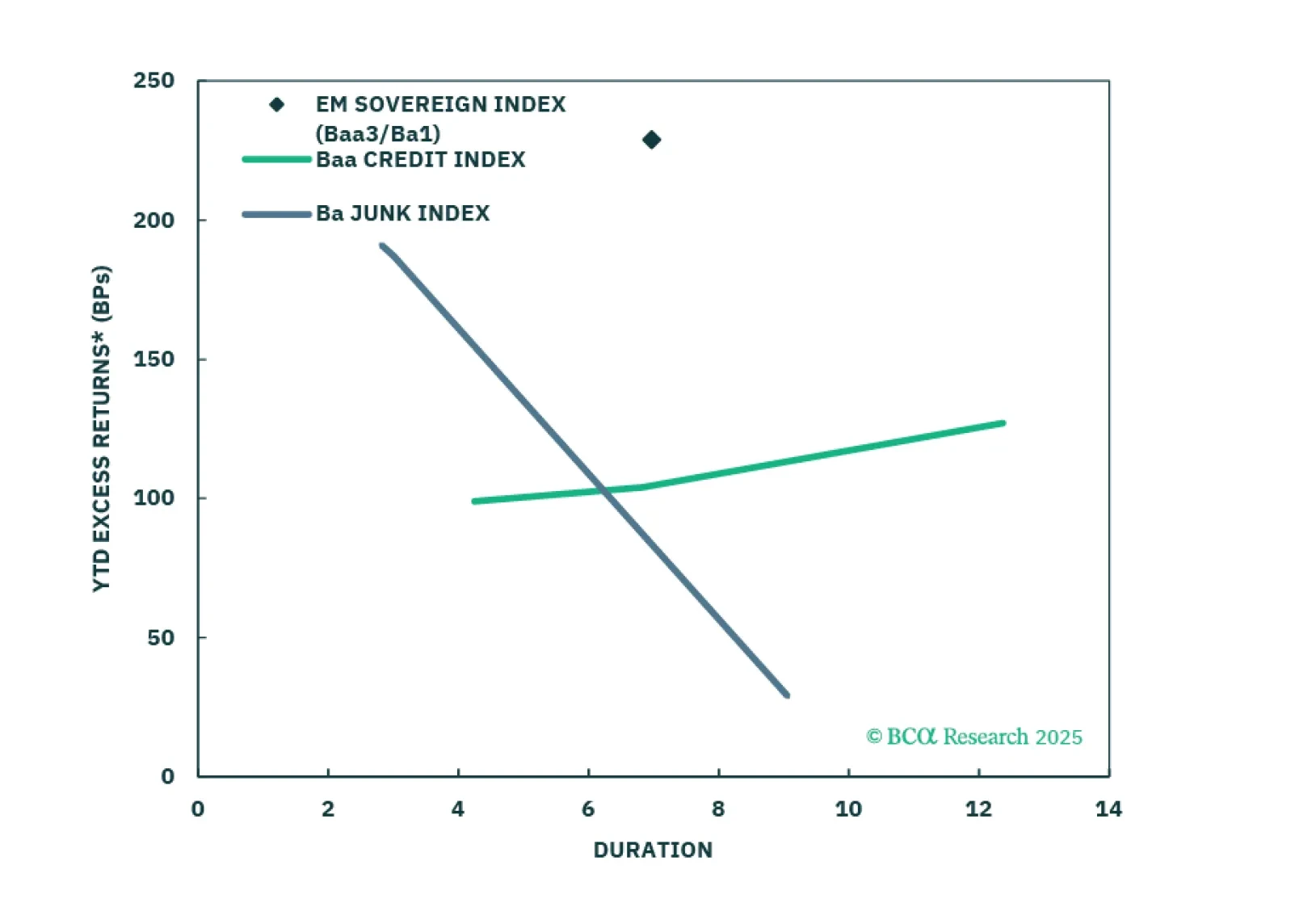

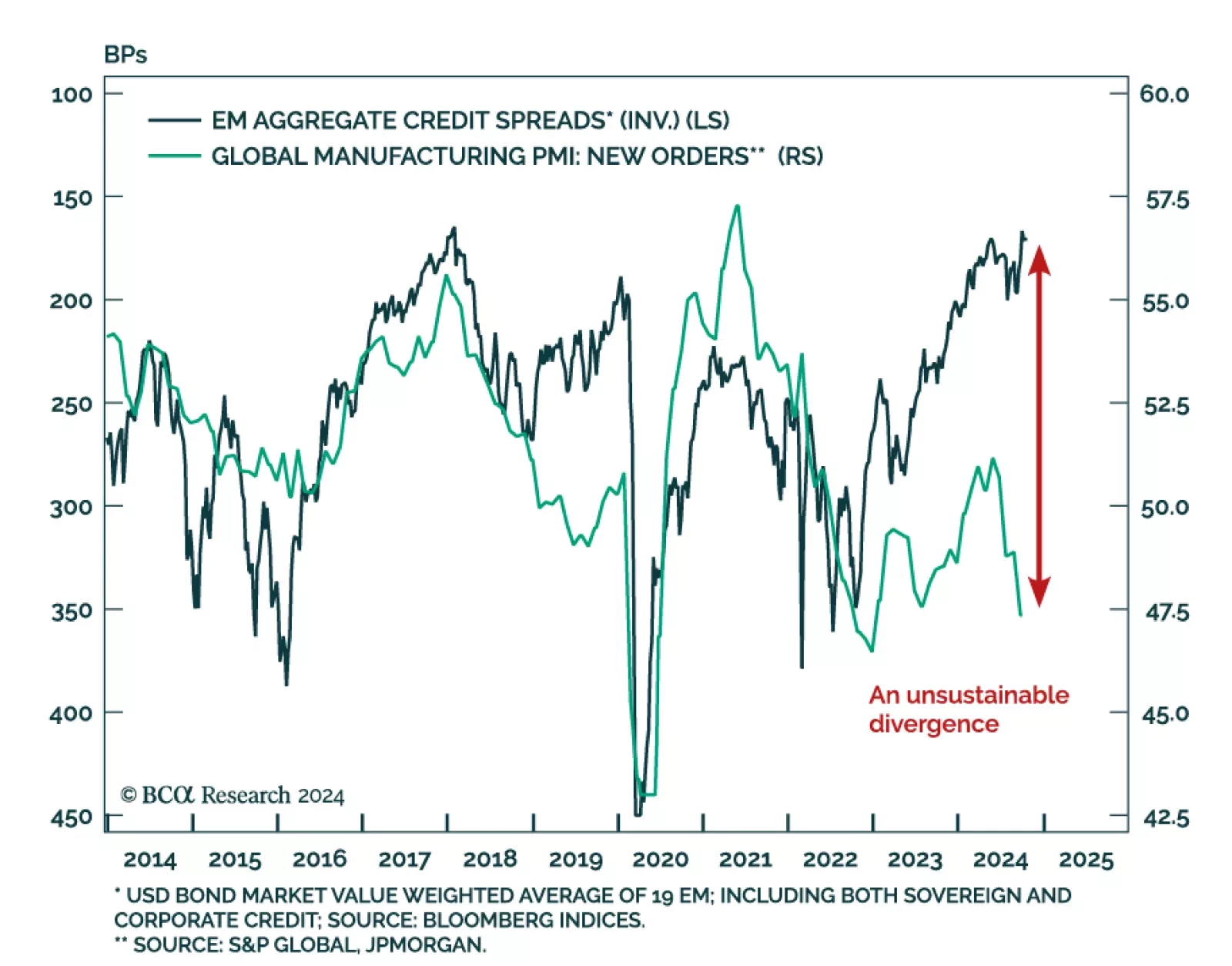

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

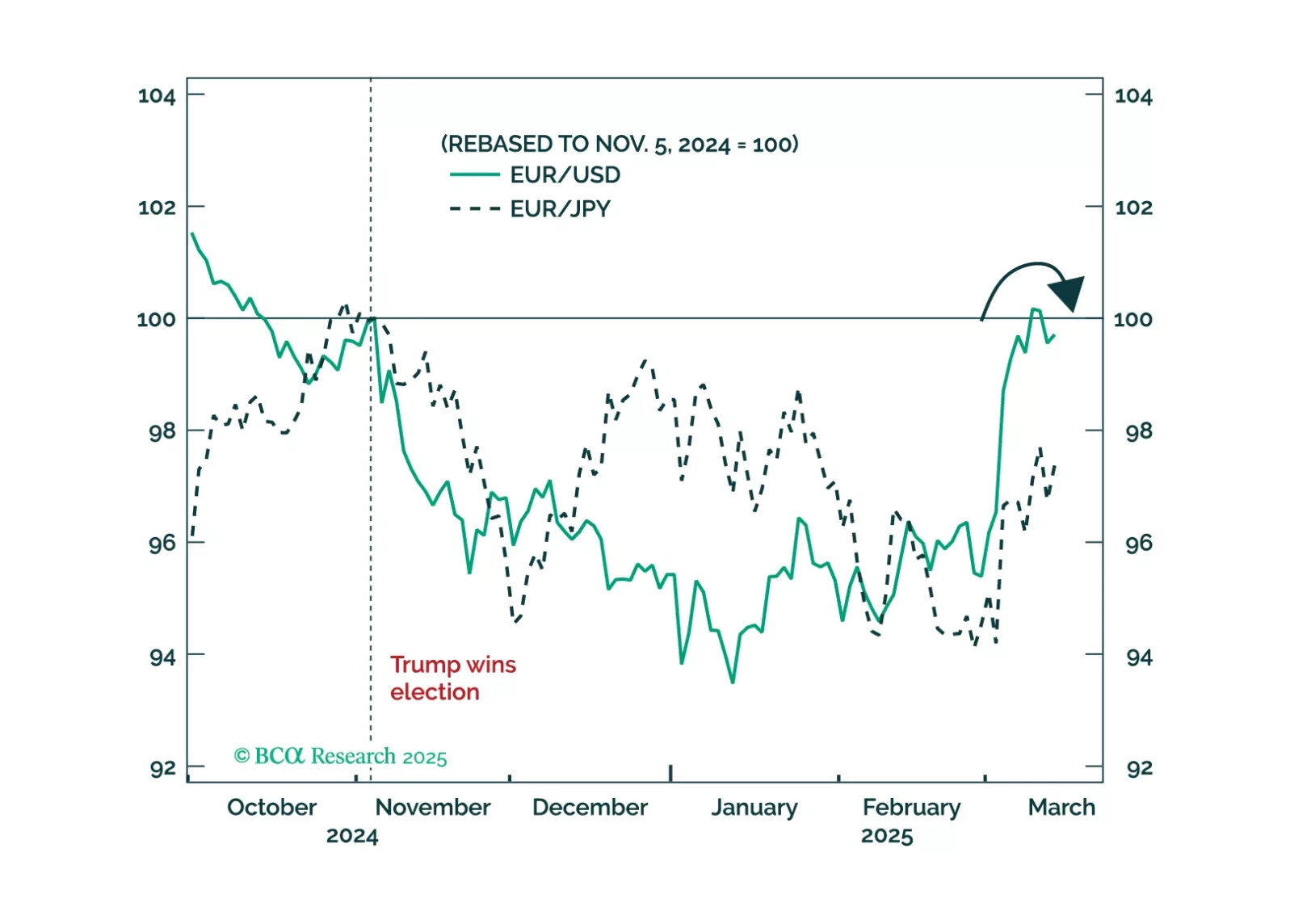

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

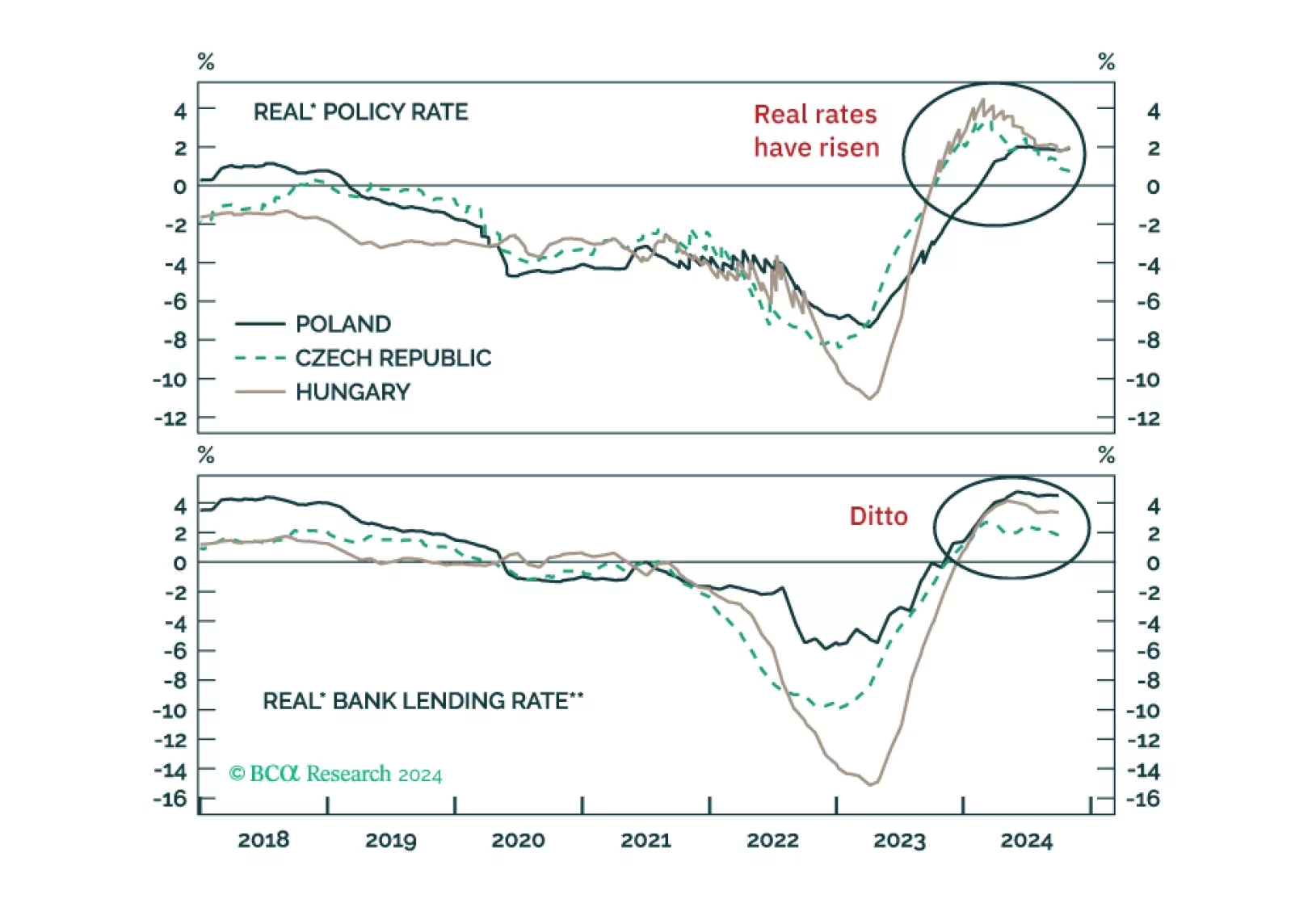

Domestic bond yields in the three major central European markets have recently inched up more than their German counterparts. This is despite economic growth staying quite weak in CE3. What should investors make of it (Chart 1)? Our…

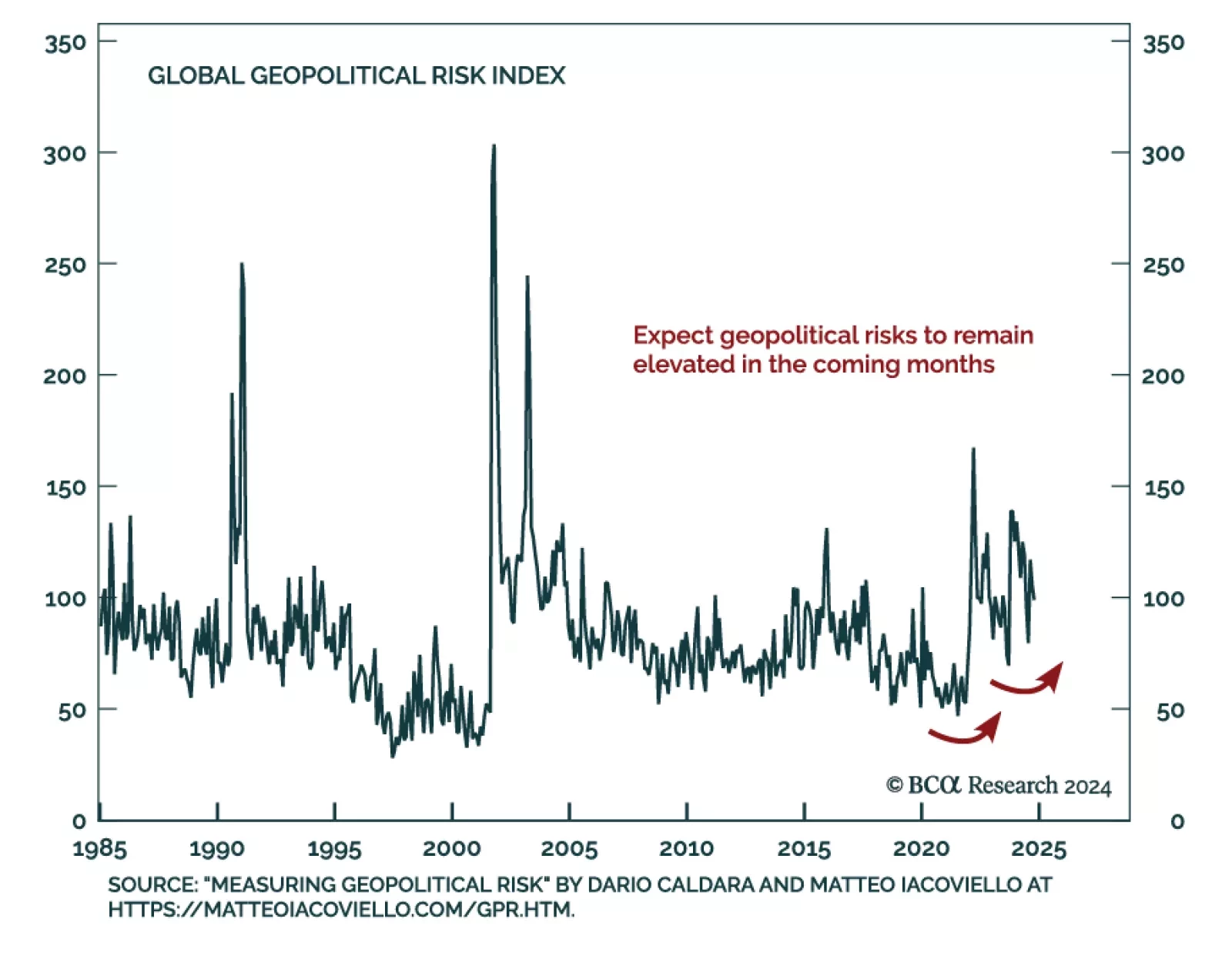

With cross-asset price action mainly revolving around the Trump trade since the election, Tuesday’s headlines surrounding Russia and Ukraine brought investors’ attention back abroad. As predicted by our Geopolitical…

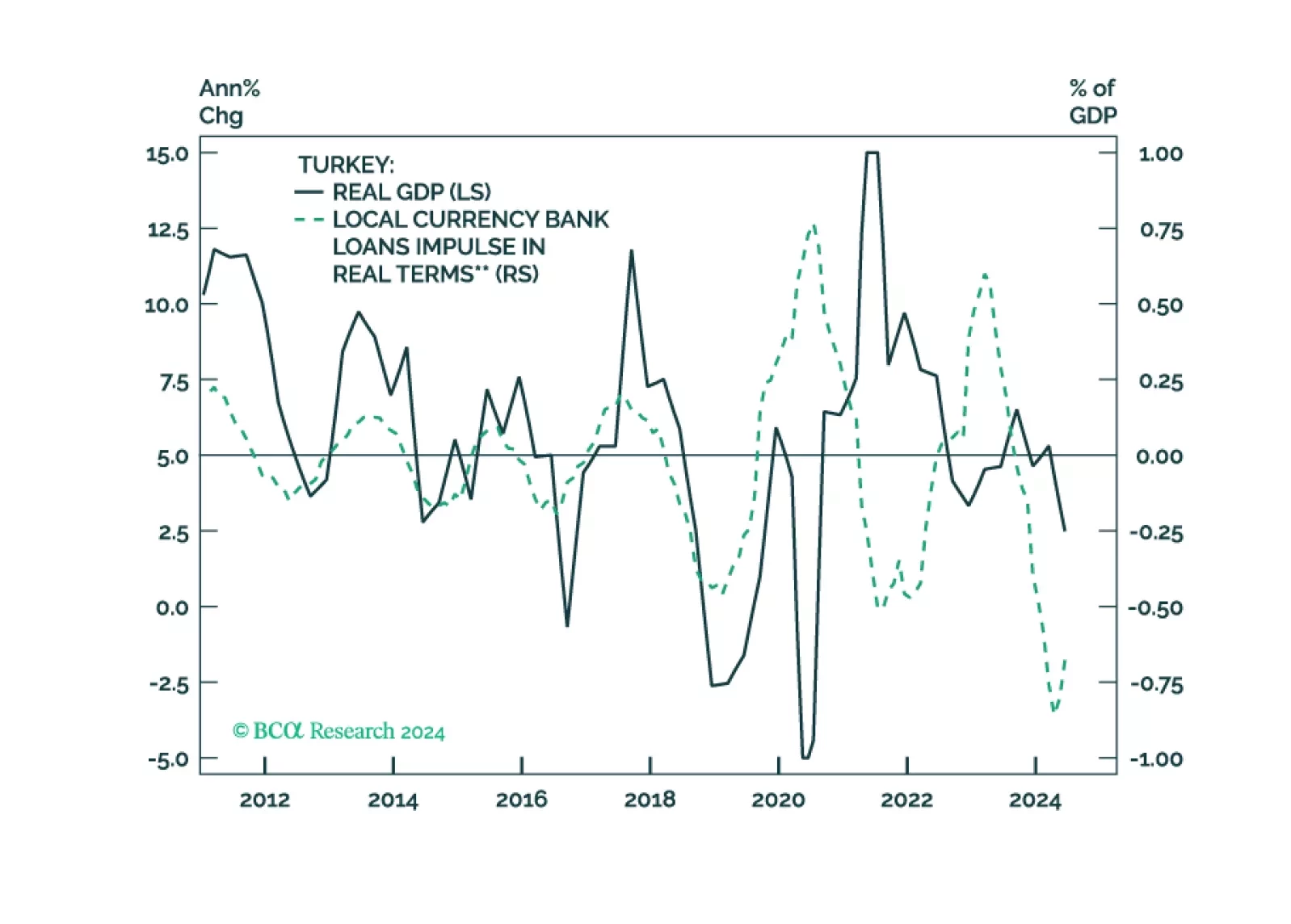

Turkey has a path toward sustained disinflation. But that will require tight macro policies for an extended period. The question is, will the authorities tolerate the consequent growth slowdown, even a recession, and surging…

EM credit markets have recently defied the selloffs in EM equities, currencies, local currency bonds, and commodities. According to our Emerging Markets Strategy colleagues, such a decoupling is unusual. A potential Trump re-…

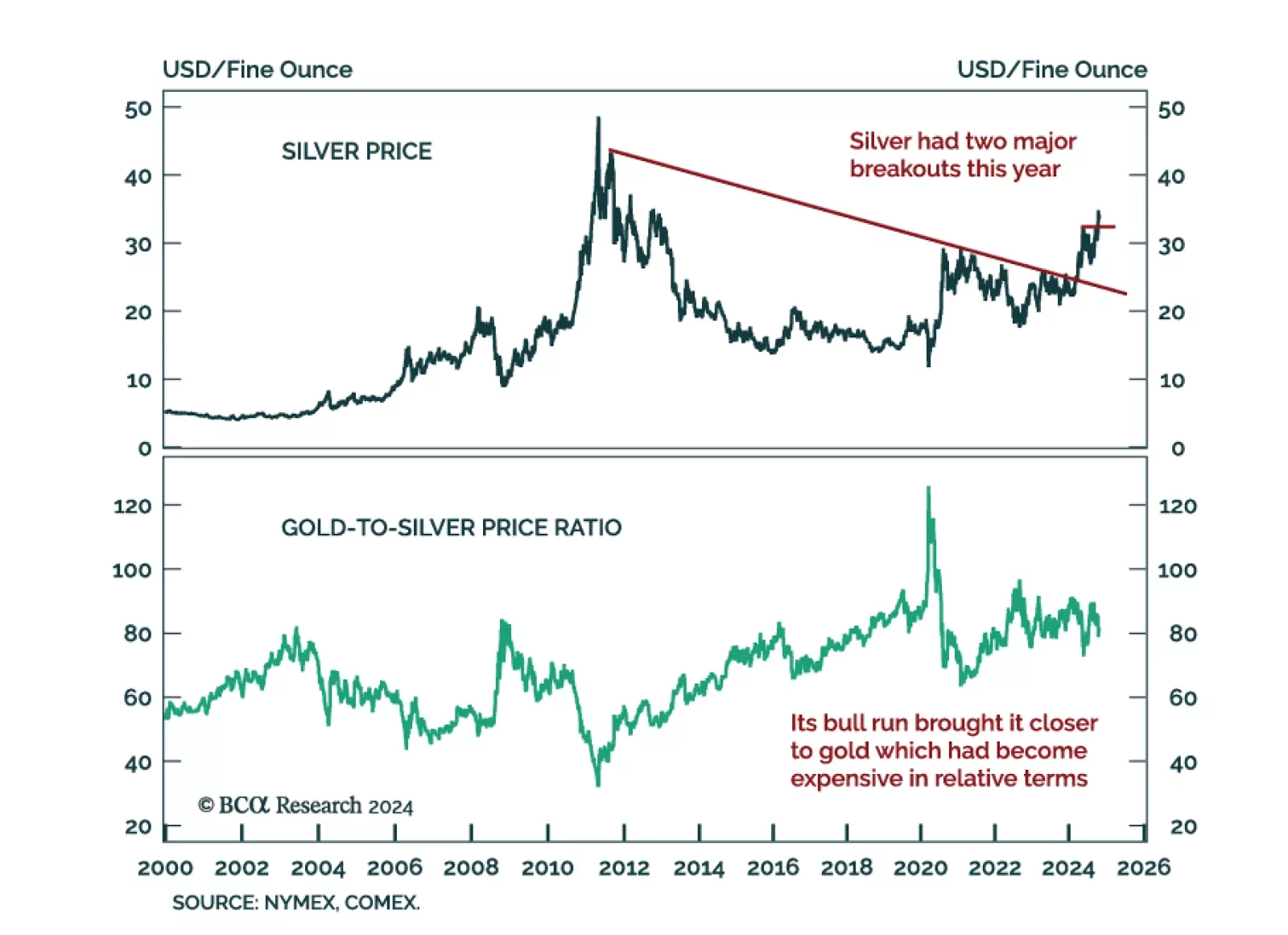

Silver has shone this year, especially after it breached a multi-decade downward slopping trendline. Silver is a precious metal, but its heavy usage in industrial processes makes us wonder whether it is sending a bullish message…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.