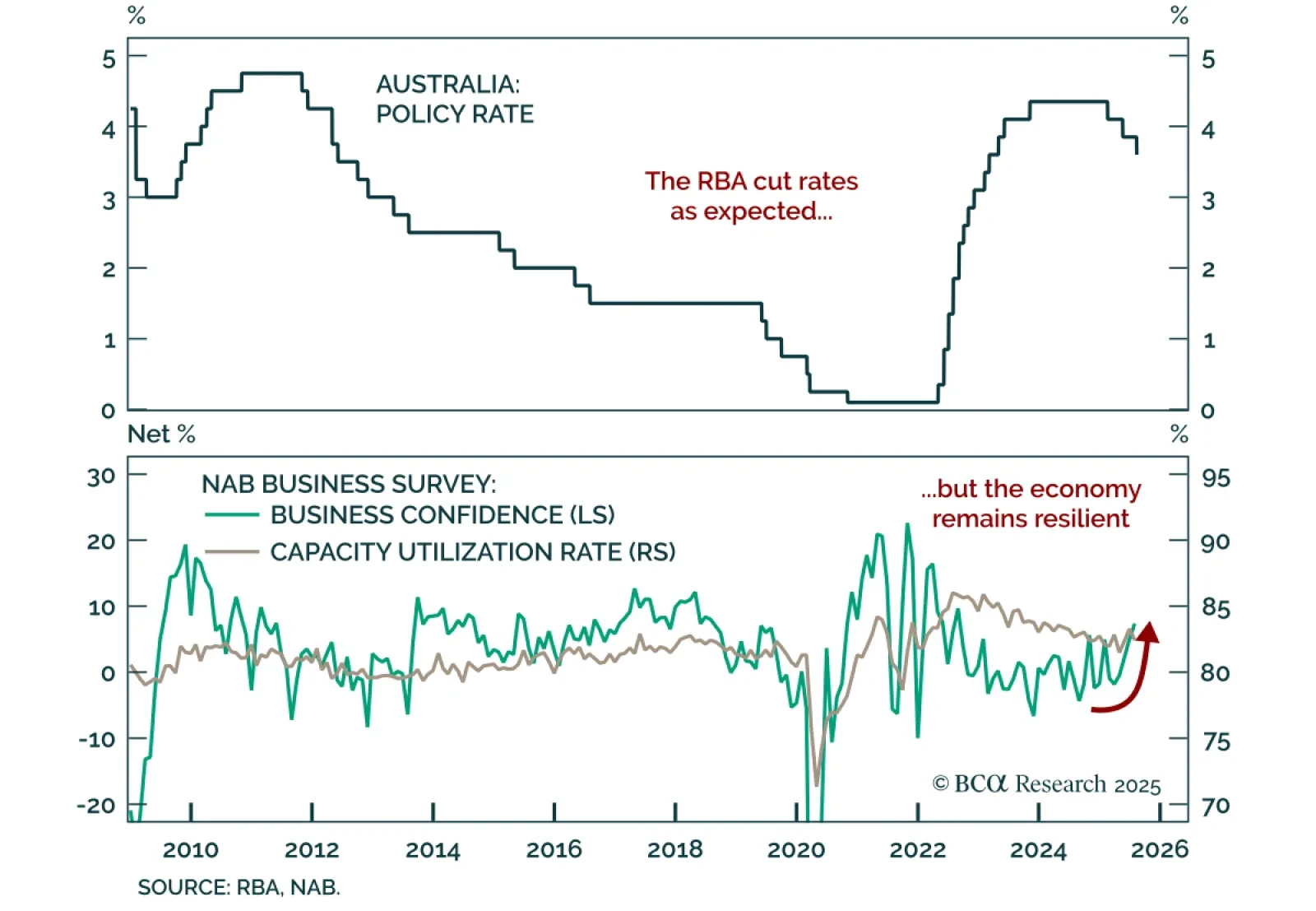

The RBA delivered a widely expected cut to 3.6%, but resilient data warrant an ACGBs underweight. The 25 bps cut was the third this year and Governor Bullock’s guidance was consistent with a cut every other meeting, keeping ACGB…

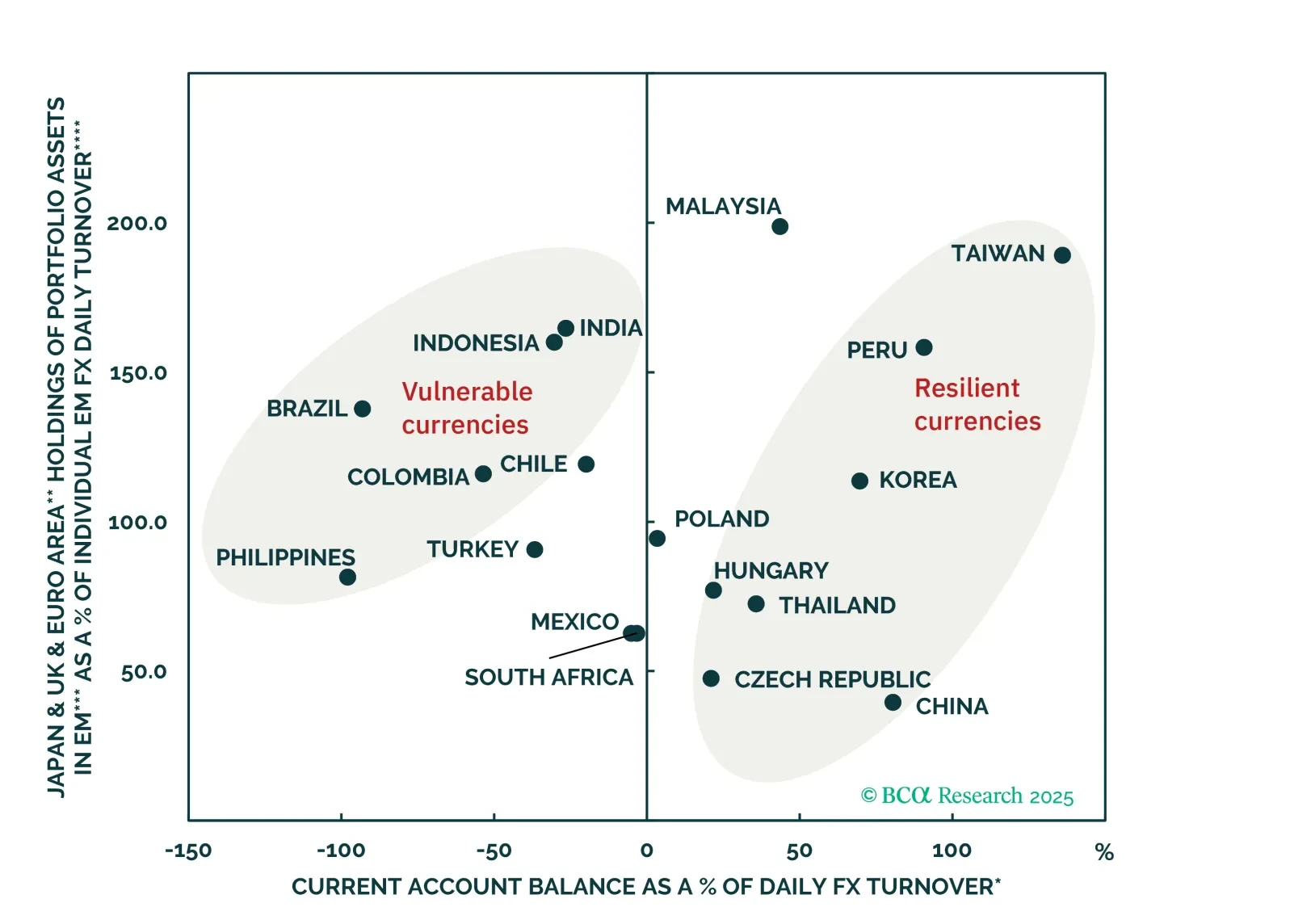

Despite widespread investor optimism Brazil’s currency outlook is challenged by a toxic mix of poor external, fiscal, and macro fundamentals. Expect BRL to underperform most EM peers.

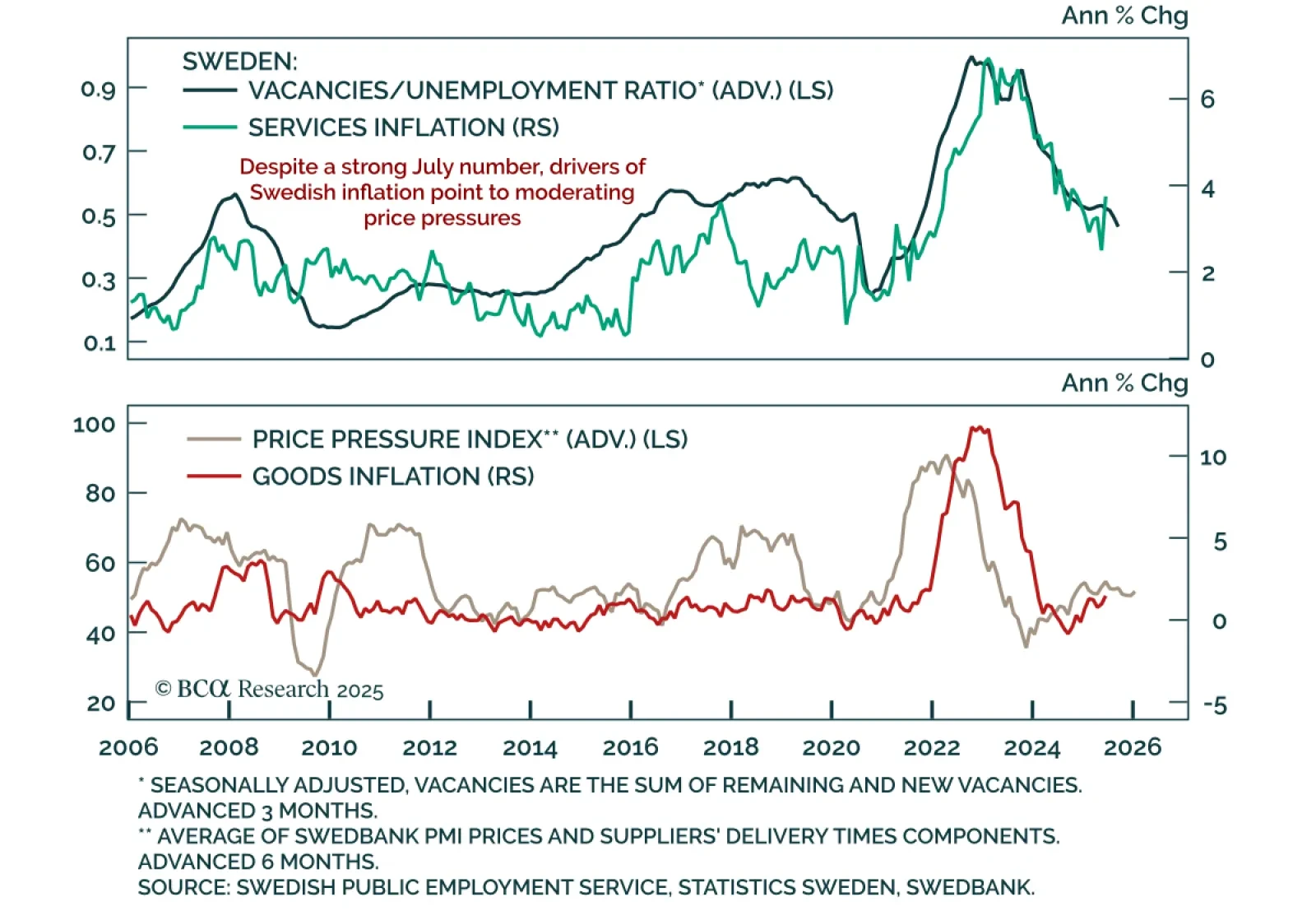

Sweden’s July inflation print came in cooler than expected, but core remains too high for an imminent Riksbank cut. CPI rose 0.8% y/y, while CPIF climbed to 3.0% and core CPIF decelerated to 3.1%, still above the Riksbank’s 2.8…

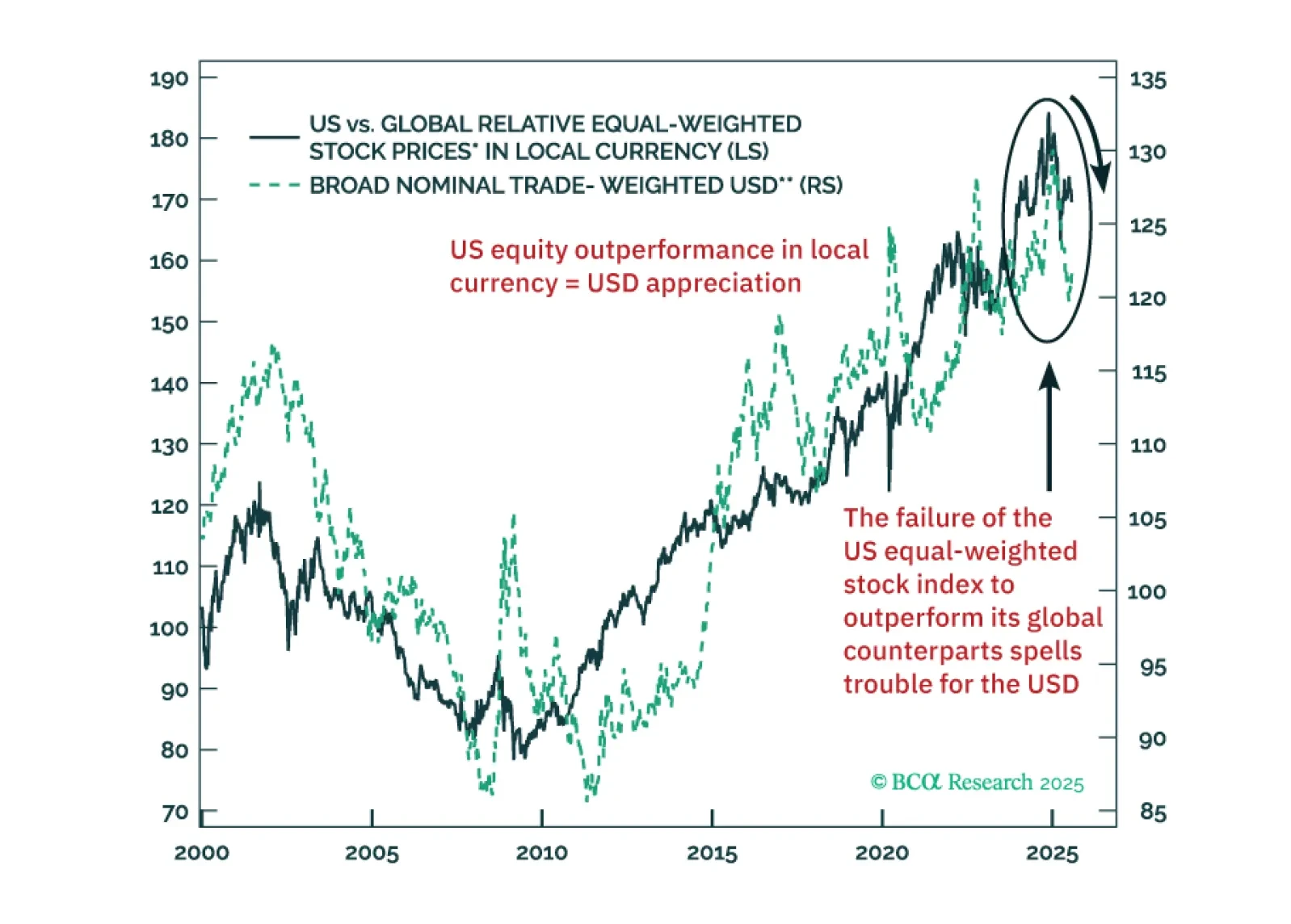

US TMT stocks have been delivering miraculous profit performance. Yet, outside US large tech, global equity fundamentals and technicals are troublesome. A near-term USD rebound should be faded.

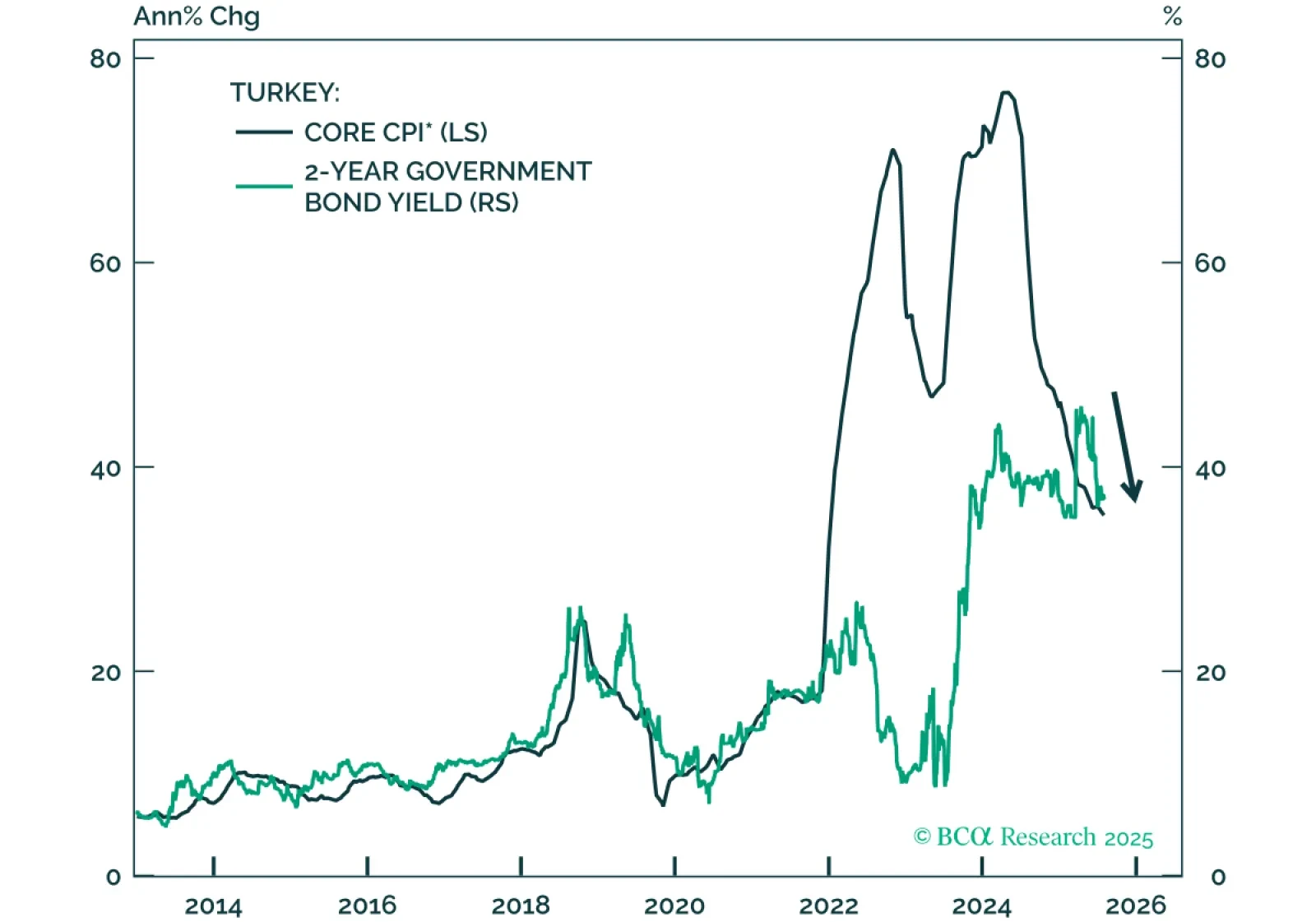

Turkey’s financial policymakers have pursued a disciplined and restrictive policy mix so far, delivering high real interest rates and curbing fiscal expansion even as the economy slows. This commitment to inflation control has paved the…

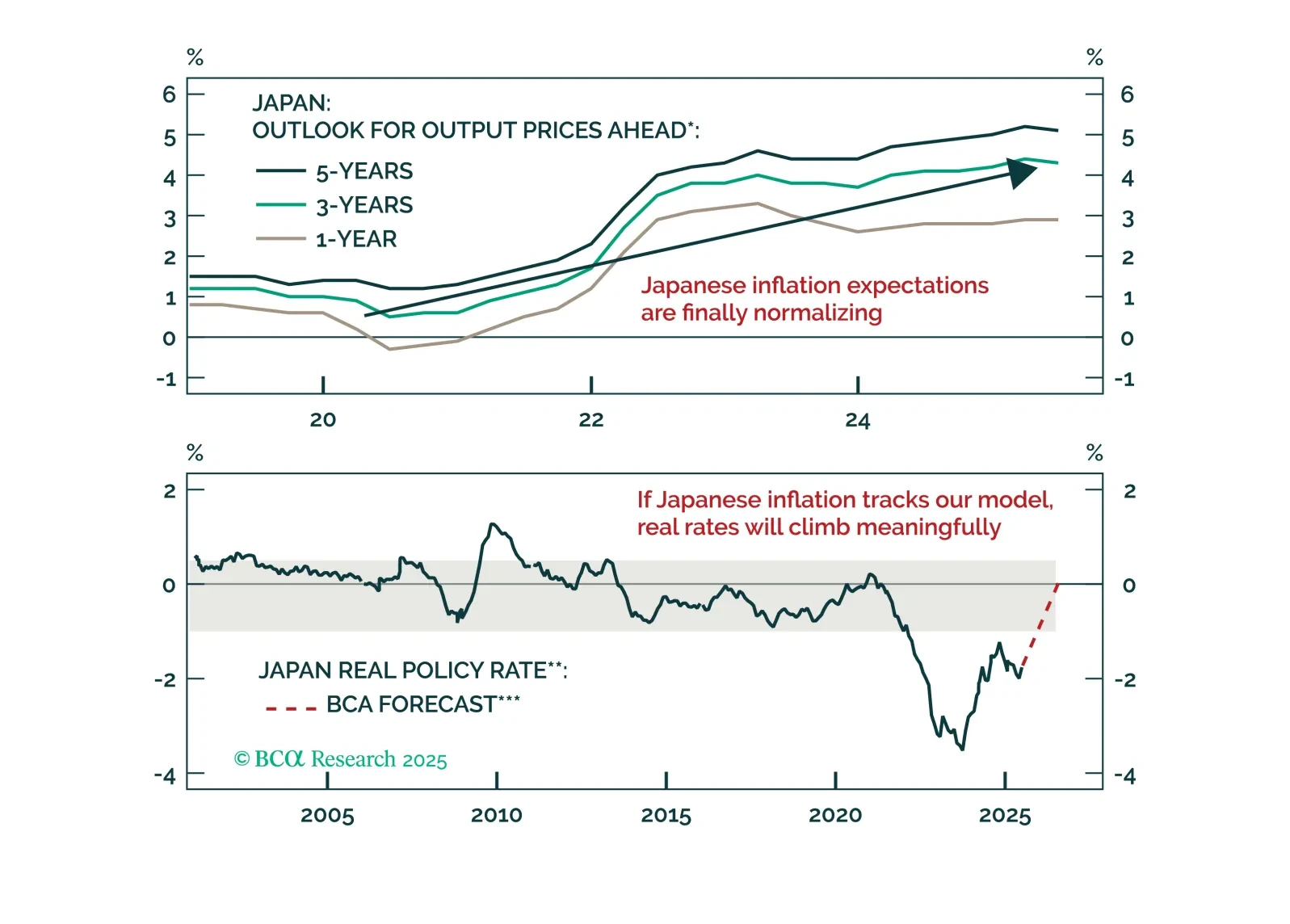

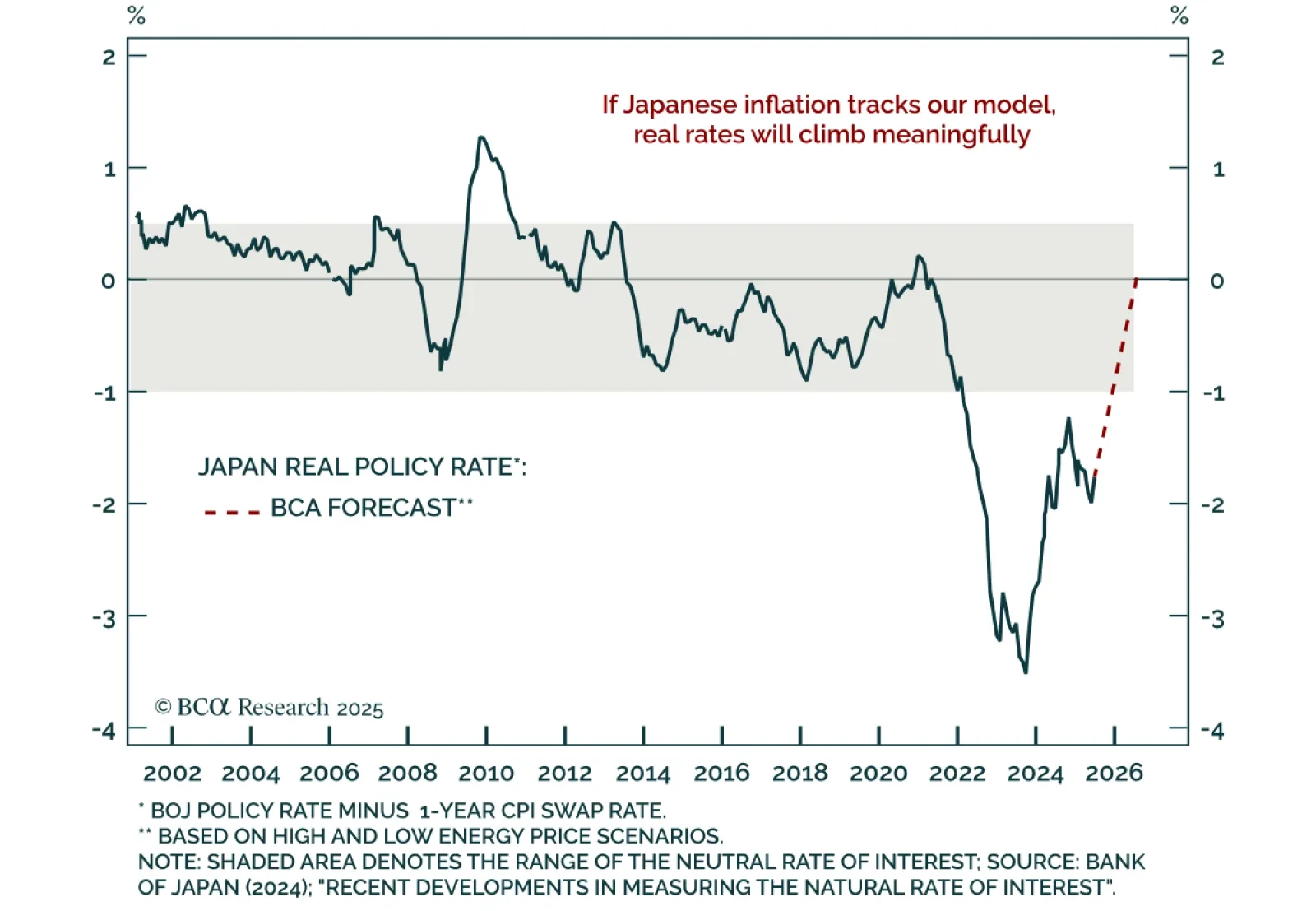

Our DM ex. US strategists see the yen entering a multi-year rally and recommend shorting EUR/JPY now while preparing to short USD/JPY as Fed cuts approach. The yen remains deeply undervalued across PPP, unit labor cost, and real…

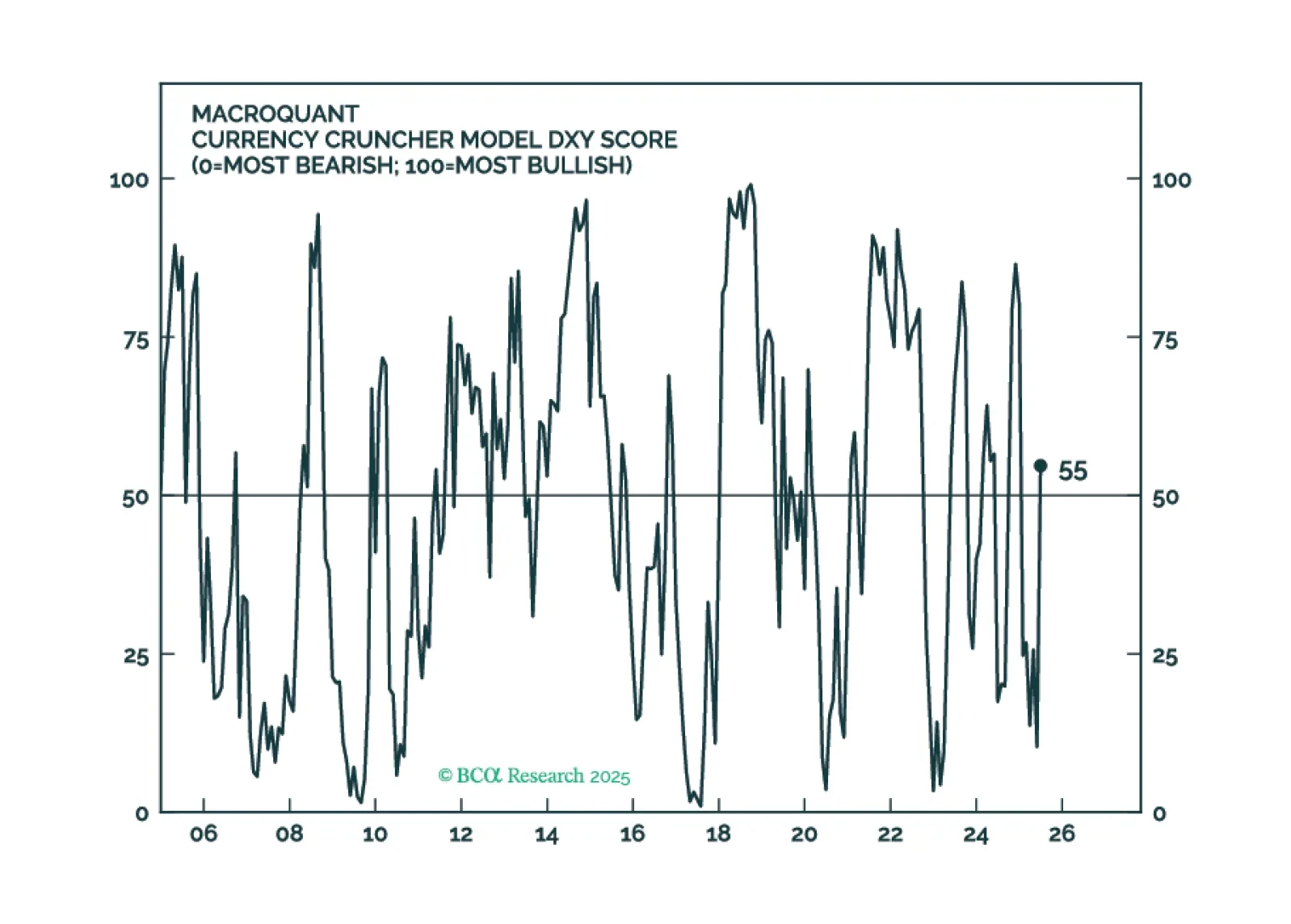

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

The yen’s discount, surplus, and rising real rates line up for a multi-quarter surge. Find out why EUR/JPY is the first short and when USD/JPY follows.

BCA’s US Political strategists warn that Russia presents an immediate market risk, with near-term pullbacks offering potential buying opportunities. President Trump is pivoting toward ceasefires and trade deals, supported by approval…

EUR/USD has broken below key support, and near-term risks justify a tactical bearish stance while longer-term investors should buy dips. The pair fell through its 50-day moving average, which, along with the 20-day, had provided…