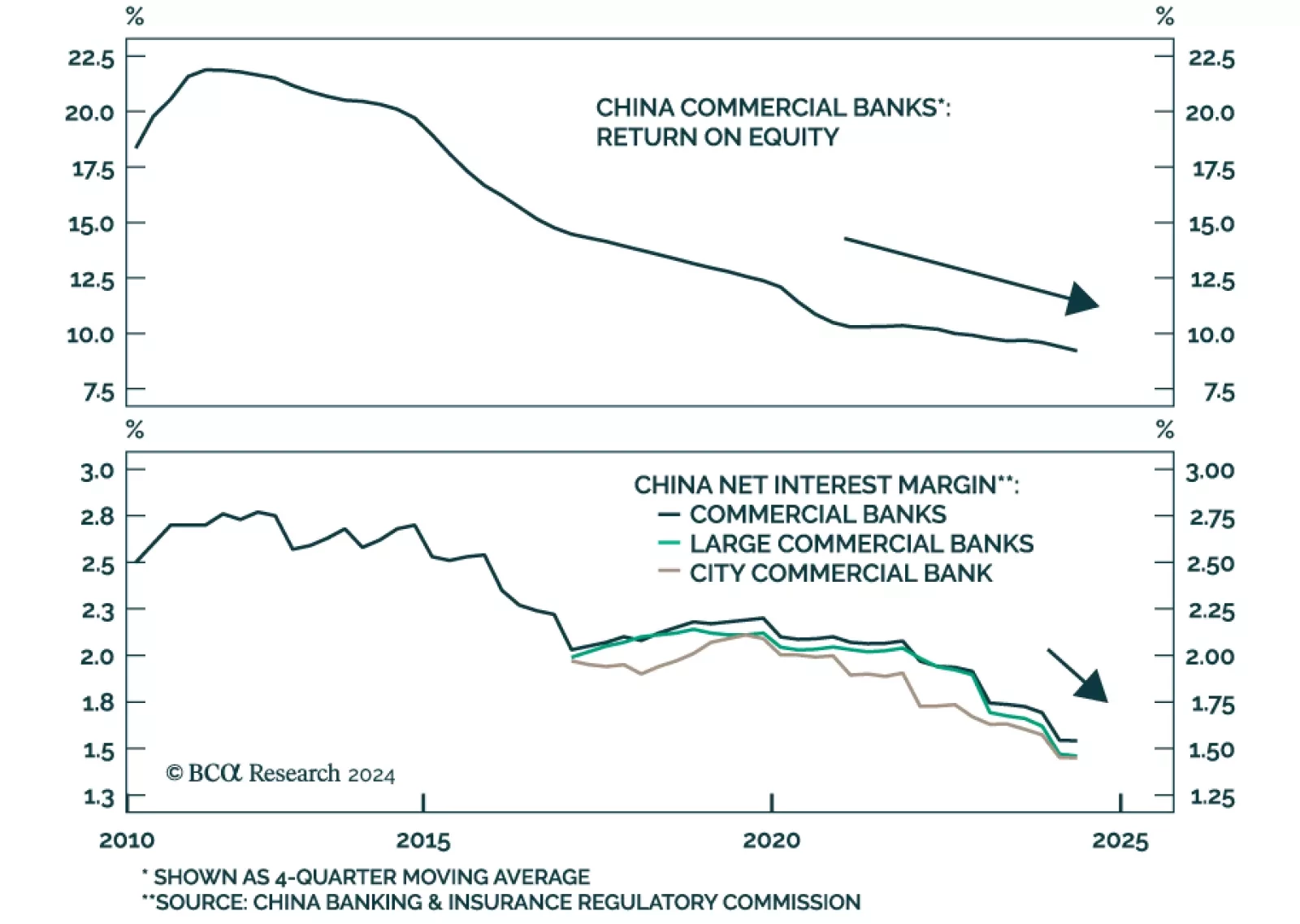

Chinese onshore and offshore bank stocks have outperformed their respective broad markets by 26% and 24% since October. Despite deteriorating return on assets, return on equity and net interest margins, investors have sought out…

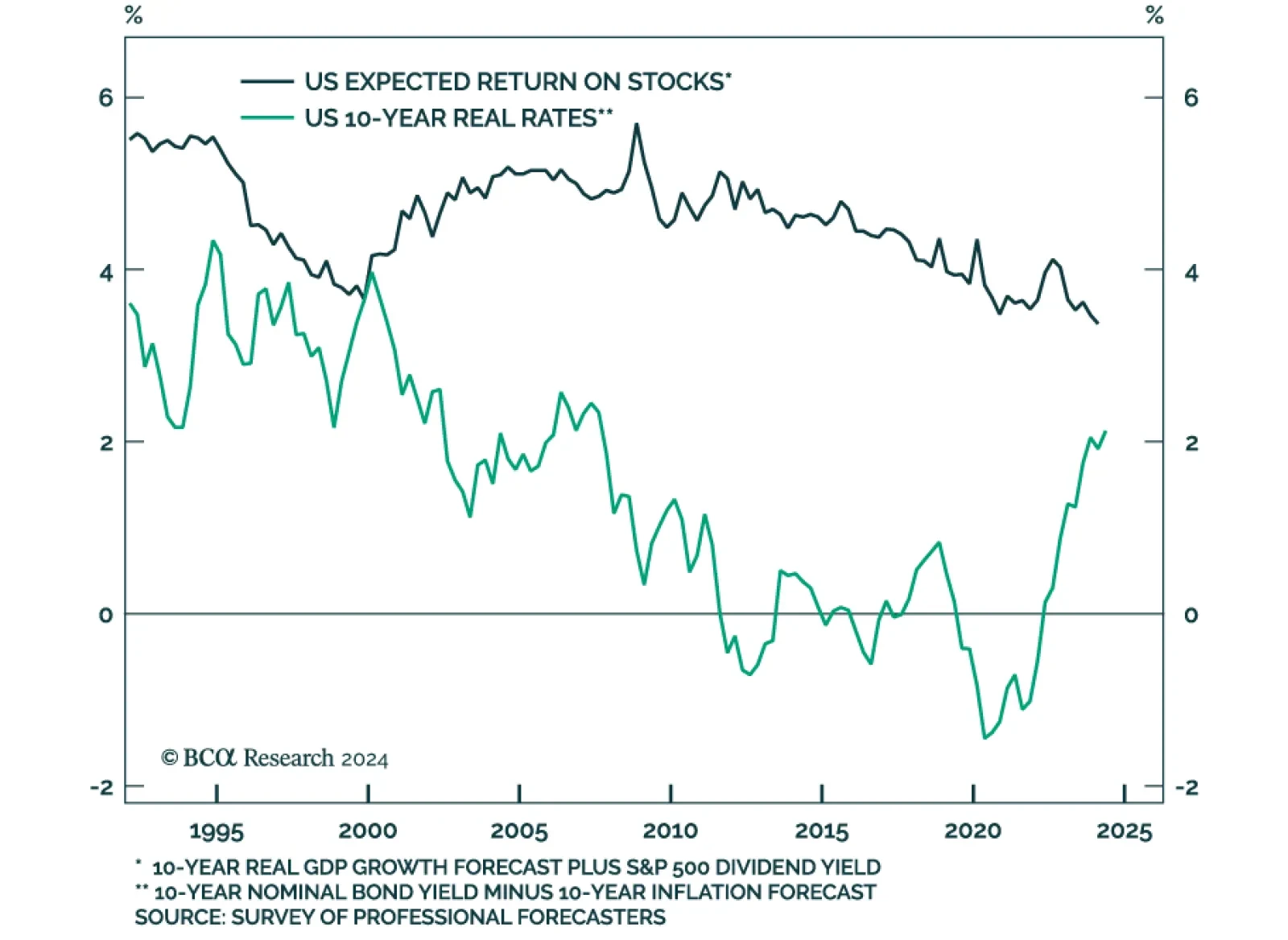

According to BCA Research’s US Investment Strategy and US Bond Strategy services, the drivers of the structural downtrend in real interest rates include: demographic trends (declining fertility rates, longer life…

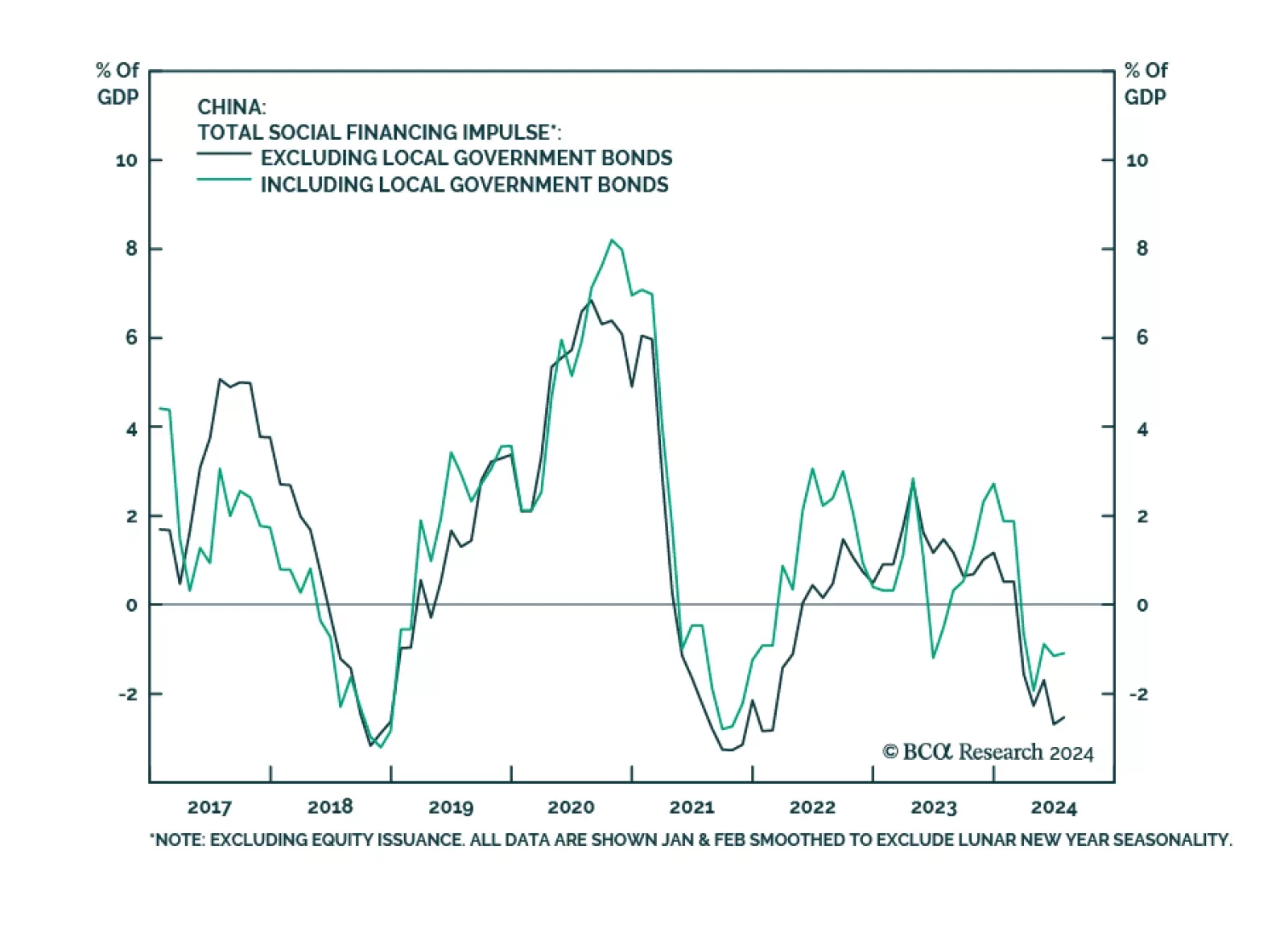

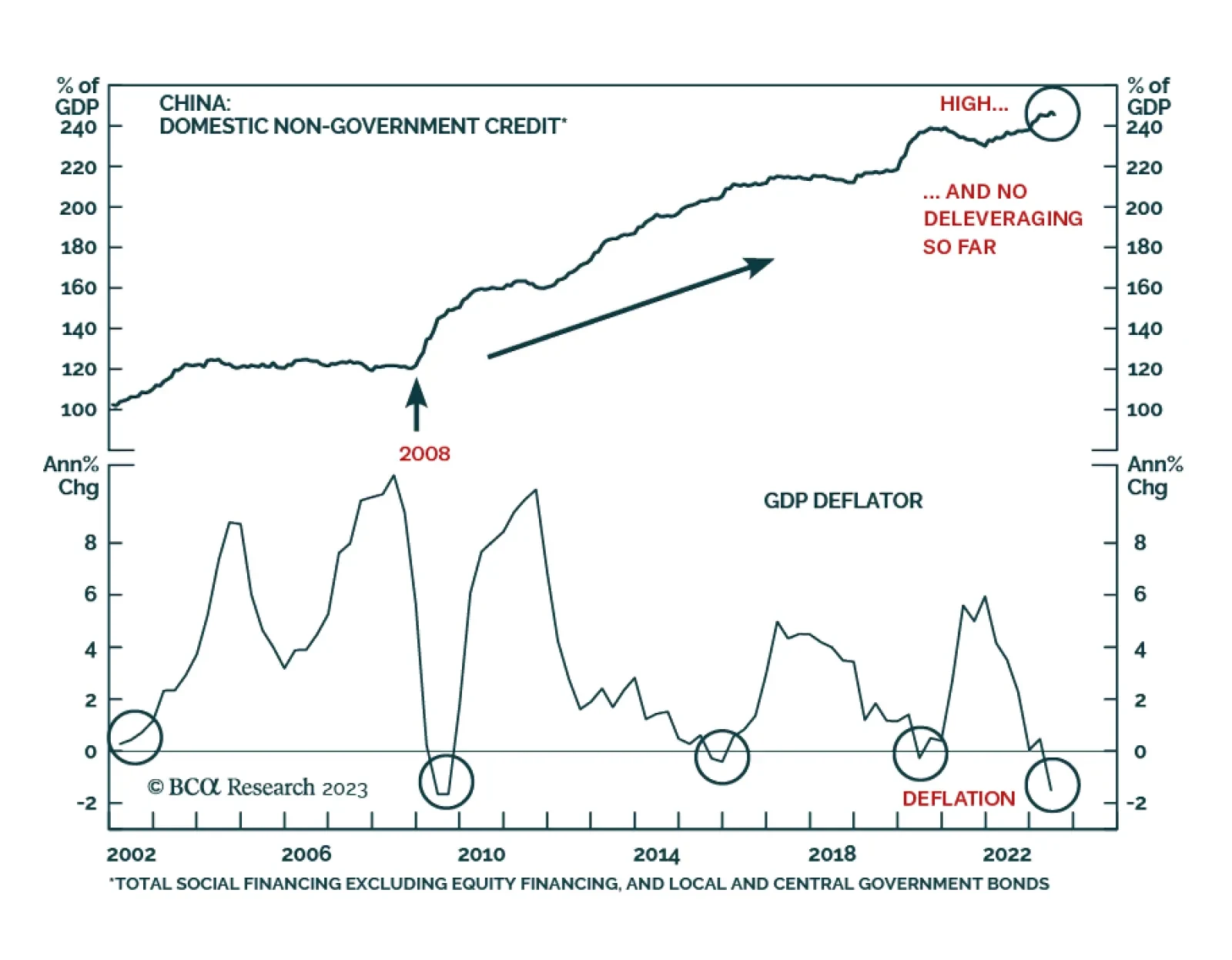

Subdued demand for credit among Chinese private-sector businesses and households persisted through July. Aggregate financing missed expectations, growing CNY 0.8bn to CNY 18.9bn in July on a YTD basis. New loans grew CNY 0.2bn…

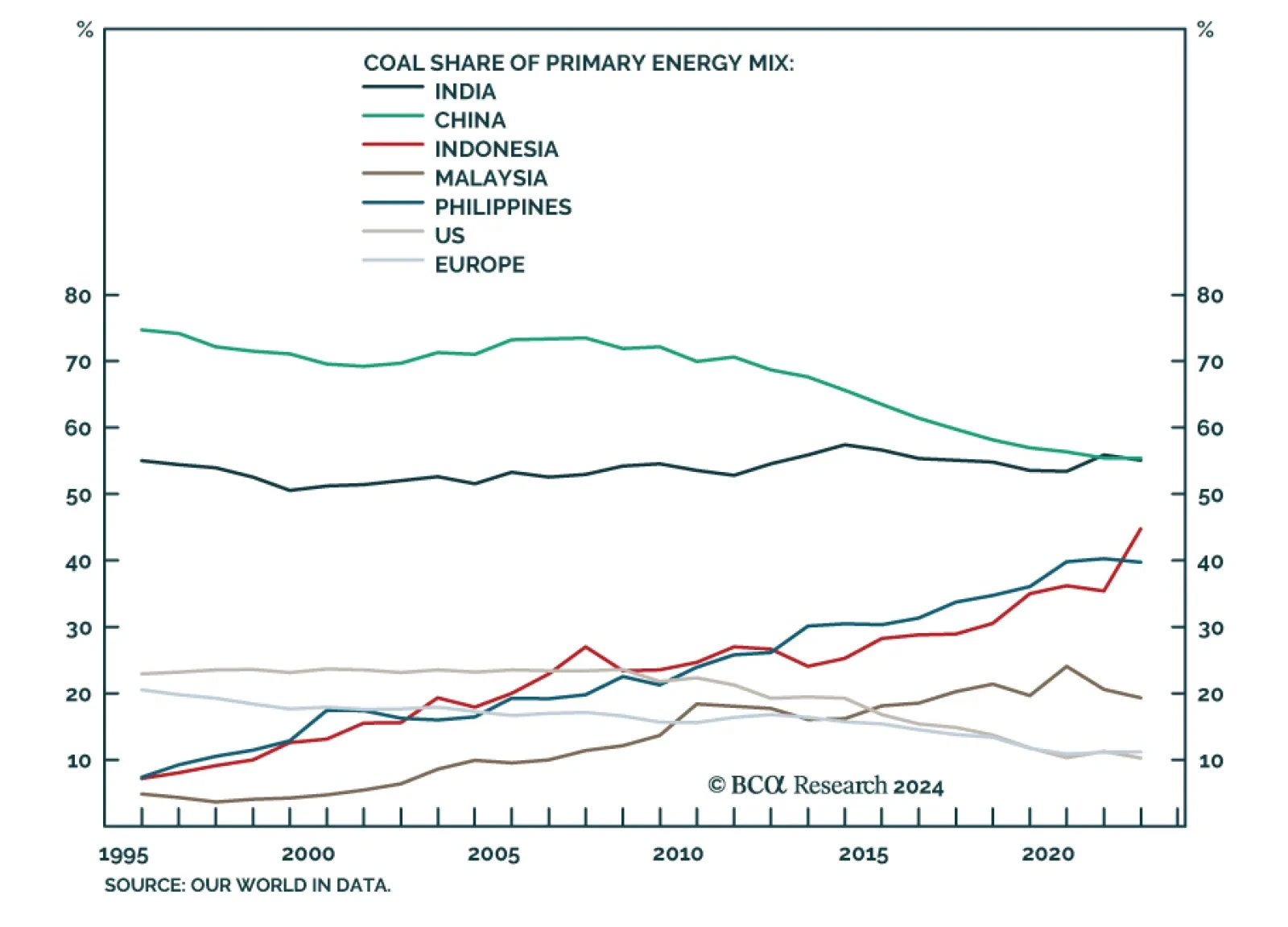

According to BCA Research's Commodity & Energy Strategy service, Qatar will be the winner as it takes advantage of the global energy transition towards renewables and the world fragments under economic and…

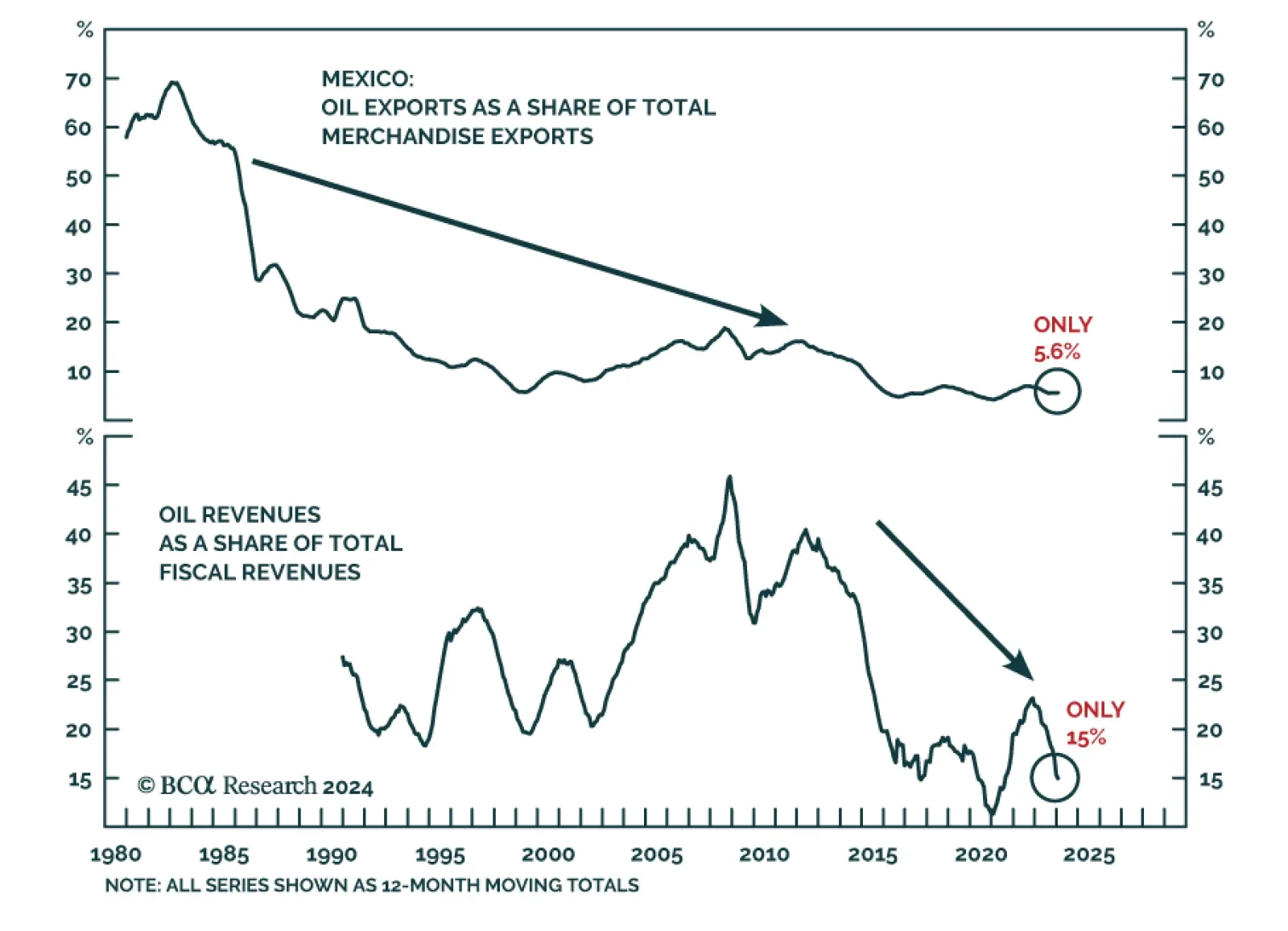

In the past couple of years, Mexico has been among the favorite markets for investors within the EM space. As our Emerging Markets Strategy team argued in a recent report, the cyclical and structural outlook for Mexican risk…

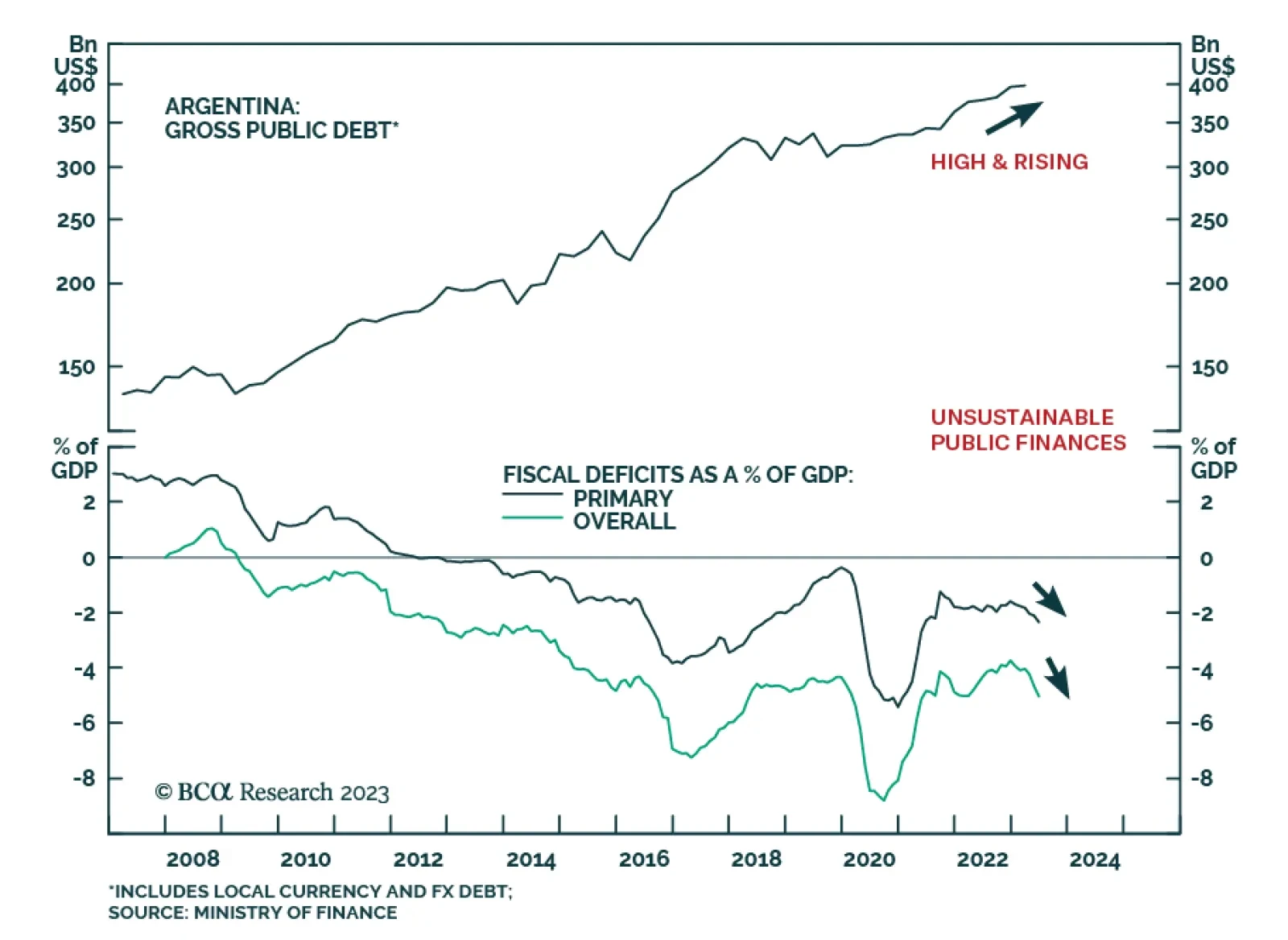

According to BCA Research’s Emerging Markets Strategy service, while it may be tempting to bottom fish, the team advises that investors maintain a cautious stance on Argentinian sovereign credit. Even though the election…

Before doctors prescribe treatments to a patient, they first make a diagnosis. The success of the treatment is contingent upon the accuracy of the diagnosis. The same is true for a country’s economy. Many commentators…

Symptoms of a liquidity trap for Chinese households are appearing. Our proprietary indicators for the marginal propensity to spend among households and enterprises continue falling. There has been a paradigm shift in Beijing’s…