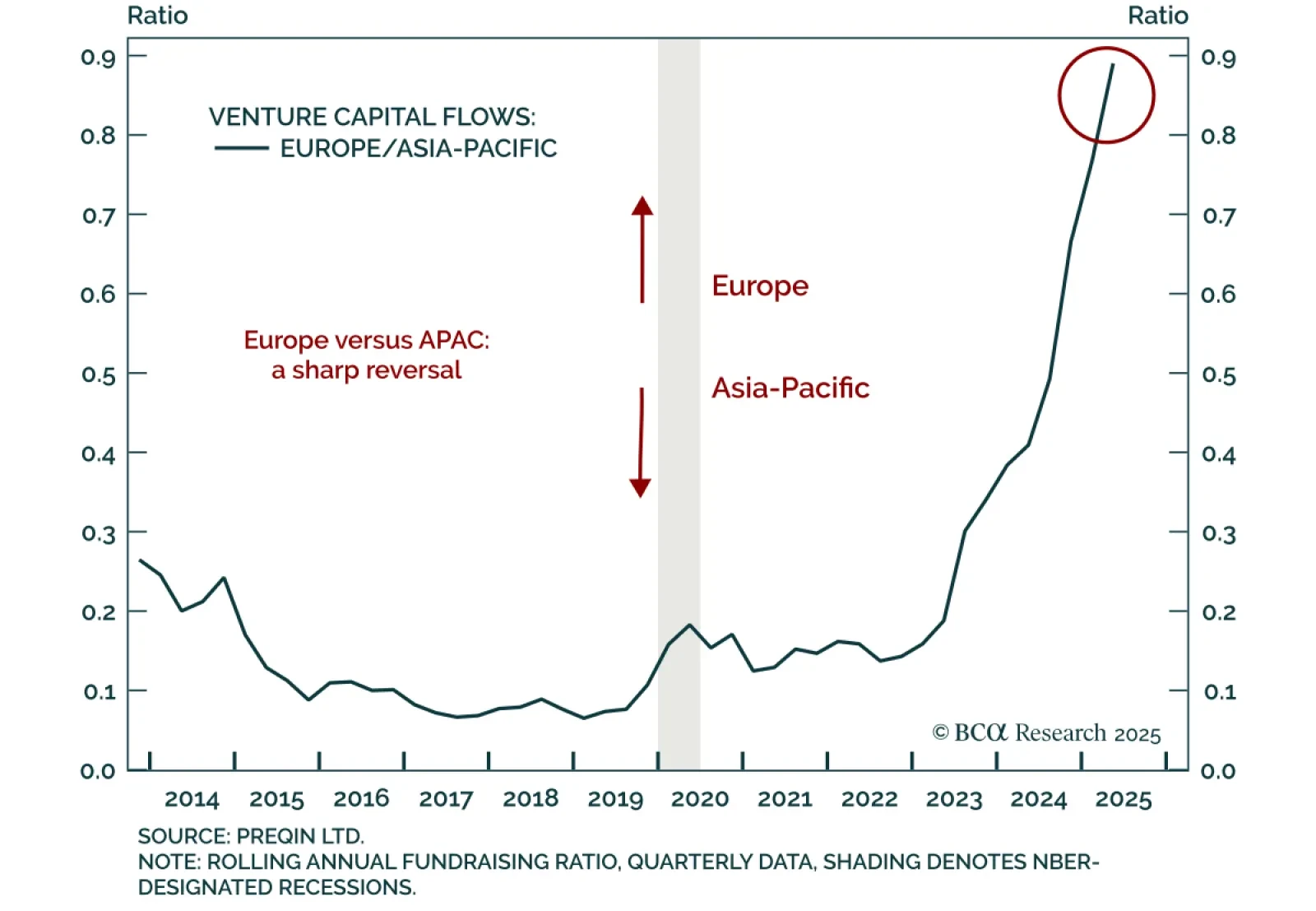

BCA’s Private Markets & Alternatives strategists recommend upgrading Global and North America Buyouts while downgrading Private Credit and Long-Short Equity Hedge Funds. Investor appetite for Europe has surged, but our colleagues…

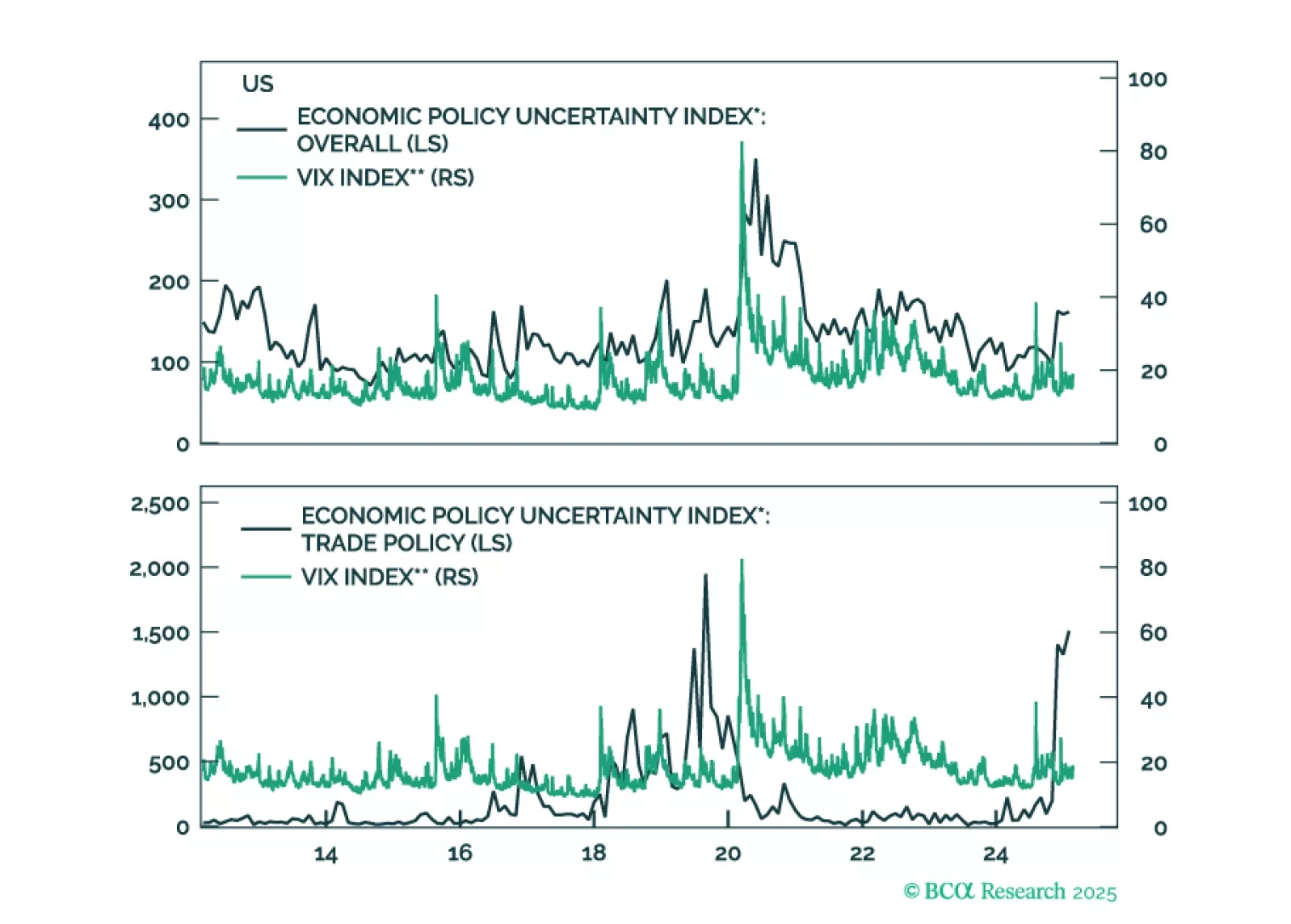

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

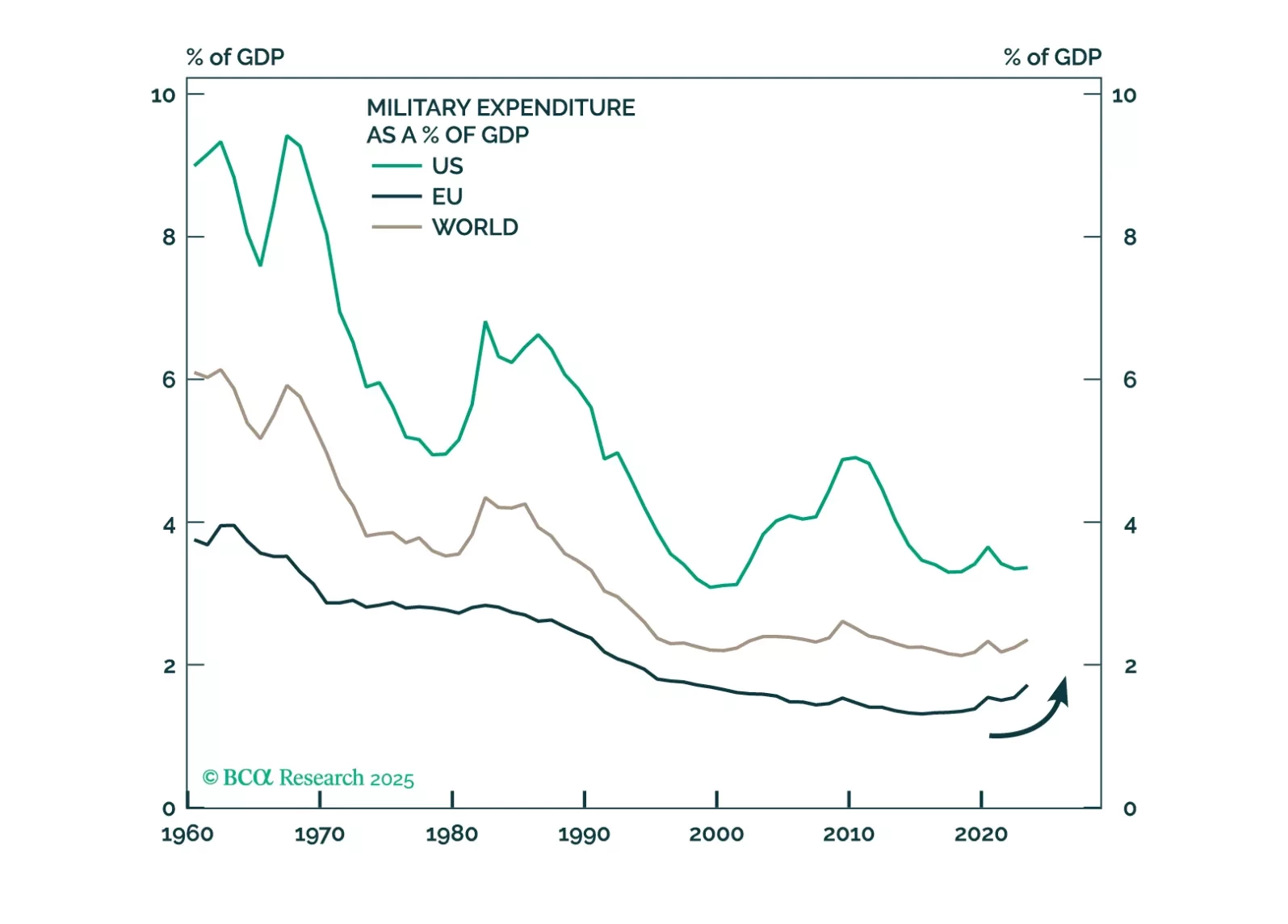

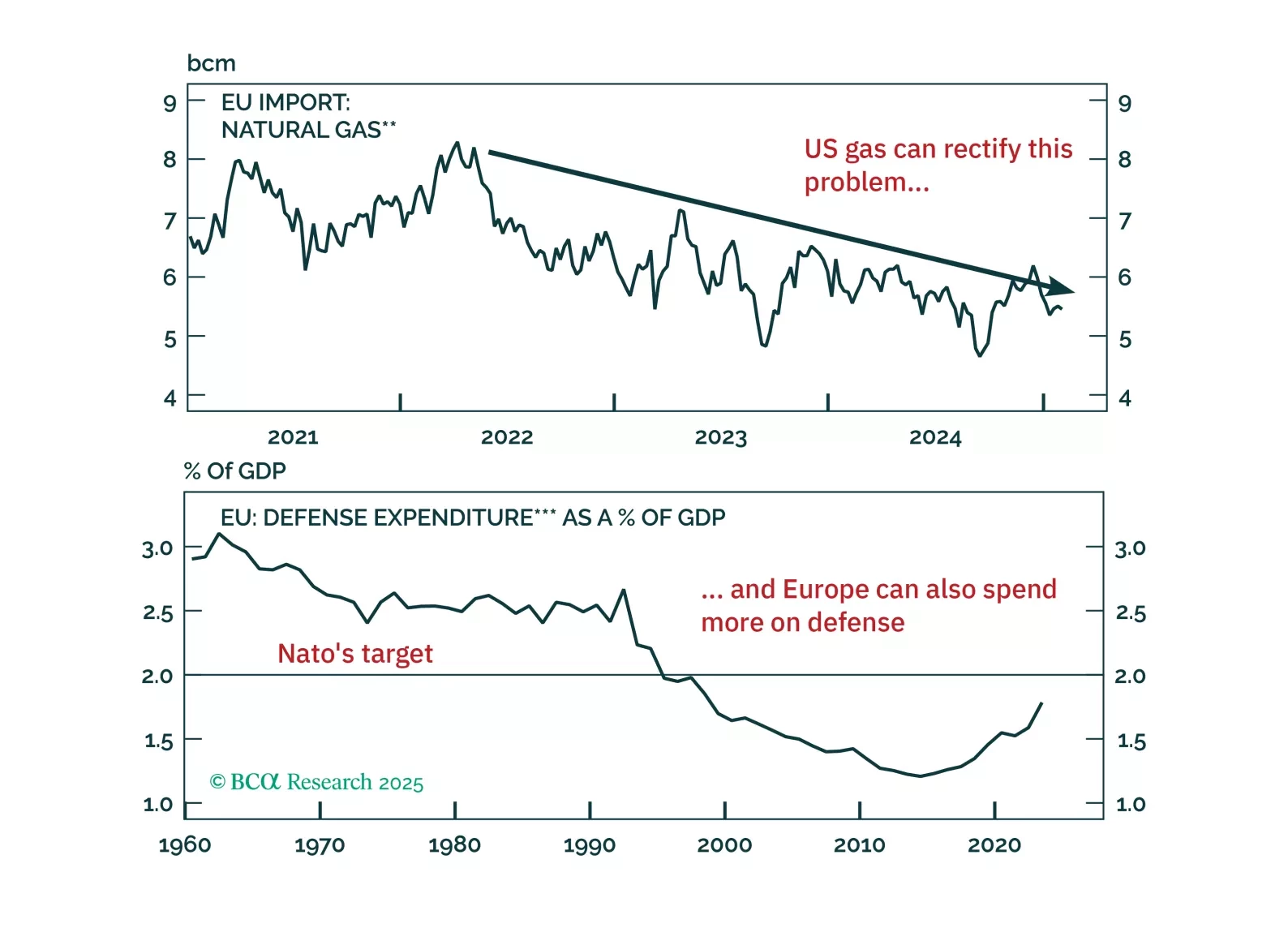

Fears of Europe’s decline due to Russian aggression and shifting US policy are overblown. President Trump’s tough stance on Ukraine is a strategic move to consolidate domestic support, not an abandonment of Europe, while Russia’s…

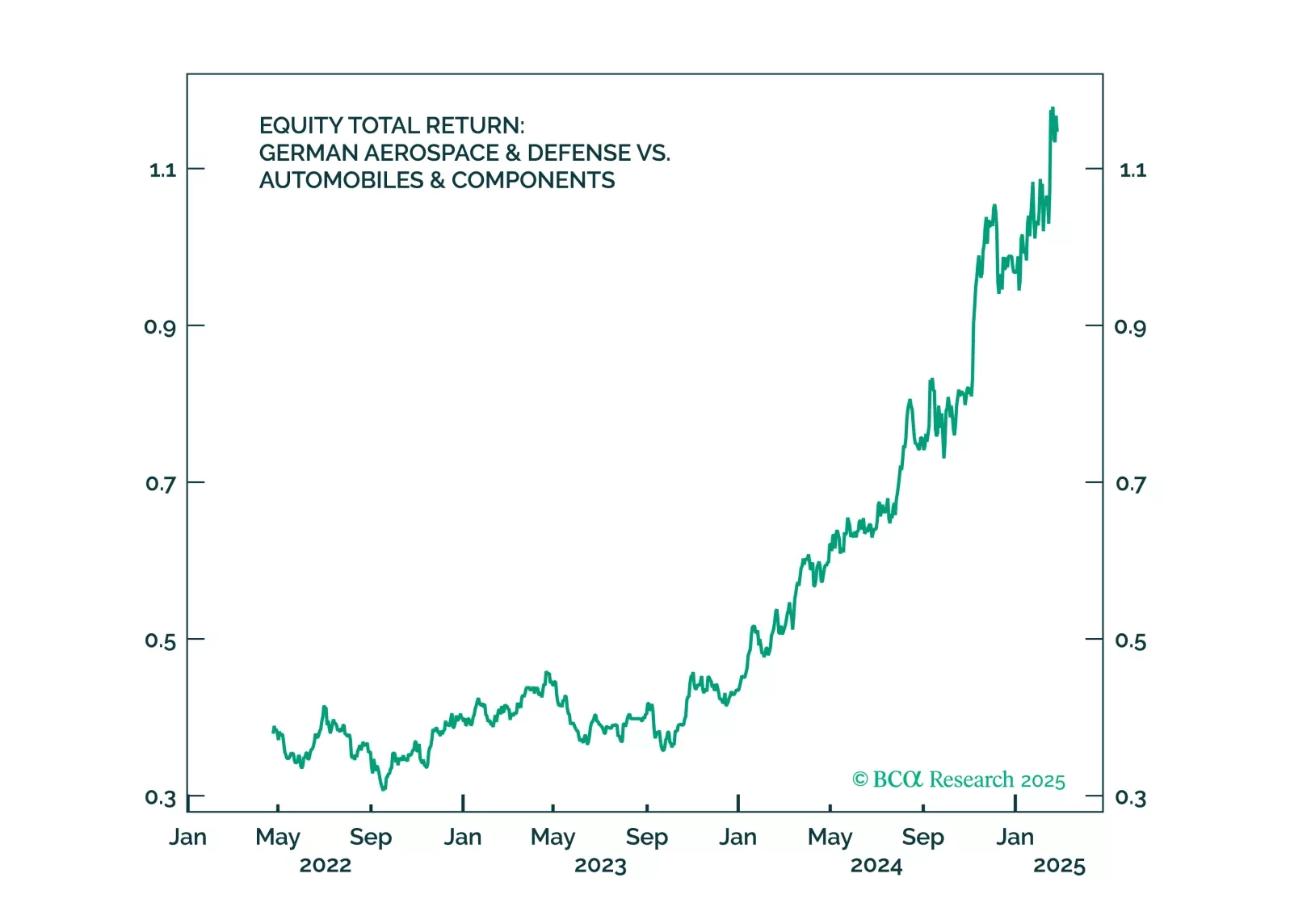

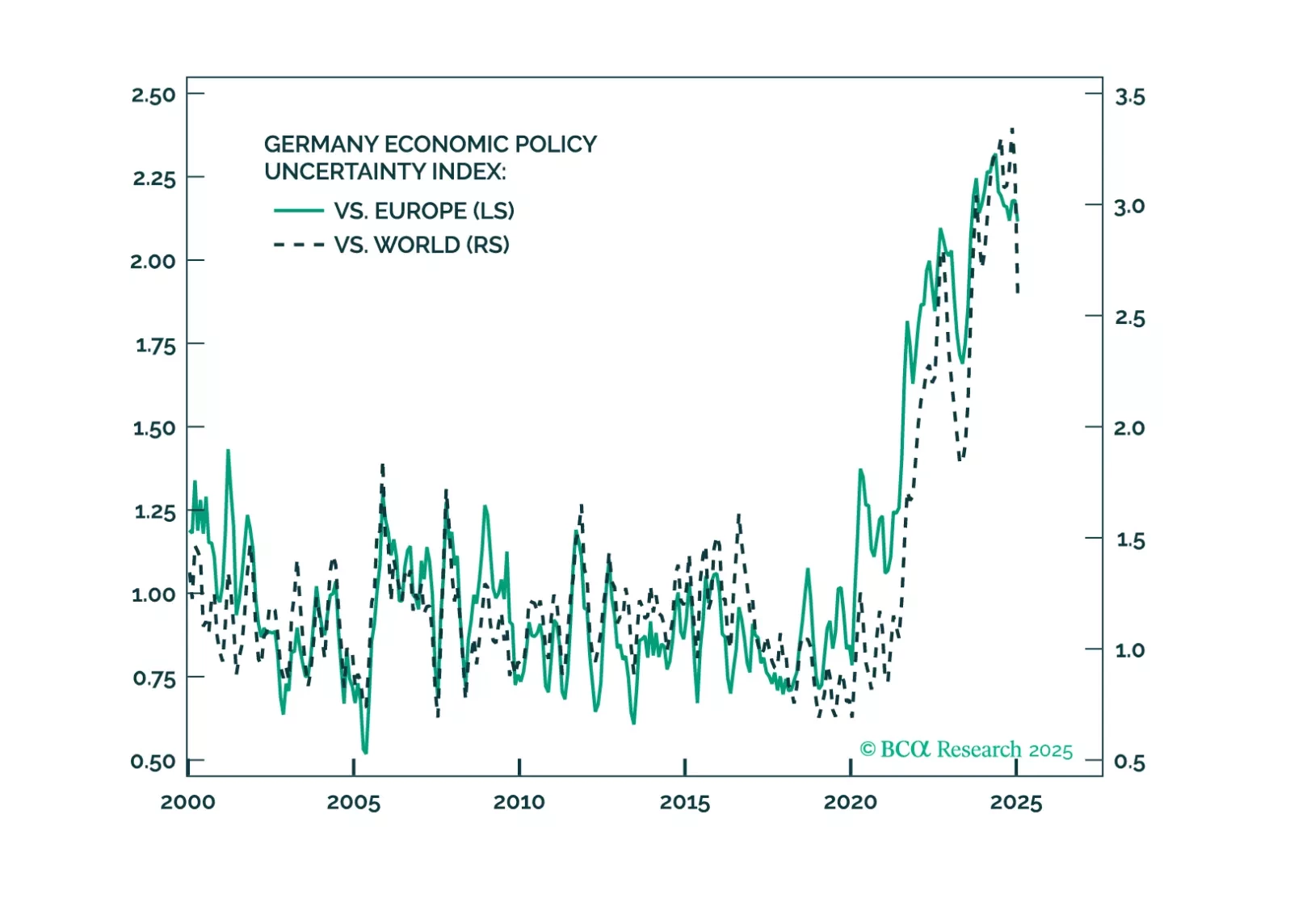

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

US growth has slowed in recent weeks. This can be seen in the weaker data on retail sales, consumer confidence, services PMIs, and a swath of housing releases (notably starts, existing home sales, homebuilder confidence, and stock…

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

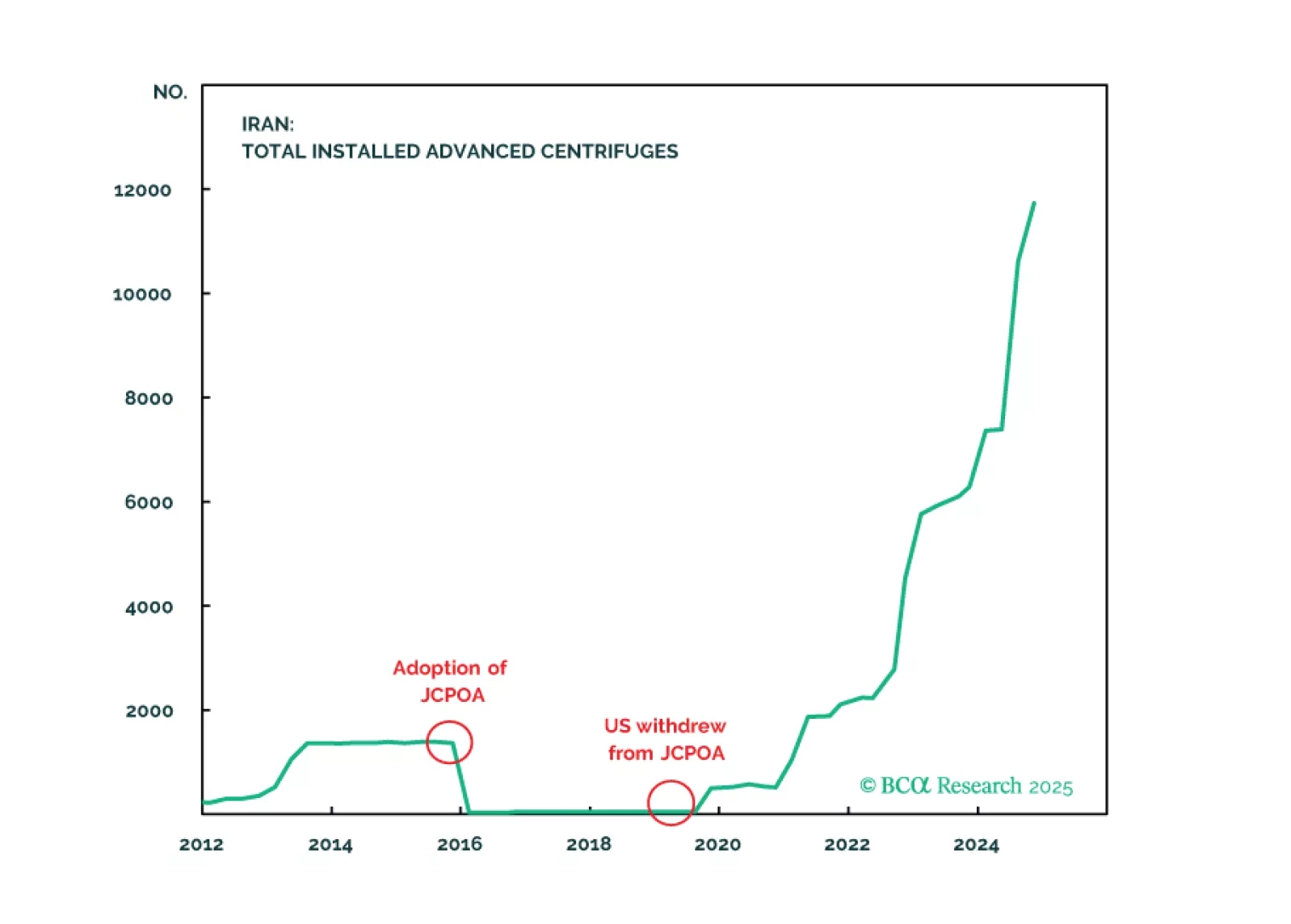

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

Developed markets Flash PMIs estimates for October were mixed, with resilient US numbers and weakness elsewhere. The eurozone composite met expectations but remains below the 50-level expansion threshold. Germany…