China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

The US and China agreed to hold trade talks more regularly on August 28, even as they fell short of establishing a strategic détente or general reduction of tensions. US Commerce Secretary Gina Raimondo visited Beijing…

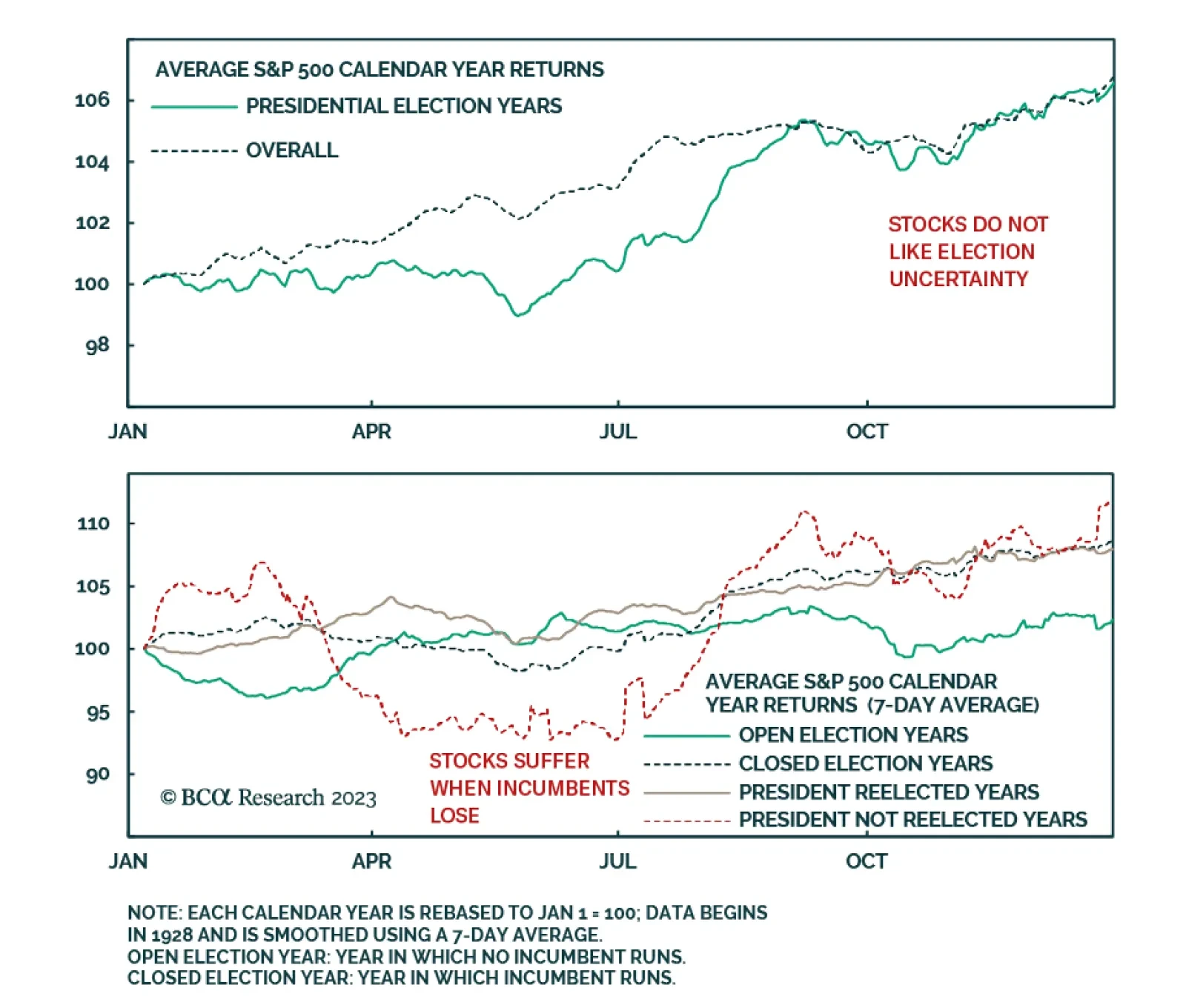

With the US presidential election approaching, our US political strategists are warning investors that stock markets are not immune to politics and geopolitics. Our colleagues have shown that out of 28 bear markets since the…

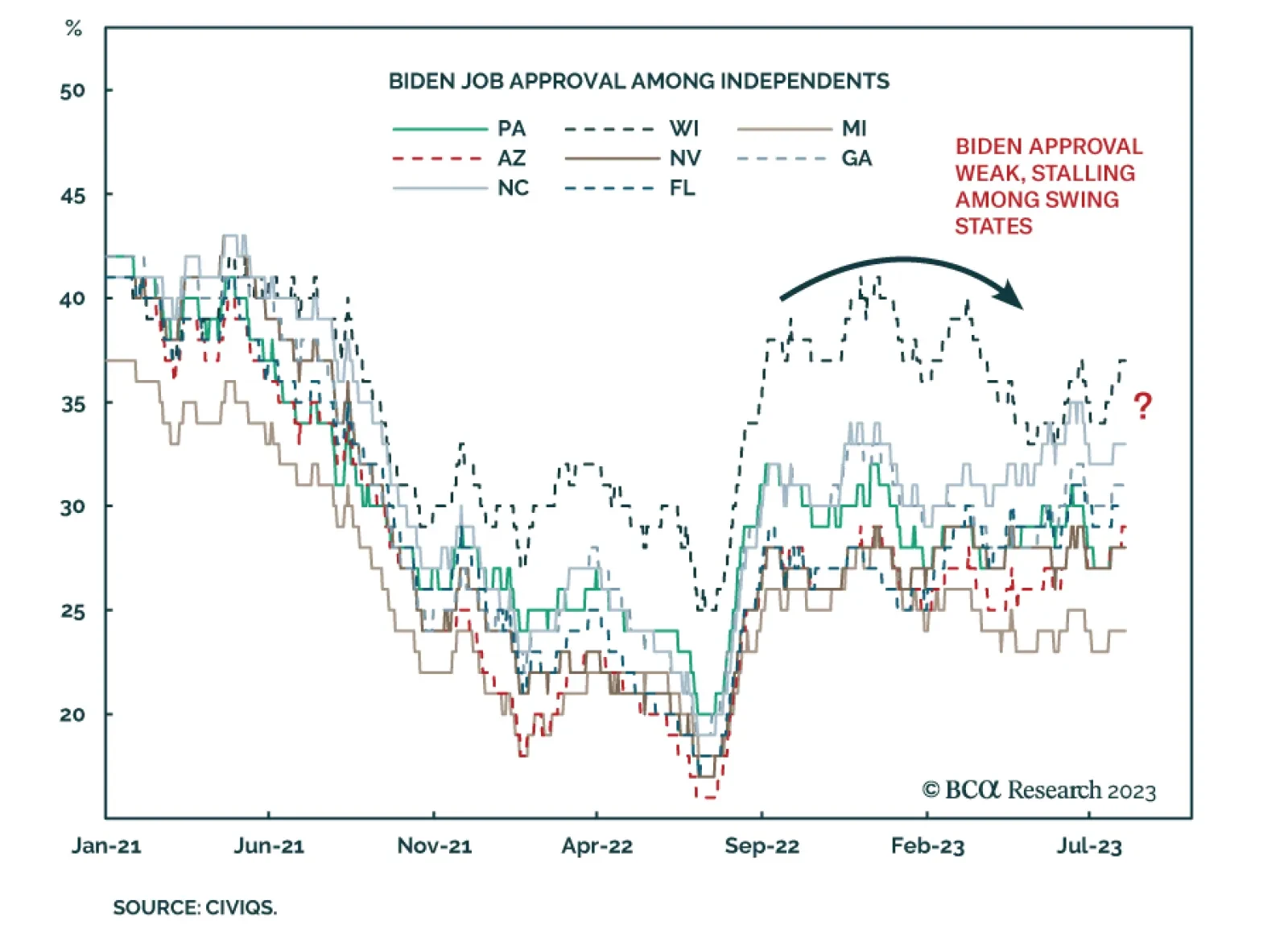

According to BCA Research’s US Political Strategy service, the Democratic Party is favored to win the 2024 election as long as it is not discredited by a major shock. But recession odds are not low. The US economy has…

Investors should prepare for an equity market pullback this fall, prefer Treasuries over stocks, and US defensives over cyclicals. A pullback could also morph into another bear market given that monetary policy is tight, policy…

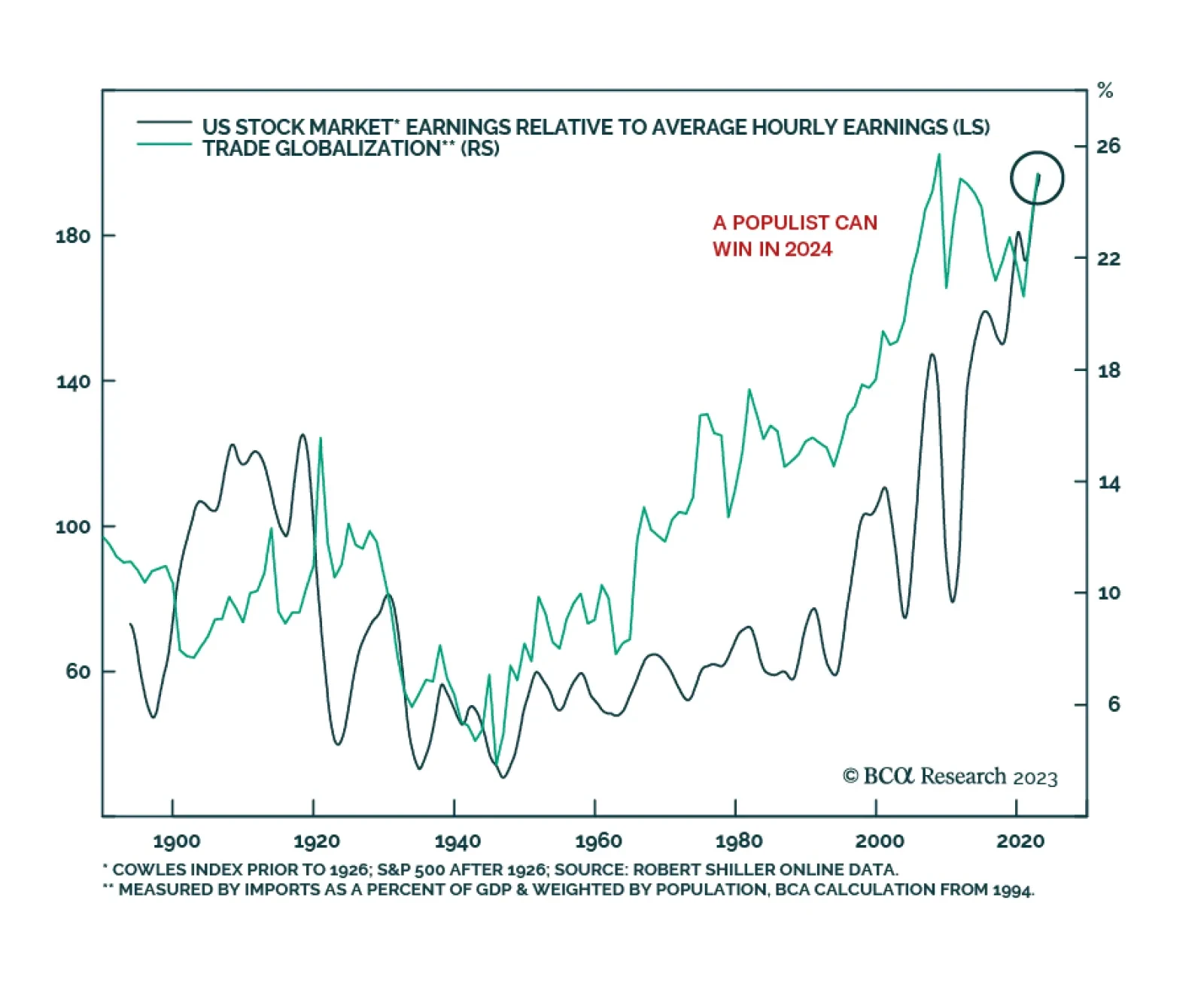

The chief question of the 2024 election is whether US anti-establishment or populist politics is a viable electoral strategy, according to BCA’s US Political Strategy. That will have domestic and global effects not only in…

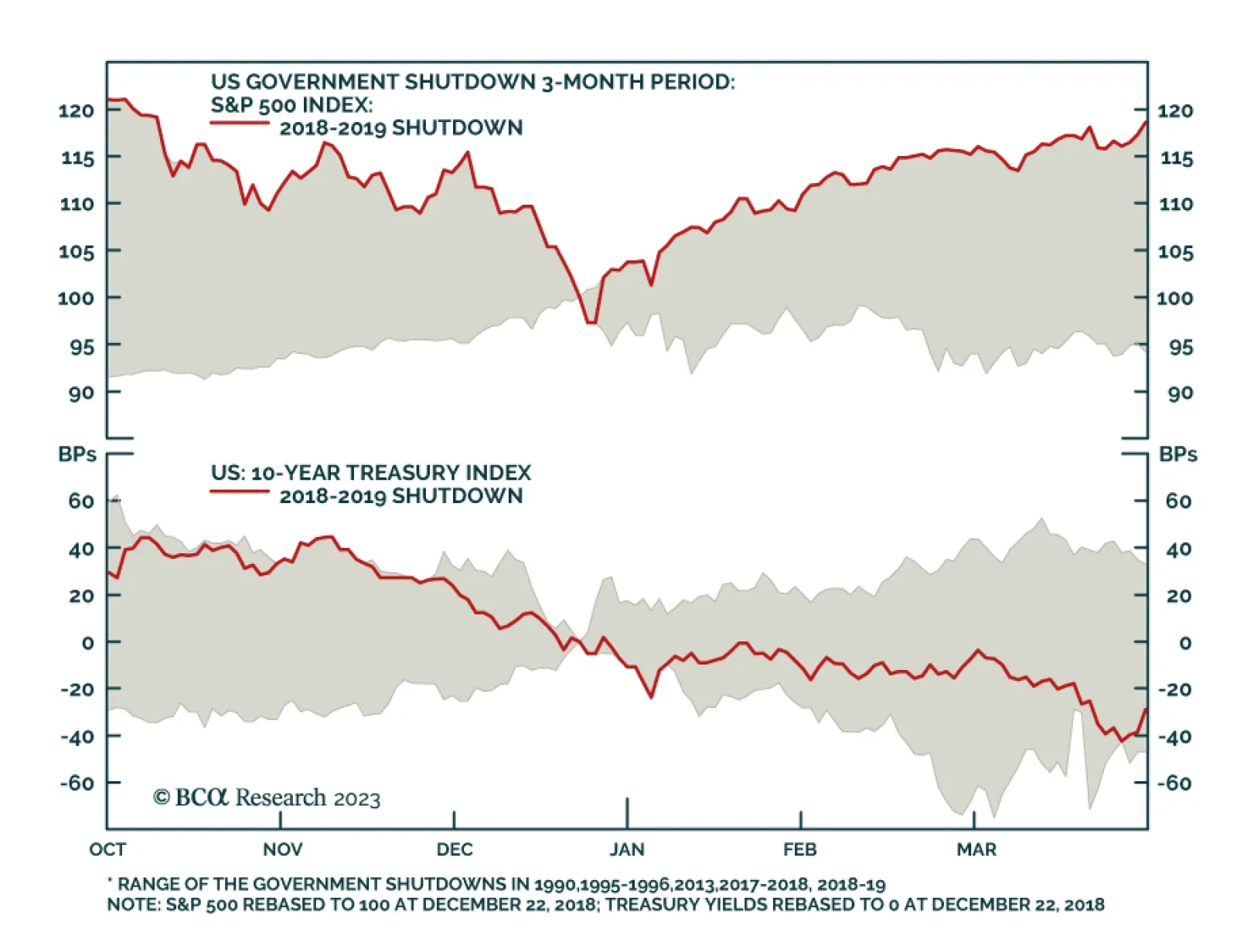

Investors are wondering about the risk of a US government shutdown as the September 30 deadline draws near. Would a shutdown be a significant negative catalyst for the stock market? While there is a high risk of a government…