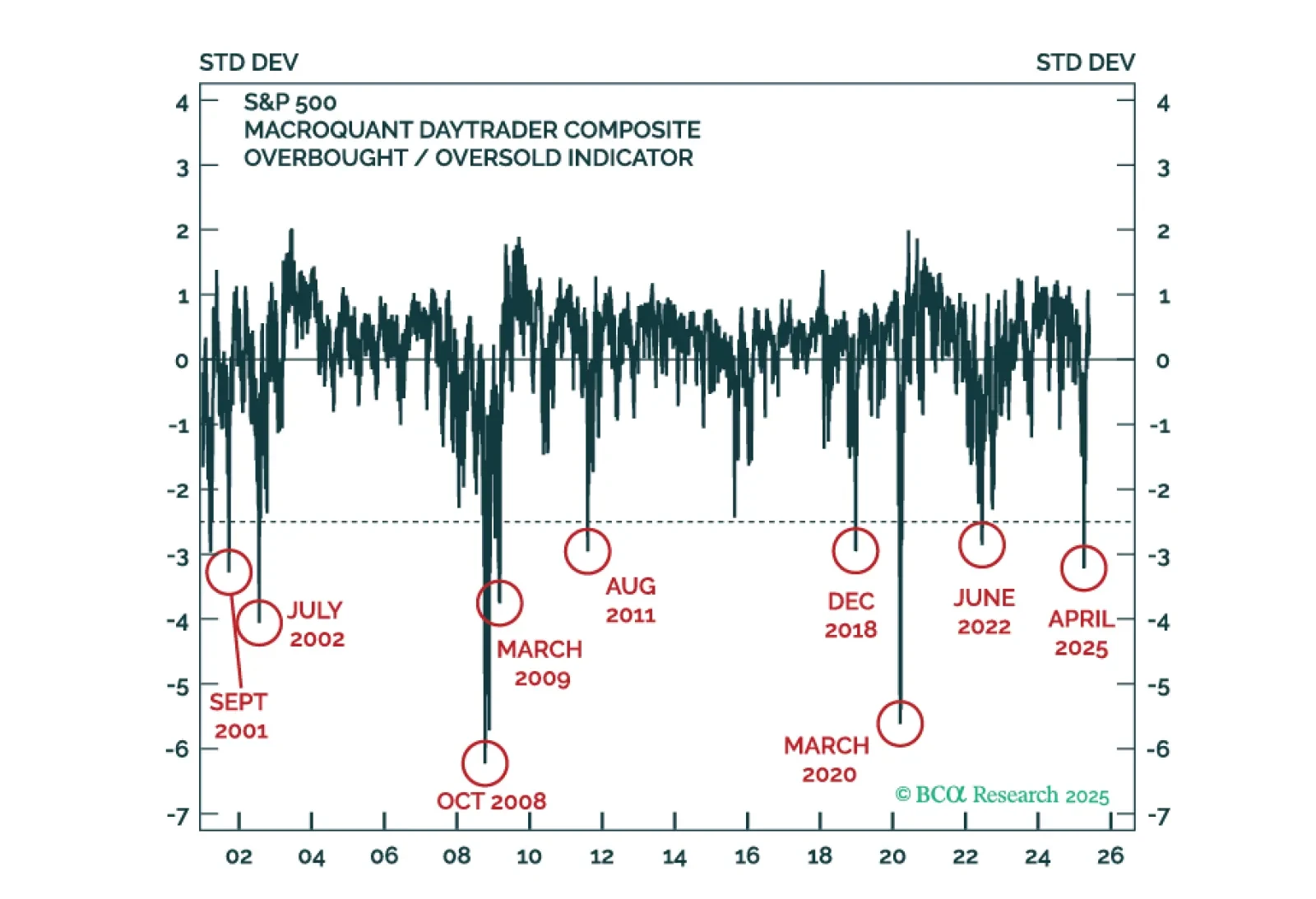

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

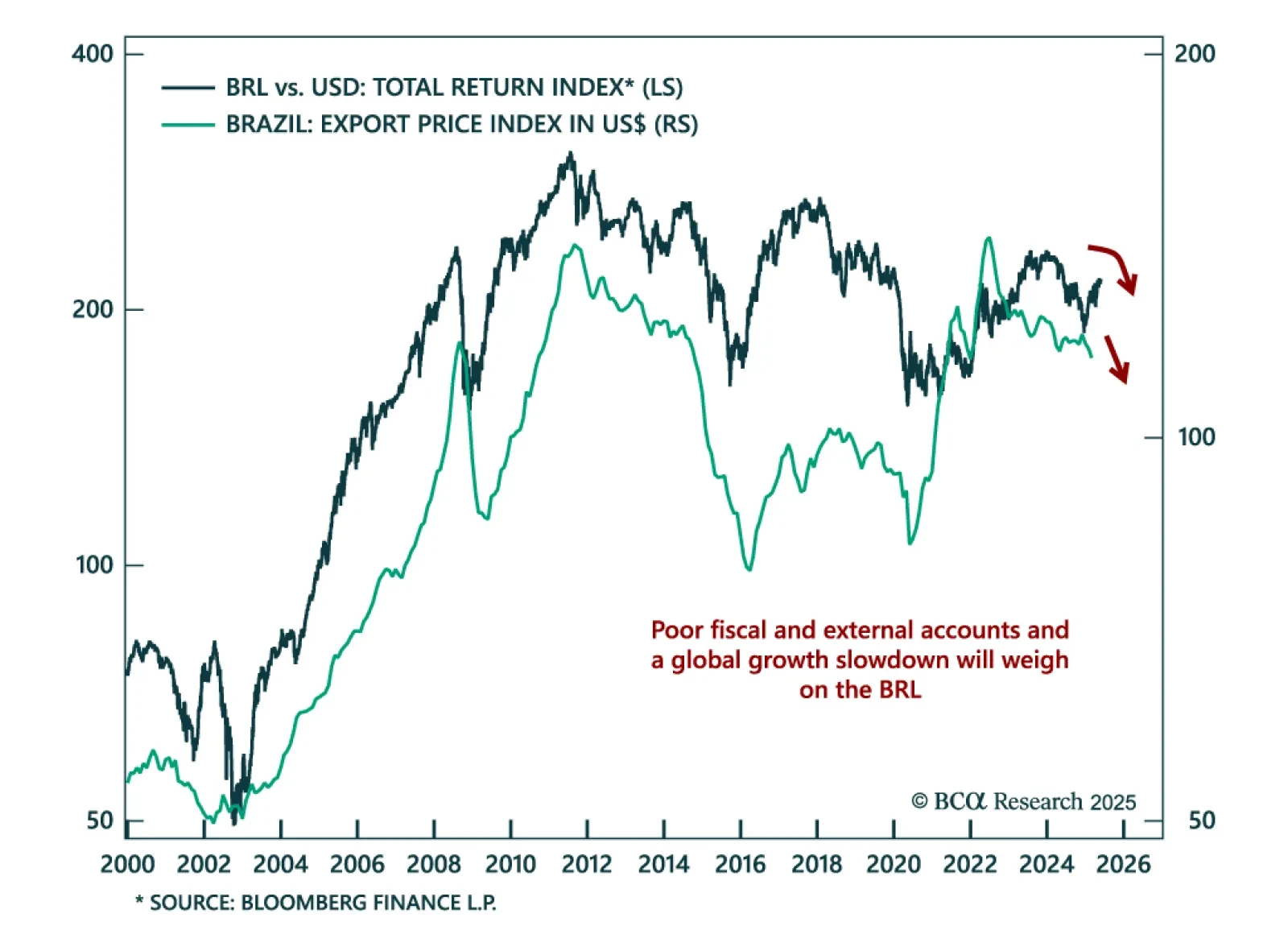

The most recent Brazilian data surprised positively, but underlying economic troubles will spoil the party for the country’s financial markets. Wholesale inflation came in at -0.49% in May relative to last month, while the…

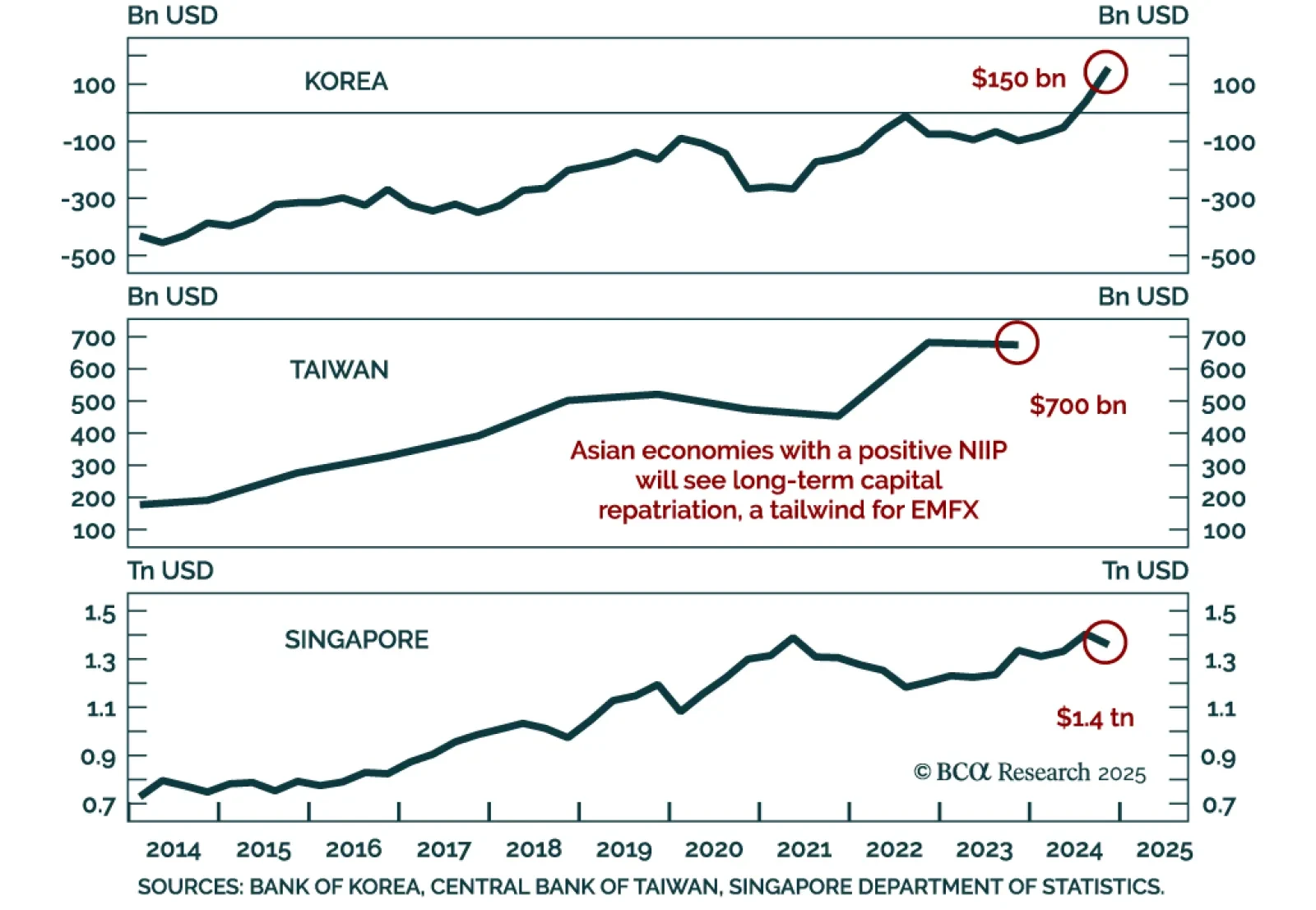

Global currency markets have entered a new era. This implies that the framework for analyzing exchange rates must also change. We introduce a new framework for analyzing EM currencies and classify them into…

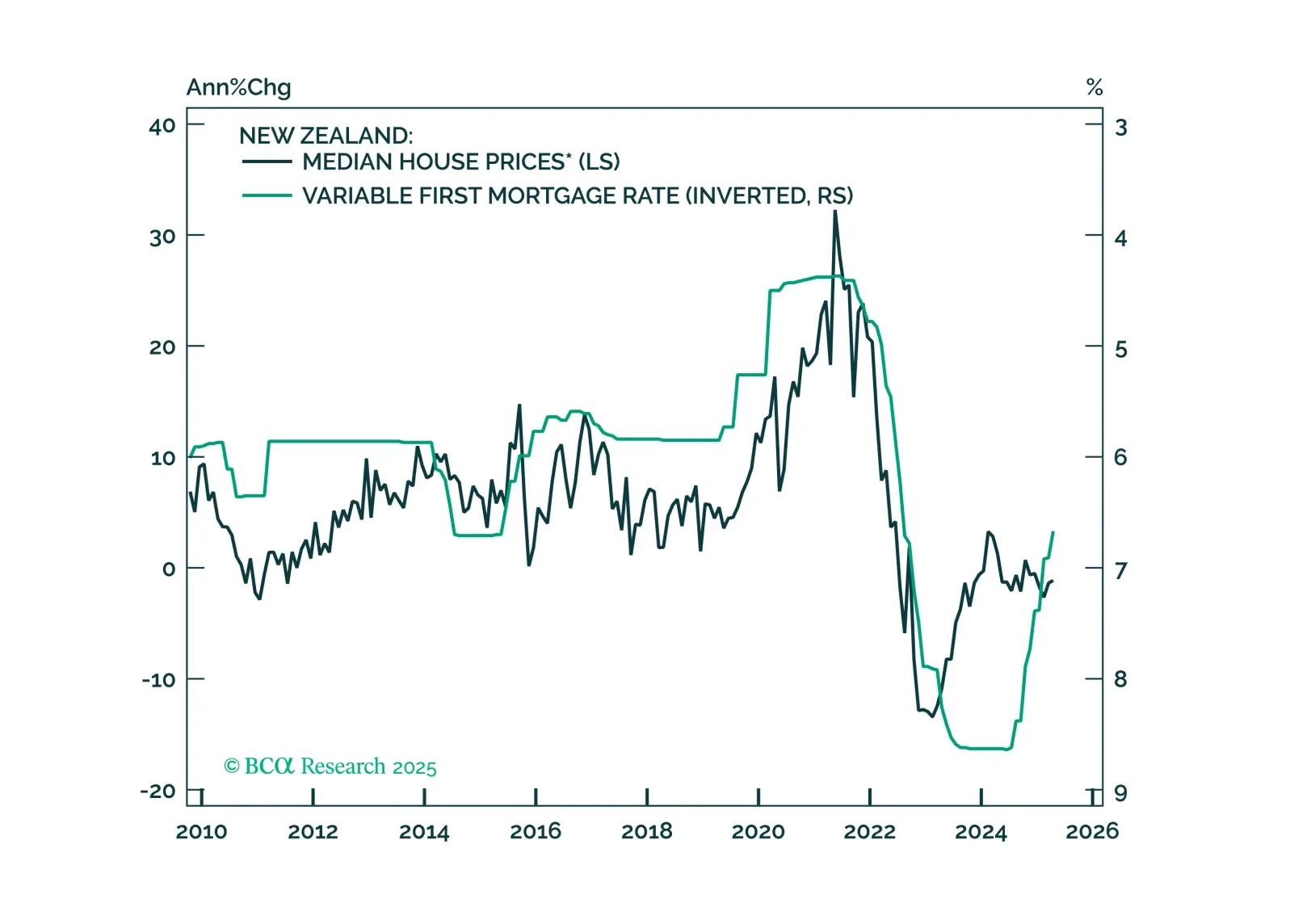

This Insight looks at the implications of the RBNZ’s rate cut on New Zealand assets.

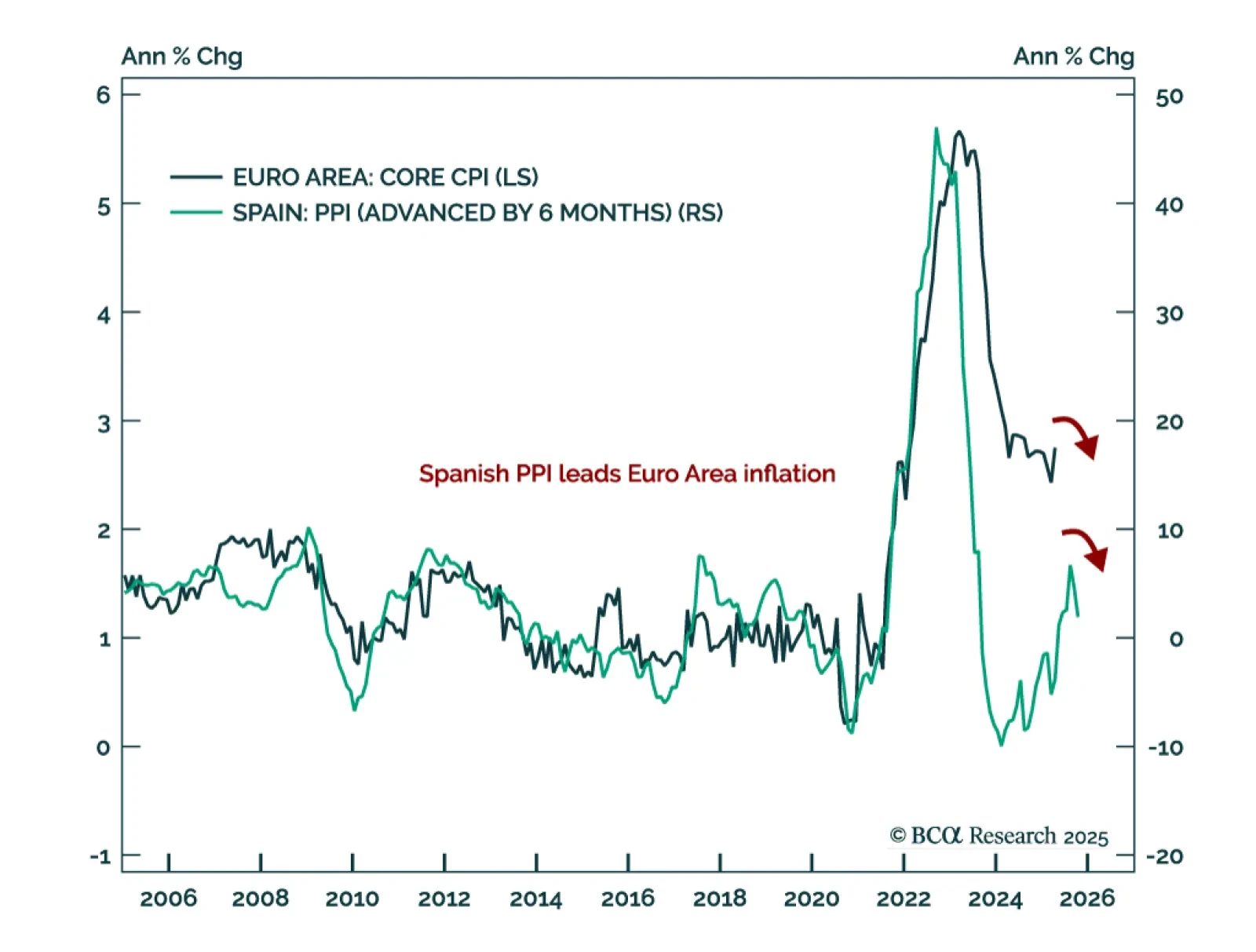

Producer prices in Spain surprised to the downside, foreshadowing a relapse in Euro Area inflation and cementing the ECB’s dovish stance. The Spanish PPI index fell to 1.9% in April, continuing the disinflation trend from the last…

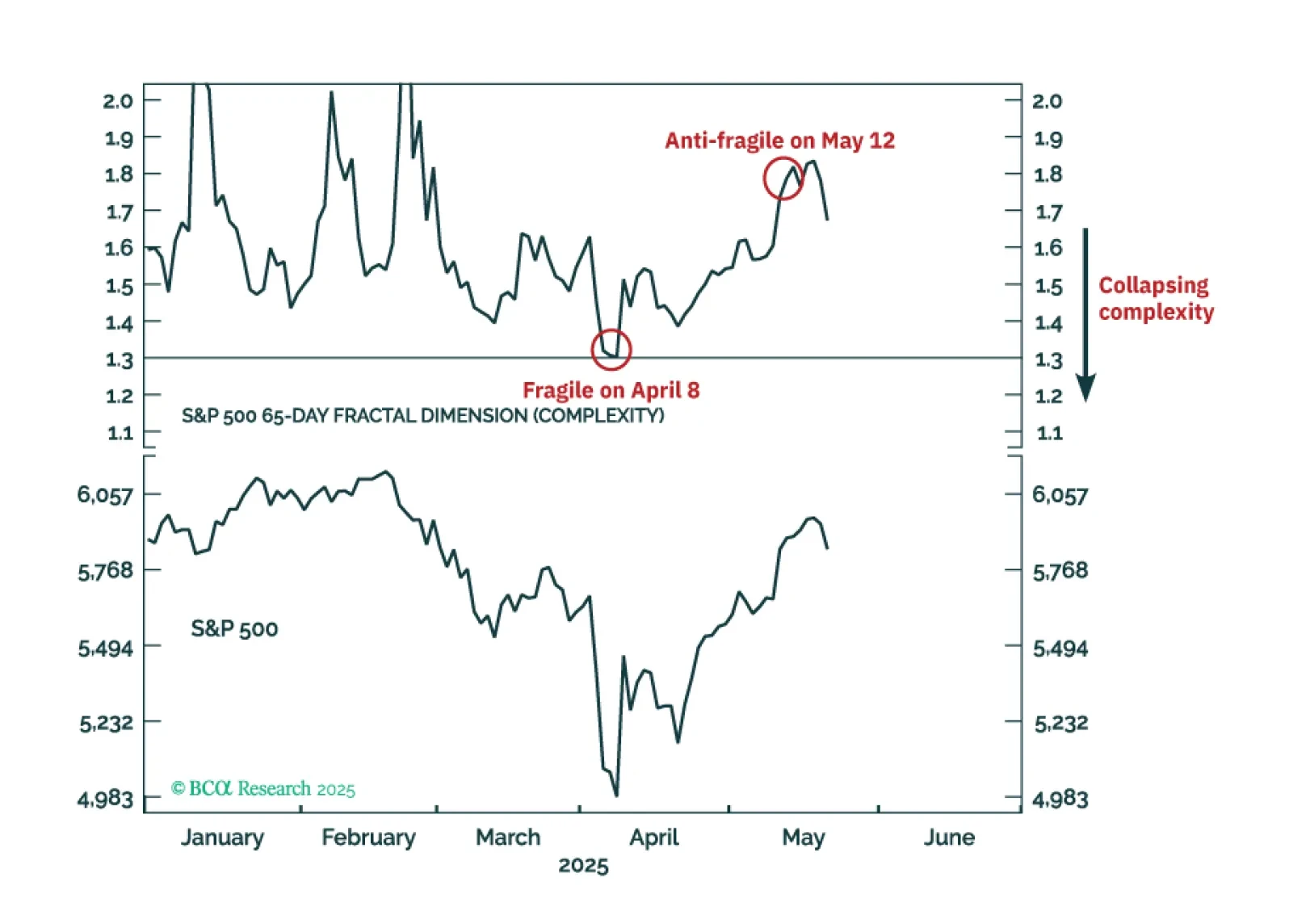

Right now, the major stock and bond markets are more ‘anti-fragile’ than fragile, and the Joshi rule recession indicators signal that a US recession is not imminent. This justifies a neutral, or default, tactical weighting to both…

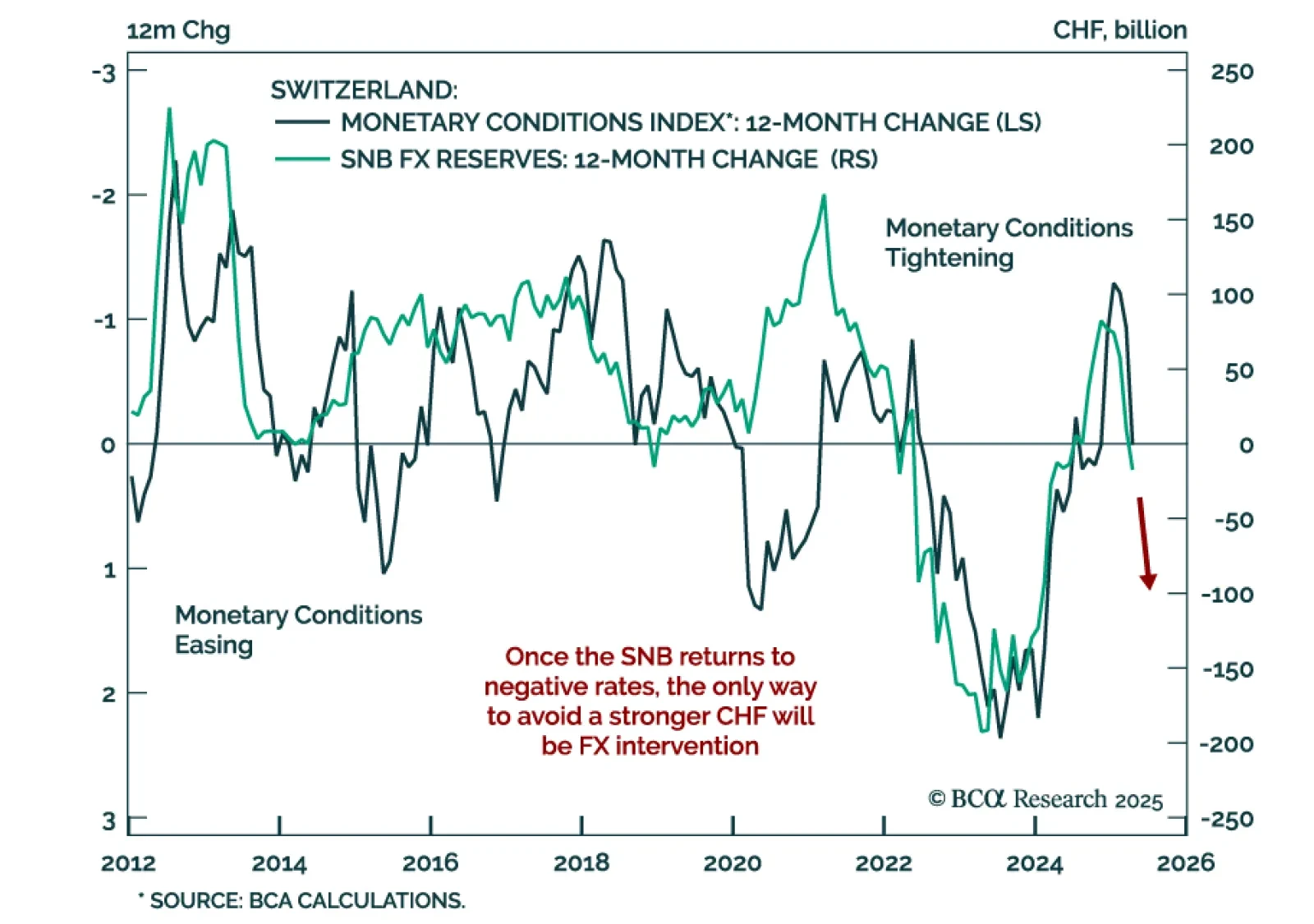

Swiss National Bank will have to resort to negative interest rates and FX intervention before year-end. Swiss inflation fell to 0% year-over-year in April, or the lower end of the SNB’s 0%-2% target range, and the continued…

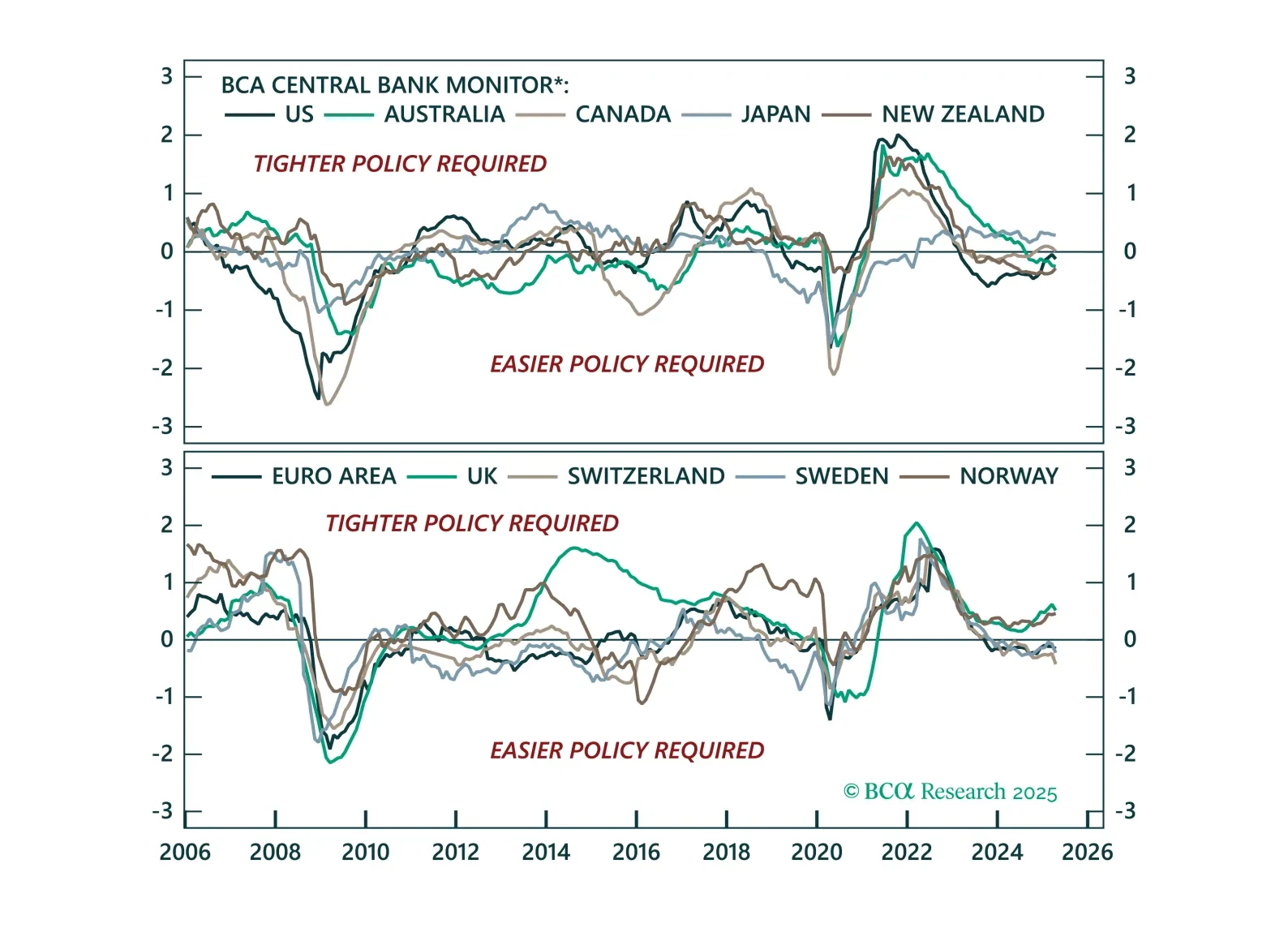

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

Our EM strategists see rising odds of a structural regime shift in Emerging Asian currencies. However, they expect a USD rebound and are looking to close short positions in IDR, PHP, and TWD. Severe deflationary shocks will drive…