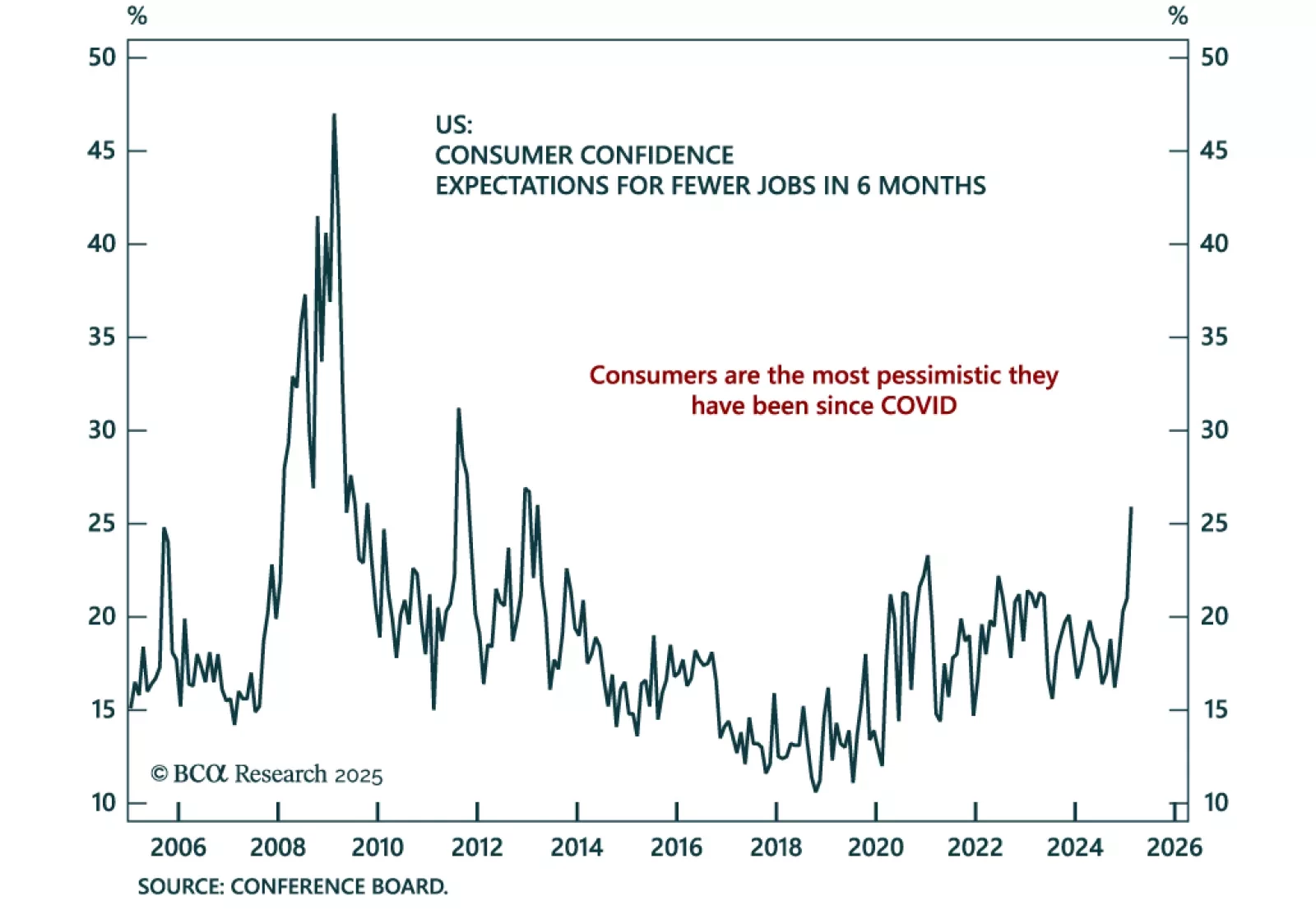

Our Chart Of The Week comes from Juan Correa, from our Global Asset Allocation (GAA) strategy service. Juan highlights weakening US growth observed in the data lately. We have seen a few growth slowdown episodes since 2022…

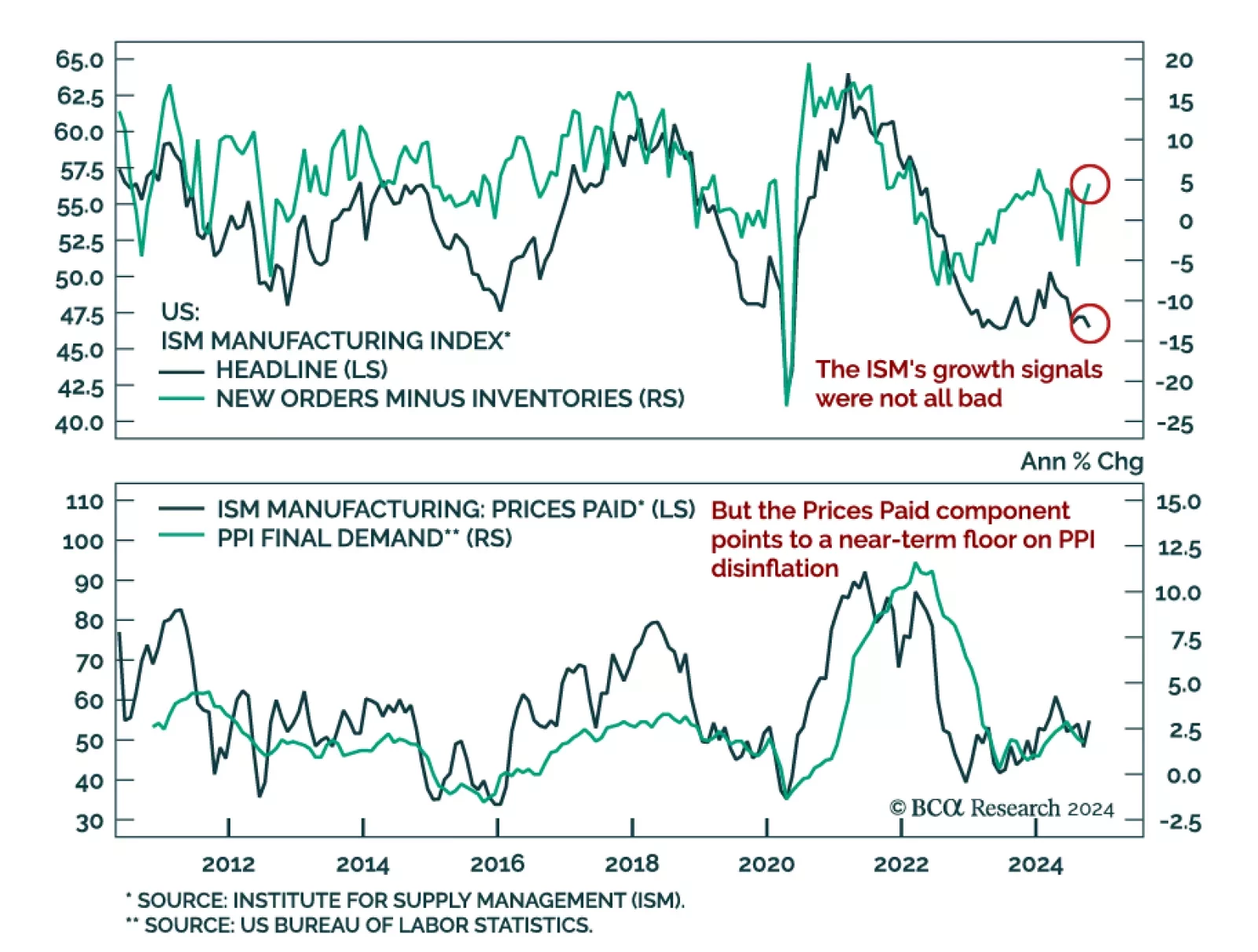

The October ISM Manufacturing missed expectations, decreasing to 46.5 from 47.2 in September. The Prices Paid component jumped, rising to 54.8 from 48.3 the month prior. New Orders showed a small upside surprise at 47.1, up 1…

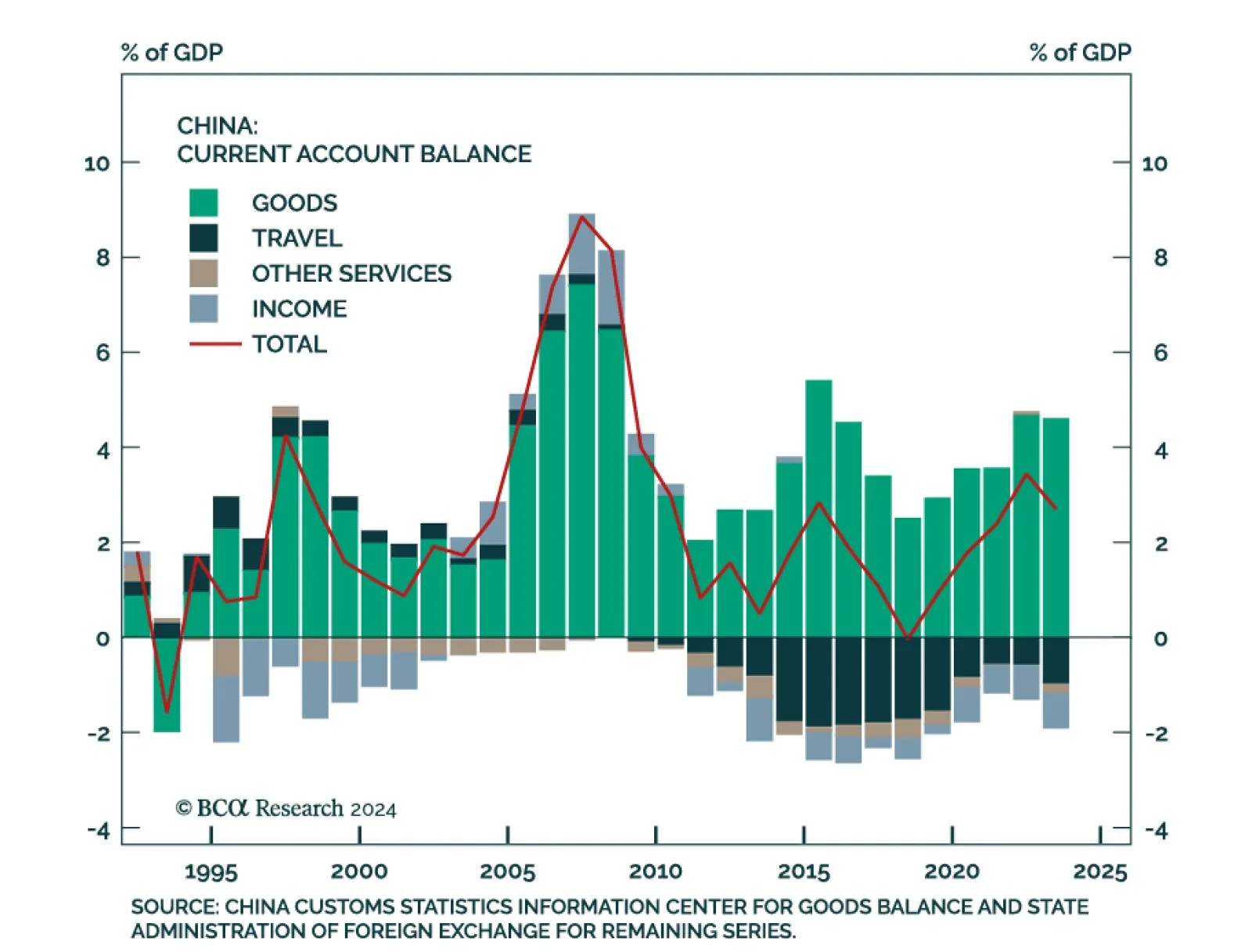

According to BCA Research’s GeoMacro Strategy service, there are two main pressure points that the US can utilize against China. First, the US consumer market is the largest in the world. Despite having diversified away…

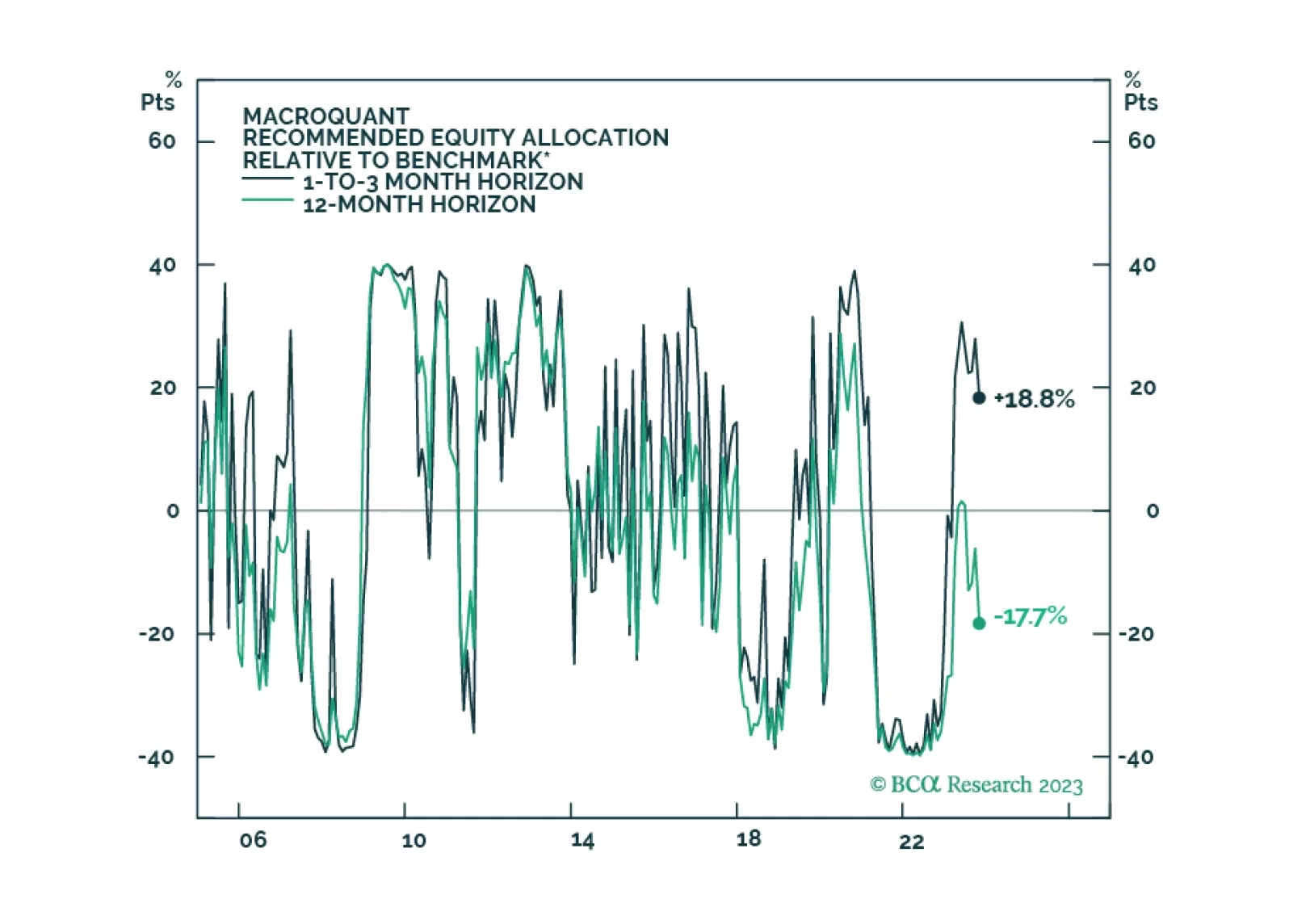

We are approaching another phase transition from boom to bust. Stocks should rally into year-end, but investors should look to reduce equity exposure early next year while increasing bond exposure.

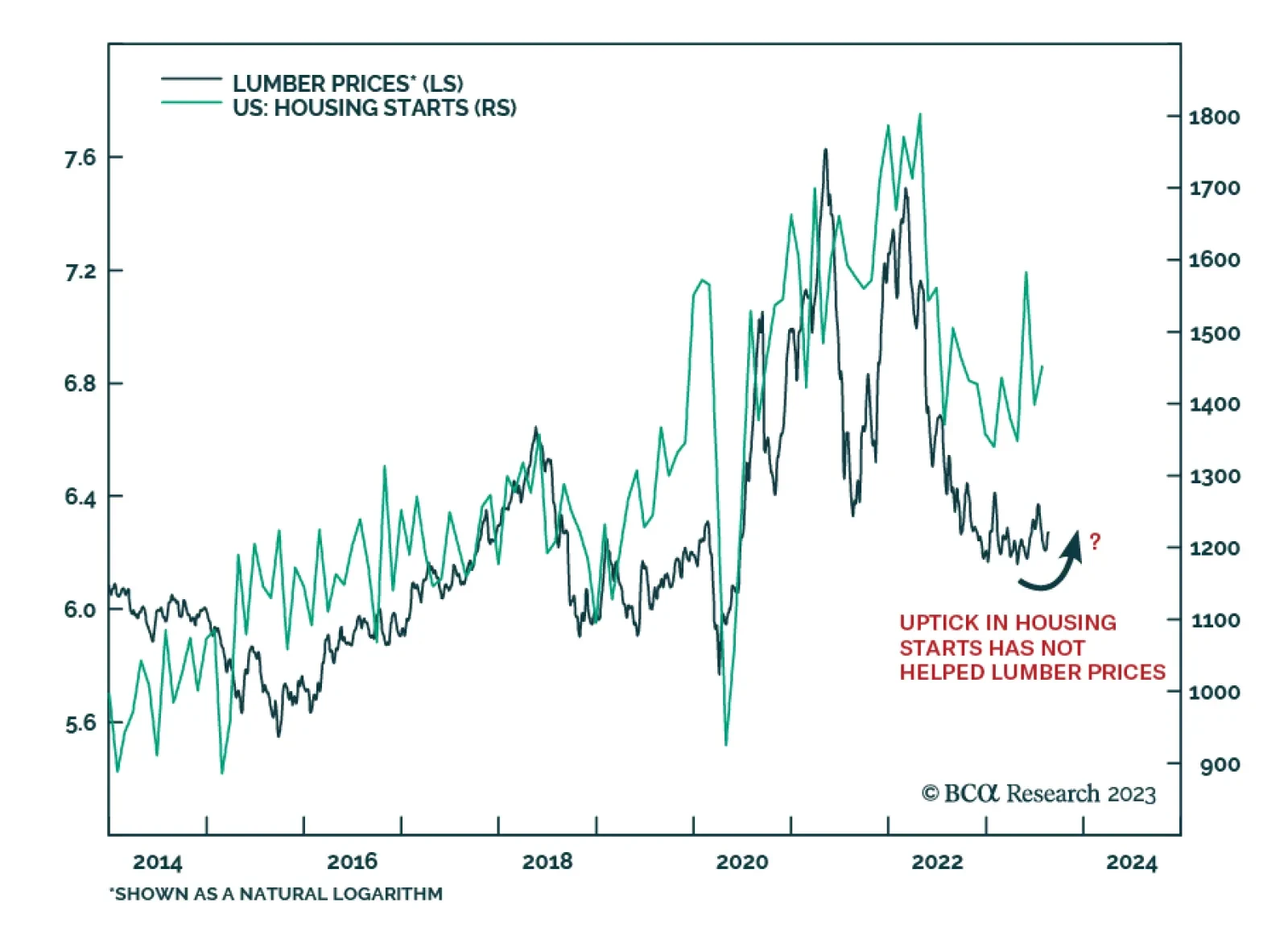

In a June insight, we discussed the possibility of a sustained lumber rally due in part to resilient housing market activity in the US and supply constraints in Canada, a major exporter of lumber. Since then, prices have remained…

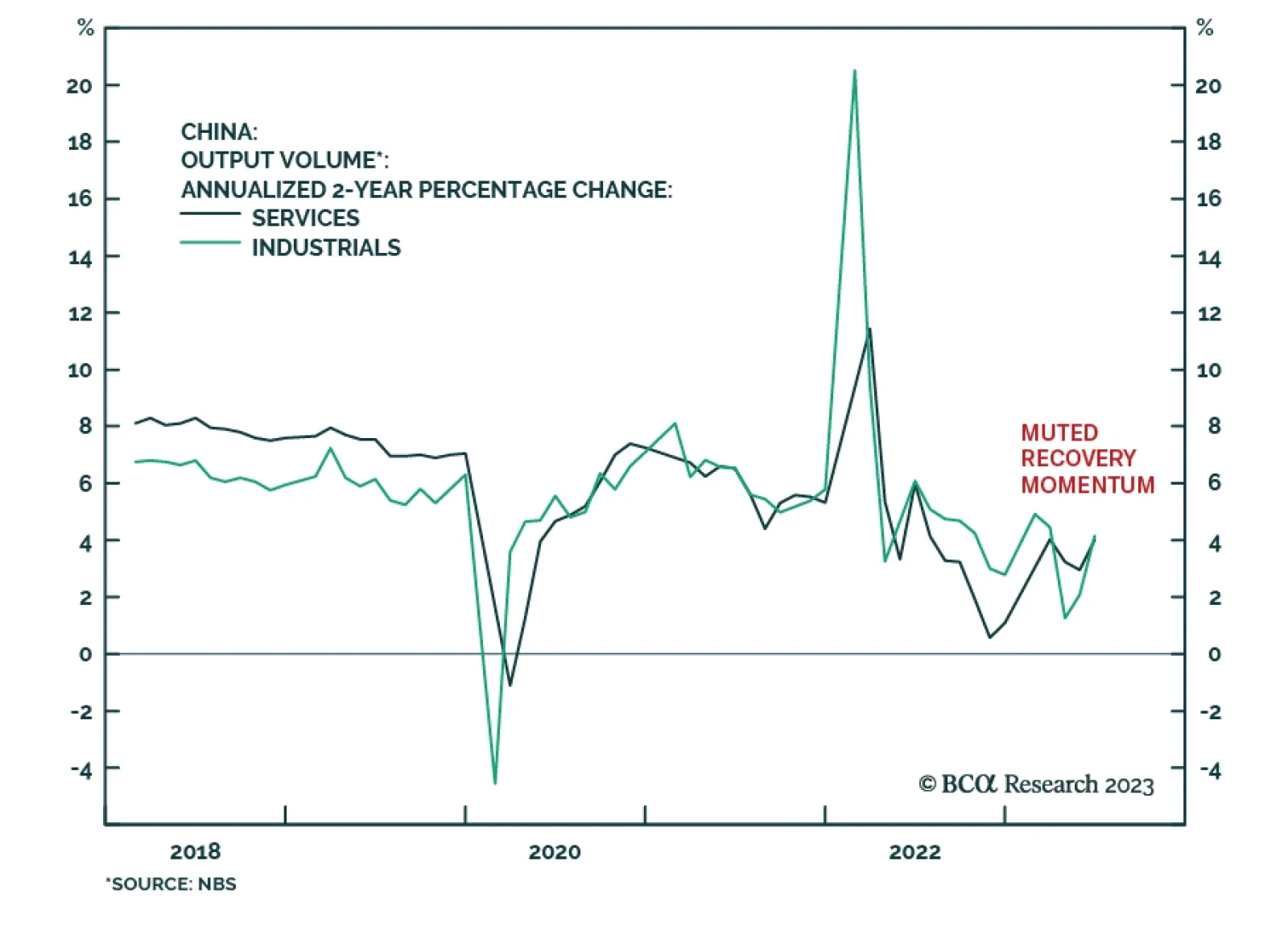

On the surface, the latest batch of Chinese economic data released on Monday shows a deterioration in consumer spending with retail sales growth slowing sharply from 12.7% y/y to 3.1% y/y in June – slightly below consensus…

President Erdogan and the Justice and Development Party emerged as the winner of the Turkish general election which was concluded yesterday. This victory means that their expansive policies of the past decade will continue, and…

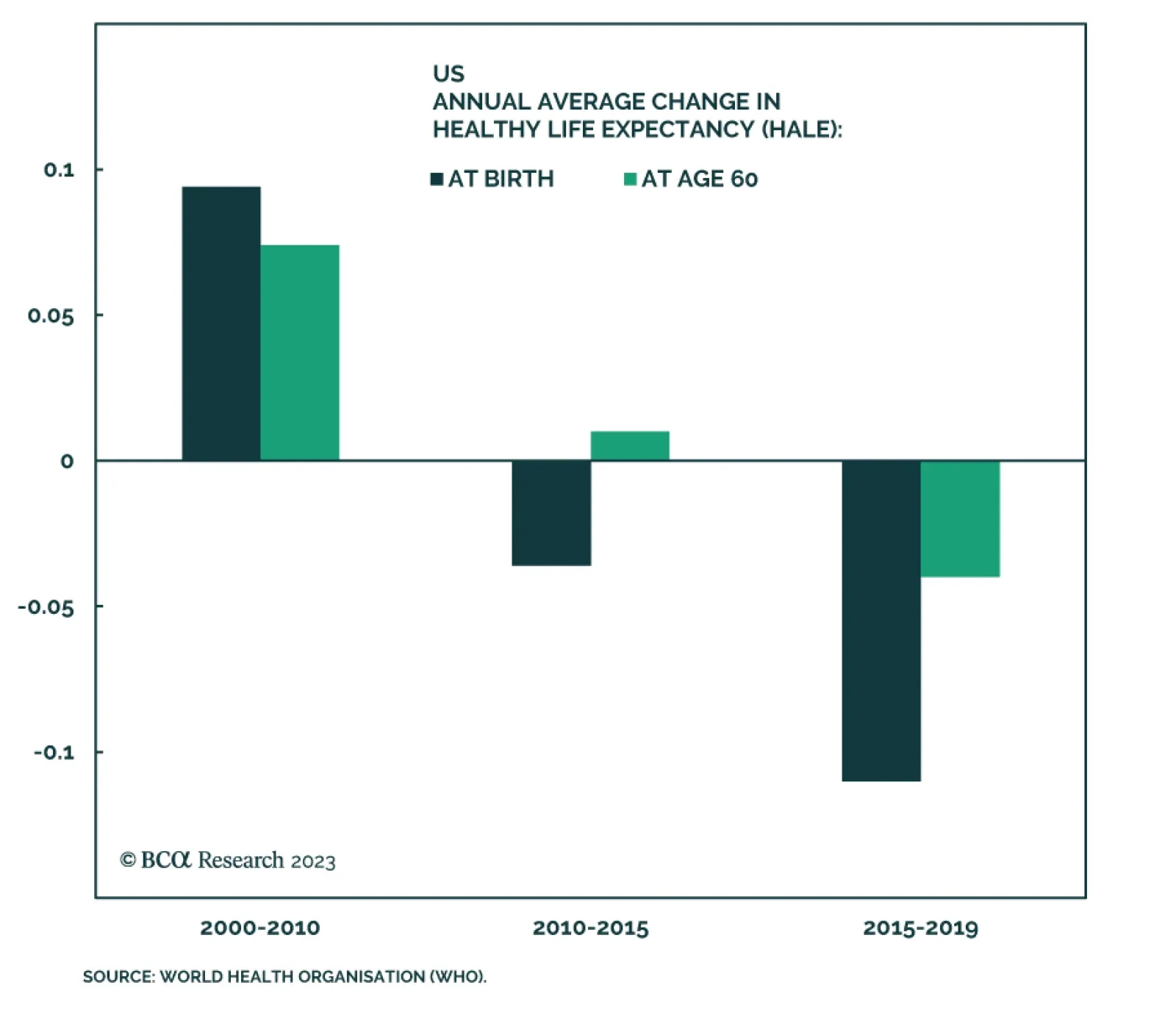

According to BCA Research’s Global Investment Strategy service, over the long run, the deterioration in health trends in the US can weigh on labor supply and productivity, put upward pressure on bond yields, and hurt equity…