The war in Ukraine has ended in late 2022… for markets at least. This is the conclusion from our GeoMacro team’s latest report, which aims to dispel five crucial myths surrounding the conflict. The myths are the…

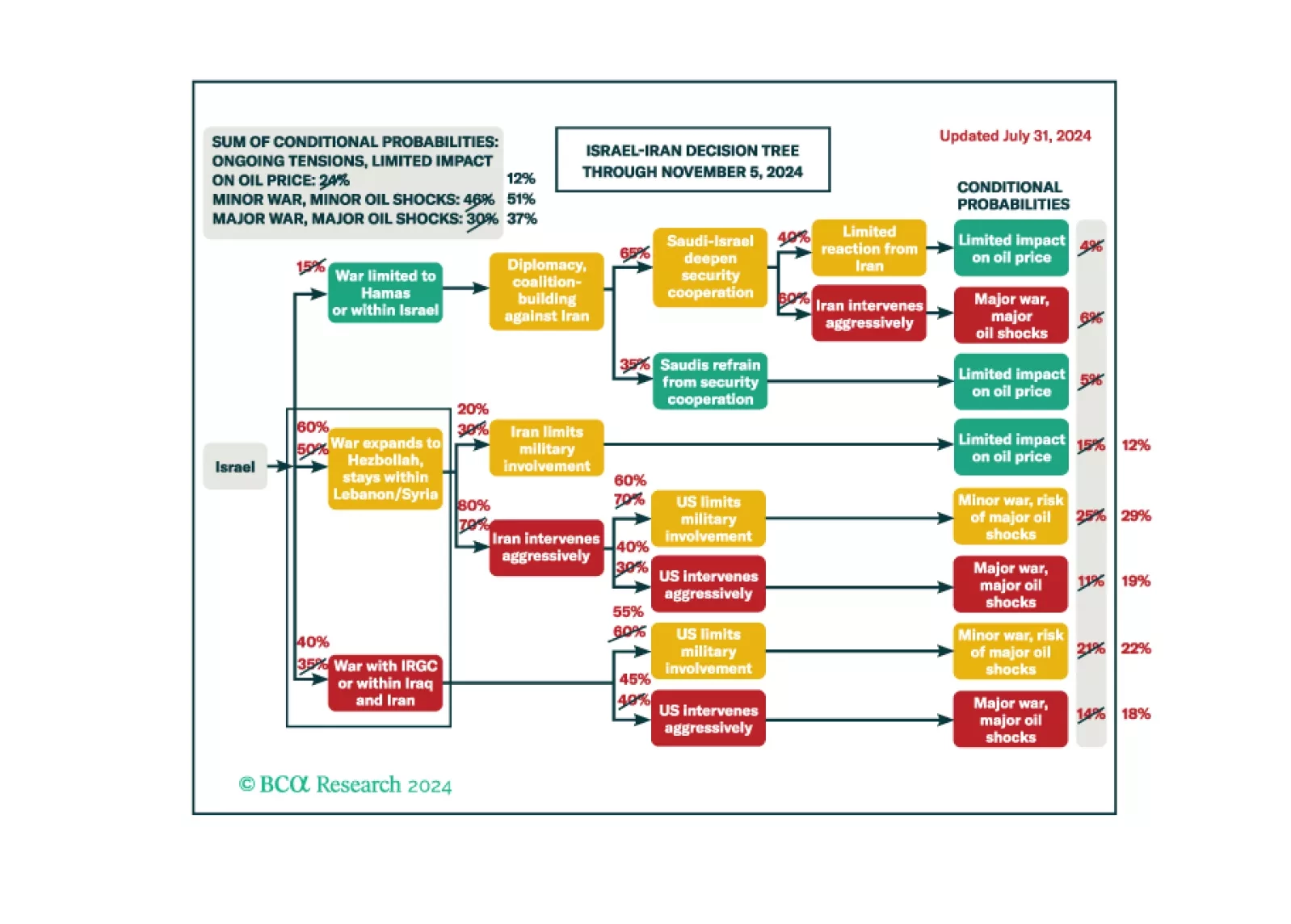

We maintain 37% odds of a major recessionary oil shock, 51% odds of minor shocks, and 12% odds of no shocks.

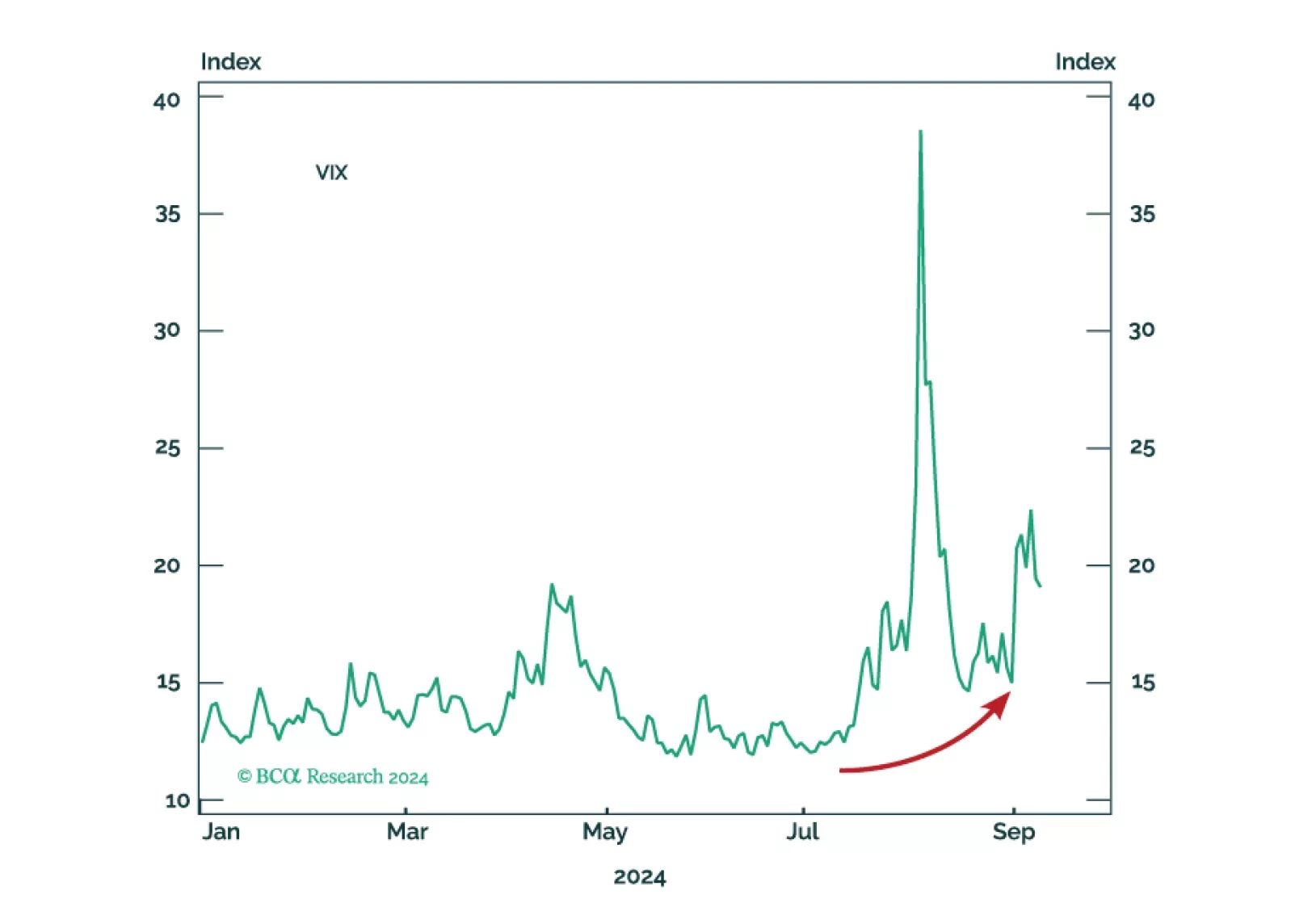

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

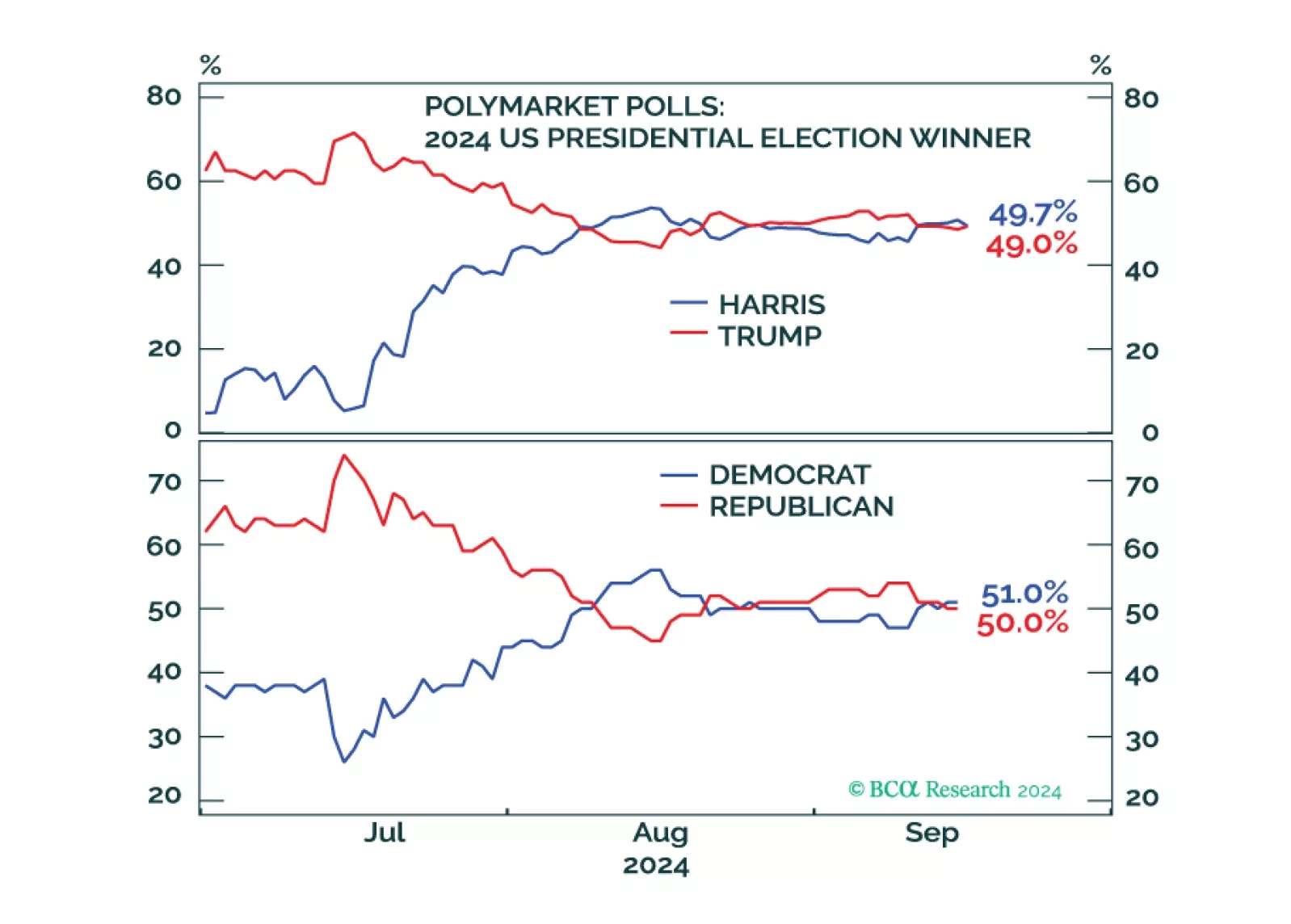

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran…

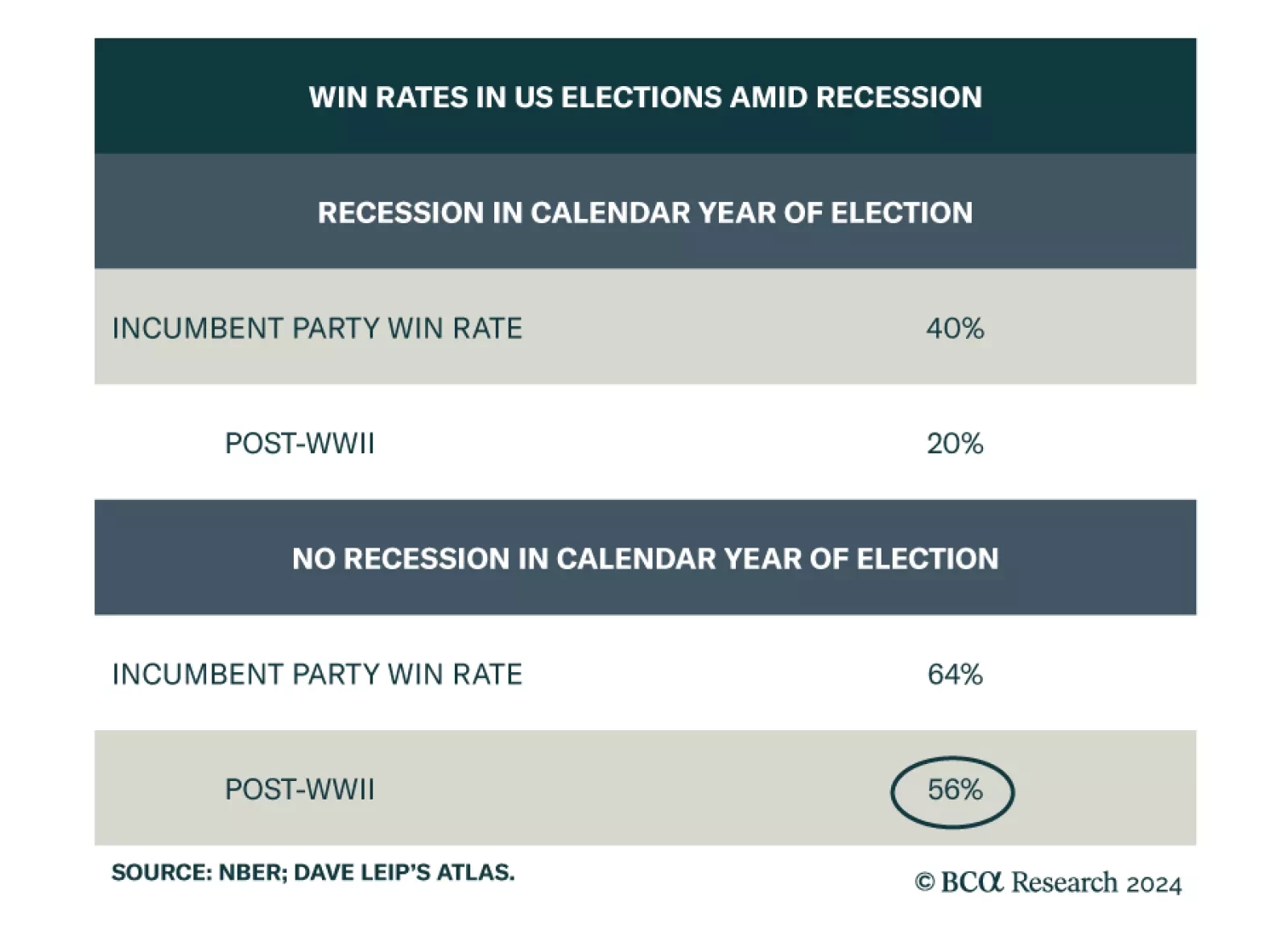

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

Despite the disastrous performance by former President Trump in the debate with Vice President Kamala Harris, there are still paths for him to come back to power. The economy and global instability could flare up anytime between now…

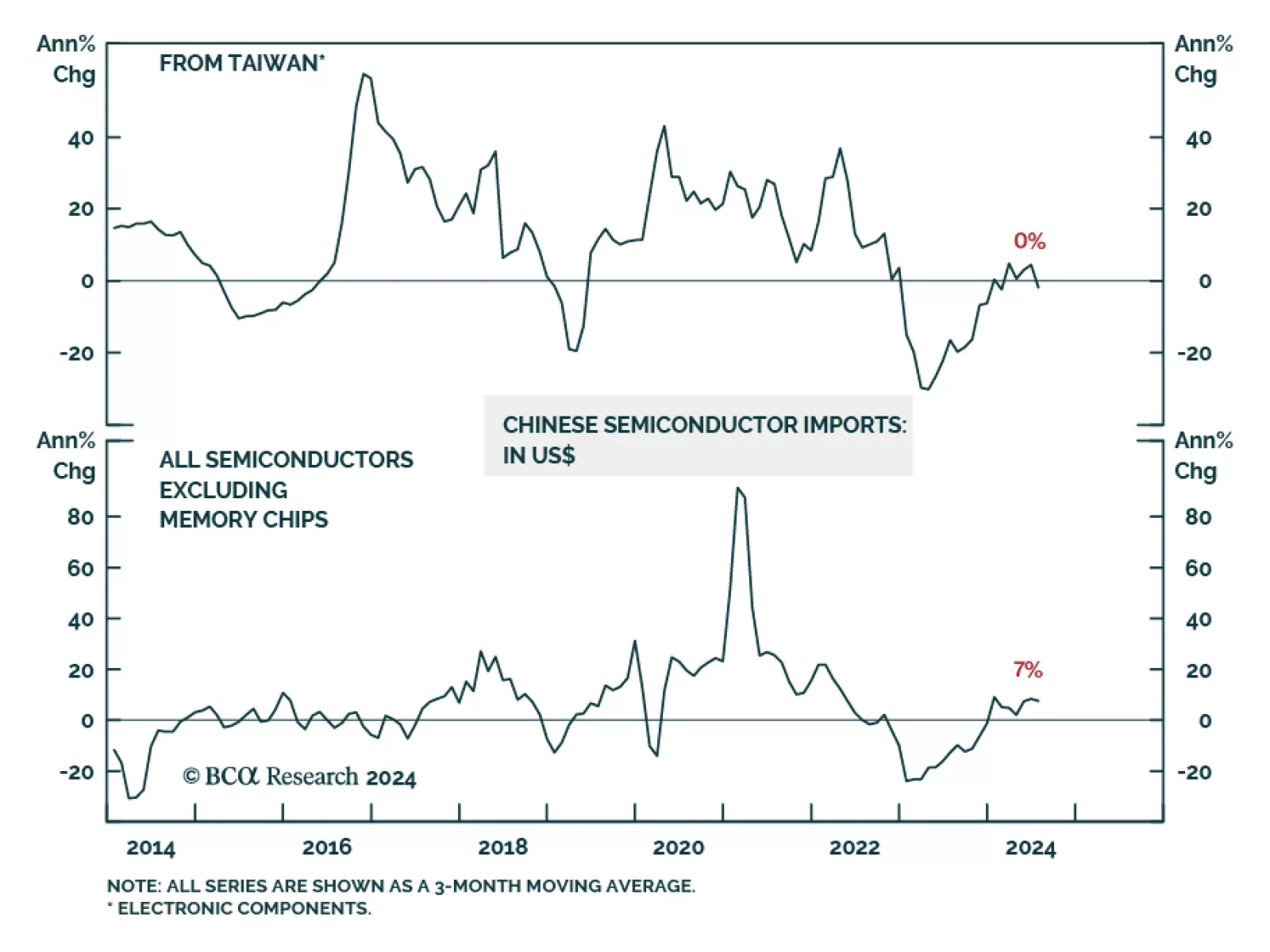

According to BCA Research’s Emerging Markets Strategy Service, China has been accumulating high-value memory semiconductors in anticipation of further US restrictions. Since October 2022, the US has been tightening rules…

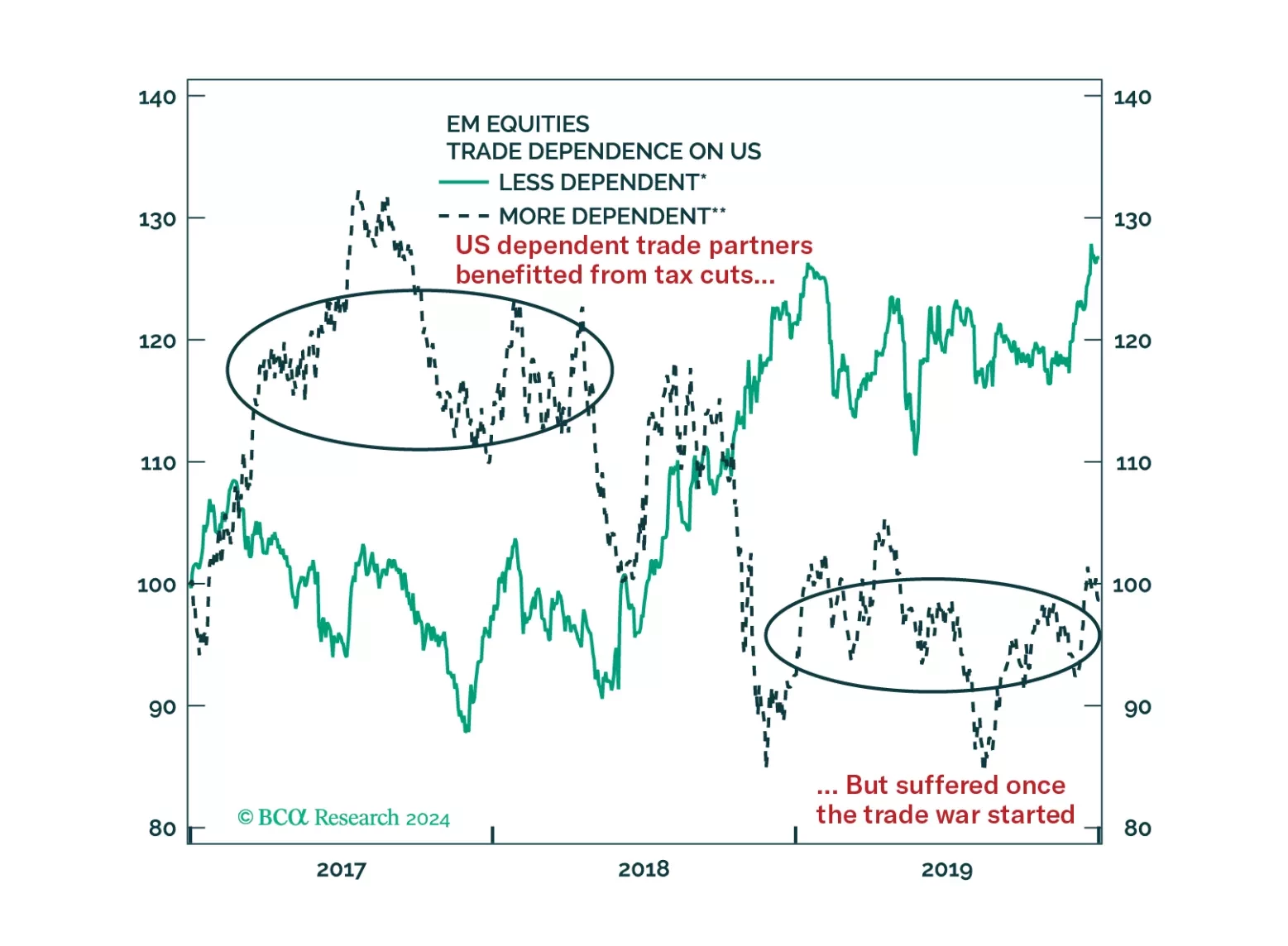

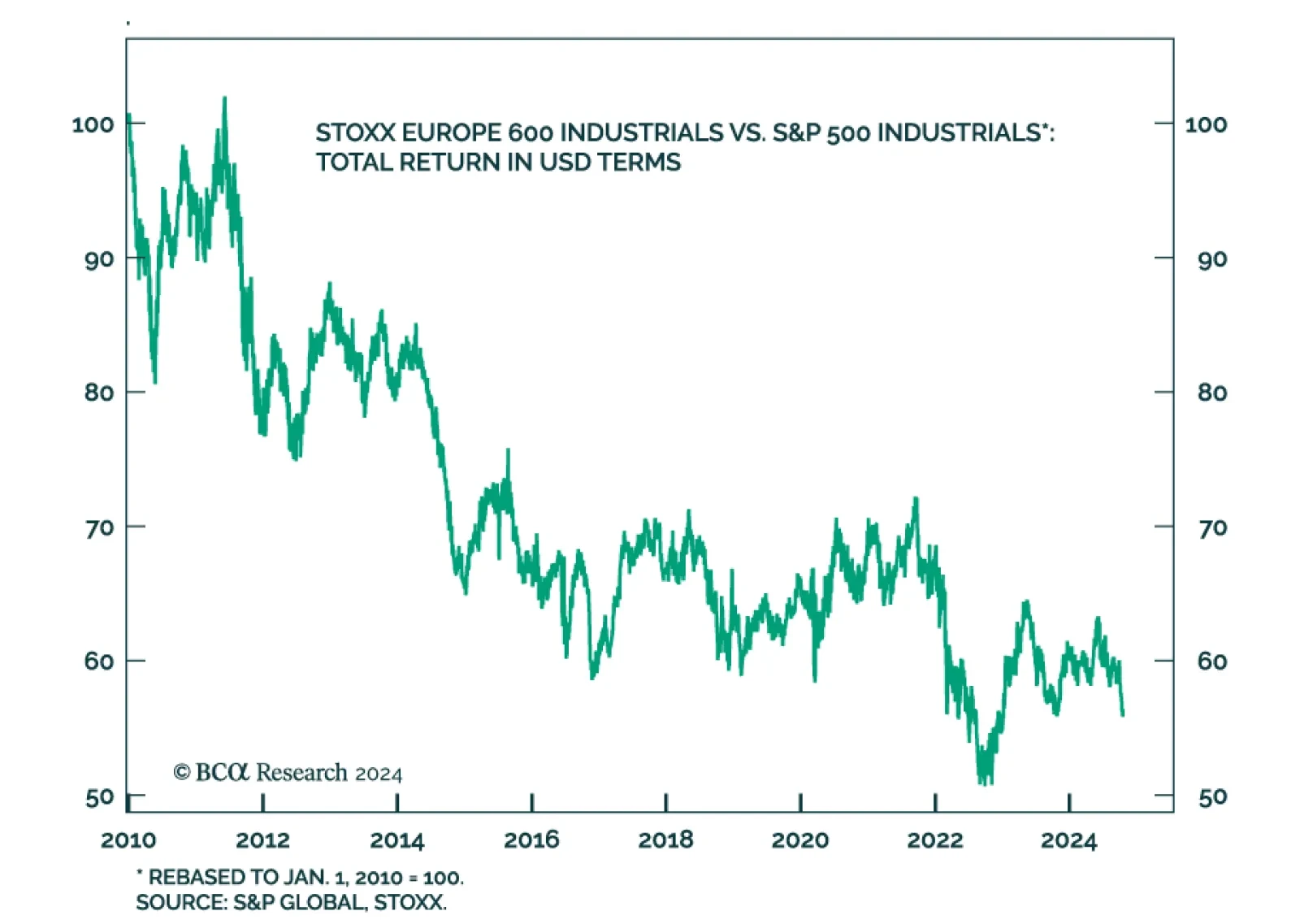

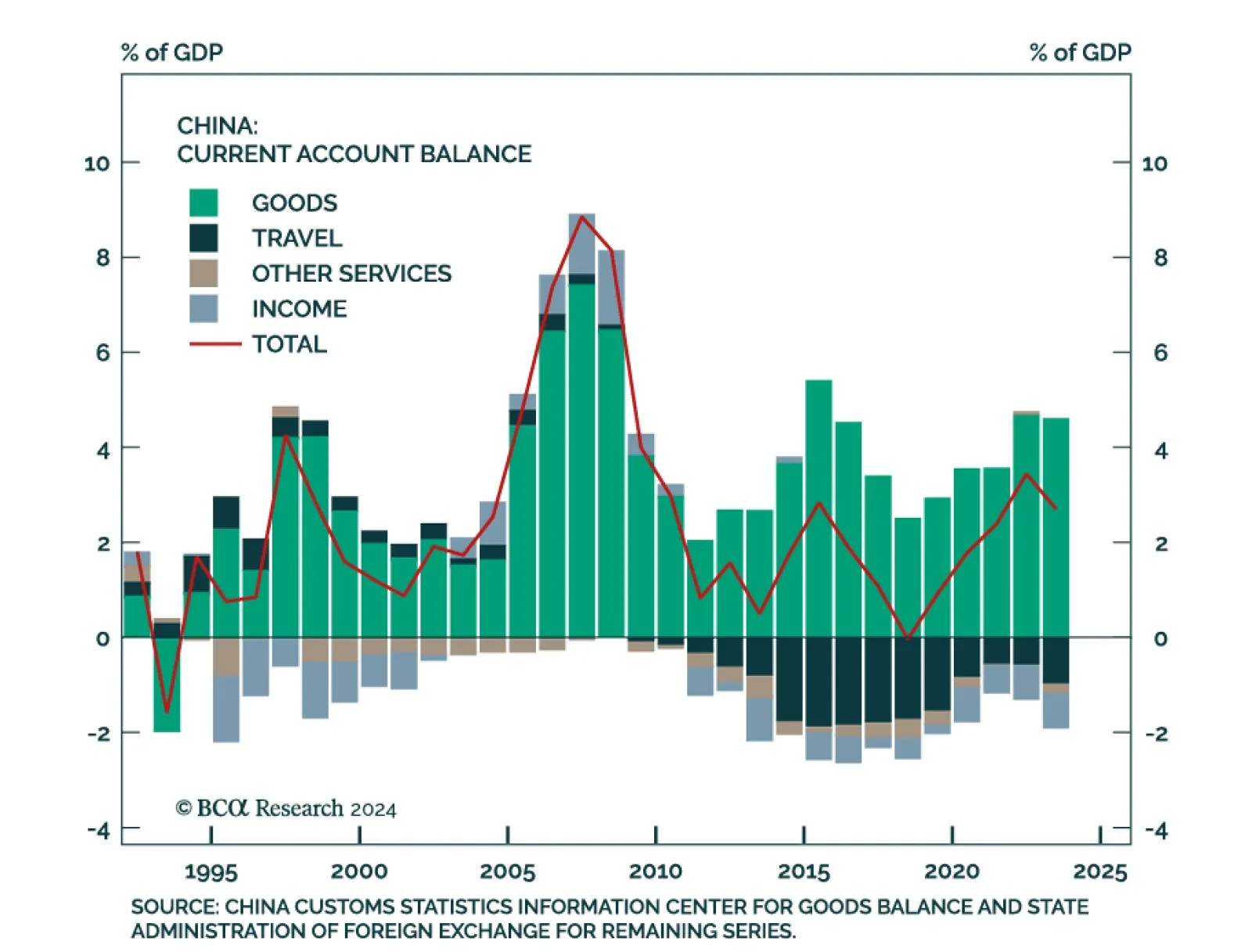

According to BCA Research’s GeoMacro Strategy service, there are two main pressure points that the US can utilize against China. First, the US consumer market is the largest in the world. Despite having diversified away…