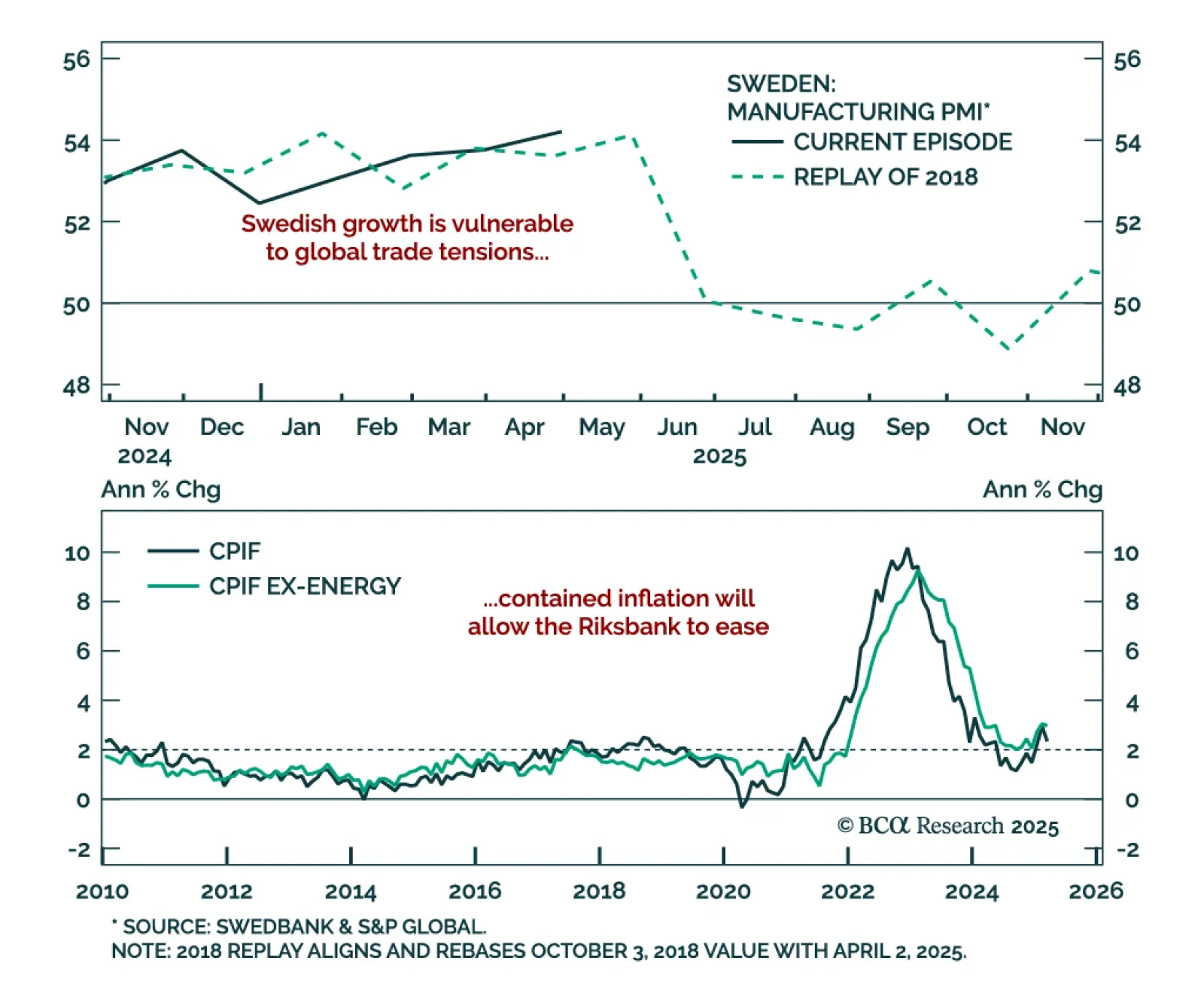

The Riksbank’s cautious stance sets up a dovish pivot, reinforcing our long Swedish bonds view and SEK fade vs. USD. The central bank held rates at 2.25% for the second time this year, with Governor Thedéen describing policy as well-…

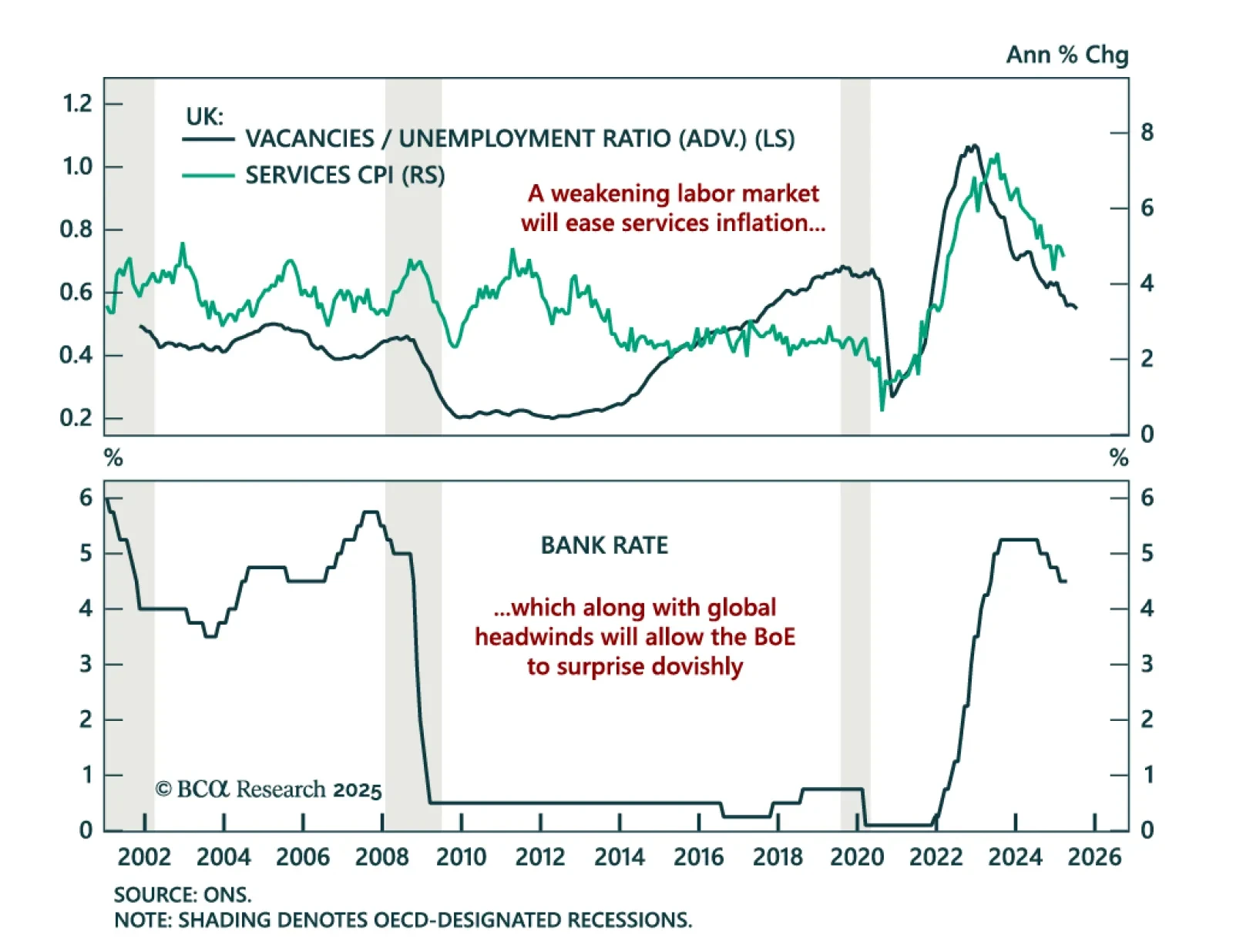

The Bank of England’s hawkish cut reinforces our Gilts overweight and tactical short GBP view as global headwinds persist. The BoE lowered rates by 25 bps to 4.25% as expected, but the MPC vote was more split than expected. Five…

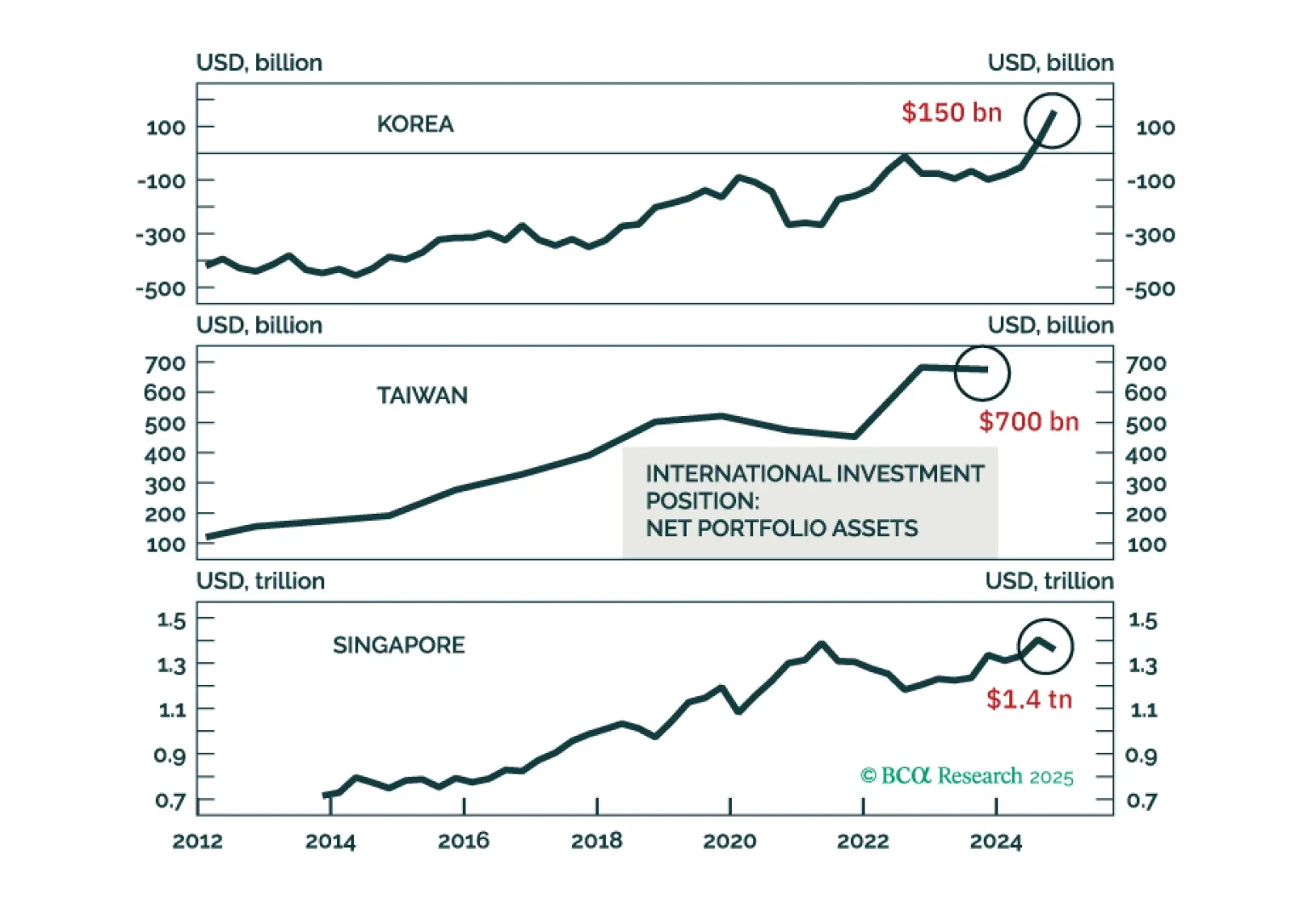

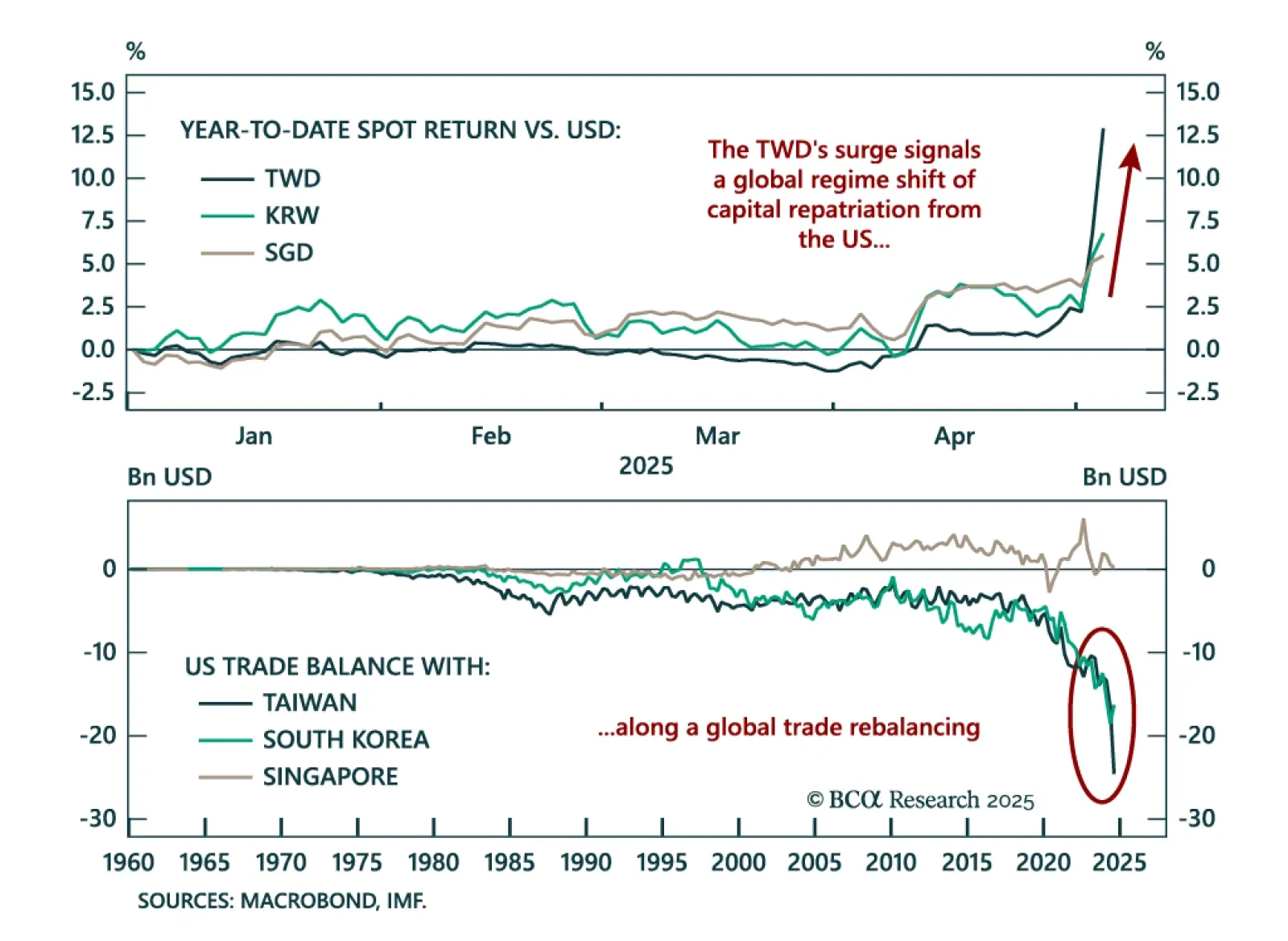

Taiwan, Singapore, and Korea's currencies might appreciate versus the USD, driven by capital repatriation from domestic private investors away from the US. This thesis is less pertinent to India, Indonesia, and the Philippines…

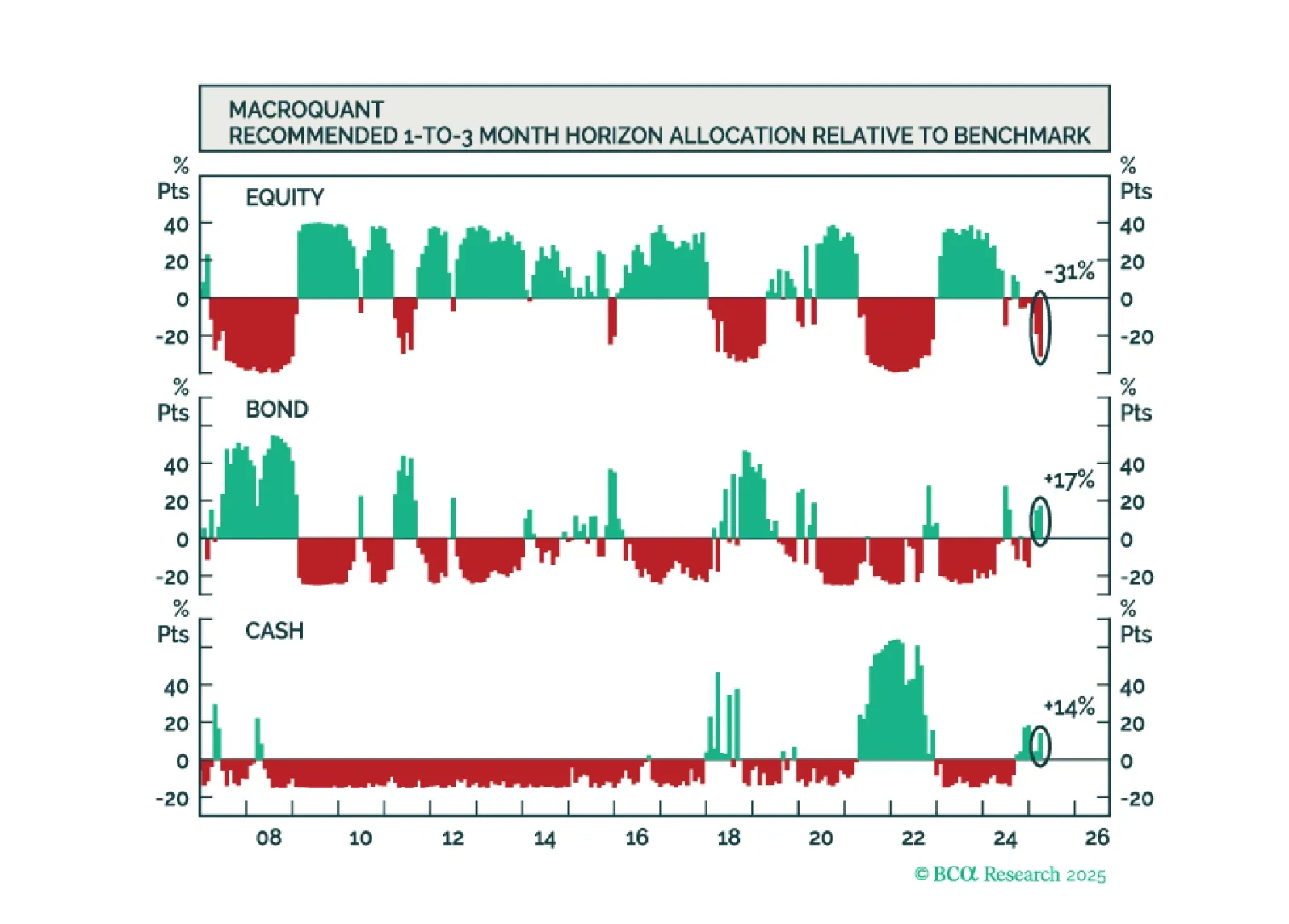

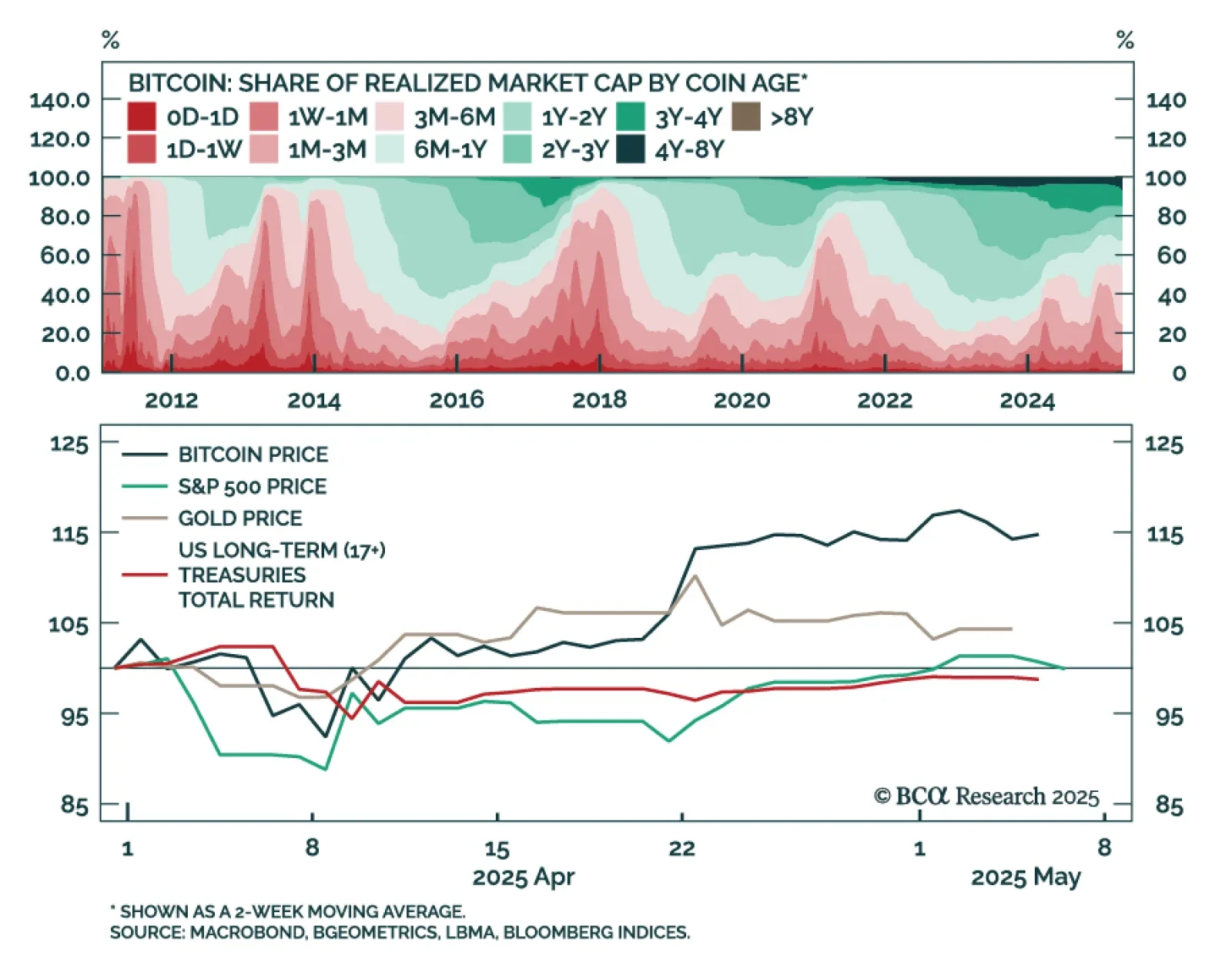

Our Global Asset Allocation strategists recommend staying defensively positioned. They remain underweight equities and the US specifically, while maintaining an overweight in fixed income yet downgrading duration to neutral.…

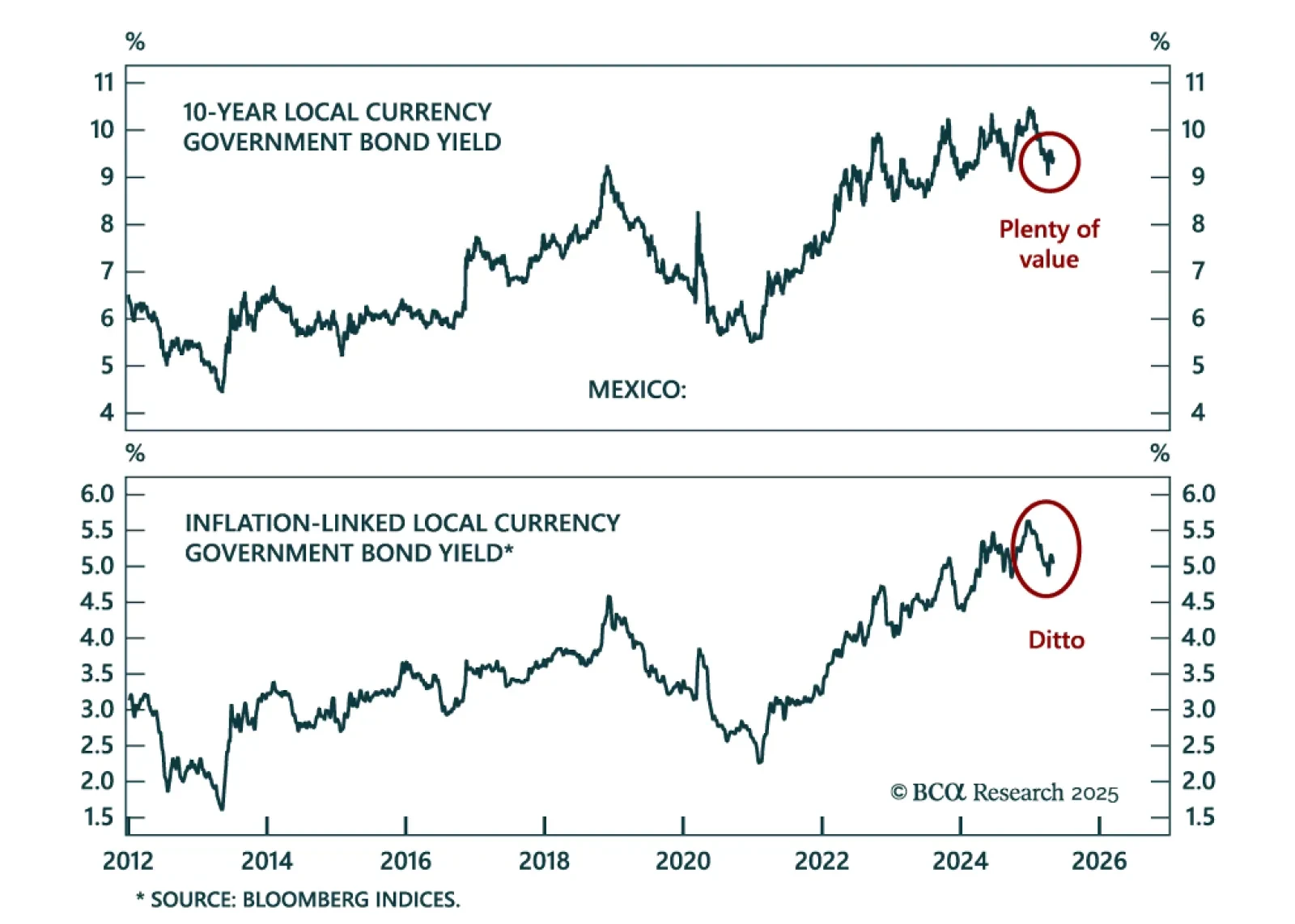

Mexico will be one of the biggest winners of the global trade war, creating a structural tailwind for its assets. Mexican risk assets and the peso are uniquely positioned to outperform while EM assets suffer as global growth slumps.…

The TWD’s surge reflects a regime shift in global capital flows that supports EM Asia government bonds. Alongside other Asian currencies, the TWD has rallied sharply against the USD since late last week. While the first wave of…

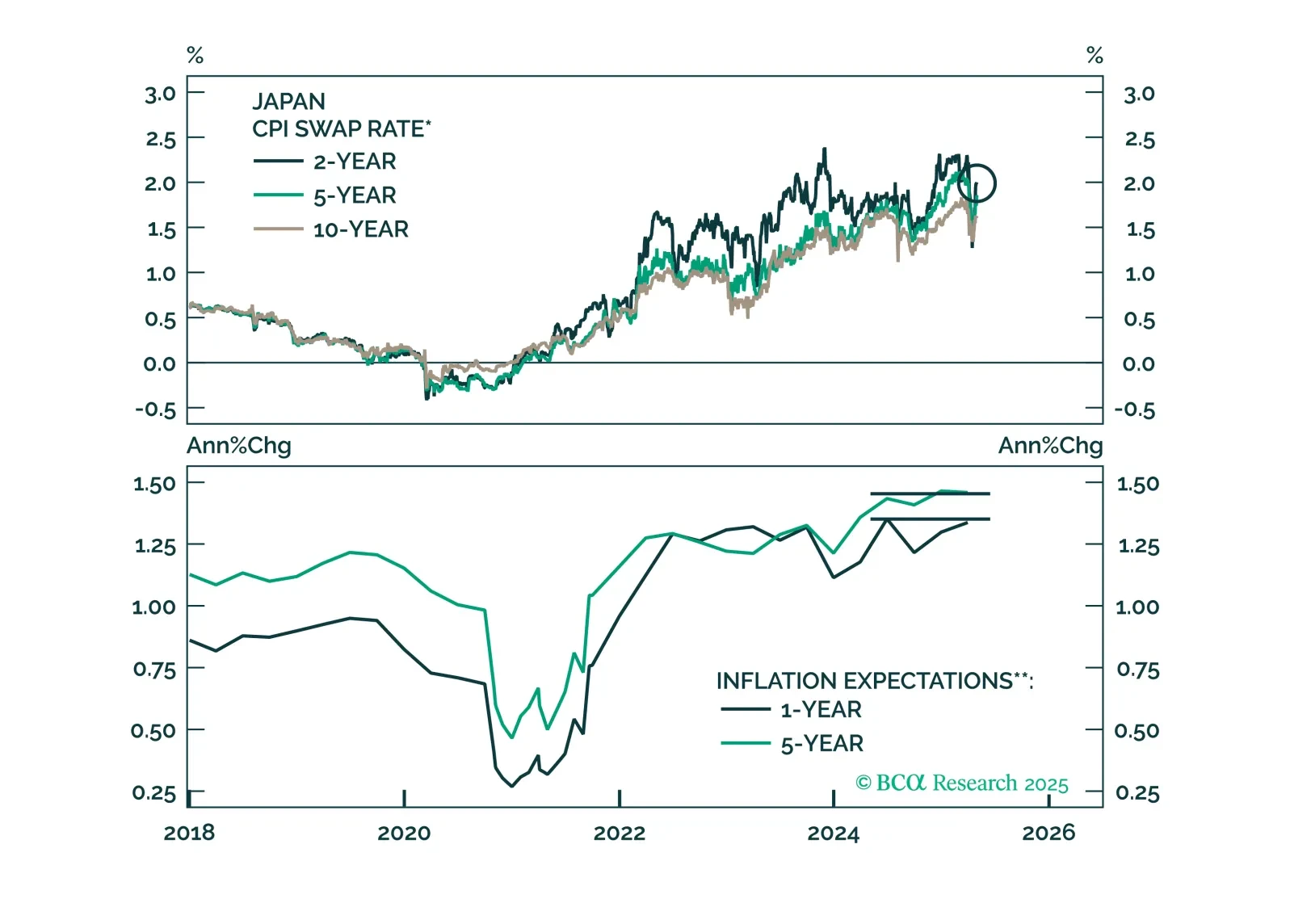

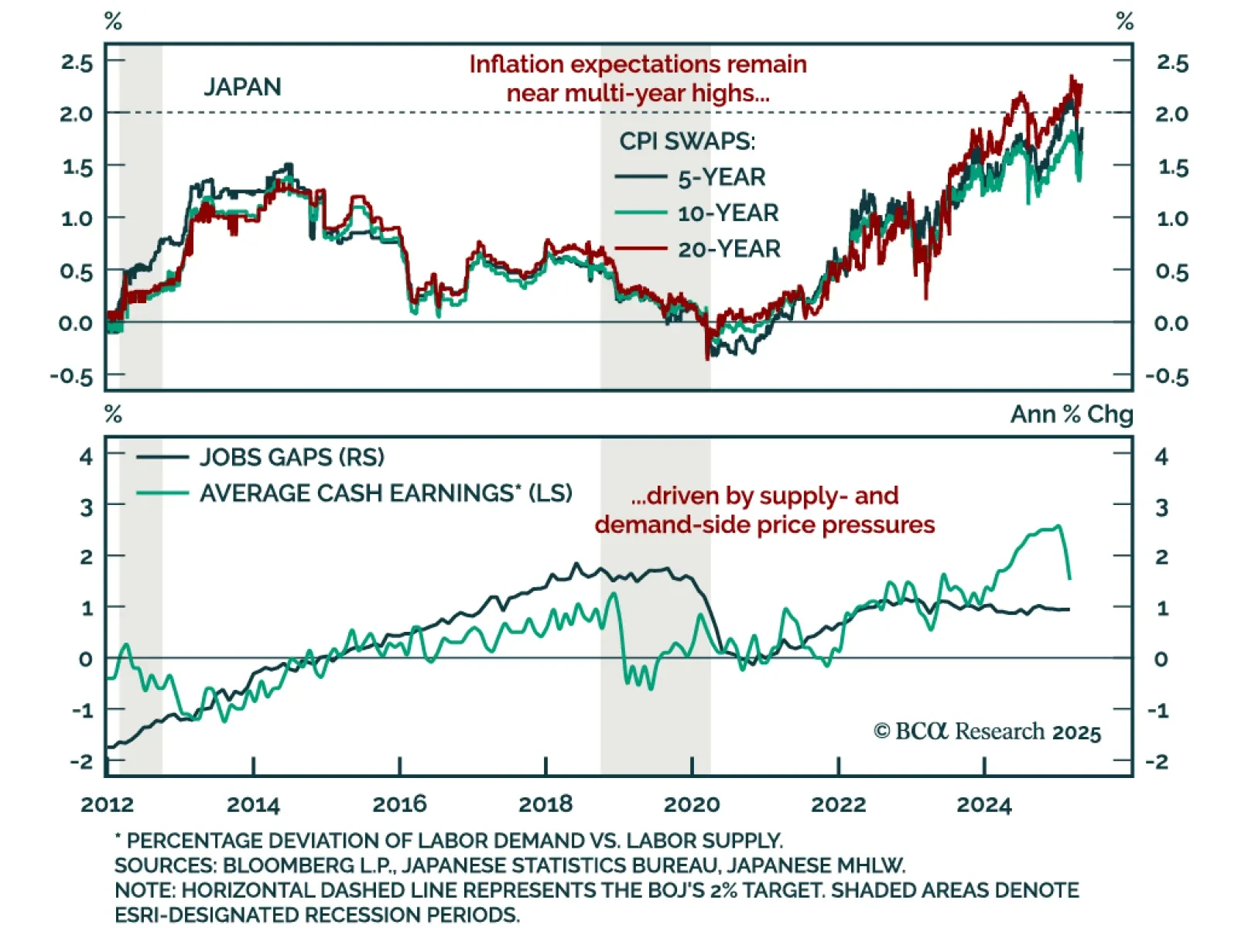

The Bank of Japan’s dovish hold does not contradict BCA’s underweight JGBs and long JPY recommendations. The BoJ left its policy rate unchanged at 0.5% for a second meeting, but slashed its GDP and inflation forecasts for 2025 and…

This week’s report looks at Japan, with the recent BoJ meeting. While a trade war has injected uncertainty into the Japanese economy, our conviction remains high that JGBs will underperform other government bond markets, and the yen…

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.