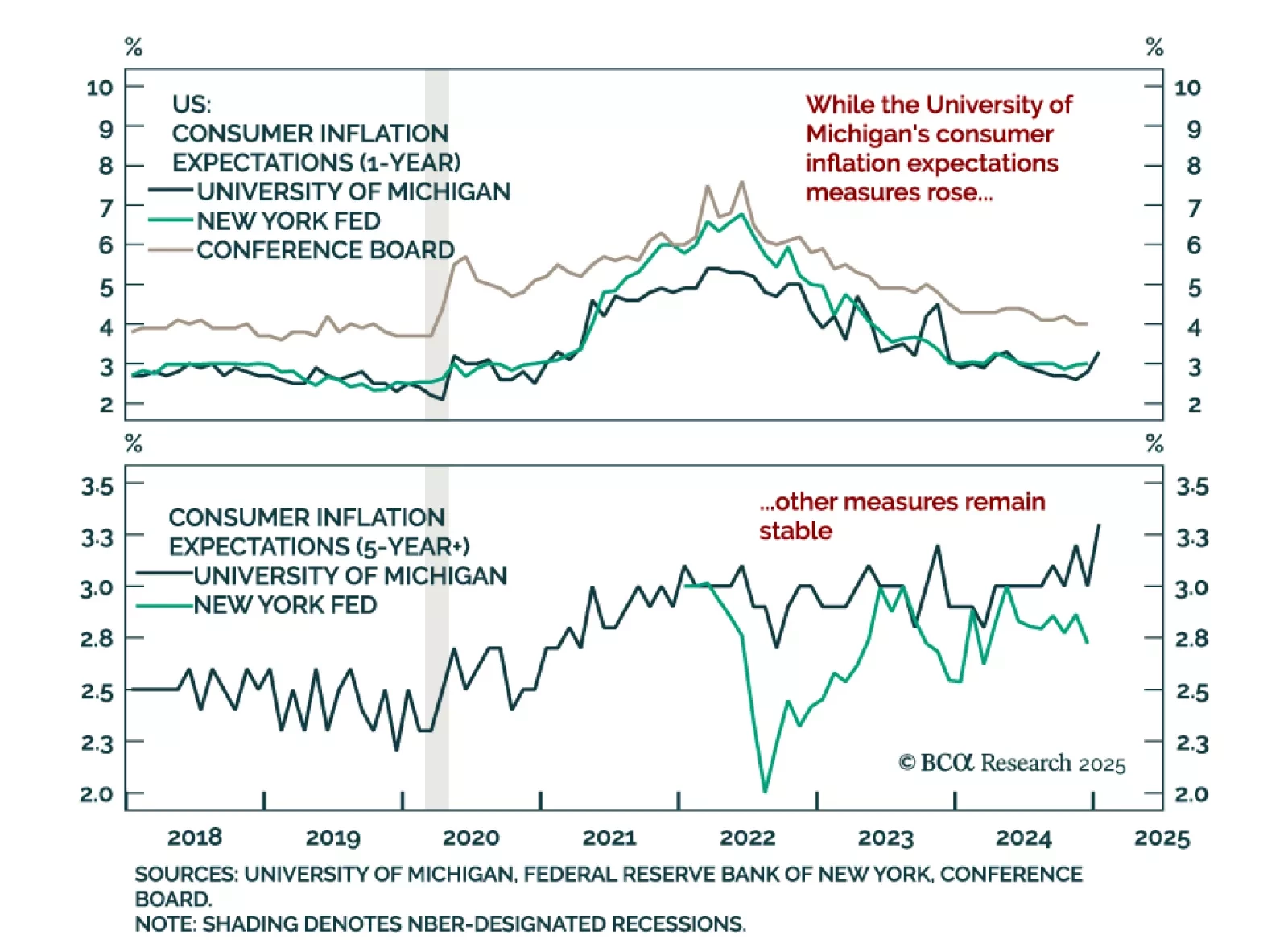

The preliminary January University of Michigan Consumer Sentiment Index missed estimates on Friday, driven by a cooling of consumer expectations. Worryingly, both the 1-year and 5-to-10 year inflation expectations ticked up to 3.3%…

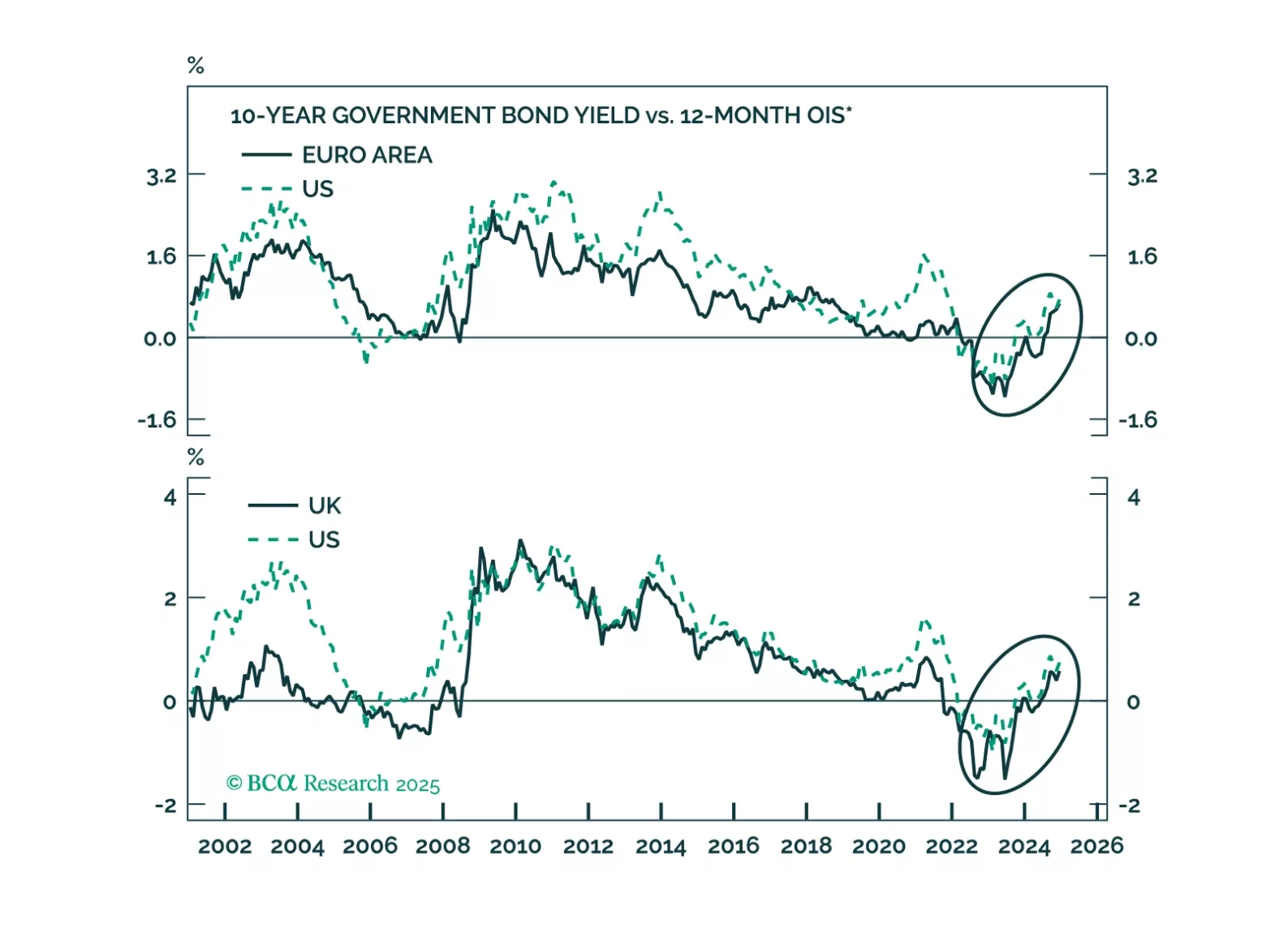

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

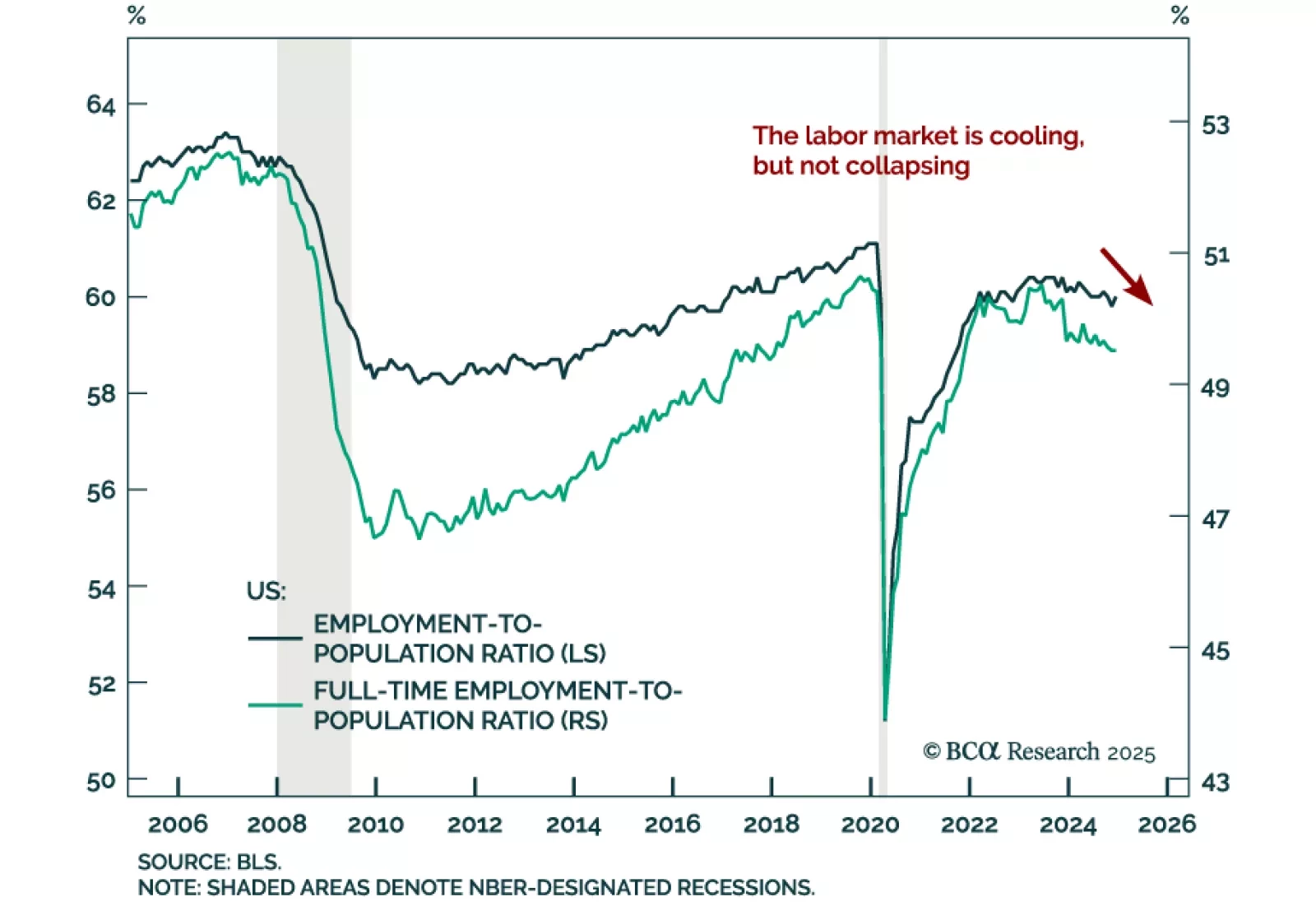

Thoughts on the increase in bond yields and this morning’s employment data.

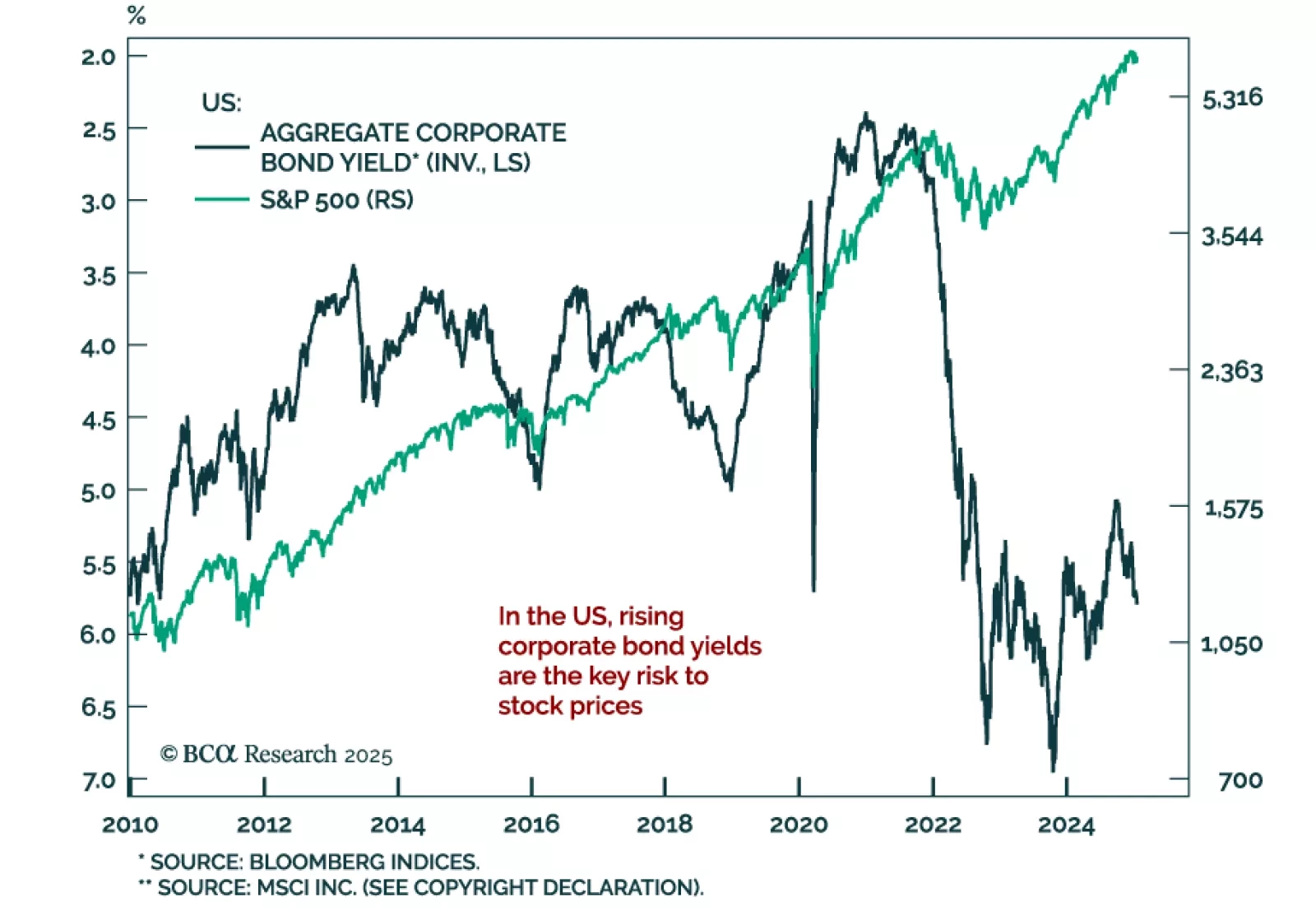

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist for our Emerging Markets Strategy service. Arthur discusses the relationship between corporate bond yields and stock prices. Historically, US stocks suffer when…

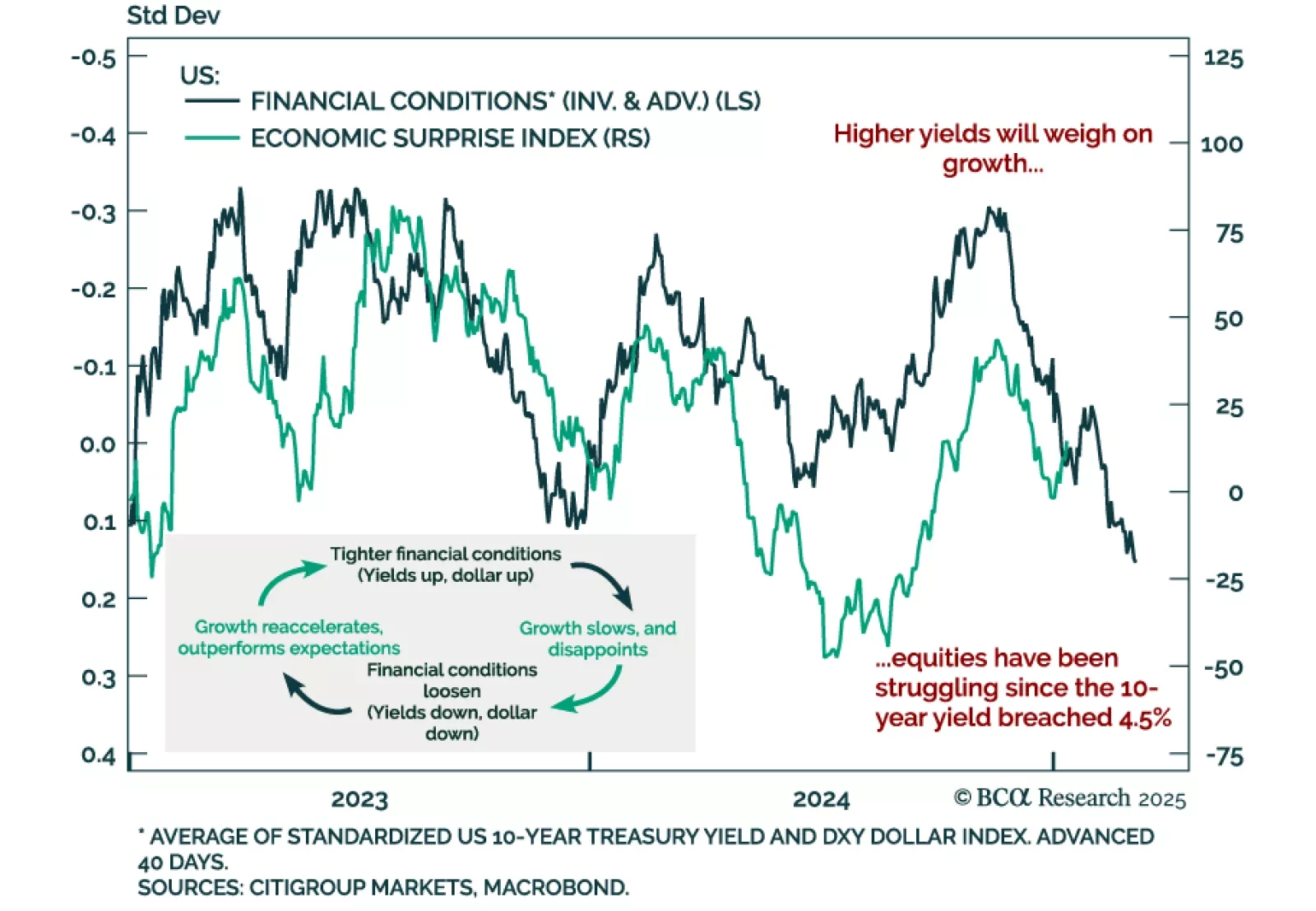

The global economy is subject to numerous cycles displaying reflexivity and feedback loops. One of these is the relationship between financial conditions and growth. Given this relationship, economic strength can plant the seeds of…

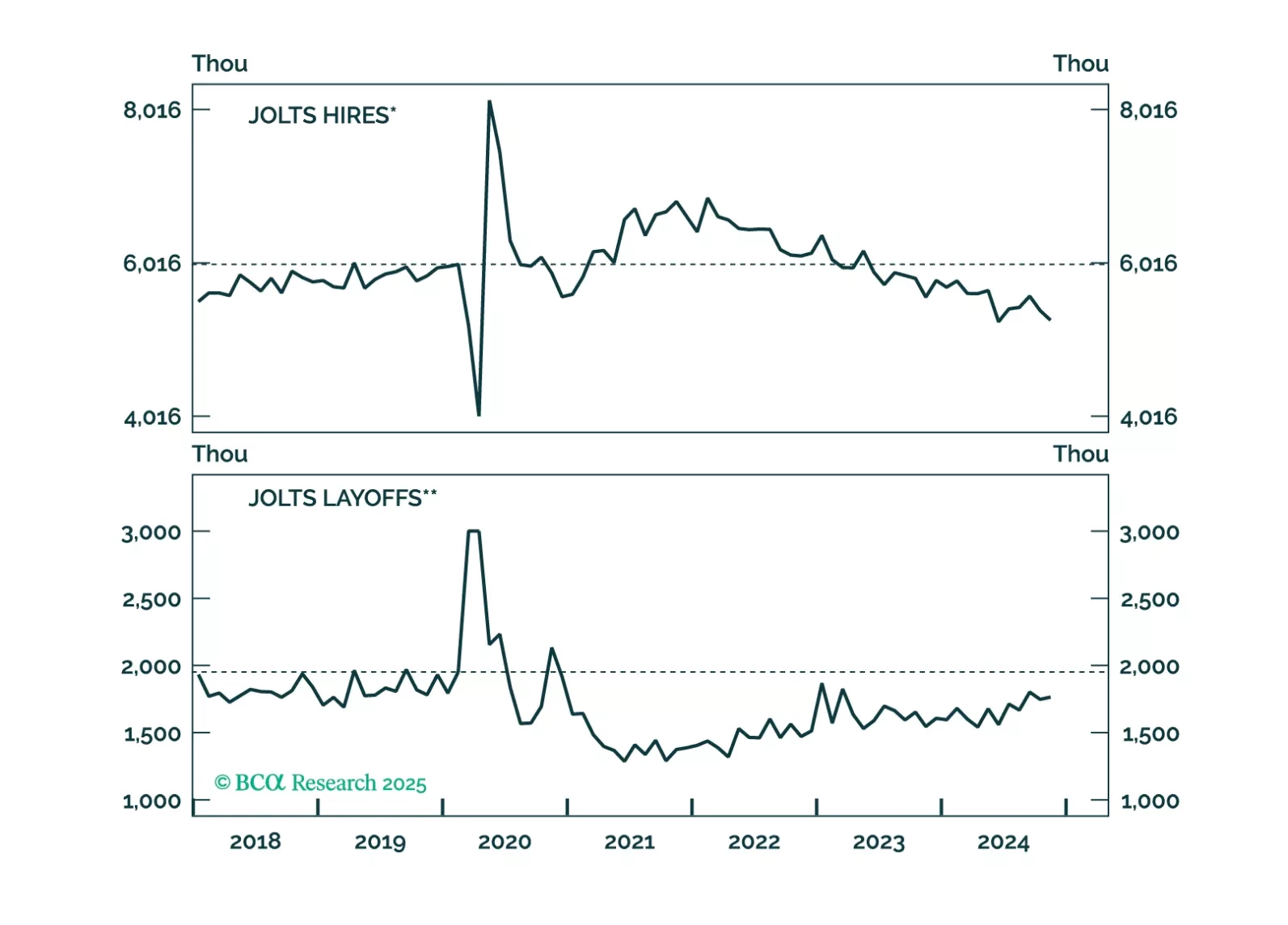

The US December jobs report came in stronger than expected. Payrolls rose by 256k vs. a downwardly revised 212k in November, leaving the 3-month moving average at about 170k. The unemployment and underemployment rates decreased to 4.…

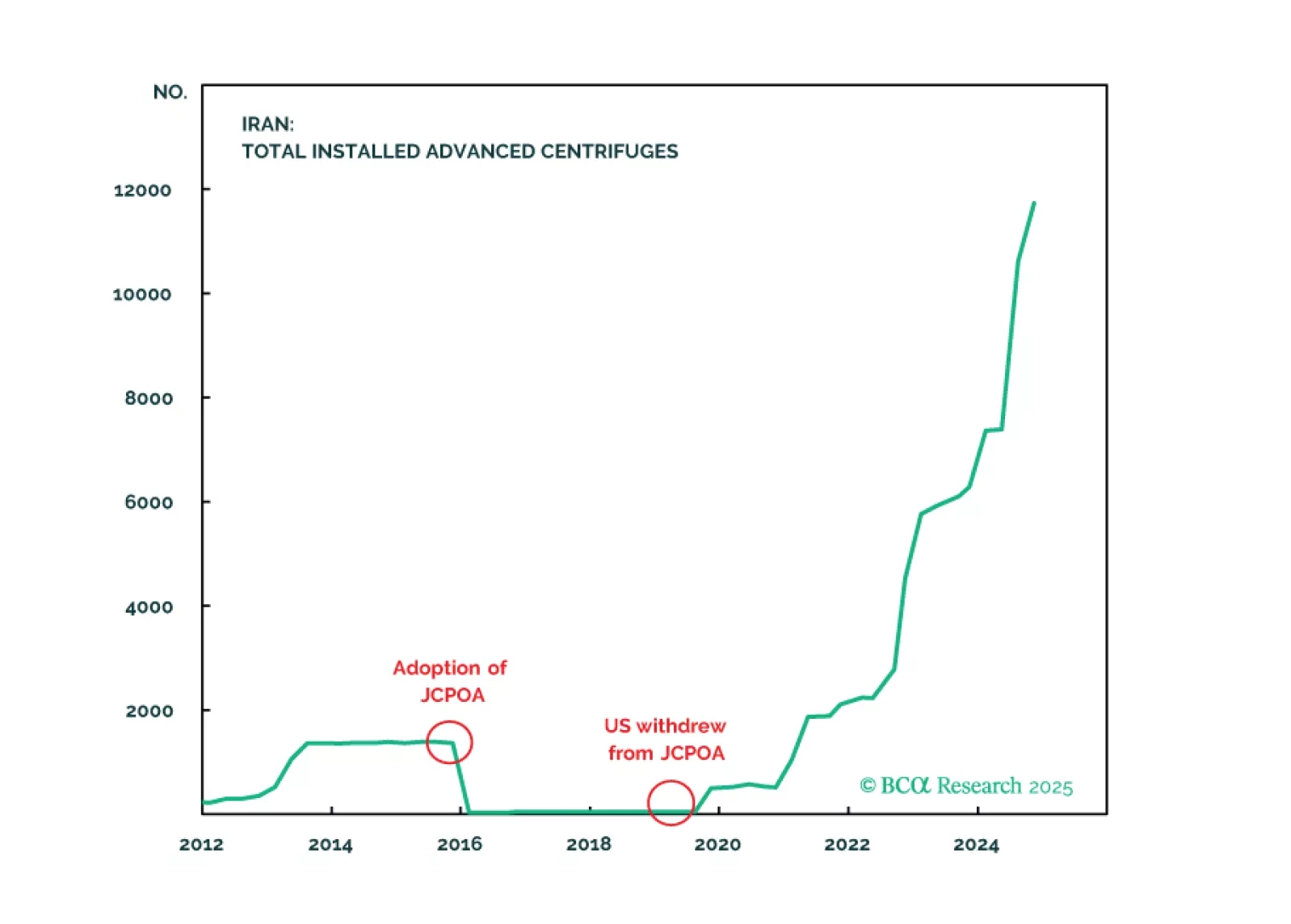

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

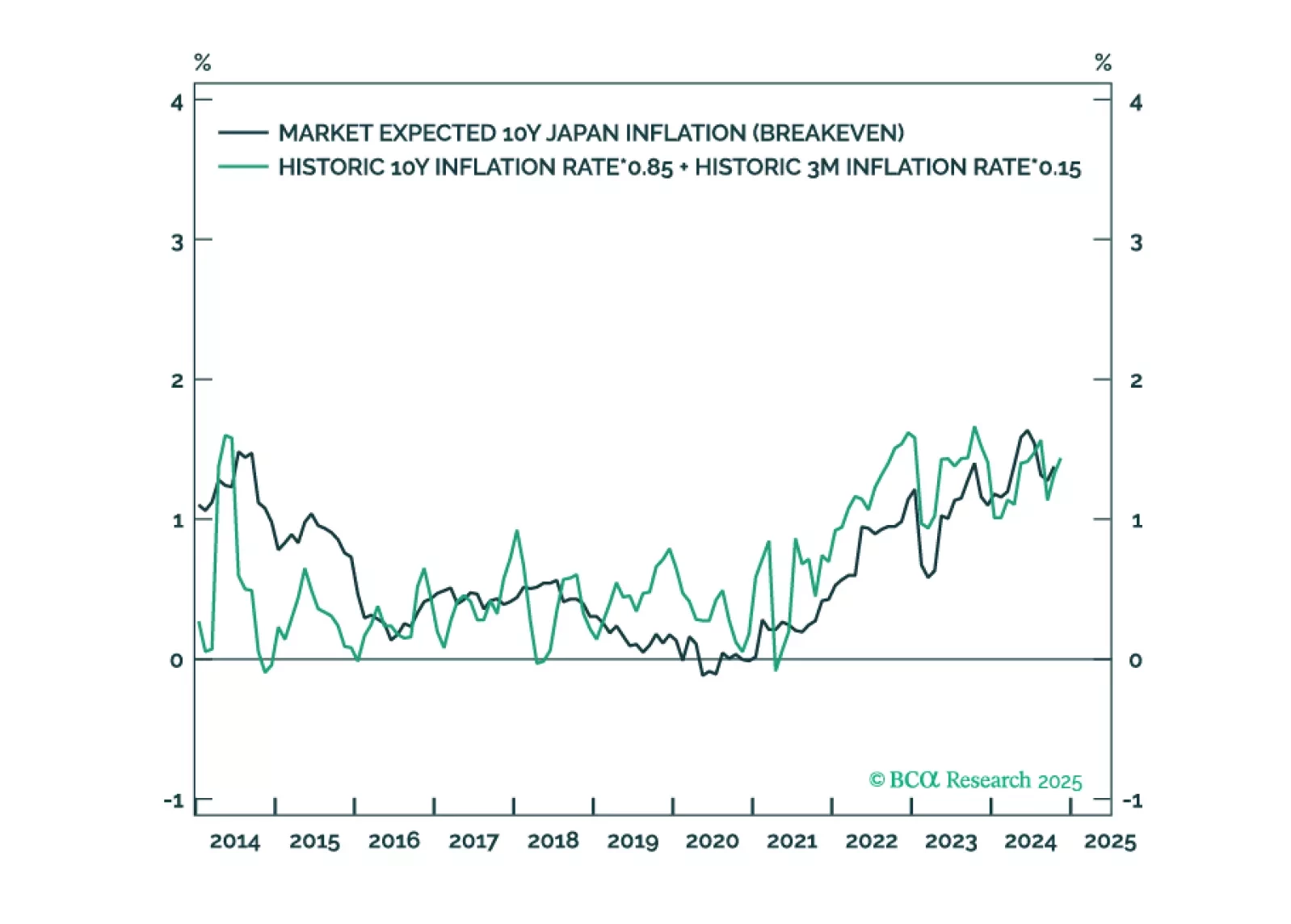

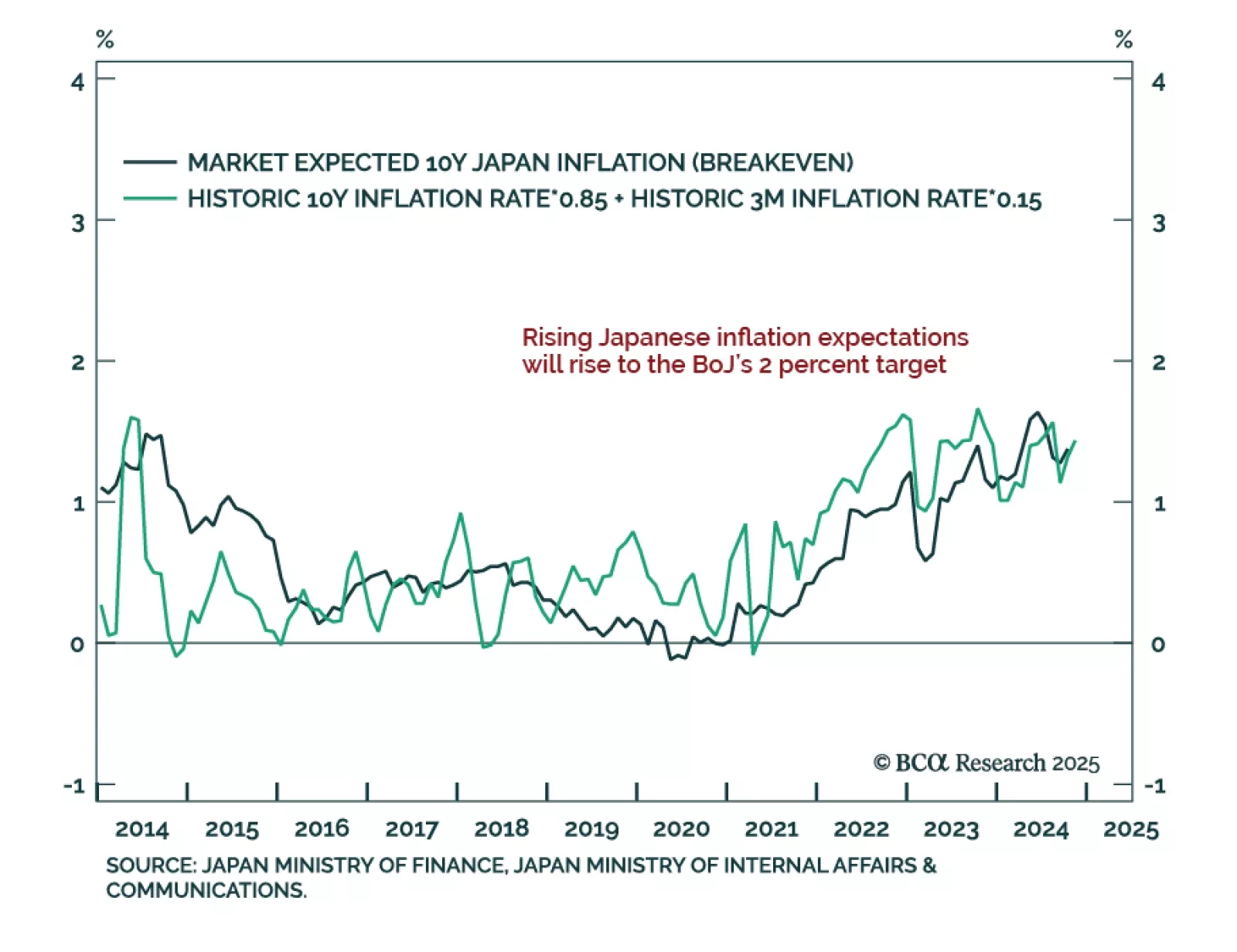

Our Counterpoint Strategy team sees Japanese real yields as the key risk to global equities. Rising inflation expectations in developed markets, excluding Japan, will keep inflation above target and limit further rate cuts.…

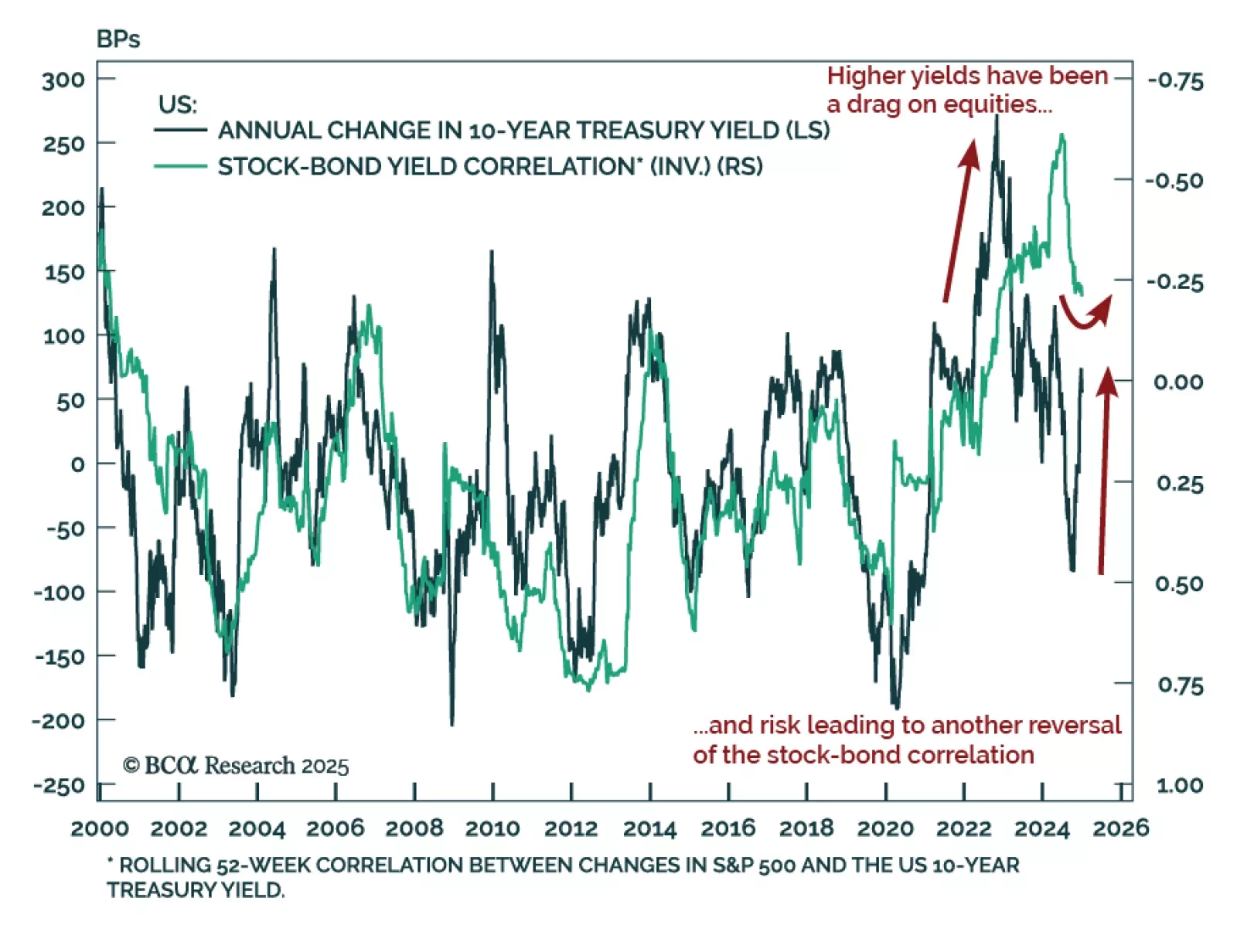

The post-COVID inflation impacted the most important cross-asset relationship: the stock-bond correlation. Higher inflation expectations pushed yields higher, leading to a correction in bond and stock prices. As price pressures…

In most developed economies, rising inflation expectations will lift them further above the 2 percent target, limiting the scope for further interest rate cuts. But in Japan, rising inflation expectations will lift them up to the BoJ…