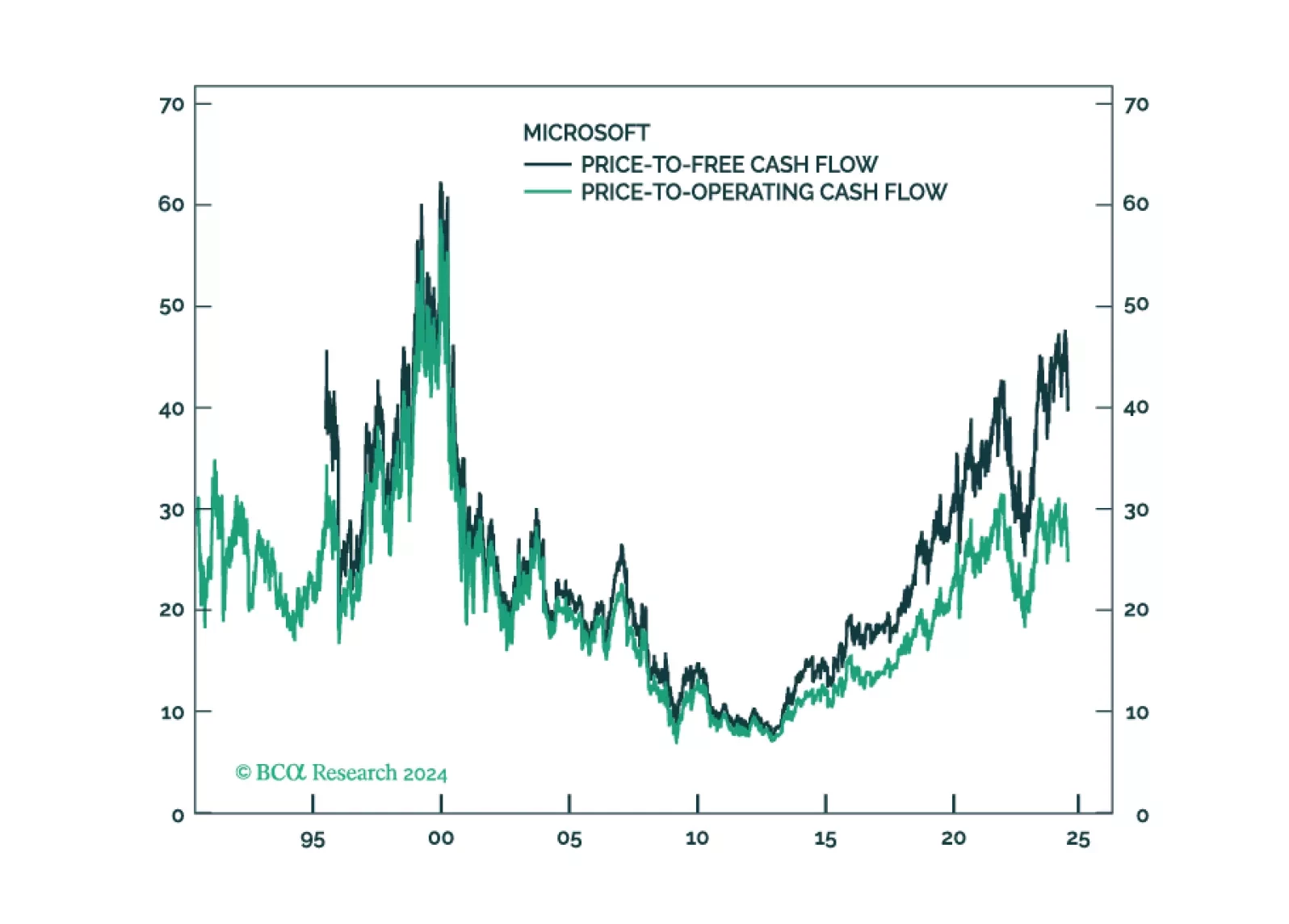

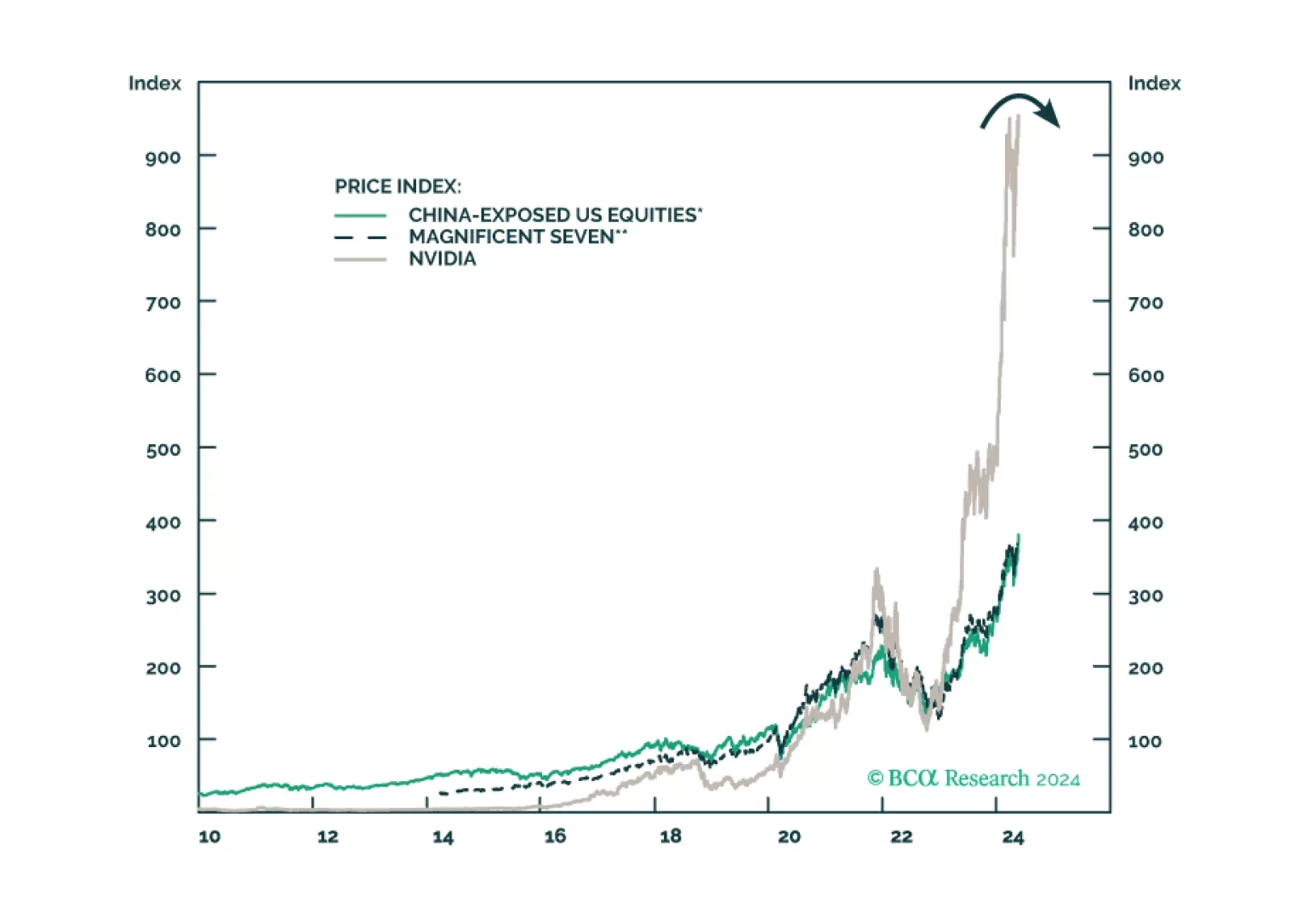

Over the past few weeks, global equities have been hit by rising scepticism over the bullish AI narrative and increasing concerns over global growth. Stocks should stabilize in the near term, but the medium-term direction is to the…

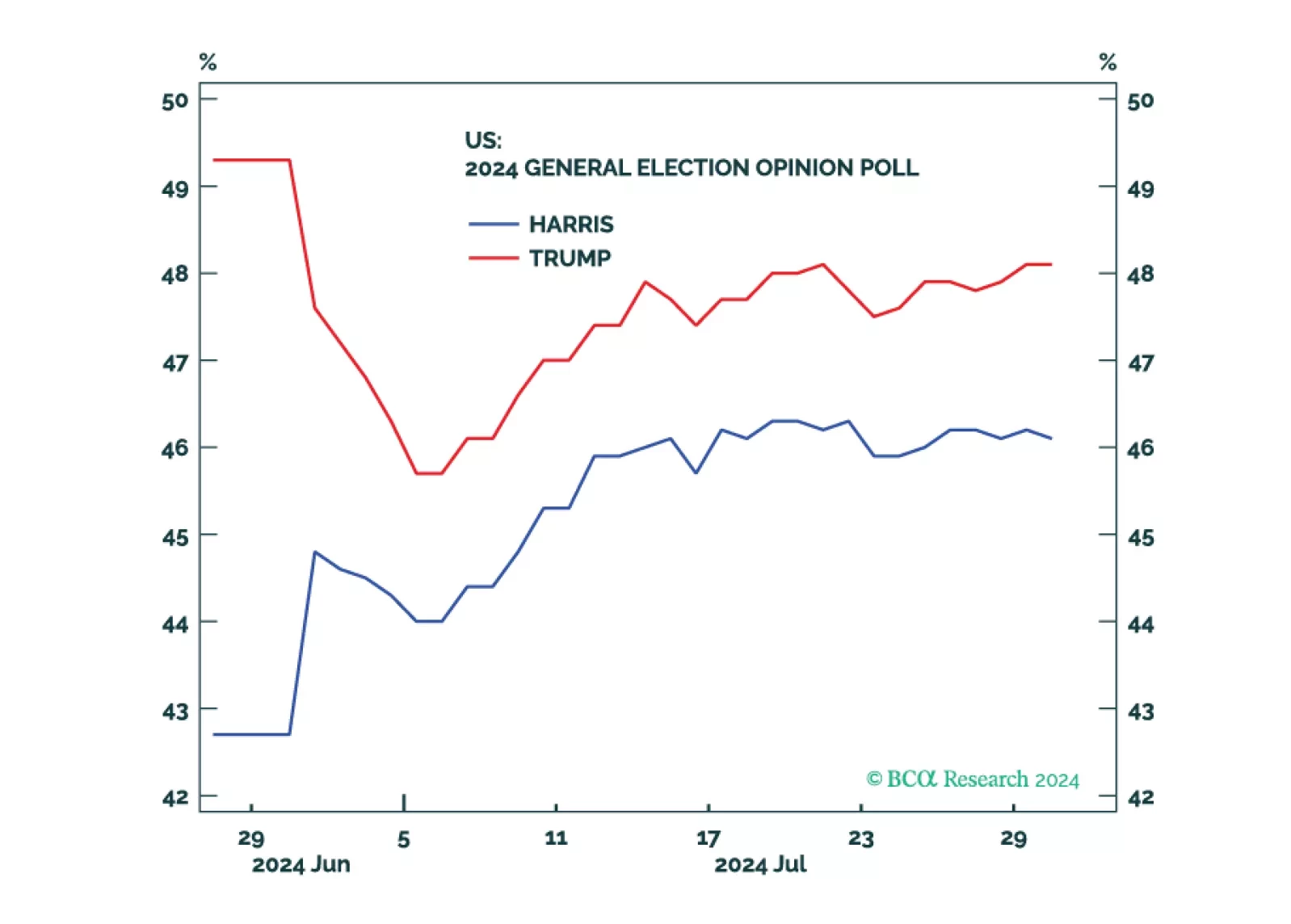

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

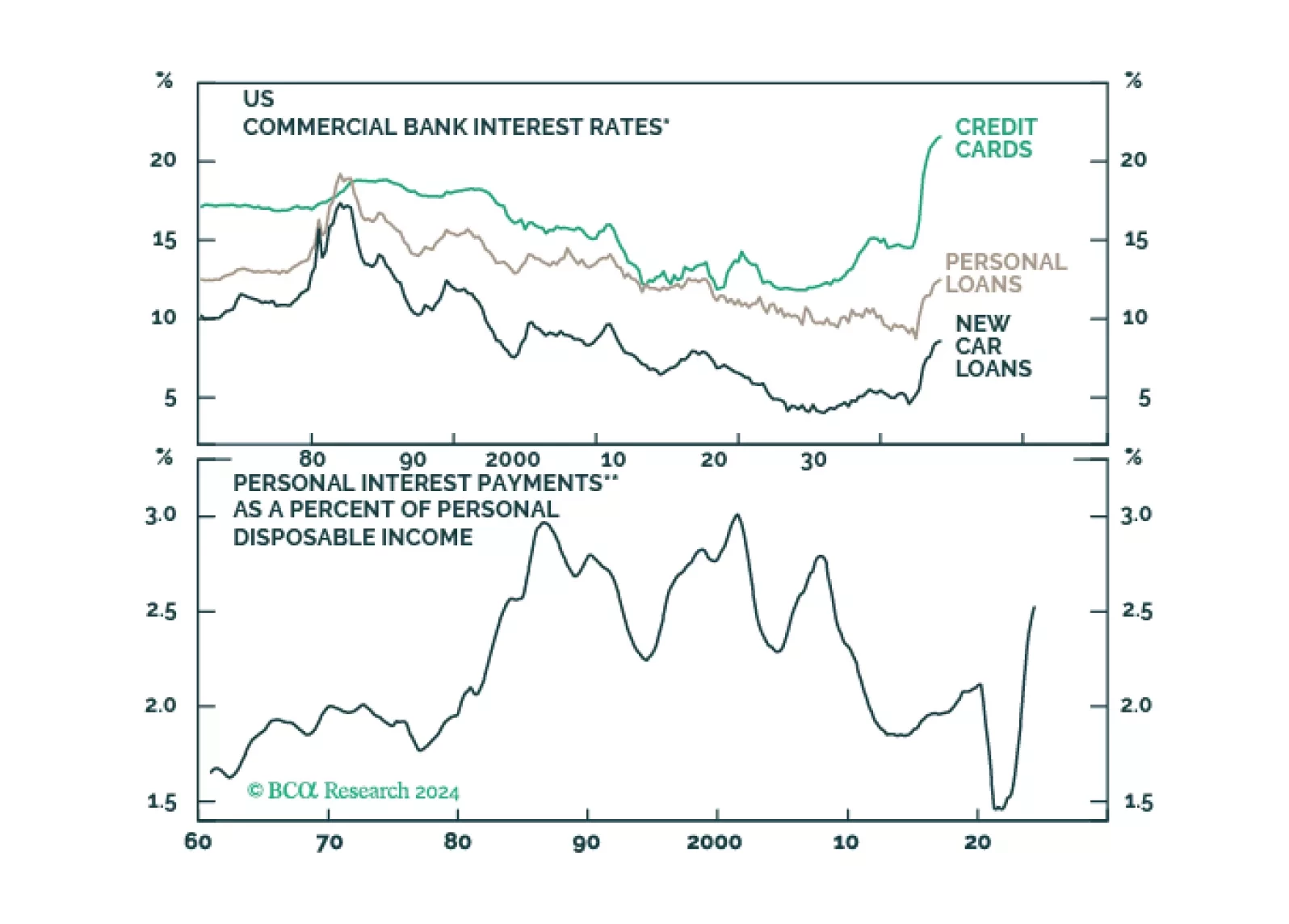

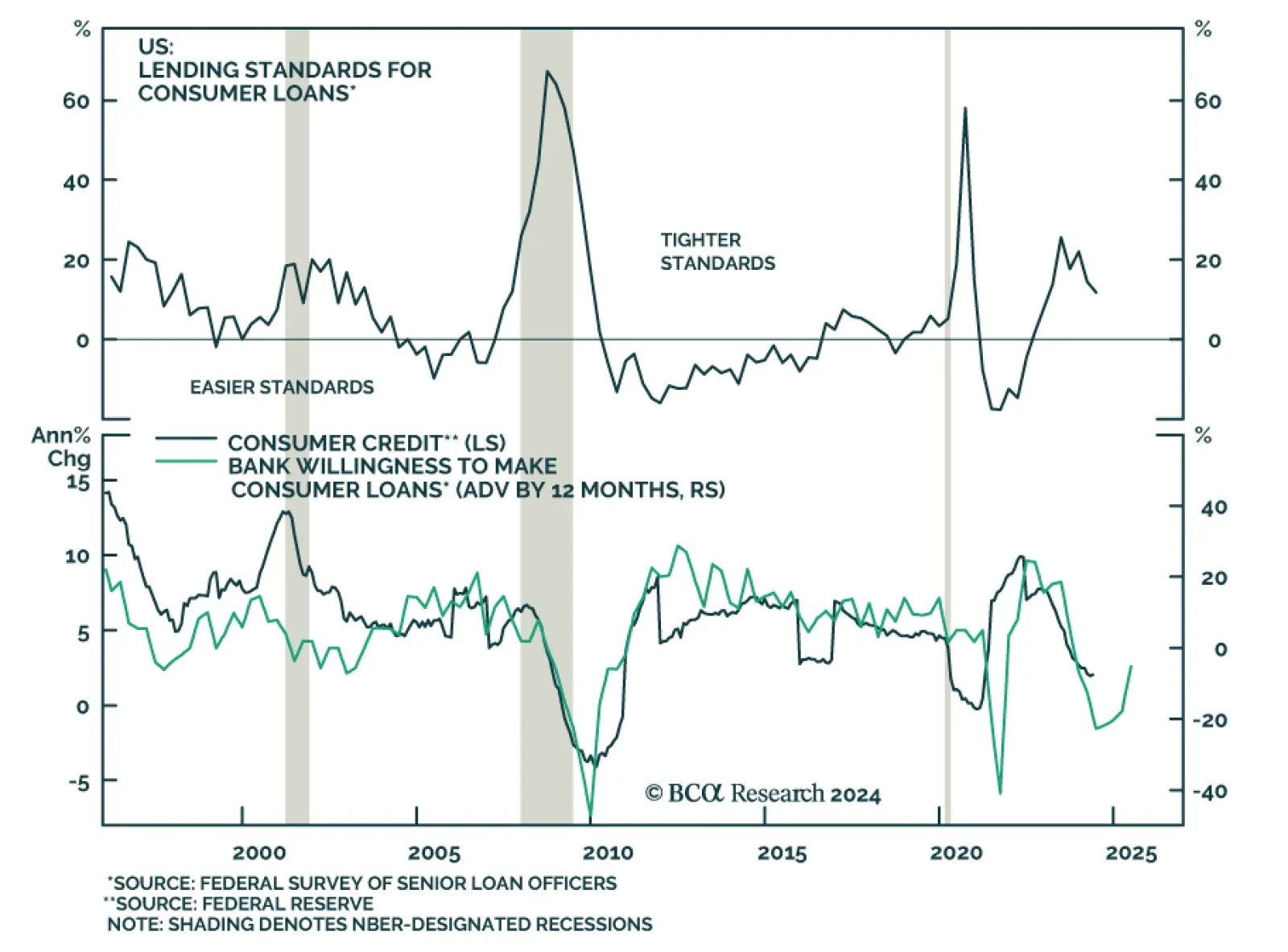

Total consumer credit rose by USD 11.4 billion in May (to USD 5,065 billion outstanding) from a slightly upwardly revised USD 6.5 billion increase in April, surpassing expectations of a smaller increase. Notably, revolving credit…

The conventional wisdom is wrong: Trump is not going to substantially cut taxes once in office; he is going to raise taxes by jacking up tariffs. To the extent that this dampens economic activity, it is bad news for stocks but good…

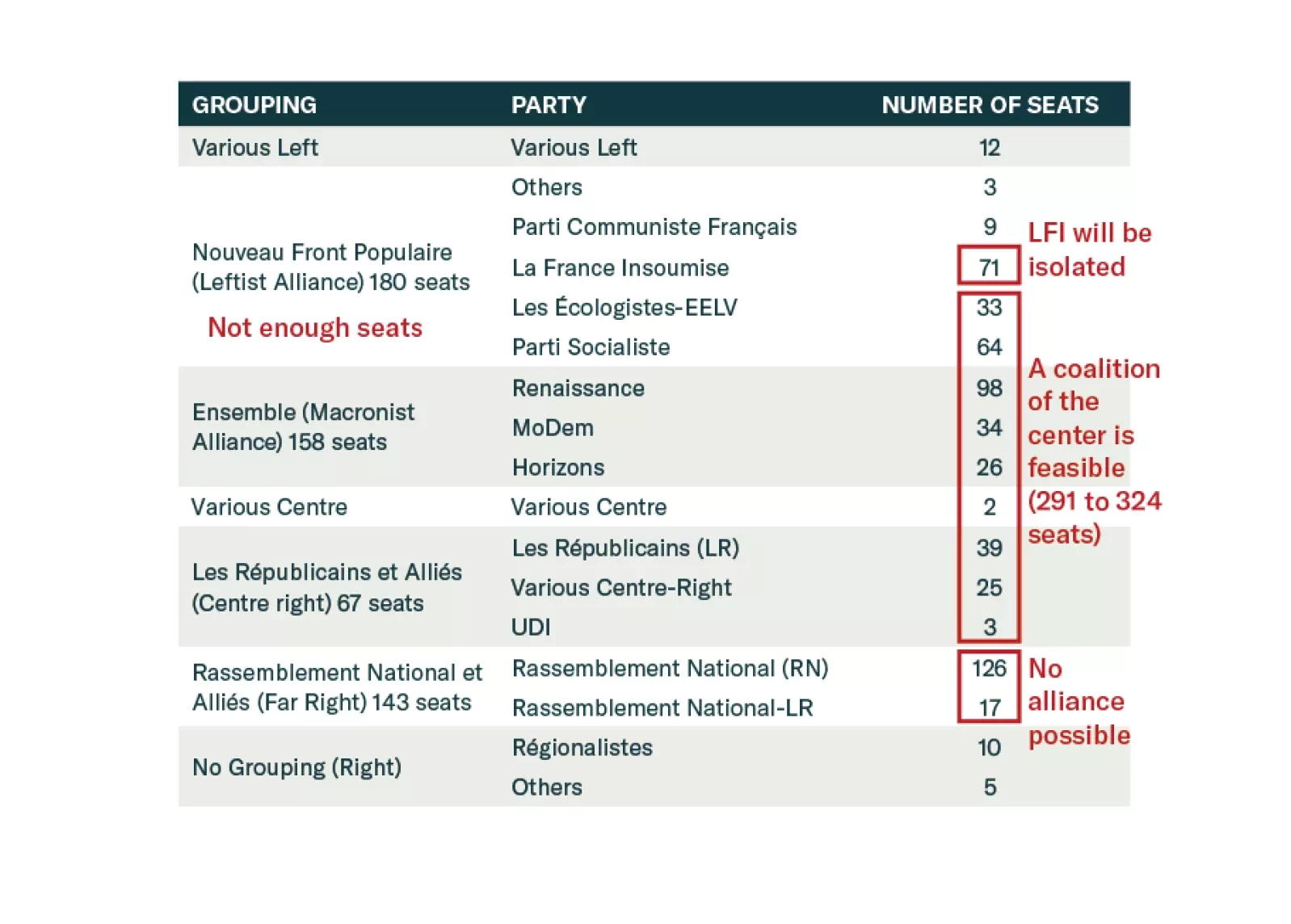

At first glance, France has moved to the far left. However, this coalition is fragile, and Macron’s allies still hold the balance of power. What are the assets that will benefit from this new political setup, and those that will not…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

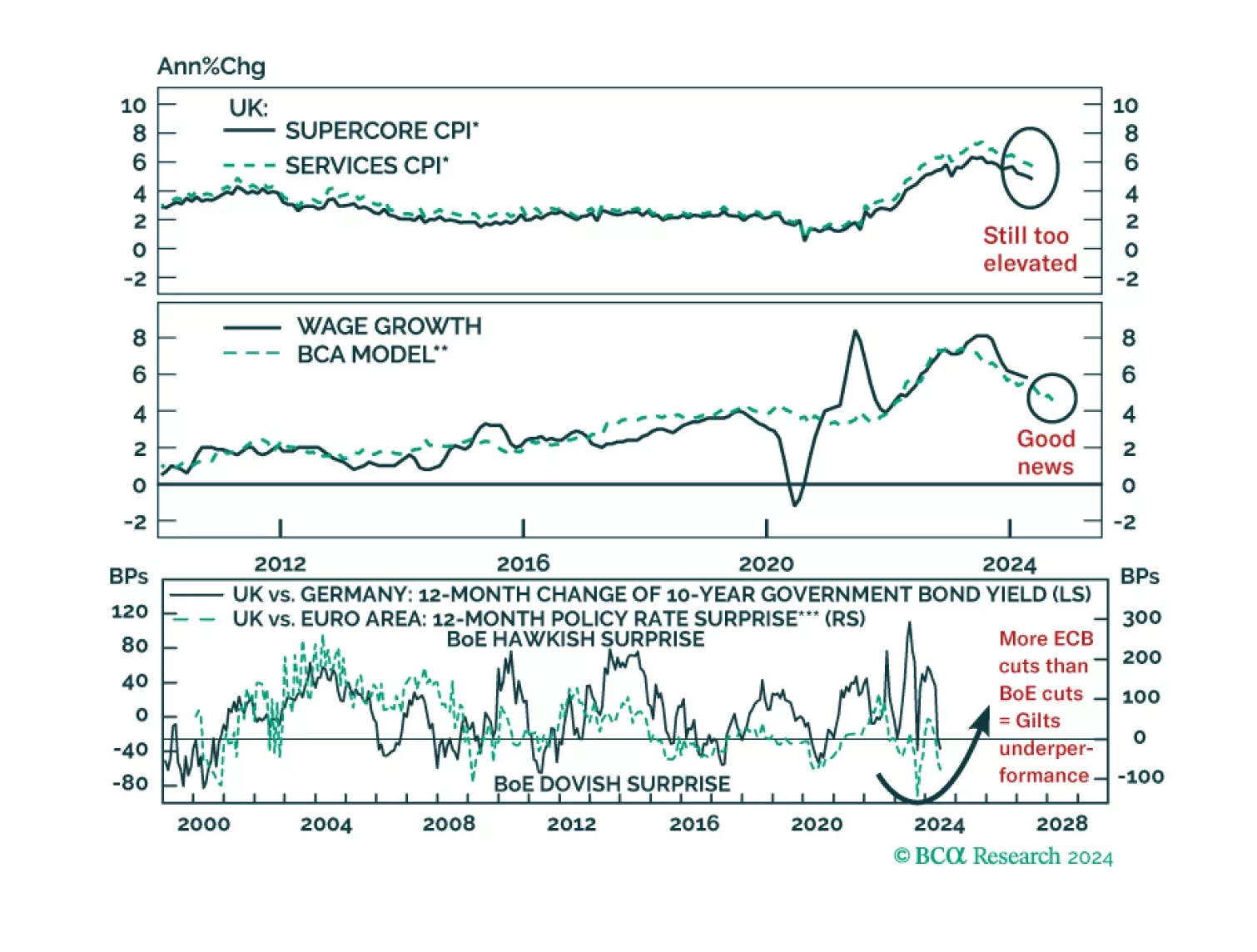

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?

Global consumer spending is likely to slow over the coming quarters, culminating in a major economic downturn in late 2024 or early 2025. Investors should maintain benchmark exposure to equities for now but look to turn more…

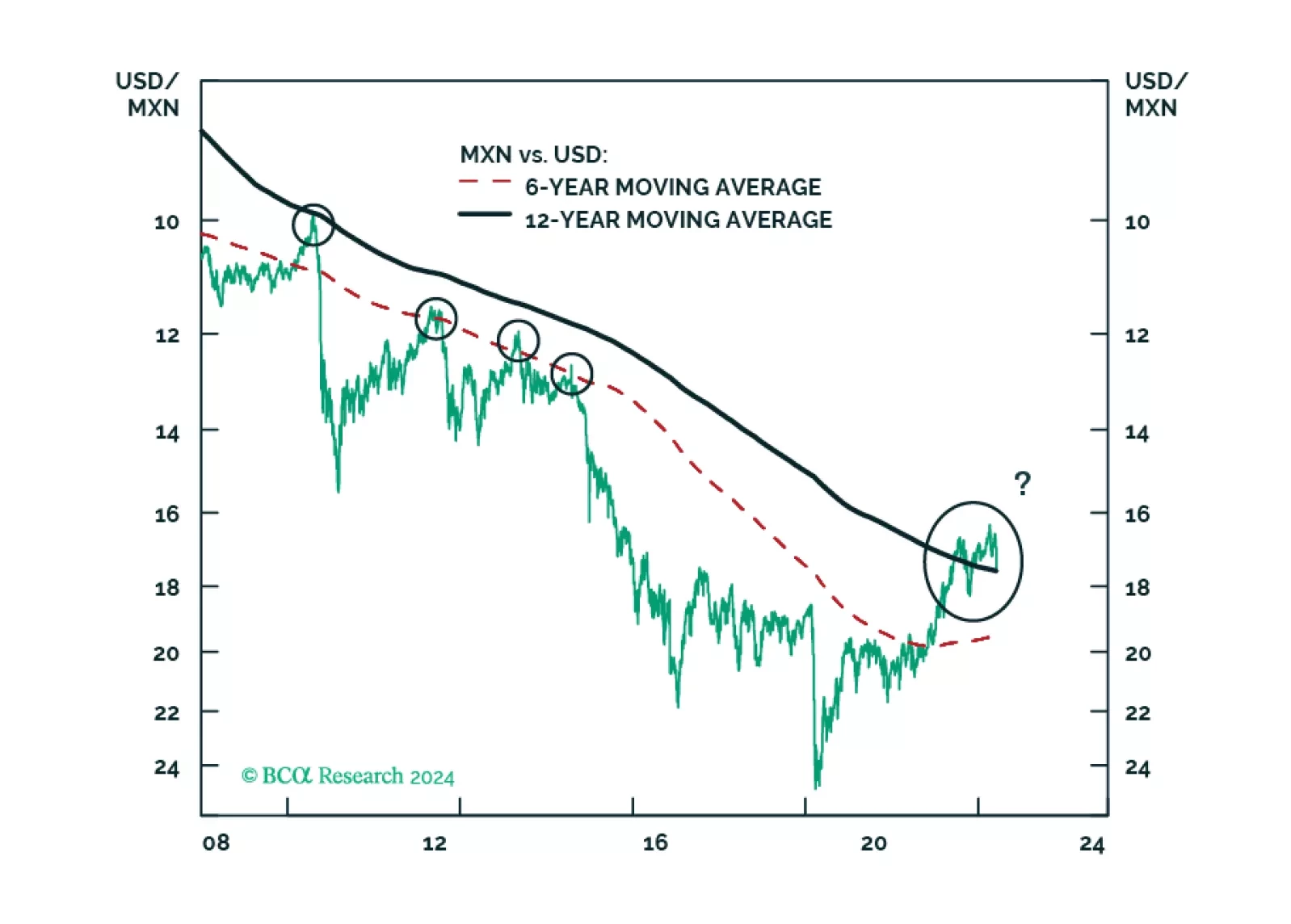

MORENA has once again swept the Mexican election: Claudia Sheinbaum will be president, with little to no constraint in Congress. All in all, Mexican politics will remain stable and overall supportive of markets. In the medium term,…