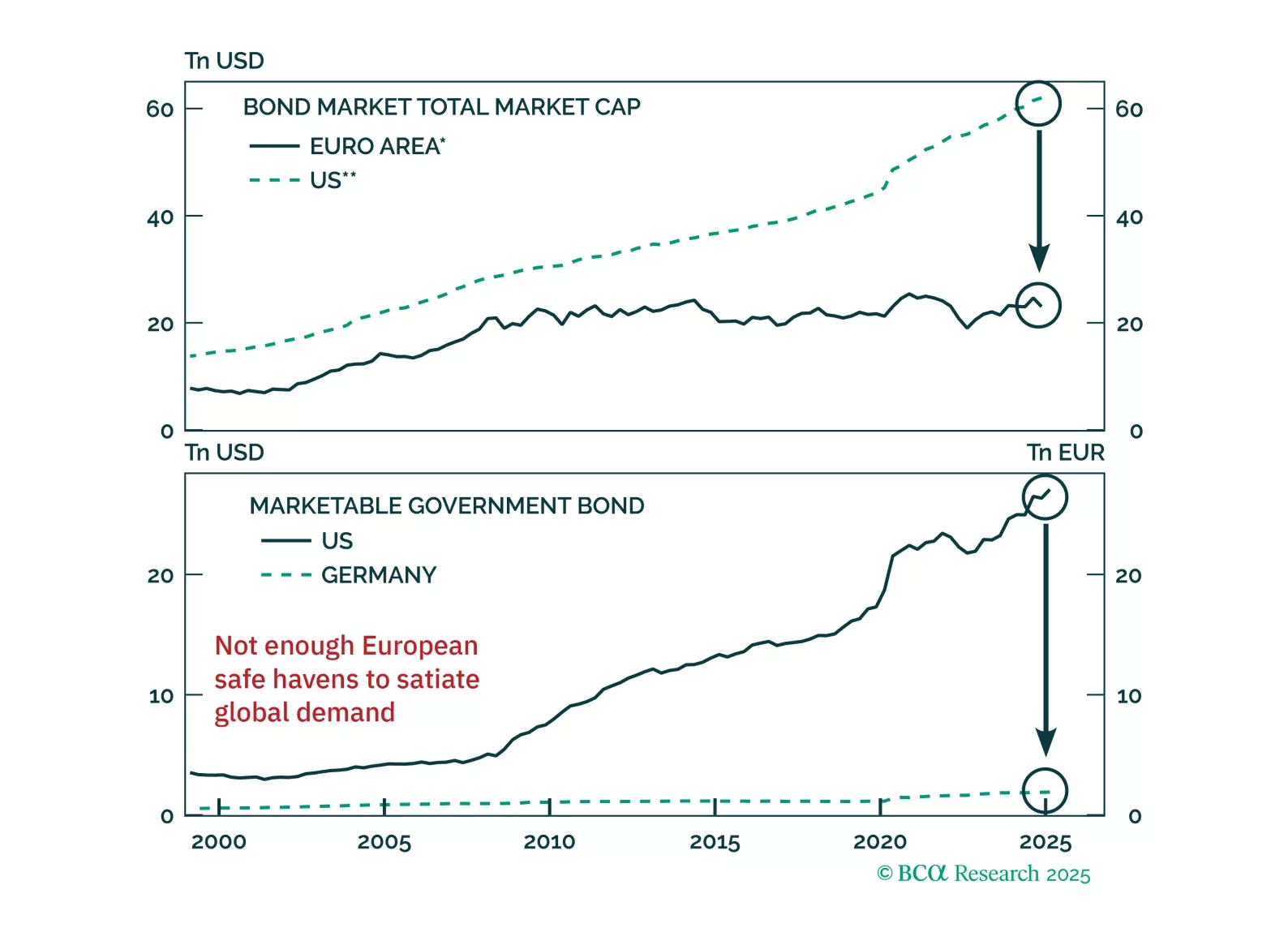

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

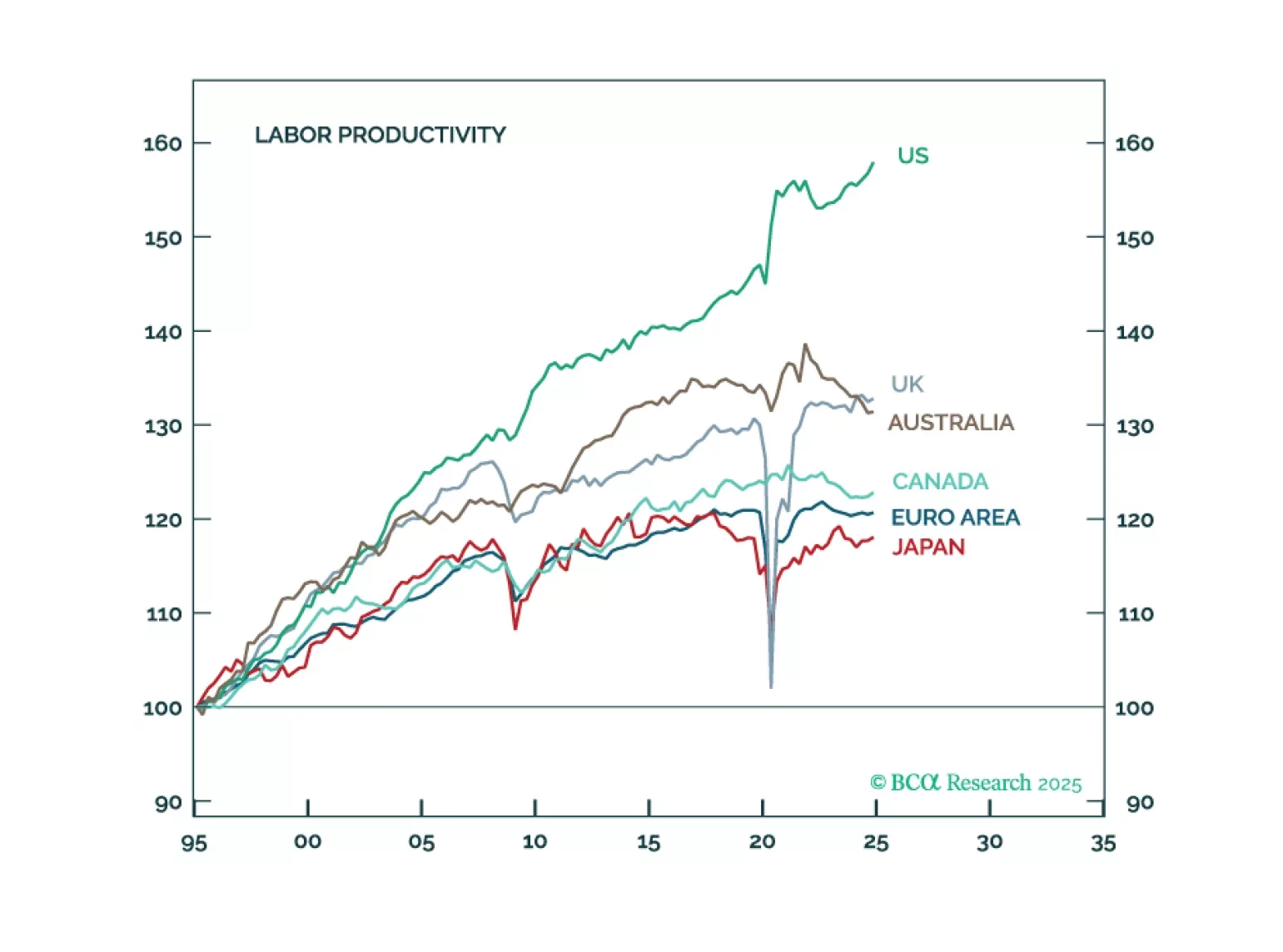

Although the sell-off in the US dollar and relative outperformance of non-US stocks will pause over the coming months as a global recession begins, the fading of US exceptionalism will still cause the dollar to weaken and US stocks…

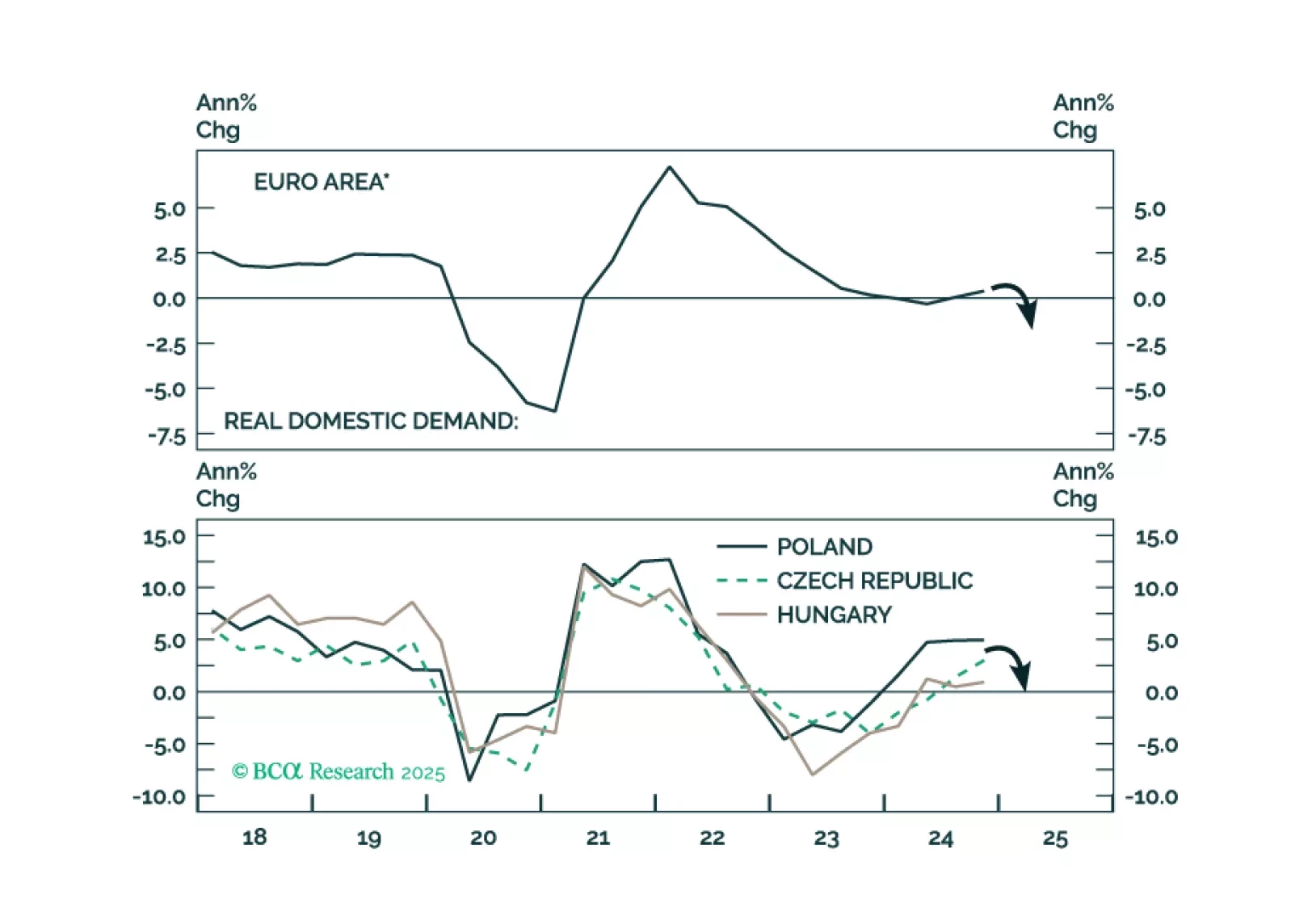

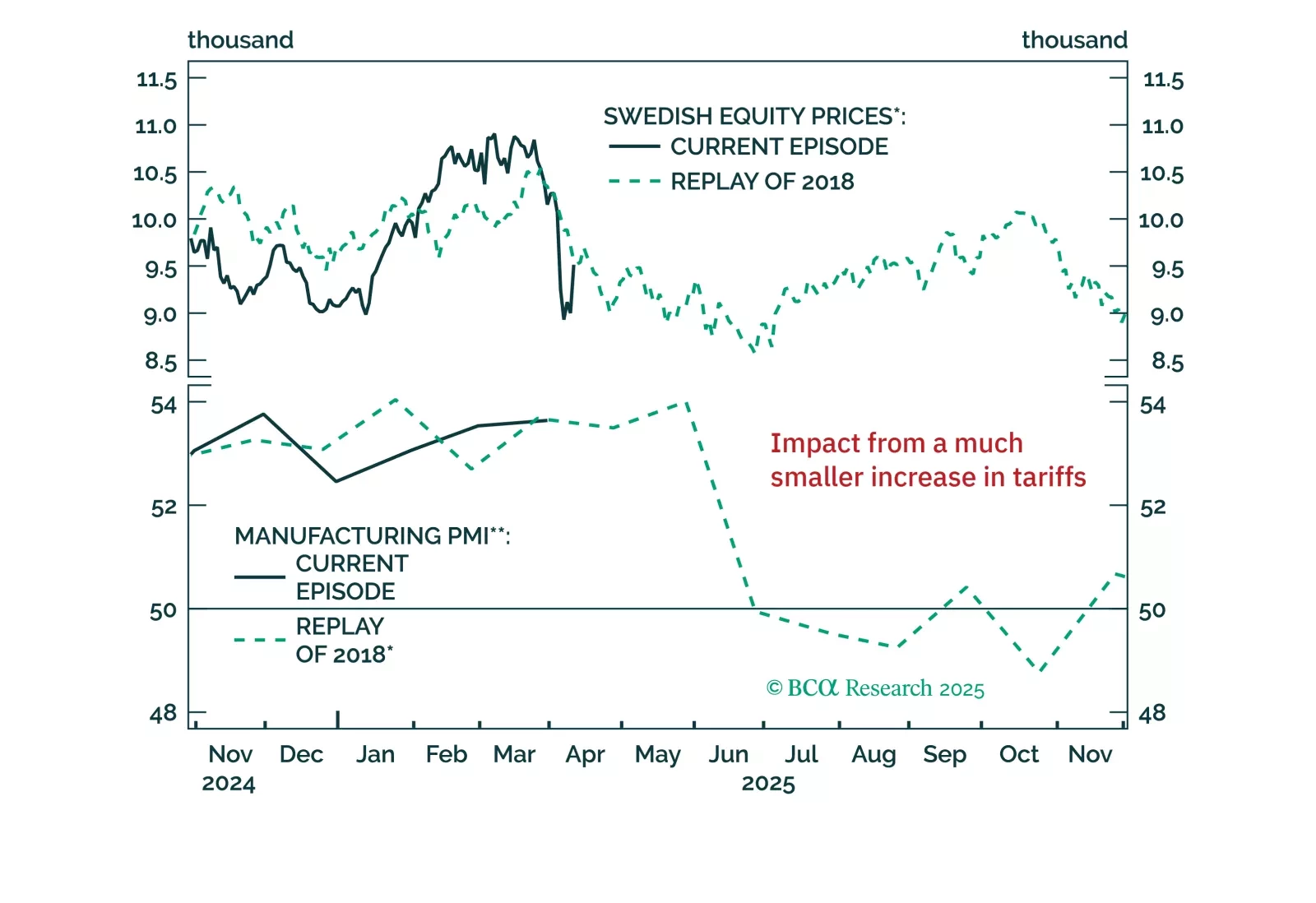

The European economies are facing a major deflationary shock. We recommend that investors stay long a basket of Central European (CE3) domestic bonds. They should also upgrade CE3 bonds and stocks in their respective EM portfolios.

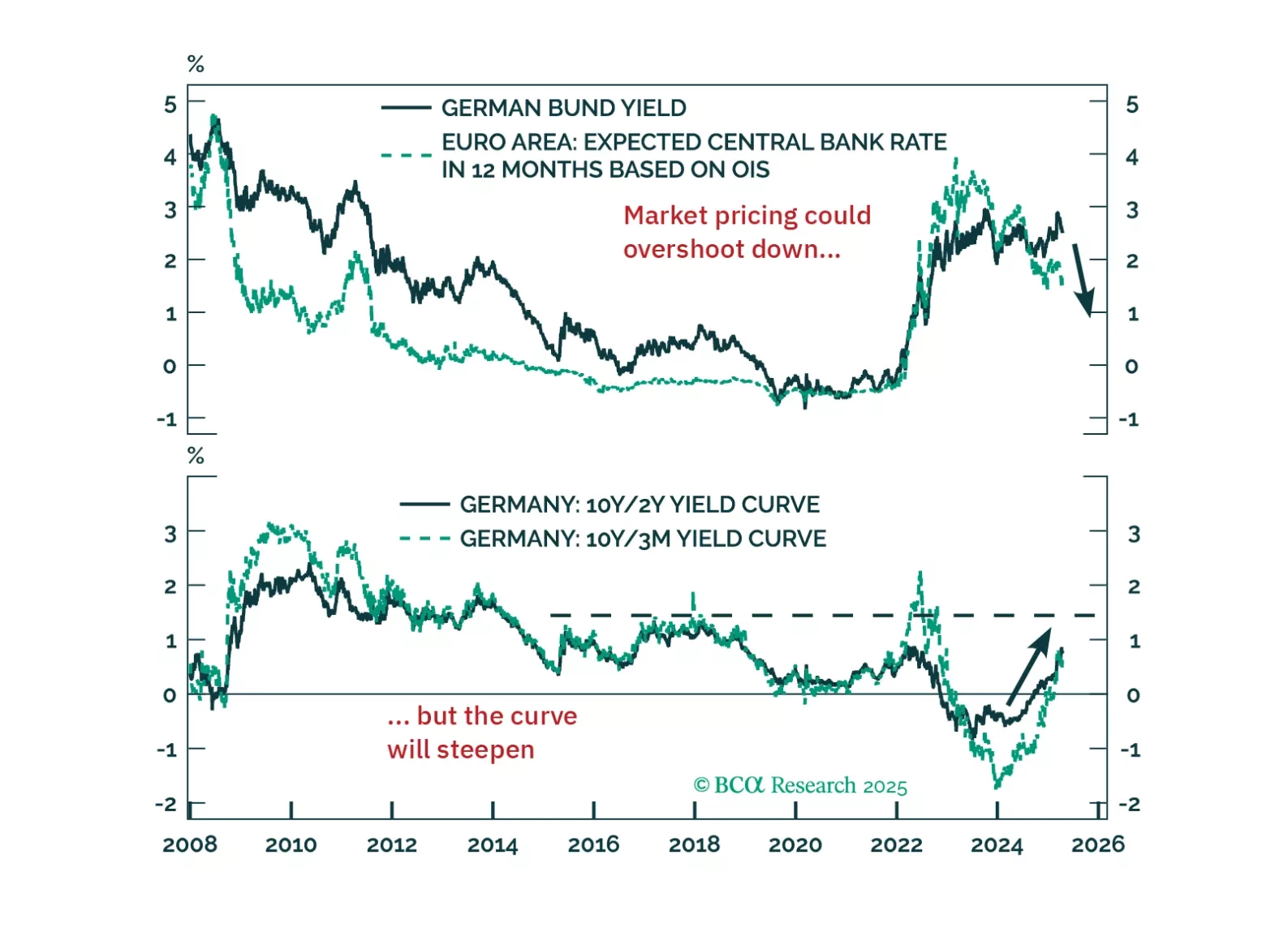

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

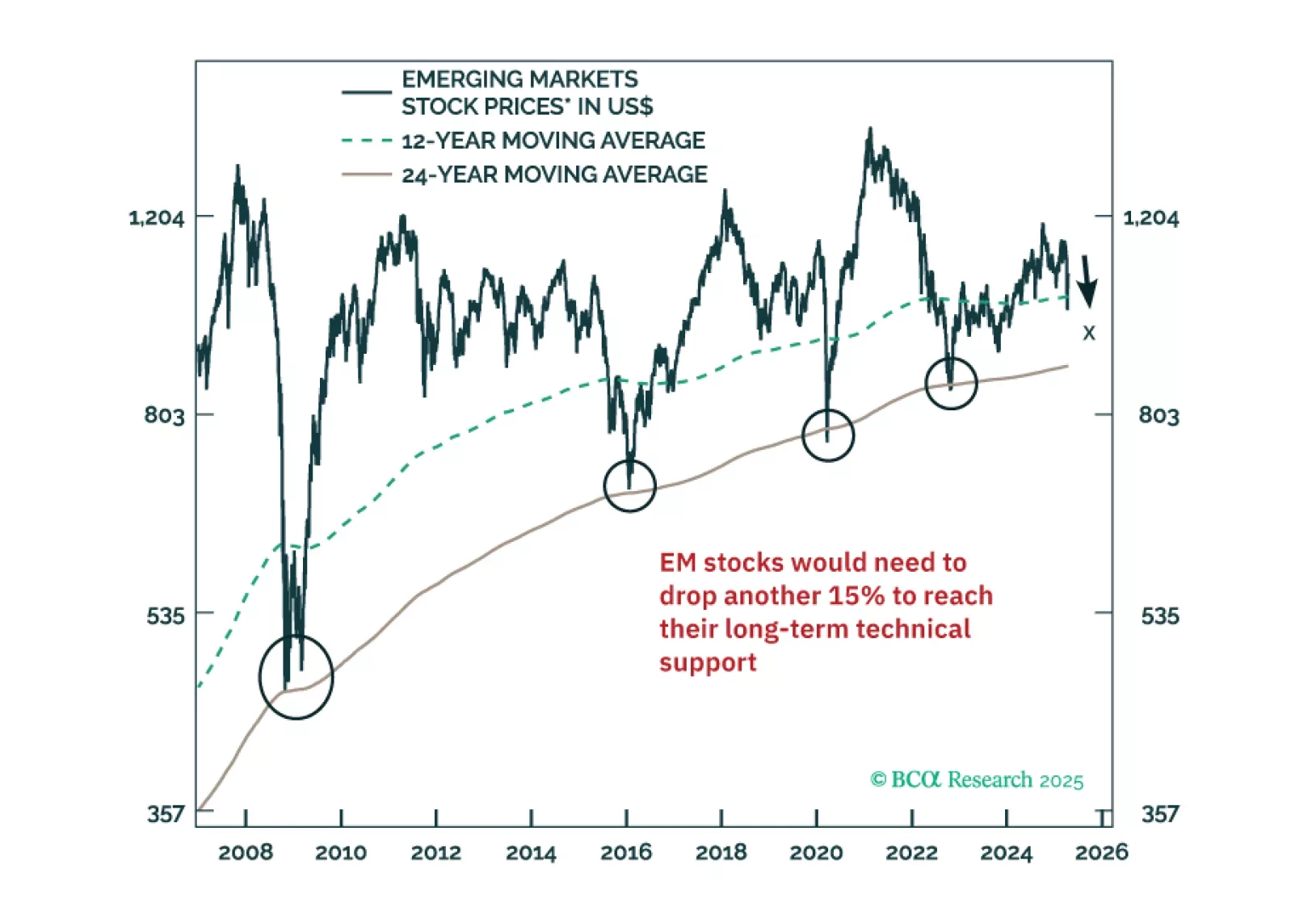

Even after policymakers retract their prejudicial actions, financial markets might continue selling off. We compare the current tariff shock with two past episodes when policy reversals did not produce market turnarounds: (1) the RMB…

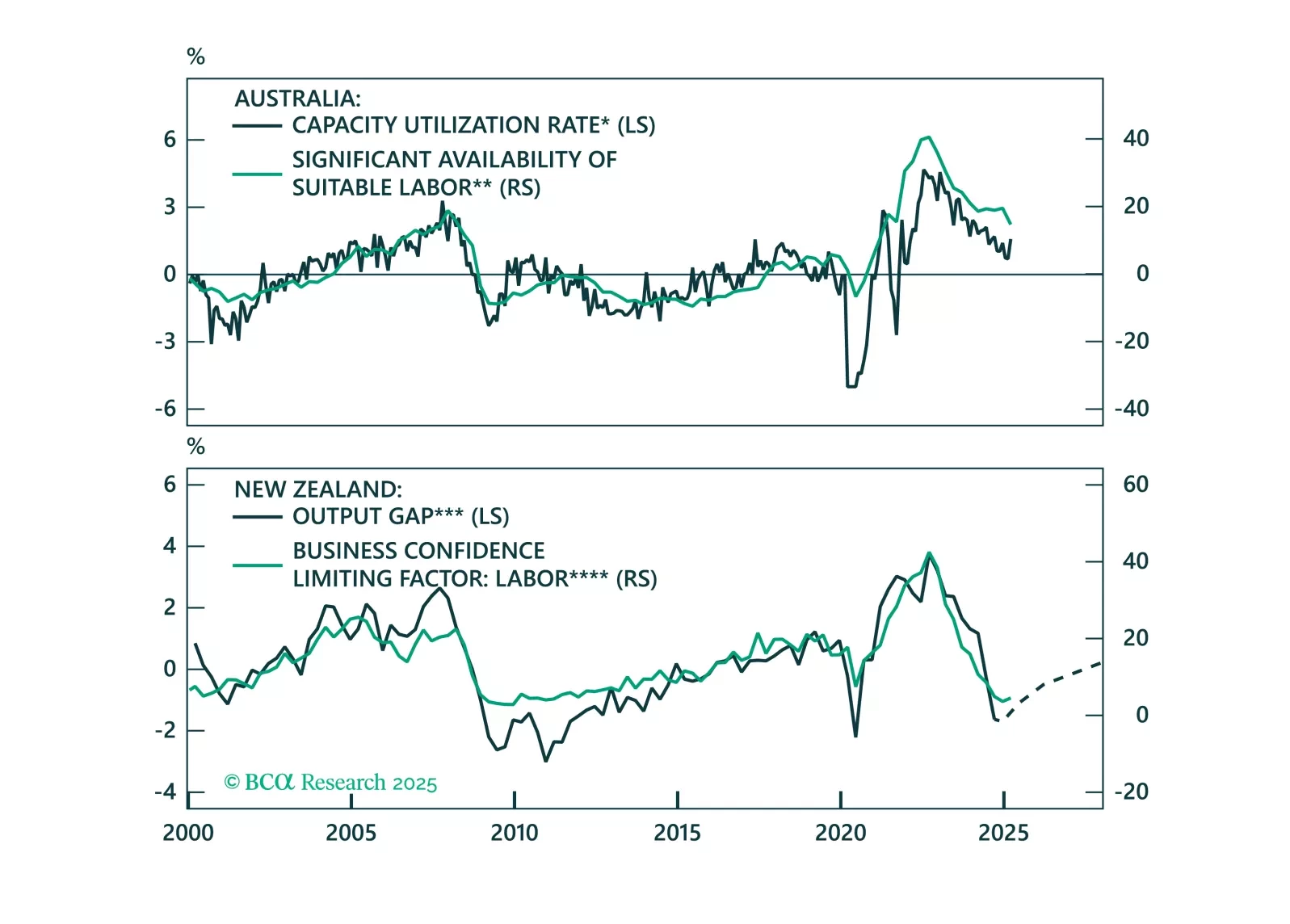

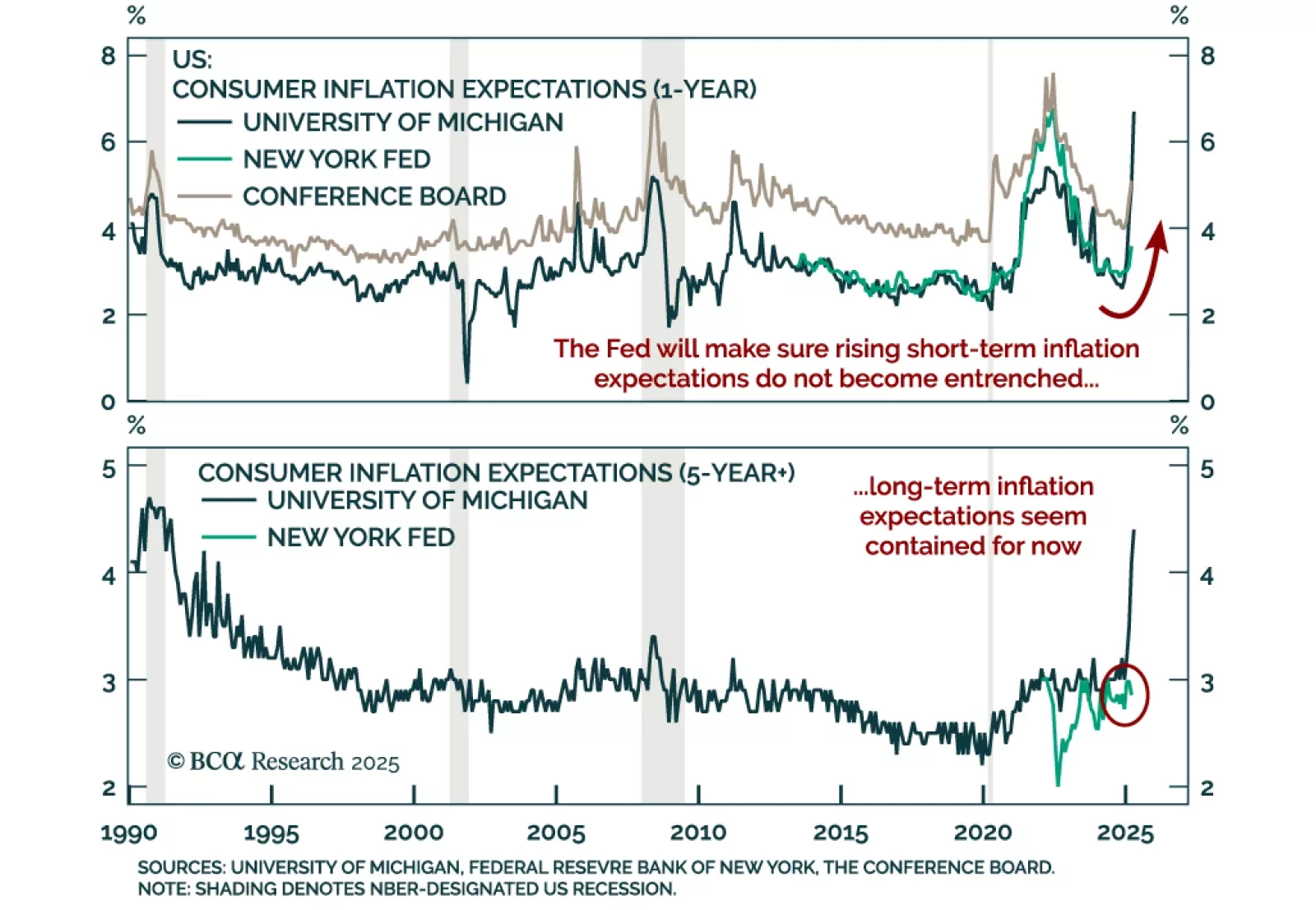

The latest NY Fed Survey of Consumer Expectations reinforces our defensive stance, with growth concerns deepening even as long-term inflation expectations remain anchored. The survey is a useful cross-check against broader sentiment…

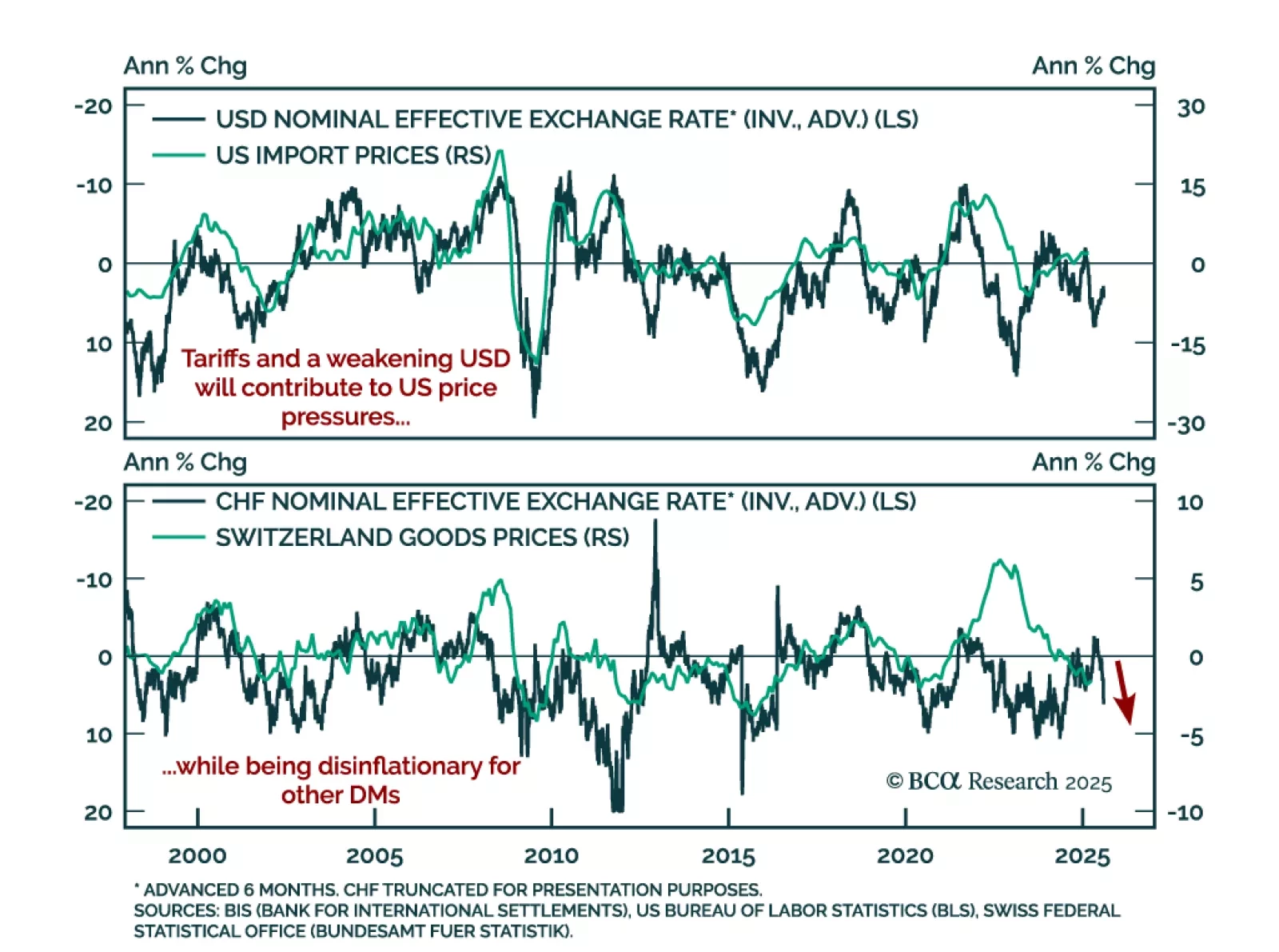

Tariff-driven inflation is diverging across economies, with the US facing mounting pressures while disinflation persists elsewhere. In theory, US tariffs should strengthen the dollar and weaken targeted currencies. In practice, the…